Naftogaz Eurobond issue has to sit out the 2019 elections storm

Last week, Naftogaz of Ukraine postponed its five-year $500m Eurobond issue citing volatile market conditions and elevated funding levels. We think that the key reasons for the issue’s failure were fragile investor sentiment in the global financial markets, and a host of political risks facing Naftogaz in the run-up to the presidential and parliamentary elections in 2019. Should the elections clear visibility of Ukraine’s outlook in the eyes of investors, Naftogaz may return to the markets with a new offer as soon as the autumn of 2019.

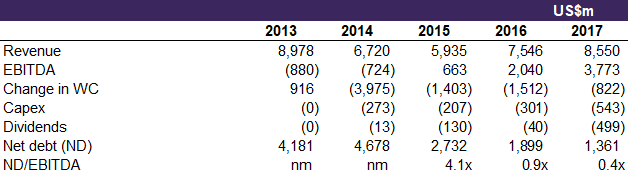

Raising $0.5-1bn in the financial markets would be quite helpful for Naftogaz. According to market sources, the company was going to make $200-300m FX debt redemptions in 4Q18. In addition, the company is a significant contributor to the state budget, and should transfer around UAH16bn or $570m of dividends by the end of the year. At the same time, Naftogaz has an ambitious and capital-intensive exploration and production programme of raising its output of natural gas from 15bcm in 2017 to 20bcm in 2020. In 2017, the company’s capex increased by 46% to $540m, and we expect it to remain at similar elevated levels in 2018-20.

Naftogaz initially set the Eurobond pricing in the 10.9% area, approximately 150bps wide of the sovereign. However, market participants responded to Naftogaz’s offer with a wide range of price views that ultimately did not allow the company to reach the required size with an affordable yield. According to some investors, political uncertainty around the company warrants a 200-300bps spread over the respective Ukrainian sovereign. Among the most sensitive issues, potential buyers of Naftogaz notes mentioned pending litigation with Gazprom, dim prospects of future transit of Russian gas, and lack of clarity in the planned unbundling of the company.

Some of these concerns are quite arguable. For example, consequences of the legal dispute with Gazprom are unlikely to turn negative for Naftogaz, as the Swedish Court of Appeals has made the final ruling in favour of Naftogaz, with Gazprom having exhausted all alternative ways to counter. While the timing of the $2.56bn award payment to Naftogaz remains highly uncertain, Fitch has already accounted for this risk and excluded the amount from Naftogaz’s receivables for rating purposes. As for the issues of unbundling and gas transit, they are closely related in their low impact on the company’s future cash flows, as the unbundling actually means a spin-off of the transit business, which should still leave the company’s debt/EBITDA well below 1x.

Still, investors’ overall cautious attitude towards Naftogaz is justified given the company’s heavy vulnerability to politics, especially given the approaching Ukrainian double elections in 2019. Many investors still question the readiness of the Ukrainian authorities to continue converging gas prices for the population with the market prices. It was artificially low gas prices that made Naftogaz’s business heavily lossmaking as recently as before 2015. The timing of the issue does not look ideal either against the backdrop of volatile financial markets, rising interest rates, and growing cautiousness towards emerging economies.

As a result, order books reflected approximately $0.7bn of interest, an amount obviously insufficient to secure the average yield below 11%. It should be noted that state regulations do not allow the cost of the company’s FX borrowing to exceed 11% this year.

We may see significant interest of investors returning to Ukrainian instruments only after reassuring results of the elections, maybe next autumn, as the best case. During that period, our corporates may see an opportunity of a window opening in the financial markets. And we see Naftogaz as the most likely to try and seize this opportunity.

Financial statement highlights of Naftogaz

Sources: Naftogaz, ICU