Sergiy Nikolaychuk, Head of Macroeconomic Research at ICU

IS CORONAVIRUS CRISIS LEADING US TO GLOBAL DEFLATION OR INFLATION?

One of the main debated topics among macroeconomists today is about the outcome of the coronavirus crisis and authorities’ reaction to it for price development in advanced economies.

Will it lead to inflation or deflation? The answer depends on the magnitude of supply and demand shocks that the crisis invoked as well as on the policy responses of governments and central banks.

The massive economic stimulus amid the supply disruptions imposed by lockdowns around the globe raised concerns that inflation may surge as a result, probably when lockdown restrictions are eased (Goodhart and Pradhan, 2020). But many economists worry instead about deflation, or at least less inflation than they would like (e.g. Blanchard (2020), Miles and Scott (2020)).

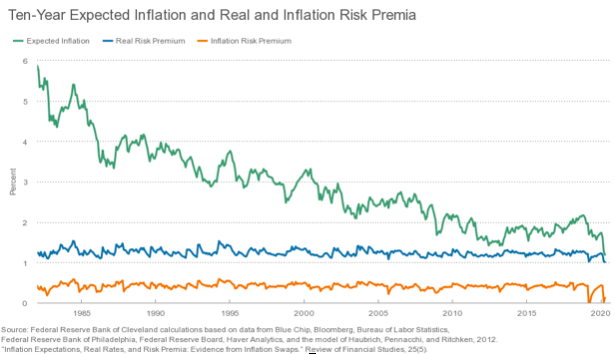

The latter view is currently supported by financial markets: the expected inflation proxied by the difference between the rate on nominal bonds and inflation-indexed bonds is about 1%. Thus, investors predict that five to ten years from now the Fed, ECB and Bank of Japan will not be able to fuel inflation up to their inflation targets (2%). Expectations for average inflation in the US over the next decade calculated by the Federal Reserve Bank of Cleveland fall from 1.7% in January to 1.2% in April, the lowest historical level (figure 1).

Figure 1.

Falling commodity prices is another important signal. Moreover, extremely low energy prices will pass through to other prices in the economy during the following months intensifying the deflationary pressure. Besides, annual headline and core inflation declined in the US and Euro area in March compared to February.

Other arguments for prevailing deflationary pressure to persist in the nearest future are the following:

- While the supply shock is strong enough due to shutdowns, layoffs, and firm exits, the demand overreacts and leads to a demand-deficient recession. This fact described in the literature as “Keynesian supply shock” is well explained in the paper of Guerrieri et al (2020): the plunge of demand from workers in closed sectors is amplified by additional drop from workers in unaffected sectors due to decline of incomes and a contraction of employment there.

- Governments’ support measures at best merely substitute for the demand suppression due to social distancing

- Additional precautionary savings may arise among workers in unaffected or recovered sectors due to the expectations of the second wave of pandemic and uncertainty about their employment. Thus, demand for durable goods, travel, services of hotels, restaurants and cafeteria (HoReCa), etc will remain subdued (while some deterred demand can be realized in the first few weeks/months after relaunching the economy)

- Investment by companies will be subdued amid the lack of sufficient demand and the fears of the second wave of pandemic. Of course, the latter will force investments into hospitals, medical equipment, pharmaceutics, IT services, organization of distant work, automation and robotization, etc. But it will not offset completely the overall drag on investment.

- The natural rate of interest will fall because of lower productivity and a glut of savings. Blanchard (2020) considers a very large increase in the neutral rate as a result of high supply of government bonds and the need to raise the rate by governments to sell them on the market as one of potential reasons for return of inflation. However, he assigns very low probability to such a scenario. Moreover, Jorda et al (2020) using a dataset of 15 major pandemics from the 14th century find that real rates of return were substantially depressed for about 40 years after pandemics.

- Although Jorda et al (2020) find that real wages somewhat elevated following pandemics, we do not think that Covid-19 will bring the same outcome. Previous pandemics caused large death toll and labor scarcity, while Covid-19 has relatively low mortality rate, especially for those of working age. Thus, Covid-19 is not expected to shrink the labor force sizably. Meanwhile, the ongoing pandemic has been increasing the number of unemployed dramatically and labor excess is expected to prevail in the nearest future.

- When restaurants and hotels reopen, they are likely to charge lower prices amid precautionary behavior of population and keeping social distancing, which will drag down inflation

- There is no physical destruction of capital, and exit from lockdown may bring the potential output to its pre-crisis level very fast. Meanwhile, the adjustment of demand will be lagging behind even under government stimulus.

The main risk for deflation scenario not to be realized comes from political considerations. Nowadays, high inflation appears as the most desirable policy response to the current crisis. This may be coupled with financial repression through which the governments will try to stimulate demand for their bonds.

If inflation happens to accelerate significantly due to the massive fiscal and monetary stimulus, monetary authorities would have ammunition to slow down inflation to a desirable (targeted) level while imposing the additional drag on economic recovery. However, such experience of monetary financing of public spending may provoke enormous political pressure to keep the support. It will be forced by the intention to lower the debt-to-GDP ratio primarily through higher nominal GDP (reflecting the so-called “fiscal dominance”) while imposing an “inflation tax” on savers. And if central banks try to raise interest rates in such a context, they will face political ires to a point that might threaten their ‘independence’ (Goodhart and Pradhan (2020)). Probably, the Fed should be much more concerned about such an outcome, while the ECB is more shielded by political preferences for low inflation.

Another potential risk is stemming from the deterioration of Sino-American relations amid the blame game for the COVID-19 pandemic and reemerging trade wars. Under this scenario, rising import prices may push upwards overall inflation in the US. Growing protectionism at the global scale may bring the same outcome.

While in general we think that the baseline scenario is a low-inflation environment, there are two important caveats here.

First, as pandemic causes dramatic changes in economies’ structure and agents’ behavior, the measurement of consumer inflation will be a serious challenge in coming months. Goodhart and Pradhan (2020) state that “at a time when the basket of goods and services that we buy has so suddenly been distorted out of all recognition, it will become almost impossible over the next few months to put together sensible and meaningful data for CPI, RPI, or any other inflation series”. That may distort significantly both the inflation statistics published by national statistical offices and authorities’ reaction to them.

Second, the same dramatic changes in consumer patterns caused by pandemic definitely will lead to significant relative prices movements. While prices for the most durables and services may remain subdued for some time, prices for some goods and services may jump as a result of switching consumer preferences. For example, prices for pharmaceutical products and medical services most likely will accelerate due to strong demand and rising labor costs. Also, food security considerations may cause some countries to implement restrictions on food exports leading to shortfall of supply and hence raising food prices in advanced economies (AE).

Besides, there has been a strong demand for online services (like online TV, games, educations, etc.) and IT hardware since the start of the quarantine, which is expected to continue. However, such demand will likely stimulate the increase in supply and will not lead to sizable inflation movements as the last decades show. Meanwhile, increasing demand and production (together with business investment in IT infrastructure) may push the demand and prices of important intermediate products like rare earth elements.

Such low-inflation and fuzzy environment in advanced economies may bring both challenges and opportunities for emerging markets (EM) including Ukraine. On the one hand, commodity exporters representing the majority of EMs usually suffer during low-inflation periods. On the other hand, lower imported inflation widens the room for domestic stimuli via fiscal and monetary tools. However, as always, such stimuli have to be well calibrated in order to maximise the economic recovery while ensuring price and financial stability. In contrast to AEs nowadays struggling to fuel inflation expectations, authorities in EMs like Ukraine may easily reach such outcomes but with negative consequences for macrofinacial stability and thus undermine the economic recovery from lockdown.

________

Author: Sergiy Nikolaychuk, Head of Macroeconomic Research at ICU

Source: Vox.Ukraine