|  |

|  |

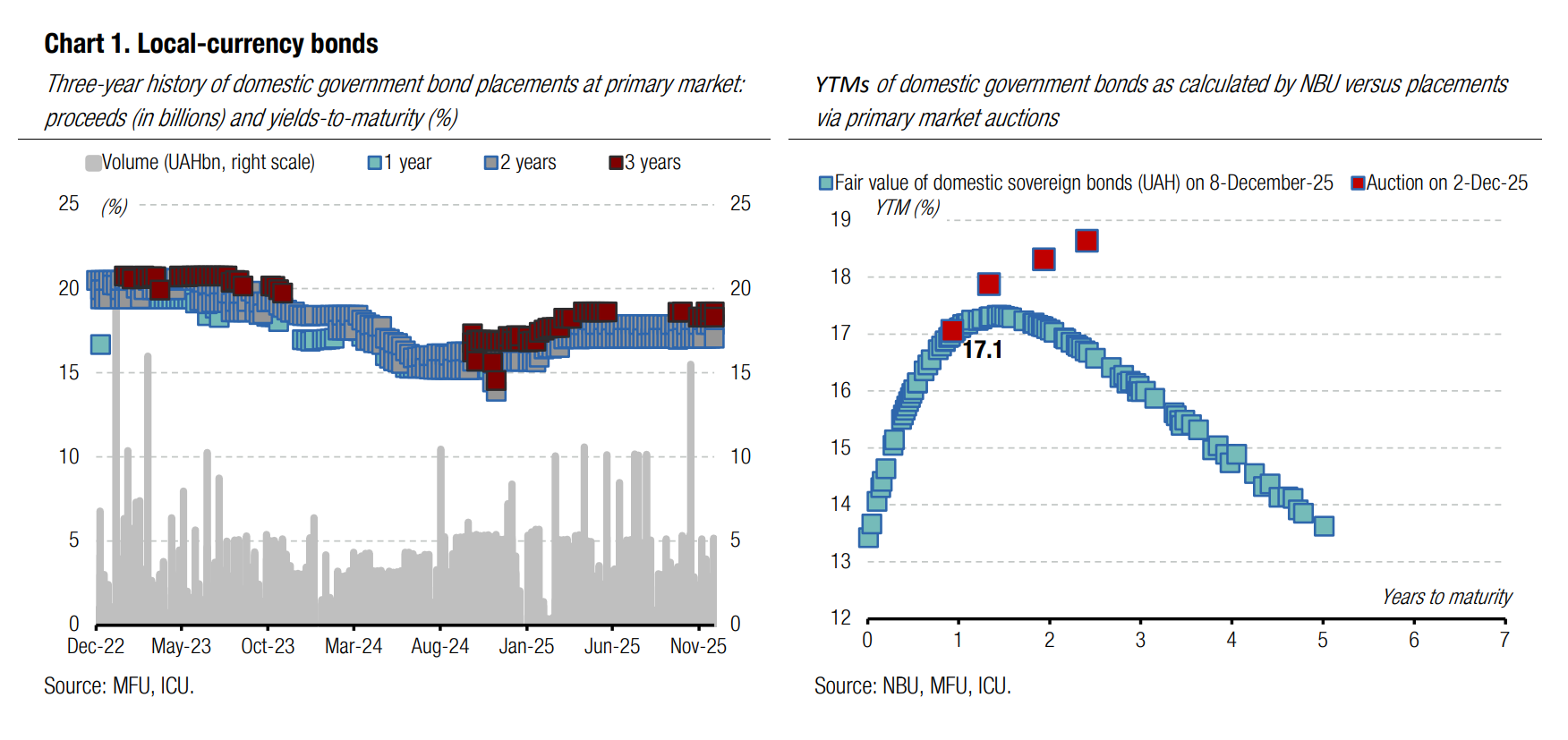

Bonds: MoF aims for local debt rollover just above 100%

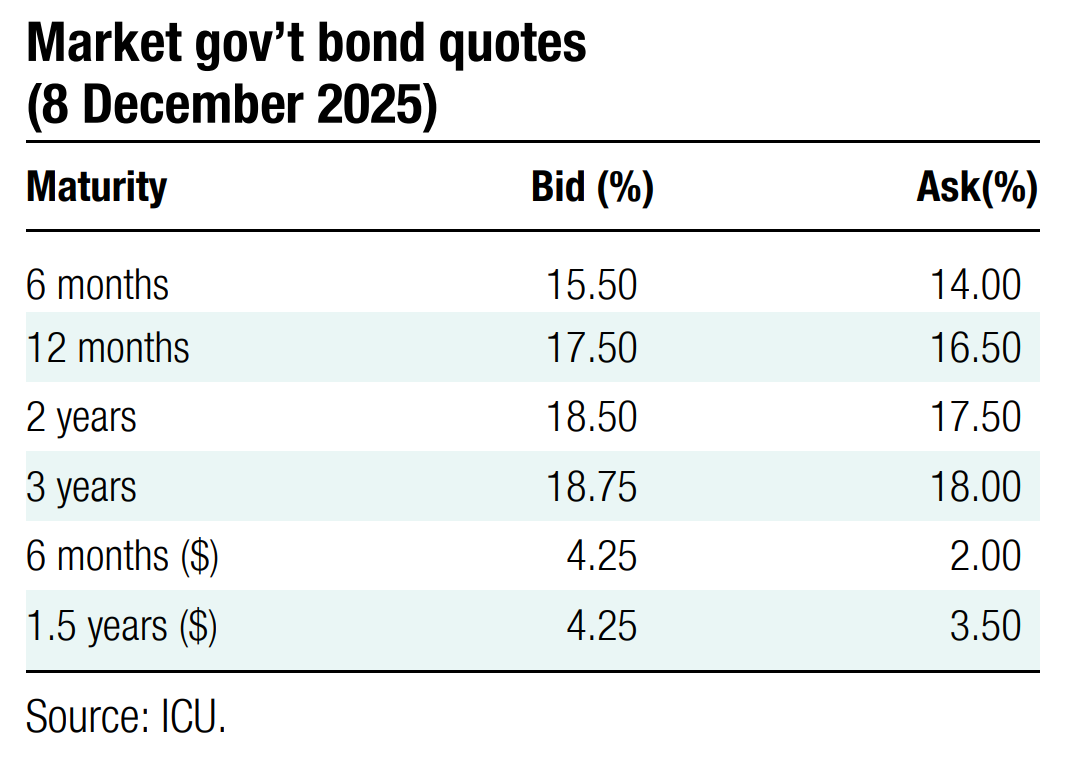

The Ministry of Finance reduced the supply of bonds and is maintaining the debt rollover slightly above 100%.

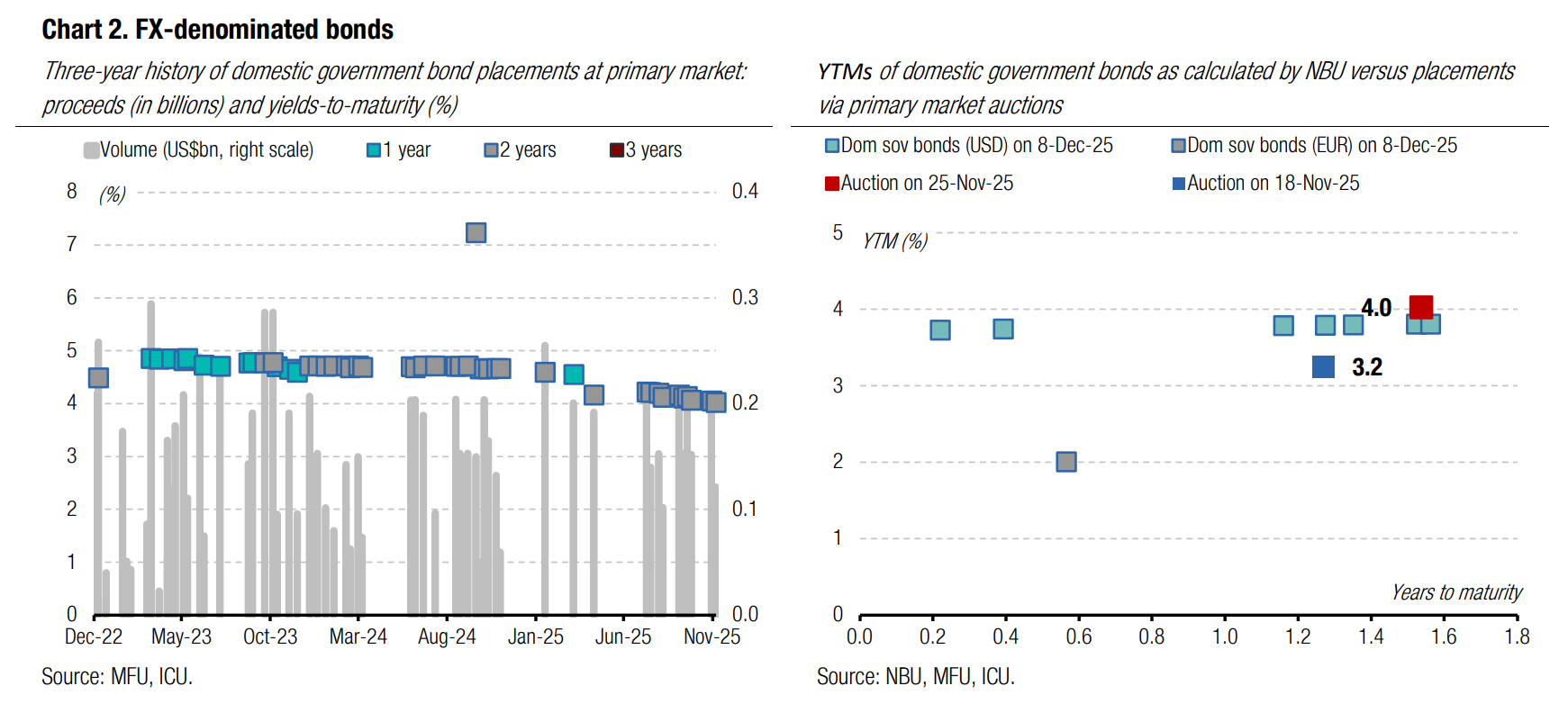

Initially, the MoF planned to offer USD-denominated bills twice in December, but revised the auction schedule in late November. The updated schedule includes only one offering of USD-denominated paper tomorrow. The MoF will also offer securities in euros tomorrow, even though the demand for them was insignificant at the end of November.

The MoF reduced the supply of UAH securities for tomorrow's auction to UAH1bn for the paper due in June 2027 and UAH2bn for the military bond maturing in March 2028. The MoF will offer only US$150m of USD-denominated bills, which is less than last week’s redemption.

ICU view: The MoF reduced the offering of two issues of UAH bonds as their outstanding amount is approaching UAH20bn, which is the MoF's unofficial target for each UAH-denominated issue. At the same time, the reduction in the supply of US dollar securities is consistent with the MoF's goal to gradually reduce the stock of local FX-denominated bonds. As we approach the year-end, it is becoming clear the MinFin is targeting a rollover rate for local debt of just above 100%, which is consistent with its beginning-of-the-year target that was later amended to become much more ambitious.

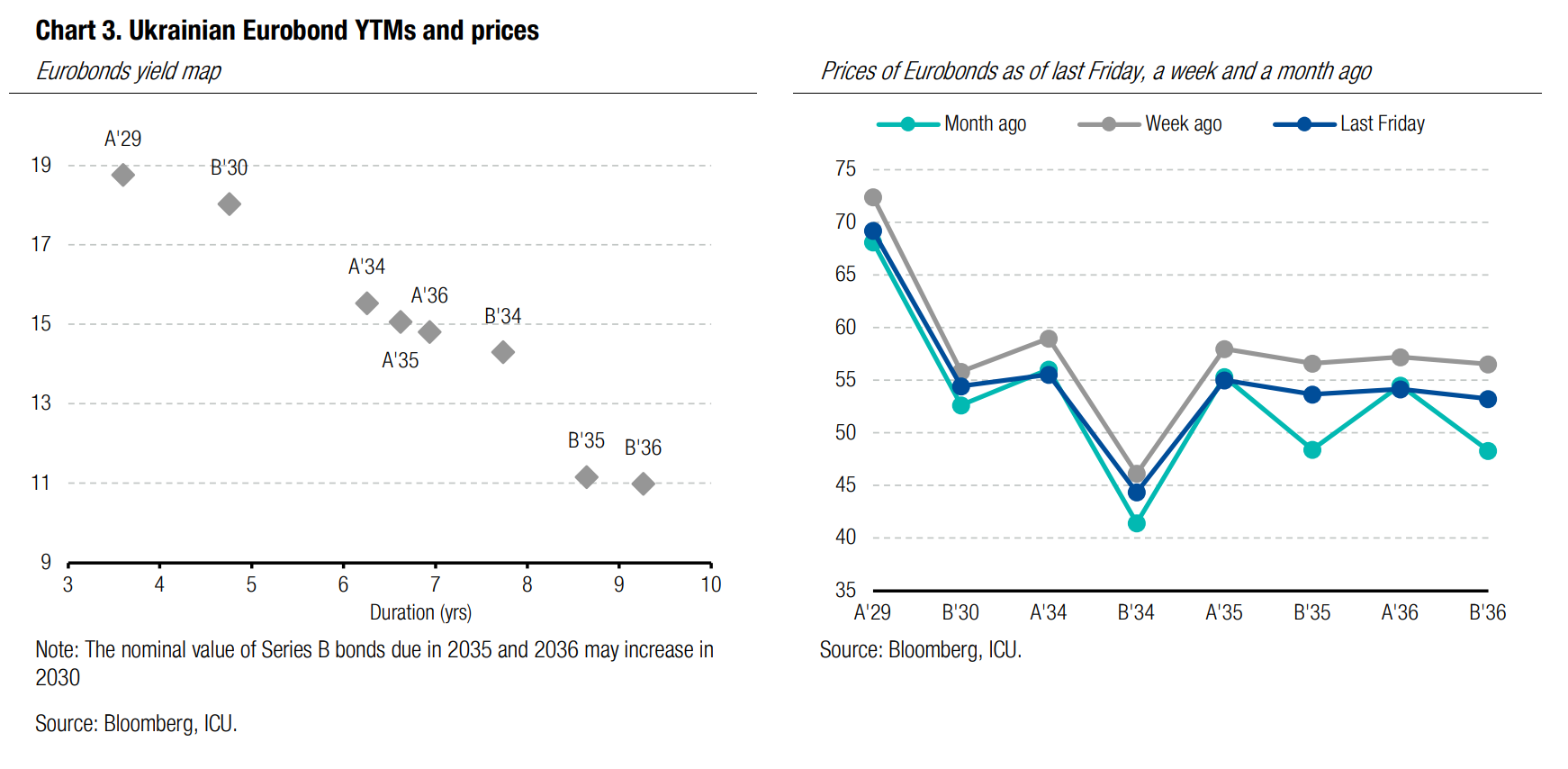

Bonds: russia expectedly rejects the peace plan

Last week, the US representatives visited moscow to discuss the peace plan, but russia apparently rejected the proposal. This news immediately affected the Eurobond prices.

On Tuesday, US representatives S.Witkoff and D.Kushner visited moscow and presented the peace plan that was agreed upon between Ukraine, the US and the EU. However, russian president expectedly rejected this peace plan, insisting, in fact, on Ukraine's surrender. On Tuesday, Eurobond prices began to decline, and by the end of the first week of December, prices slid by almost 5%.

ICU view: Bondholders' optimism was expectedly premature. russia rejected proposals from Ukraine and its allies, insisting on its terms of the peace plan, which would essentially imply Ukraine's surrender. The current week will likely be less active in terms of international peace efforts, although past experience has shown that the negotiation process often takes unexpected turns.

Bonds: MoF announces exchange offer for VRIs

Last Monday, the Ministry of Finance published a proposal for restructuring the VRIs, without reaching an agreement with a group of warrant holders, and invited all holders to vote by December 17.

The MoF published its proposal to exchange each US$1,000 of VRI's notional amount for US$1,340 of new series C bonds. The new bond will be an amortising paper, with 45% of the nominal value due in 2030 and 2031, and the remaining 10% due in 2032. These securities will have semi-annual coupons paid on February 1 and August 1. The coupon rate will gradually increase: 4% from the issue date until February 1, 2027, 5.5% from February 1, 2027 to August 1, 2029, and 7.25% from August 1, 2029 to maturity on February 1, 2032.

The MoF set the early bird deadline for December 12 and the final deadline for December 17. Participants may receive higher consent fee is submit their votes up to December 12, especially when over 75% of holders support the deal.

If the MoF receives only 50% of the outstanding VRIs tendered for the exchange offer, it will exchange only this part of VRIs. However, if the MoF receives 75%+ of the votes, the exchange structure will be different: holders who did not participate in the exchange will receive $1,360 series B bonds maturing in 2030 and 2034 in equal parts. All exchange offer participants will receive a payment of $10 for each US1,000 of the notional value of the warrants, as well as an additional $10 if more than 75% of the VRIs outstanding participate in the exchange.

The group of warrant holders noted on Friday that there still remains a number points to be resolved in relation to the terms of the new C Bonds before it could support the exchange. VRI price exceeded the notional value last week.

ICU view: The MoF expects that the VRI holders will agree to the exchange. The terms of the offer have improved significantly compared with proposals made at the end of November. However, they seem to be worse than the demands of holders made public last month. According to our calculations, with an exit yield of 15%, the MoF's offer is equivalent to 98 cents per dollar of the notional value of the warrants. We expect that the Ministry of Finance and the group of warrant holders will agree on the contentious points, and ultimately, the exchange will happen.

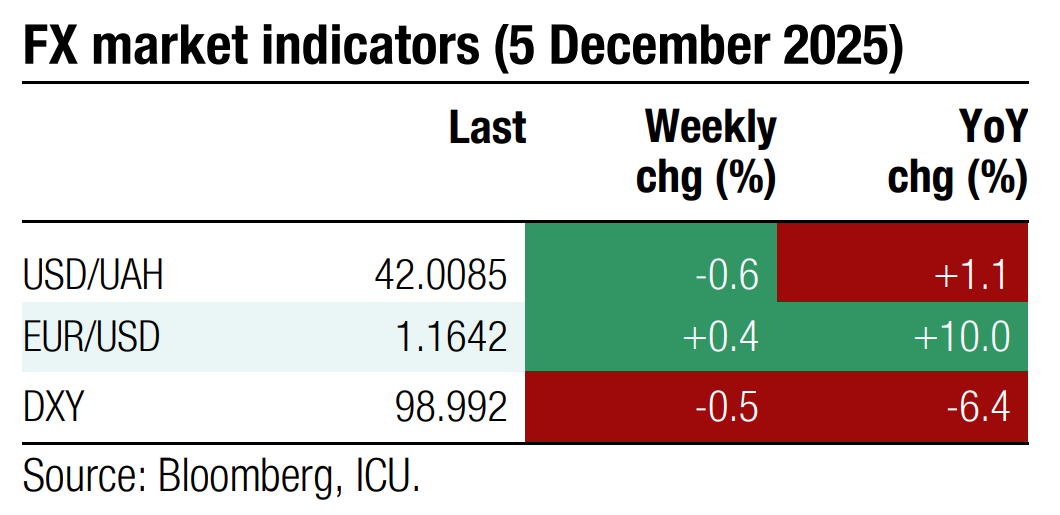

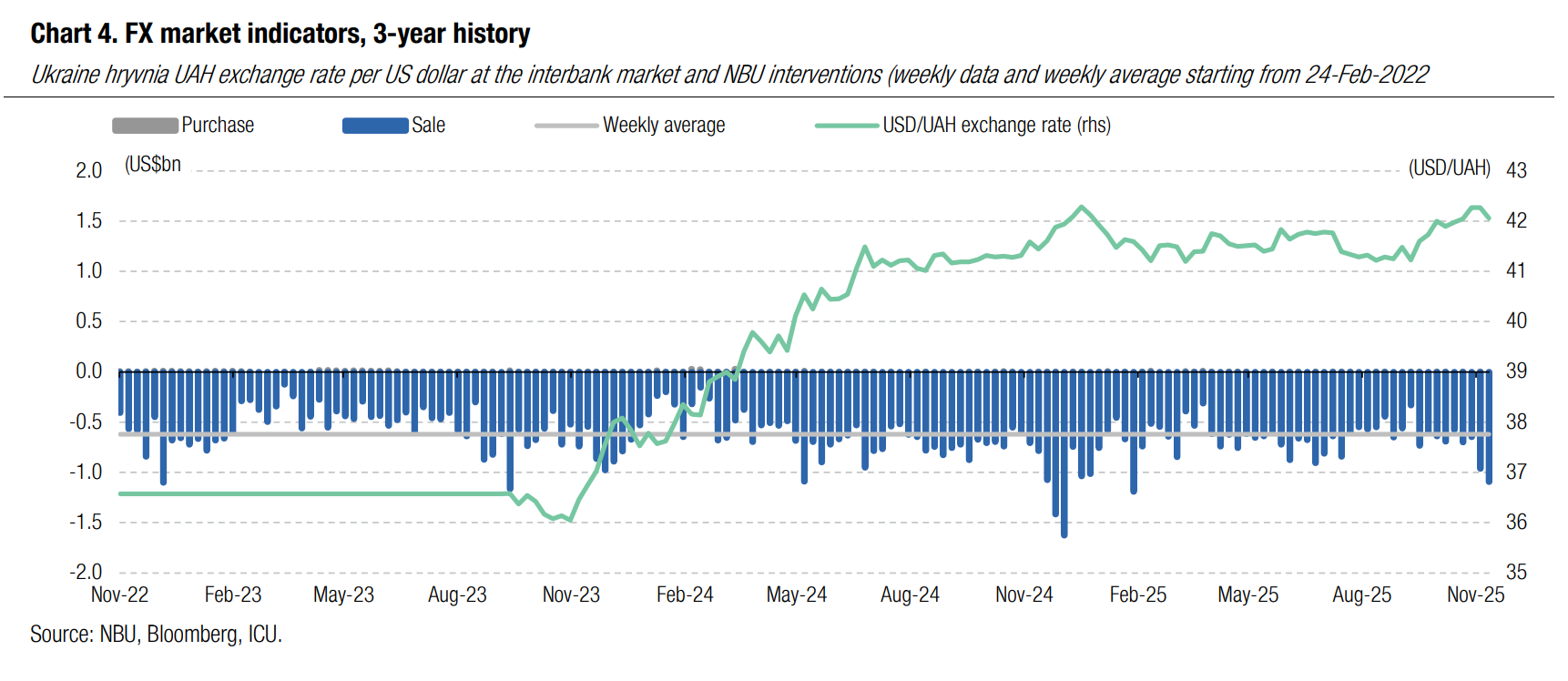

FX: NBU strengthens hryvnia with significant interventions

The NBU strengthened the official hryvnia rate again last week, while increasing interventions significantly.

The FX market shortage last week declined by almost ¼ WoW (in four business days) to US$525m. The weekly gap exceeded US$500m, the level that was seen just a few times this year. To cover the deficit, the NBU had to increase interventions by 14% to almost US$1.1bn, just US$100m below this year's largest weekly interventions in February.

The range of hryvnia exchange rate fluctuations widened further last week, as market quotes shifted last Friday to about UAH42/US$ after reaching UAH42.5/US$ in November. The official hryvnia rate today is UAH42.06/US$, 0.5% stronger than last week and 0.8% stronger than this year's maximum recorded in November.

ICU view: The NBU continued to widen the range of hryvnia fluctuations. Yet, it seems fully reluctant to significantly weaken the hryvnia despite expected increase in FX demand towards the end of the year. We expect such fluctuations to persist in the near future, with a gradual return to the official exchange rate of approximately UAH42.5/US$ by the end of the year.

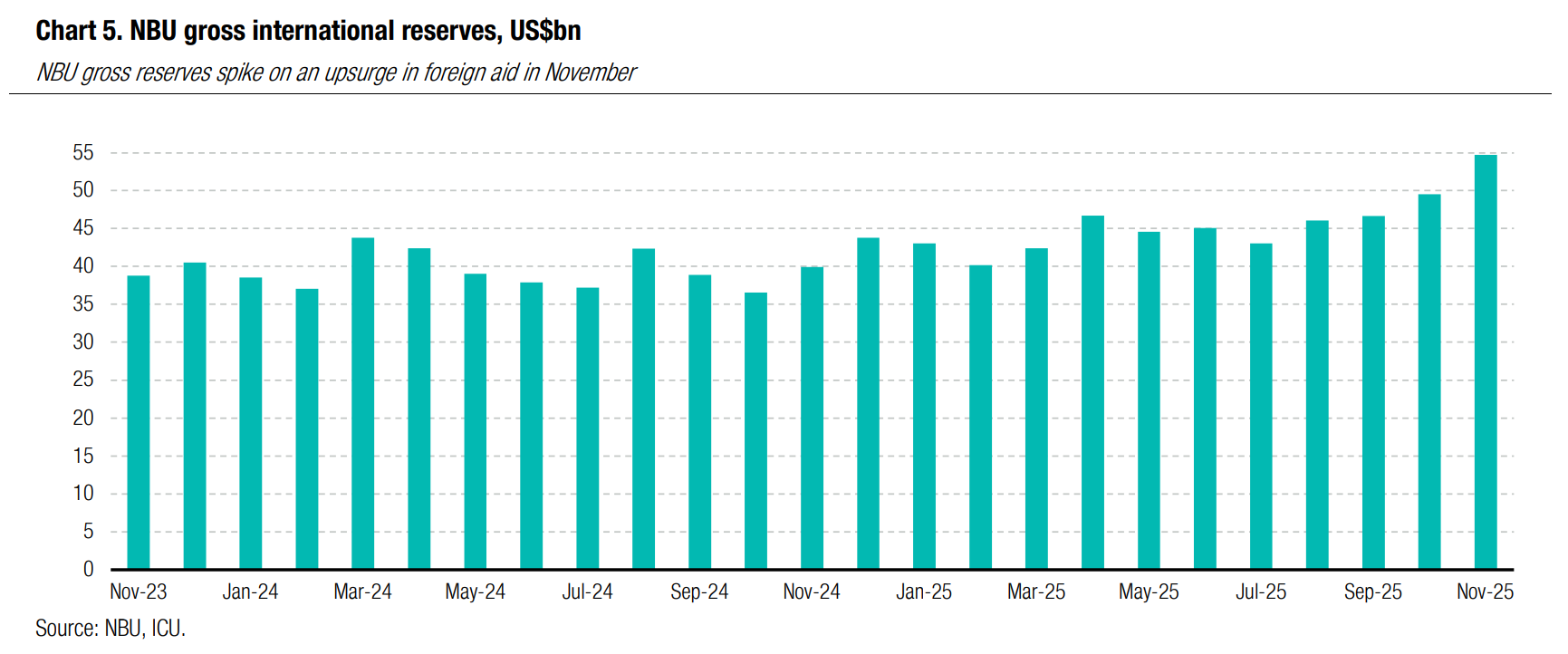

Economics: NBU reserves hit new high

Sizeable inflows of foreign aid in November pushed NBU reserves to a new all time-high level of $54.7bn (+11% in November and +25% YTD).

The spike in reserves primarily came on the back of $6.9bn EU funding that includes ERA and Ukraine Facility, and a $0.8bn funding via the World Bank. Additionally, the NBU booked $0.6bn in gains on its foreign assets. Meanwhile, the central bank spent net $2.7bn on sale interventions in the FX market and $0.4bn was earmarked to external debt servicing of the government. The NBU estimates its end-November reserves are equivalent to 5.6 months of future imports.

ICU view: We expect NBU reserves to remain above $50bn at least through end-2026 if the EU approves a reparations loan or an alternative funding facility for Ukraine. This will fully enable the NBU to maintain control of the FX market and exchange rate at least in the next 12 months.

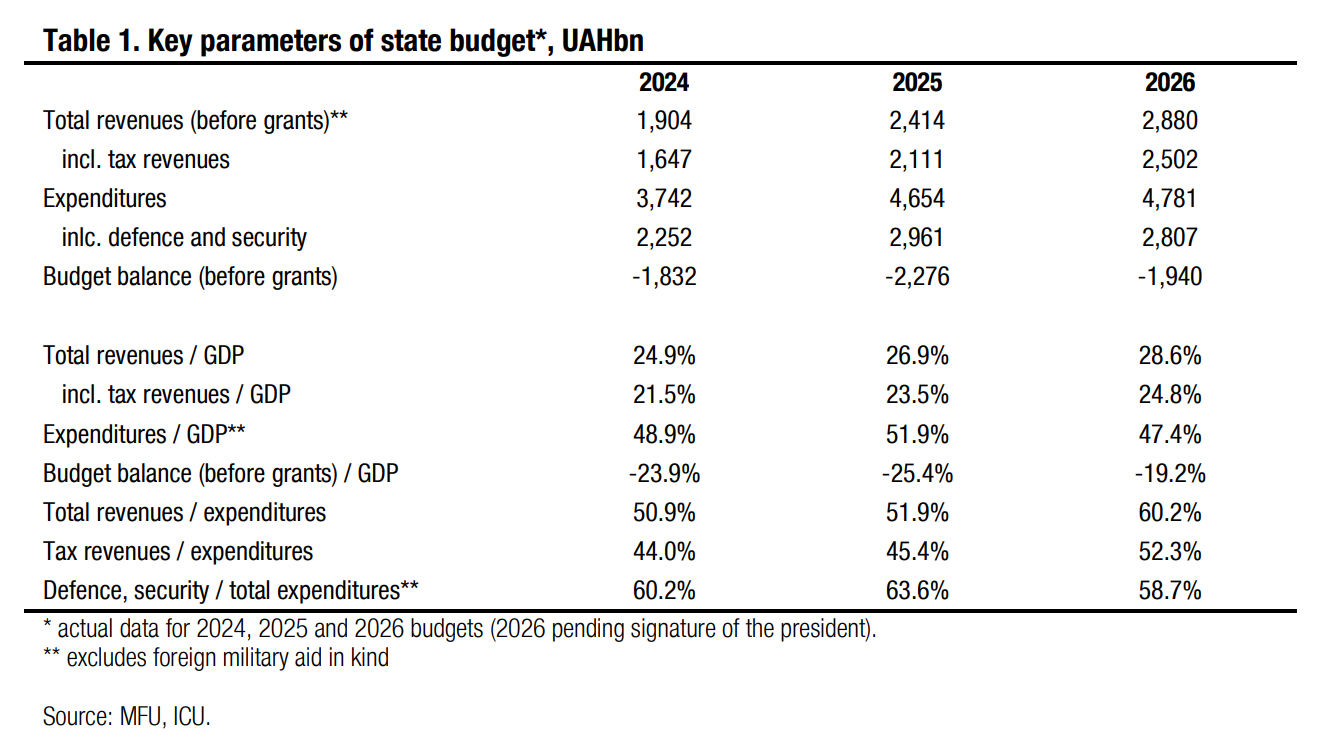

Economics: Parliament approves 2026 state budget

The Ukrainian parliament approved the 2026 state budget last week. The deficit is planned at UAH1.9trn, an equivalent of US$46bn at the current exchange rate, or 19% of GDP.

Gross external financing needs are estimated at UAH2.1trn, an equivalent of US$51bn at the current exchange rate. The government plans to increase expenditures by 3% vs. the 2025 targets, with outlays on the defence and national security sectors making up almost 60% of the total.

ICU view: So far, Ukraine’s allies committed $20bn in foreign financial aid in 2026. Additionally, the government will likely have some leftovers of foreign aid of $5-6bn received in 2025 (pre-financing received in 2025). This means that about half of 2026 budget funding needs remain uncovered at this point. Our eyes are on developments around the EU reparation loan (or an alternative instrument) that is to be discussed by the European Council on December 18-19th.