Yesterday, the MoF held its debut swap auction to exchange bonds due in a week for two-year paper.

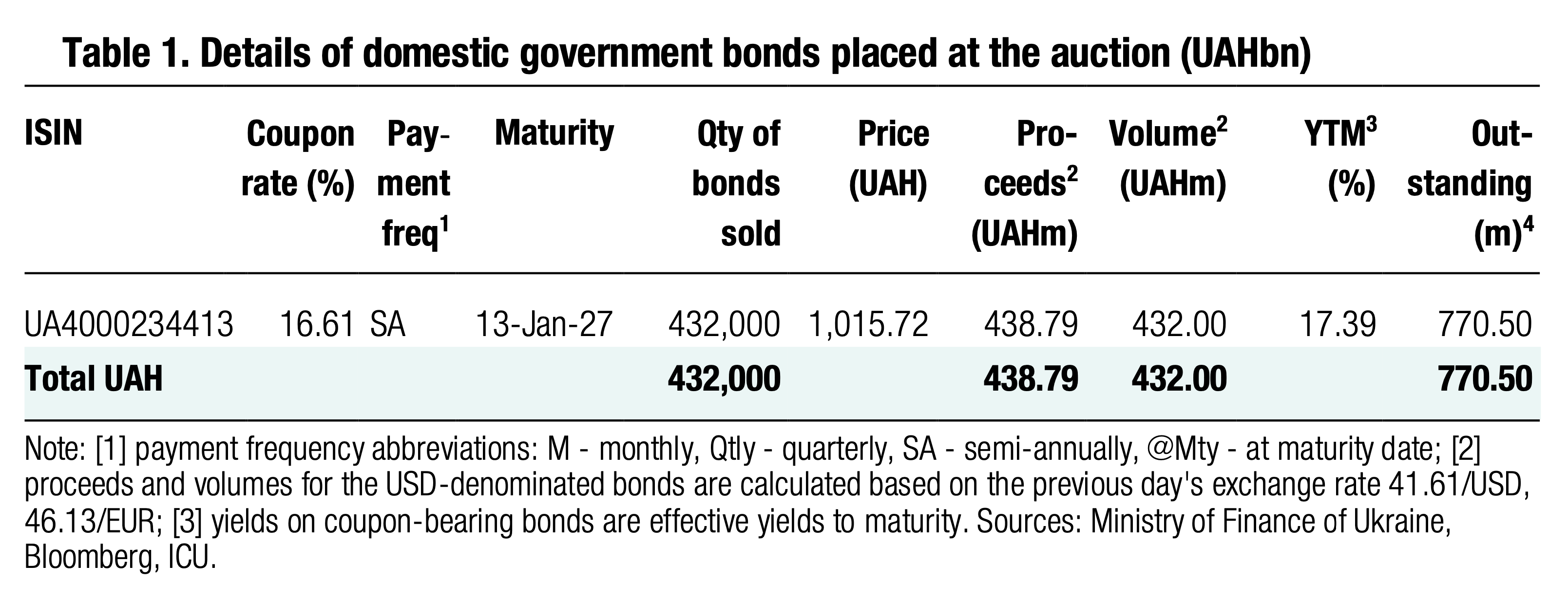

The MoF offered the market a deal to exchange bonds maturing on February 26 with UAh41bn of two-year paper at par due January 2027. Bidders had to send a bid for a quantity of new bonds, which would be paid for with old securities. The settlement date is this Friday.

Bondholders likely had limited time to prepare for their participation, and there were just a few bids. The MoF received just eight bids for UAH432m with interest rates equal to last week's cut-off rate.

Nevertheless, the paper maturing next week is a very tradable bond, with over UAH6bn of deals YTD. Therefore, for many holders, it was short-term paper, and most of them were not ready to swap it for two-year bills.

In general, this debut swap auction was successful, and we anticipate further auctions with better combinations of securities.

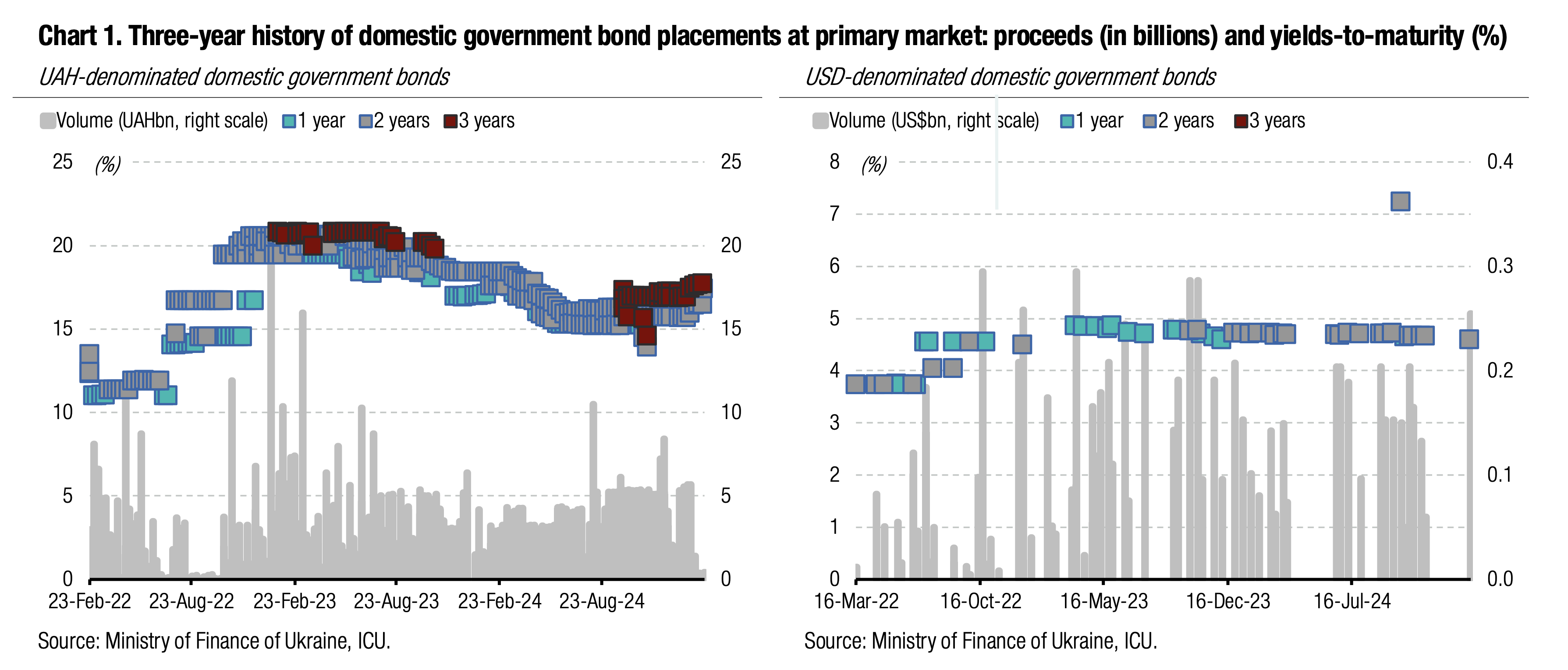

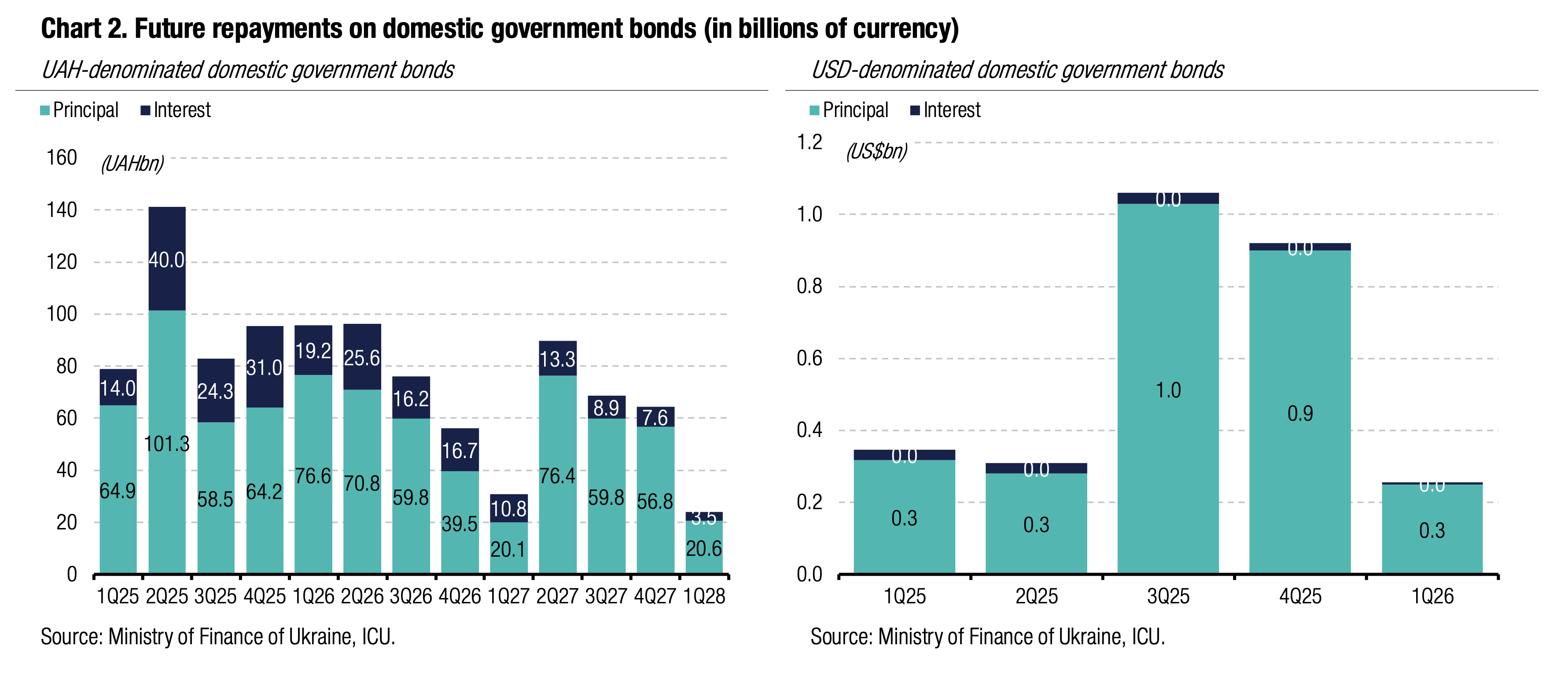

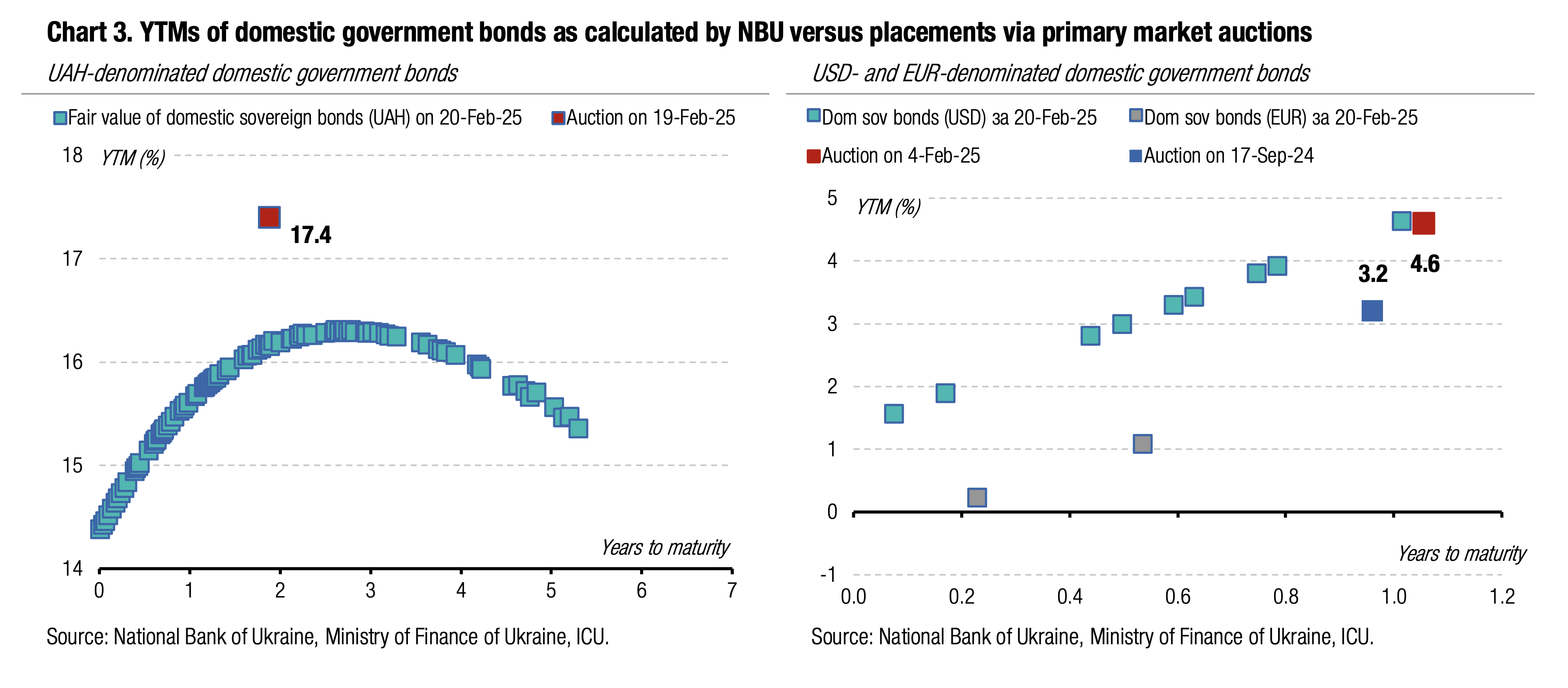

Appendix: Yields-to-maturity, repayments