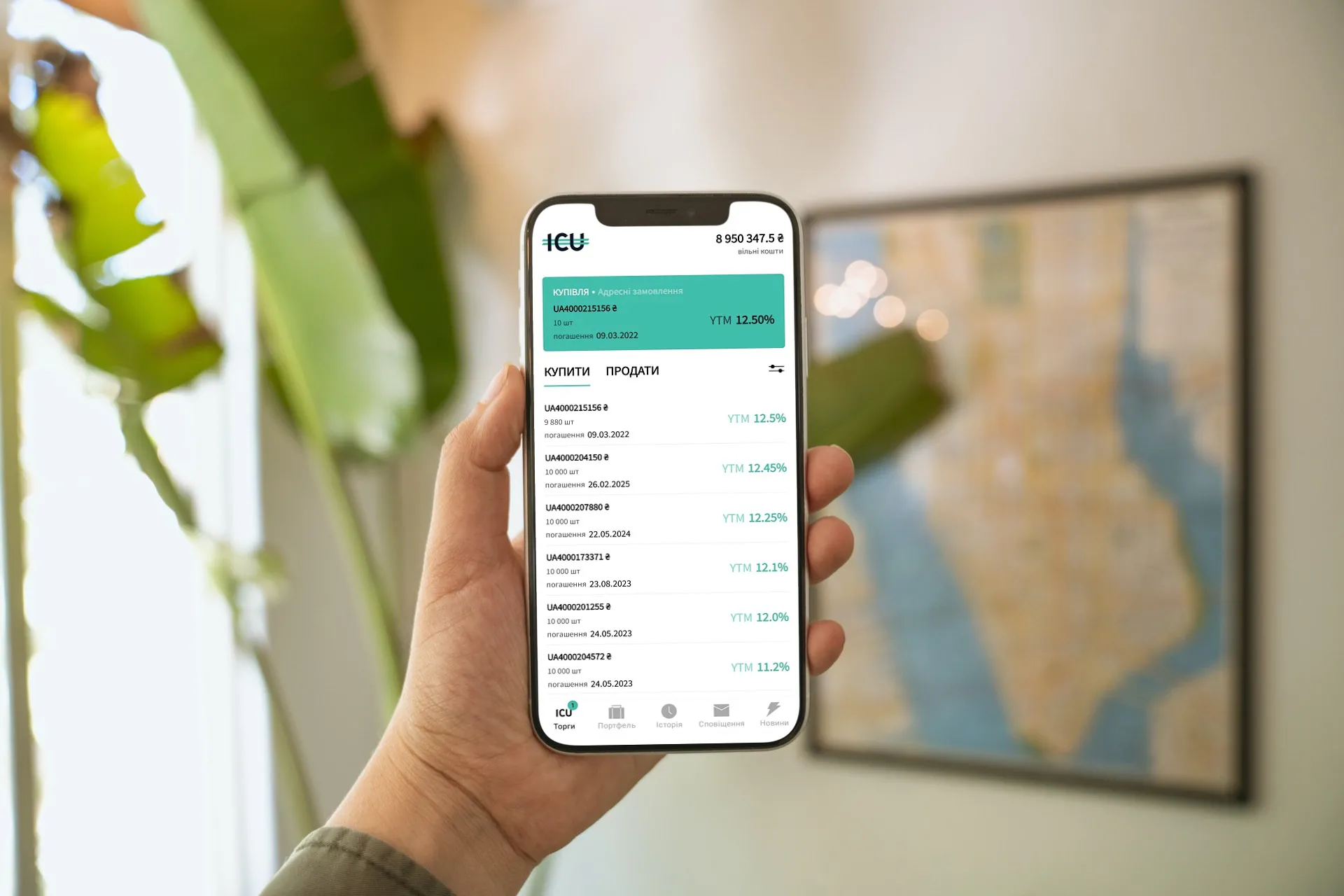

ICU has launched the ICU Trade mobile application, which allows investors to buy and sell Ukrainian government bonds in real time from any mobile device.

The application is a mobile version of the ICU Trade online platform, which the company launched in the fall of 2020, аnd the first mobile application of its kind in Ukraine.

ICU Trade allows investors to:

- view detailed information on available government bonds;

- buy / sell government bonds in real time;

- receive individual offers on government bonds;

- control the cashflow and account balances;

- withdraw funds to a bank account 24/7.

“Our goal was to create a product that makes it as easy as possible for investors to trade government bonds from mobile devices. I am sure that investors will appreciate the simplicity and intuitiveness of ICU Trade with the process of buying bonds literally only involving three clicks,” said Deputy Director of ICU Yevgeniya Gryshchenko.

The application is already available for download on the App Store and Google Play platforms.

“The convenience of ICU Trade, combined with a 100% state guarantee, zero taxation and high liquidity, make government bonds the optimal instrument for Ukrainian investors. We are pleased to see the growing increase in private individuals' interest in government securities. We are already working on adding all other available securities on the local market to ICU Trade,”said ICU founder Konstantin Stetsenko.

About ICU

ICU is an independent asset management, private equity and investment advisory firm specialising in the emerging markets of Central and Eastern Europe. Founded in 2006 by senior investment professionals from ING, ICU is Ukraine's leading asset manager. We currently manage over $500m in assets.

Our veteran investment team has experience in private equity, high yield corporate debt, distressed debt, restructurings and other special situations across a number of emerging markets. Investment decisions are supported by robust macroeconomic and sectoral analyses from our in-house team of research economists.

We aim to provide our clients with superior risk-adjusted returns across a number of asset classes. The firm is expanding its reach into key European markets via a combination of organic growth and acquisition and continues to expand the range its investment offerings.