|  |

|  |

Bonds: MoF starts the year with active borrowings

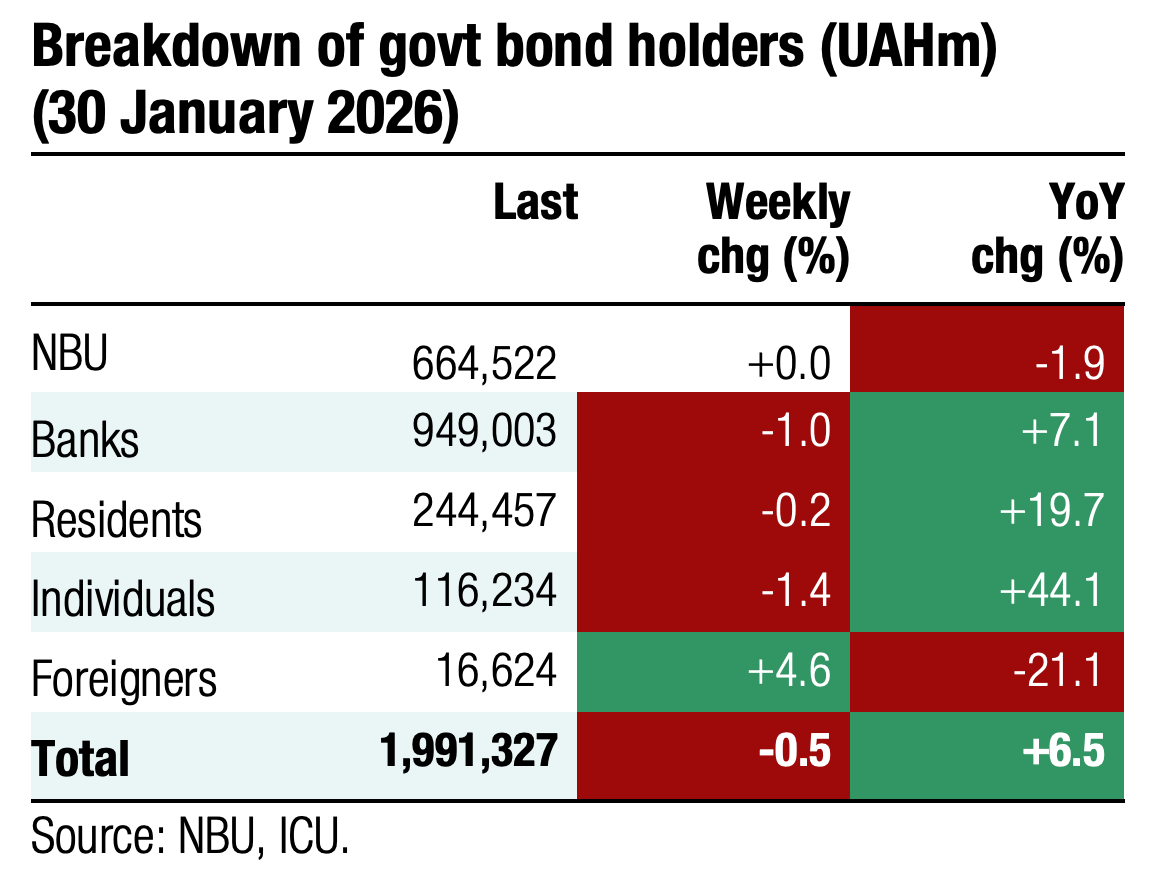

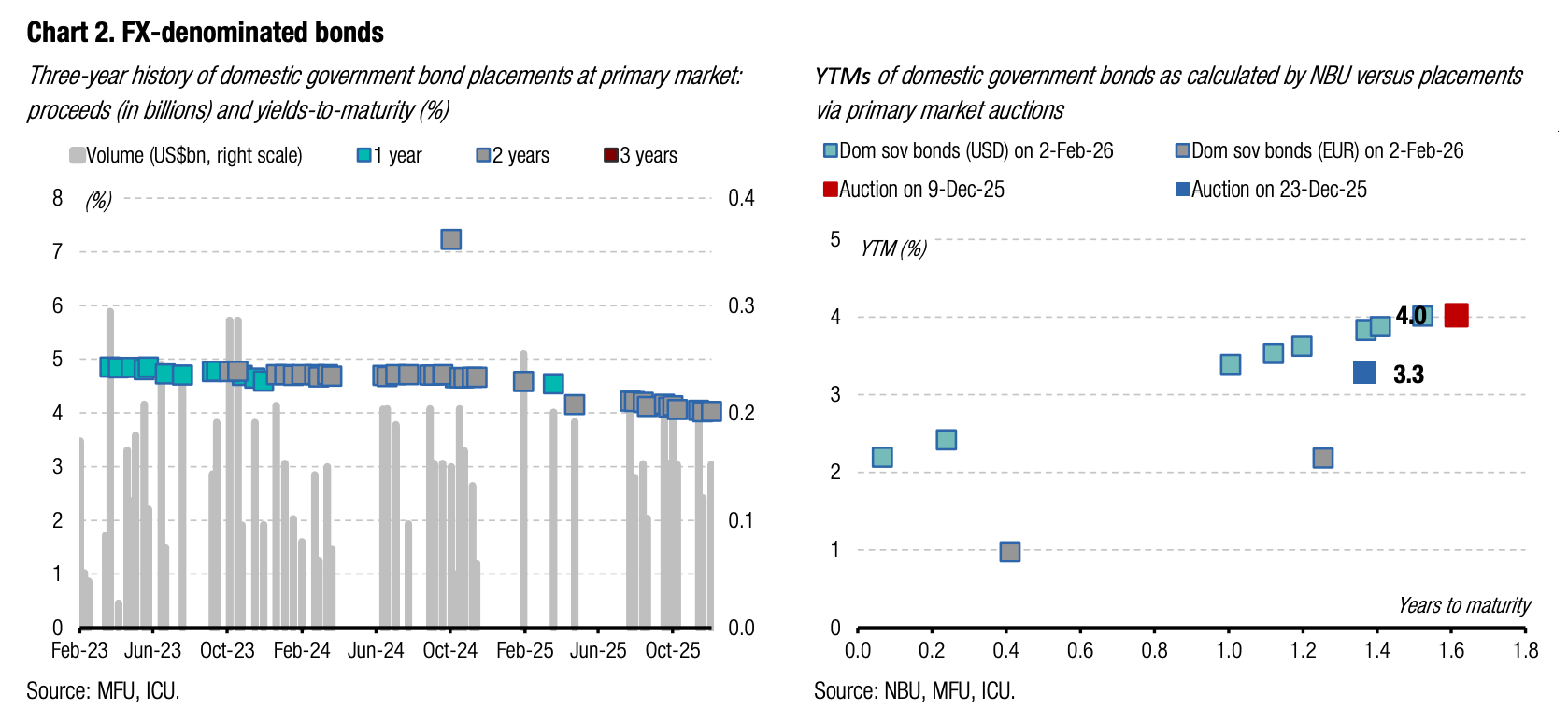

In January, the Ministry of Finance sold UAH61.5bn worth of securities, well above total monthly redemptions.

Last month, the MoF redeemed two bonds: a small-size issue of an indexed bond of UAH6bn and an ordinary UAH18.5bn paper. The ministry also held a swap auction to exchange reserve bonds due on February 18 for new reserve paper for a total of UAH16bn. Redemptions, thus, totalled UAH40.9 billion in January.

At the same time, the MoF raised UAH44.1bn through four regular primary auctions and UAH17.4bn via the issue of a reserve paper. In total, the borrowings stood at UAH61.5bn. Therefore, the MoF secured a 150% rollover rate of UAH debt in January. Since there were no FX redemptions or borrowings, debt rollover in all currencies was also 150%.

The Ministry of Finance needs to redeem UAH18bn and US$450m in local debt in February.

ICU view: The Ministry of Finance actively raised funds in January as it refinanced all outstanding redemptions and also reduced the scheduled redemptions for February. That likely reinforced the ministry's decisiveness to reduce yields at the end of the month ahead of the NBU’s move to lower rates. We expect relatively muted borrowing this month on the back of smaller redemptions and the MoF's intention to further reduce the cost of new debt.

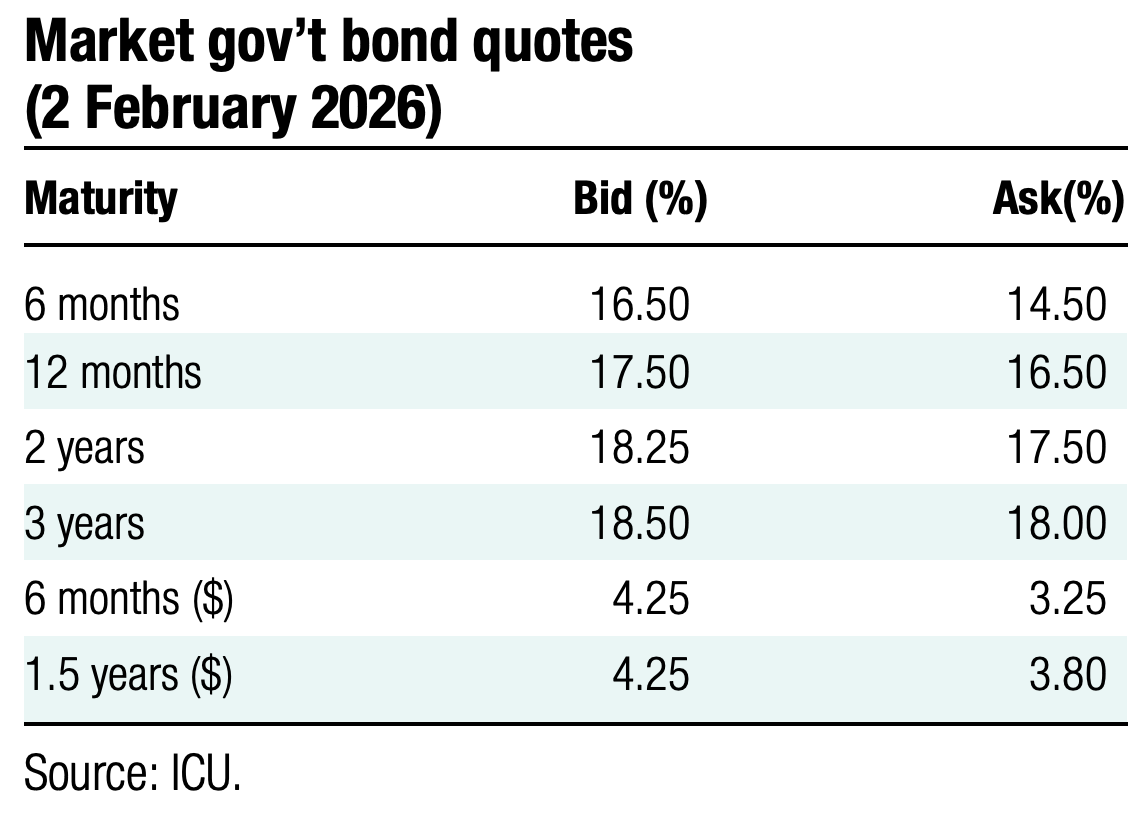

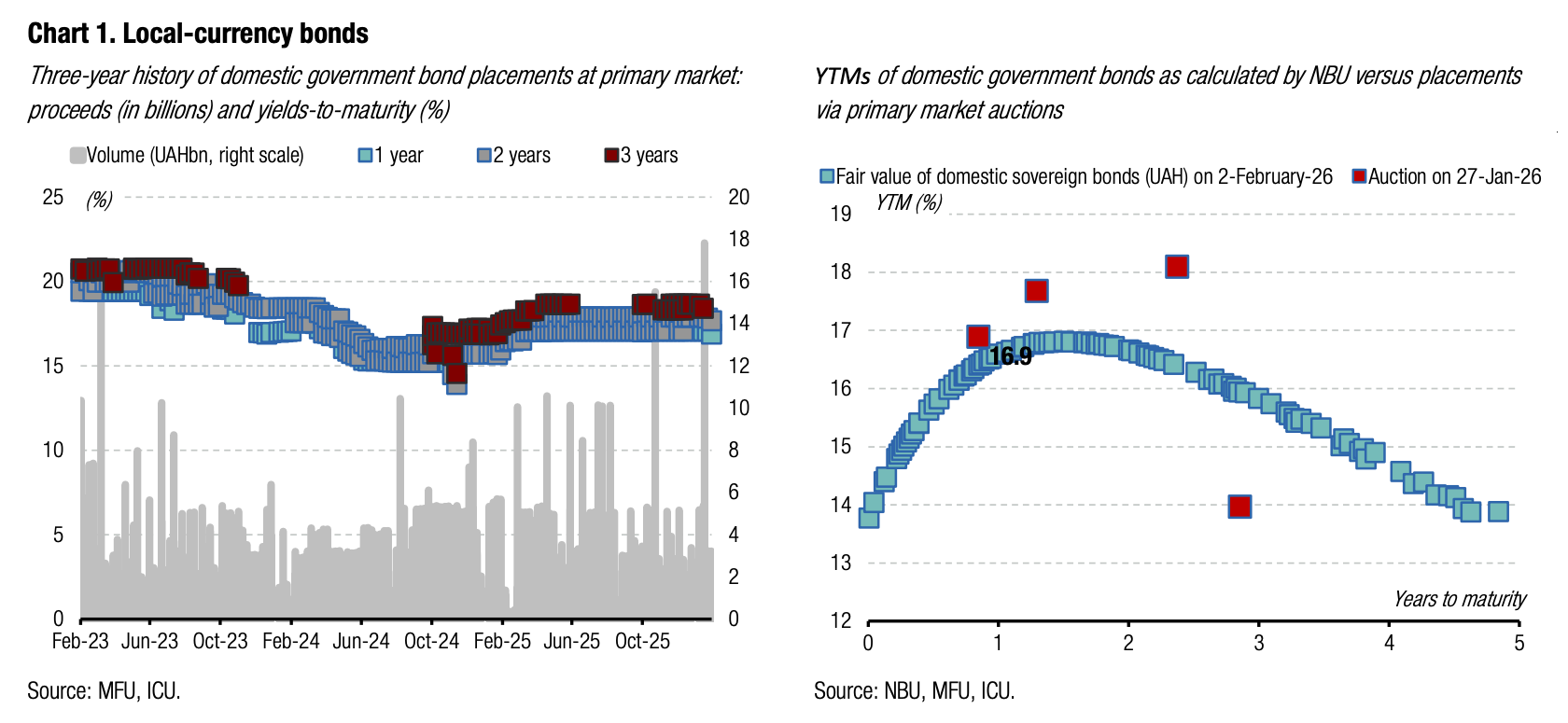

Bonds: UAH bond yields edge down further

The Ministry of Finance moved to reduce bond yields further ahead of the NBU's decision on the key policy rate.

Last week, the MoF encouraged bidders to reduce rates at the primary auction again, following the trend that it set a week before. Last week, the shortest military government bonds had rates cut for the first time by 16bp, while rates on 1.5- and 3-year securities also continued to decline. Over the two weeks, the cumulative decline in yields on 1.5-year bonds was 19bp (the weighted average rate), and on 3-year securities it totalled 50bp. See details in the auction review.

Tomorrow, the MoF plans to offer only UAH4bn worth of bonds: UAH2bn of new military bills due March 2027, and UAH2bn of a three-year paper due March 2029.

ICU view: Last week, the NBU lowered the key policy rate by 50bp and revised its forecasts. As per its current vision, the key rate will be cut by another 50bp only one more time this year (see comment below). They believe the expected key rate cut soon may keep yield competition at primary auctions tense. We expect the yields on shorter instruments, for which the rate cut was the smallest so far, to see more cuts in the coming weeks.

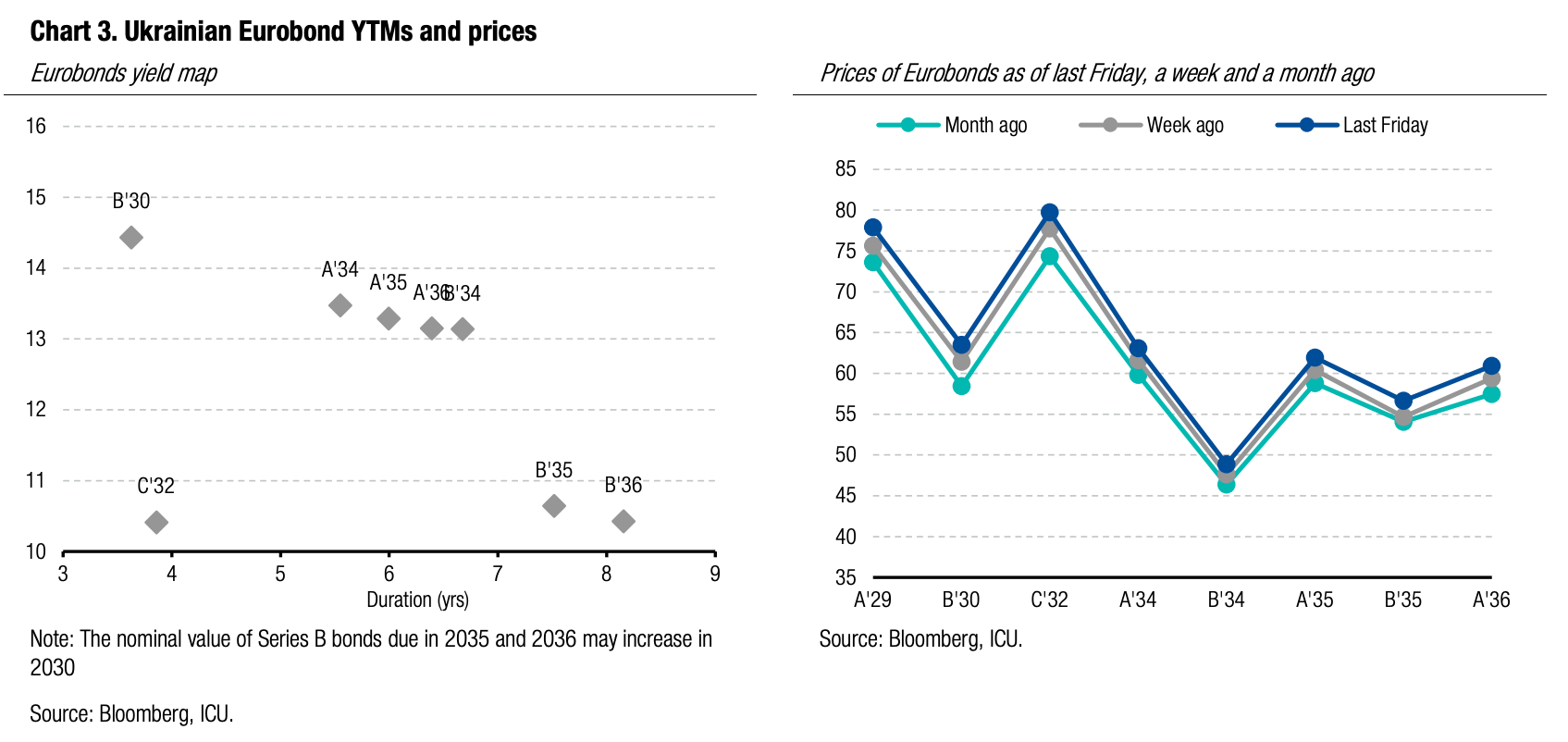

Bonds: Prospects of an energy truce supports optimism

Last week, the market expectedly welcomed the trilateral peace talks. An informal agreement to temporarily suspend shelling of energy infrastructure strengthened optimism.

Last week began with optimistic global sentiment over all emerging markets. The EMBI index rose by 0.25% in the first two days of the week, and Ukrainian Eurobond prices followed with a 1.1% increase.

On Thursday, the US president said his russian counterpart agreed that Ukraine and russia suspended shelling each other’s energy infrastructure in preparation for a new round of talks. In the end, Ukrainian Eurobond prices rose by almost 3% over the week, and yields fell by an average of 56bp.

ICU view: The dynamics of the peace talks remain the most important factor that shapes investor sentiment. russia is still far from having made a fundamental decision to reduce hostilities along the front line. So, the short-lived agreement to reduce shelling of civilian infrastructure is in no way an indication of russia’s intention to de-escalate the war.

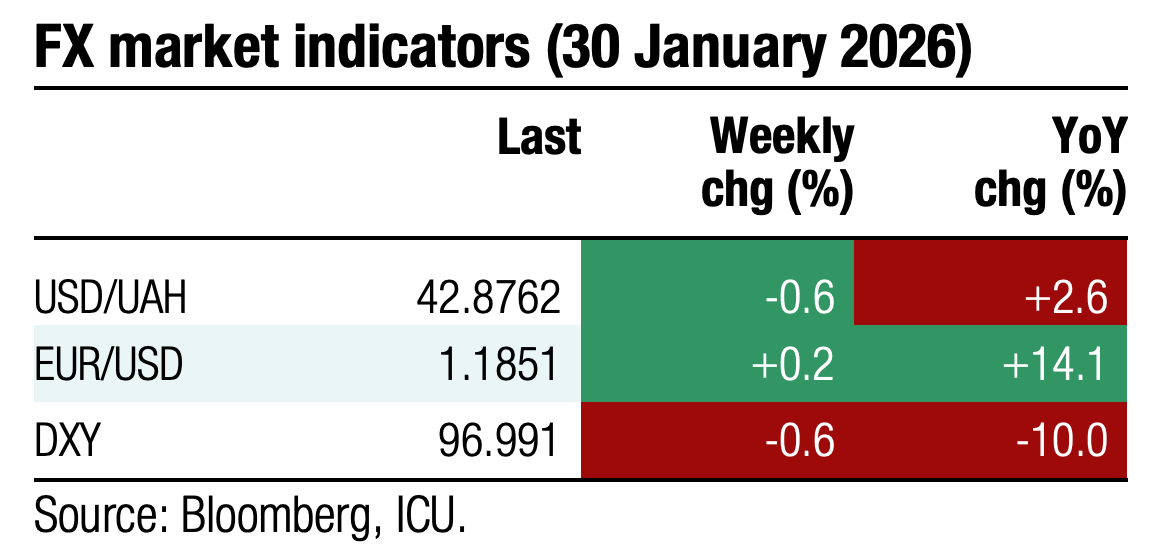

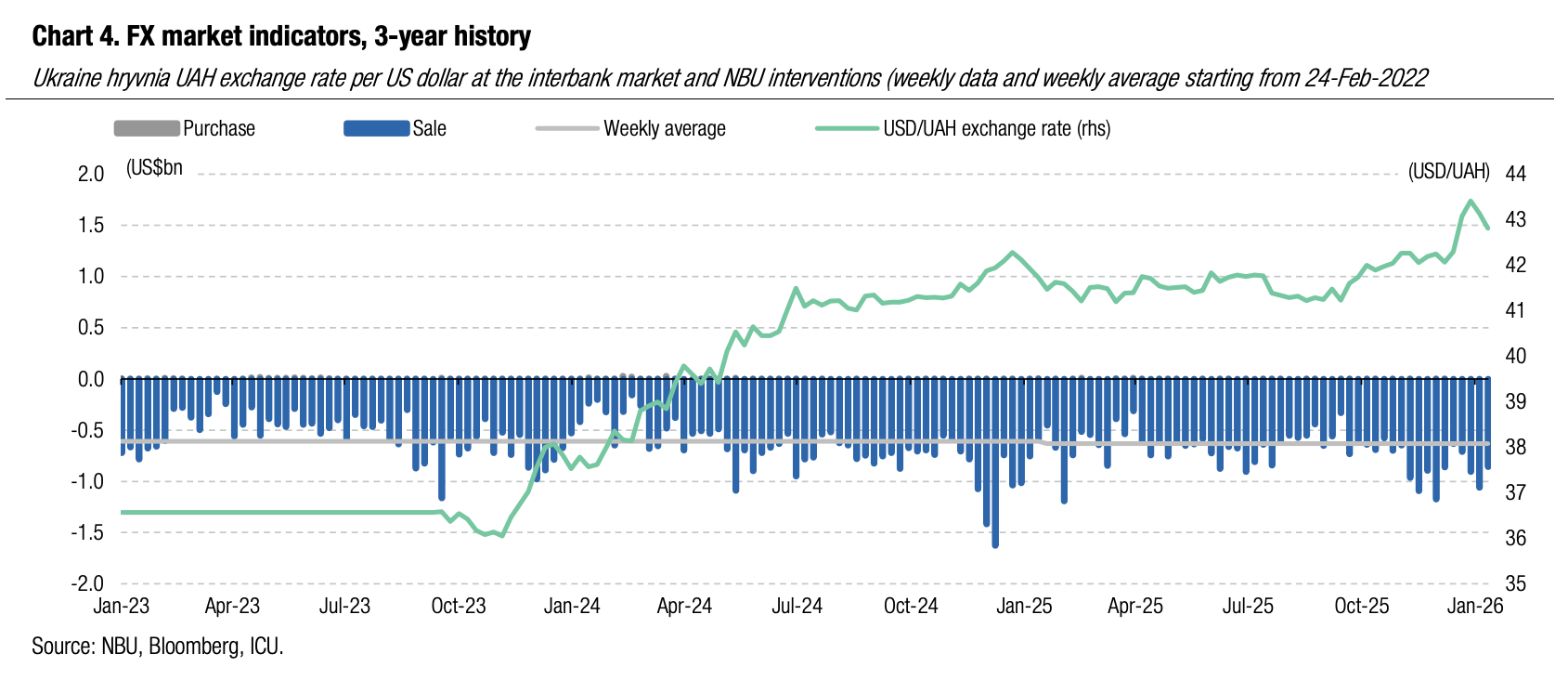

FX: NBU strengthens hryvnia

Lower market imbalances enabled the NBU to strengthen hryvnia to below UAH43/US$ while reducing interventions.

The foreign currency shortage in the market began to narrow last week, falling to US$518m over four business days, or almost a quarter less WoW. The NBU reduced interventions by a fifth to US$860m. The NBU likely could have opted for even smaller interventions and to maintain the hryvnia exchange rate above UAH43/US$. However, the National Bank clearly preferred a swift strengthening of the hryvnia exchange rate to UAH42.8/US$ at the end of last week. In total, NBU interventions in January amounted to US$3.74bn, nearly the same size as in January 2025.

ICU view: We expect FX market imbalances will decline in February. At the same time, the NBU is unlikely to let the hryvnia strengthen further and may keep the rate close to UAH43/US$ through the months ahead.

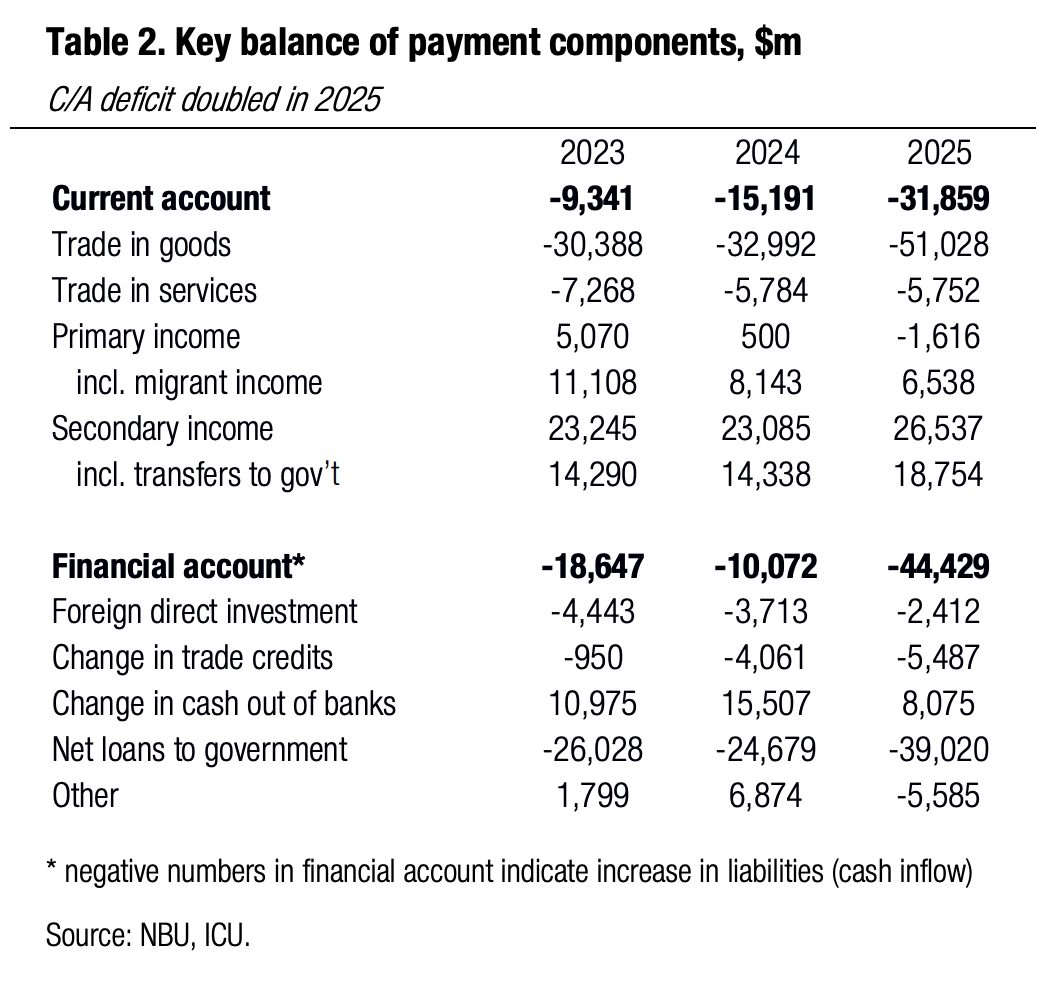

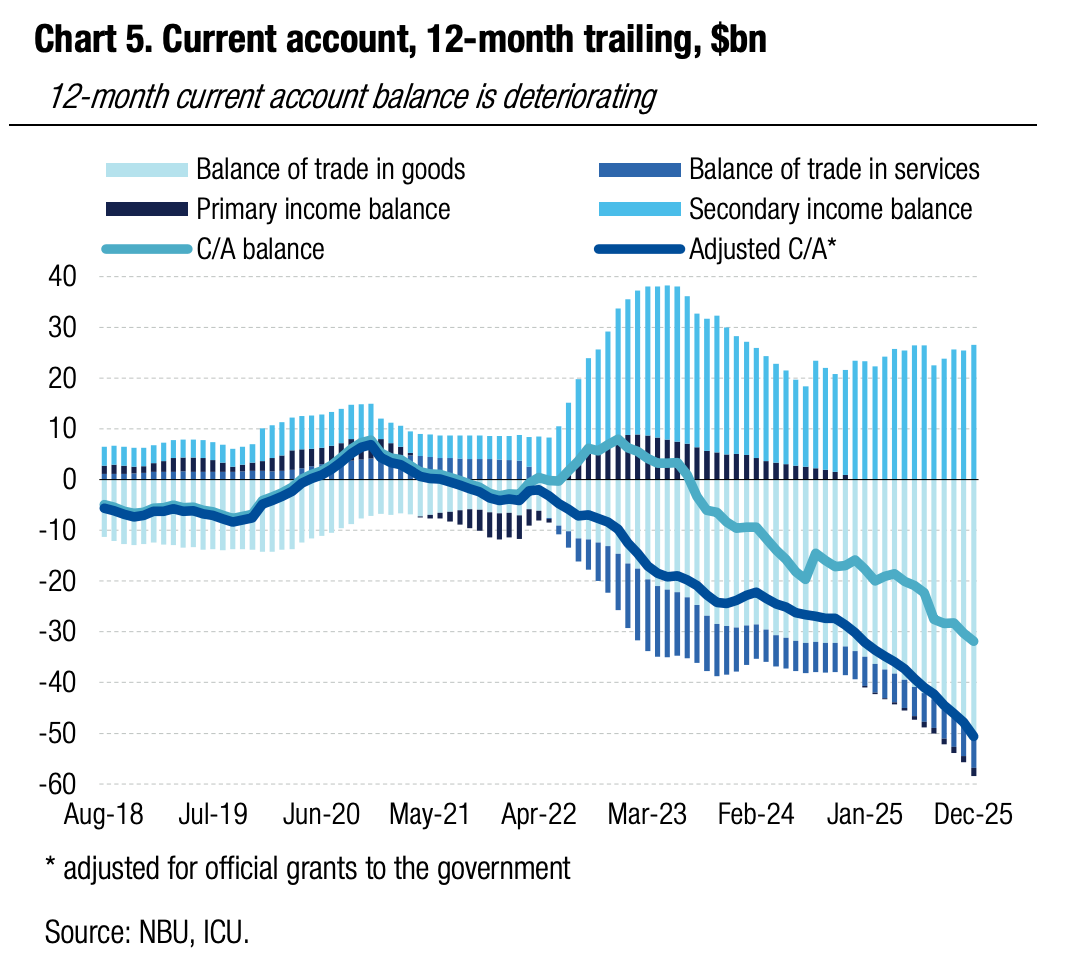

Economics: C/A gap doubles in 2025

Ukraine’s current account (C/A) deficit more than doubled to US$31.9bn (14.9% of GDP) in 2025 on a historic high gap in trade-in-goods.

The increase in the trade-in-goods shortfall was driven by an unprecedented upsurge in imports, which rose 23% YoY and was two thirds above the pre-war level of 2021. The key driver was a boom in deliveries of machinery products, split between energy saving/generating equipment, military equipment, and cars for household use. Another important driver was “other goods” that to a significant extent shows inflows of consumer goods delivered via postal service. Exports declined 3% YoY in 2025, and were 16% below the level of 2021. Sales abroad were primarily hurt by lower agricultural harvest. The balance of trade in services was little changed in 2025 vs 2024. Primary income turned negative as labor income contracted while income of non-residents (in the form of dividends and interest) was slightly up. The surplus of secondary income came on the back of a massive official grants to the Ukrainian government and helped offset a huge part of the trade gap.

The surplus of the financial account was at a record high as Ukraine’s partners stepped up financial support and provided US$39bn in loans to cover the fiscal gap in 2025 and frontload support for 2026. Another important positive development was a substantial decline in outflows of FX cash from the banking sector as household demand for FX cash moderated on the back of a stable exchange rate. Overall, a hefty financial account surplus fully offset the C/A deficit and helped boost NBU reserves 31% YoY to US$57.3bn.

|  |

ICU view: Growing external imbalances (net of foreign financial aid) remain the key vulnerability of Ukraine’s economy. We expect the foreign trade deficit will remain close to its current level in 2026 while the C/A gap will increase due to lower official grants (lower secondary income surplus). The total size of foreign aid scheduled for 2026 should be sufficient to offset the C/A gap, but we don’t expect the NBU will be able to boost its reserves further. As the reserves will be plateauing in 2026 before starting to decline in 2027, we think the NBU may need to continue to weaken hryvnia marginally over the course of this year to prevent further build-up of external imbalances.

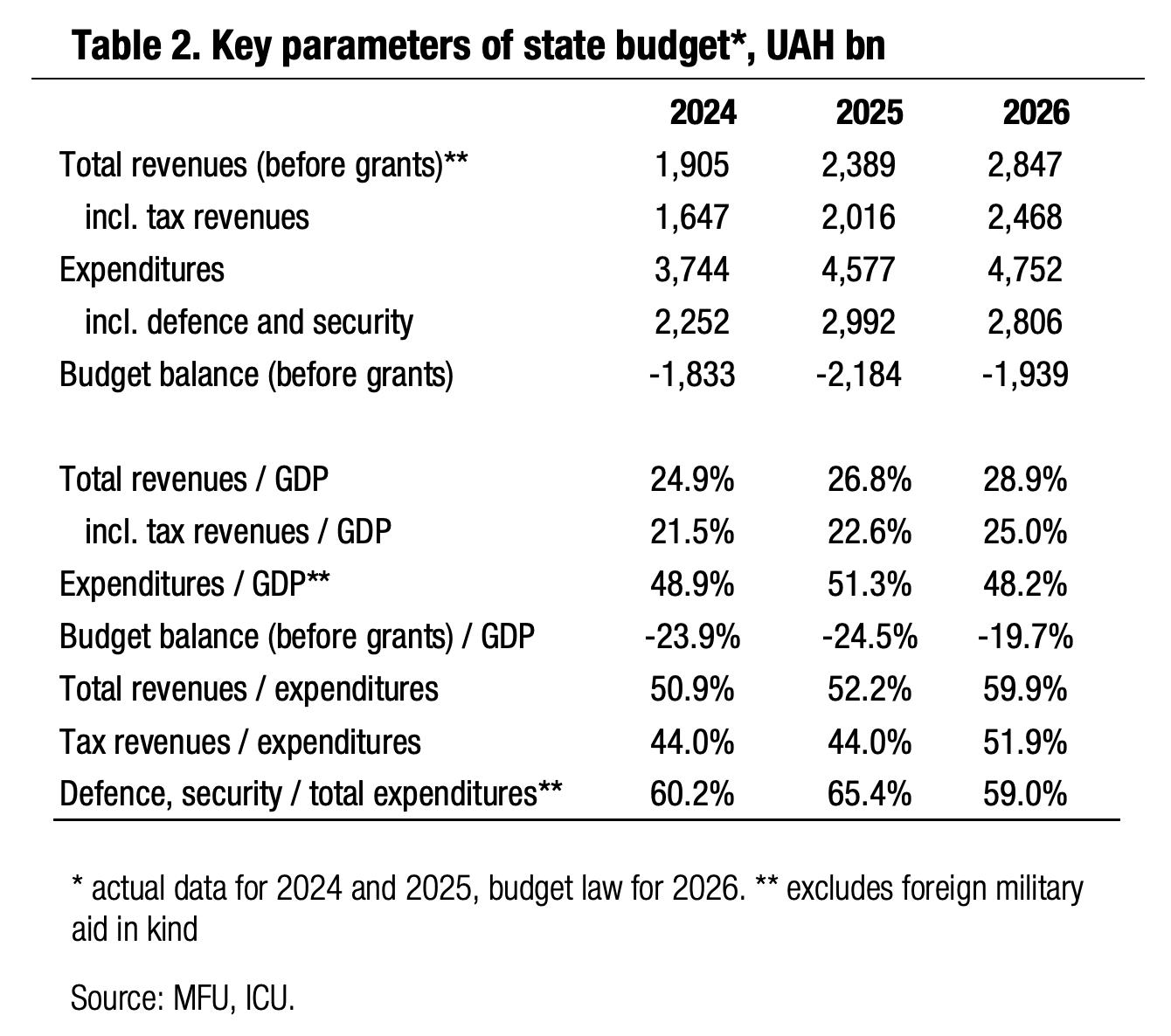

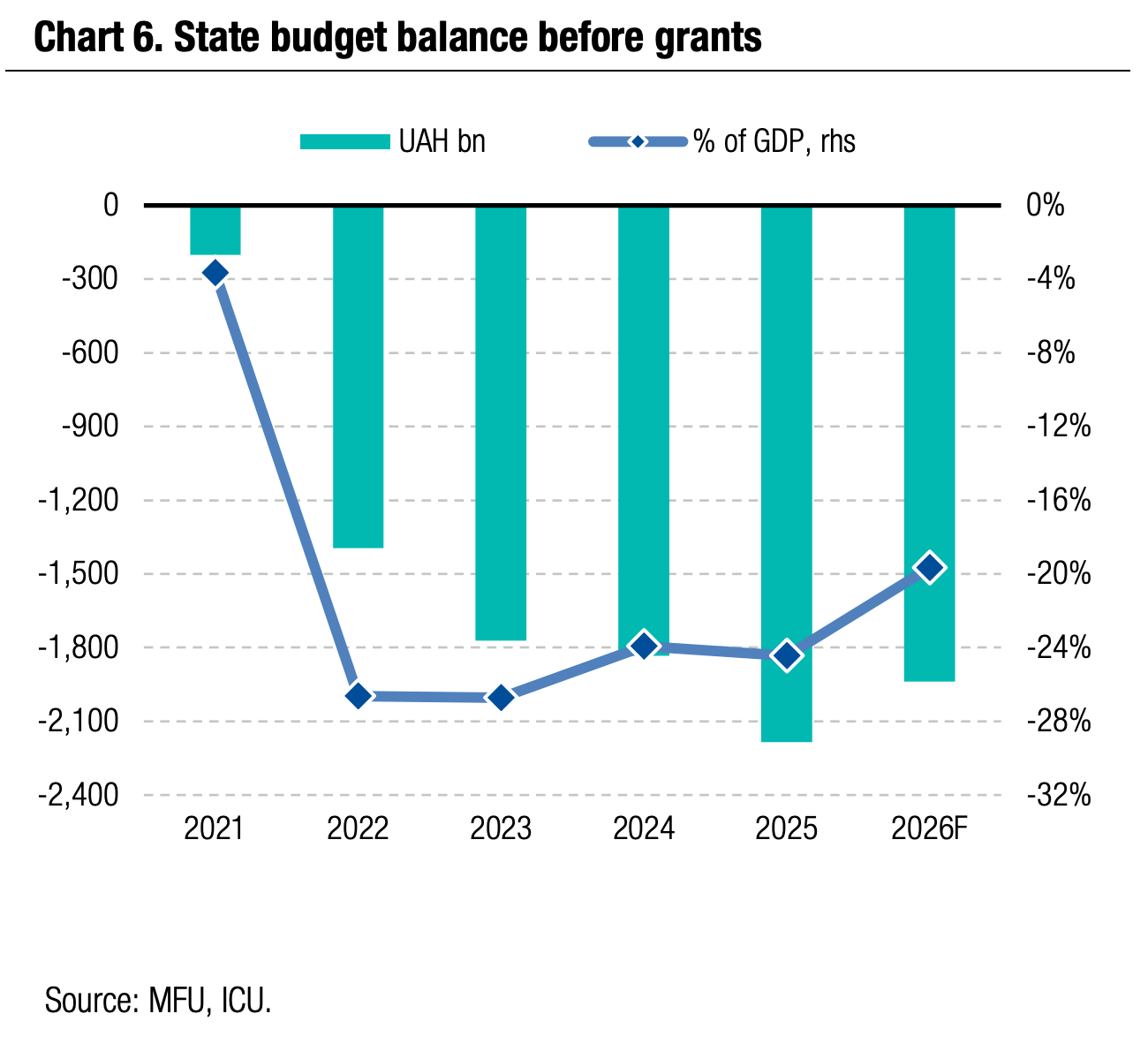

Economics: State budget deficit widens in 2025

The state budget deficit before grants widened to 24.5% of GDP in 2025 from 23.9% in 2024.

The budget saw healthy growth of revenues driven by an upsurge in tax collections by 22% YoY. Expenditures were also up 22% driven by the increase in outlays on defence and national security. The latter accounted for nearly 65% of total budget expenditures. The deficit was nearly fully covered with external grants and borrowings, while net domestic borrowings covered less than 5% of the total fiscal gap.

|  |

ICU view: Heightened expenses of the army continue to keep the budget deficit at a level that is whoppingly high. We expect a decline in the 2026 fiscal gap by around 4% of GDP, largely in line with current government projections. The projected deficit should be safely covered with new external financial aid and cash leftovers from 2025. Should the government review military expenditures and increase them during the year, the increase in expenditures will likely need to be balanced with additional tax collections prompting the need for a broader tax base and/or higher tax rates. In view of this, legislative tax amendments will remain the focus of the upcoming IMF program.

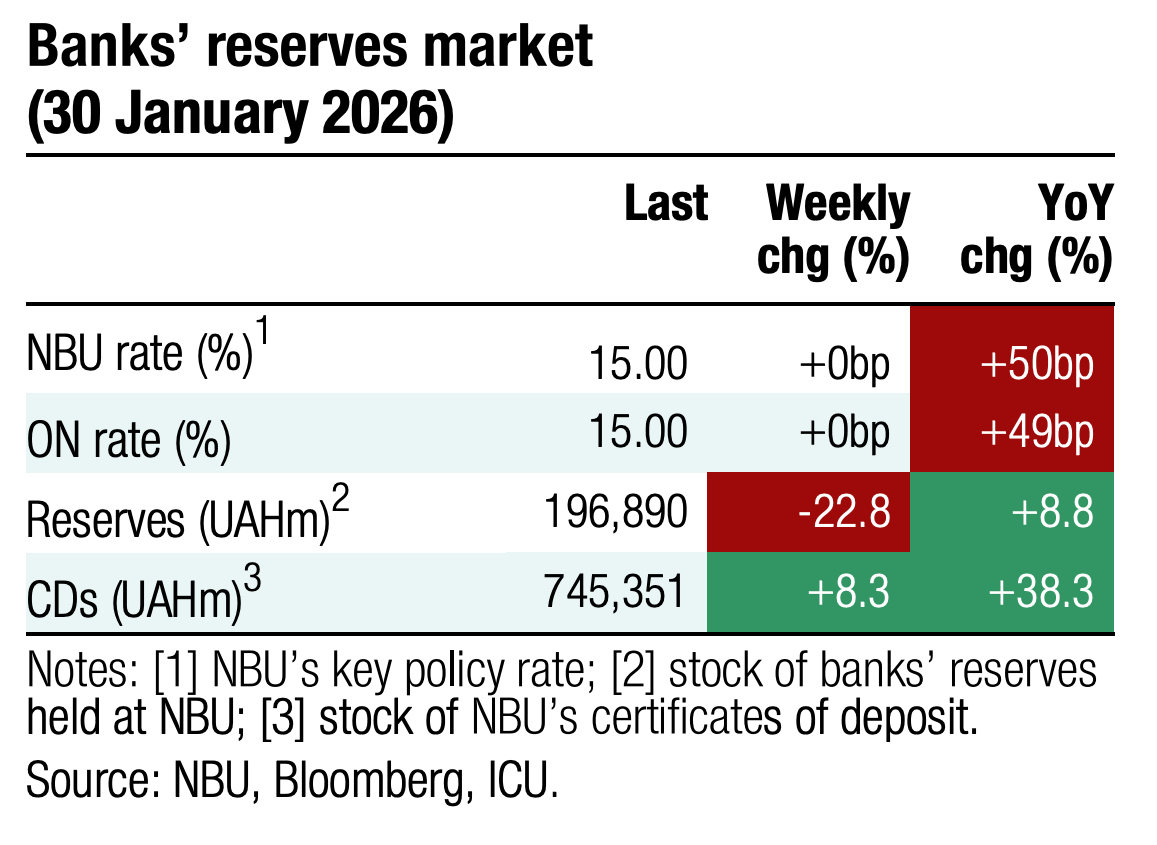

Economics: NBU starts easing cycle

The regulator lowered the key policy rate by 50 bps to 15.0%, initiating a cycle of monetary easing against a backdrop of declining inflation and secured external financing.

The decision to cut the rate is driven by sustained disinflation and reduced external risks. Inflation slowed to 8.0% in December 2025, and is projected to moderate to 7.5% in 2026, returning to the 5% target only by 2028. However, the forecast accounts for higher energy deficits, limiting real GDP growth to 1.8% in both 2025 and 2026.

Secured external financing was a decisive factor. The EU's EUR 90bn package for 2026–2027 and an expected USD 8.1bn IMF program have significantly lowered financing risks. International reserves are projected to reach USD 65bn by end-2026. compared with previous forecasts to address persistent price pressures.

ICU view: While the monetary policy easing has begun, the NBU revised its rate trajectory upward and significantly worsened its forecast for the key rate for both 2026 and 2027. Instead of the previously implied six 50bps cuts for this year, the regulator now projects only two, with the remaining cut likely occurring in April. We believe this conservative forecast is reasonable and not overly optimistic given the prevailing energy and security risks. However, should these risks decrease, the regulator might implement one or two additional cuts later in the year.