|  |

|  |

Bonds: UAH bond market stays calm

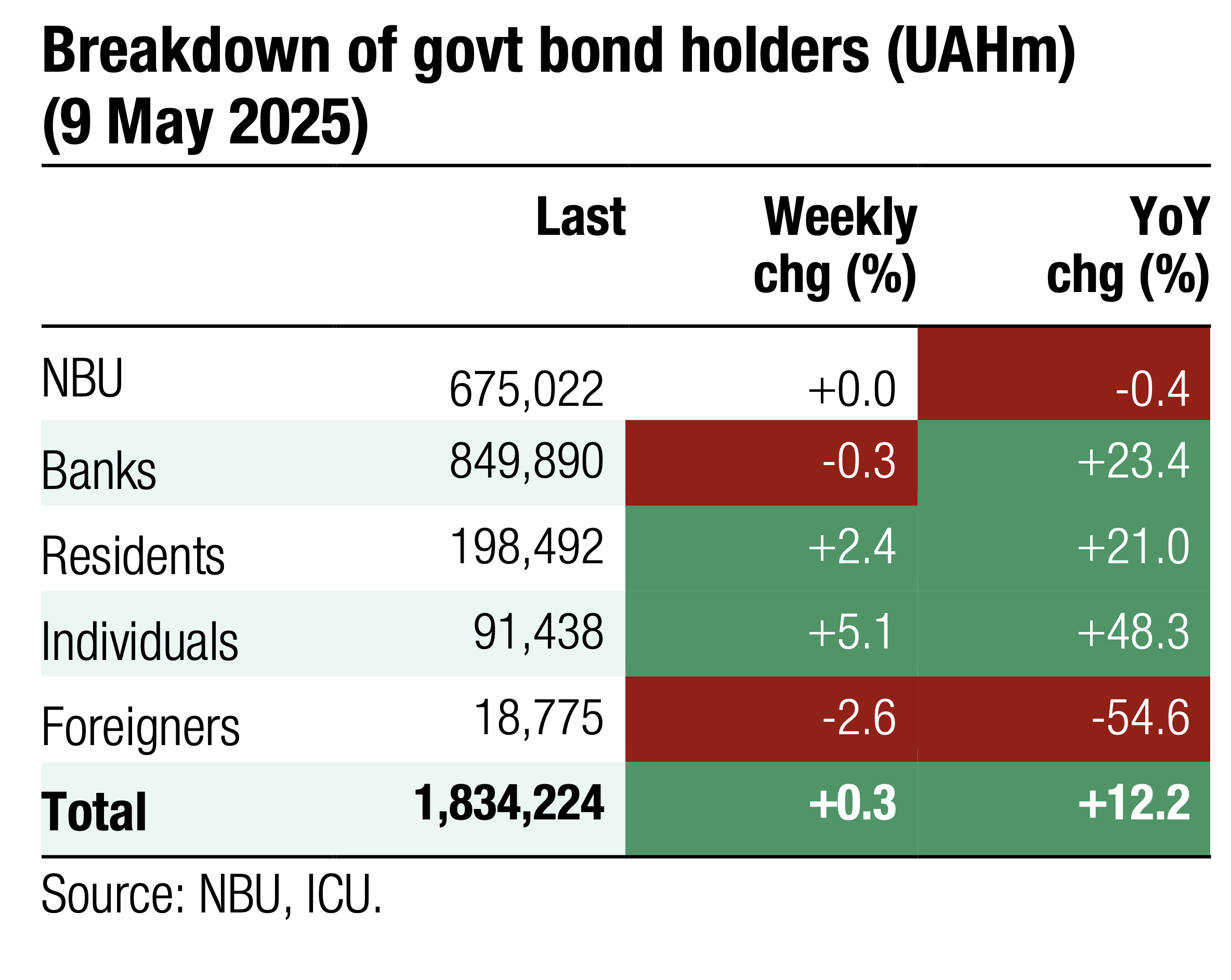

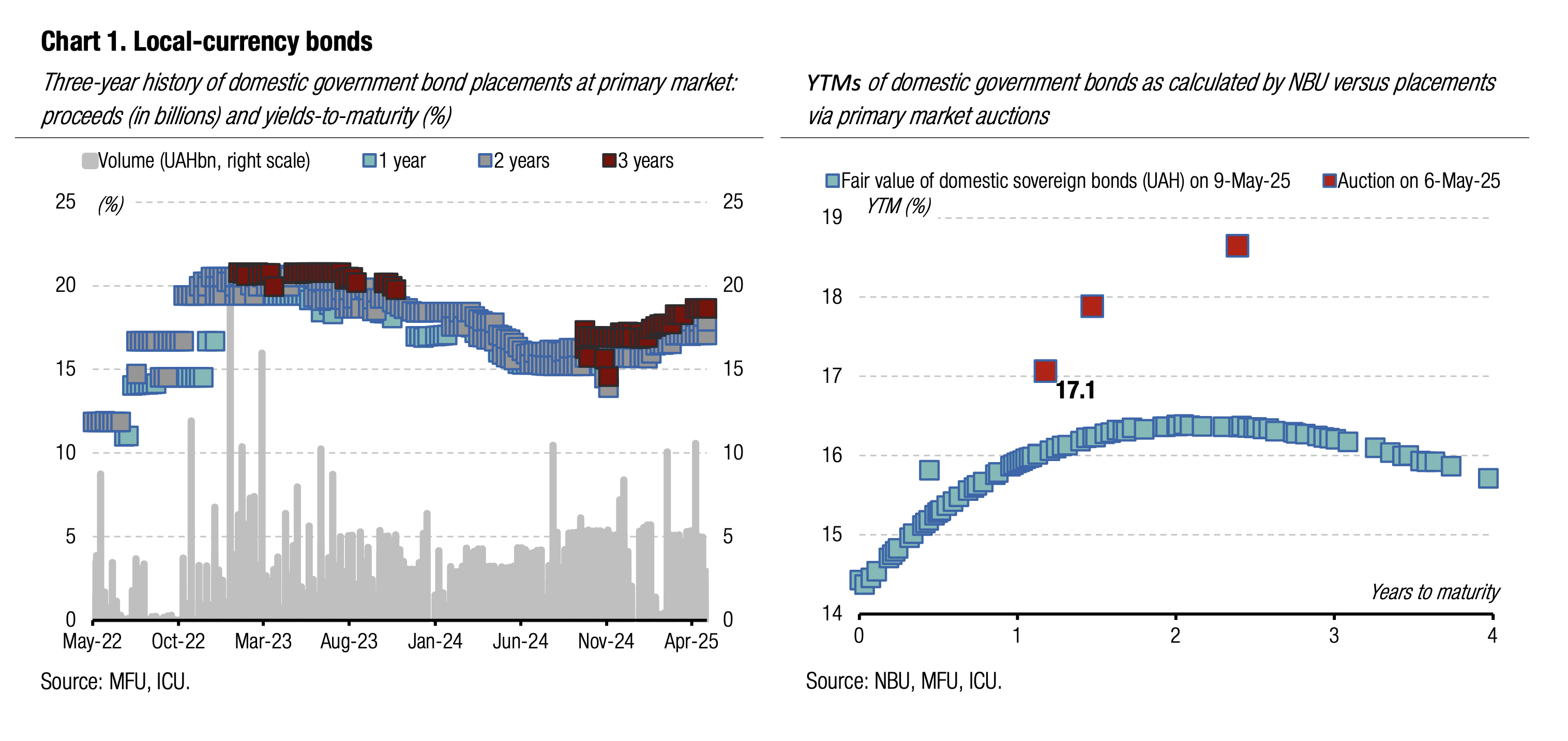

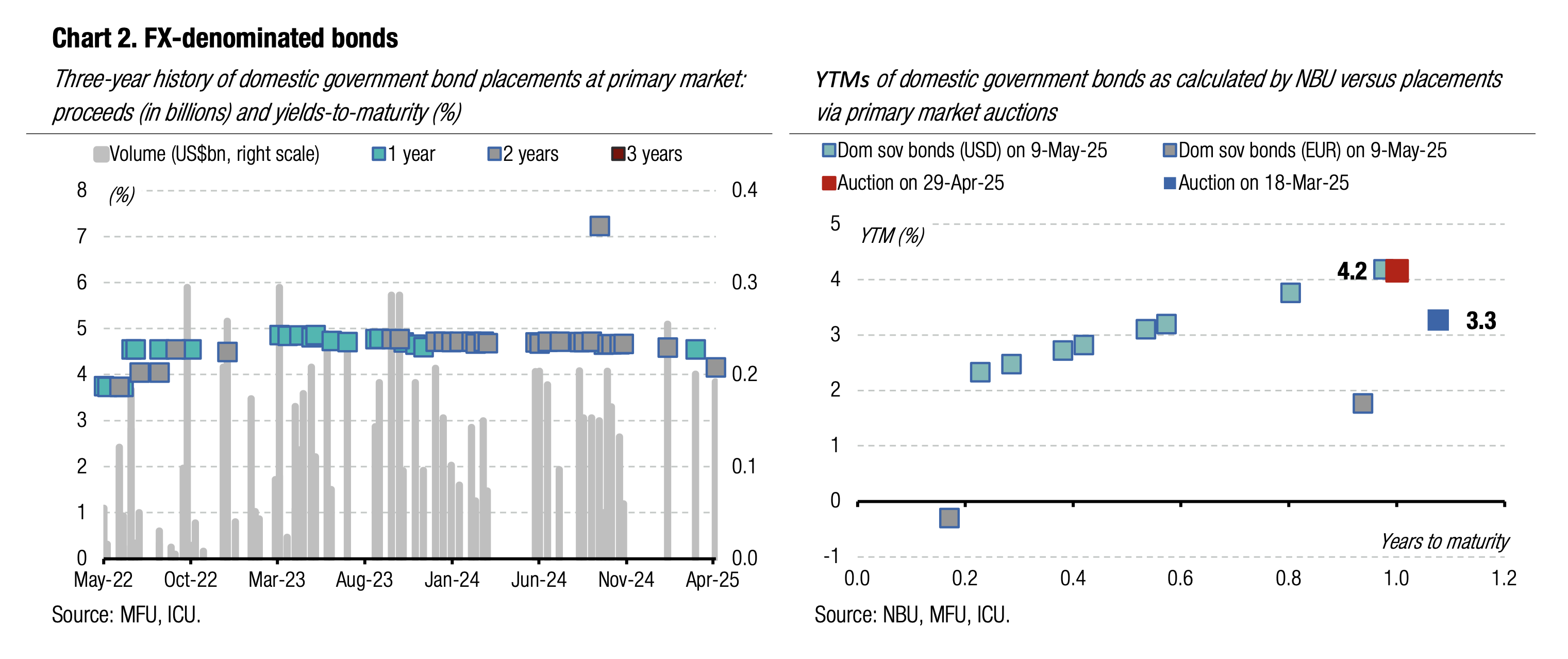

May started with low activity in the UAH bond market.

The MoF borrowed UAH6.5bn in the primary bond market without any change in yields. Borrowings were distributed evenly between securities, unlike in the previous week, but military bills remain the most demanded by bidders. See details in the auctions review.

Trading in the secondary market almost halved WoW to about UAH9.4bn. The most traded papers were military bills with an over 77% share. Also, about half of all deals in the secondary bond market were with military bonds maturing in the next few months. Yields in the secondary bond market remain steady with low fluctuations.

Portfolios of non-banking financial entities and the portfolios of individuals increased 2.6% and 3.5% WoW, respectively. However, portfolios may decline again this week due to the redemption of EUR156m of bonds.

ICU view: The MoF remains reluctant to increase borrowings and keeps offering bonds with a maturity of over a year. Meanwhile, investors are much more interested in short-term bills with a maturity below six months. We expect much of the same demand/supply pattern over the coming weeks with total bonds outstanding remaining close to the current level.

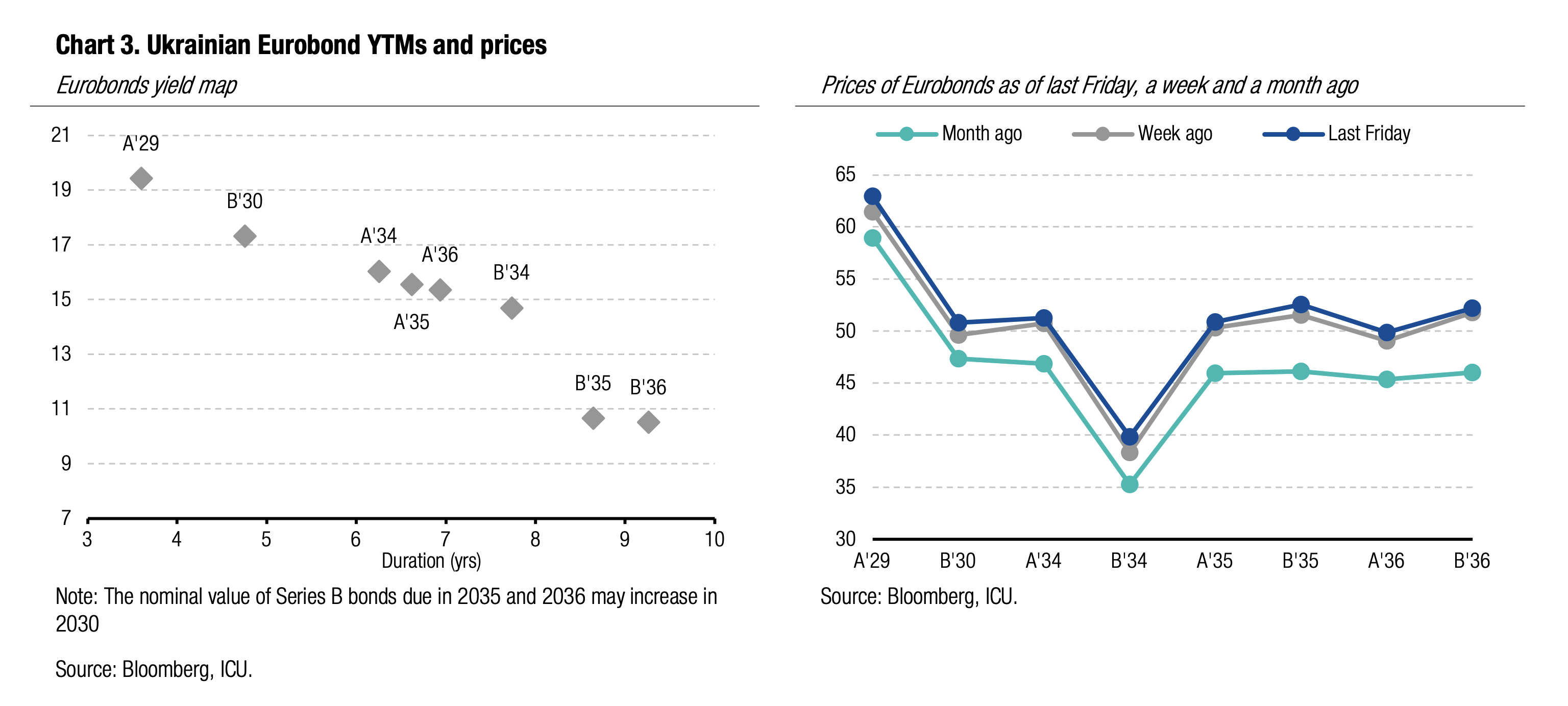

Bonds: Ceasefire talks infuse some optimism

Prices of Ukrainian Eurobonds rose slightly while the market watched closely as small but repeated steps were made towards more active ceasefire talks.

Ukrainian Eurobond prices rose on average by 2% WoW. The VRI price remains above 72 cents per dollar of notional value as the market awaits a new restructuring offer from the MoF. The EMBI index rose 0.35% last week.

Last Friday, media announced that United States and its European allies are finalising a proposal for a 30-day ceasefire in Ukraine. The next day, the new German Chancellor, the French President, and the Prime Ministers of the UK and Poland visited Ukraine. During the visit, a joint video conference of the Coalition of the Willing was held, at which the participants called on russia to begin a full-fledged and unconditional ceasefire. The US President also supported this position. Instead of this, Russian president proposed direct talks in Istanbul this Thursday.

ICU view: Small steps towards more substantive ceasefire negotiations were not particularly promising, but still enough to improve the mood of Eurobond holders slightly. At the same time, ratification of the minerals deal with the US by Ukraine’s parliament went largely unnoticed by the market. This week, all eyes will be on prospective peace negotiations in Istanbul as President Zelensky confirmed he’s ready to meet putin in person to lift a critical hurdle for the talks. It remains to be seen if putin himself agrees to meet.

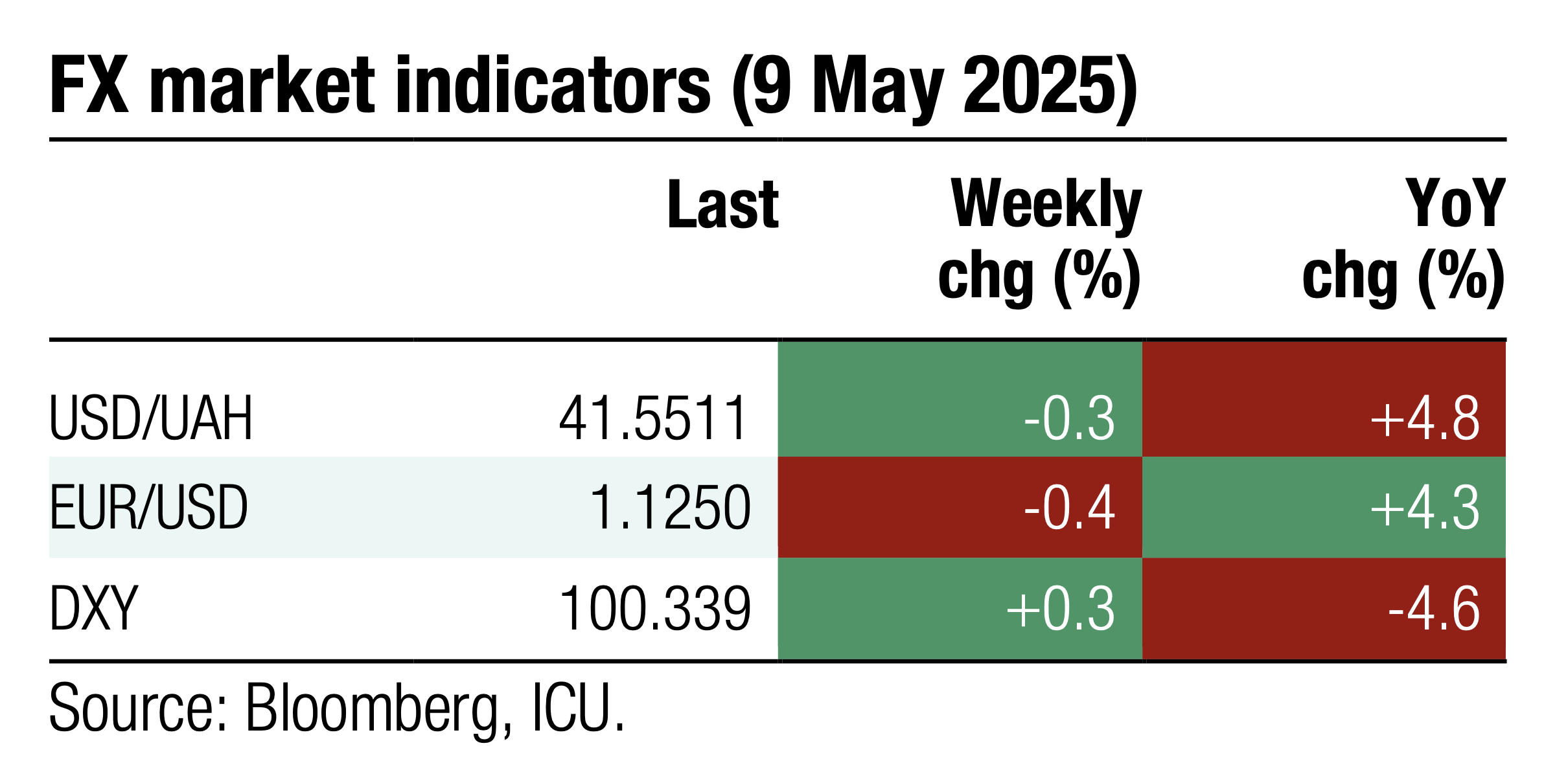

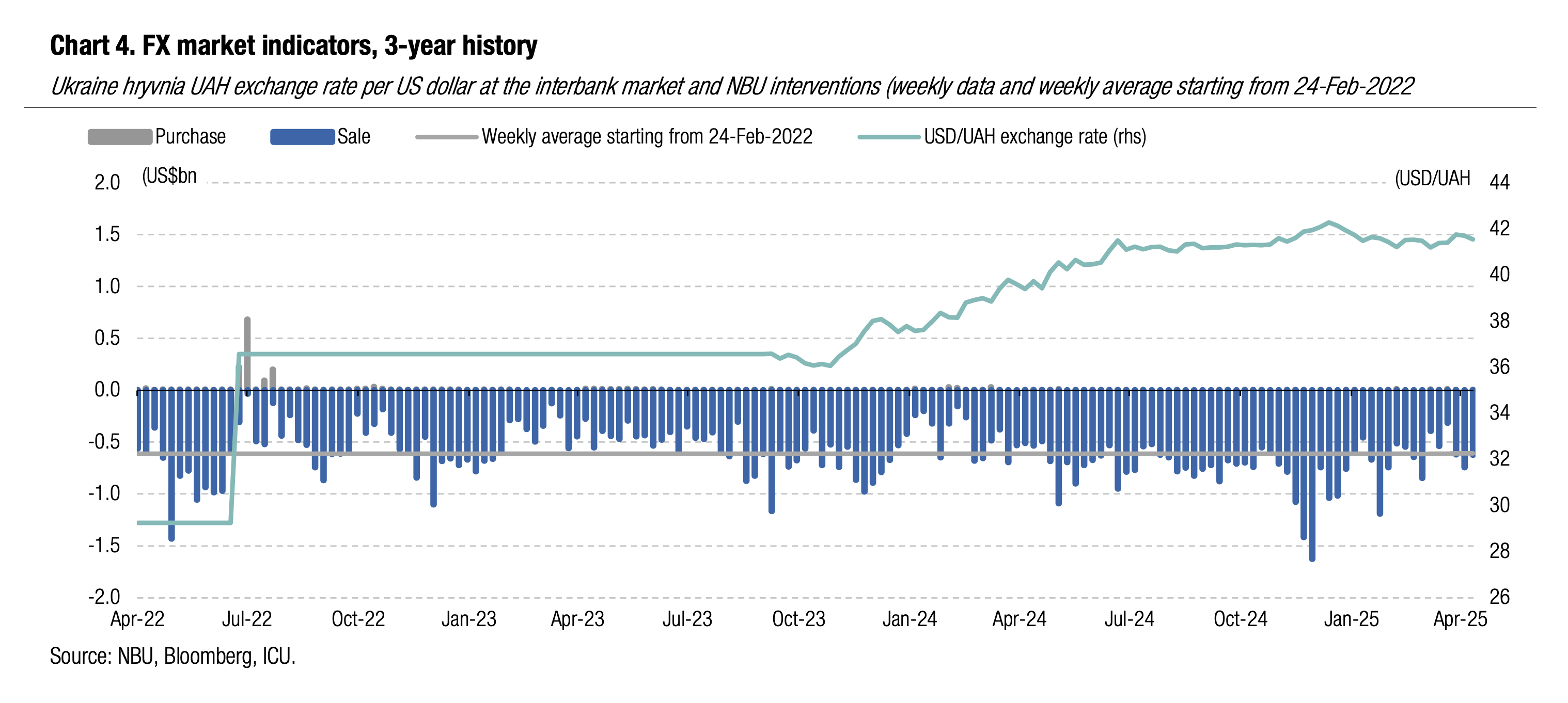

FX: NBU updates FX restrictions

The NBU finetuned some of its FX restrictions last Friday. As most of the changes were relatively nominal they will have little impact on the FX market.

According to new regulations, the NBU allowed FX forward transactions between banks and with clients. Also, Ukrainian companies may now increase financing of their foreign representative offices; residents are allowed to make payments related to lawsuits where non-residents failed to fulfil contracts; limits for payments with corporate bank cards abroad were increased.

This NBU decision came after the situation in the FX market improved slightly in recent weeks. Specifically, last week, net FX purchases halved WoW to US$260m, and NBU interventions slid by 16% WoW to US$624m. The NBU strengthened the USD/UAH exchange rate by 0.4% WoW to UAH41.55/USD.

ICU view: The NBU expects that its fresh regulatory updates will not have a significant impact on the FX market. Last week’s NBU communication related to capital controls reveals the regulator is not prepared to take further decisive steps in the near future, including those related to repayments of external debt principal. The most important Friday’s change for the Ukrainian FX market is the relaxation of controls related to FX forward transactions, as it improves the ability of legal entities to hedge FX risks.

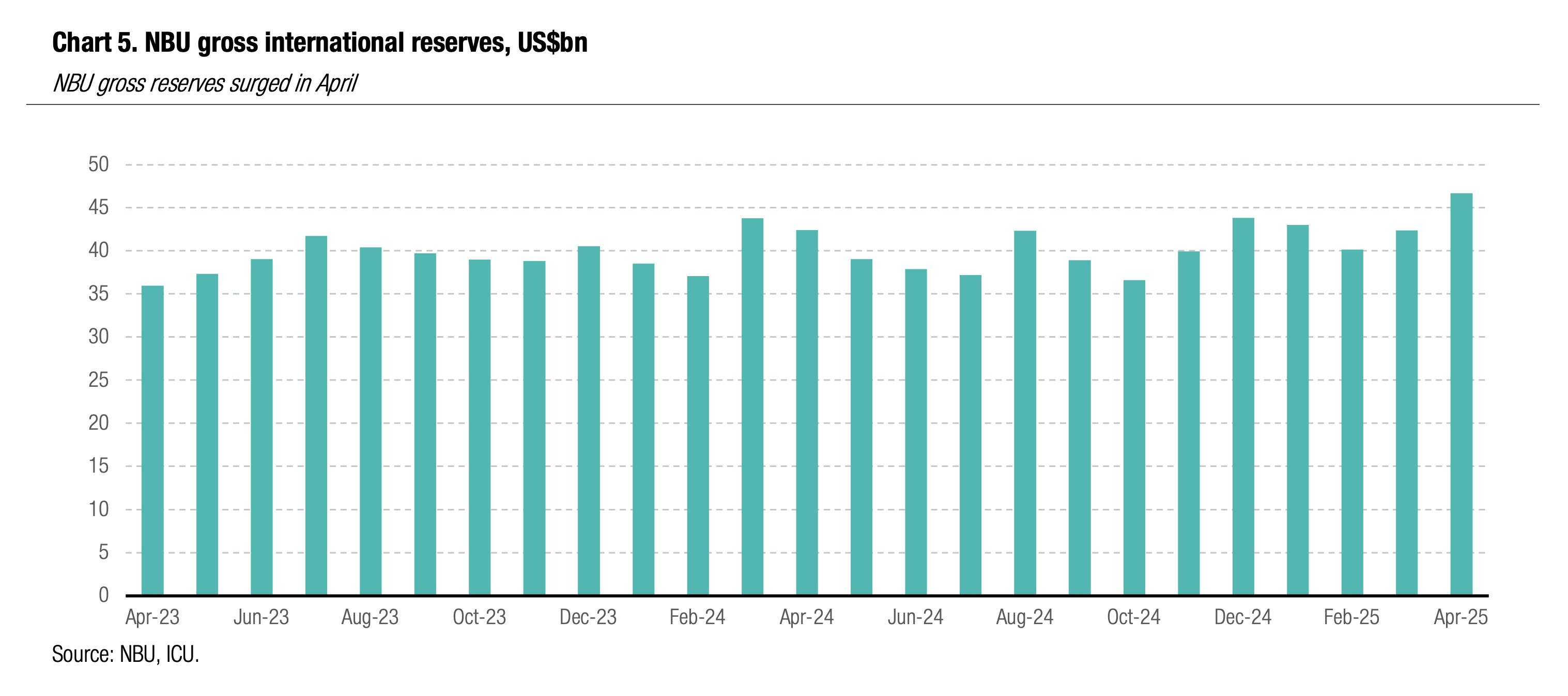

Economics: NBU reserves surge 10% in April on foreign aid

Gross international reserves of the NBU were up 10.1% in April and 6.6% YTD to US$46.7bn, an all-time high, on generous inflows of foreign financial aid.

Specifically, Ukraine received a US$4.9bn loan from the EU within the ERA program and an US$1.3bn facility from the World Bank. The NBU also informed that the US$1.0bn ERA facility from the UK provided in March was not included in the reserves given the restrictions related to the use of this money (likely for purchases of military equipment). Meanwhile, the NBU spent net US$2.2bn on FX sale interventions while external debt servicing (including to the IMF and the WB) amounted to US$0.3bn. The net reserve revaluation result was positive at US$0.7bn. The NBU gross reserves are now equivalent to 5.6 months of the future imports.

ICU view: NBU reserves will continue to grow and exceed US$55bn by the end of 2025 thanks to generous external financial aid. This level of reserves will represent a solid cushion and enable the NBU to keep the hryvnia relatively strong. We see the exchange rate at UAH43.5/US$ at the end of 2025. Yet, reserves are set to decrease substantially in 2026, as financial aid will subside next year in a baseline scenario.

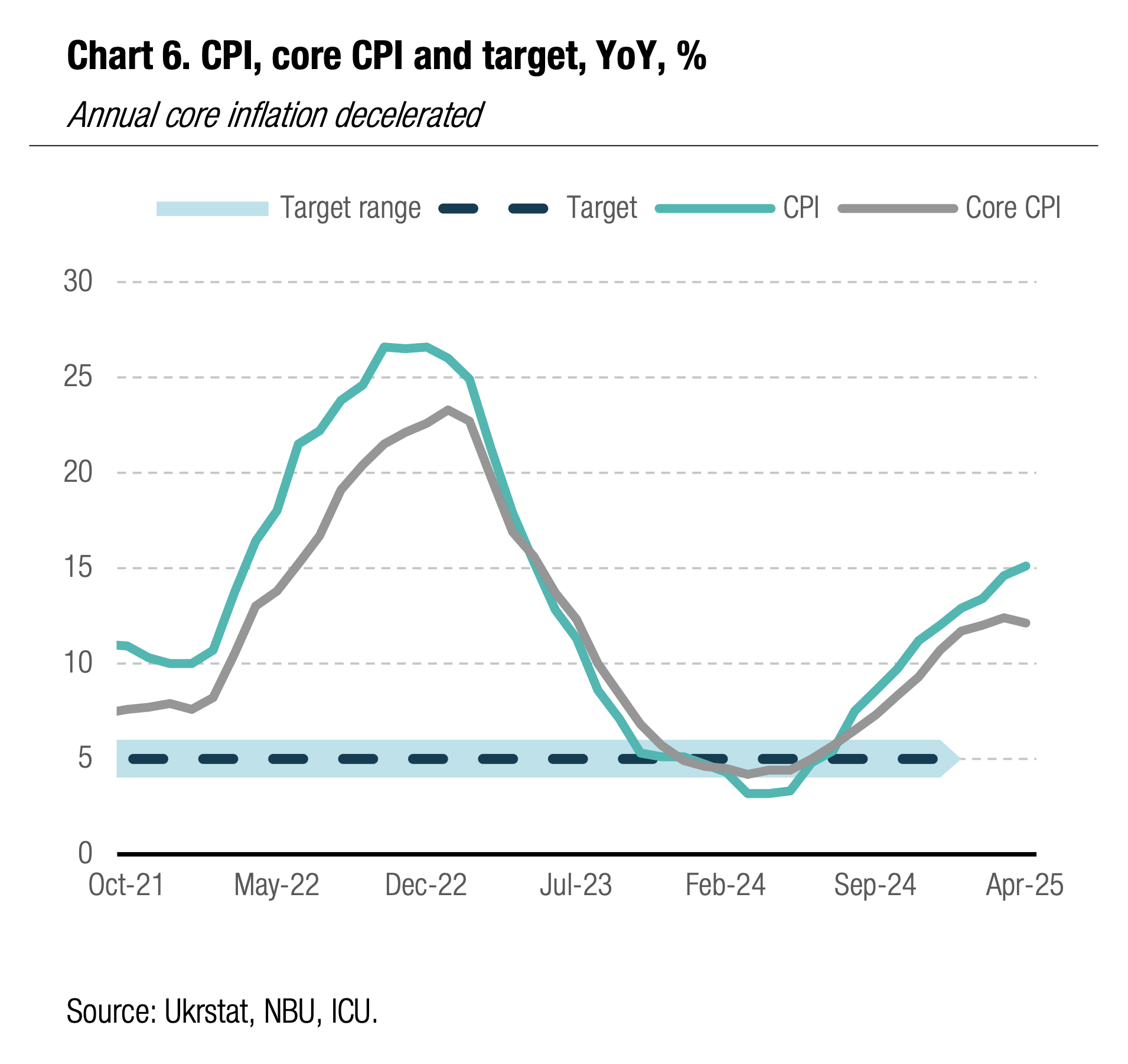

Economics: Annual core inflation decelerates notably in April

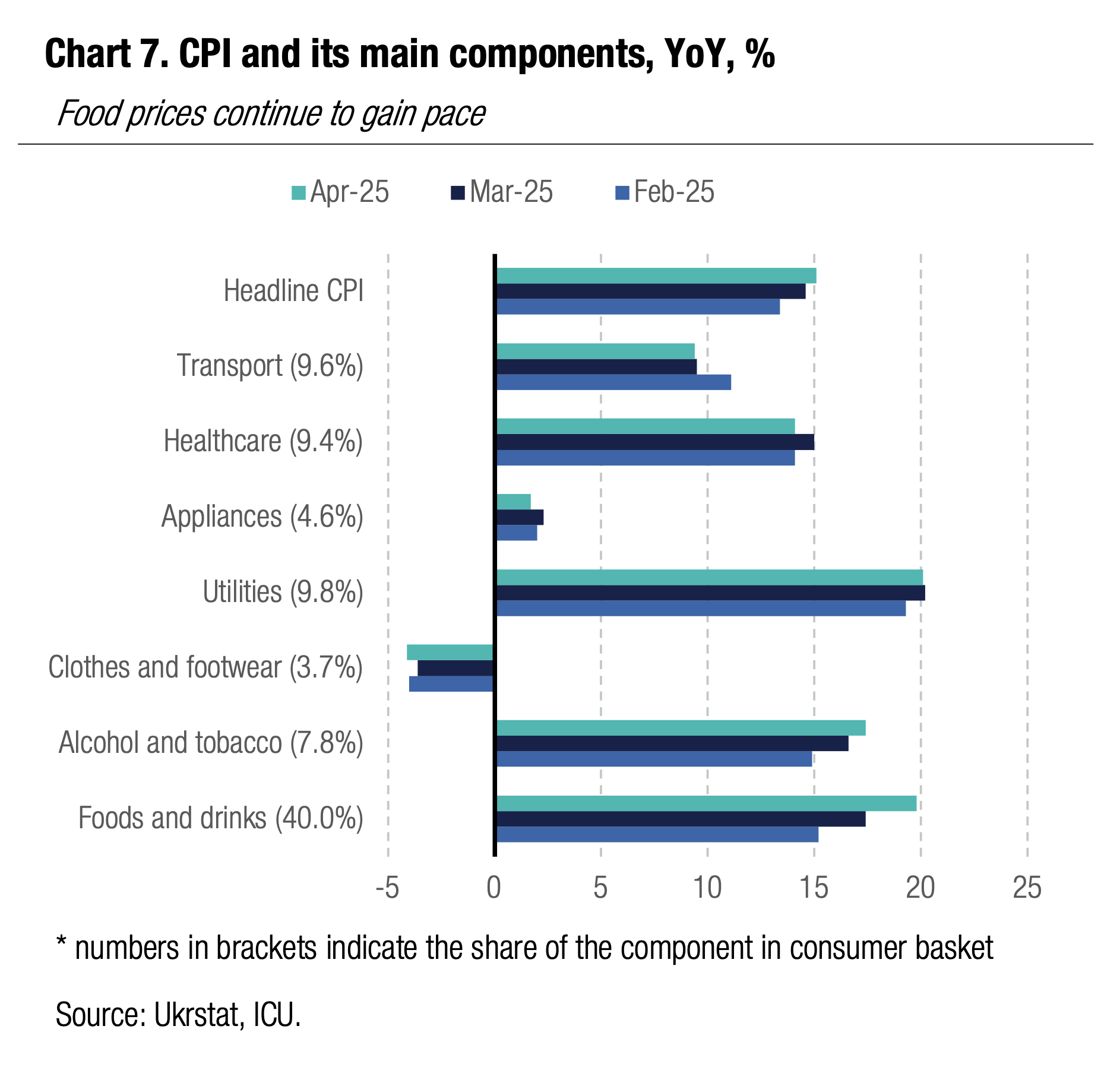

Monthly headline inflation decelerated notably in April to 0.7% from 1.5% in March. Annual headline inflation still continued to accelerate and reached 15.1% due to last year’s low comparison base.

Surprisingly, prices for food continued to accelerate and their annual growth reached 19.8%, up from 17.4% in March. Last year’s poor harvest combined with growing production costs continue to have a pronounced impact on prices of both raw and processed food products. Meanwhile, annual growth of prices for the vast majority of the consumption basket components decelerated somewhat in April, indicating that fundamental prices pressures are likely starting to ease. Importantly, core inflation showed the first significant deceleration in more than a year as it stood at 12.1% vs. 12.4% in March.

|  |

ICU view: The CPI reading in April was in line with our expectations. Annual inflation will peak in May and will embark on a steep downward trend from June. We expect consumer price growth will be at 7.6% at the end of 2025 if weather doesn’t harm this year’s harvest and the authorities do not revise gas and electricity tariffs for households. With inflation trending down, the NBU will be in a position to switch to a monetary policy easing cycle from September, but we expect a very slow rate of key policy rate cuts as the situation in the FX market will start to gain weight in NBU’s decision-making process at the end of the year.