|  |

|  |

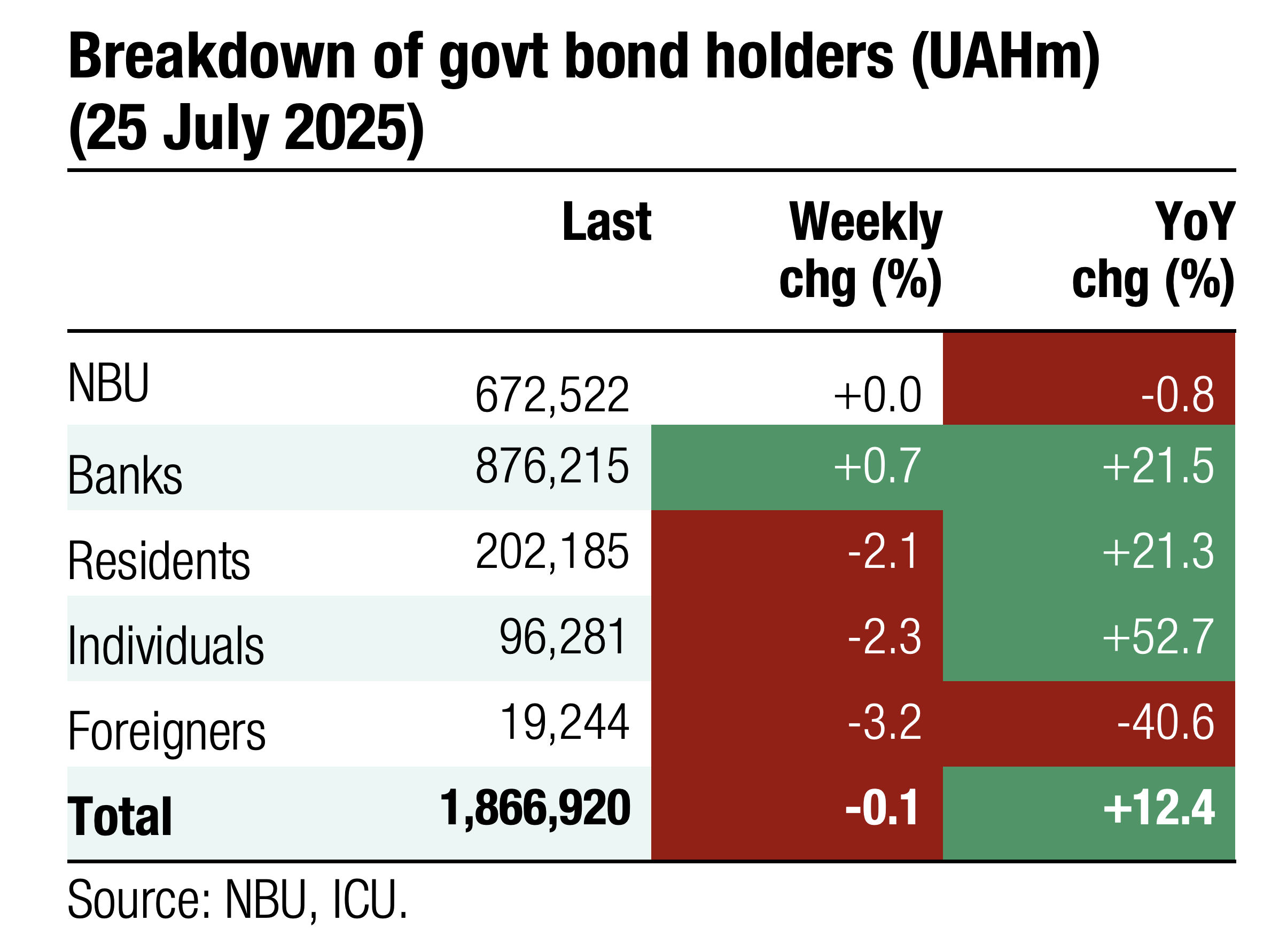

Bonds: MoF reduces stock of FX bonds

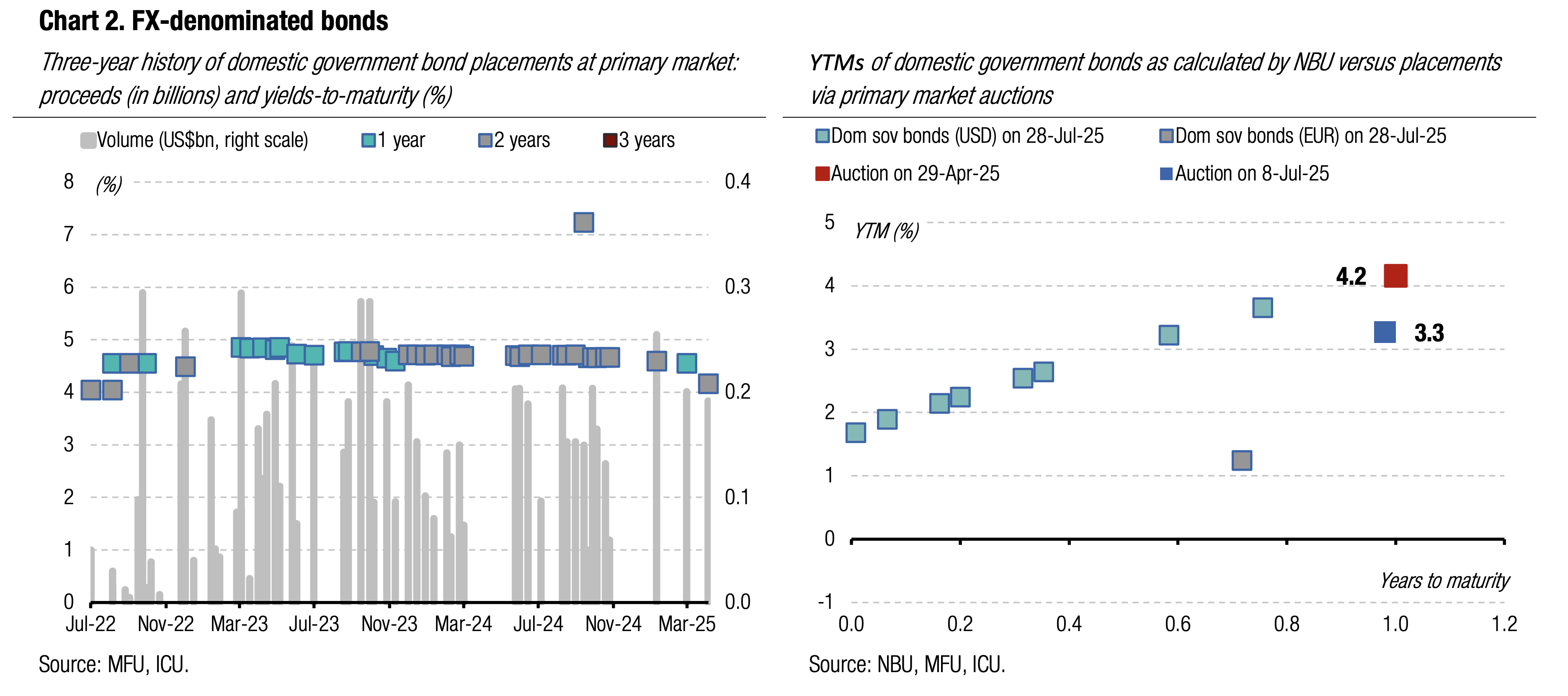

In recent years, the MoF has made it a practice to reduce the stock of outstanding FX-denominated bonds, with the current year being no exception.

In 2021 and 2022, the MoF decreased the volume of outstanding FX-denominated domestic bonds by 11% and 30%, respectively. However, in 2023, the trend reversed temporarily as the MoF increased the stock of local FX-denominated debt by 23% against the backdrop of temporary liquidity shortages.

In 2024, the MoF was again back on track to reduce the amount of FX-denominated bonds having cut the stock by 10%. The outstanding amount of FX-denominated bonds was down from US$3.3bn at the beginning of the year to below US$3bn (US$2.2bn and EUR645m).

This week, the MoF has to redeem US$400m worth of bonds and will offer new bonds tomorrow with a cap pf US$250m that is likely to be upped next week.

ICU view: We expect the MoF to maintain its policy of reducing the stock of FX-denominated bonds. The MoF has repeatedly emphasized it aims to gradually replace FX paper with UAH borrowings, targeting a phase-out of FX bonds in the mid-term. FX proceeds are expected to come solely from concessional loans provided by Ukraine’s partners. Yet, offering of FX paper will remain in the short term, as many local investors are now interested in such bonds for hedging FX risks. About 1/3 of all FX-denominated bonds are now in the portfolios of the population, while for banks, local FX bonds are the only investable instrument in the local market.

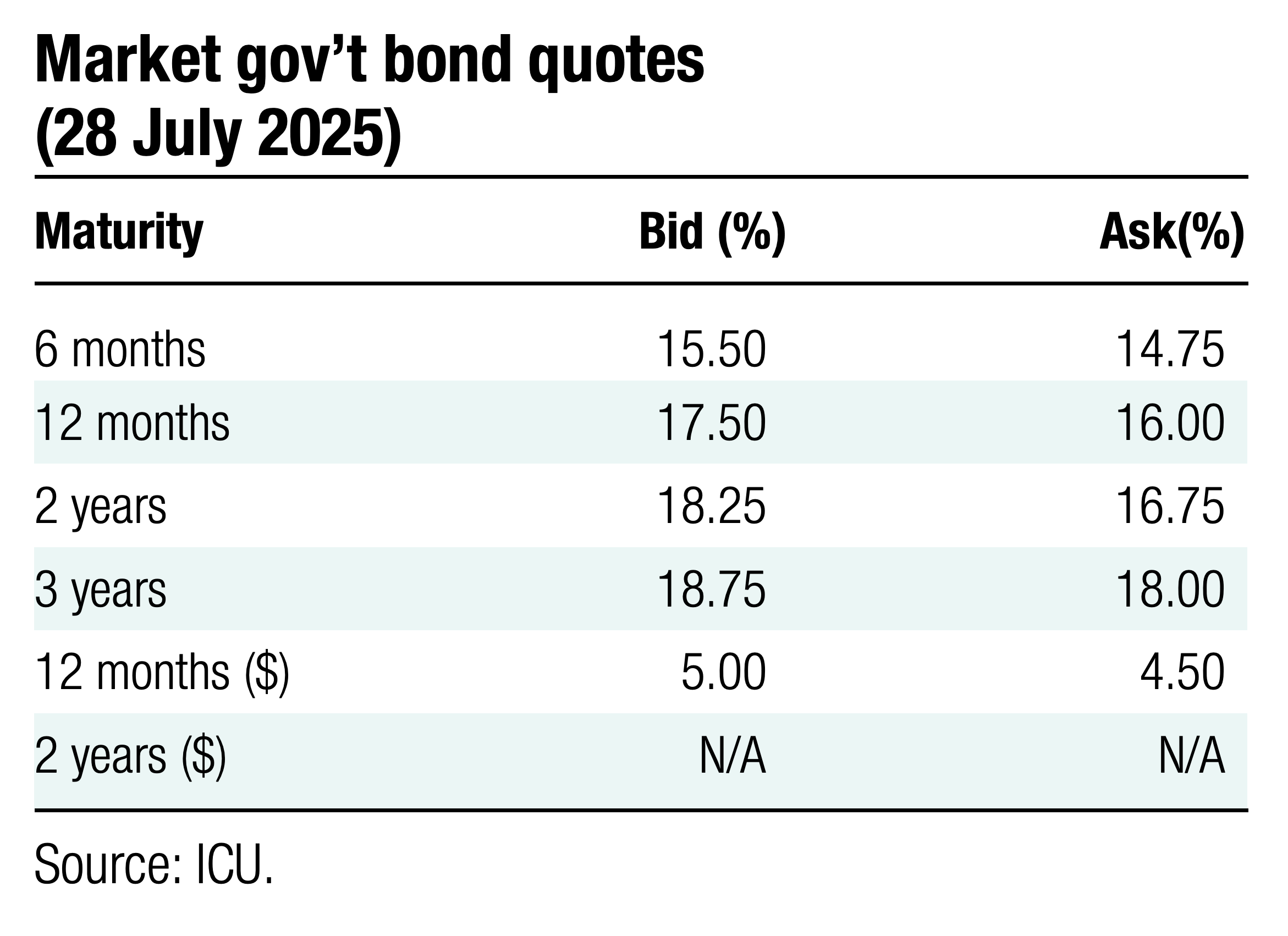

Bonds: Week full of discouraging news for investors

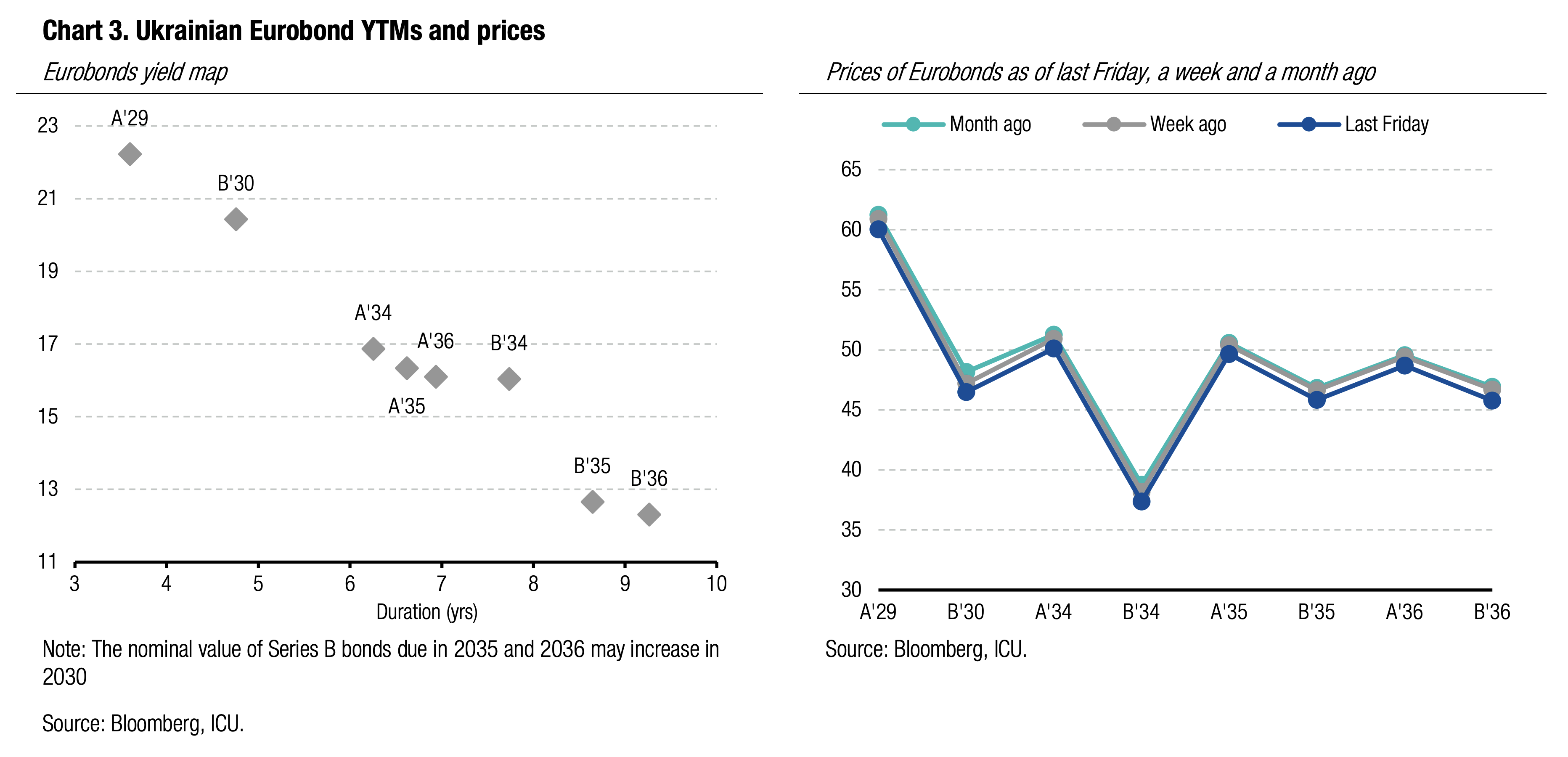

Last week, investors had to digest the new Prime Minister's announcement that the government intends to launch a new IMF program and also the backslide in anti-corruption efforts by the Ukrainian authorities. Additionally, a fresh NBU macro update indicates that the probability of a principal increase for Series B Eurobonds is minimal.

The new Ukrainian Prime Minister said in an interview with Bloomberg that Ukraine may launch a new program with the IMF next year. During its August visit to Kyiv, IMF staff will try "to determine whether a new program would be reasonable and what its likely parameters could be," she said.

Other major news came out on Tuesday when Ukrainian lawmakers voted to strip the nation's anti-corruption agencies, NABU and SAPO, of their independence. This decision caused an immediate backlash from international partners and peaceful protests by the Ukrainian public. The authorities promptly announced they will reverse the changes to ensure that the anti-corruption agenda remains credible.

Last Thursday, the NBU released its updated macro forecast for 2025-27. The new numbers for both real and nominal GDP imply the probability of reaching the thresholds required for the principal increase of Bonds B is minimal.

Ukrainian Eurobond prices fell by about 3%, mostly below 50 cents.

ICU view: In the coming weeks, the market will assess the implications of the government’s intention to replace the current IMF program with a new one. The key question is whether a new program implies higher/lower probability of the ultimate debt treatment envisaged by the existing IMF program. The progress with new legislation that reverses the corruption reform backslide is something else to follow closely.

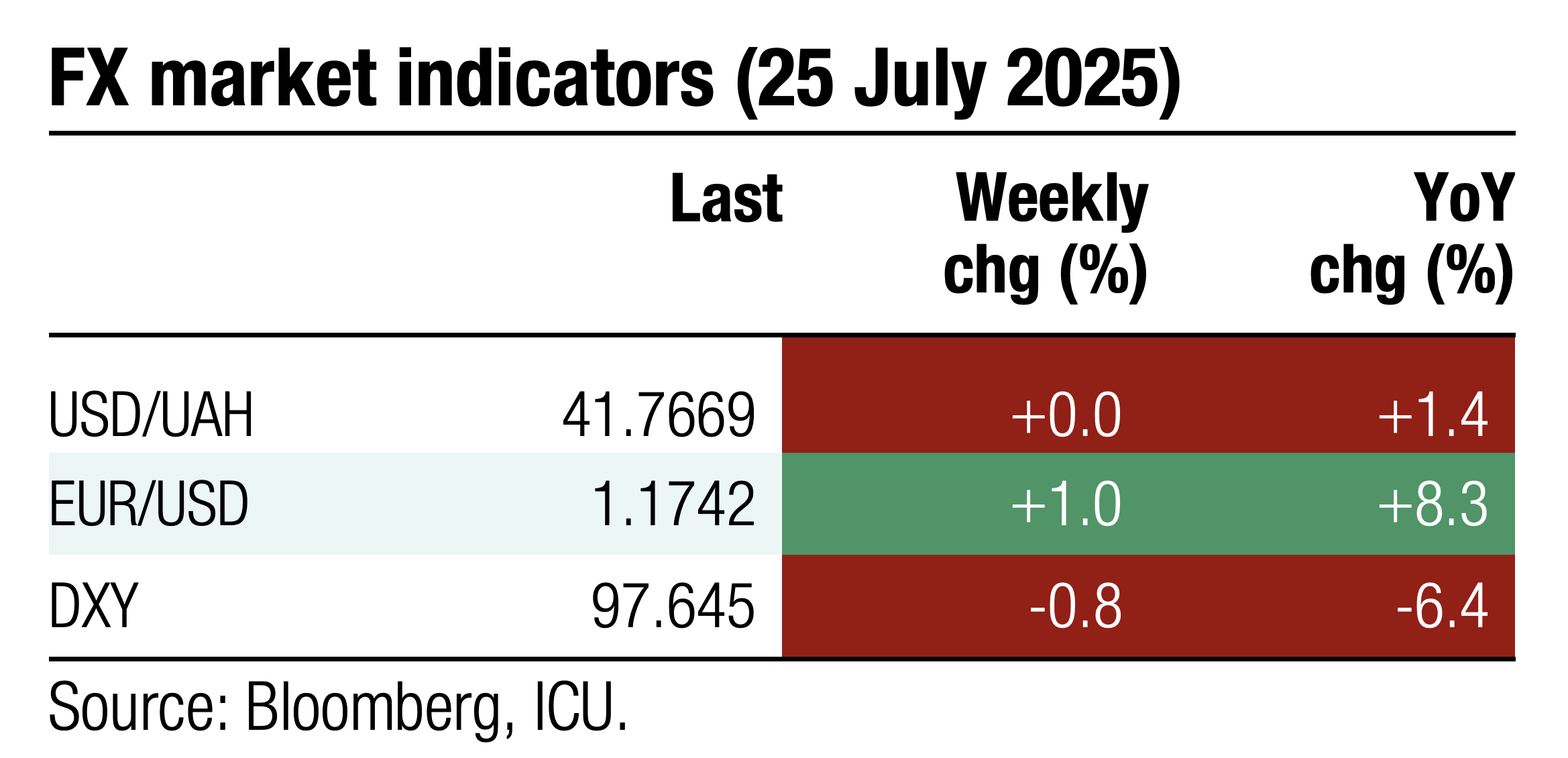

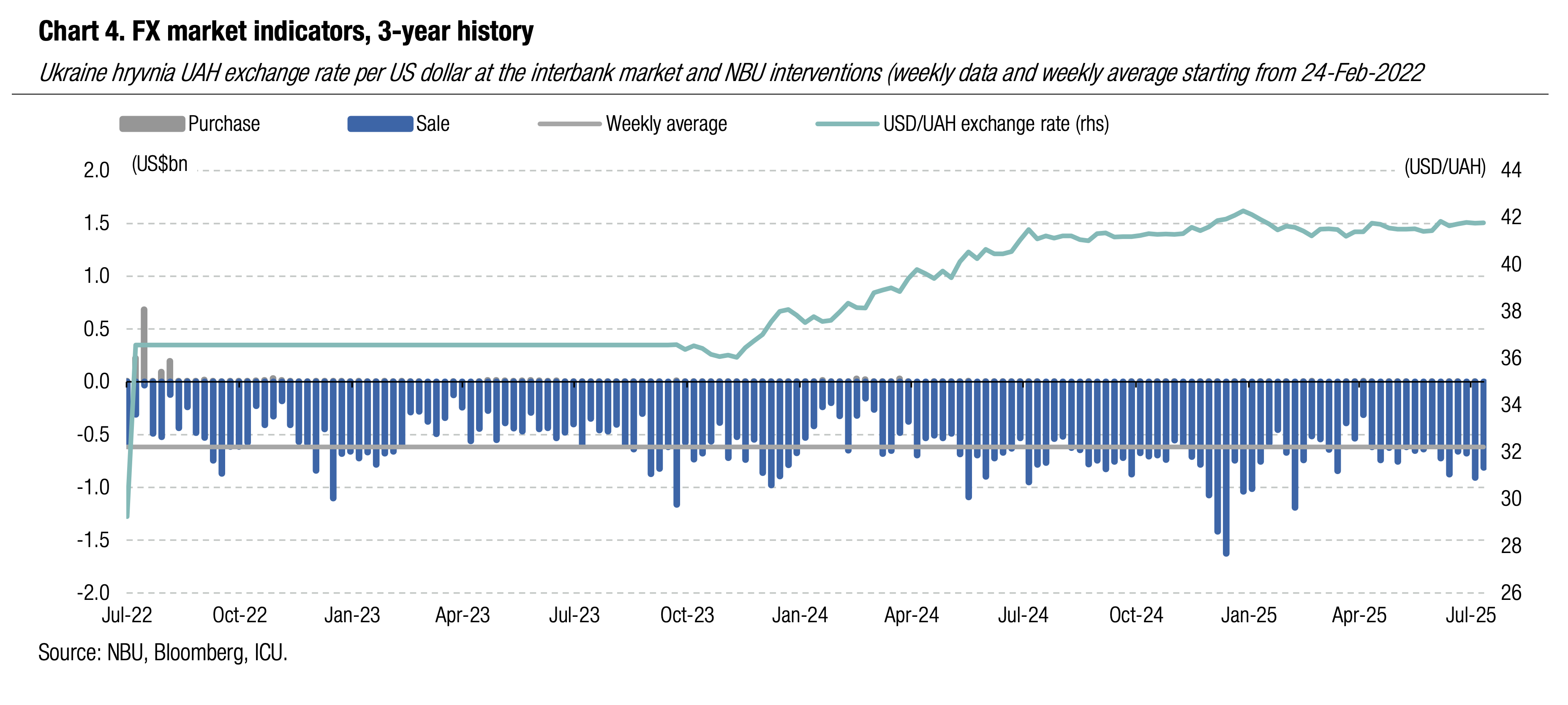

FX: NBU keeps FX fluctuations in a narrow range

Despite the huge hard currency deficit, the hryvnia exchange rate fluctuations were insignificant.

In the interbank FX market, net hard currency purchases changed by a mere 9% to US$508m. Therefore, the NBU decreased its interventions by just 10% to US$811m.

The NBU managed the hryvnia exchange rate at about UAH41.8/US$ and set the official exchange rate for today at UAH41.78/US$, almost unchanged WoW.

ICU view: Despite interventions remaining significantly above the weekly average, the NBU looks comfortable with them and is in no hurry to weaken the hryvnia. According to last week's update of the macro forecast, the NBU expects significant amounts of foreign aid, which will allow it to keep international reserves relatively high in 2026-27.

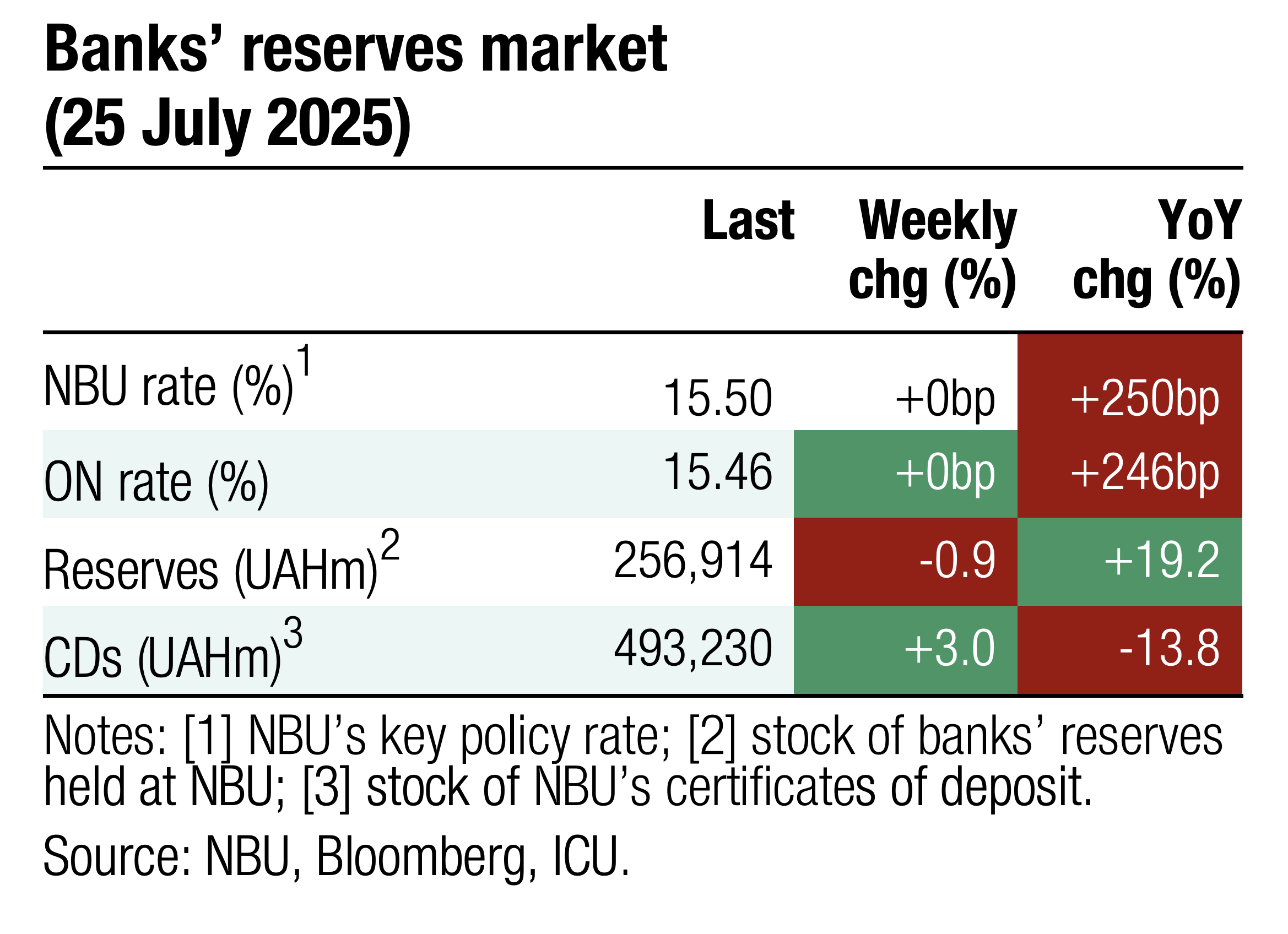

Economics: NBU signals prolonged tight monetary policy

The NBU left its key policy rate at 15.5% at the July meeting, as expected, while reiterating a cautious stance amid persistent inflation risks.

June inflation, although down to 14.3% YoY, remained higher than forecast, with the central bank pointing to adverse weather and war-related disruptions as major factors. The NBU now expects inflation to slow more gradually, reaching 9.7% YoY at end-2025, and hitting the 5% target only in 2027.

The regulator emphasized that it will maintain sufficiently tight monetary conditions for as long as necessary to anchor inflation expectations and preserve currency stability. The NBU acknowledged the risk of a slower economic rebound and emphasized that any easing of the policy rate will be possible only if the inflation trajectory and other conditions allow.

ICU view: The regulator has revised its forecast and anticipates just two 50bp cuts by the end of 2025—in line with our recent projections. This marks a step down from the overly optimistic views prevailing at the beginning of the year and reflects the changing macro situation.