|  |

|  |

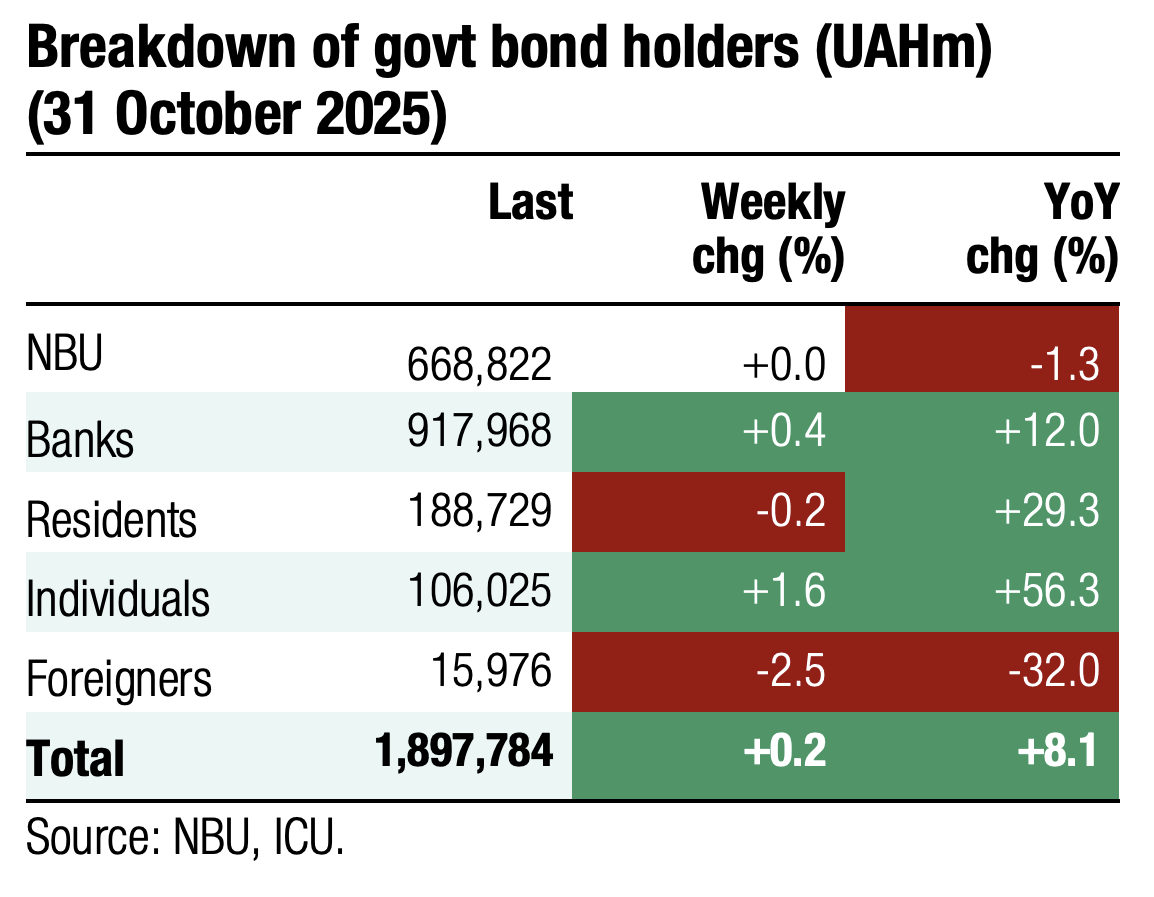

Bonds: MoF readies to increase net borrowings

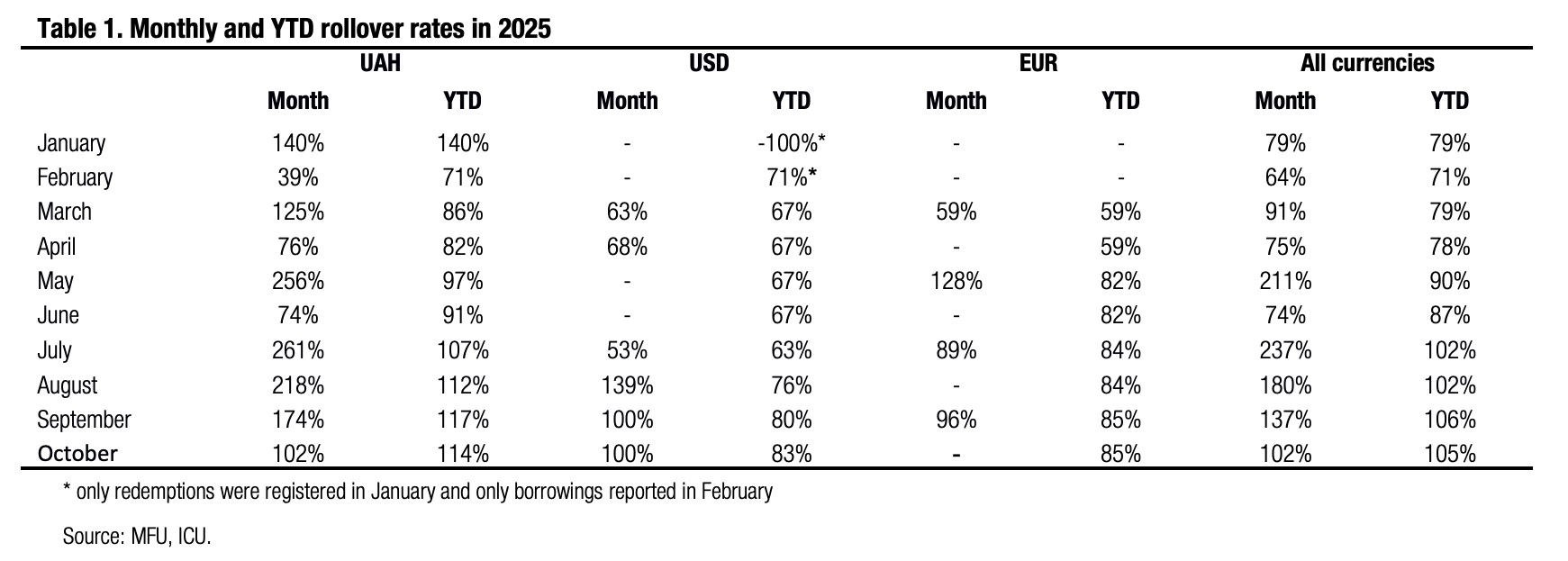

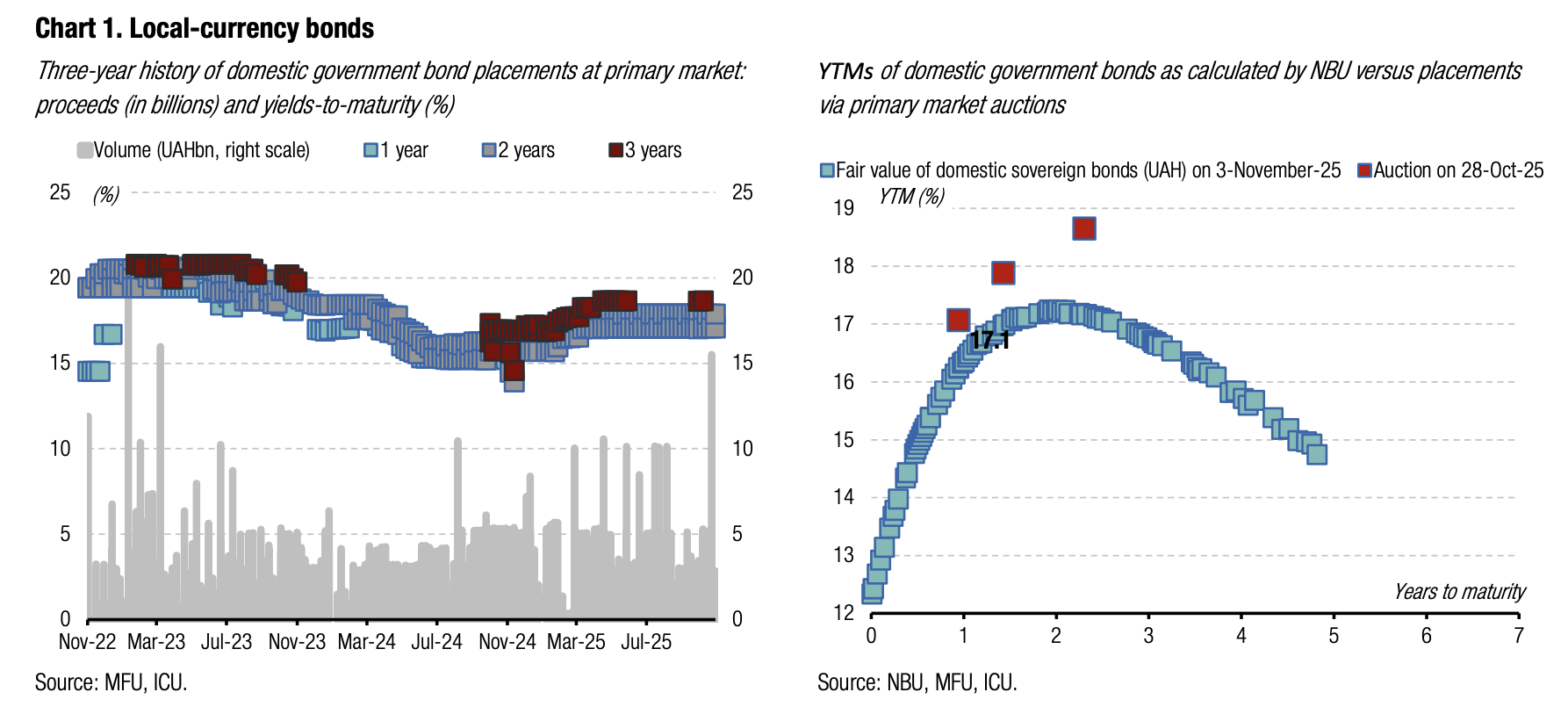

In October, the Ministry of Finance maintained domestic debt rollover slightly above 100% and made it easier to increase net borrowings in the last two months of the year.

In October, the MoF sold UAH62.4bn of UAH bonds, while repaying almost UAH61bn, including the swap auction for reserve bonds. The ministry also raised US$350m in October, which was exactly the size of the redeemed USD-denominated bond in the same month. The MoF did not borrow or redeem papers in euros in October.

The rollover of hryvnia debt was 102% in October and 114% in 10M25. For US dollar debt, the respective numbers were 100% and 83%. The rollover in euros remained unchanged from 9M25 at 85%.

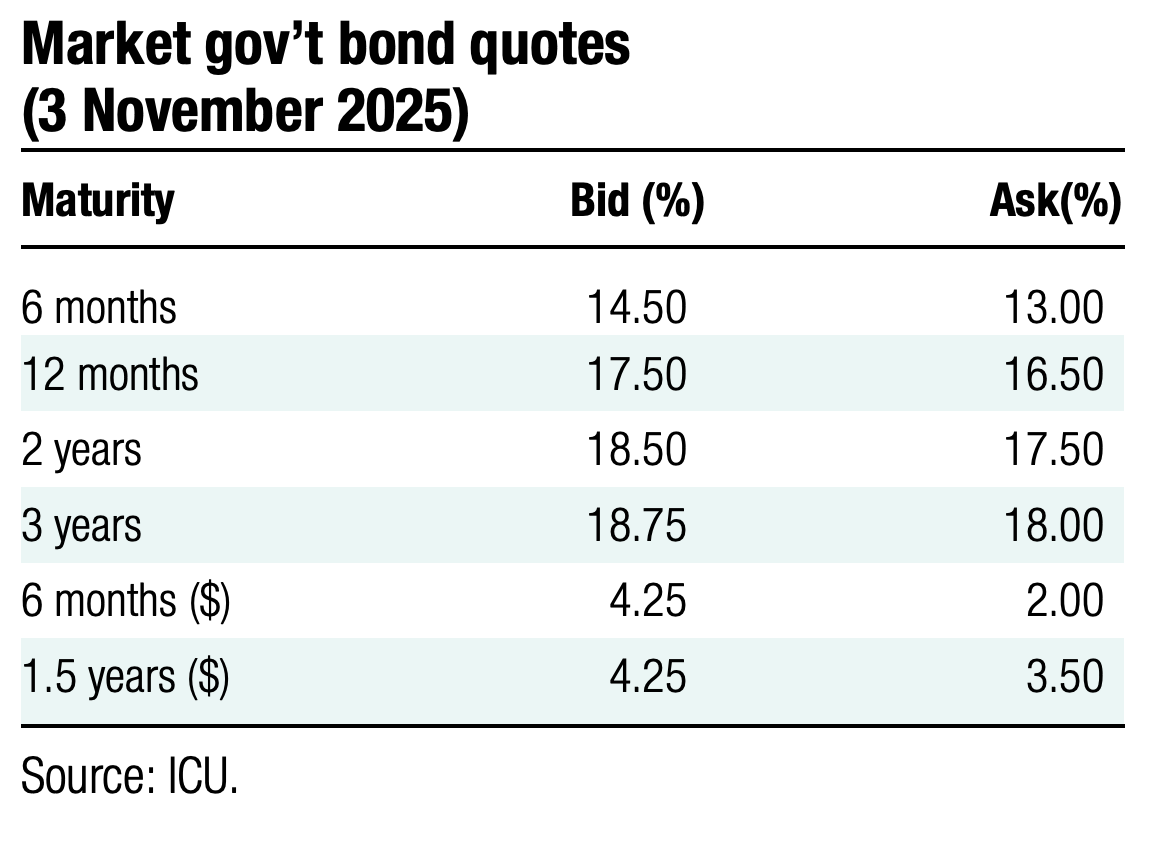

In November, scheduled redemptions are relatively small and include UAH18bn and US$362m. Therefore, the MoF will offer a USD-denominated bill in the last two weeks of the month.

In November, the offer will include the usual securities with maturities of one year, 1.5 years, and three years. On top of that the MoF will offer a new paper due in spring 2028. Most likely, the ministry expects this new paper will draw healthy demand and allow increasing UAH borrowings.

ICU view: The MoF refinanced all redemptions in October, and also exchanged the larger part of the reserve bond due this Wednesday. Now, with relatively small redemptions in November and December, the MoF will be in a position to increase net borrowings and domestic debt rollover. However, we do not expect the MoF will aim to meet its budget law target for domestic borrowings; a part of planned domestic loans may be offset with foreign aid.

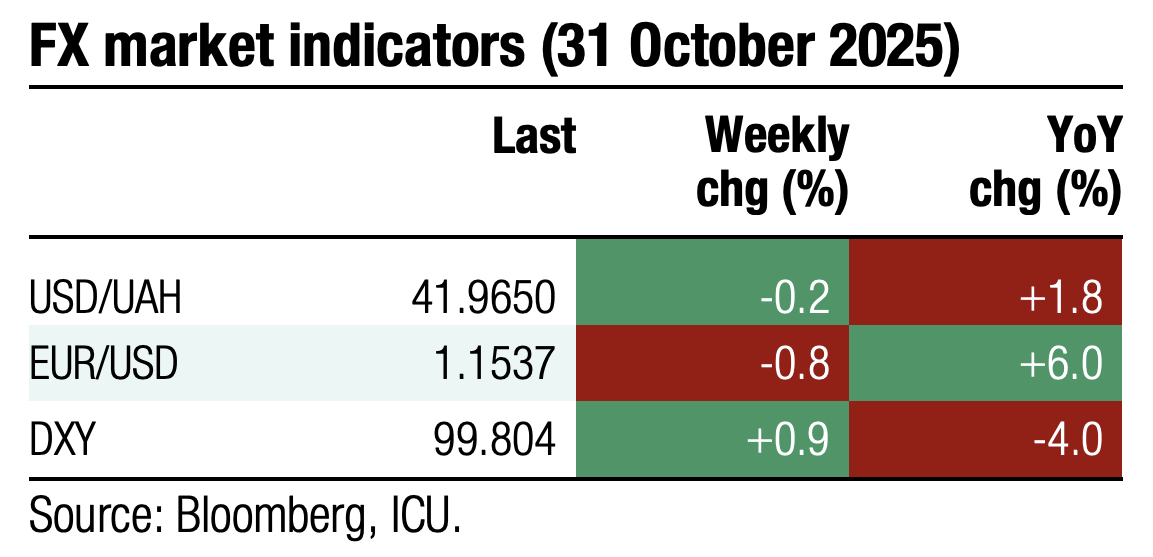

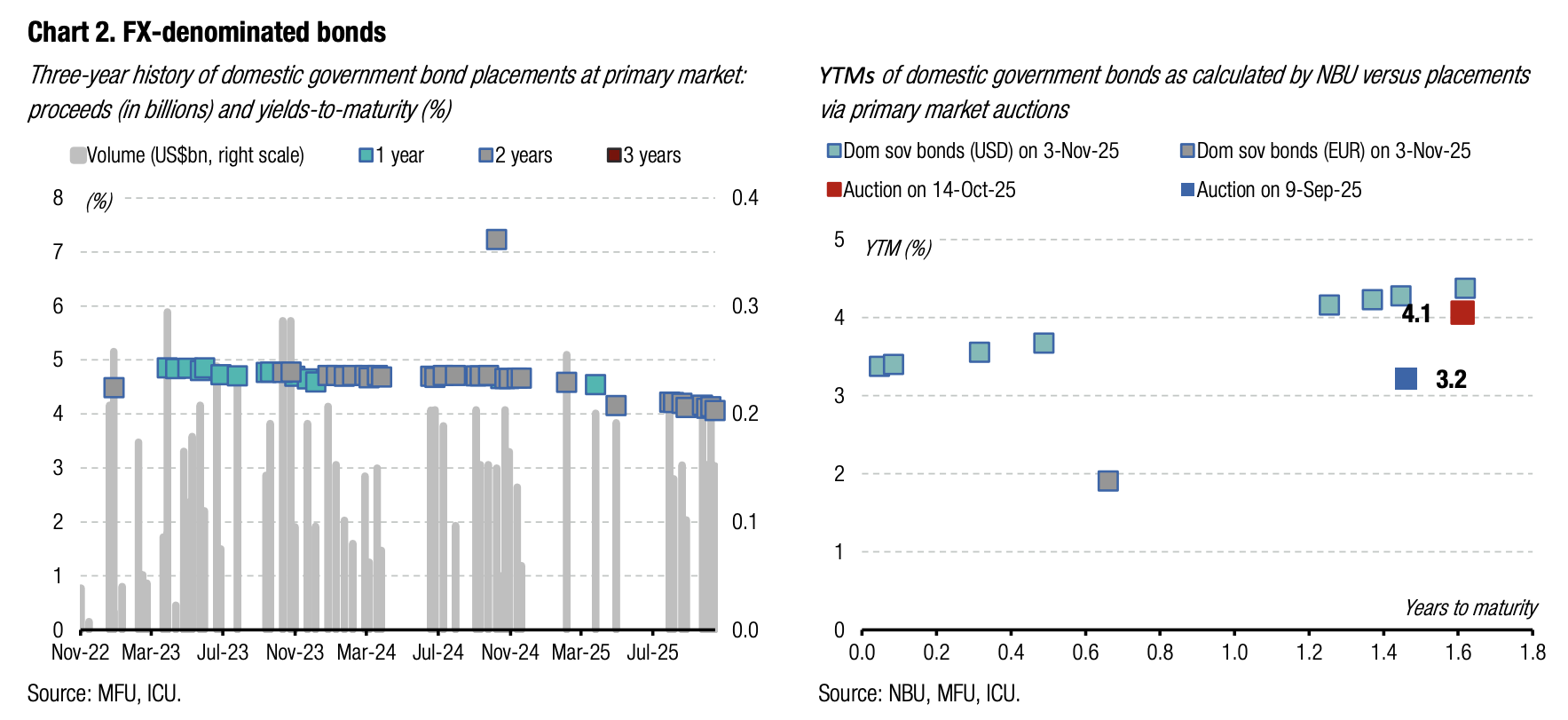

FX: NBU sharply weakens the hryvnia in October

The NBU weakened the hryvnia at the end of the month to almost UAH42/US$ despite relatively small imbalances in the FX market.

In four business days last week, the shortage in the FX market amounted to US$274m. Therefore, it likely remained below US$500m for the full week, the same as in the two previous weeks. Interventions were relatively stable in October, with a weekly volume exceeding US$700m only once. Last week, net FX sales by the NBU were US$692m.

Yet, the NBU allowed the hryvnia to weaken to UAH42.08/US$ at the beginning of last week, but then strengthened the official rate to UAH41.89/US$ by the end of the week. In October, the NBU weakened the hryvnia against the US dollar by 1.8%. However, the hryvnia remains 0.3% stronger than at the beginning of the year and 0.9% stronger compared with this year’s maximum dollar price of UAH42.28/US$ in January.

ICU view: In October, the NBU apparently changed its approach to interventions in the interbank FX market, as the hryvnia weakened noticeably even though FX market imbalances were significantly below peak volumes seen this year. That most likely signals the NBU's readiness to widen hryvnia fluctuations bank and move away from a de facto fixed exchange rate that prevailed in the last few months. We do not think the weakening of the hryvnia in recent weeks is a signal the NBU is prepared to start a managed depreciation. We anticipate the exchange rate will not exceed UAH42.5/US$ by the end of 2025.

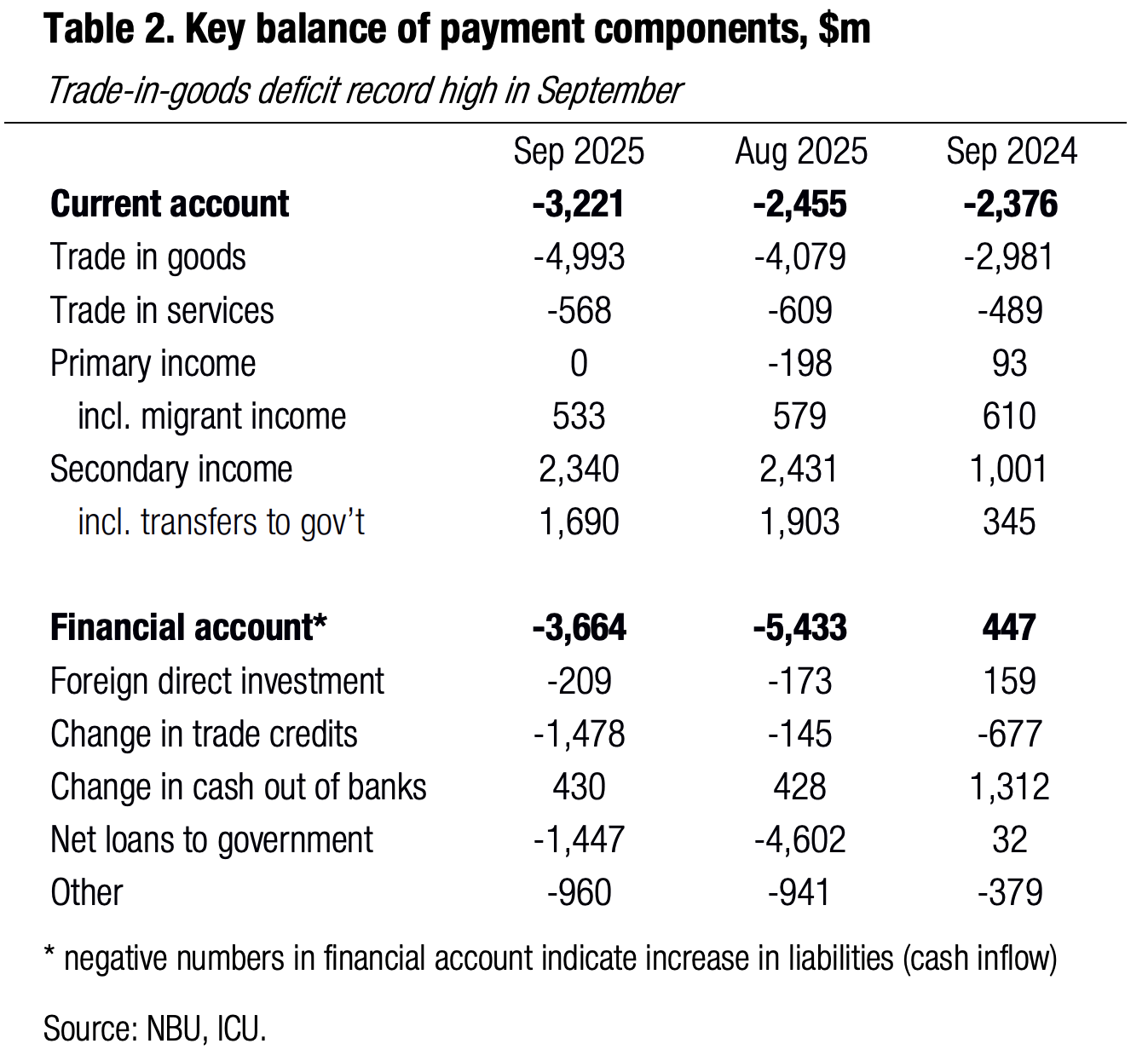

Economics: Trade deficit hits new record high

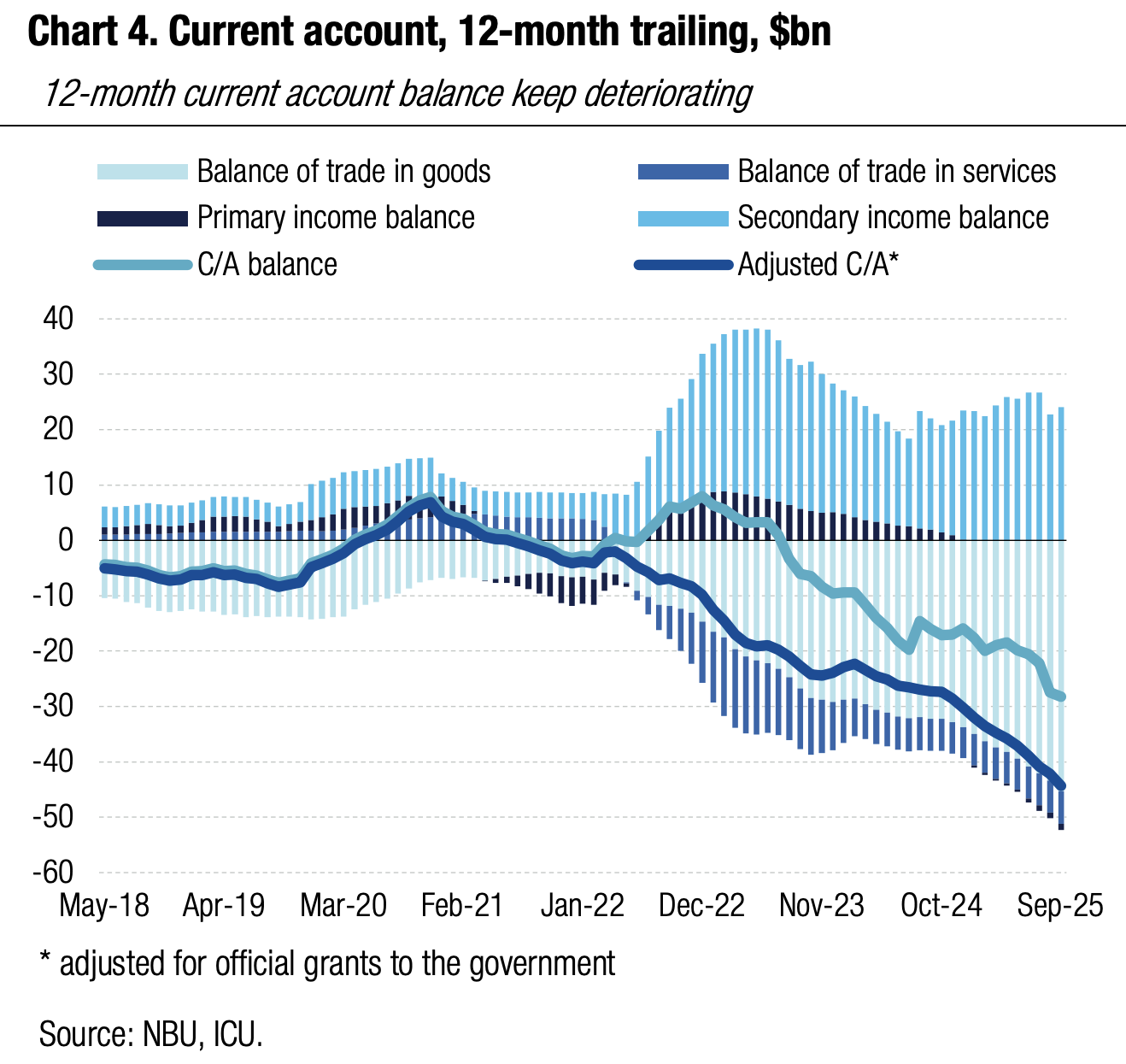

The monthly current account (C/A) deficit stood at US$3.2bn on a record foreign trade-in-goods gap of US$5.0bn in September.

Import of goods hit a record high at US$8.0bn in September (+34% YoY) on surging imports of machinery and equipment. Meanwhile, export was almost unchanged vs last September. In 9M25, the trade-in-goods deficit reached US$35.4bn vs US$23.2bn in the same period last year. The services balance was at negative US$4.5bn in 9M25, little changed from the previous year. The primary income balance was close to zero in September as incomes of migrant offset foreign income on investments and debt to Ukrainian entities.

The financial account surplus was more than enough to offset the C/A deficit. Surprisingly, the key driver of the surplus was a reduction in the stock of foreign trade credits, which largely reflects faster return of export proceeds by exporters and increases in import of goods that was paid for in previous periods. Inflows of concessional loans were the second most important factor. NBU reserves were up 1.3% in September to US$46.6bn.

|  |

ICU view: The 12-month trailing C/A gap will keep widening in the coming months and will exceed 21% of GDP (net of transfers to the government) in 2025, which is a record high amount. Meanwhile, there is no doubt the C/A shortfall will be fully covered with capital inflows via the financial account, primarily thanks to concessional loans from foreign governments and IFIs. This type of BoP pattern will enable the NBU to keep the FX market fully under control while somewhat increasing its gross international reserves in the near future.