|  |

|  |

Bonds: Domestic debt rollover up in May

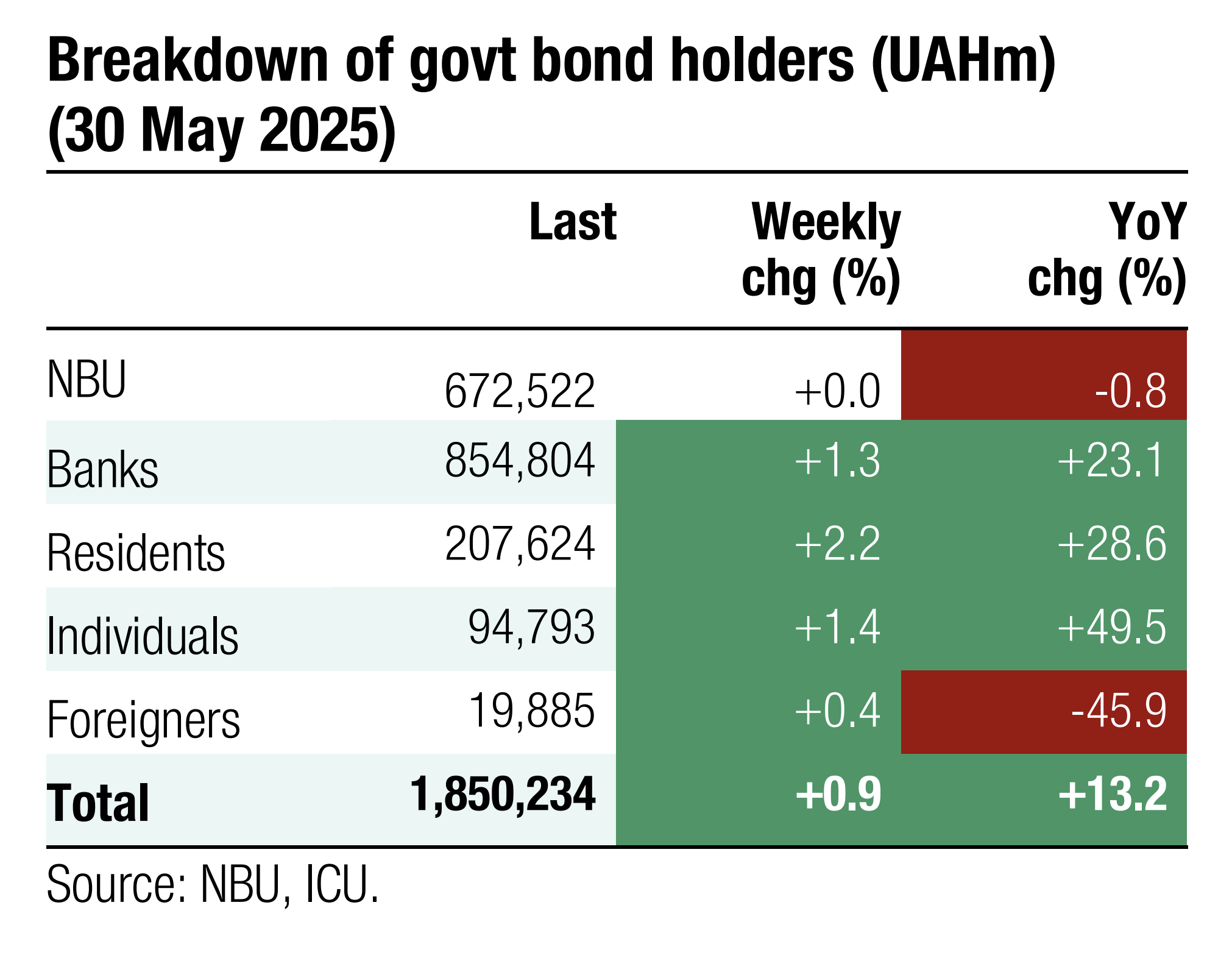

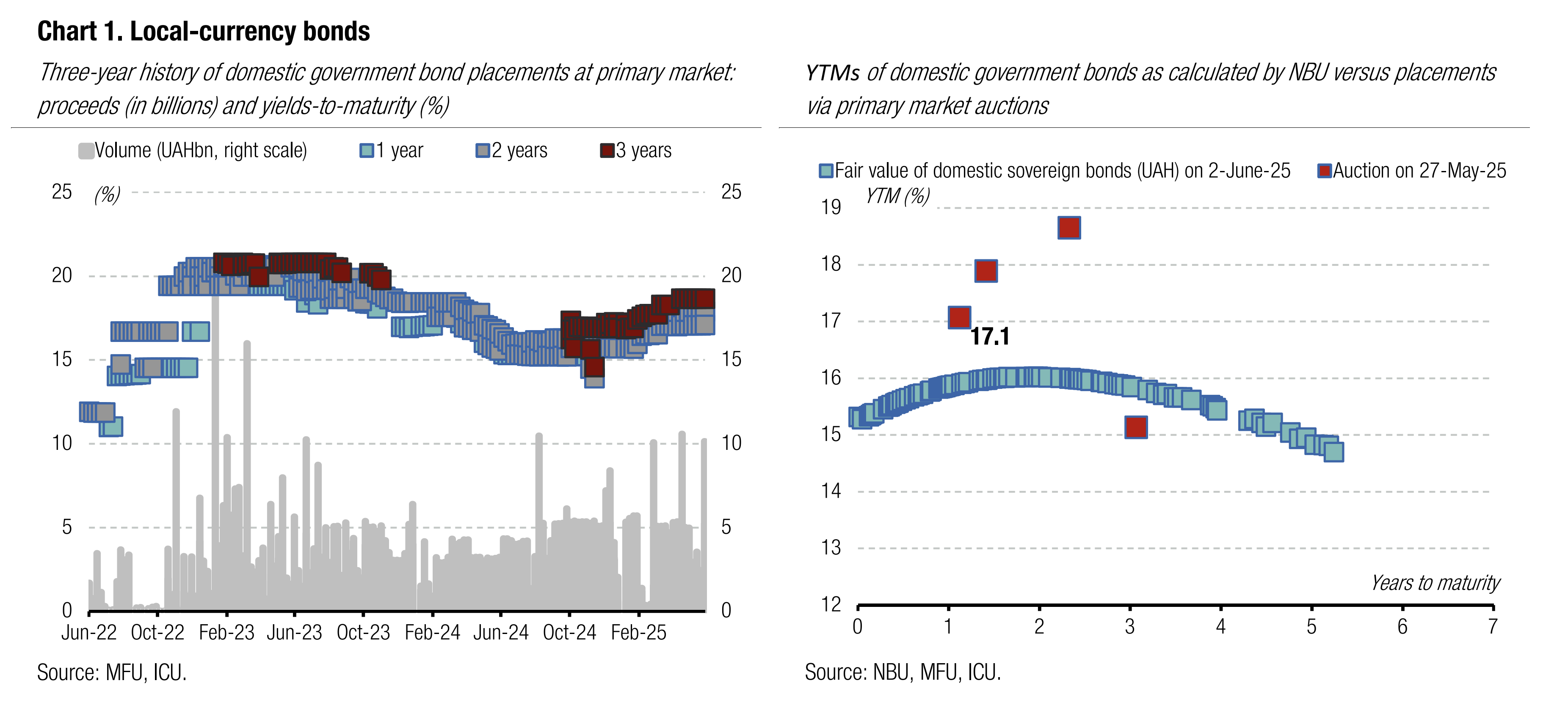

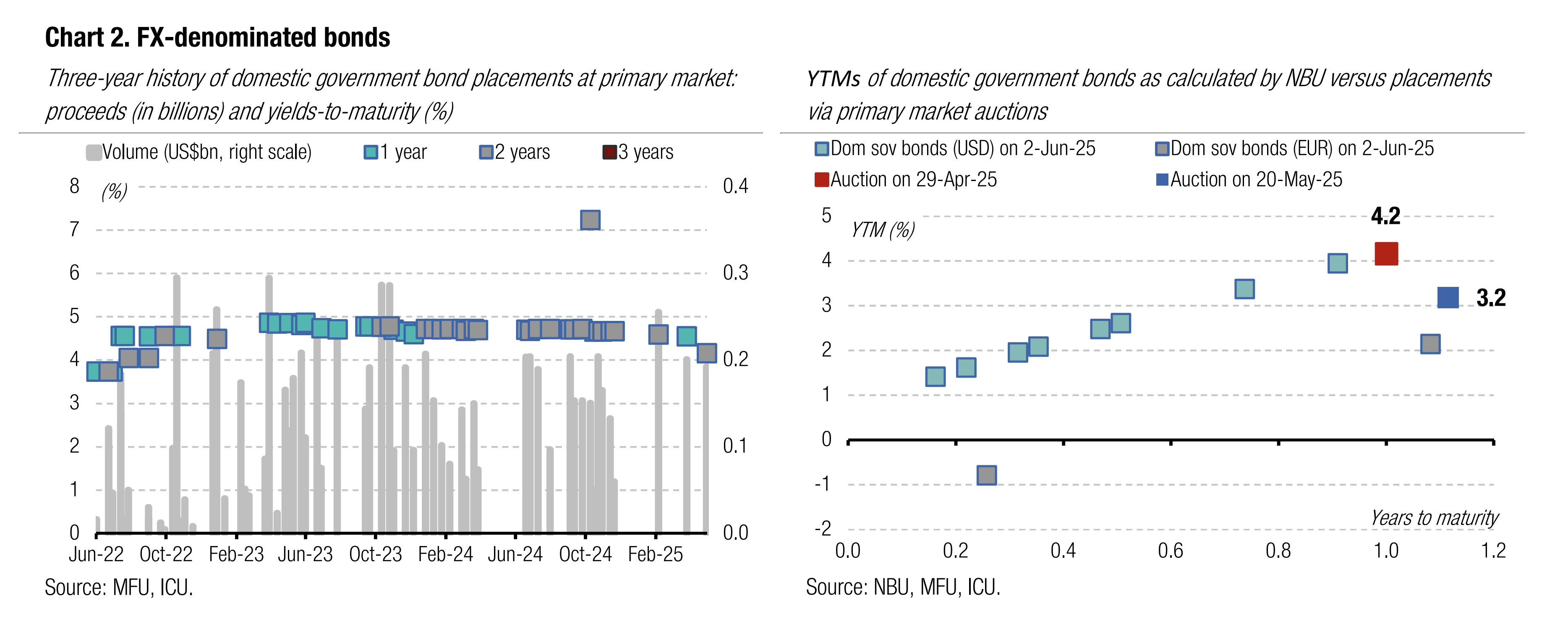

In May, the MoF faced only minor redemptions and managed to increase domestic debt rollover substantially.

Last month, the MoF redeemed bonds worth EUR156m and UAH13bn while borrowing EUR200m and UAH33.3bn. As a result, the April rollover ratio was 256% for UAH debt and 128% for EUR-denominated debt. YTD figures for the UAH debt rollover improved to 103% in 5M25 (89% in 4M25). Likewise, the EUR debt rollover rose to 82% in 5M25 from 59% in 4M25. Domestic debt rollover in all currencies increased to 94% in 5M25 from 82% in 4M25.

The recent offering of reserve bonds was the main contributor to an uptick in the rollover rate last month. The new bonds were oversubscribed 4x, and were sold at a weighted average rate of 14.56%. This rate is 64bp above the rate on a similar note issued at the end of January. See details in the auction review.

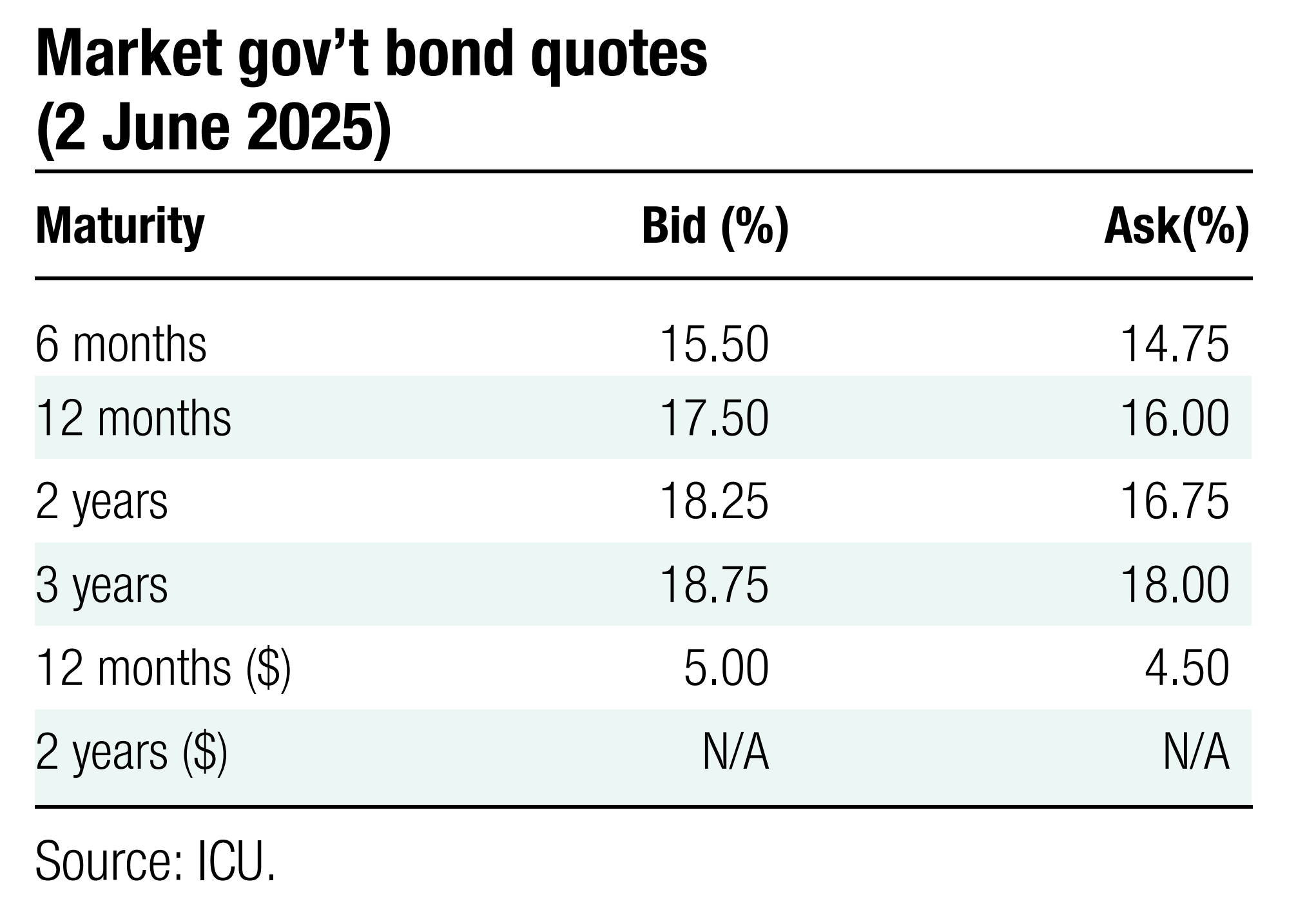

The MoF must redeem UAH40.6bn of bonds in June, and there are no scheduled redemptions in hard currency. To maintain the current rollover ratio, the MoF borrowings need to average at UAH10bn per week, which seems unrealistic if reserve bonds are not added to the offerings. The current auction schedule for June only includes military and regular bonds.

ICU view: The MoF resumed offering reserve bonds at the end of May and sold UAH10bn worth of the new securities. The NBU will likely soon include them in the list of bonds that banks can use to meet the mandatory reserve requirements. This placement contributed almost a third to all UAH borrowings in May and was instrumental in improving the rollover rate YTD. However, the rollover may again decline in June as the MinFin will face difficulties in raising UAH40bn if reserve bonds are not added to the offerings. The new three-year note (maturity in November 2028) added to the offer pipeline in June is unlikely to be designated as a reserve bond and unlikely to face significant oversubscription.

Bonds: Ukraine in default on VRIs

Ukraine missed the scheduled payment on VRIs and is no longer under time pressure to negotiate the restructuring terms.

The MoF informed that it’s not making today’s scheduled payment on VRIs totalling US$665.5mn based on GDP growth in 2023. The 5.5% GDP increase in 2023 was a bounce following the economy's collapse in 2022 due to a full-scale russian invasion. In 2024, the Cabinet of Ministers suspended payments on both Eurobonds (the payments were subsequently resumed after a successful restructuring) and VRIs. The MoF reiterated that the moratorium on VRI payments will remain in place until the restructuring is completed. The government expects to reach a fair and comprehensive restructuring deal on the GDP-linked warrants that ensures long-term debt sustainability without threatening Ukraine's recovery and reconstruction.

The government failed to agree to restructuring terms with VRI holders in April as the parties’ starting proposals were too far apart. Last week, VRIs' price declined 3% to 73 cents per dollar of notional value, reflecting the broader sentiment toward Ukrainian debt.

ICU view: While VRI holders had little hope for any cash payments based on 2023 GDP growth, they still expected the MoF would submit a new restructuring proposal with significant concessions. Now that a default has occurred, the government is no longer under time pressure to design a new proposal and likely feels it now has greater leverage over the process. The Eurobonds are technically unaffected by the default on VRIs as a cross-default clause was removed during the restructuring last year.

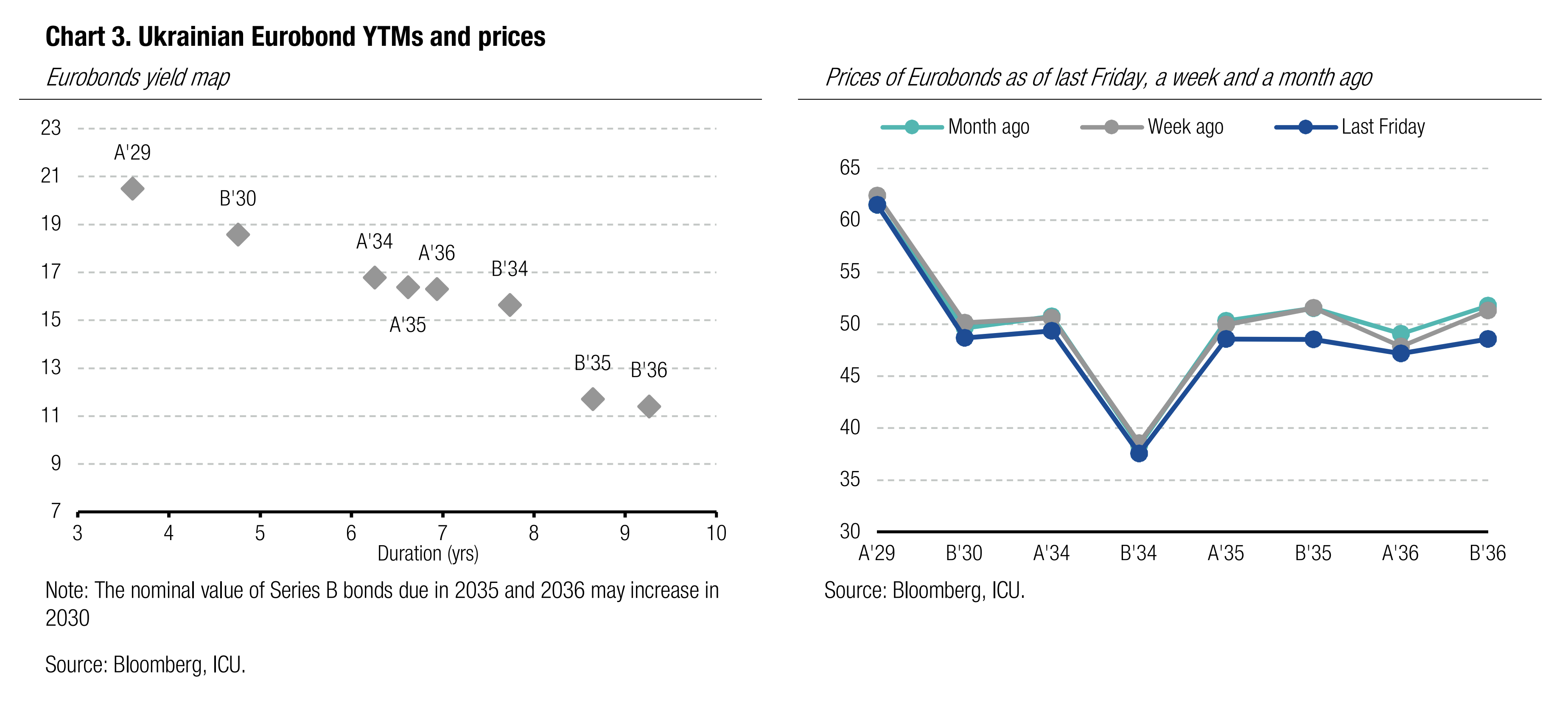

Bonds: Mood gloomier among Eurobond holders

The stall in ceasefire negotiations and recent large-scale aerial attacks on Ukraine made investor mood sour even further.

Last week, the preparations for the second round of negotiations yielded little hope for a productive meeting. russia refused to provide its list of realistic conditions for ceasefire, implying little chance for meaningful discussions in Istanbul.

Against this backdrop, Eurobond prices slid by 3.1% on average last week while the EMBI index rose by 0.6%.

ICU view: russia shows no interest in negotiations and is scaling up its daily aerial strikes on Ukraine’s civilian infrastructure with drones and missiles. Given this harsh reality, investors were not encouraged by a staff-level agreement reached between Ukraine and the IMF on 8th review of the EFF program.

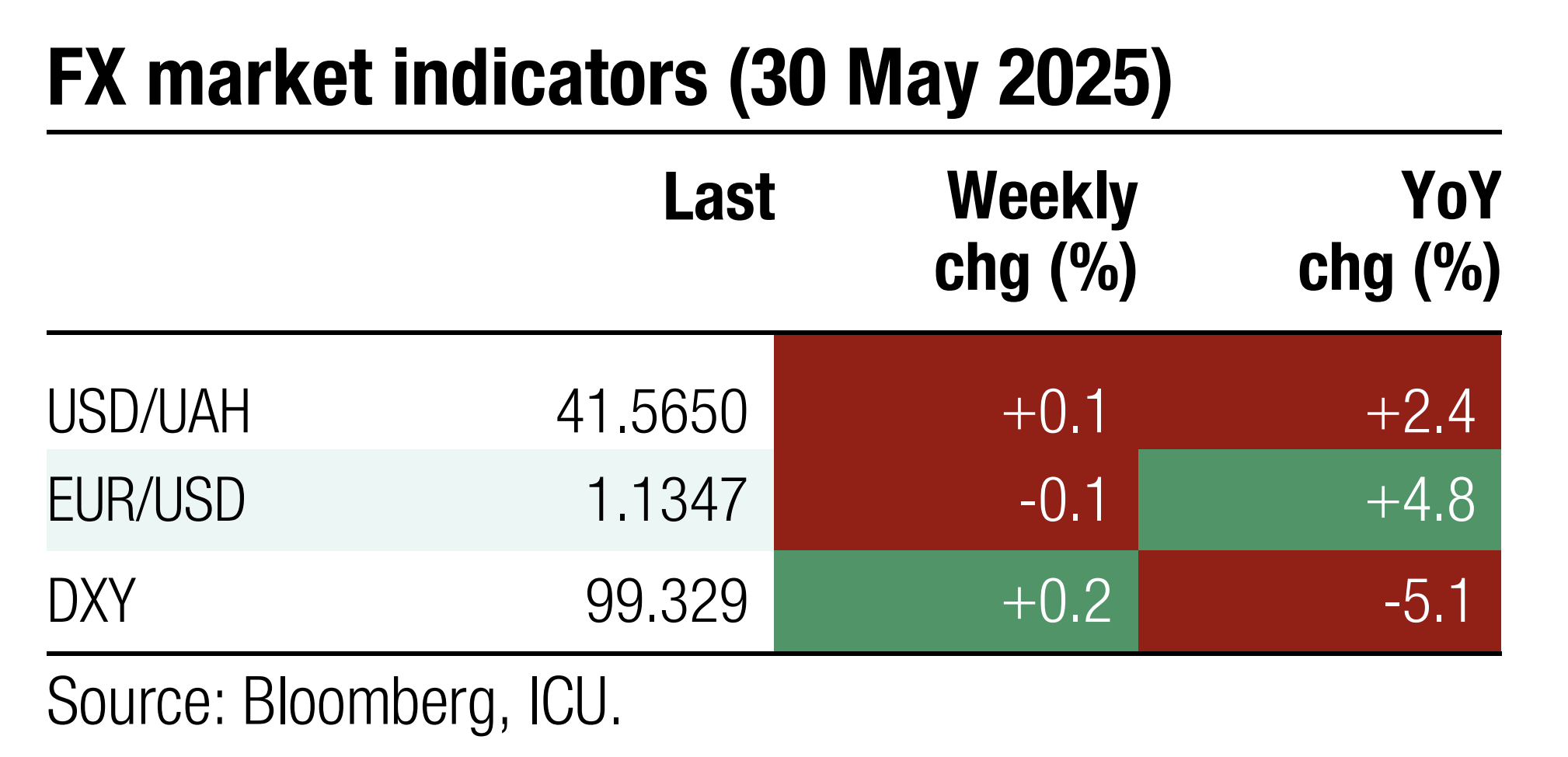

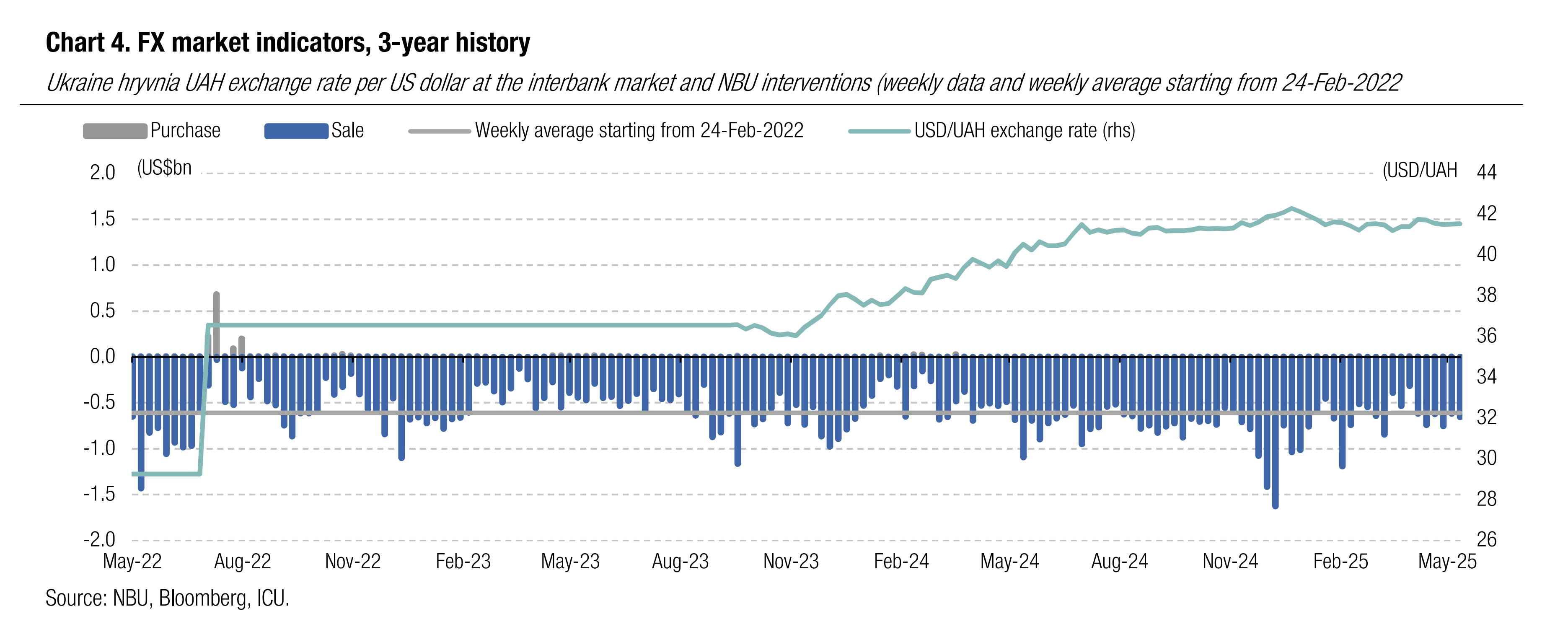

FX: NBU curbs hryvnia volatility

The NBU slightly increased its interventions last week, keeping the hryvnia exchange rate close to UAH41.5/US$, marking insignificant hryvnia weakening during May.

The NBU maintained the USD/UAH exchange rate almost unchanged at UAH41.53/US$ last week implying dollar prices were up by only UAH0.06 in May.

The FX shortage rose by 7% WoW to US$389m last week, including an increase in net hard currency purchases in the interbank FX market by 12% WoW to US$375m.

NBU's interventions were up last week by 6% WoW to US$653m, which is just 7% more than the weekly average interventions during the full-scale war.

ICU view: The NBU keeps selling FX from reserves without any limits to keep exchange rate in a narrow band. We expect the NBU will maintain this approach in the nearest months.

Economics: Financial account surges on foreign aid in April

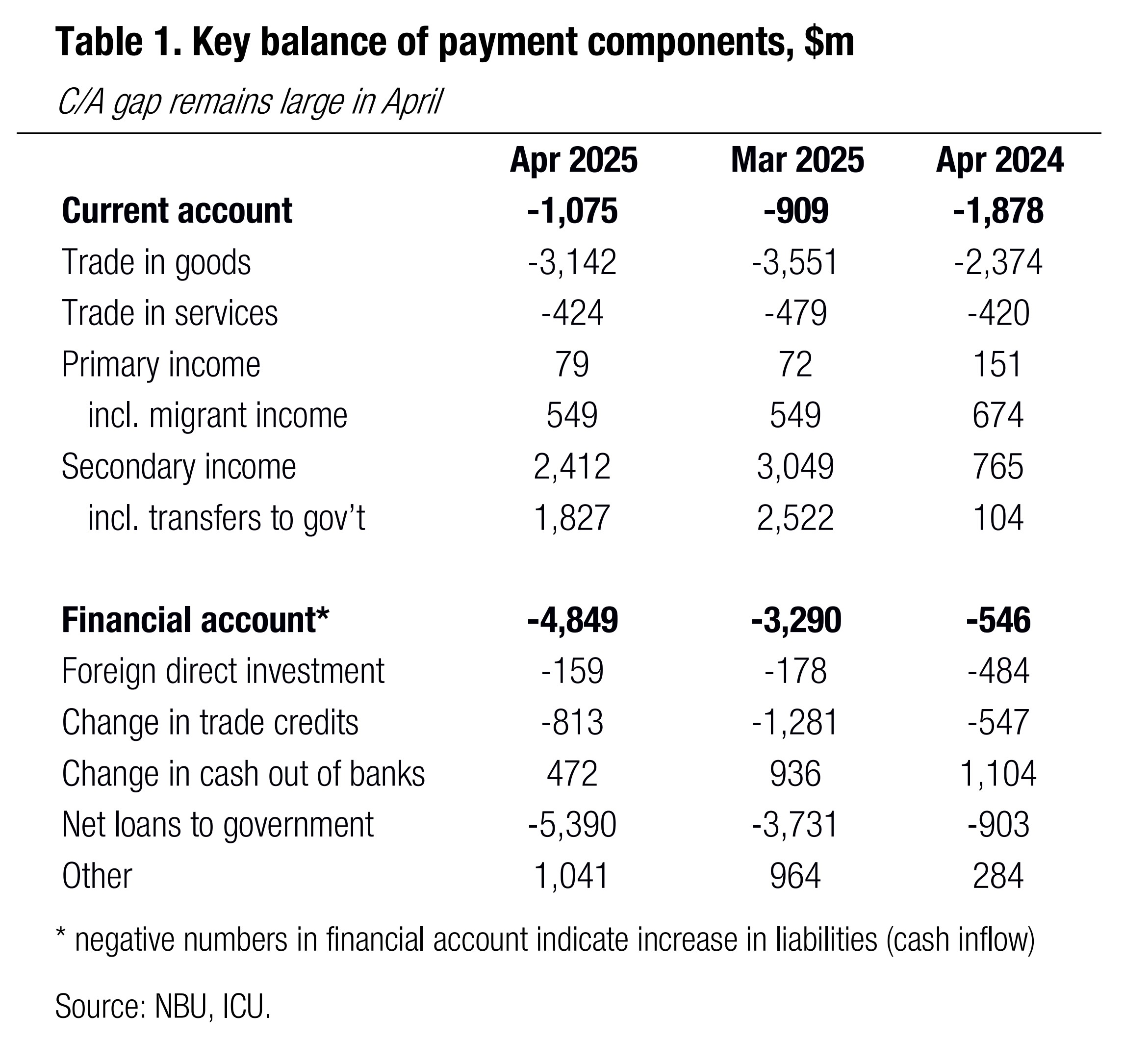

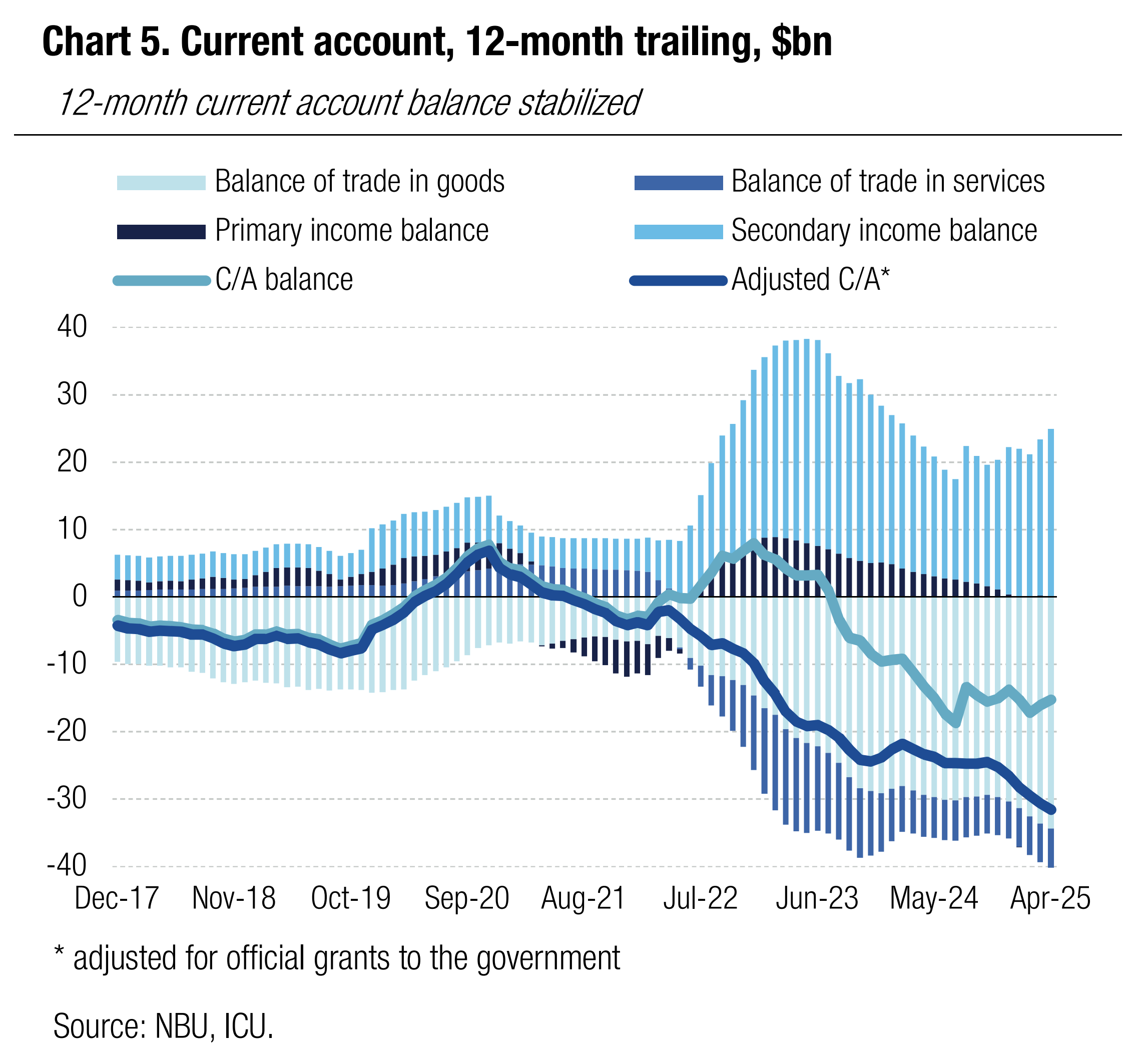

In April, Ukraine’s current account deficit stood at US$1.1bn while the financial account surplus surged to US$4.8bn on inflows of concessional loans.

The C/A balance remained under pressure of the trade-in-goods deficit as import was up 9% YoY while export contracted 8% in April. The balance of foreign trade in services was little changed, and so were the balance of primary income, including incomes of migrants. The secondary income was supported with a US$1.7bn in grants under ERA facility.

Unlike the current account, the financial account recorded a huge net inflow of capital driven by US$5.4bn in new concessional loans to Ukraine. Also noteworthy was a substantially lower increase in FX cash outside the banking system compared with March and last year’s April, which reflects better household sentiment with regard to exchange rate stability.

A huge financial account surplus boosted NBU reserves by 10% to US$46.7bn in April.

|  |

ICU view: We maintain our projection of C/A deficit at 12-13% of GDP this year (if foreign grants are not included into C/A balance). Yet, the inflow of concessional loans from Ukraine’s allies will be more than enough to offset the C/A deficit. Against this backdrop, we expect the NBU reserves to exceed US$55bn at the end of 2025, implying significant NBU firepower to maintain the hryvnia strong. We, thus, expect only limited depreciation this year, but expect significant FX market pressures next year.