Natural gas production in Ukraine in 2018: on the threshold of change

Recent deregulation steps may significantly bolster the sector

According to Ukrtransgaz, in 4M18, natural-gas production in Ukraine declined 1% YoY to 6.8bcm. Over-regulation of the sector adversely affected the numbers: jumps in royalty tax rates during recent years, bureaucracy, and the complexity of the licensing system spooked investment away from the capital-intensive oil and gas sector. At the same time, Ukrainian companies find it increasingly difficult to restrain the natural decline in gas extraction from mature Ukrainian deposits, most of which have a long lifetime.

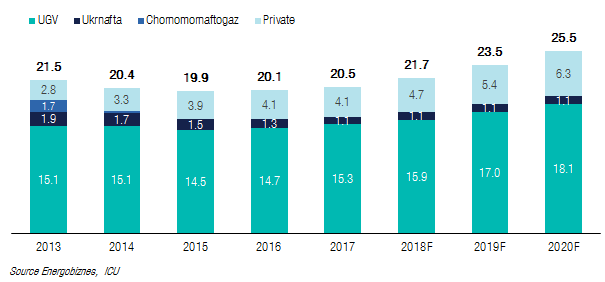

But over the past few months, the state regulation of the oil and gas industry has undergone radical positive changes, which can significantly revive business activities in the sector this year. According to the Association of Gas Producers of Ukrainian, the volume of drilling may increase by 35% this year. In general, the Association expects an increase in gas production by 7%, to almost 22bcm this year. The forecast is very optimistic, but there still is a possibility it will be realized. Our expectations are more cautious. Gas production in Ukraine may grow by 4 to 6% in 2018, to 21.3–21.7bcm. But if deregulation becomes a stable trend, volume growth may significantly accelerate and reach 25–26bcm in 2020.

Natural gas production in Ukraine, bcm

Rules of the game change: good progress already, but further steps should be made

During the last four to five months, important legislative changes for the industry were adopted. First, in December 2017, rent rates for natural gas extraction were reduced to 12% from 29% for wells up to 5,000 m deep, and to 6% from 14% for wells with a depth of more than 5,000 m. New rates are fixed up to 2023 as a guarantee of an unchanging tax regime. Decentralization of the rent is also important: starting this year, 5% of the rent paid by gas-production sector companies will be allocated to local budgets, which will also motivate local authorities to provide extraction and land allotments to gas producers.

Also, in 1Q18, the Cabinet of Ministers and the Verkhovna Rada adopted a number of legal acts that significantly simplified the rules for developing oil and gas fields, facilitated access to production sites and reduced the number of permits.

All these changes considerably increase the attractiveness of the oil and gas industry for investments, which will not only help to increase extraction volumes, but will also motivate large industry players to come to Ukraine and bring with them more advanced technologies and better business practices. To do this, however, investors still need to be reassured in the effectiveness of these changes. Thus, the government needs to continue deregulation, to establish a transparent system of auctions of new licenses, and also to carry out modernization of laws on oil and gas extraction and the Code on Mineral Resources in accordance with European norms.

State companies: new impulse for development, old problems with effectiveness

State companies continue to play a critical role in gas extraction. Changes in the regulation of domestic gas prices significantly improved Naftogaz's ability to finance extraction. But low efficiency of public administration, problematic relationships with regulatory bodies and local councils cause great difficulty for state companies to increase gas production.

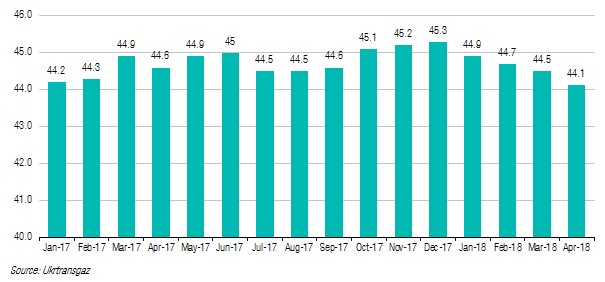

Daily volume of gas extraction by Ukrainian state companies, mcm

Naftogaz’s production branch UkrGasVydobuvannya (UGV) has more than 73% of the total volume of gas extraction in Ukraine. In 2018, UGV plans to increase gas production by 600mcm, or by 3%, to 15.9bcm. The company is pursuing an ambitious "Program 20/20", according to which gas extraction should increase by 4.7bcm, up to 20bcm in 2020. But the success of achieving such an ambitious goal is becoming more and more questionable. The company has so far failed to carry out the drilling plan according to the schedule, and observers point out the slow involvement of external contractors and, in particular, foreign service companies with modern drilling equipment. At the beginning of the year, UGV has already announced a 3% reduction in the 2018 production plan, and accused local authorities in the Poltava region for not providing permits for the subsoil use. Nevertheless, due to the reform of gas prices and the resulting improvement of the financial position of Naftogaz, UGV now has far more opportunities to invest in production, with budgeted capex up to about US$1bn versus US$200–250m in 2015–16.

Ukrnafta, the second-largest gas producer in Ukraine, continued to decrease production volumes due to a lack of exploration and production investments, even despite oil prices starting to rise beginning last year. In 2017, the actual drop in production (14.8%) was almost the same as the natural decline rate of 15%, indicating catastrophically insufficient drilling volumes. In addition, regulatory barriers affected Ukrnafta even more than UGV, due to the blocking of special permits in six production fields. The company believes that it is possible to increase investments in production from UAH0.6bn to UAH3.1bn assuming high oil prices this year. But prolonged underinvestment in exploration and production during previous years makes recovery in output quite problematic. Even stabilization of production volumes in 2018 is becoming difficult, given that the average monthly volume of gas production of Ukrnafta continues to decrease, and April’s daily output declined 6% YTD.

Private companies: contribution will further gain strength

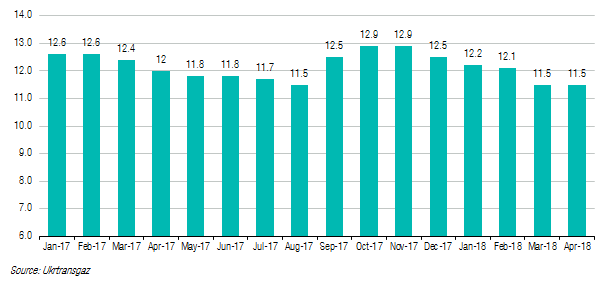

While the public sector struggles to increase gas production, the role of private businesses continues to grow. In 2017, the private sector held only 20% of the total volume of gas production, but in the period from 2015 to 2017, its production grew by 6%, compared with 2% growth of state companies. Private players can provide most of the extra cubic meters this year. If the key private companies succeed in realizing their ambitious plans, their share in total production may increase to 25–30% in 2020, and production will increase by 45–70%, to an annual 6.3–7bcm.

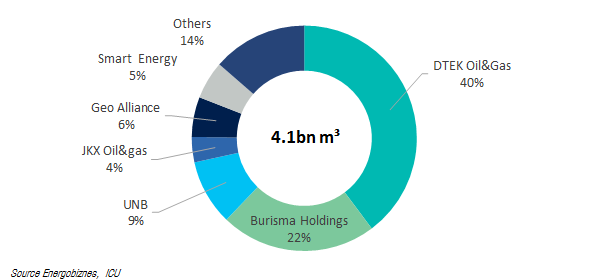

Gas production by private companies in Ukraine in 2017

Daily gas production of private companies, million m3

The largest private player, DTEK Oil & Gas, plans to increase gas production to 3bcm from the current 1.65bcm per year by 2020. Last year, DTEK Oil & Gas drilled one well and started drilling a second one, reconstructed the Machuhska plant for gas preparation, and also carried out work on the intensification and repair of existing wells. The company plans to commission three to four new wells annually, which can give 50–100mcm each in the first year of operation.

The second largest private mining company, Burisma Holdings, drilled 16 new wells in 2017. However, gas production last year dropped by 11%, to 0.9bcm, although the company had planned to increase production to 1.5bcm. This year, the company plans to drill another 16 wells, and drilling and infrastructure capex will amount to US$150m.

The third largest producer, Ukrnaftoburinnia, in 2017 increased production by 50% to 390mcm. As of the end of 2017, the company has drilled three wells. In 2018, the company plans to increase production by another 50%.

The rest of the private players, first of all such companies as Smart Energy, Geo Alliance, and JKX Oil & Gas, also have a chance to significantly increase production in 2018.

Overall, there are possibilities for Ukrainian companies to break the current negative trend in gas production. Of course, there are high risks that producers will not have enough time to substantially increase their volumes in 2018. But it is already quite likely that we will see rapid growth of the industry in the next two to three years.