|  |

|  |

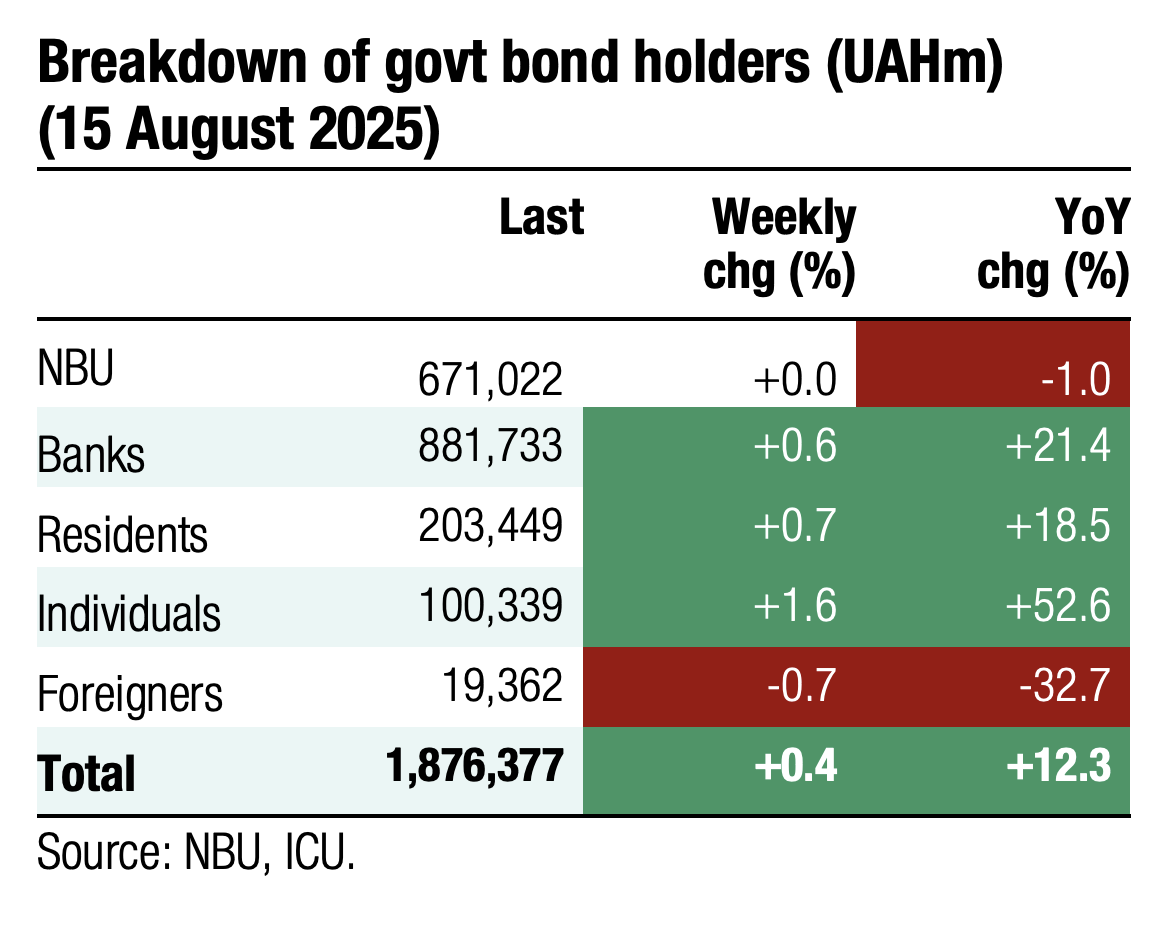

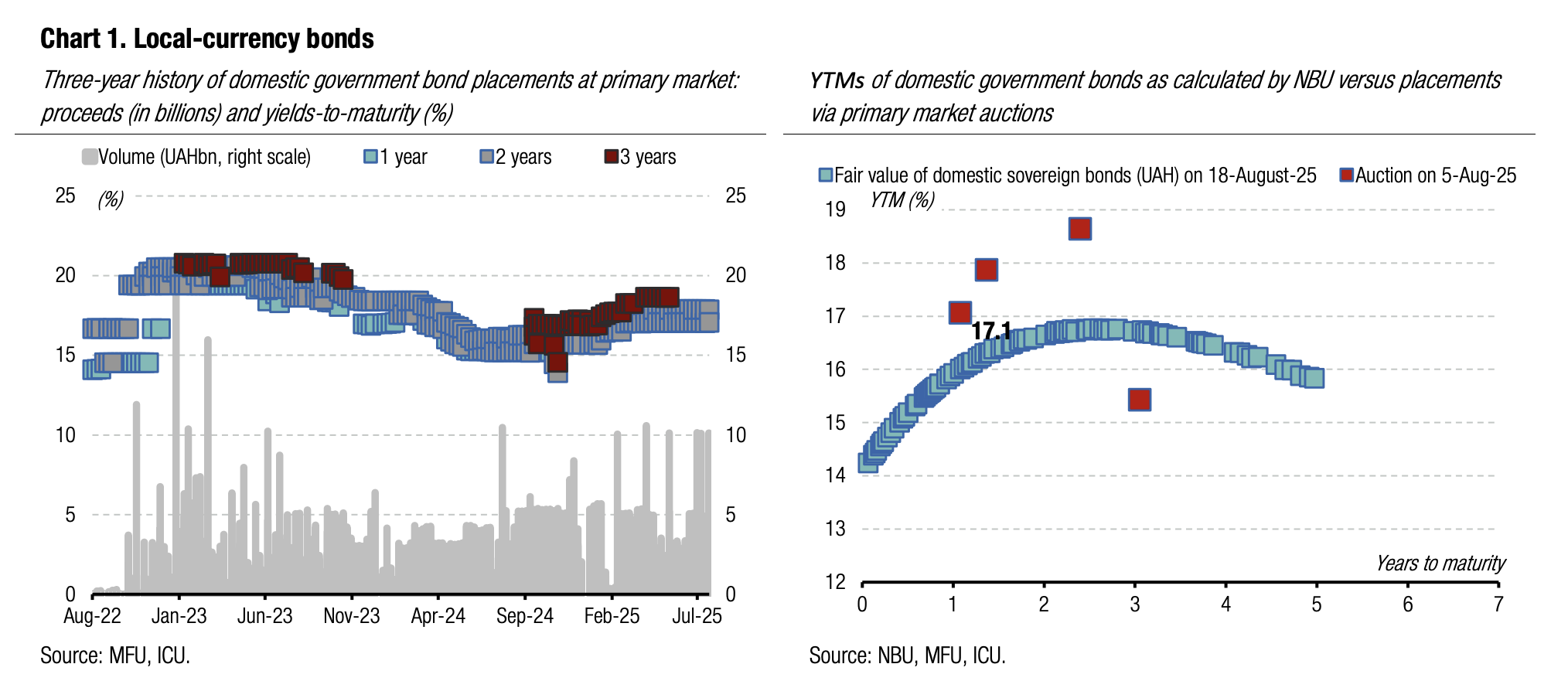

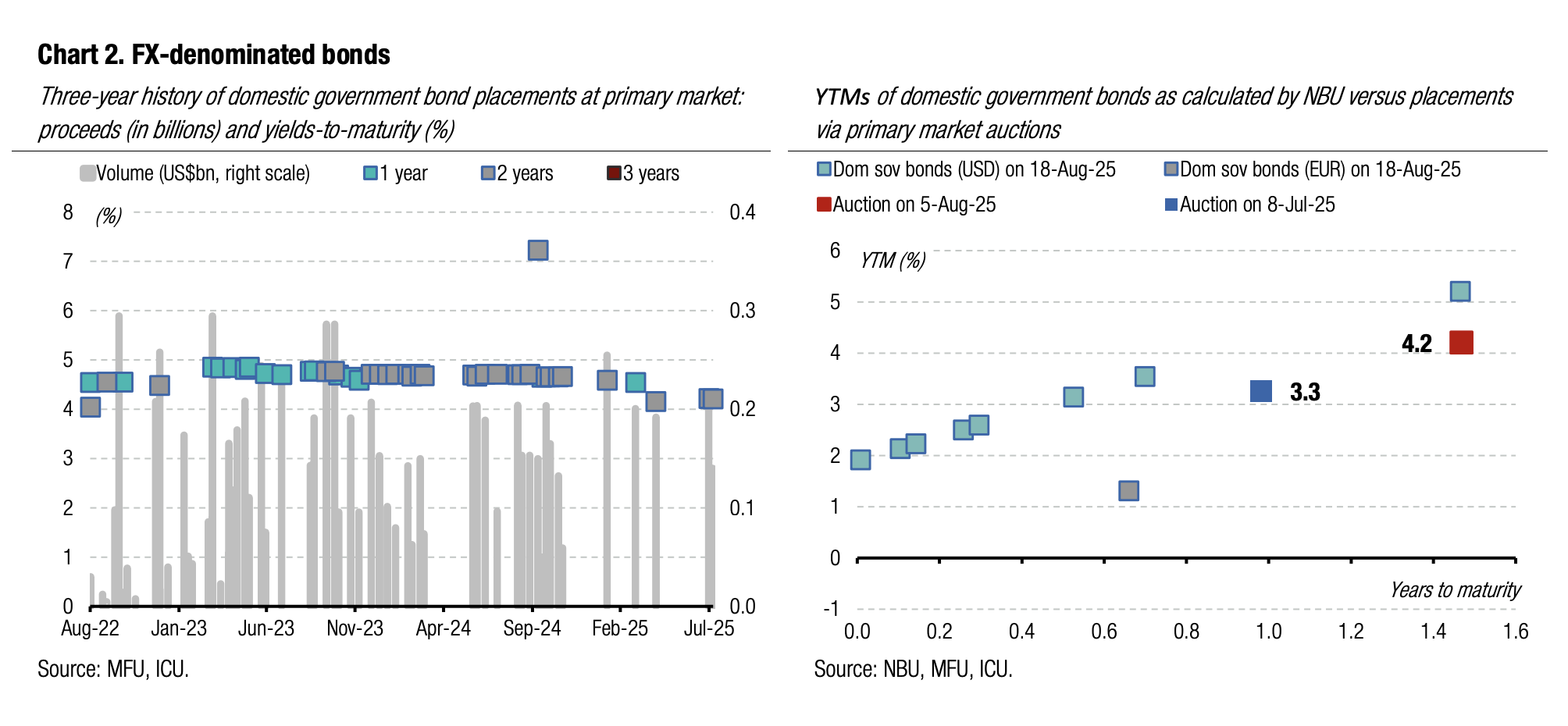

Bonds: Retail bond portfolio exceeds UAH100bn

In August, individuals reinvested proceeds from recent bond redemptions and also invested new savings, pushing their portfolio to a new record high of UAH100.5bn.

Individuals' bond portfolios sharply fell below UAH93bn after the MoF redeemed a USD-denominated bill at the end of July. However, individuals rebuilt their portfolios by reinvesting funds with no delays, and last week, their combined portfolio of domestic government bonds exceeded UAH100bn (US$2.4bn) for the first time.

Individuals' portfolios rose by 28% YTD with a slight shift in the FX structure to UAH bonds, as their share rose to 55% from 50% at the beginning of the year.

ICU view: Retail investors maintain their high interest in FX-denominated bonds, which remains an appealing tool for hedging FX risks. Yet, the outstanding retail sub-portfolio of FX bonds is still below the maximum seen in April. The increase in the total portfolio was primarily driven by high interest in hryvnia-denominated paper.

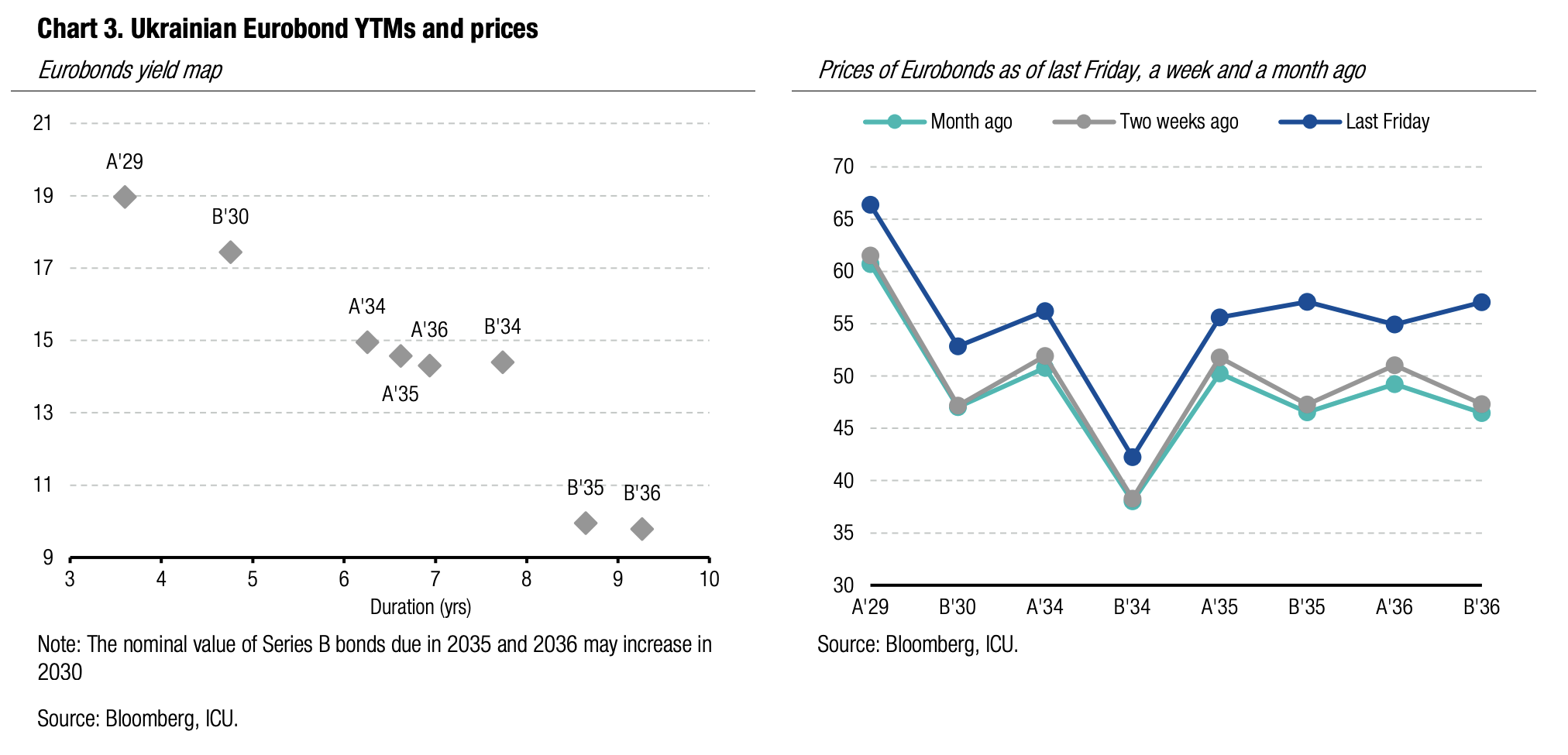

Bonds: Diplomatic efforts improve war expectations

The general sentiment towards Ukrainian Eurobonds improved significantly last week against the backdrop of preparations for the meeting of the US and russian presidents.

Last Friday, US President Trump met with the russian president. They discussed ending the war in Ukraine. Today, the US and Ukrainian presidents will meet in Washington. However, it is currently totally unclear how Ukraine and its partners will proceed given that russia’s aggressive ultimatum is completely unacceptable. Yet, the prospect of a ceasefire soon has significantly improved investor sentiment. Against this backdrop, the price of series A bonds rose by an average of 8% to 55-66 cents, while the prices of series B bonds maturing in 2030 and 2034 rose by 12% and 10%, respectively. The prices of B bonds due in 2035-36 sharply rose by 20%.

ICU view: Investors are very optimistic about reaching a deal to end the war in Ukraine, although this reaction may prove to be premature. Holders of series B bonds with a principal increase clause were the most optimistic. They may see a principal increase if Ukraine's real and nominal GDP in 2028 exceed the IMF's forecasts. Eurobond prices will remain extremely volatile in the coming weeks. On the one hand, we should expect numerous face-to-face and online negotiations to find a formula for ending the war. On the other hand, there are few convincing signals at this stage that such efforts can be effective.

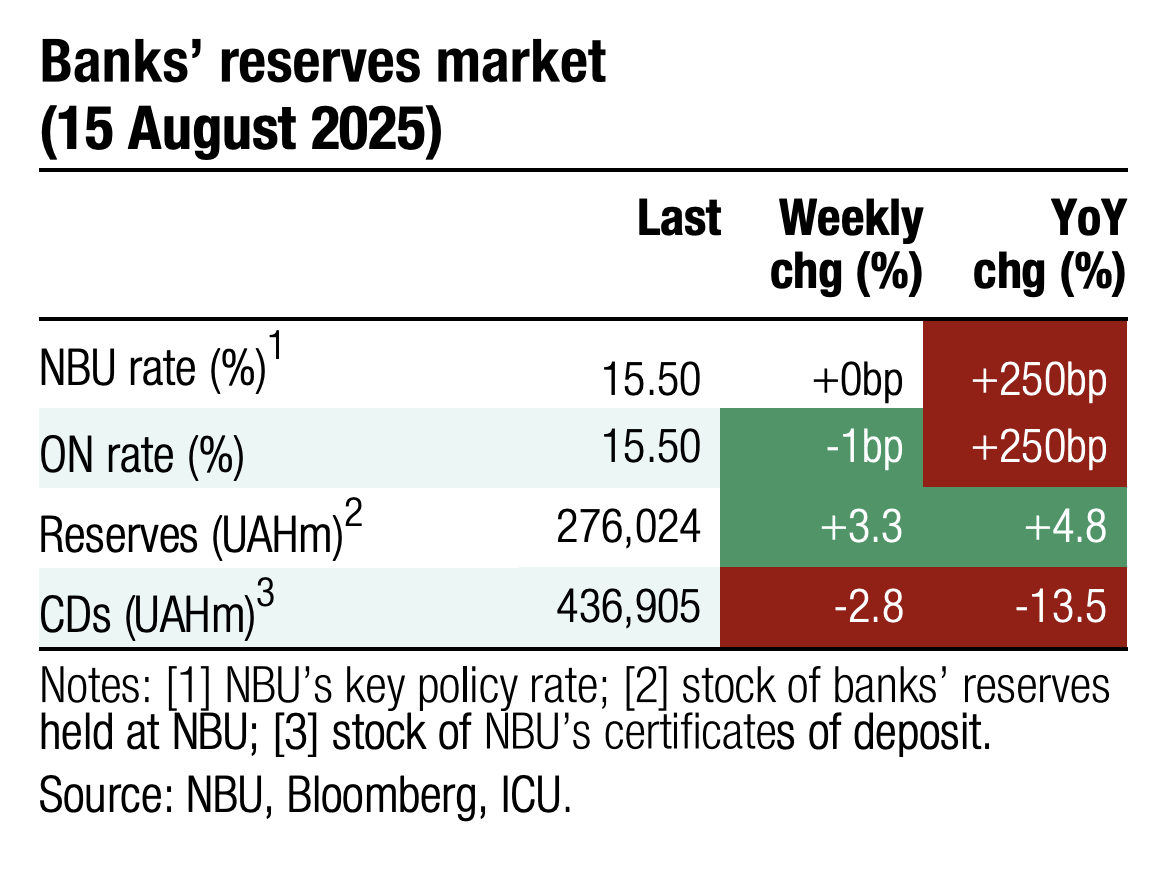

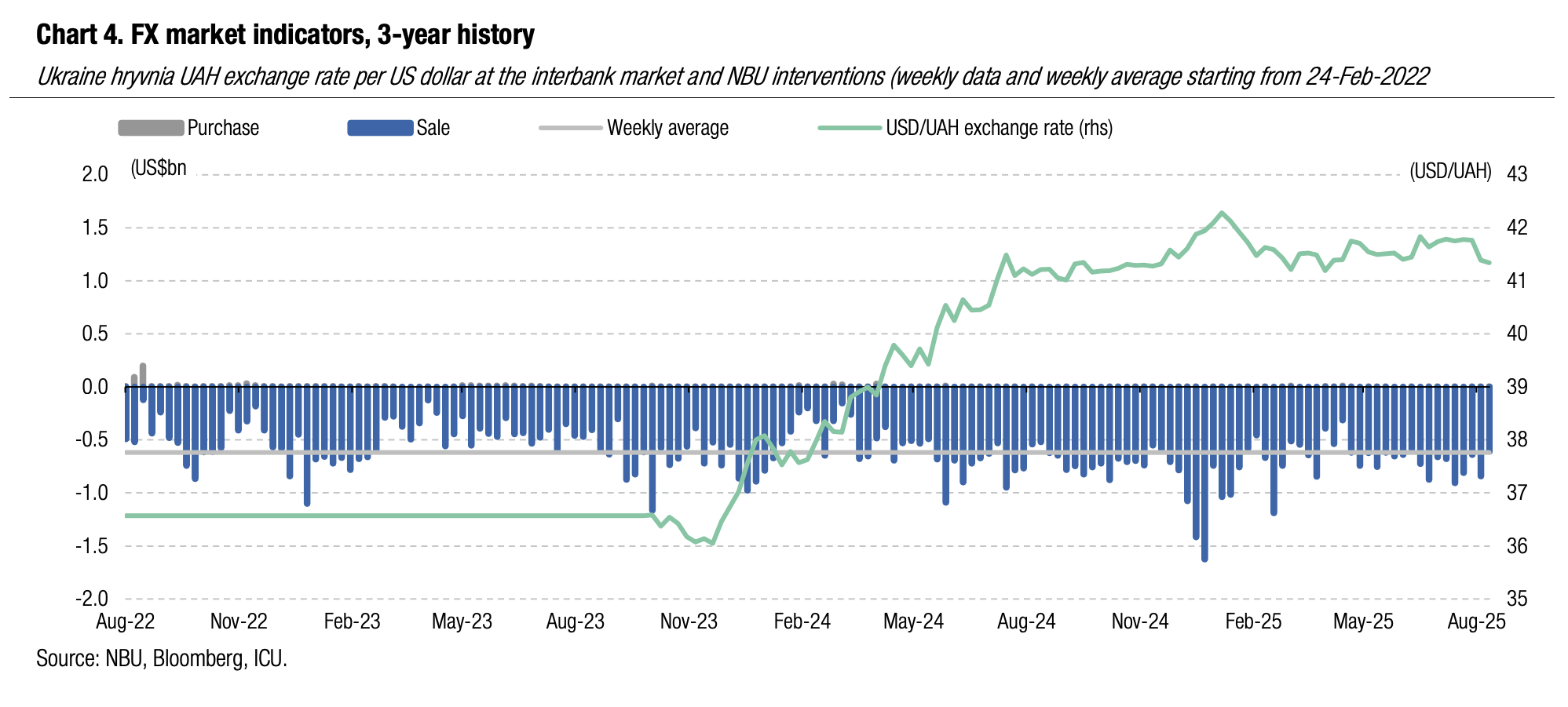

FX: NBU strengthens hryvnia with huge interventions

At the beginning of August, the NBU significantly stepped up its FX interventions, strengthening the hryvnia to a four-month high.

During the first week of August, the NBU sold US$843m from international reserves, strengthening the hryvnia to below UAH41.5/US$. Last week, the NBU strengthened the hryvnia to UAH41.34/US$, while decreasing interventions to US$608m. The hryvnia exchange rate is now at its strongest level vs US$ since April 10. However, the effective exchange rate is little unchanged in August, as the hryvnia weakened against the euro.

ICU view: The NBU’s move to strengthen the hryvnia in August was somewhat unexpected. This decision to push the hryvnia exchange rate up was apparently a signal that the NBU wants to see the hryvnia moving in both directions and likely in a wider range. We remain of the view that the NBU will maintain its strong hryvnia policy in the coming quarters and we see only marginal deprecation of hryvnia vs US dollar of less than 3% by the end of the year.