|  |  |

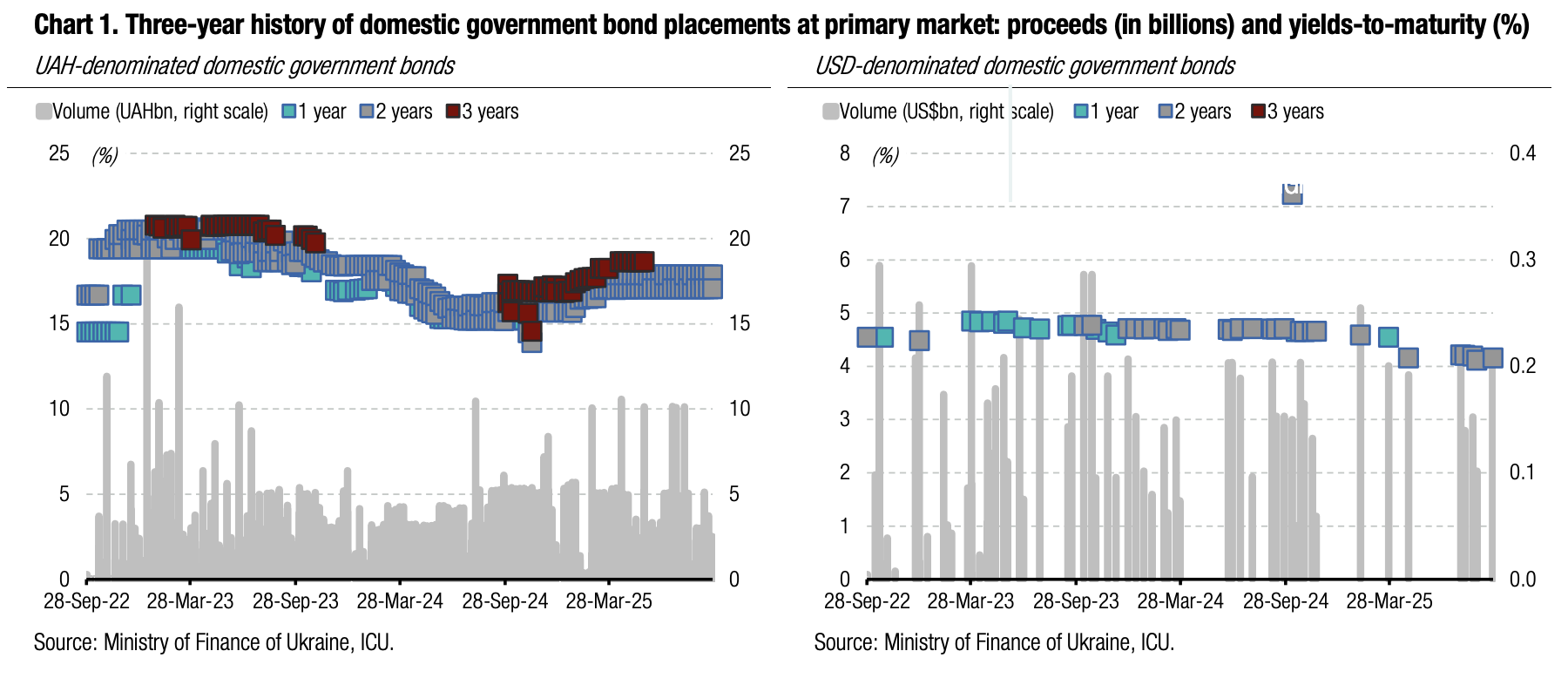

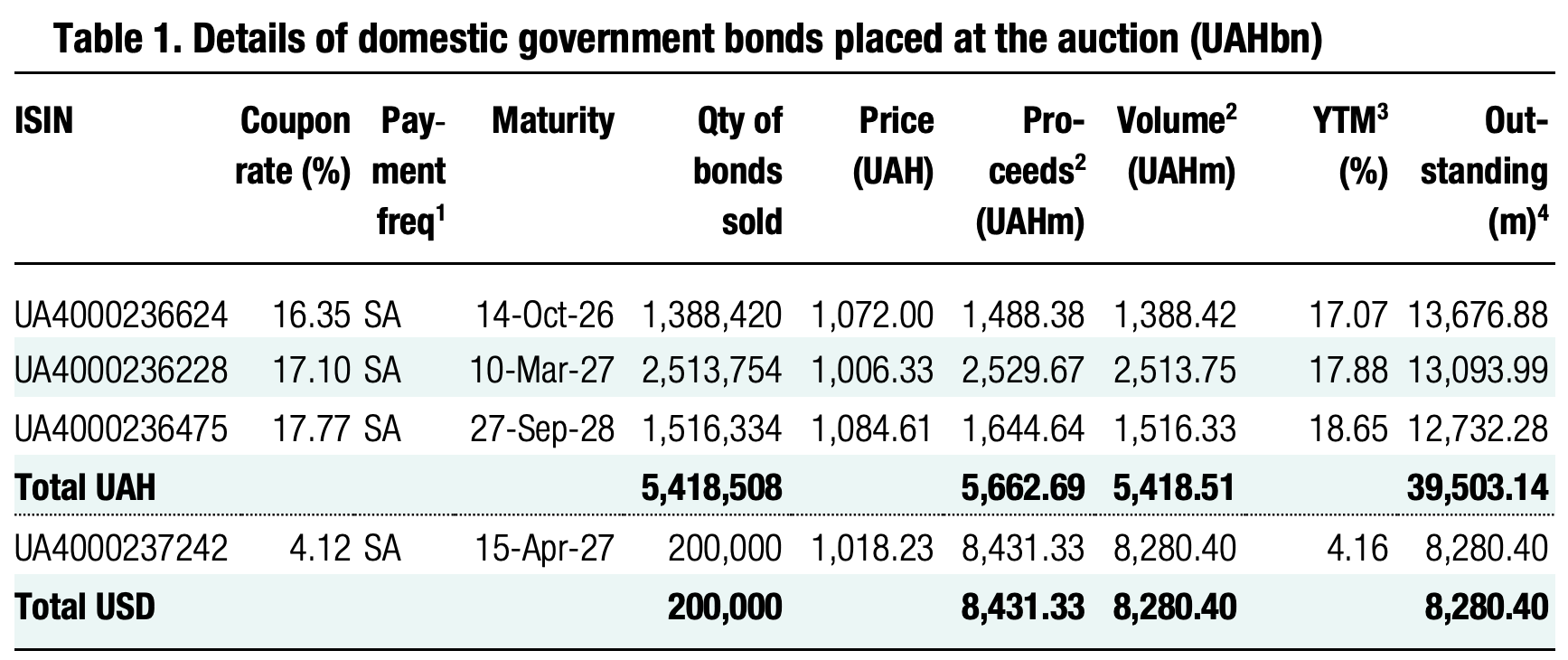

Yesterday, the Ministry of Finance almost doubled borrowings compared with last week, thanks to the new military USD-denominated bond offer.

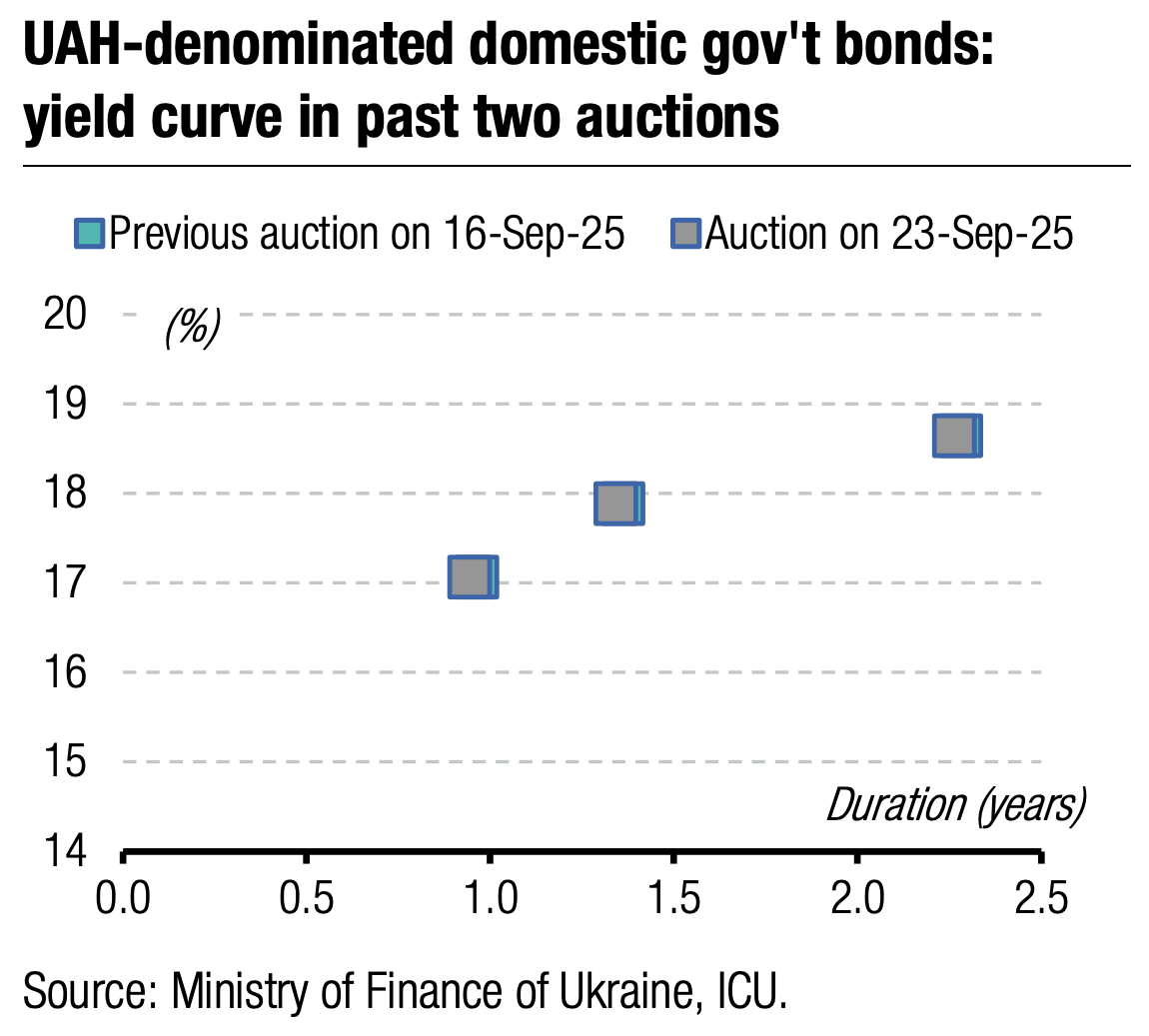

Demand for UAH bonds focuses on 1.5-year paper, which received the largest volume of bids yesterday – UAH2.5bn – the most for this bond in almost three months. One-year and three-year bonds collected UAH1.4bn and UAH1.5bn of bids, significantly less than last week. So, UAH bonds brought the budget almost UAH5.7bn, or a quarter less than the week before.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.4/USD, 48.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

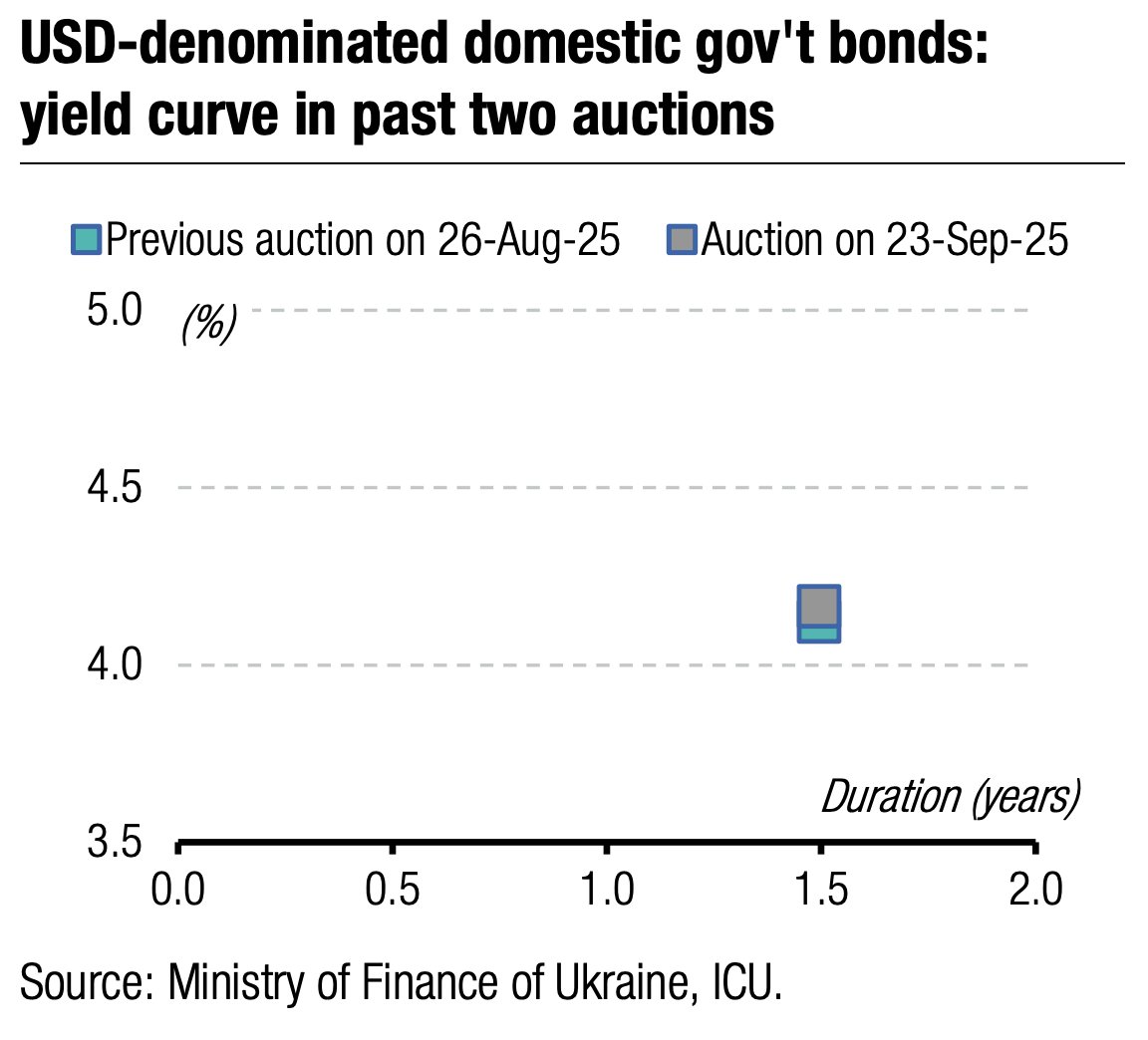

Yesterday's key offer was a USD-denominated bond. The Ministry offered US$200mn of securities with maturity in April 2027 and saw 20% oversubscription. Again, these were military bonds, not ordinary bonds like the previous paper sold in August.

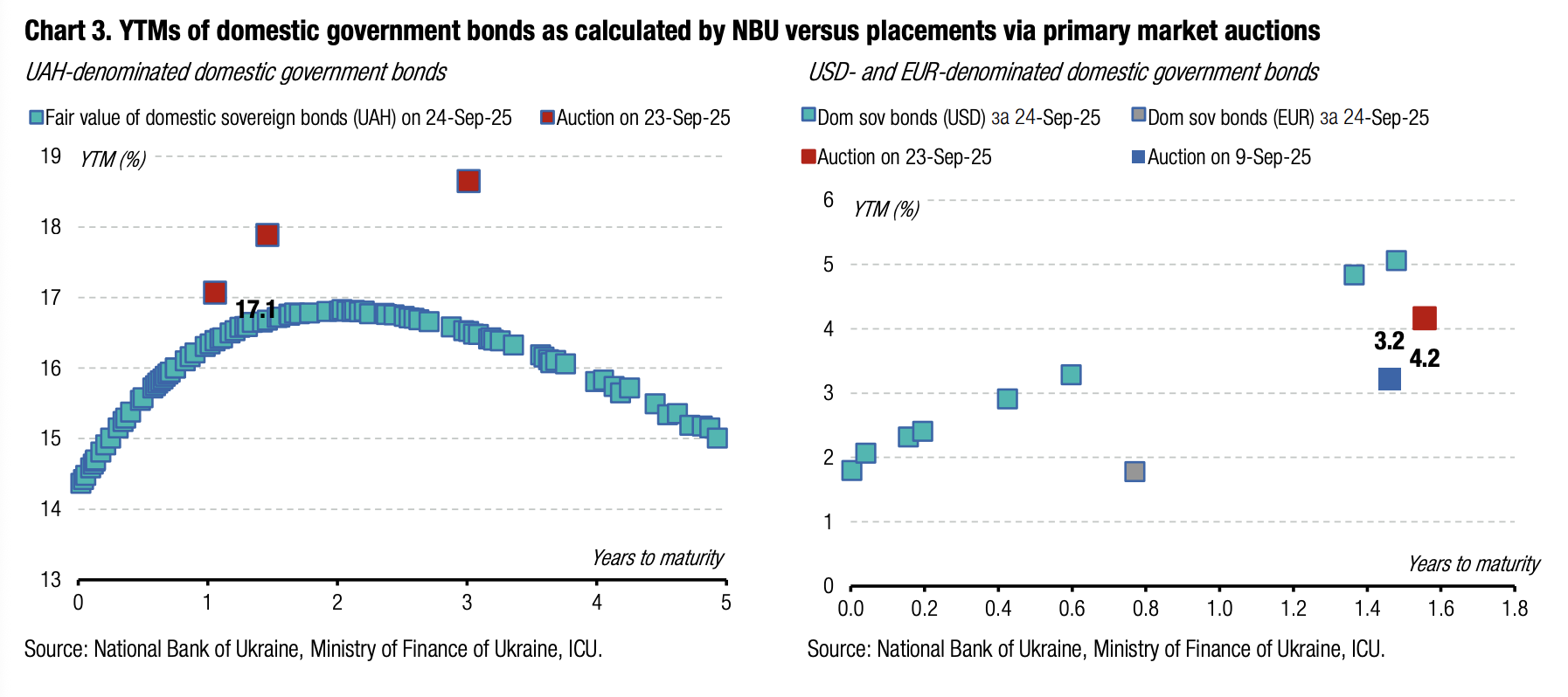

The MoF received 74 bids for USD-denominated bonds with rates from 4% to 4.8%, but satisfied 72 at the usual parameters, maintaining the cut-off rate of 4.15% and slightly increasing the weighted average rate to 4.12% from 4.08%.

The Ministry rejected only two bids that required an increase in the cut-off rate. However, they were unlikely to be more than US$42mn, so some participants purchased fewer bonds than they wanted and will try to buy additional USD-denominated securities next week. Therefore, the weighted average rate may decline again.

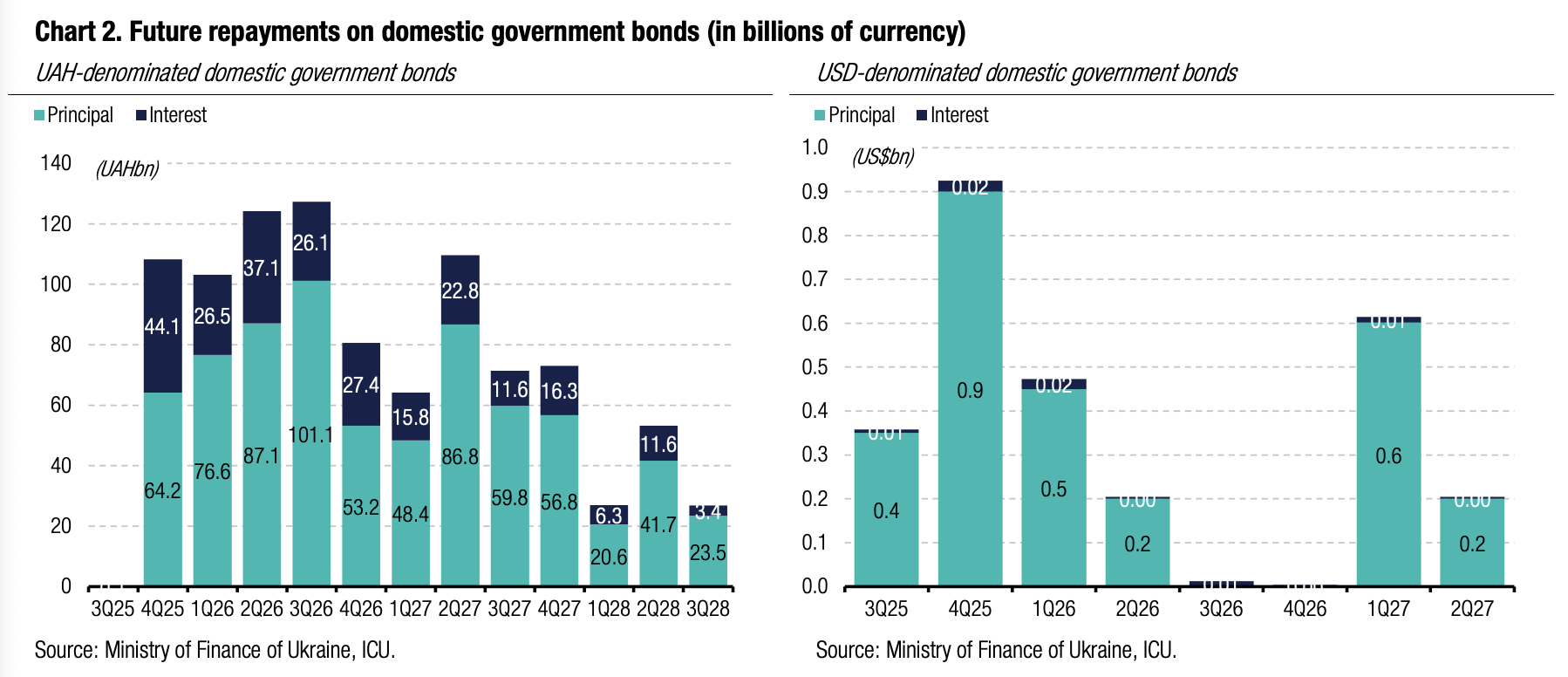

Appendix: Yields-to-maturity, repayments