|  |

|  |

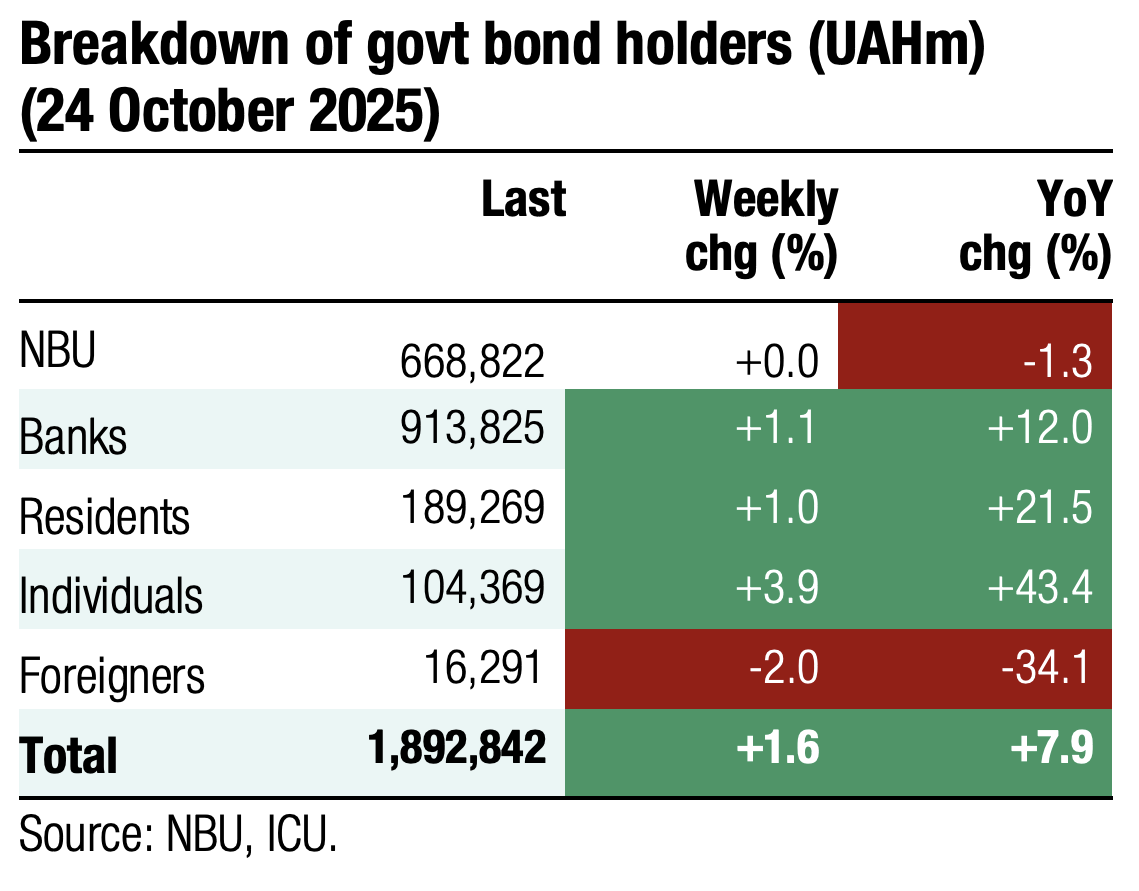

Bonds: Retail portfolio close to record high

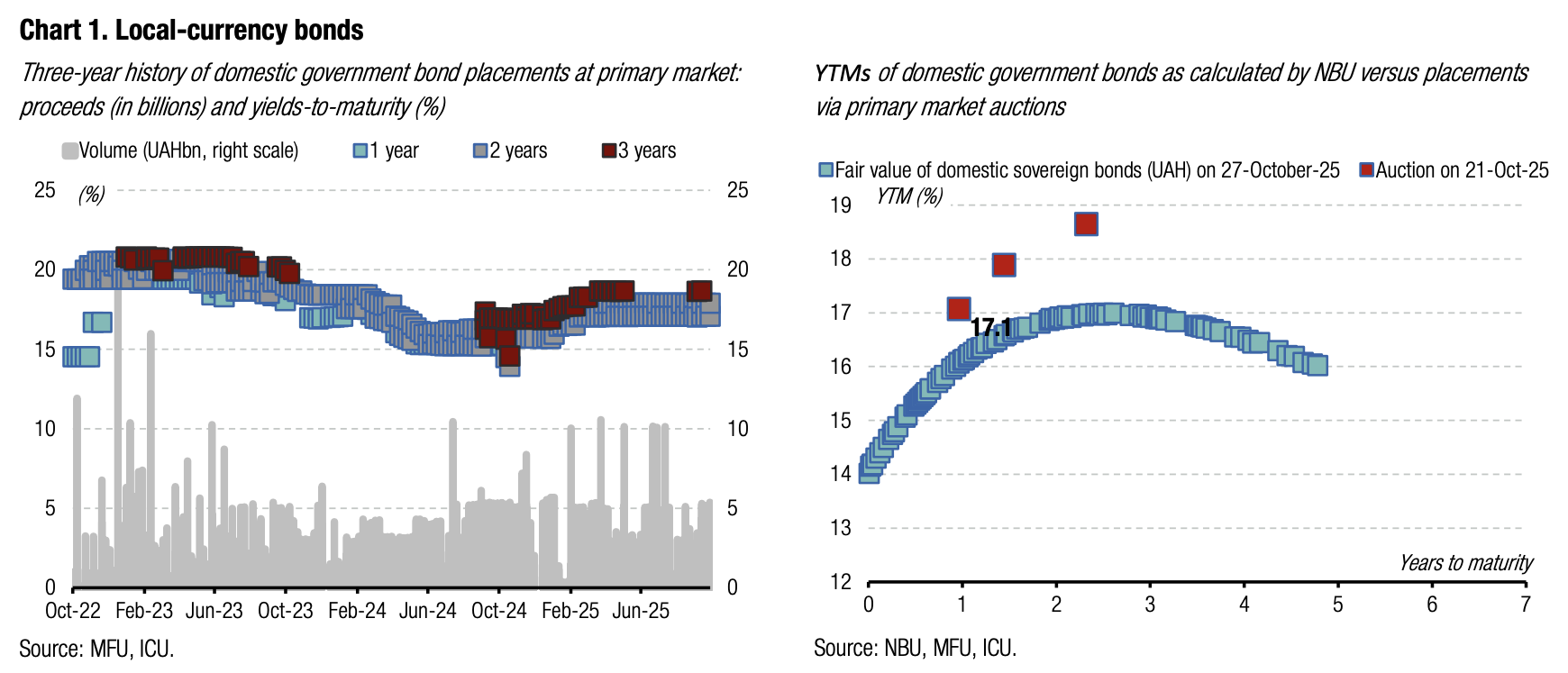

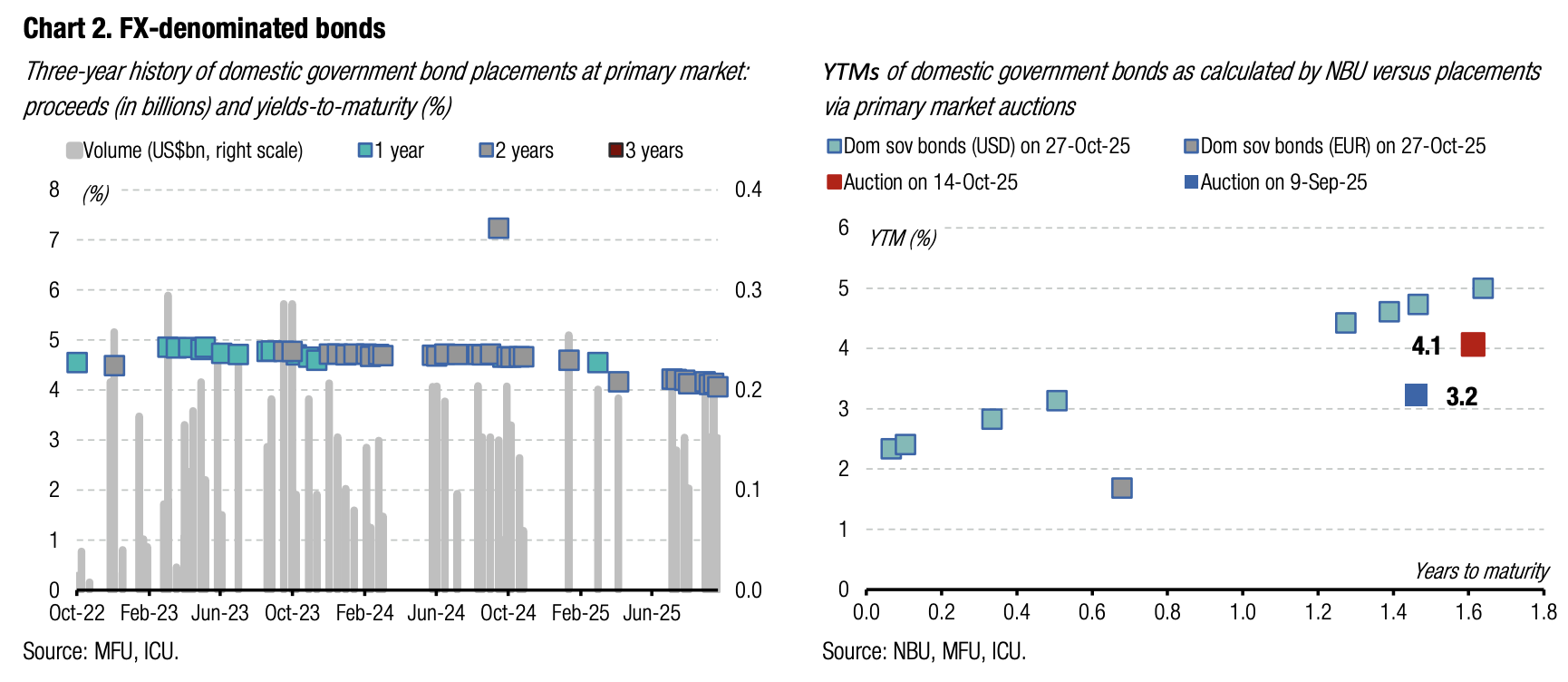

Local debt portfolio of individuals returned to record high last week.

In October, the Ministry of Finance redeemed four bonds, one of them was owned by the NBU. The retail portfolio, thus, declined on three occasions, including after the redemption of UAH bonds on October 1, USD-denominated paper on October 9, and another hryvnia bond on October 15. Individuals were fast to reinvest funds and their portfolios reached UAH104.8bn, close to historical high.

Recently, individuals have shown a preference for FX-denominated bonds. Retail UAH portfolios currently stand at UAH57.2bn, which is still below the high of UAH58.7bn recorded on October 14. The share of UAH paper in portfolios declined to 54.8% from 57% two weeks ago.

ICU view: Households recently shifted their preference towards bonds in US dollars and euros, which they treat as FX hedging instruments. Yet, they also remained active in reinvesting funds in UAH securities. We expect retail portfolios to keep growing robustly going forward.

Bonds: US and EU stepping up pressure on russia

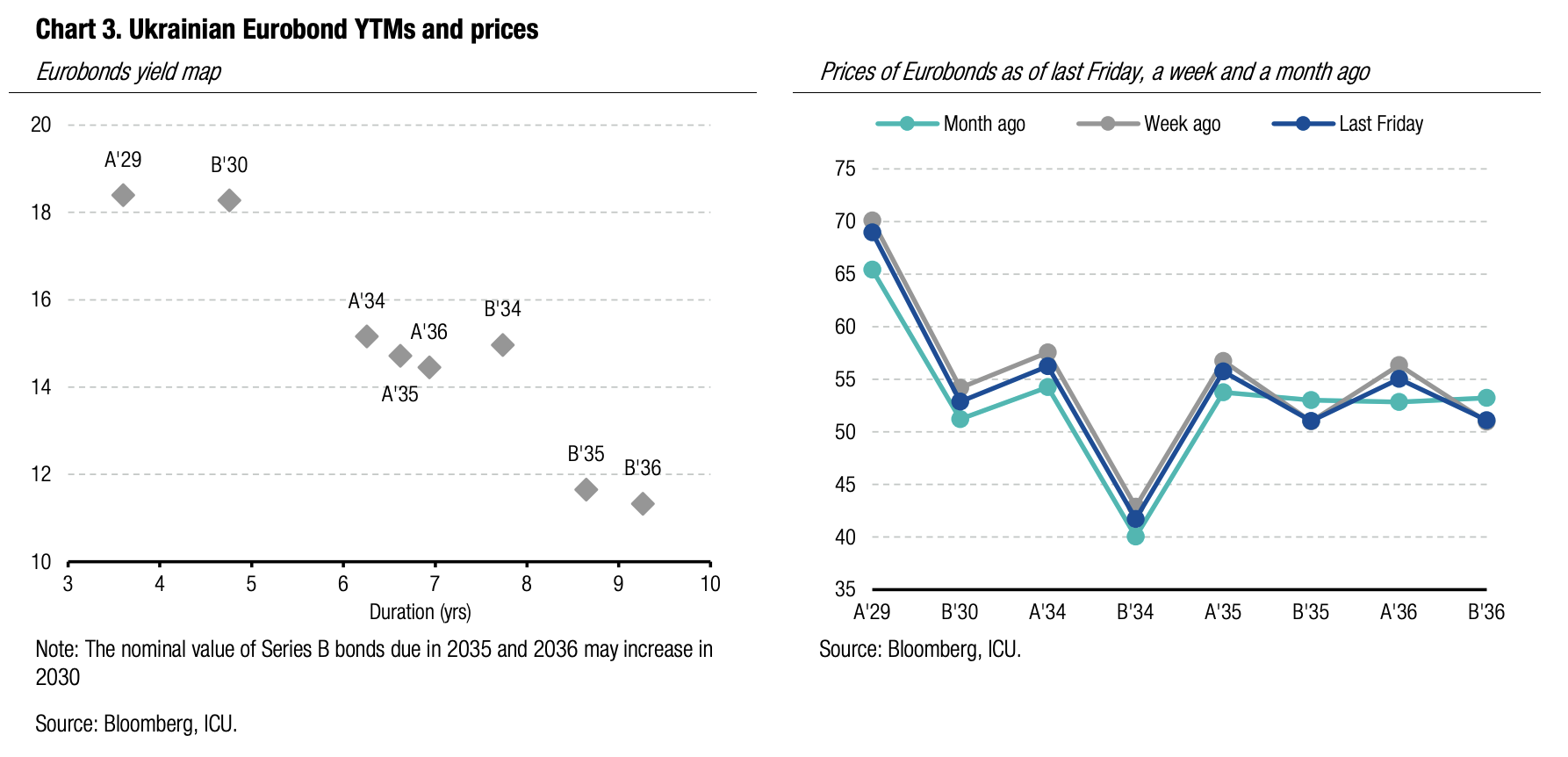

New sanctions imposed on russia by the US and EU supported Eurobond prices.

The news of a meeting of the US and russian presidents in Budapest being cancelled pushed Eurobond prices down at the beginning of the week. However, Thursday and Friday delivered some positive news and the price trend reversed. The decline in Eurobond prices for the week was close to 1.5%.

Sanctions imposed by the US on russia’s oil and gas industry were the first set of sanctions against russia during Trump’s second presidency. Meanwhile, the failure of the EU to agree on a framework for Ukraine’s reparation loan due to opposition from Belgium was disappointing news for the market. The reparation loan will be back on the EU agenda in December 2025.

ICU view: The US sanctions were the most powerful step in a stick-and-carrot strategy towards russia delivered by President Trump to date. The thing to watch in the coming weeks is whether there will be backtracking on this issue. If the tough stance is maintained, this may give some tangible hope that the russia’s war on Ukraine will be deescalated in the coming quarters. The news of the EU reparation loan for Ukraine being delayed had little impact on the Eurobond prices, and the market appears to be fully confident the loan will be approved by the end of 2025.

Bonds: VRI price up amid restructuring rumors

VRI price reached the level last seen in February amid rumours that the MoF and the warrant holders restarted restructuring negotiations.

Last week, the VRI price rose to above 84.5 cents per dollar of notional value, the highest level since February 2025. At that time prices rallied on optimistic expectations of a quick resolutions of the war as promised by newly-elected US President D.Trump.

The recent price increase came on the back of rumours that the MoF and the holders committee began a round of restructuring negotiations after a six-month break. In April, the two parties failed to reach an agreement due to the MoF's insistence on not making any cash payments. Ukraine aims to complete the restructuring this year and before a new IMF program starts.

According to rumours a new MinFin proposal may include an issuance of new Eurobonds in exchange for warrants as well as a cash payment. Investors expect a new issue that is not related to securities issued last year.

ICU view: Given the tight timeframe, Ukraine is likely to make some concessions to creditors compared to its position in April and there is a high chance the new negotiations may be successful. However, cash payments are very unlikely to be significant.

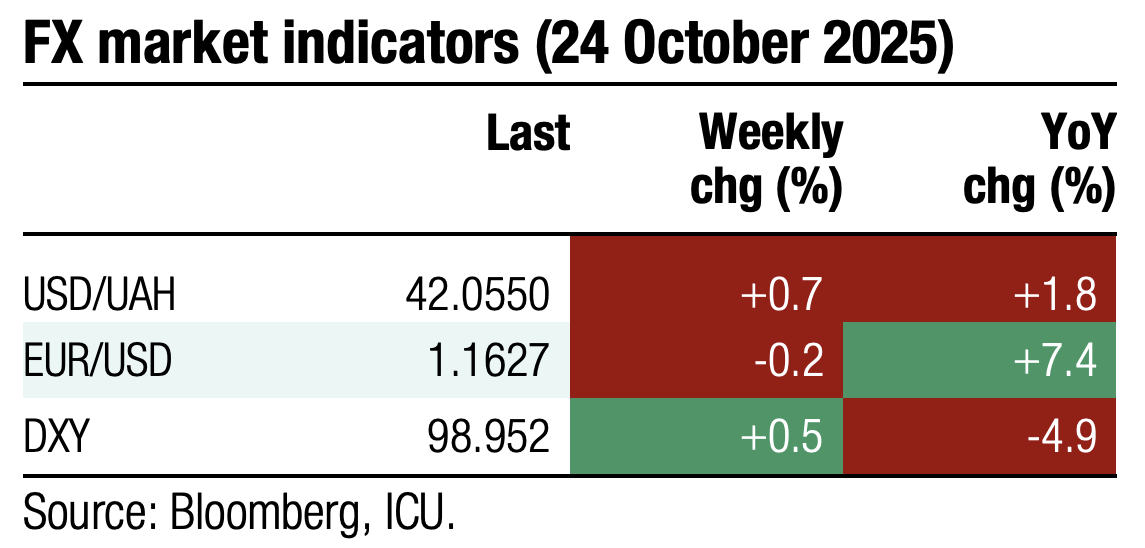

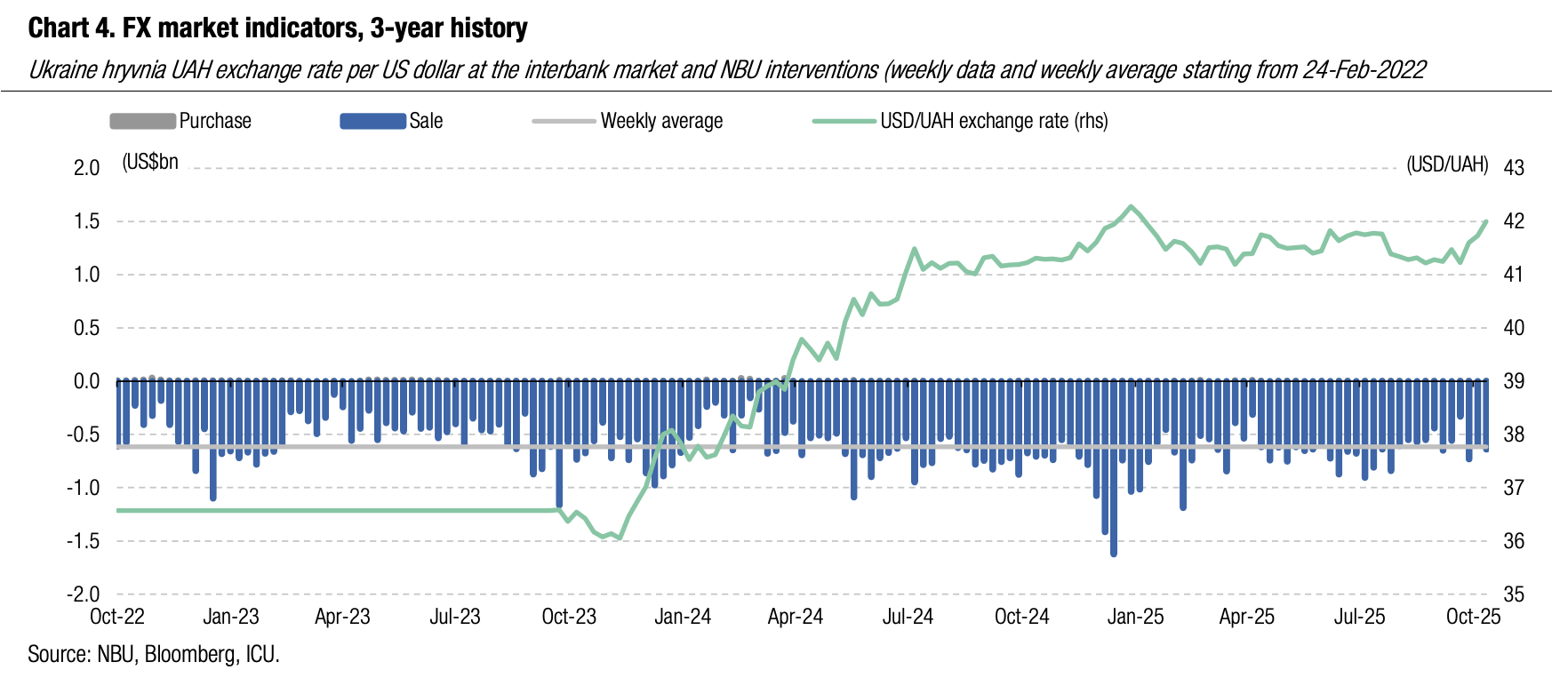

FX: NBU weakens the hryvnia sharply

Last week, the NBU devalued the hryvnia sharply to UAH42/US$, the weakest level since the end of January.

The NBU weakened the hryvnia by 0.6% to almost UAH42/US$ last week, the lowest level since the end of January. The hryvnia exchange rate to the euro did not change last week.

The National Bank sold US$641m from international reserves, slightly more than in the week before. The hard currency shortage slid last week. In the interbank FX market, net purchases of foreign currency by bank clients in four days amounted to only US$166m, while households almost doubled net purchases WoW to US$155m.

ICU view: The NBU was in no rush to sell FX in sufficient quantities to prevent further weakening of the hryvnia. Last week, net demand was up primarily due to higher demand from households, which had become somewhat worried with the depreciation trend. The weakening of the hryvnia followed a Bloomberg publication stating that the IMF remains insistent on a more significant weakening of the hryvnia. We don’t think last week’s trend indicates that the NBU started a long-term managed weakening of the hryvnia. We interpret the last week’s action as a central bank step towards larger fluctuations that are likely to be maintained in the future.

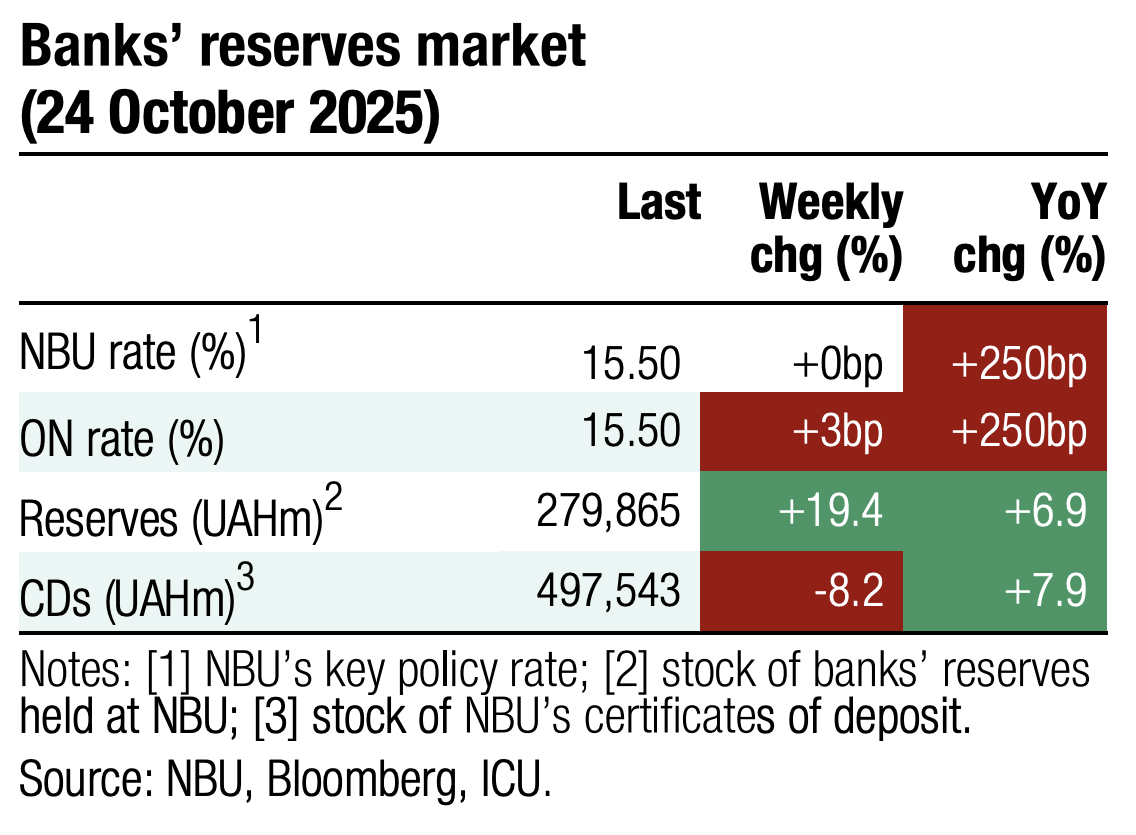

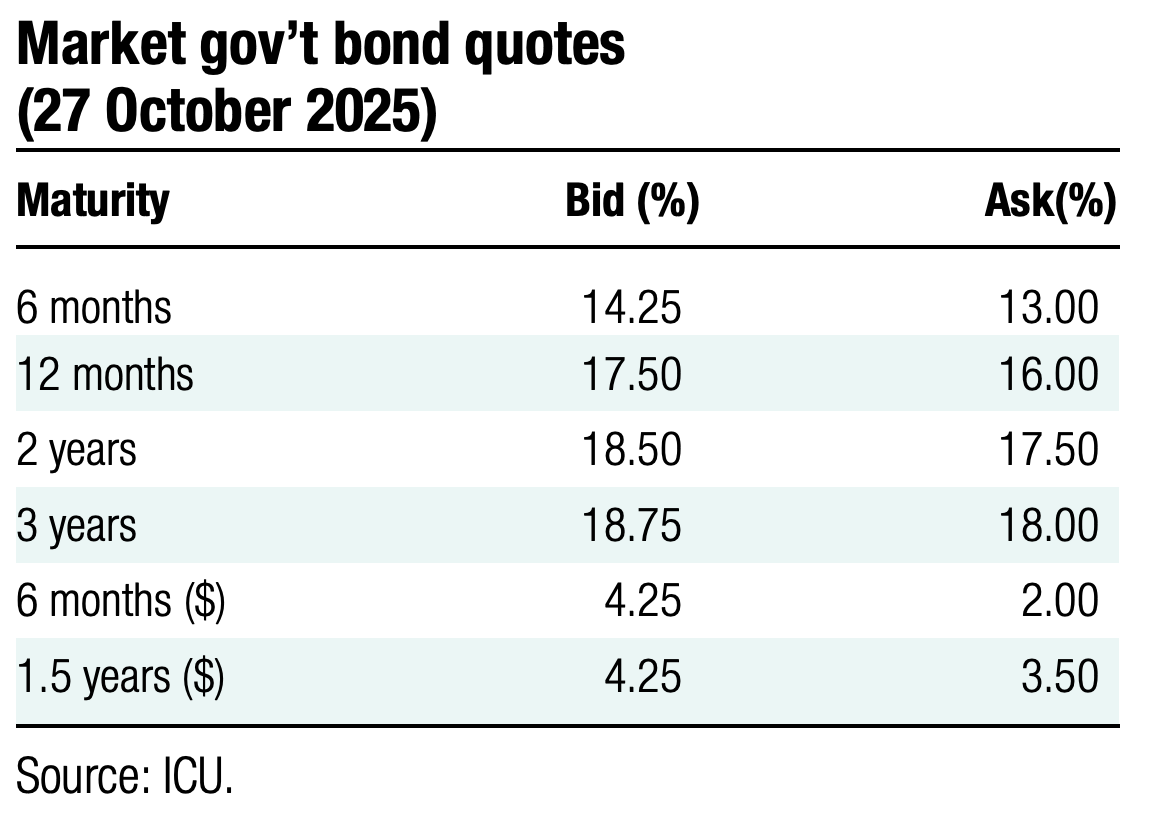

Economics: NBU postpones rate cuts

The central bank maintained the key rate at 15.5%, indicating that monetary easing is unlikely before 2026, as inflation risks remain high.

The regulator left the rate unchanged and it now expects two 50bp cuts, previously projected for this year, to be postponed. According to the NBU, inflation risks remain elevated amid energy shortages and rising wages, with inflationary expectations yet to ease. The new forecast assumes the key rate will remain at 15.5% through 2025, with inflation slowing to 9.2% by end-2025 and to 6.6% in 2026.

ICU view: The NBU has changed only its near-term trajectory (4Q25–1H26) of the key rate. Starting January 2026, the regulator projects five consecutive 50bp cuts. We do not rule out that these cuts could start earlier, in December 2025, if disinflation and external conditions evolve more favourably.