Edward Lucas: Ukraine’s energy inefficiency is an opportunity for capital markets

Edward Lucas, acclaimed author, former senior editor at the Economist, and energy, intelligence, and cyber-security expert was a keynote speaker on the energy panel of the Ukrainian Financial Forum 2018. He provided many insightful and colourful observations for the audience and Ukraine’s reformers. One of them is Ukraine’s stark energy inefficiency, which may offer lucrative opportunities for investors.

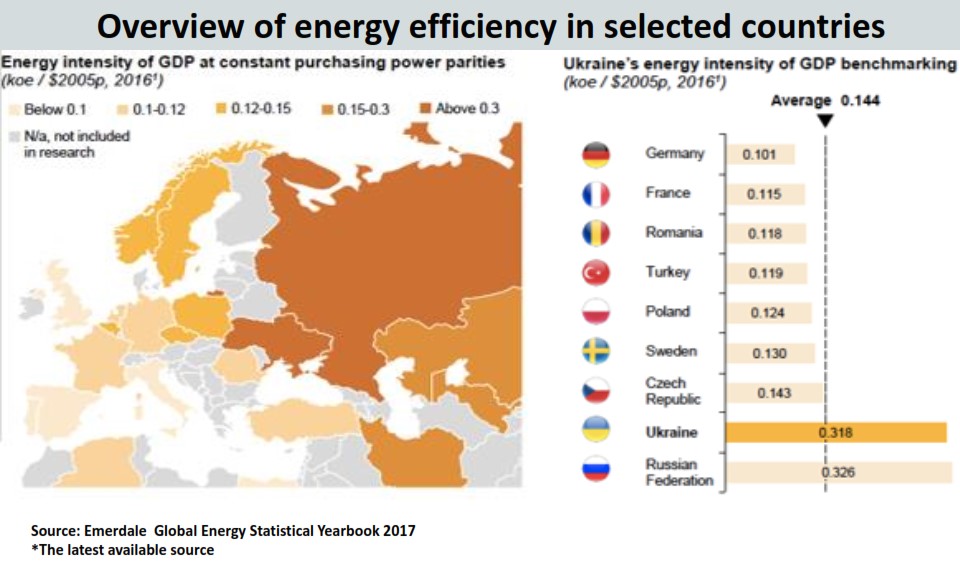

Ukraine has demonstrated substantial progress despite considerable difficulties, including making significant progress in the energy sector. However, the Ukrainian energy system remains one of the least efficient in Europe. With energy intensity of 0.318koe per thousand dollars of GDP, it exceeds the European average by 2.2x, as Lucas demonstrated on his slide overviewing energy efficiency in Europe.

“I suggest this picture of Ukraine’s incredible energy inefficiency be put on every Ukrainian policymakers’ phone screensaver, be framed and hung on their bedroom walls, and be displayed on their desks at work so they’re reminded of it constantly.” Lucas went on to say that what’s at stake here is a large pool of money that could be invested in the economy, but instead is being spent on non-productive uses like heating bills. “Compare Ukraine with Poland and the Czech Republic. Polish energy efficiency in 1989 was about the same as Ukraine’s is right now. Today, Poland has caught up with and overtaken Sweden.”

There’s an opportunity here, though, and it involves the capital markets. Something capital markets are really good at is taking a stream of future payments and turning them into an up-front, lump sum. If foreigners saw that Ukraine’s energy inefficiency was going to be solved, they would be eager to invest in Ukraine. This would add to the tax base, benefit consumers, and, in general, create a virtuous cycle. All Ukraine needs to bring this about is a predictable regulatory regime.