|  |

|  |

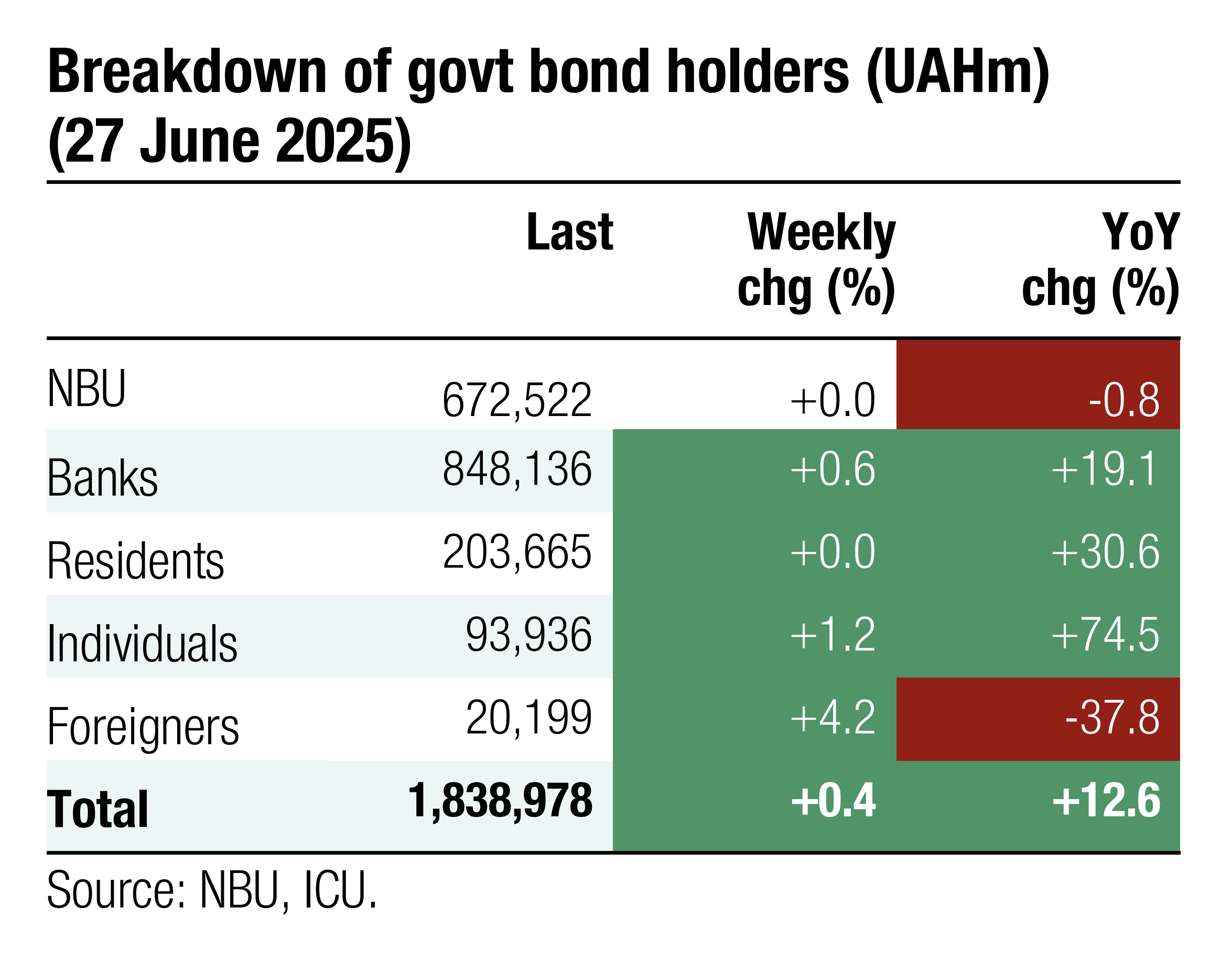

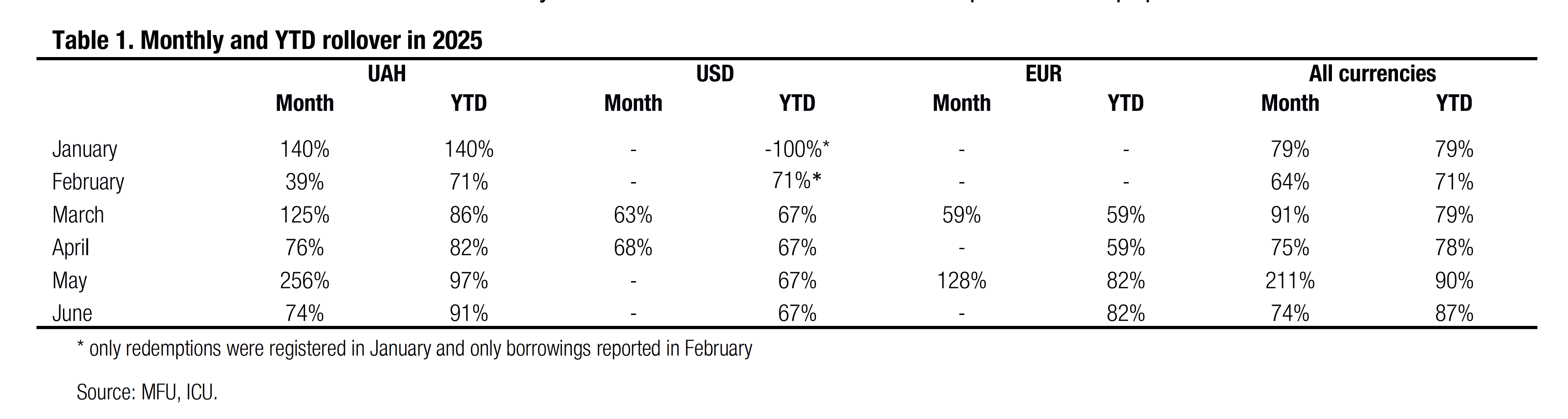

Bonds: Rollover declines in June

Refinancing of local debt redemptions remains sluggish, with YTD local debt rollover ratios slightly down vs. 5m25.

In June, the MoF borrowed UAH35.8bn while redeeming UAH48.5bn of UAH bonds. As a result, the rollover rate was just 74% in June, taking the YTD number to 91%. That includes a swap of reserve bonds whereby the MoF exchanged a portion of paper due in August for a new security. There were no issuances or redemptions of FX papers in June.

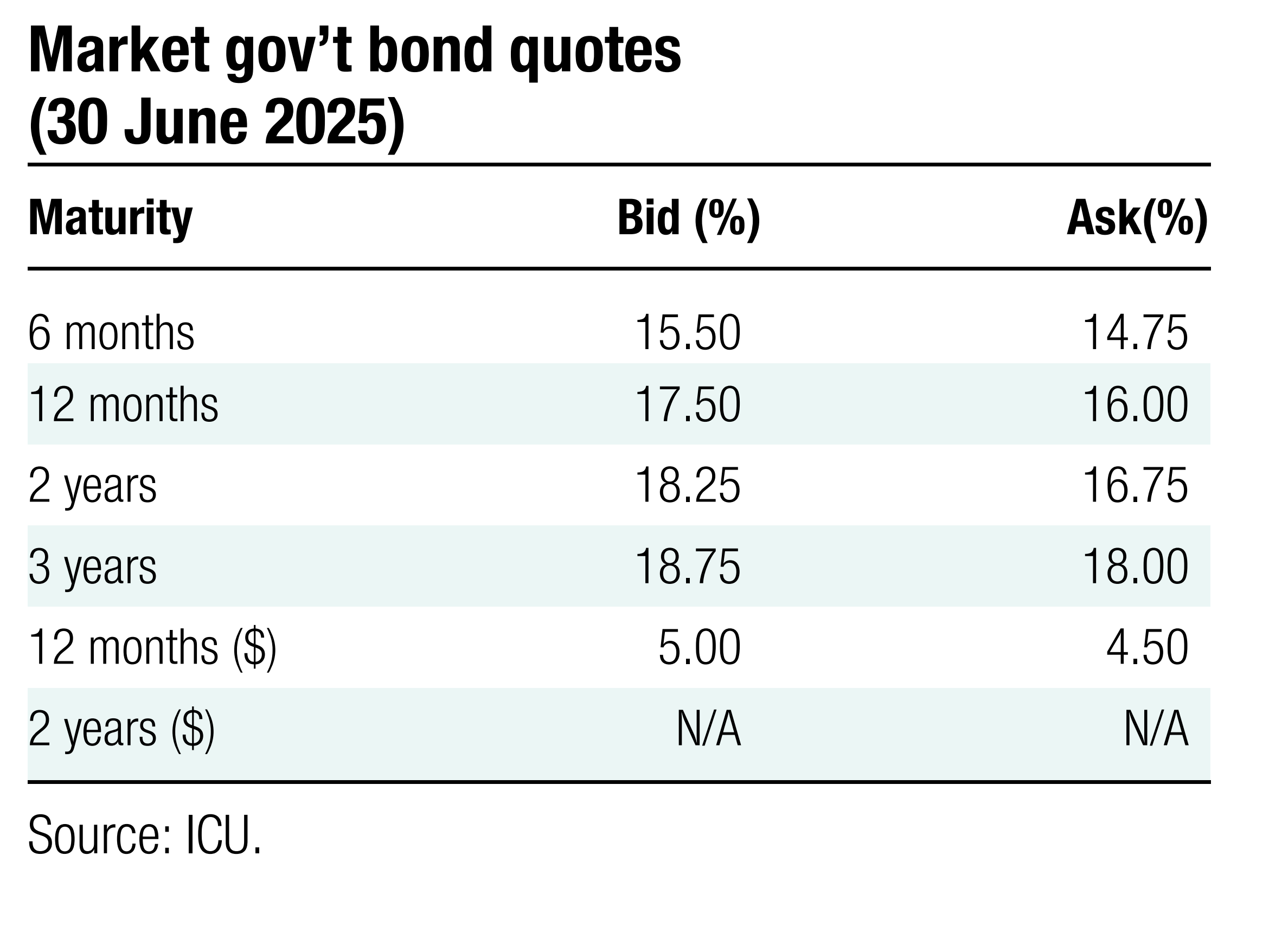

ICU view: In the UAH segment, the MoF is experiencing moderate demand, as it has not offered any short-term bonds and reserve notes. Consequently, the MoF is unable to refinance all redemptions. The MoF’s reluctance to scale up borrowings may imply it expects that yields might start declining later as the NBU may switch to monetary policy easing cycle from September. However, due to low UAH redemptions in 3Q25, the MoF may secure the monthly rollover rate for UAH debt above 100%.

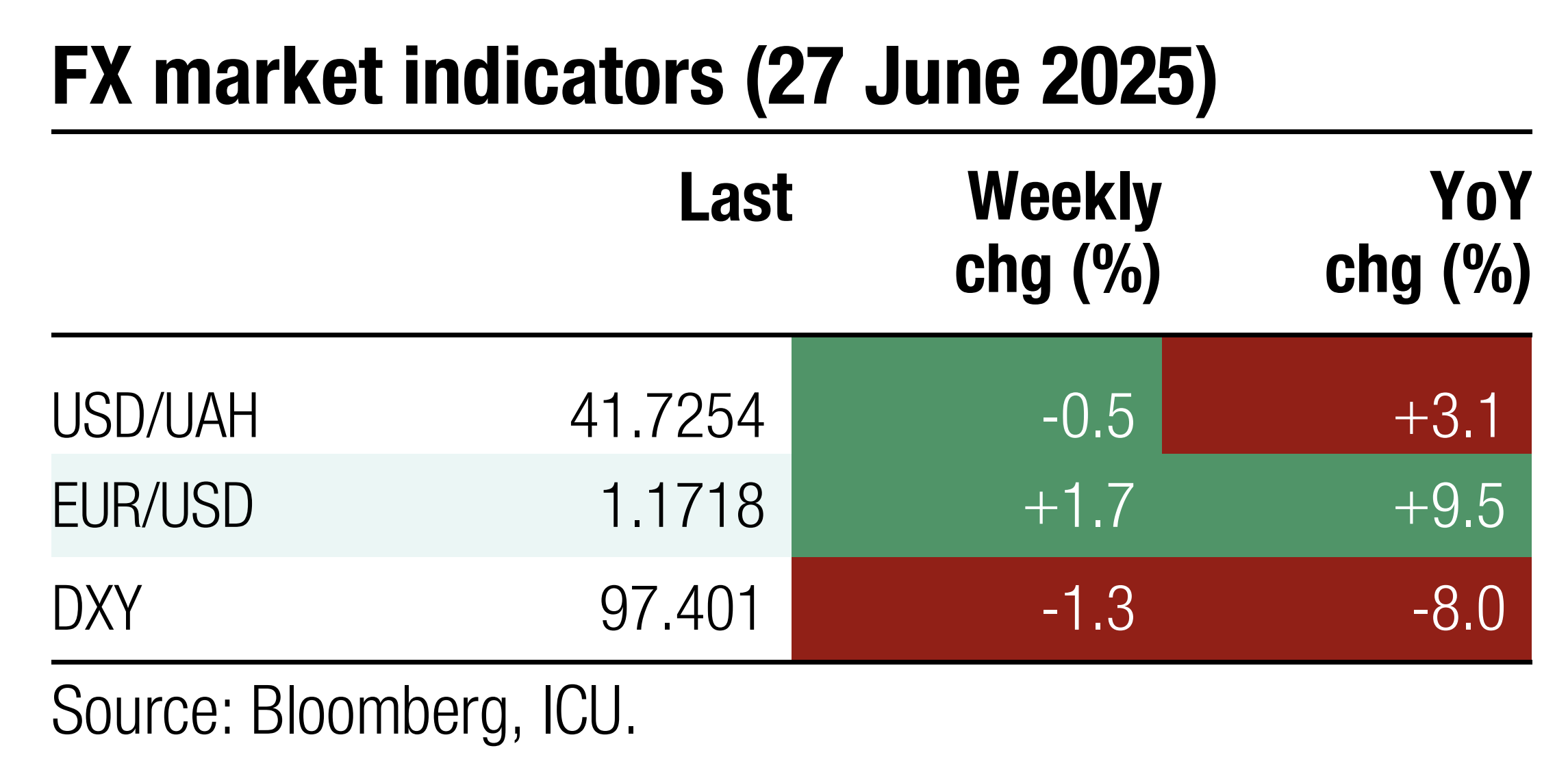

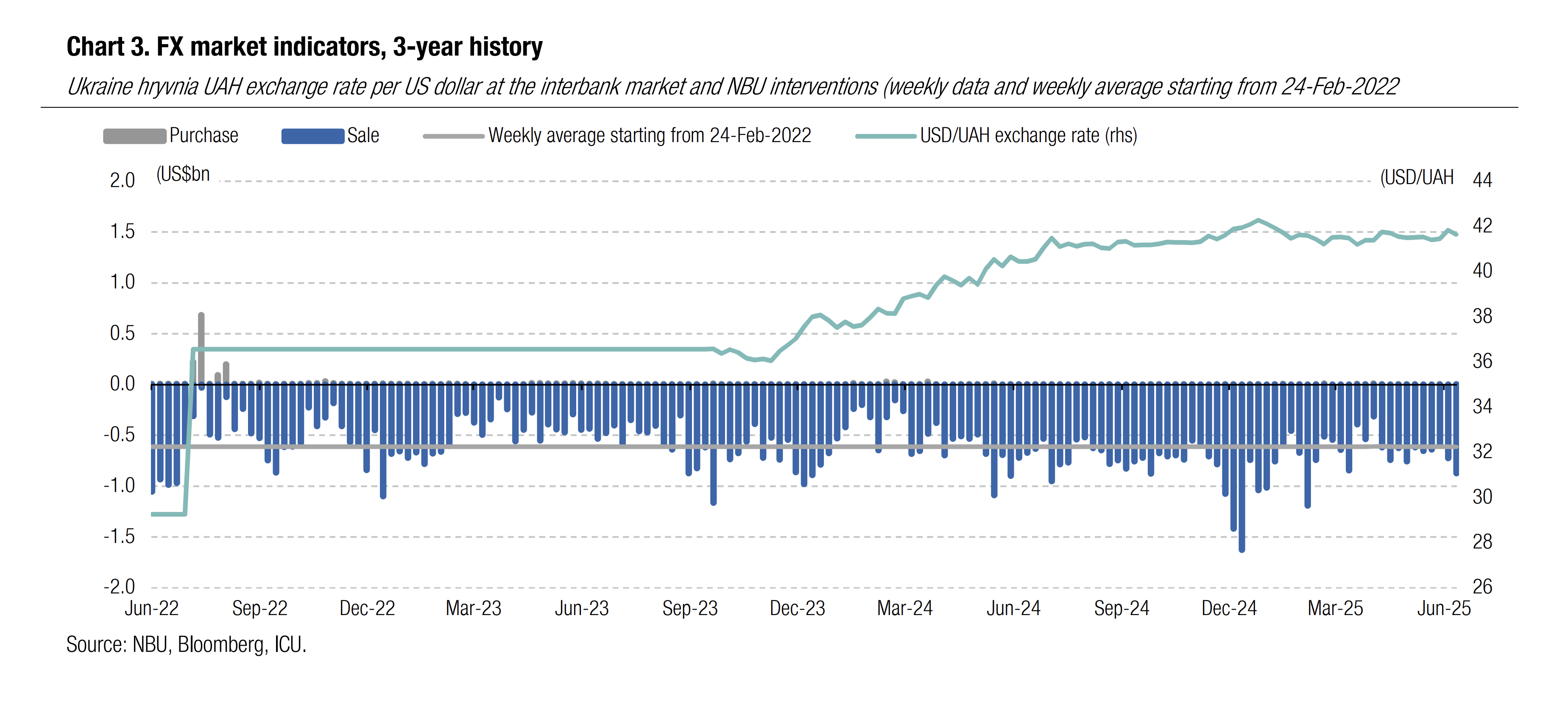

FX: NBU smooths excessive UAH fluctuations

The FX market deficit surged up in June forcing the NBU to increase interventions substantially to prevent hryvnia weakening below UAH42/US$.

The daily shortage of hard currency in the interbank FX market exceeded US$100m for nearly two weeks, while net purchases by households remained steady at approximately US$60-70m per week. As a result, the NBU had to increase its interventions to US$724m two weeks ago and to US$875m last week, the largest amount since February.

The official USD rate reached a peak last Monday at UAH41.87/US$, the highest level since January. However, sizeable interventions reversed the trend, and the hryvnia strengthened to about UAH41.6/US$ by the end of last week.

ICU view: This year, the NBU has not yet encountered such a prolonged foreign currency deficit in the interbank market. In recent weeks, the NBU's continues demonstrating its reluctance to move with a noticeable weakening of the hryvnia. However, the NBU may choose a marginally weaker hryvnia than in April-May and the first half of June.