Hedging of non-convertible currencies.

What you should know about non-deliverable forwards?

A non-deliverable forward (NDF) – is an efficient way to hedge a foreign exchange exposure against non-convertible currencies, such as UAH.

An NDF is a cash-settled, and usually short-term, forward contract. The notional amount is never exchanged, hence the name "non-deliverable”. Instead, the whole transaction is settled in the convertible currency, such as USD.

As with usual forward transaction, an NDF is fixed for an agreed notional amount, on a specific due date, and at a defined forward rate. At maturity, the forward rate is compared against the reference rate of that day, the NBU rate.

How it works?

A non-deliverable forward (NDF) is typically executed offshore, meaning outside the home market of the restricted currency. For example, if a country's currency is restricted from moving offshore, it won't be possible to settle the transaction in that currency with someone outside of the restricted country. However, the two parties can settle the NDF by converting all profits and losses on the contract to a freely traded currency. They can then pay each other the profits/losses in that freely traded currency.

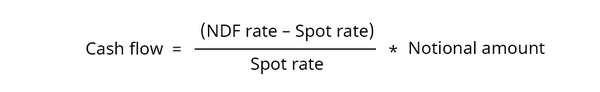

The difference between the pre-agreed forward rate and the fixing rate is settled in the convertible currency on your account on the due date. Therefore, you will either pay or receive the difference in USD.

Example

If one party agrees to buy Ukrainian hryvna (sell dollars), and the other agrees to buy U.S. dollars (sell hryvna), then there is potential for a non-deliverable forward between the two parties.

They agree to a rate of 27.50 on $1 million U.S. dollars. The fixing date will be in 6 months, with settlement due shortly after fixing.

If in 6 months the rate is 27.00, the hryvna has increased in value relative to the U.S. dollar. The party who bought the hryvna is owed money. If the rate increased to 28.00, the hryvna has decreased in value (U.S. dollar increase), so the party who bought U.S. dollars is owed money.

What ICU can offer you as a reliable NDF counterparty?

- NDFs for USD/UAH, EUR/UAH, EUR/USD currency pairs, etc

- Competitive prices and good liquidity

- Minimal credit risks

To start working with NDF, you need to:

- Go through the standard KYC procedure

- Sign the ISDA framework agreement

- Prepare initial and maintenance margin amount in USD

Take full advantage of the NDF market with ICU!

Want to start or have any questions?

Please contact ICU trader Vitaliy Sivach: