|  |

|  |

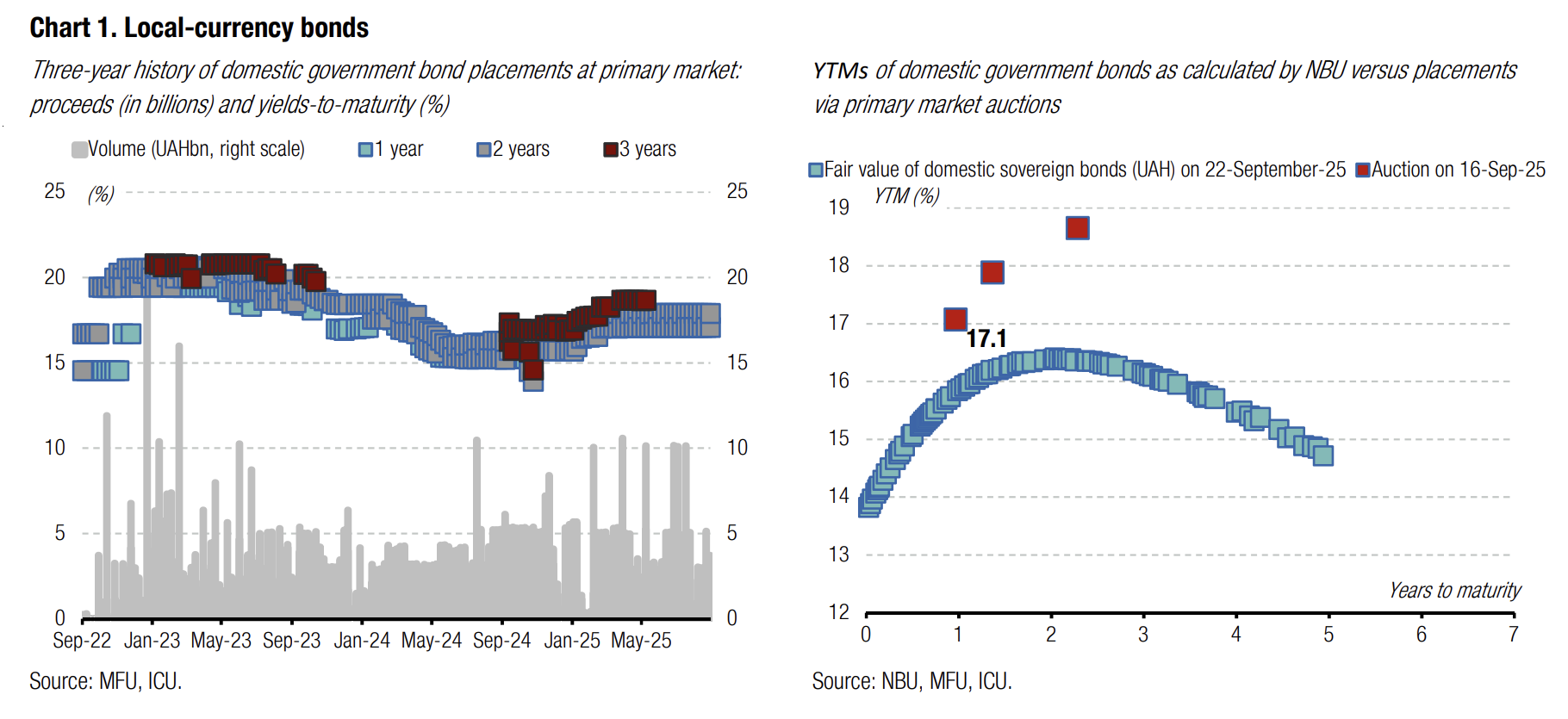

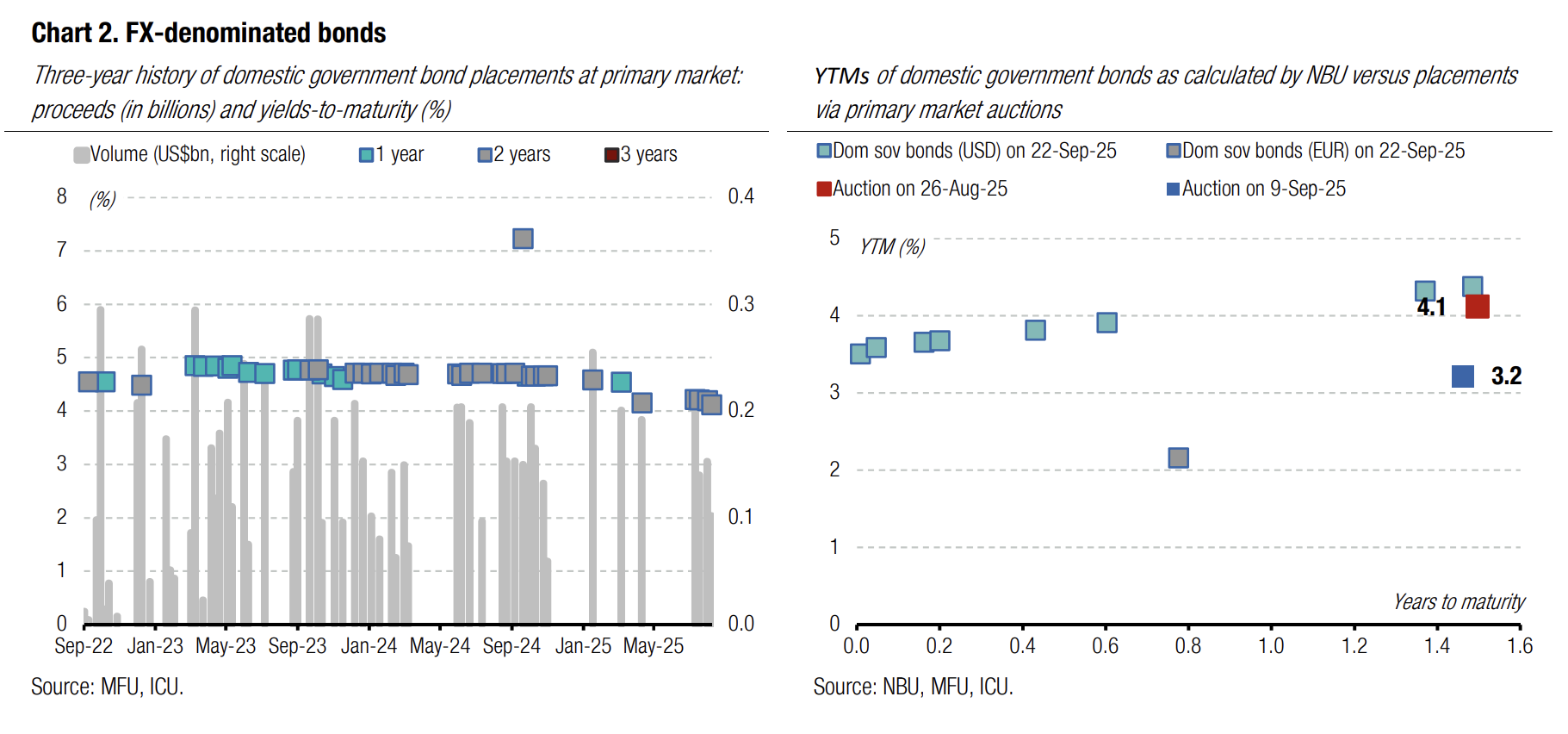

Bonds: Increase in UAH borrowings likely short-lived

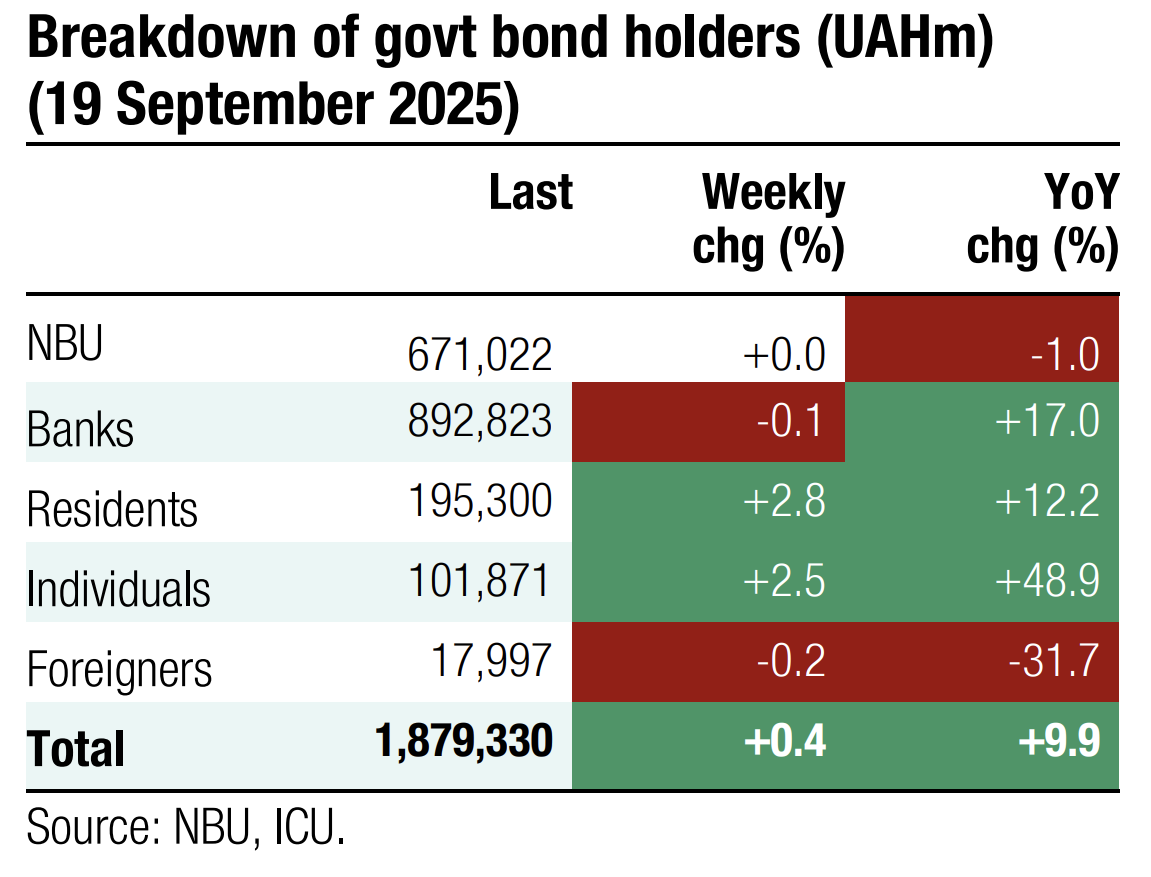

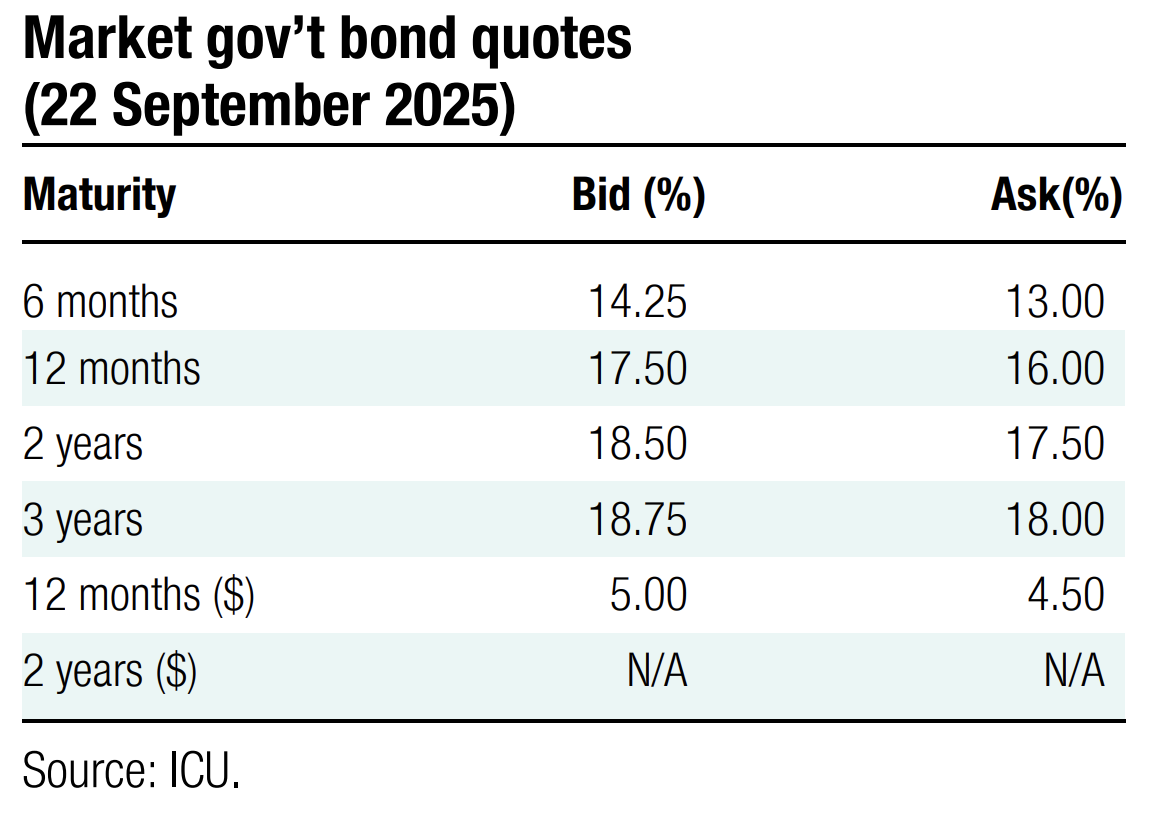

Last week, demand for UAH bonds increased significantly, likely on reinvestment of funds from recent redemptions.

Primary placements increased significantly last week. The volume of bids for regular and military UAH bonds increased more than threefold compared with the previous auction. State budget proceeds reached almost UAH7.6bn, a 10-week high. See details in the auction review.

However, the volume of trading in UAH bonds in the secondary market decreased last week to UAH12.8bn, down nearly one-third from a week before.

ICU view: Retail and small investors clearly prefer the secondary market that offers a wide selection of bonds across maturities ranging from a few weeks to three years, in contrast to a very narrow offer in the primary market.

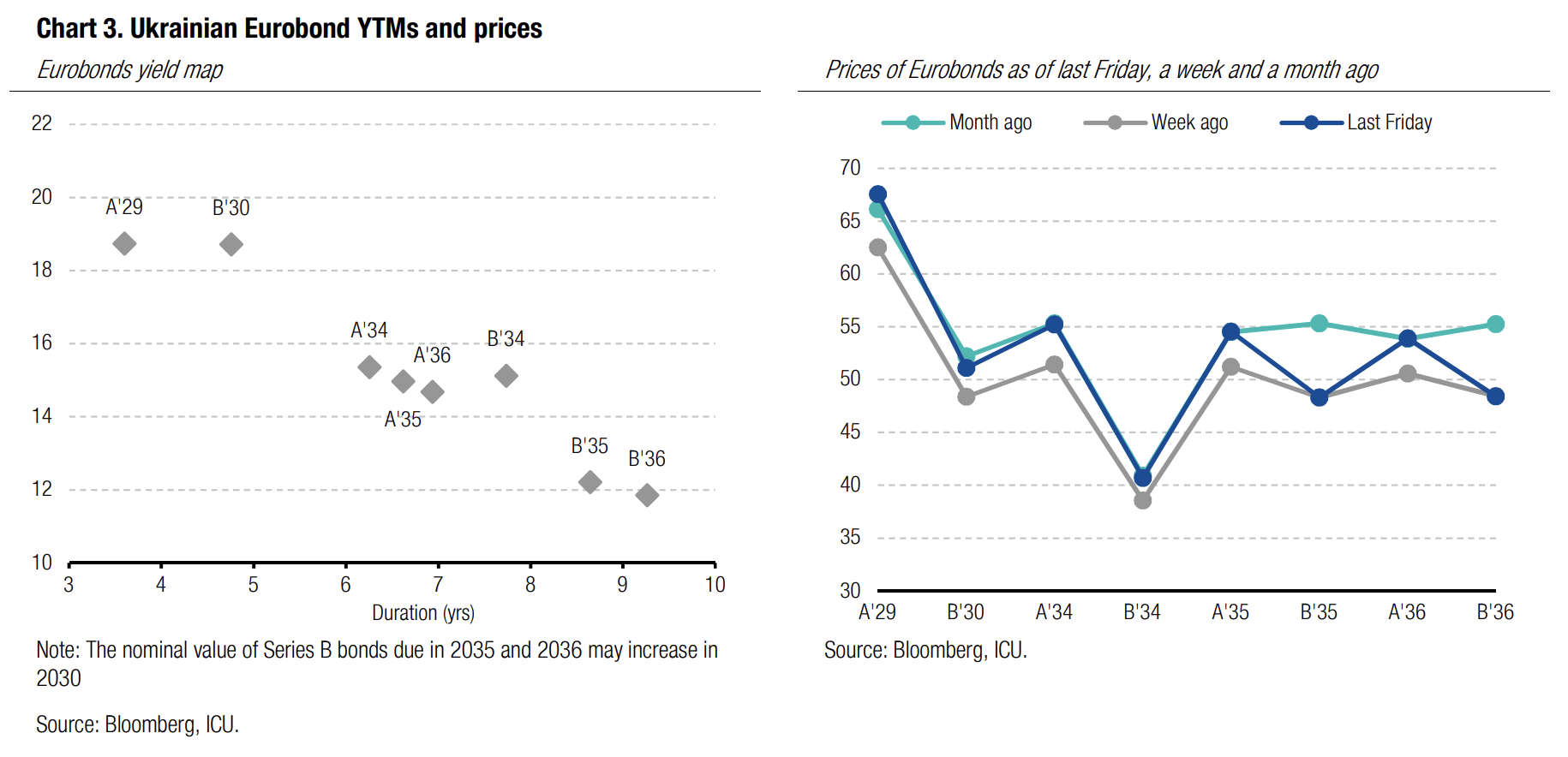

Bonds: Wave of optimism in Eurobonds emerges last week

Last week, the price trend for Ukraine Eurobonds was shaped by discussions of new mechanisms for EU financial support for Ukraine and the comments of the Ukrainian public debt commissioner.

More details emerged in the mass media about possible schemes of the EU financial support for Ukraine in 2026-27. The EU may use cash owned by russia to fund Ukraine while replacing russian the cash with its zero-coupon bonds, so that technically the size of russian frozen assets remains unchanged. Cash transfers from the EU will be dubbed as "reparations loans", repayable by Ukraine only if and after russia makes compensatory payments to Ukraine for war-related damages. Over the weekend, the UK signalled it may implement a similar mechanism. The Minister of Finance of Ukraine announced that a new IMF program should be as large as US$150-170bn over four years.

Additionally, investors were encouraged by comments from Ukraine's public debt commissioner that any financial support from the EU should ideally be DSA-neutral. He also signalled that a launch of a new IMF program is unlikely to require an immediate new treatment of Eurobonds, even though a treatment may still be needed towards the end of the program.

Against this background, Ukrainian Eurobonds rose by 6-8%. Following a small correction towards the end of the week, the weekly price gains were just above 5%. The price of VRIs also rose significantly last week, 4% to over 78 cents per dollar of notional value.

ICU view: Signals from the EU have encouraged the market, as the likelihood has increased that Ukraine’s needs will be fully financed with foreign aid and the country will not be forced to suspend scheduled Eurobond payments. Comments from representatives of the Ukrainian Ministry of Finance further reinforced this positive perception of the outlook.

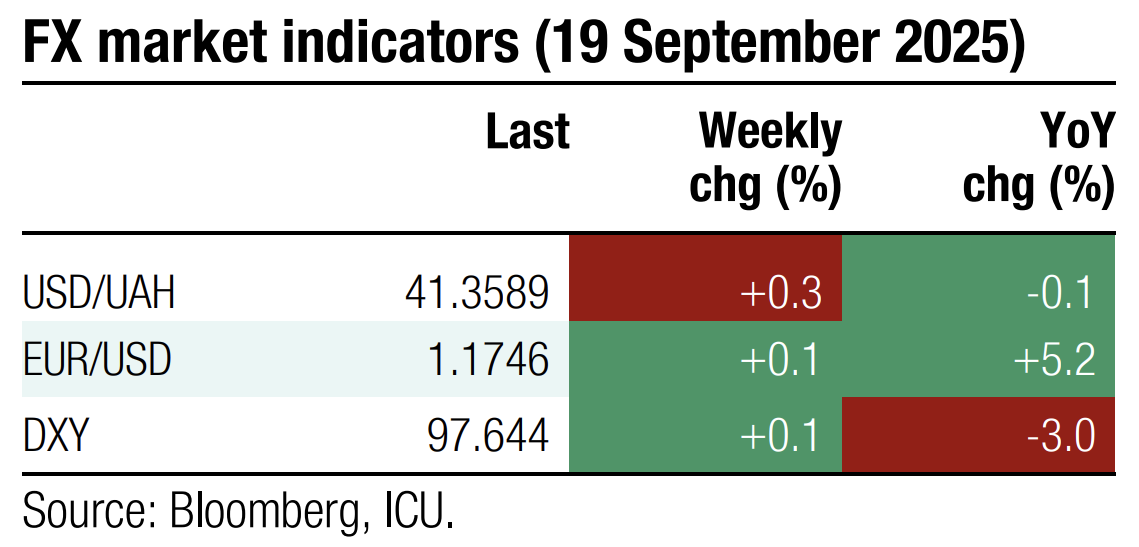

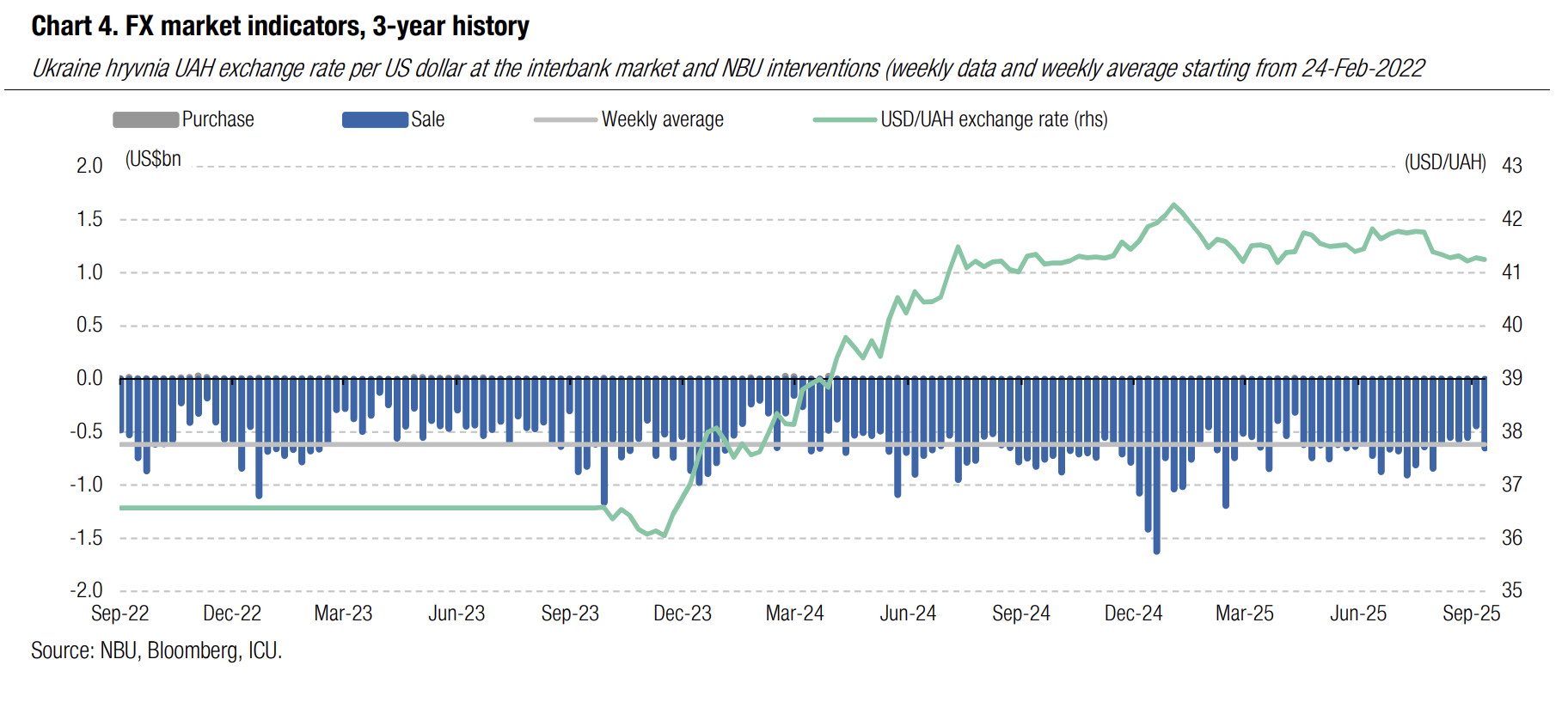

FX: NBU moves out of comfort zone

After several weeks of operating in a comfort zone with relatively small interventions, the NBU increased FX sales last Friday.

The foreign currency shortage increased marginally last week (over four business days) to US$242m. During these four days, the NBU sold an average of less than US$100m per day. However, interventions increased sharply on Friday, probably to about US$300m. Overall, the NBU sold US$652m from international reserves last week.

During the week, the NBU allowed relatively minor fluctuations of the hryvnia without letting the official rate go above UAH41.3/US$. Then, the hryvnia weakened on Friday to UAH41.36/US$ in the market.

ICU view: A relatively small foreign currency deficit allowed the NBU to remain in the comfort zone for several weeks. However, a sharp increase in demand for hard currency forced the NBU to increase the sale of foreign currency and weaken the hryvnia on Friday. This increase in intervention is likely related to one-off FX purchases by government agencies. We expect the NBU to maintain the official hryvnia exchange rate close to the current level for some time, but the volatility is likely to increase gradually.

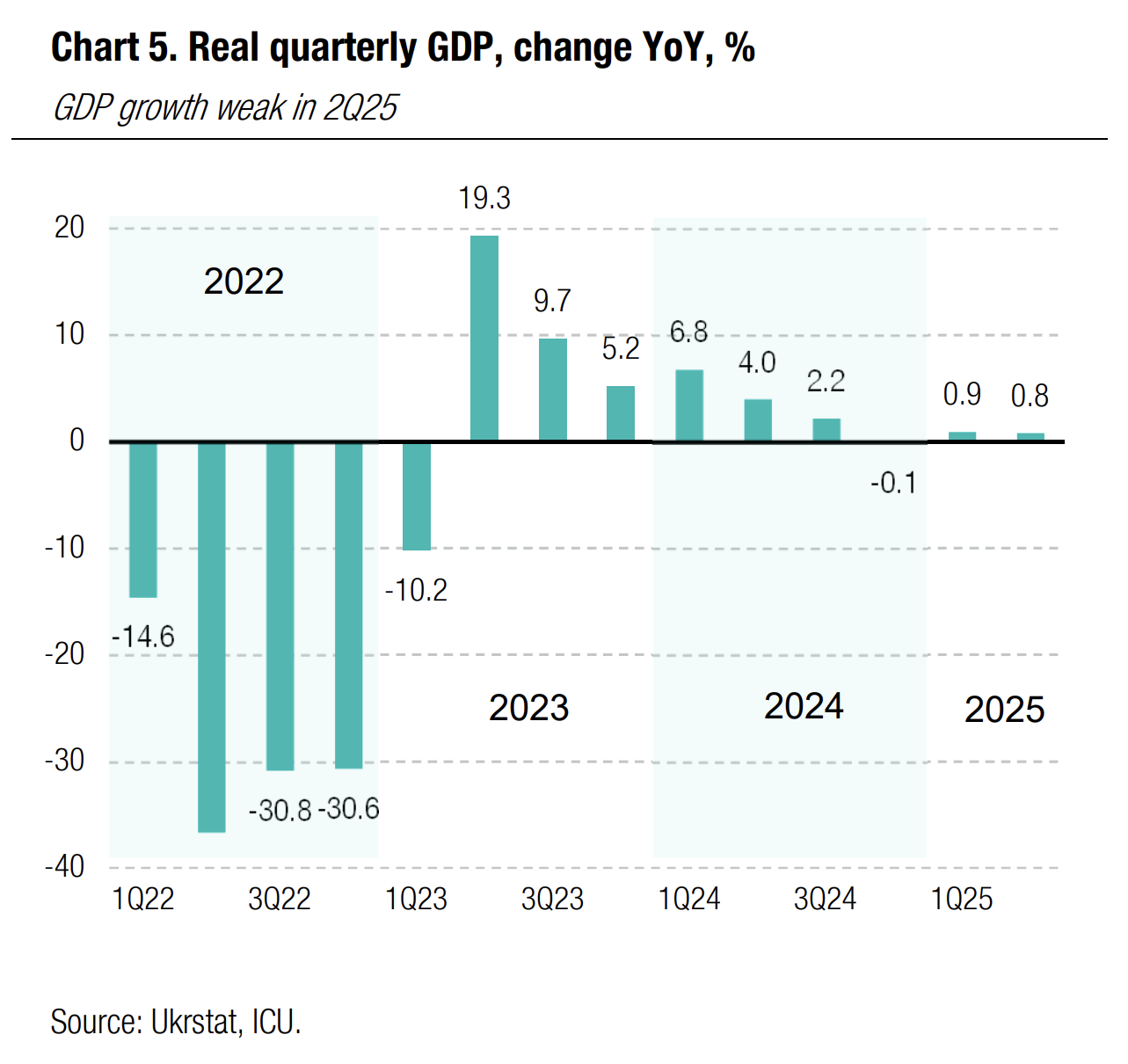

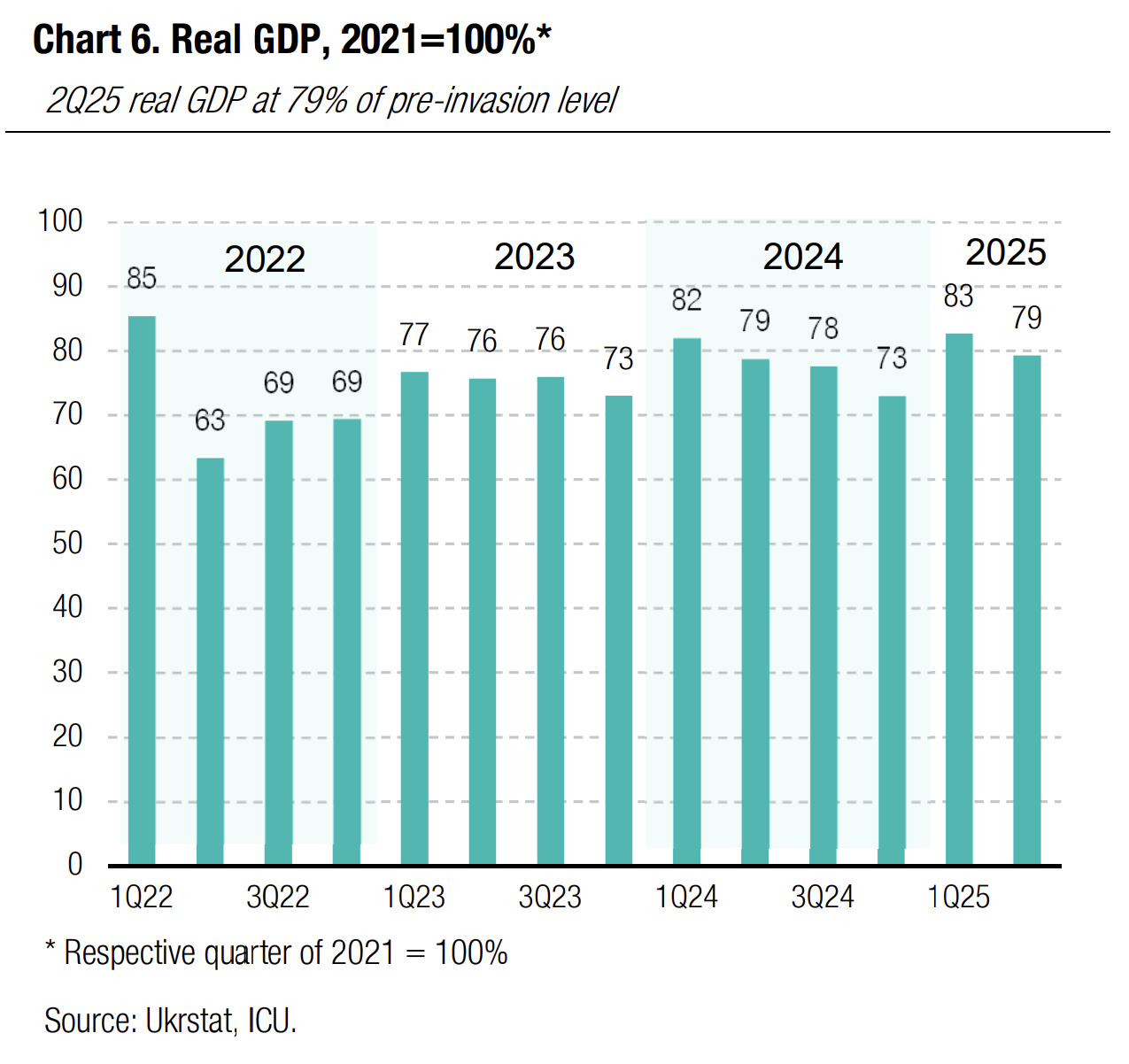

Economics: Economic growth remains subdued in 2Q25

Ukraine’s GDP inched up 0.8% YoY in 2Q25, implying it was at just 79% of the pre-invasion (2Q21) level.

|  |

ICU view: While no detailed quarterly statistics across demand and supply-side components are available, monthly data clearly indicate the weakness was pervasive across key sectors, even though activities started to improve towards the end of the quarter. Industrial production narrowed the decline from -6.1% in 1Q25 to -3.9% in 1H25. Cargo transportation turnover also narrowed the decline from -5.1% in 1Q25 to -2.7% in 1H25. Meanwhile, retail trade grew at above 6% in YoY terms in 2Q vs sub-6% growth in 1Q25. The key drag on 2Q economic growth was the agricultural sector as the harvesting campaign started later than in 2024 due to weather conditions. We expect growth to pick up significantly in both 3Q and 4Q as agriculture gains pace and supports related sectors, including food processing and transportation. Yet, we admit risks to our full 2025 GDP forecast of 2.5% YoY.

Economics: Government plans 2026 deficit at 19% of GDP

Ukrainian government submitted a 2026 draft budget to the parliament last week. The deficit is planned at UAH1.9trn, an equivalent of US$46bn at the current exchange rate, or 19% of GDP.

Gross external financing needs are estimated at UAH2.1trn, an equivalent of US$52bn at the current exchange rate. The government plans to increase expenditures by 10% vs. the 2025 targets, with outlays on the defense and national security sector making up over half of the total.

ICU view: The government sends a clear signal that Ukraine’s reliance on foreign financial aid will remain critical in 2026. The current IMF program includes US$34.4bn in gross external financing, including a US$12.2bn pre-financing in 2025 and a $11.1bn downside buffer. Ukraine expects its additional external financing needs will be covered primarily with transfers from the EU (funded with russian frozen assets).