|  |

|  |

Bonds: Reserve bonds improve rollover rate

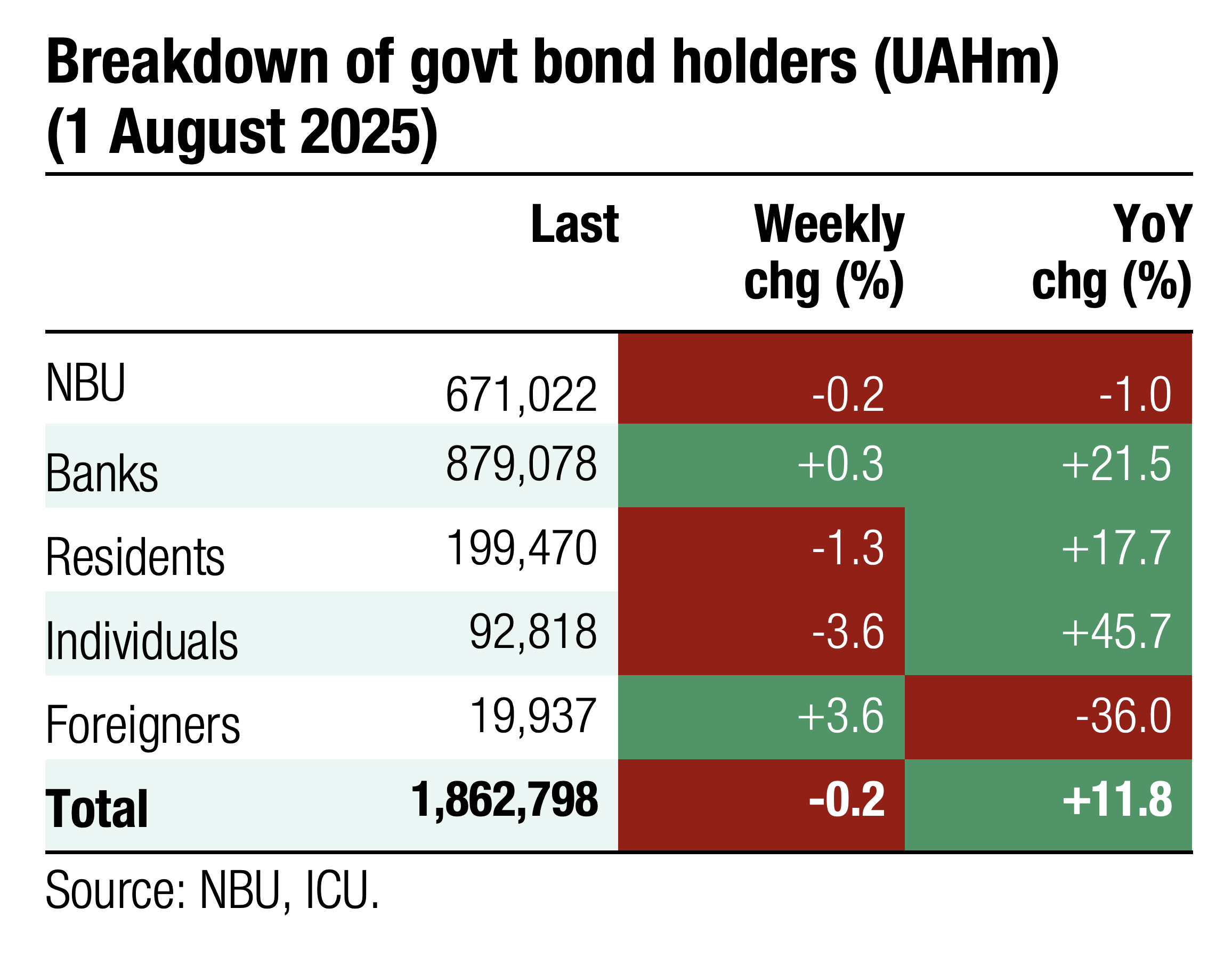

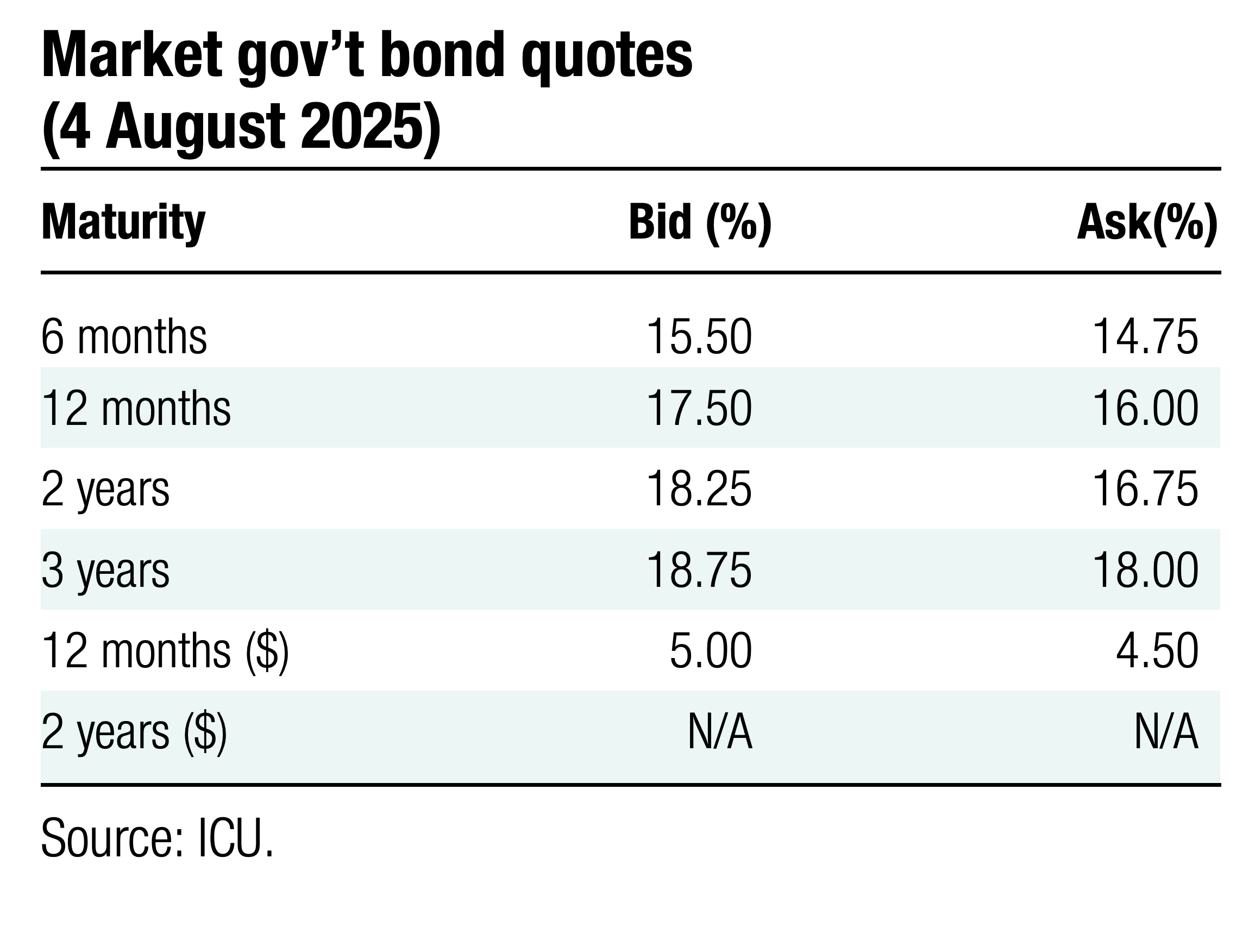

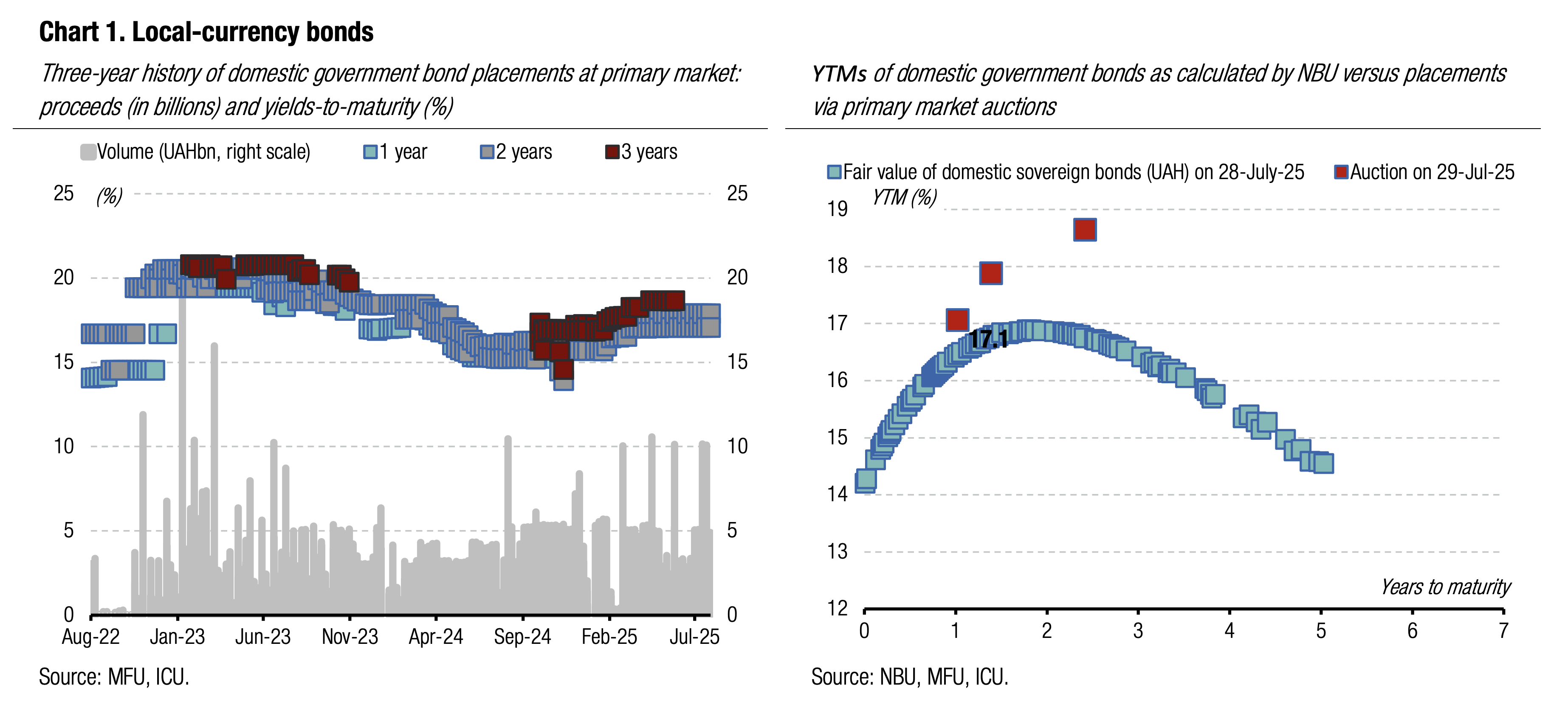

Last month, the MoF issued a new reserve bond, which improved local debt rollover rates for hryvnia and in all currencies.

The most notable July offering was a new reserve bond that helped the government raise over UAH20bn. Another UAH35bn were raised via placement of military and regular bonds, close to UAH34bn and UAH37bn raised in May and June, respectively. Larger borrowings and low redemptions raised the rollover of UAH papers to 261% in July and 107% in 7M25, up from 91% in 1H25.

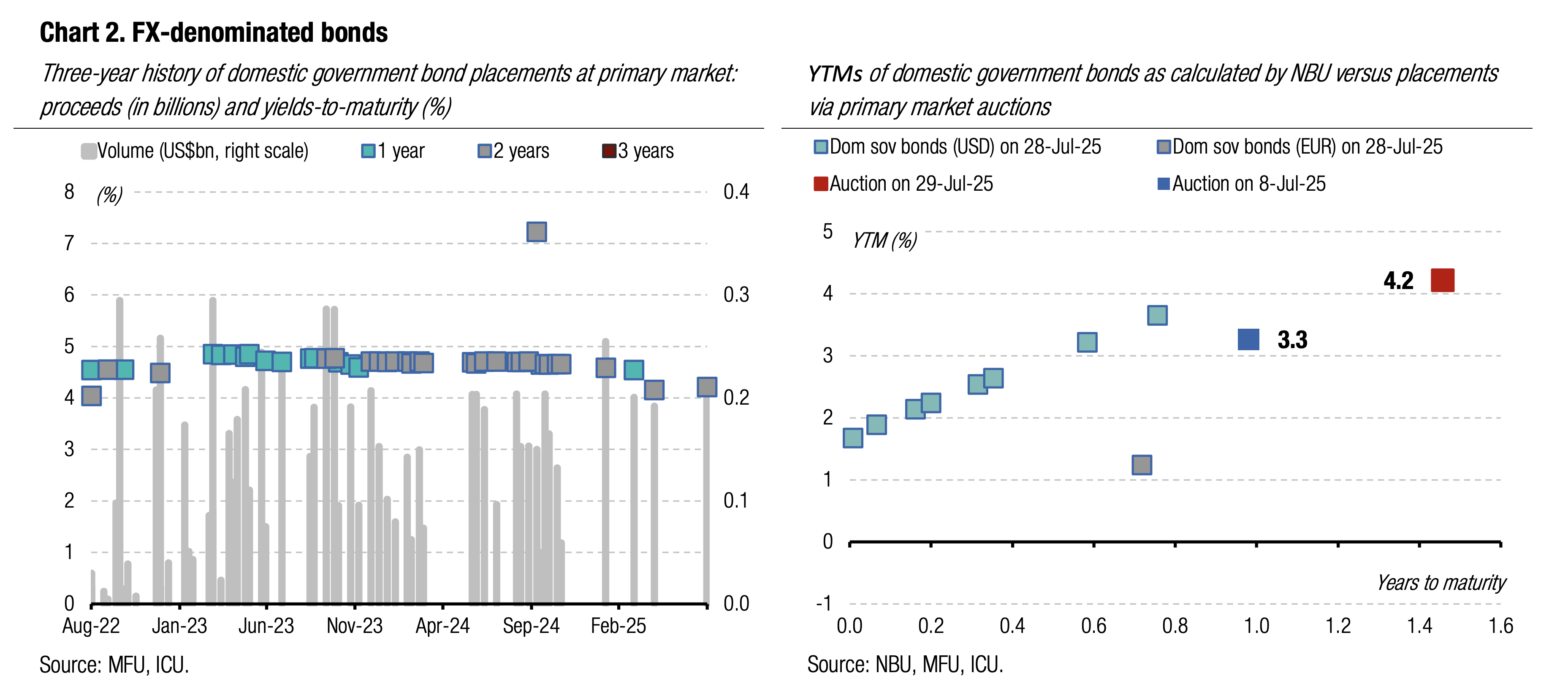

Also, in July, the MoF sold EUR169m and US$216m of FX-denominated bills while redeeming larger volumes, implying July rollover at 89% in euros and 53% in USD. Despite low rollover in the FX segment, total rollover in all currencies rose to 102% in 7M25 from 87% in 1H25.

In August, the MoF has to redeem just UAH12bn of reserve bonds (this week) and US$280m (in two weeks). Meanwhile, the MoF plans to keep its offering basket unchanged. That will include three of the usual UAH bonds with maturities of 14 months, 19 months, and three years. The MoF will also offer USD-denominated bills three times in August.

ICU view: The MoF has stepped up the placement of reserve bonds, thereby compensating for the low level of rollover of FX-denominated securities. We still expect the rollover of FX-denominated bonds to stay below 100%, while the government will increase the rollover of UAH bonds.

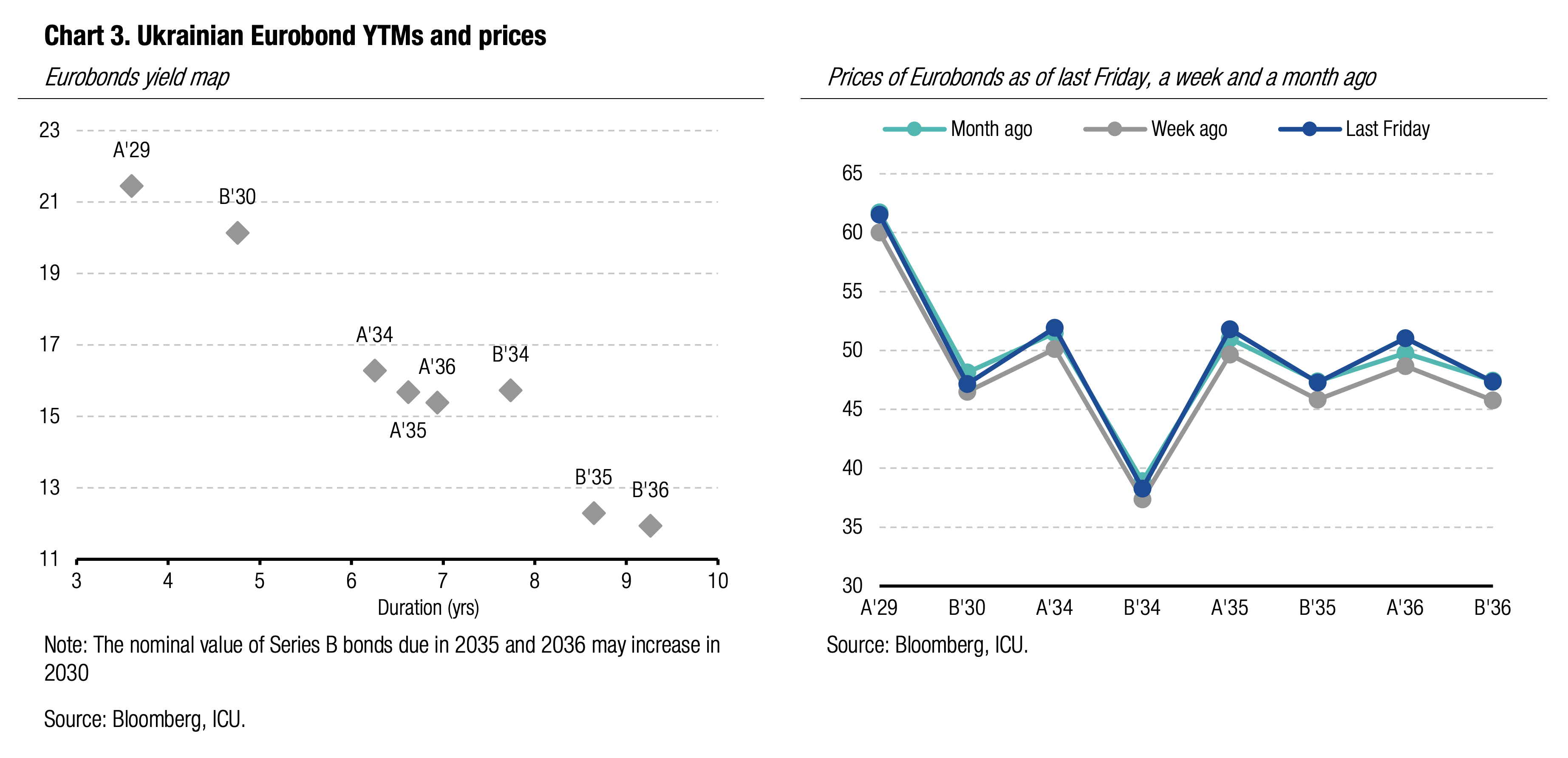

Bonds: Trump's ultimatum reignites Eurobond trading

Last week, prices of Ukrainian Eurobonds rose amid President Trump's harsh rhetoric against Russia.

Last Monday, US President Trump said he expected Russia to end hostilities against Ukraine by August 8. He confirmed he is ready to impose tough new sanctions if this demand is not met. These signals raised investor interest in Ukrainian Eurobonds. Another positive catalyst was the voting on Thursday by the Ukrainian Parliament to restore the independence of the anticorruption agencies. Against this backdrop, the prices of Ukrainian Eurobonds rose by more than 3% last week.

ICU view: The russian president has already signalled he will ignore President Trump's ultimatum. The visit of the US Special Envoy S. Witkoff to russia will likely reaffirm russia’s reluctance to move towards constructive negotiations. Therefore, the markets will be waiting for more details about a possible set of sanctions that President Trump is ready to adopt against russia. When more details are released, the markets will reassess the chances of ending the war.

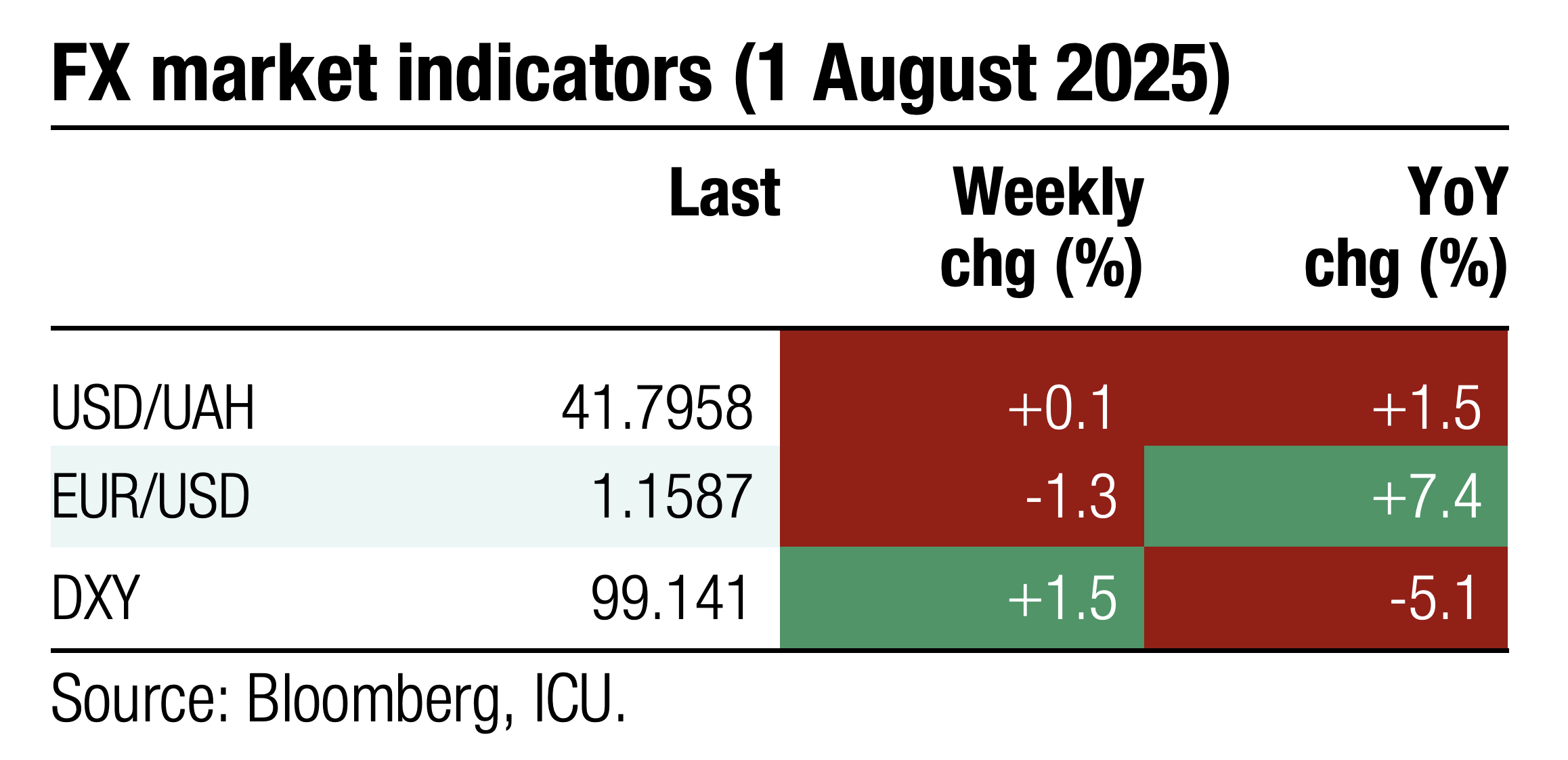

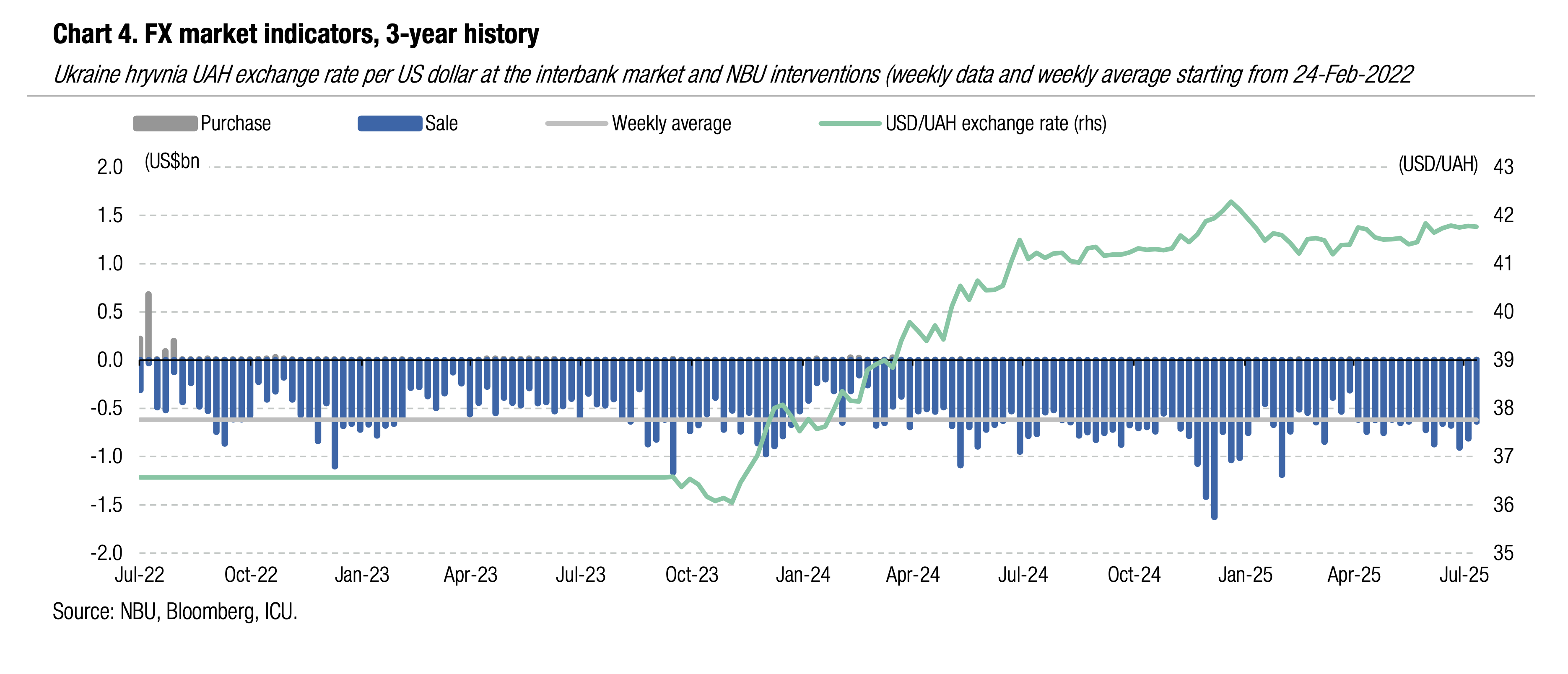

FX: NBU keeps strong hryvnia policy

NBU keeps the hryvnia fluctuations in a narrow band while downsizing interventions.

The hard currency shortage declined at the end of July by a third WoW to US$342m. Therefore, the NBU slashed interventions by 21% to US$640m.

Hryvnia exchange rate fluctuations were in a tight range around UAH41.8/US$. NBU kept the official exchange rate almost unchanged at UAH41.76/US$.

ICU view: The NBU continues to adhere to the policy of a strong hryvnia, providing a sufficient supply of hard currency to avoid sharp fluctuations of hryvnia. Thanks to large volumes of foreign financial aid provided by Ukraine’s allies, the NBU has enough resources for interventions and expects to have enough international reserves for 2026. Given that, the NBU may continue to weaken the hryvnia only very slowly this year, and may keep it close UAH41.8/US$ in the coming weeks.

Economics: Trade deficit hits record high in June

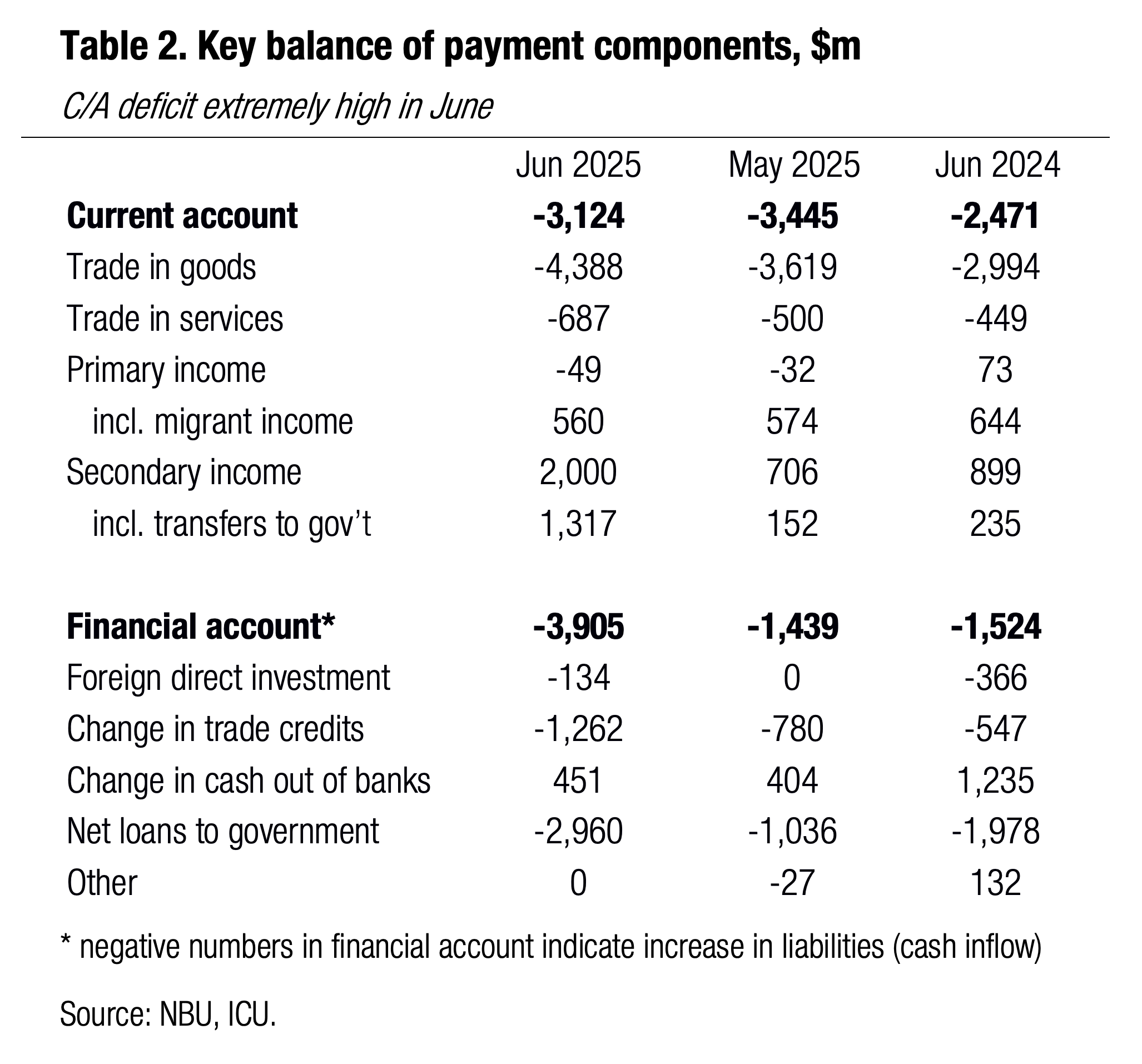

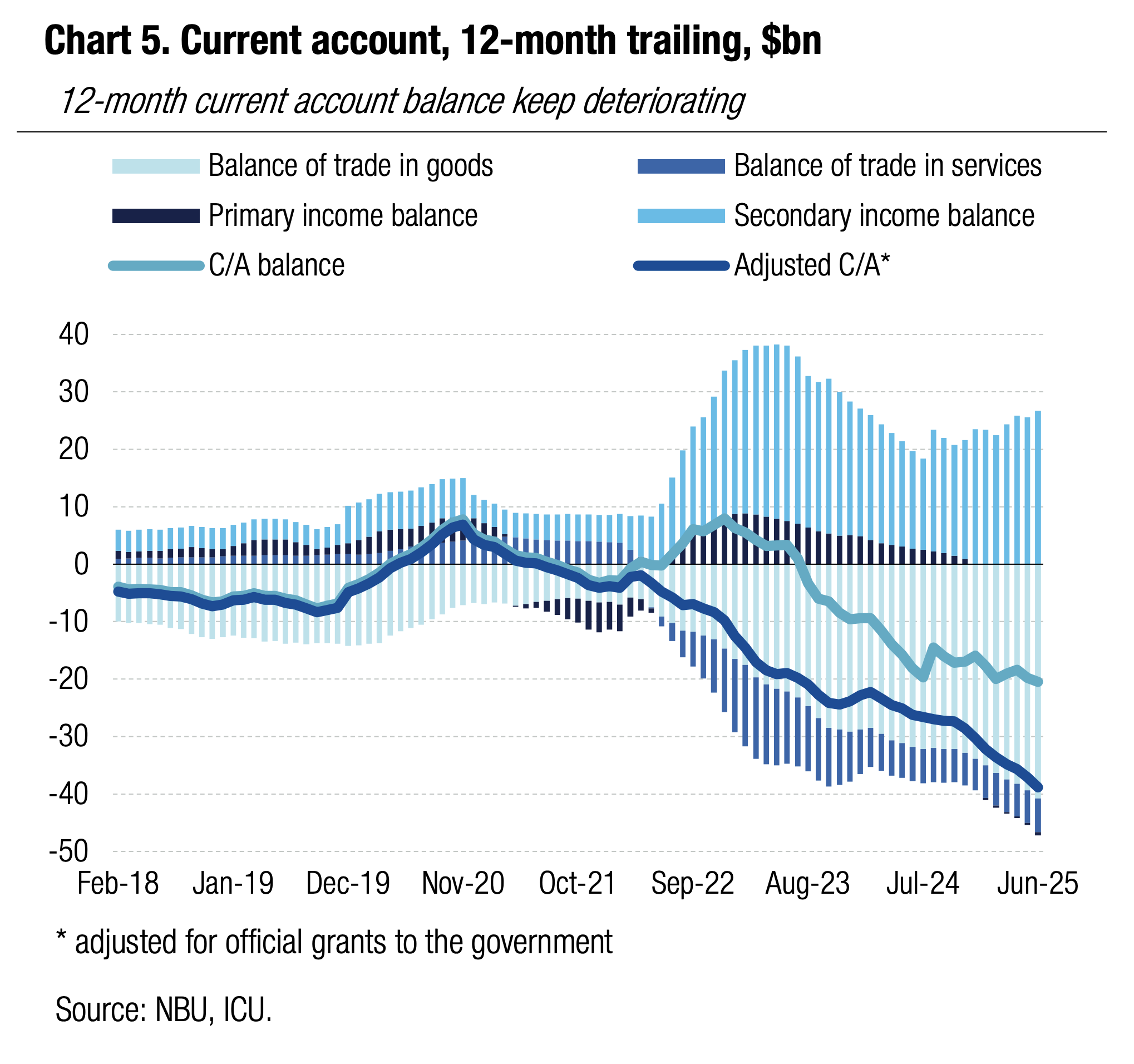

In June, the deficit of external trade in goods and services hit a record high of US$5.1bn, while the current account deficit narrowed marginally vs May to US$3.1bn.

The gap of external trade-in-goods reached US$4.4bn in June as imports surged 26% YoY and exports inched up by just 4%. An increase in imports of goods was primarily driven by purchases of machinery and equipment, which may imply that military goods are now reflected in the official statistics to a larger extent vs previous periods. The balance of foreign trade in services stood at a negative US$0.7bn, the largest monthly volume YTD, on a spike in import of financial services (no details were provided by the NBU on that component). The primary income balance was close to zero, like in previous months, while the surplus of secondary income improved on grants to the Ukrainian government.

Developments on the financial account side were positive as the stock of external trade credits decreased (likely reflecting return of money to the economy by Ukrainian exporters) while the net outflow of cash from the banking sector remained extremely low for the third consecutive month. On top of that, government raised US$3.0bn in foreign concessional loans. All in, NBU reserves were up 1.2% to US$45.1bn in June.

|  |

ICU view: The huge deficit of foreign trade-in-goods remains the largest drag on Ukraine’s external account and that will remain the key risk to Ukraine’s macro stability going forward. We expect the C/A deficit to widen close to 13% of GDP in 2025, up from 8.4% in 2024. Excluding budgetary grants, the C/A deficit is going to be 15-16% of GDP, which implies about a 1.0-1.5pp increase from 2024. Meanwhile, the C/A gap has so far been fully covered with external financial aid. We expect foreign aid will be sufficient to offset C/A imbalances at least for the next 12 months, but risks to NBU reserves and hryvnia stability may emerge in 2H26 if the inflows of foreign aid start to decrease.