|  |

|  |

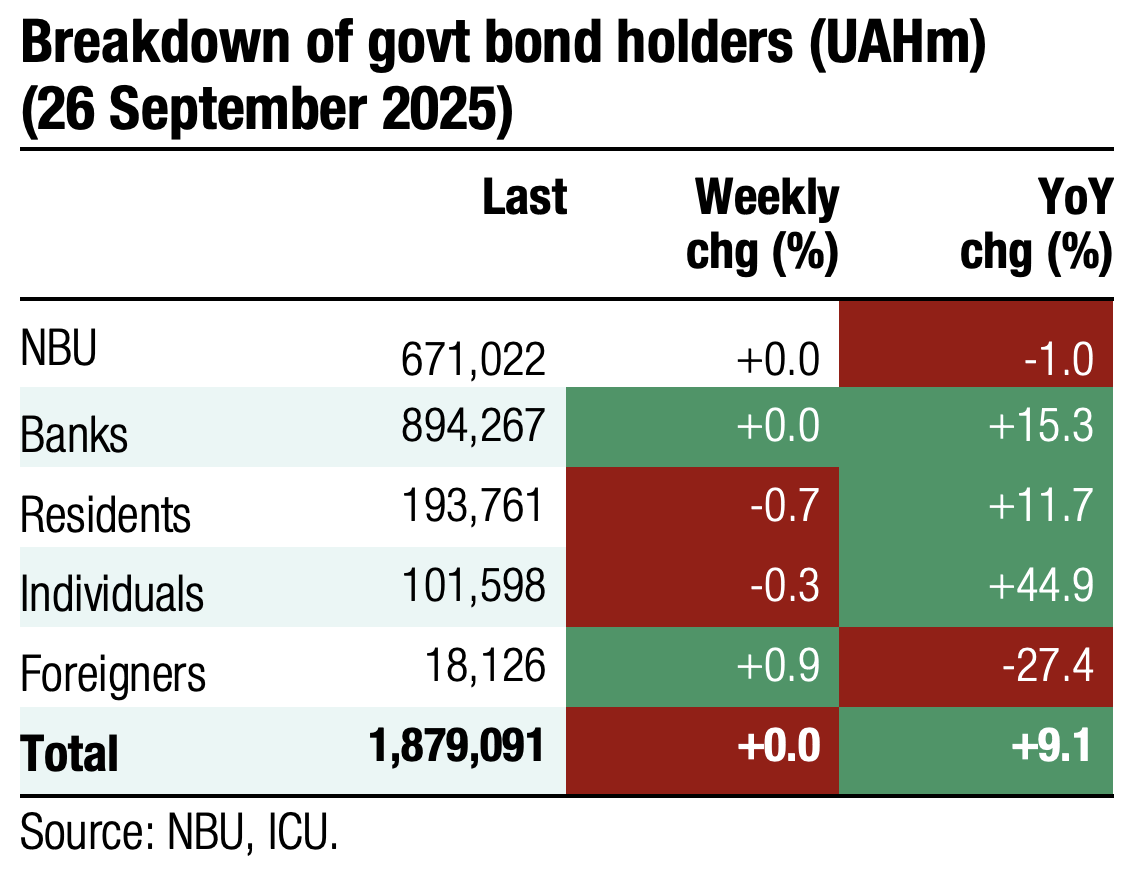

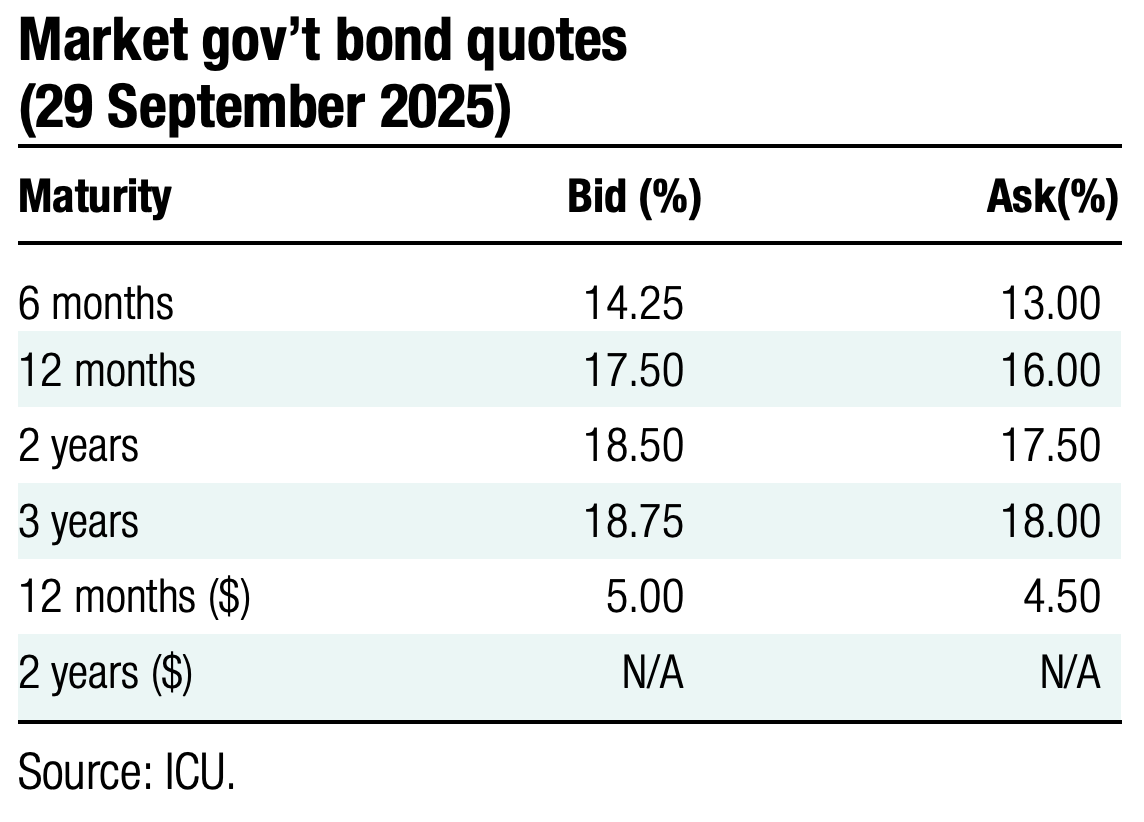

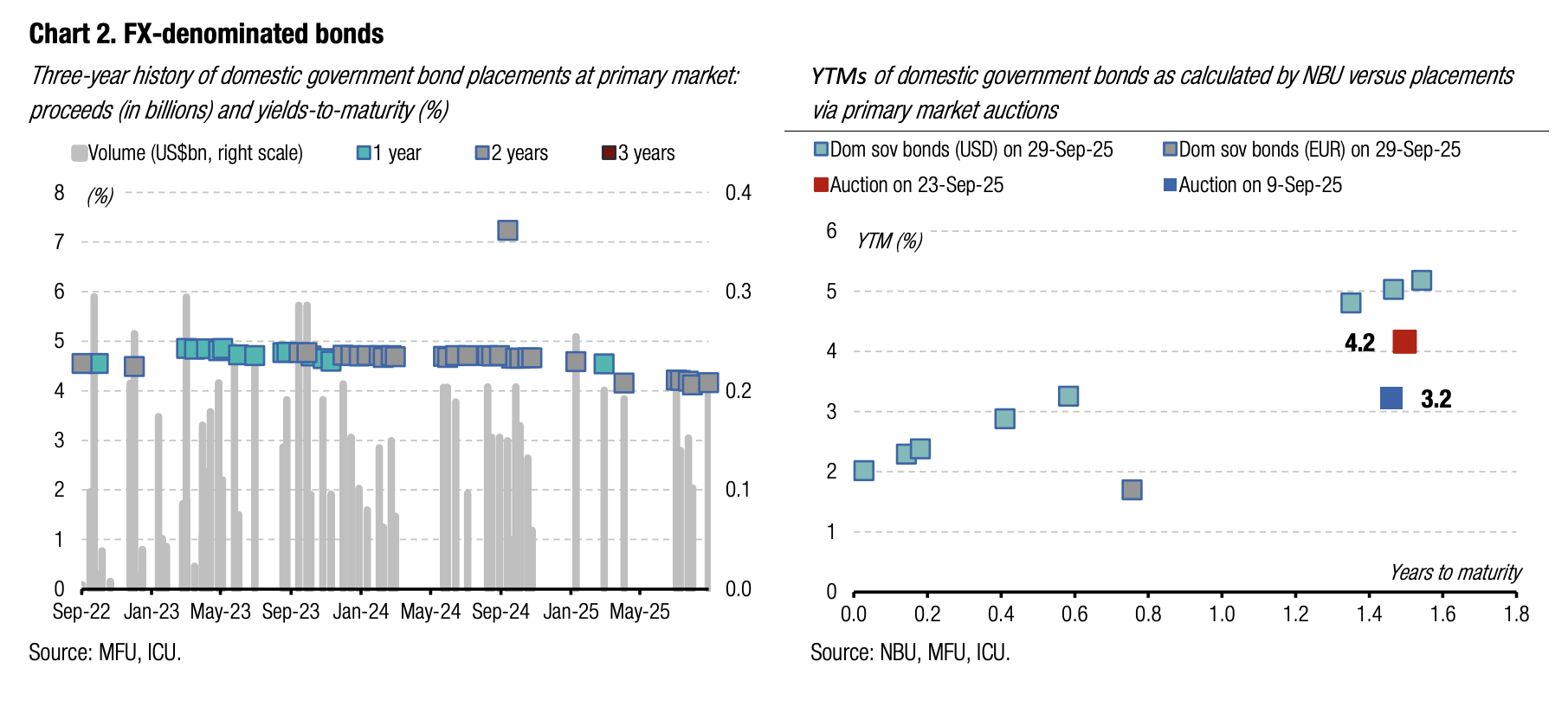

Bonds: MinFin targets full rollover of FX bonds

The Ministry of Finance aims to fully refinance last week's redemption of a USD-denominated bond.

Last week, the MoF redeemed US$350m of bonds and sold new paper with a maturity in 2027 for US$200m. Tomorrow, the MoF will offer US$150m worth of the same bond. Thus, in September, unlike in previous periods, the Ministry will likely fully refinance redeemed USD bonds.

ICU view: The Ministry of Finance typically prefers sub-100% rollover of FX-denominated bonds, but this time it targets a 100% rate. This likely implies the MoF is aiming to meet an ambitious net borrowing target in the local market. Therefore, the Ministry will likely be willing to match redemptions of local FX bonds with borrowings of the same size in the next three months. By the end of the year, the MoF has to redeem nearly US$900m of FX bonds, including US$350m in October, almost US$362m in November, and nearly US$188m in early December.

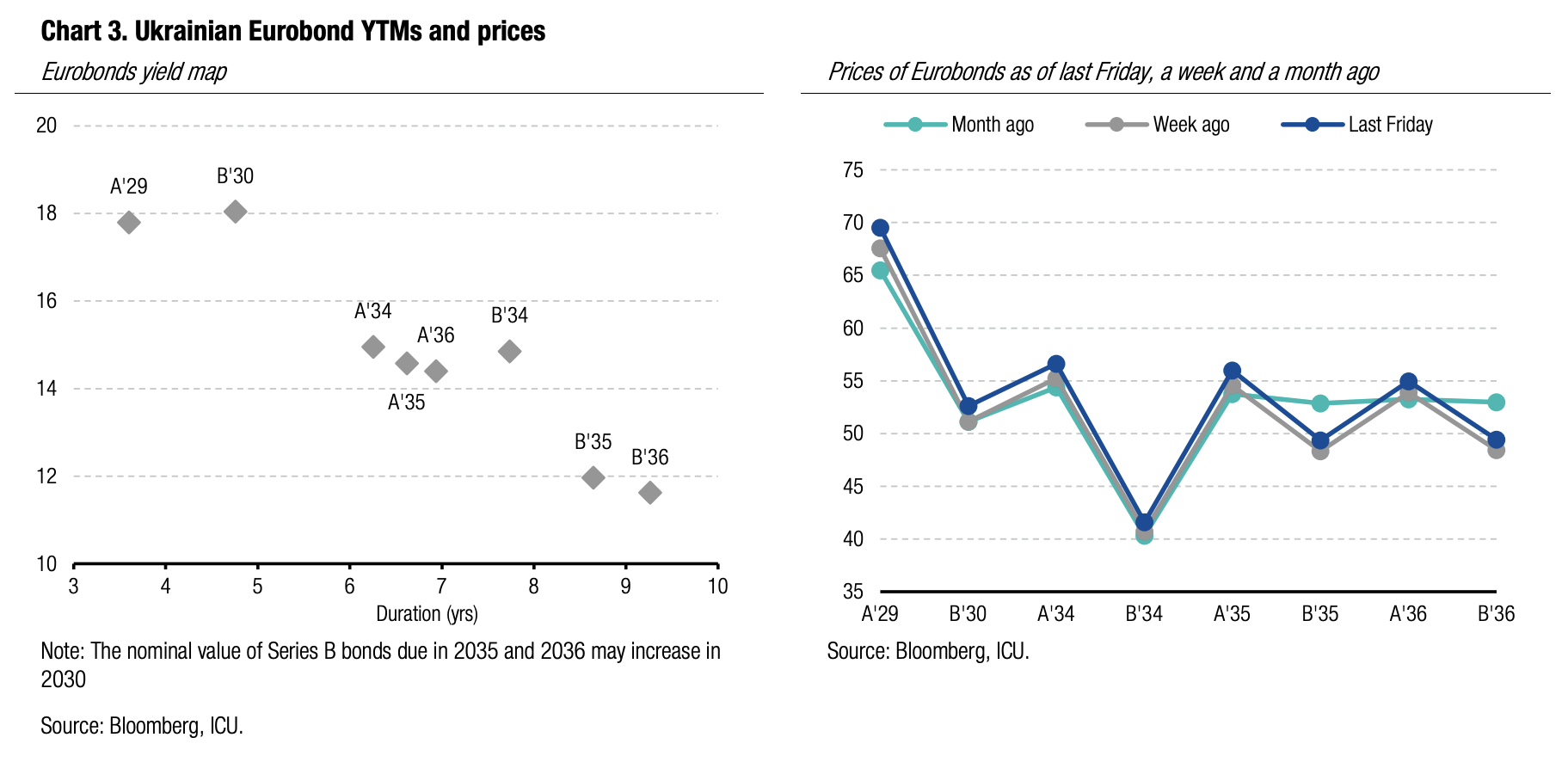

Bonds: Optimism for Eurobonds strengthens

Continued discussions of the size and form of new financial support for Ukraine strengthened investor optimism and drove Eurobond prices.

Last week, the presidents of Ukraine and the United States met in New York, with President Trump confirming the US’s continued support for Ukraine via sales of weapons through NATO partners. Later into the week, the German Chancellor stated in a column for the Financial Times that the EU is working on an interest-free loan for Ukraine for EUR140bn that relies on frozen russian assets. However, he noted that these funds should not be used for Ukraine's general budgetary needs, but should rather be directed to purchases of weapons and strengthening Europe's defences. The week concluded with an interview of the President of Ukraine. He said that he had asked for long-range missiles and President Trump promised to work on this request.

Ukrainian Eurobond prices rose by an average of 2% on Friday. VRIs' price rose by nearly 3% to almost 81 cents per dollar of notional value, the highest since mid-March.

ICU view: Continued military support from the US through NATO and the preparation of a massive new EU support program for Ukraine have been the main catalysts for an increase in Eurobond prices. With regard to Chancellor Merz's comments, the key question is whether the EU will find it possible to provide funds for Ukraine for general budgetary needs. The potential financial package of EUR140bn could potentially fully cover the state budget needs for the next four years, even in the downside scenario of a prolonged war. However, should Germany insist that the funds be used exclusively for purchase of weapons, Ukraine will likely struggle to raise funds to finance other budgetary needs.

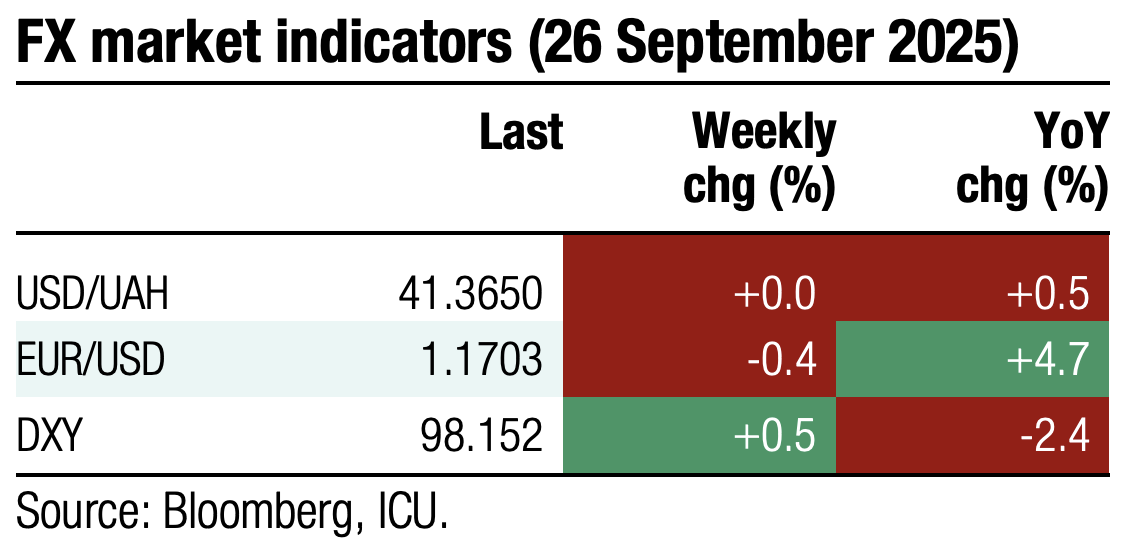

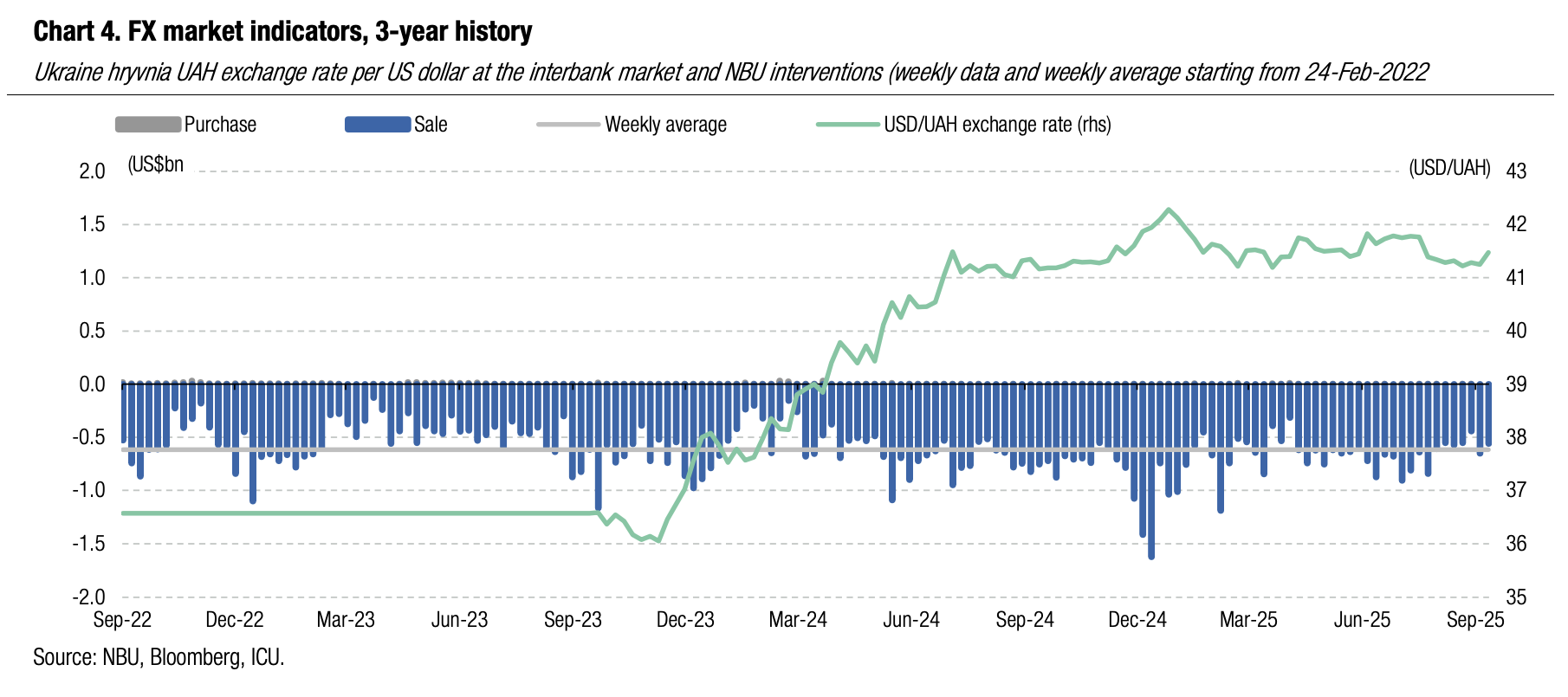

FX: Hryvnia fluctuation range broadens

Last week, the NBU let the hryvnia weaken to almost UAH41.5/US$, decreasing interventions.

Last week, the NBU reduced its interventions to US$560m, again below the average weekly volume since the start of the full-scale war. At the same time, the NBU allowed the hryvnia exchange rate to fluctuate in a wider range. Last week, the official hryvnia exchange rate approached to UAH41.5/US$, the maximum since early August.

ICU view: Lower hard currency shortage due to the lack of one-off demand from governmental agencies allowed the NBU to again reduce FX sales from international reserves. At the same time, the National Bank has moved to show that it is prepared to widen the hryvnia fluctuations band.