|  |

|  |

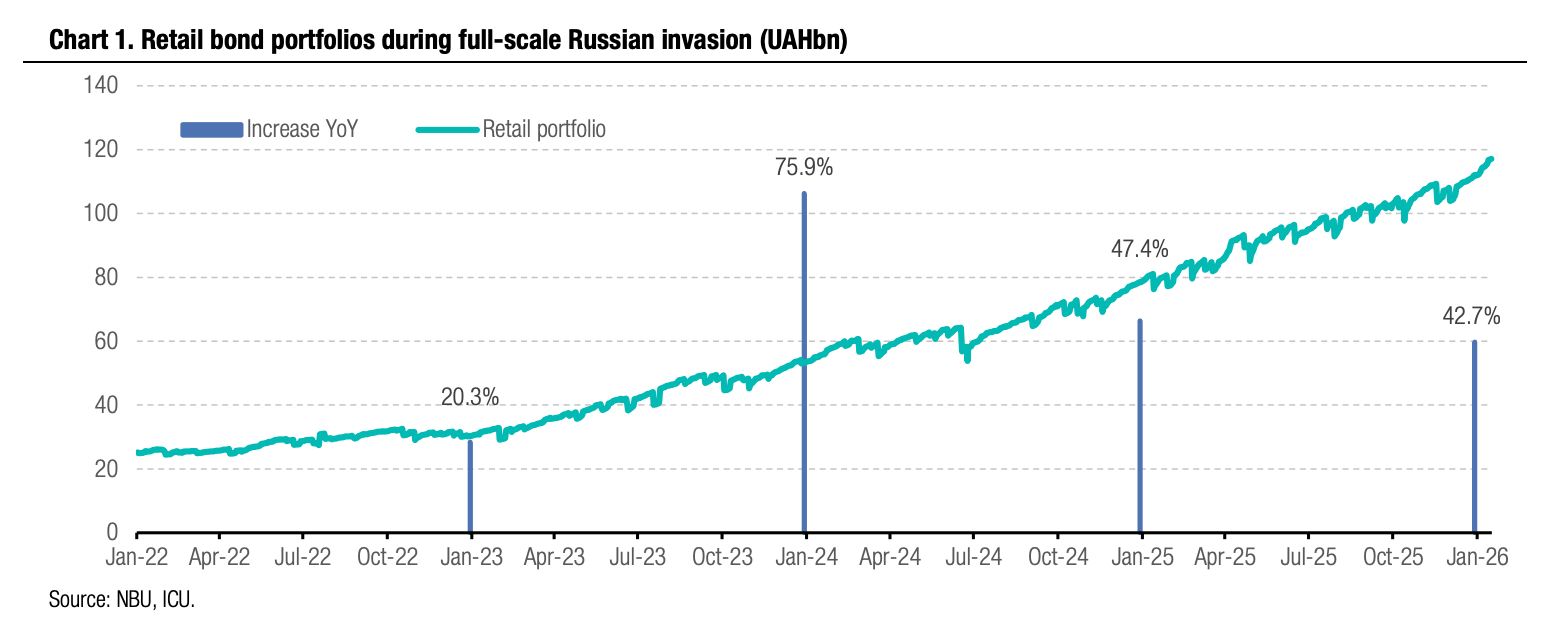

Bonds: Retail demand for UAH bonds robust

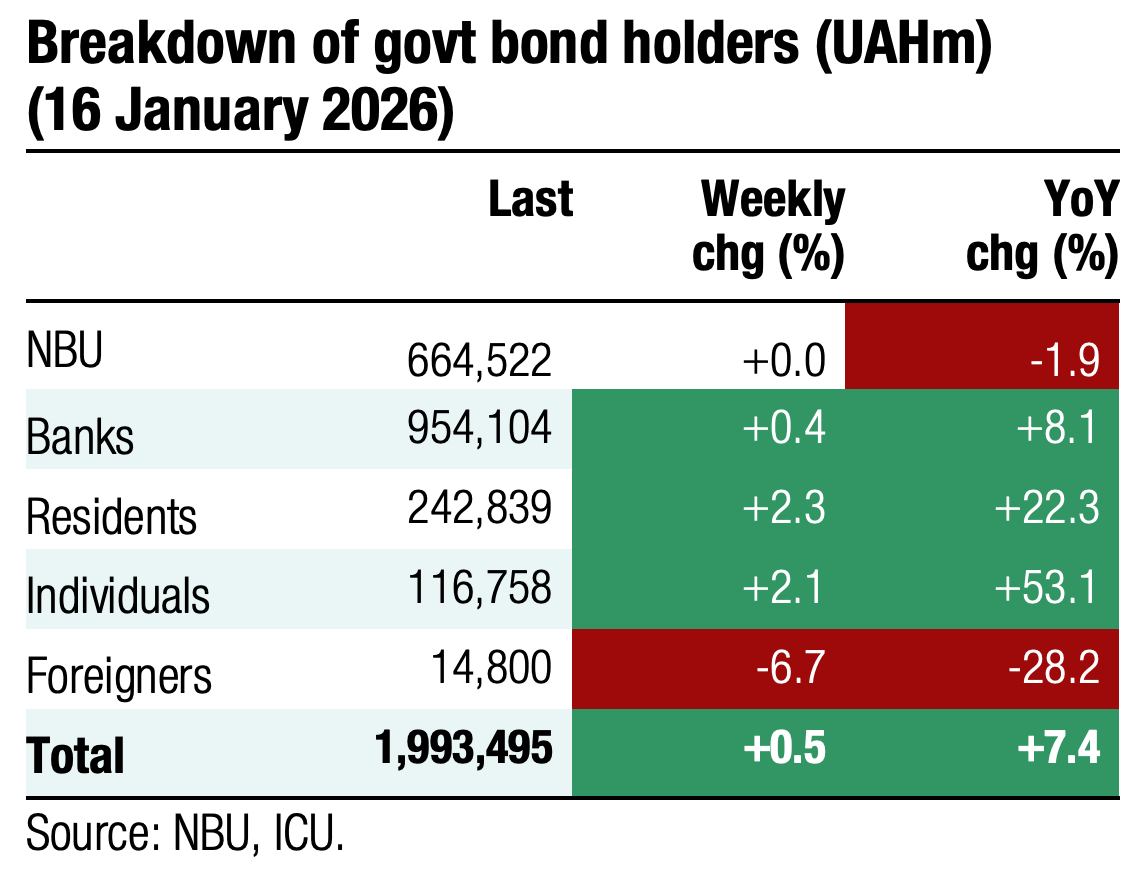

As of today, households’ total investments in domestic government bonds reached UAH117bn (US$2.7bn). Retail investors now account for 9% of the total stock of government bonds outstanding, excluding NBU’s portfolio.

In 2025, Ukrainian households increased portfolios by UAH33.5bn or by almost 43%. The share of bonds in all currencies owned by individuals in the total stock of government bonds (excluding NBU ownership) increased from 6% to 8.6% over the year. The share of UAH instruments in individuals' portfolios rose by 9pp to 59% in 2025.

Individuals invested over net UAH5bn in government bonds YTD, increasing their portfolios to UAH117.1bn, and their share in the government bonds outstanding to 9%. The share of UAH securities in their total portfolios increased to 59.2%.

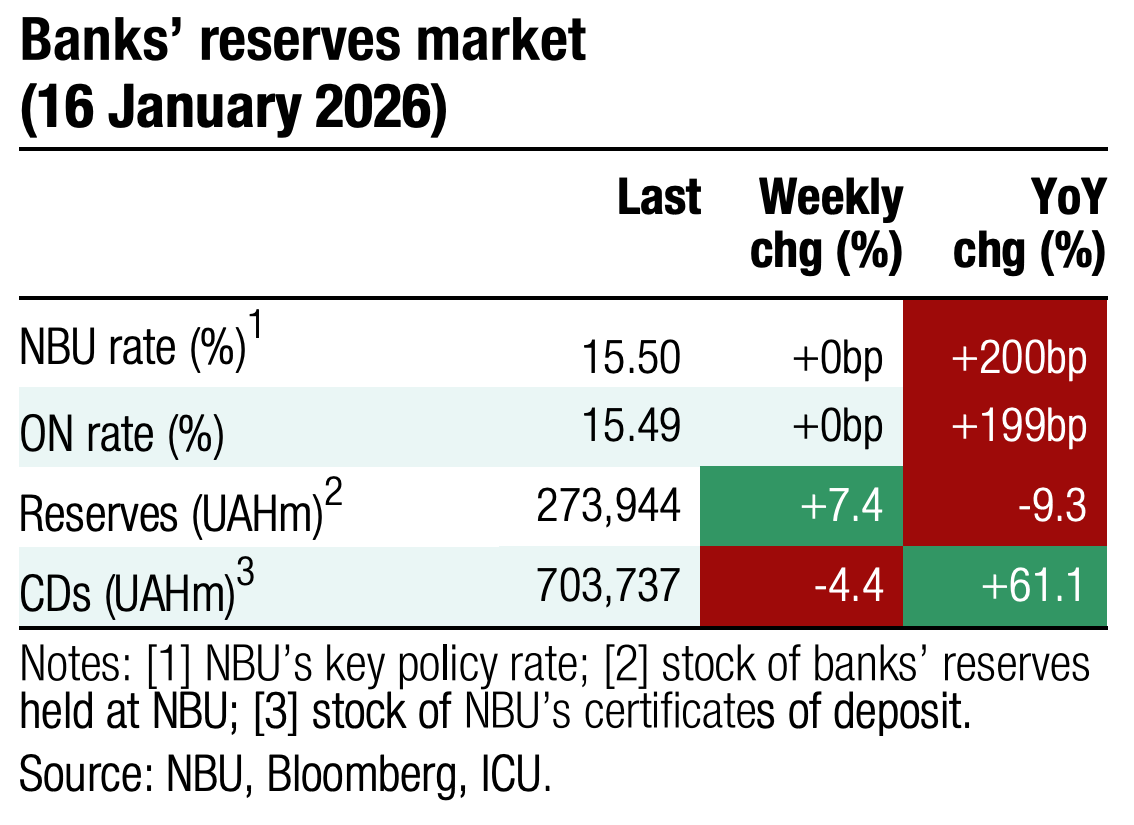

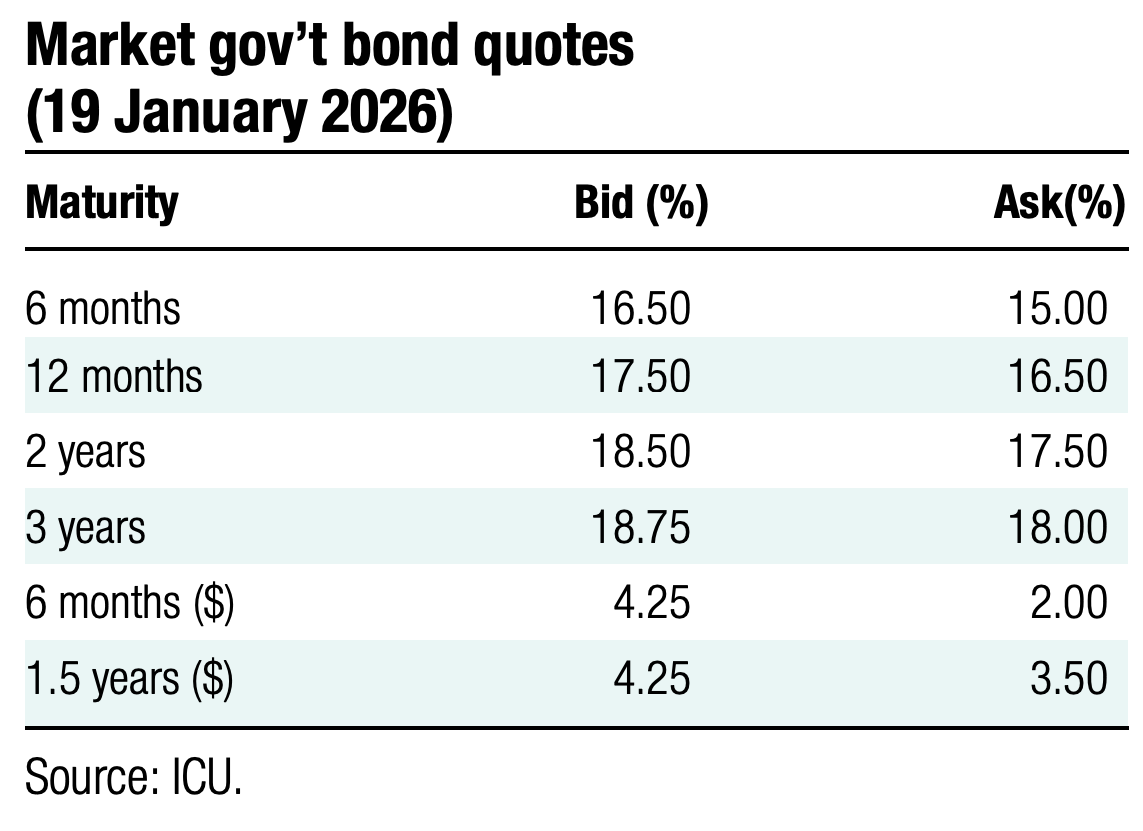

ICU view: Since there were no significant redemptions in January, the portfolios of retail investors continued to grow robustly. Individuals remain attracted by high yields and income tax exemptions on coupons received. The relative stability of the UAH/USD exchange rate throughout 2025 was also a positive contributing factor. We expect bond yields to start decreasing gradually from February after the NBU switches to a monetary policy easing cycle in late January by cutting the rate by 50bp. The cumulative reduction in the key policy rate may reach 200bp over 2026, with all cuts expected in 1H26. The MinFin is likely to be fast in taking advantage of lower rates by cutting coupons for new securities immediately after the NBU moves. Regarding the exchange rate, we believe that despite a turbulent start of the year, the NBU is very likely to keep the FX market under control and reverse some hryvnia losses YTD. We expect a slow, managed hryvnia devaluation to about UAH44.3-44.5/US$ by year-end. This implies government bonds will remain the most attractive savings instrument available in the local market, with hryvnia deposits and local FX bonds likely delivering significantly lower returns over 2026. Retail bond portfolios are set to continue to grow robustly over 2026.

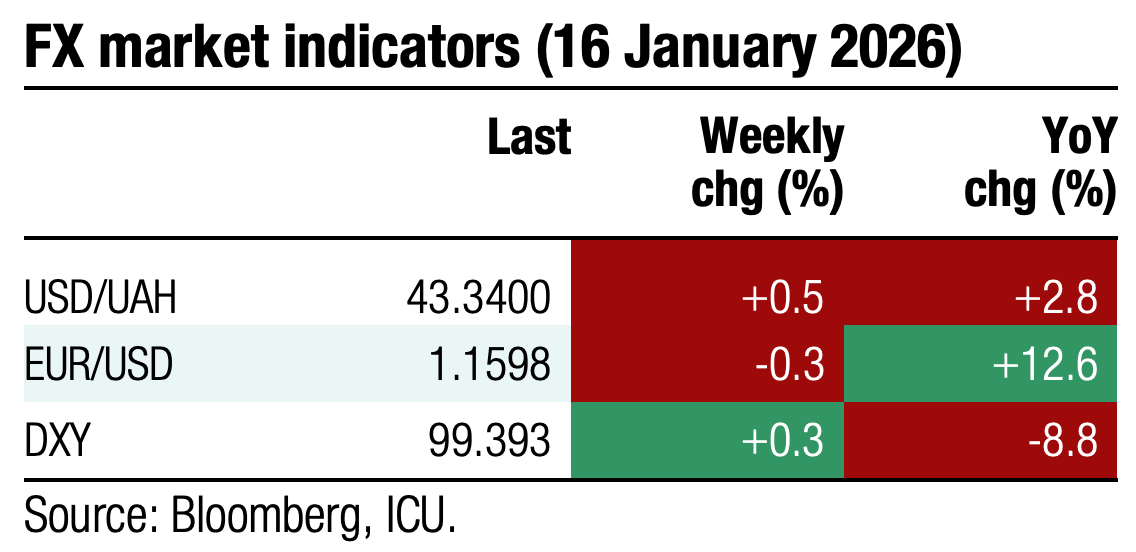

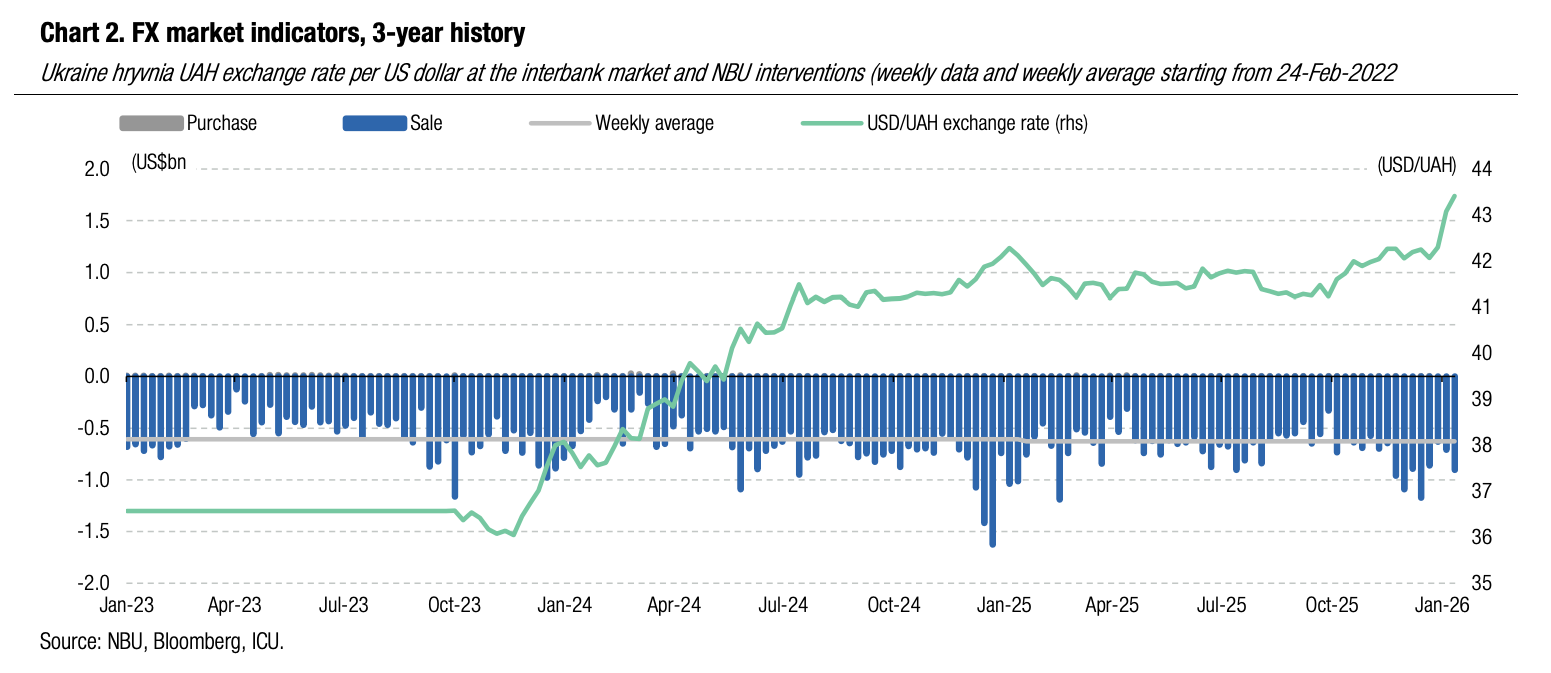

FX: NBU in no hurry to reverse hryvnia trend

The NBU continued to weaken the hryvnia exchange rate last week while FX market imbalances increased.

Last week, demand for hard currency was up significantly. The total FX market shortage increased by 20% WoW, to US$552m. Therefore, the NBU had to increase interventions to US$905m, a 27% WoW increase.

The NBU allowed the official hryvnia exchange rate to weaken by another 0.8% last week to UAH43.4/US$. In total, the hryvnia has already weakened by 2.5% YTD.

ICU view: In the first weeks of January, demand for foreign currency typically increases, pushing the hryvnia rate down and forcing the NBU to increase interventions. This year is no exception, but the heightened demand appeared more persistent than a year before. We expect the hryvnia exchange rate to return to approximately 42.5 UAH/$ in the coming weeks, and the NBU will continue a gradual, managed weakening of the hryvnia to 44.3-44.5 UAH/$ by the end of the year.