|  |

|  |

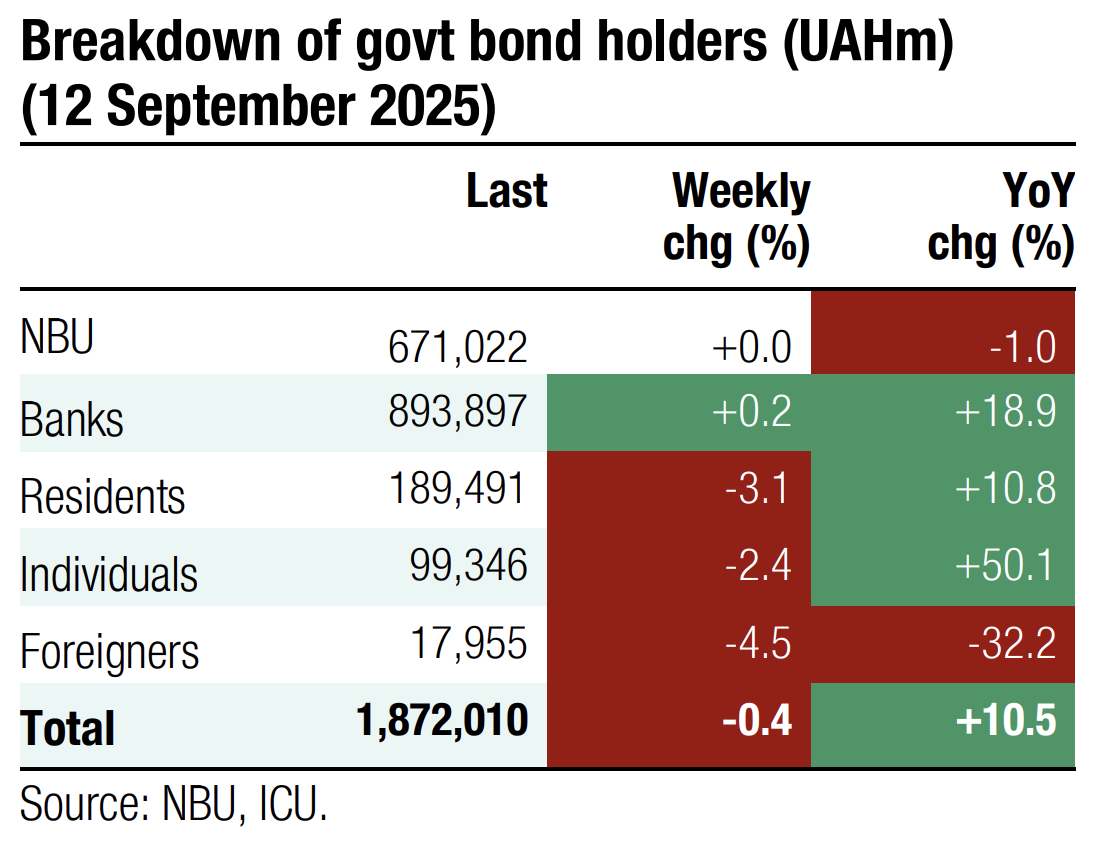

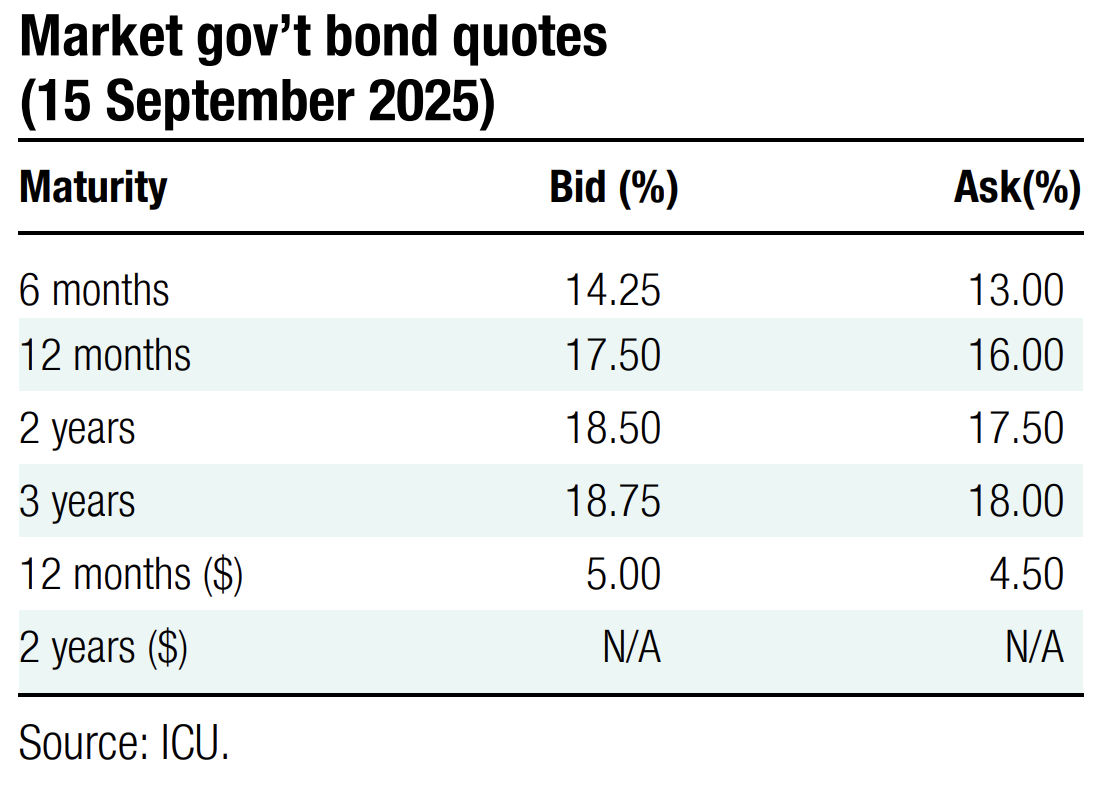

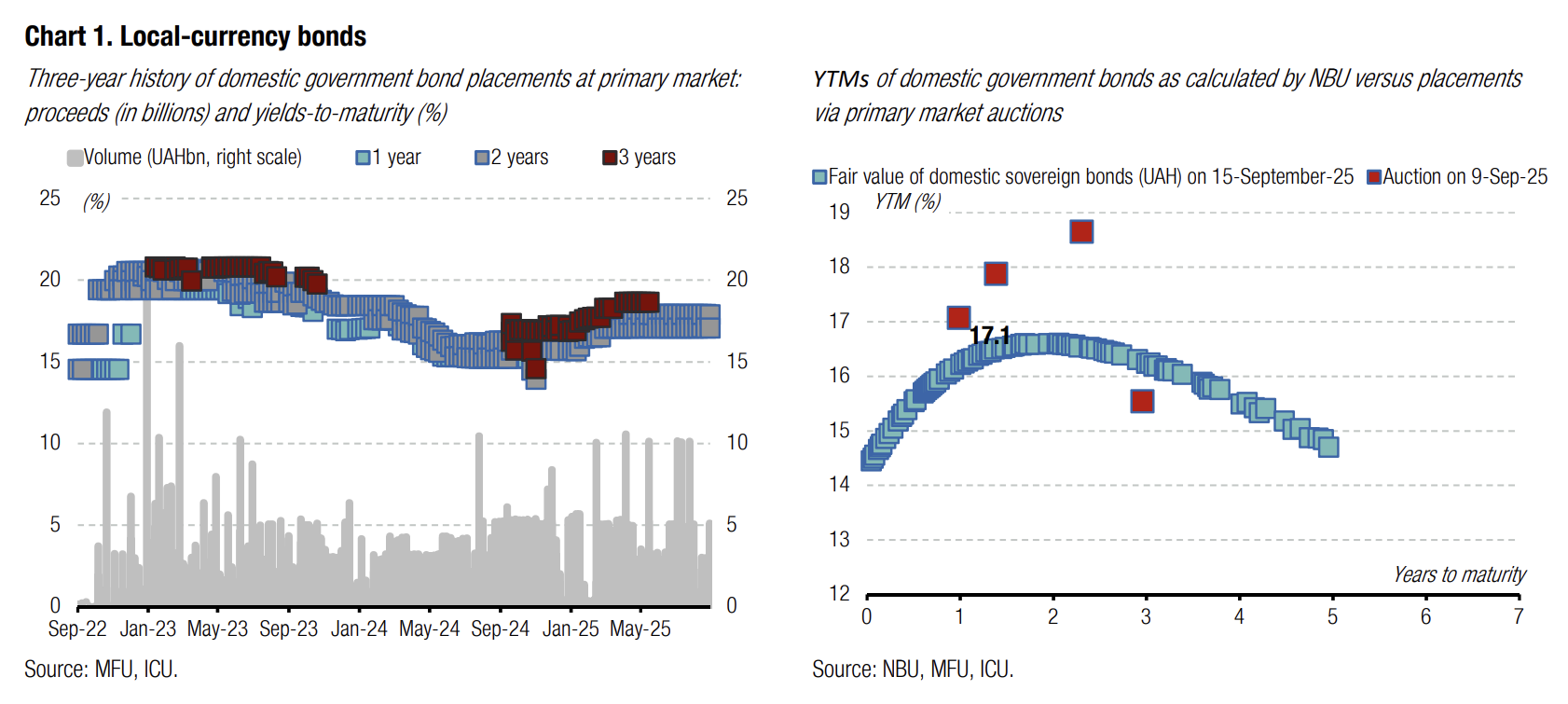

Bonds: Retail portfolio declines temporarily on redemptions

Last week, the redemption of UAH bonds lent to a reduction of retail portfolios to a five-week low. We expect it to recover quickly.

The retail portfolios of local government securities shrank by UAH4.7bn last Wednesday to UAH97.7bn, a five-week low. The share of UAH bonds was down by 2pp to 55%. The maximum portfolio volume was registered at UAH103bn as of September 4. However, over the next two days following the redemption, households reinvested almost net UAH2.2bn, while clearly giving preference to UAH-denominated securities.

ICU view: Individuals remain the most dynamic group of investors in government bonds. They actively and quickly reinvest funds in other bonds to rebuild their portfolios post redemptions. While no redemptions are scheduled for this week, it is highly likely that retail portfolios will reach a new all-time high soon.

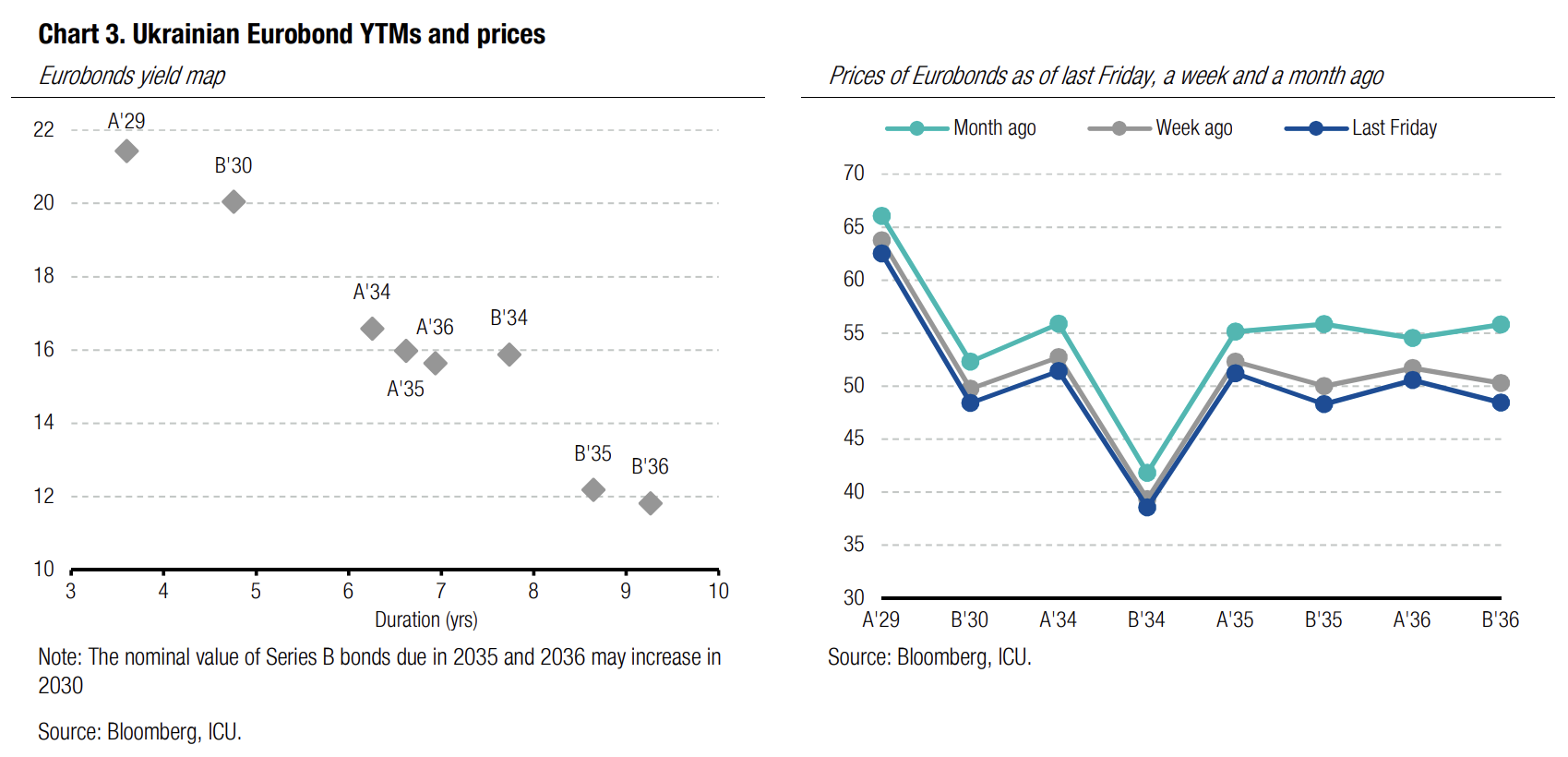

Bonds: Pre-Alaska boost to expectations fades away

Eurobond prices reached levels last seen before the Alaska summit, implying investors lost confidence that the US is ready to step up pressure on Russia.

The lack of progress on the diplomatic side became fully obvious over the past couple of weeks. In the meantime, investor focus shifted to a discussion of a new Ukraine-IMF program and possible sources of foreign financial assistance to Ukraine over 2026-27. The IMF mission held talks in Kyiv last week and signalled Ukraine’s application for a new program will be discussed over the coming weeks/months. Bloomberg reported that Ukraine’s funding needs over the period may exceed government estimates by US$10-20bn. Meanwhile, the President of the EU commission Ursula von der Leyen in her State of the Union address mentioned that the EU may explore new schemes to support Ukraine with frozen russian money.

Against this backdrop, Ukrainian Eurobond prices continued to decline. They are down by almost 10% from the August maximum and are now below the level preceding the Alaska meeting. The StepUp bonds B with maturity in 2035-36 fell the most, by more than 15%.

ICU view: As peace negotiations are very unlikely to again become a top theme surrounding Eurobonds, investor focus is shifting towards the progress in negotiations with the IMF and potential funding sources for Ukraine over 2026-27. Any new loans raised by Ukraine to finance the war will for sure increase the debt/GDP ratio and prompt re-assessment of debt sustainability by the IMF, a step that may have clear negative implications for Eurobonds. Yet, if the new funding is covered with russian frozen assets, as the President of the EU commission noted, the new debt may be excluded from DSA, similar to ERA facility.

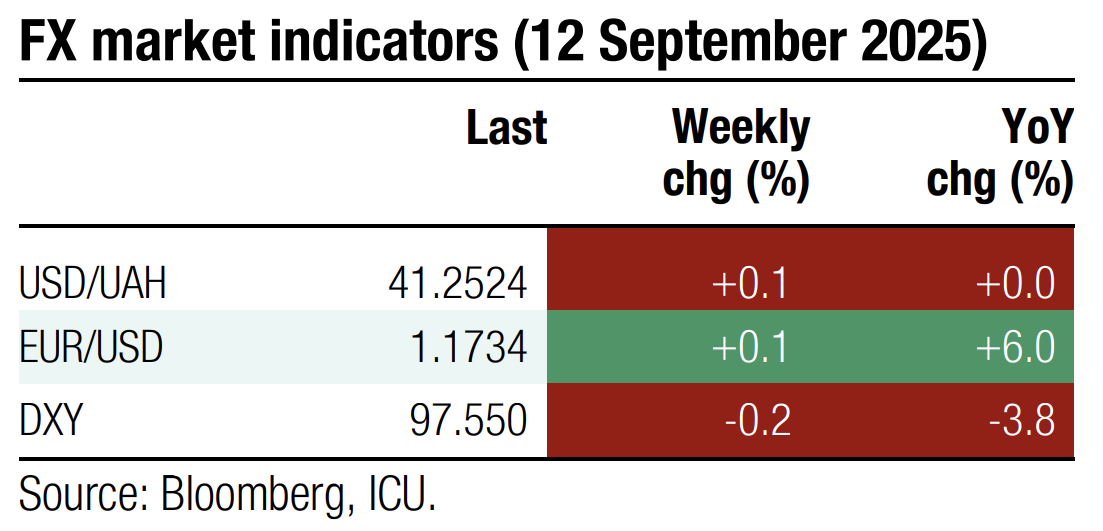

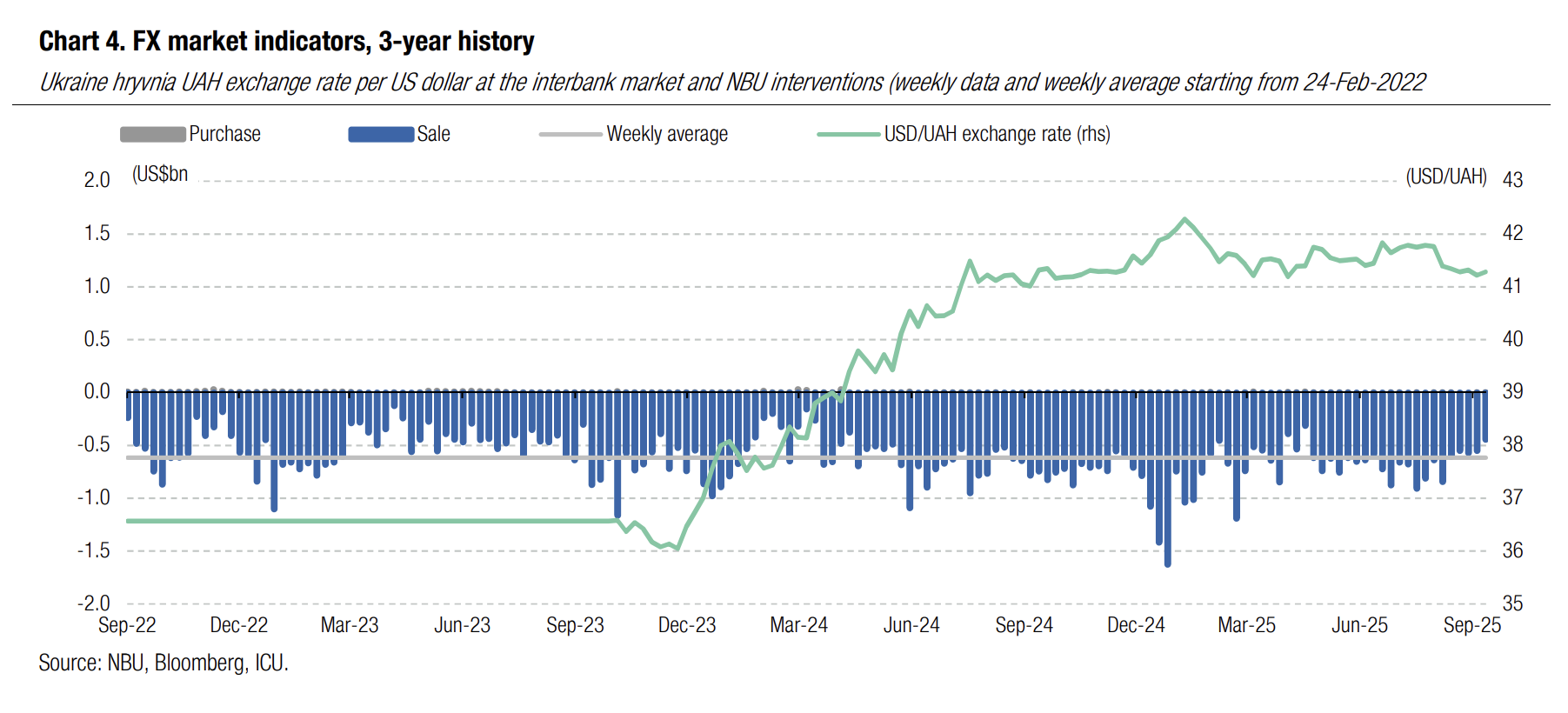

FX: NBU interventions the smallest since April

The National Bank reduced FX sales to a five-month low, while gradually allowing for larger amplitude of hryvnia fluctuations.

The NBU sold just US$443m last week, the smallest amount since mid-April, when the weekly volume of interventions was only US$314m. The shortage in the FX market almost halved to US$225m (for four business days) last week.

Meanwhile, the NBU allowed noticeable daily fluctuations in the hryvnia exchange rate even though the rate didn’t exceed UAH41.3/US$.

ICU view: A lower hard-currency shortage in the market allowed the NBU to reduce interventions further. The NBU may continue to increase the amplitude of hryvnia fluctuations, while keeping the official exchange rate close to the current level for some time.

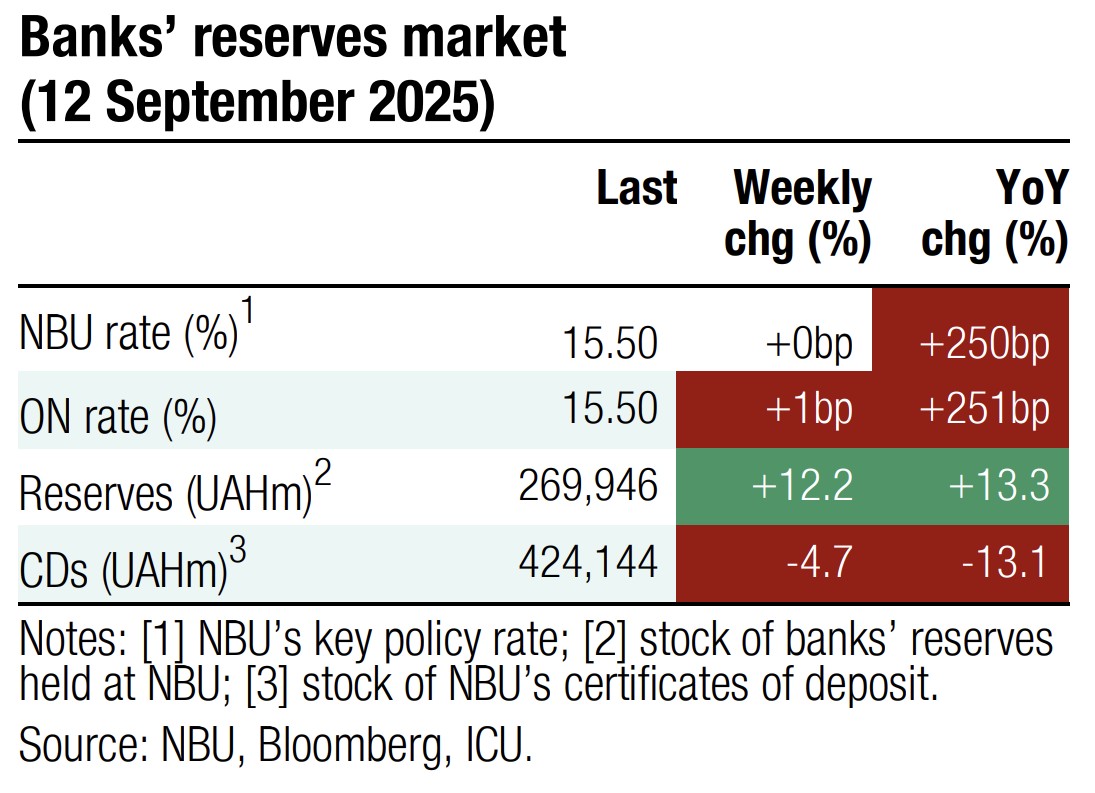

Economics: NBU keeps the key rate at 15.5%

As expected, the regulator decided not to change the policy rate.

The central bank explained that tight monetary conditions remain necessary to control inflation and safeguard the stability of the hryvnia. At the same time, its communication suggested that policy easing may proceed more slowly than projected: the NBU does not rule out a later start to cuts, or even a rate hike in the case of adverse scenarios.

ICU view: We expect the regulator to start the easing cycle in October with a 50bps cut, in line with earlier plans.

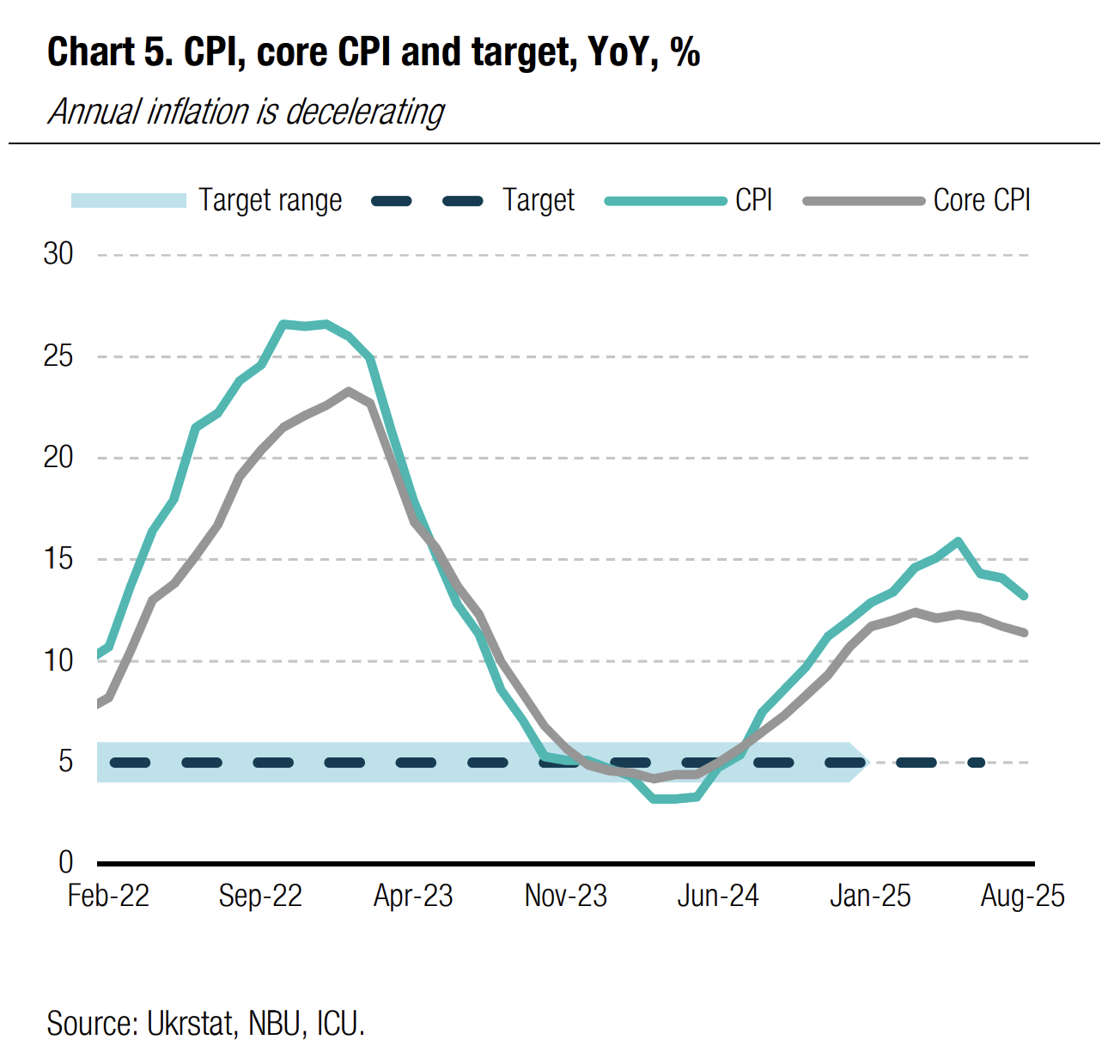

Economics: Annual inflation keeps decelerating

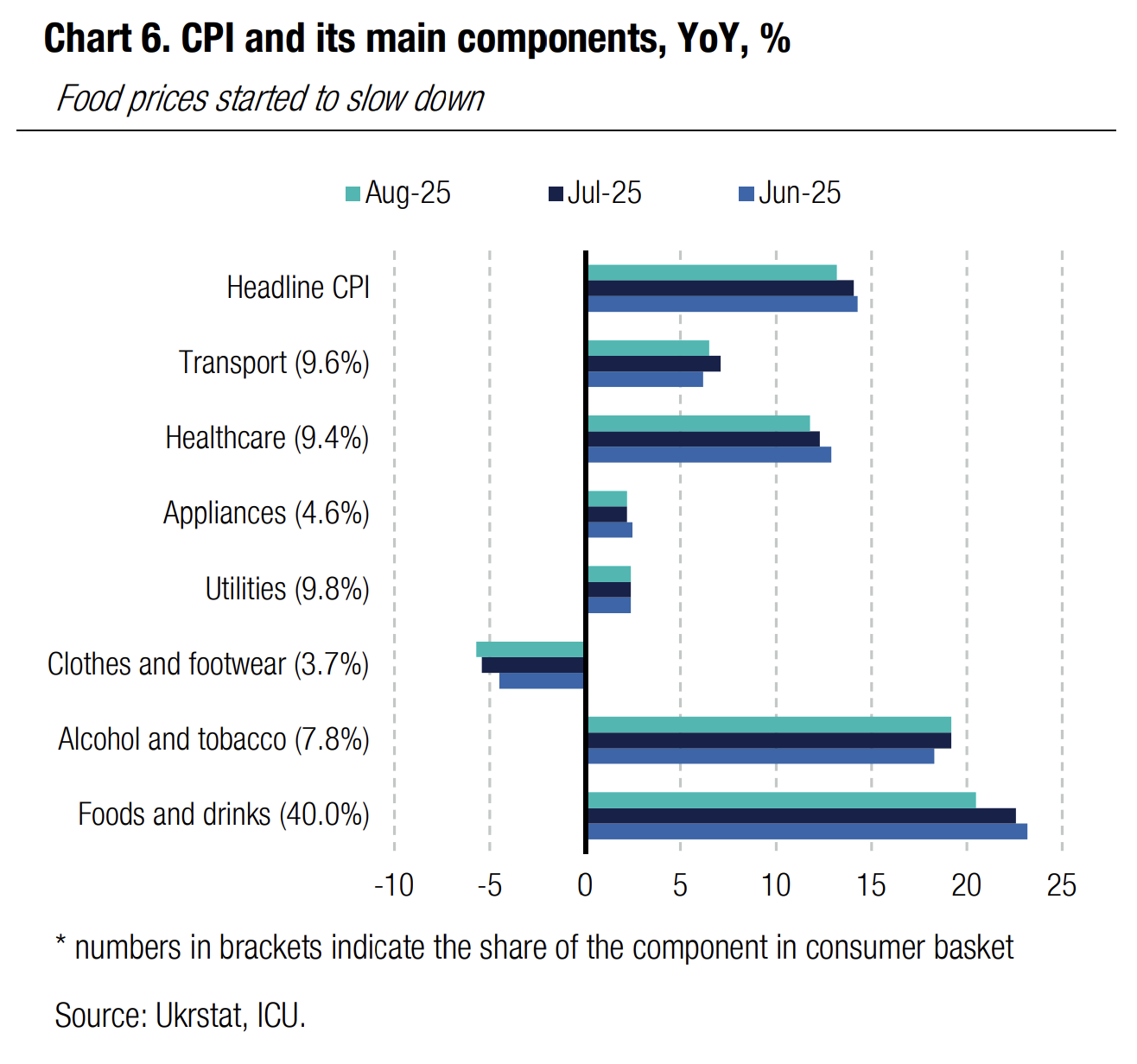

Ukraine’s annual CPI decelerated to 13.2% in August from 14.1% in July. This is below market consensus, but somewhat above our expectation. Core CPI slowed to 11.4% from 11.7% a month before.

The deceleration in prices was broad-based indicating the disinflationary process is becoming robust. The slowdown in food prices was particularly visible – 20.4% YoY in August vs. 22.5% in July – largely on a bumper harvest of vegetables and fruits. The only component of the CPI basket that saw an uptick in price growth rate is communication.

|  |

ICU view: We expect the annual CPI will slow in every single month at least over the next six months, while slipping into single-digit territory in November or December. The slowdown in price growth will likely beat NBU expectations. However, we don’t think this will change NBU’s plans to reduce the key policy rates gradually and in small steps. As inflation slows, the central bank’s focus will be shifting towards the FX market, which is likely to see much larger imbalances towards the end of the year. We see end-2025 NBU key policy rate at 14.5%, in line with the current NBU guidance.