The lingering war and heightened safety risks imply Ukraine will remain critically dependent on foreign financial aid for its defense efforts and macroeconomic stability. A new IMF program would be of little help if not funded properly. Fortunately, the EU started serious discussions about an EUR140bn reparation loan for Ukraine linked to russian frozen assets.

The Ukrainian authorities believe the loan approval is highly likely and only the timeline is uncertain. Should the loan be stamped, Ukraine will receive much-needed reassurance that its fiscal needs are fully covered even in a pessimistic scenario of a prolonged war. Also, the NBU would be fully equipped to keep the FX market and hryvnia exchange rate under its full control for many years.

The flipside is that russian frozen assets were supposed to cover Ukraine reconstruction needs after the war, but the lack of alternative funding leaves no other choice for Ukraine and the EU but to start tapping them now.

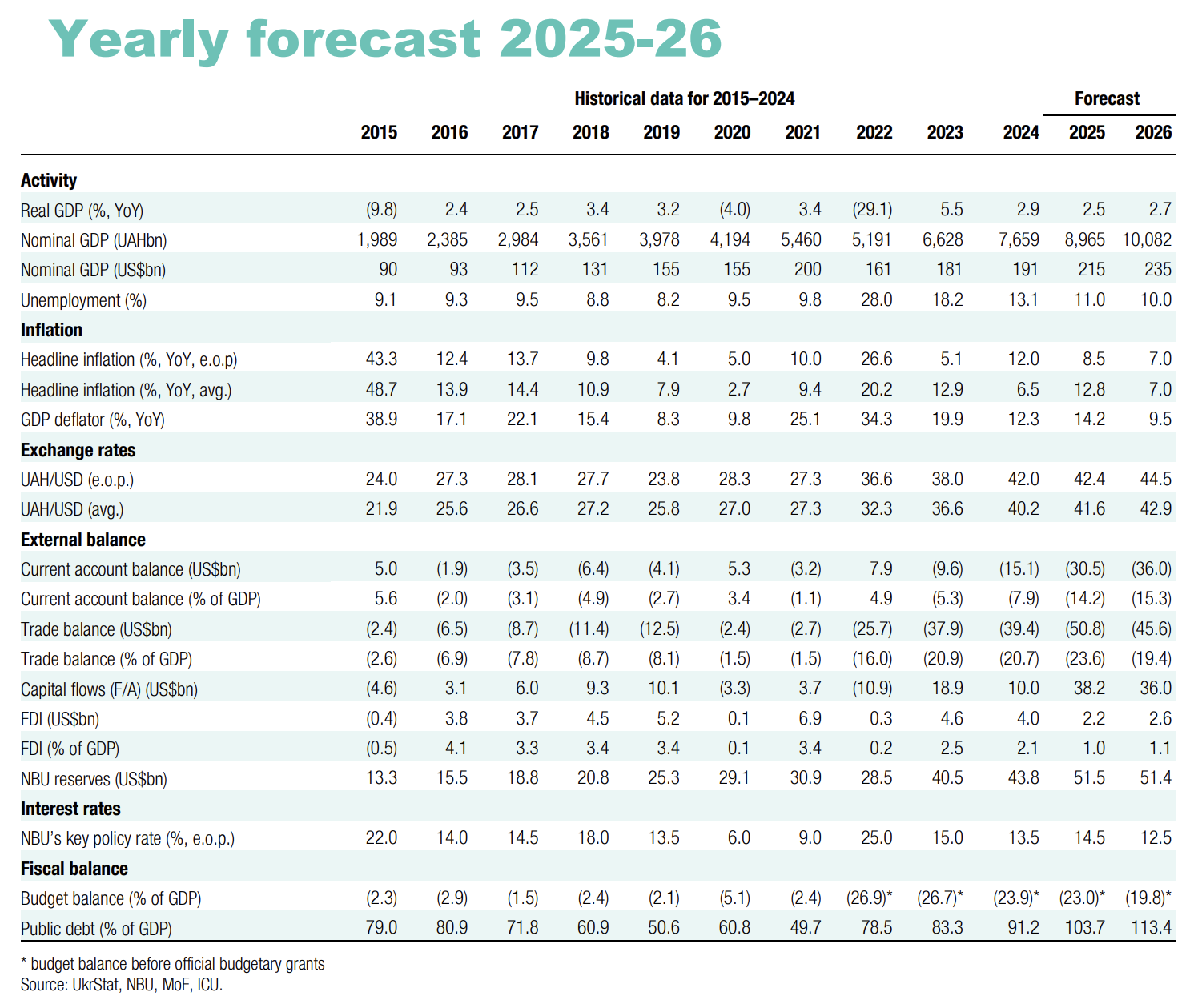

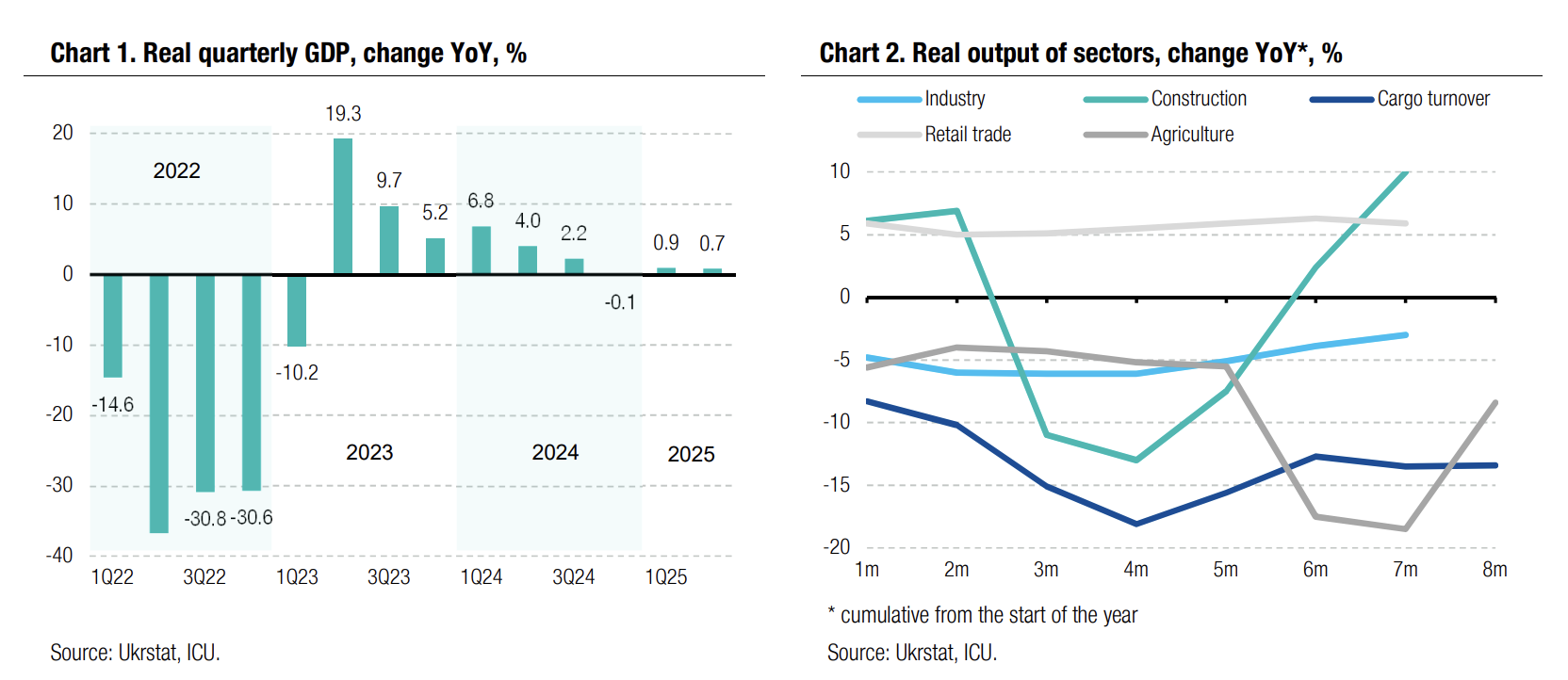

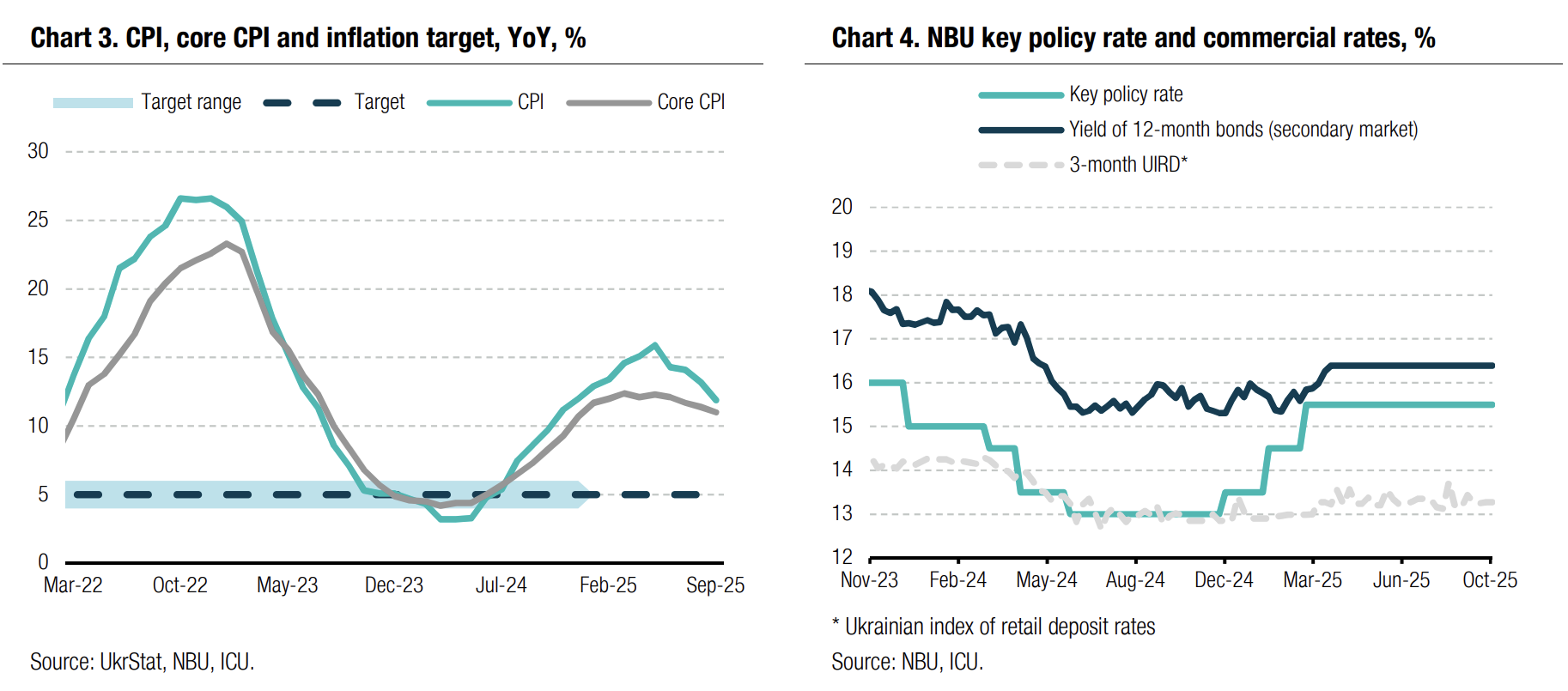

Economic growth is set to remain sluggish in the near future unless safety risks subside considerably. Inflation is decelerating at a good pace, exceeding NBU expectations. Price growth for nearly all consumer-basket components is slowing, indicating the disinflationary process is robust. However, we think that the NBU’s inflation target of 5% will remain out of reach in the coming years. All in, we believe preconditions are now in place for the central bank to switch to a gradual monetary-policy loosening cycle next week. We see the end-2025 key policy rate at 14.5%. In 2026, rate cutting will gain pace if a reparation loan is eventually approved.

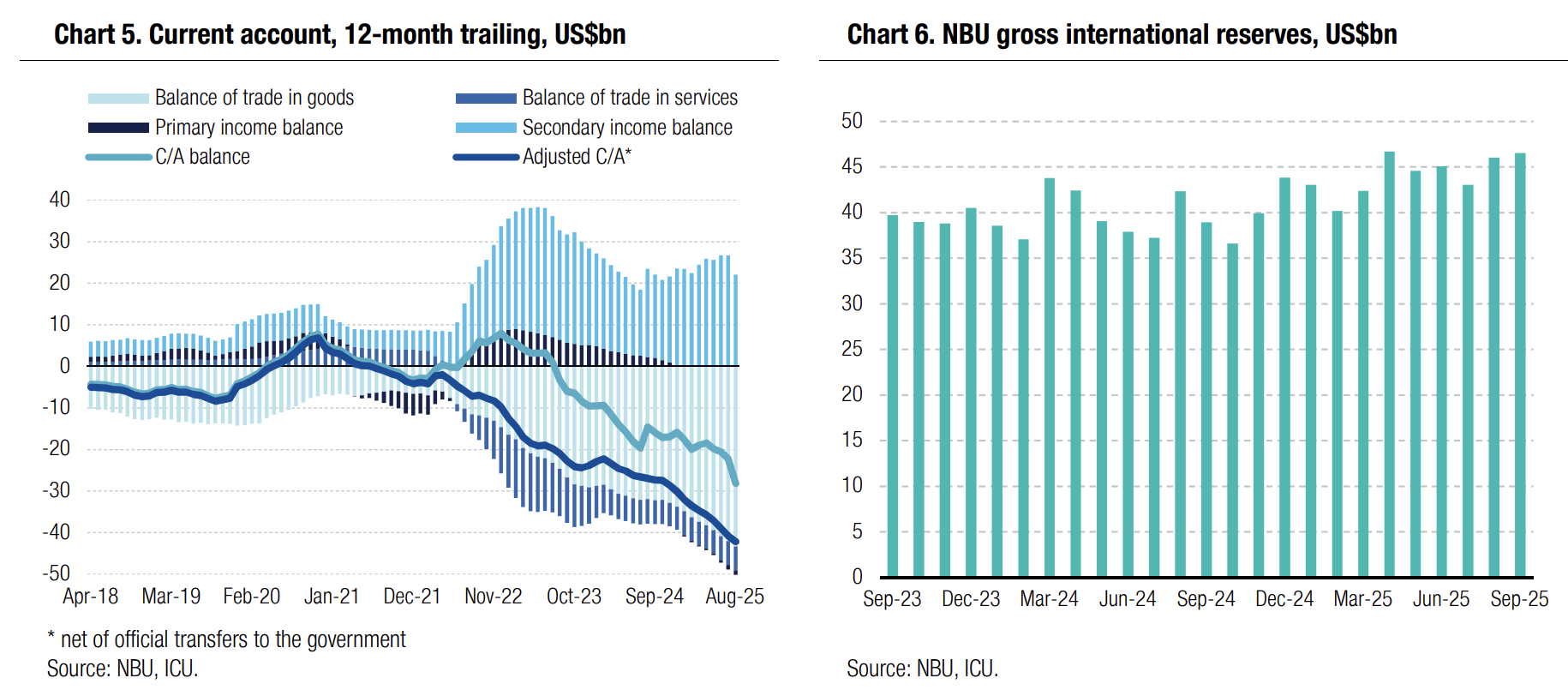

The ample current-account deficit will remain a major long-term challenge, but it should be safely covered with foreign aid in the mid-term. Given this, we take a more constructive view on the exchange rate and see the end-2025 level at UAH42.4/US$ and end-2026 level at UAH44.5/US$. Our conviction is that growing external imbalances (net of foreign financial aid) will force the NBU to change its de-facto fixed exchange-rate policy and start a managed gradual hryvnia depreciation policy.

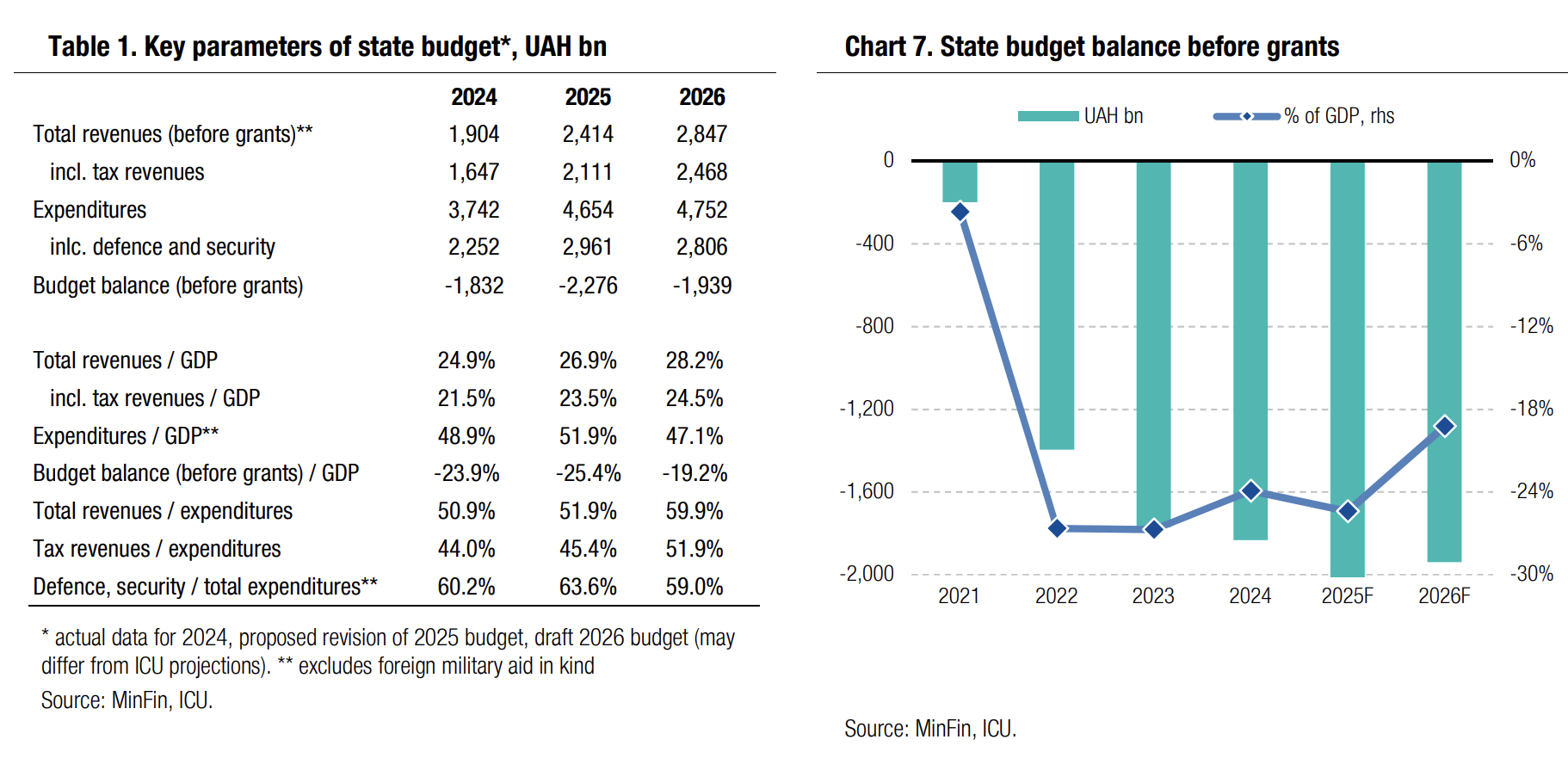

On the fiscal side, we see few risks as long as reparation loan approval is a realistic scenario. Importantly, this loan will not affect Ukraine’s debt sustainability metrics.