|  |

|  |

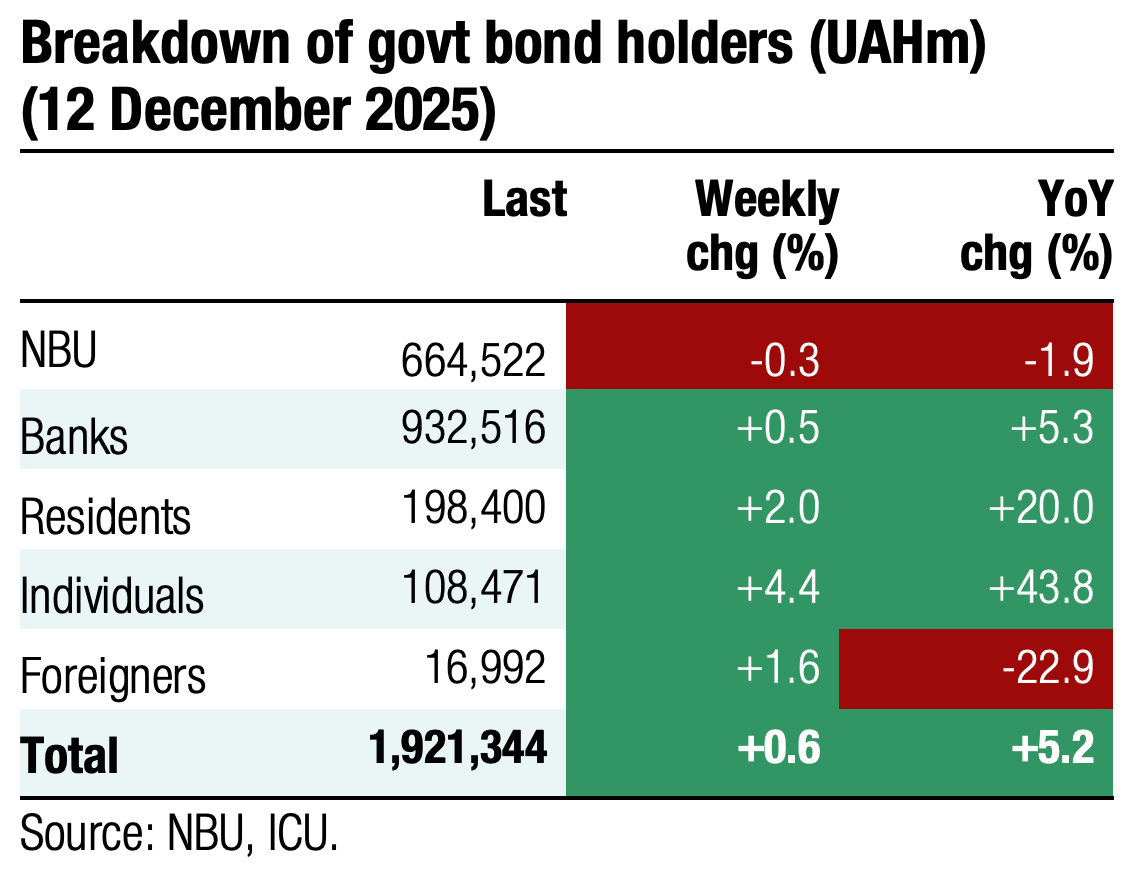

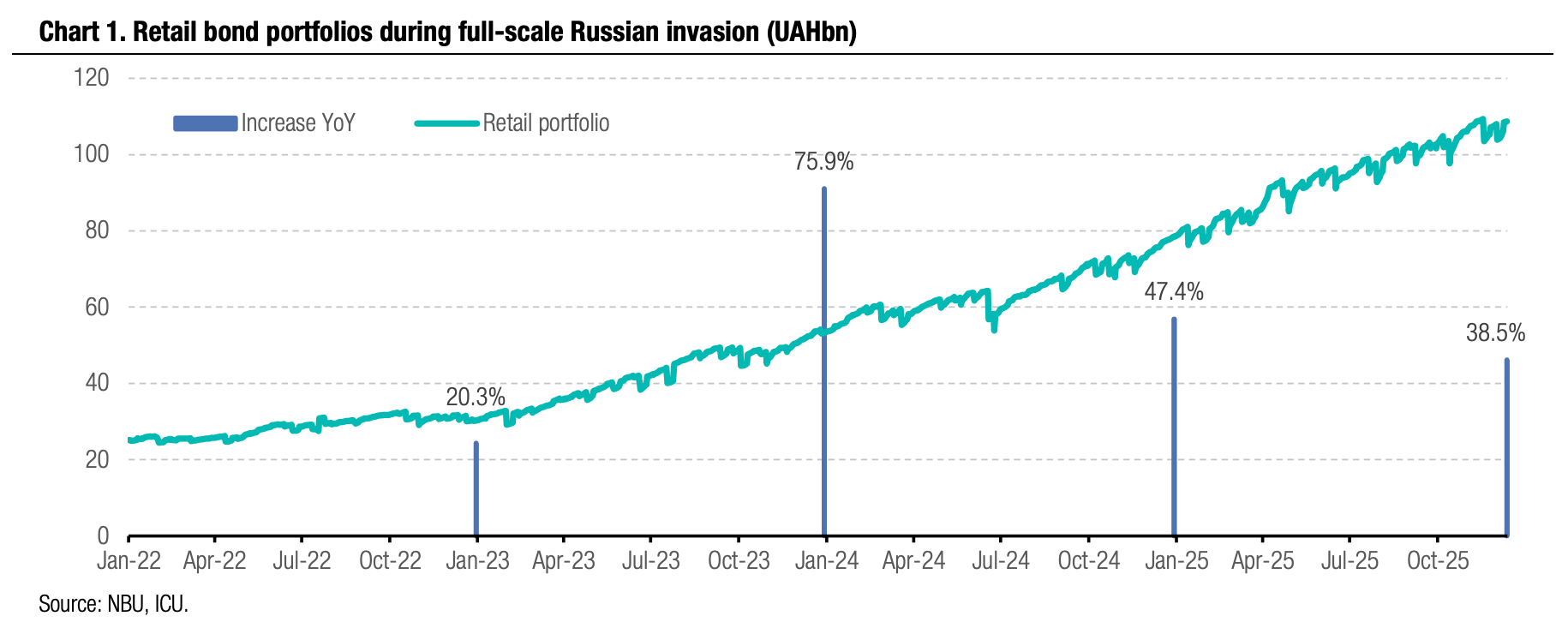

Bonds: The retail bond portfolio grows 40% in 2025

The volume of government bonds owned by individuals increased by almost 40% YTD and has quadrupled during the full-scale war.

Retail investors have steadily increased their investments into government securities. The retail portfolio in all currencies (in hryvnia equivalent) grew by about 38.5% YTD as of December 15. The volume of UAH-denominated bonds owned by individuals increased by 62% YTD, and the volume of FX-denominated bonds was up by 14%. Since the start of the full-scale war, the holdings of retail portfolios increased fourfold. However, the share of retail portfolio in total stock of local government debt (excluding NBU holdings) remains insignificant, at 8.7%. Nevertheless, this represents a noticeable increase from 3.6% before the full-scale invasion. For FX-denominated bonds, this share is higher – 33% (vs 12% before the invasion).

The share of UAH-denominated securities in retail portfolio has been gradually increasing. At the beginning of 2022, the share was 47%; it reached 50% at the start of 2025, and almost 59% as of today.

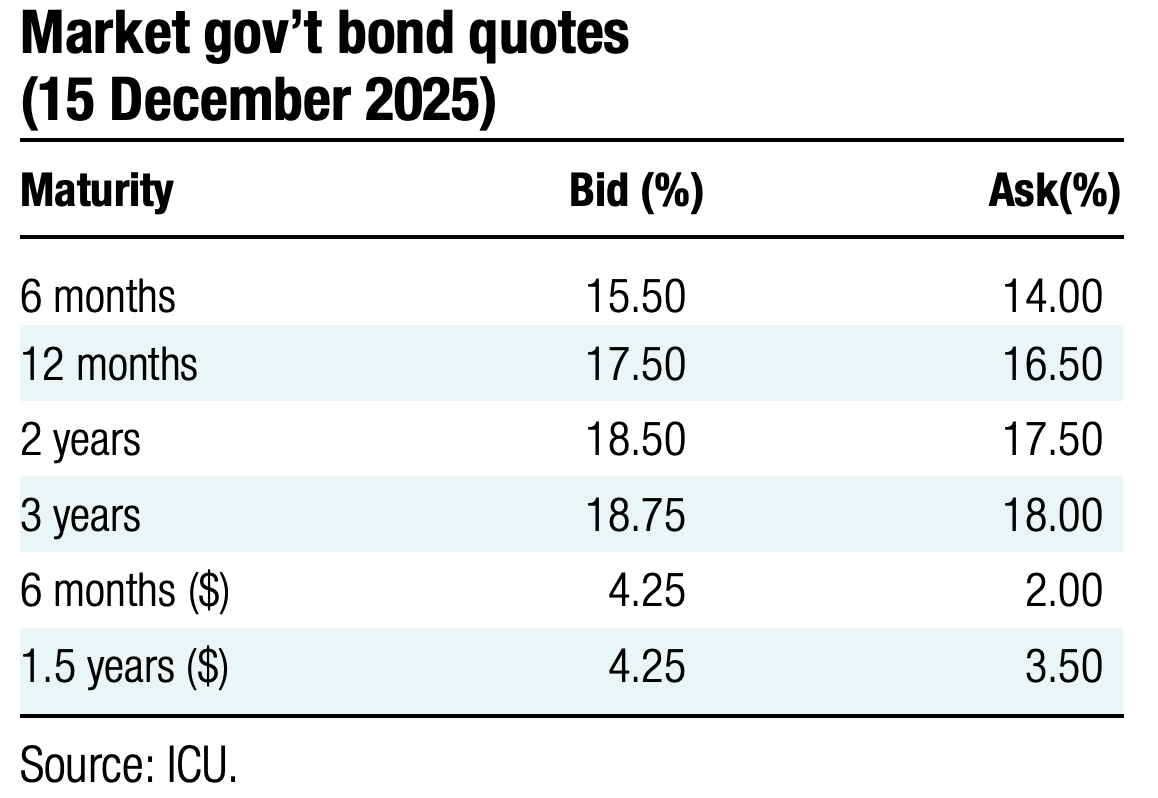

ICU view: Retail investors continue to invest their savings in local government debt, and they increasingly prefer UAH instruments. Their preference for local currency is supported by both the high yields of UAH bonds and the MoF's policy to gradually reduce the stock of outstanding FX-denominated bonds. The NBU has kept the key policy rate at 15.5% for the tenth consecutive month while keeping the UAH/US$ rate relatively flat, therefore, hryvnia assets are set to remain attractive at least in the near future.

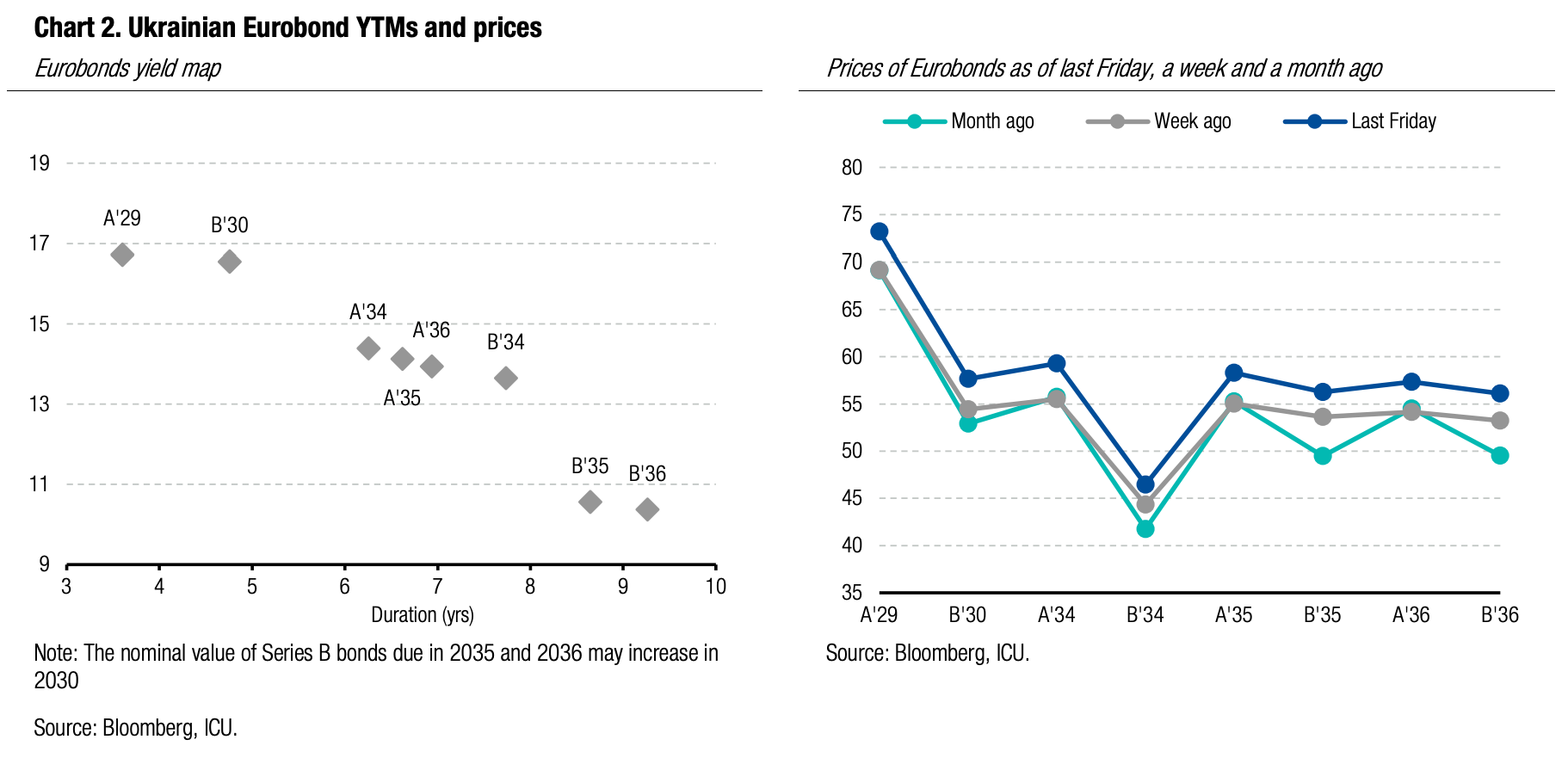

Bonds: Investors' optimism growing

Prices of Ukrainian Eurobonds rose again last week, while VRIs' quotes stayed above their notional value for the second week.

The restructuring of the GDP warrants is progressing as the ad hoc group of holders finally gave the green light for the MoF's proposal. After further discussion, some changes to the memorandum were agreed upon, in particularly regarding the terms of the new Series C bonds that will receive enhanced loss reinstatement protection in the event a new restructuring happens in the future. For the Series A and B bonds, the loss reinstatement clause will expire in 2026. The early-bird deadline is today, and the final deadline for joining the transaction is this Wednesday.

Series A and B bond prices rose again noticeably last week as investors’ eyes were on the peace negotiation progress. The President of Ukraine had several important meetings in Europe and stated that elections and a referendum on the exchange of territories should not be ruled out once safety conditions and security guarantees are established through a ceasefire.

ICU view: The current wave of investor optimism is quite strong. The US President and his team continue to engage with European and Ukrainian representatives, but the rhetoric of russian officials currently suggests that russia will avoid a settlement at all cost, at least in the coming couple of months. Prices of Ukrainian Eurobonds rose again last week, while VRIs' quotes stayed above their notional value for the second week.

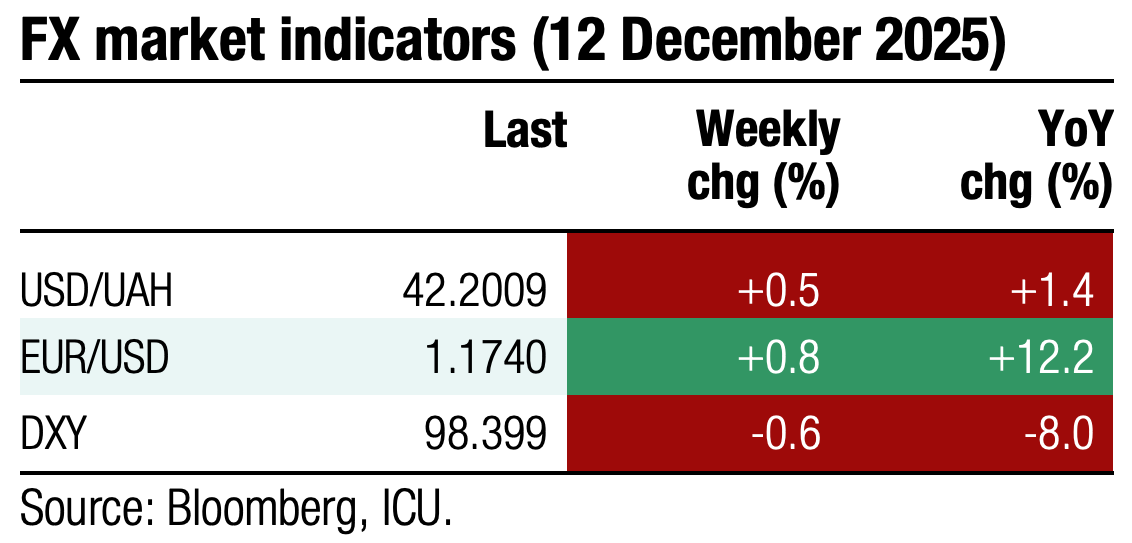

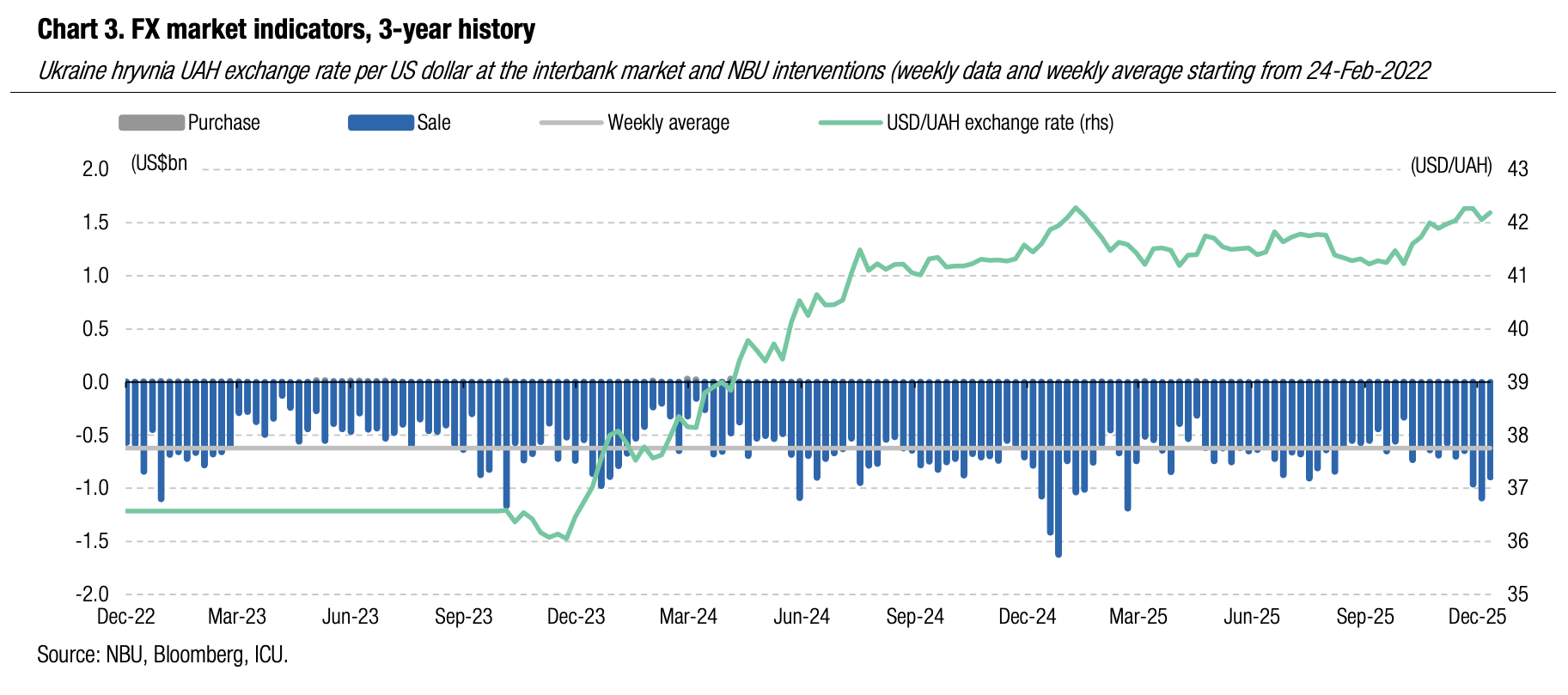

FX: NBU holds back hryvnia exchange rate

The National Bank is watching closely the progress around the EU reparation loan and, meanwhile, holding the hryvnia in a relatively narrow band.

The FX shortage remained high last week, little changed vs the first week of December. The NBU slightly reduced interventions, which indicates a temporary reduction in imbalances in the interbank market. Total NBU interventions amounted to US$895m last week - a quarter below this year's maximum.

The official exchange rate last week remained significantly below this year's record high, within the UAH42.07-42.2/US$ range, and weakened by only 0.3% over the week.

ICU view: The National Bank is concerned about the prospects of international financial support next year, since there is still no final decision on the reparations loan. The NBU's further policy will depend on the EU's decisions, which we expect to be positive. Therefore, we anticipate the NBU will continue to stick by a conservative currency policy, allowing only a moderate weakening of the hryvnia throughout 2026. Given risks to external funding, the NBU decided to keep the key policy rate unchanged this time, again to ensure that yields on hryvnia assets are attractive enough and that pressures on the FX market do not build.

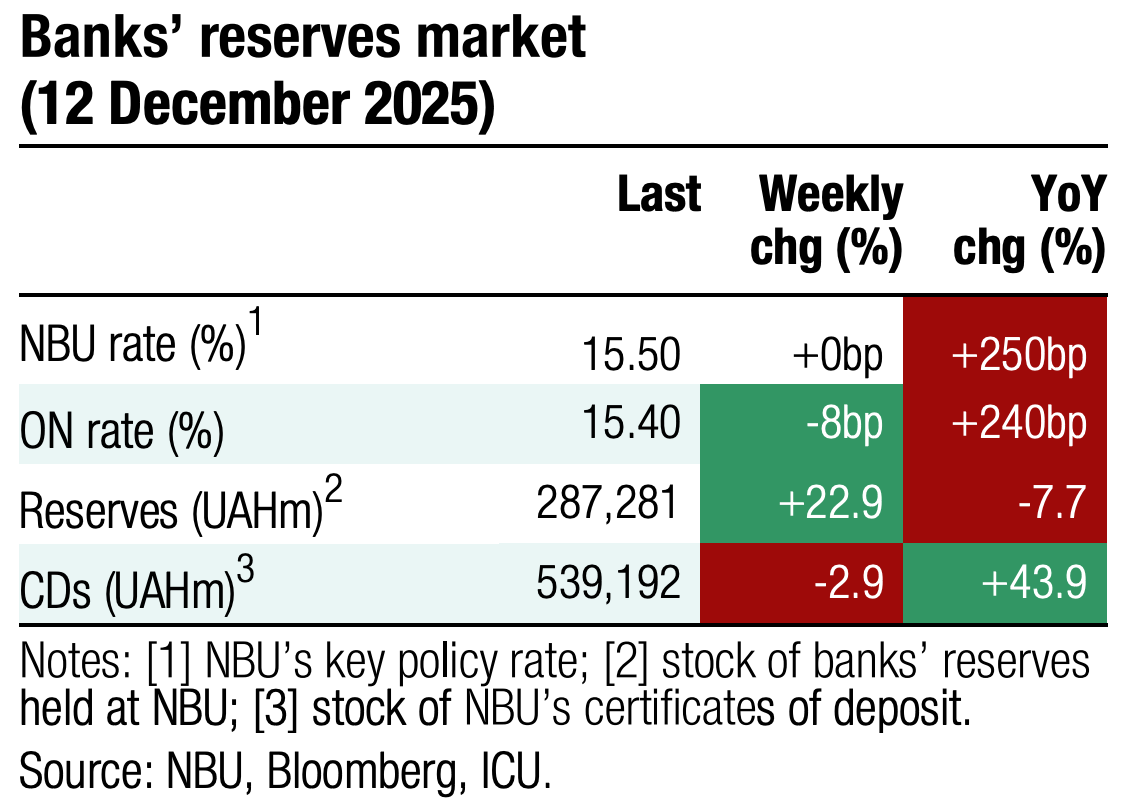

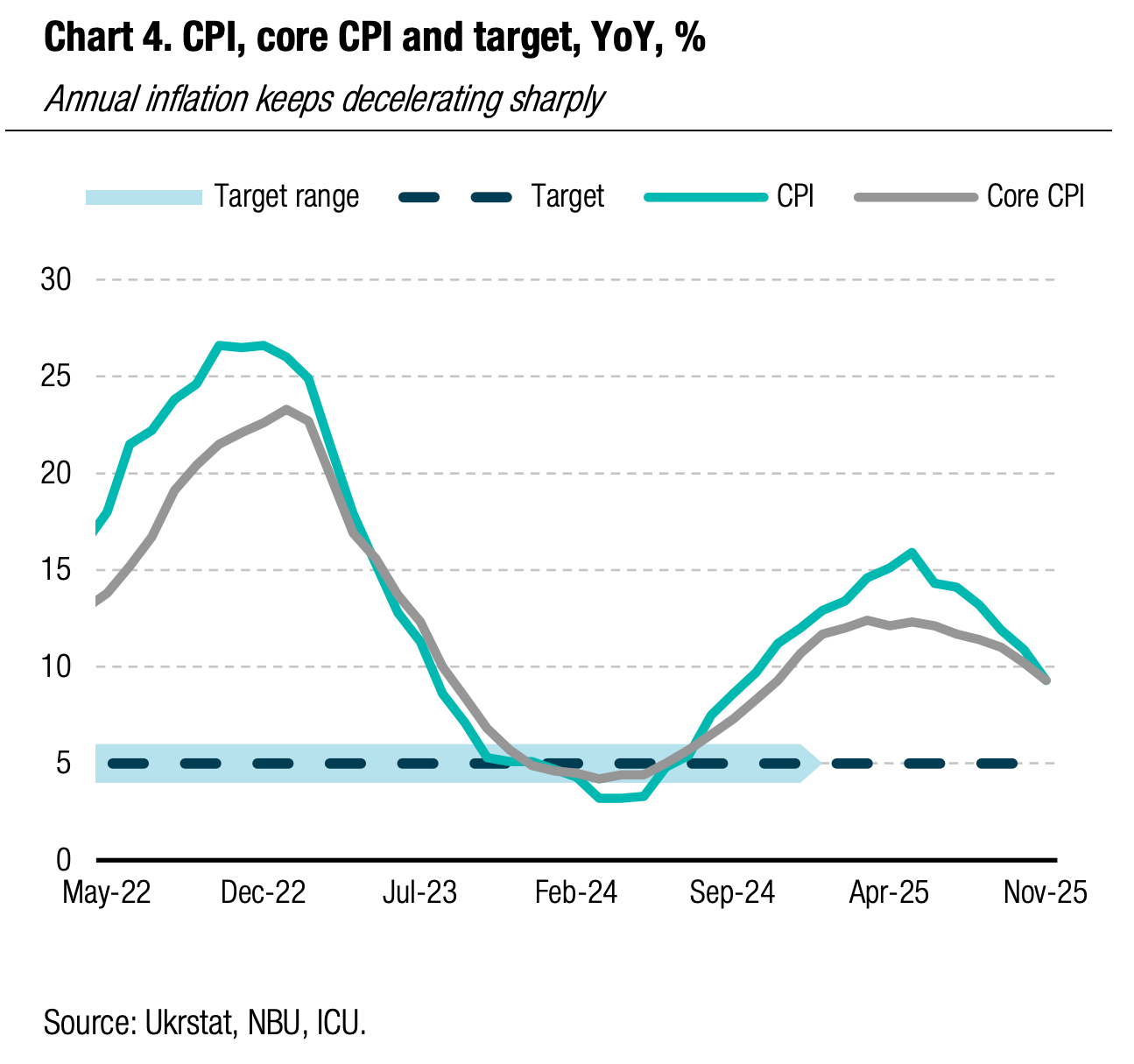

Economics: NBU keeps key rate unchanged at 15.5%

The regulator will maintain this rate at least until the January 29 meeting, citing uncertainty over external financing for 2026-2027 as the primary reason for postponing monetary easing.

The NBU Board left the key policy rate at 15.5% on December 11, in line with expectations signalled at the previous meeting. The decision reflects heightened concern over securing international financial support rather than domestic inflation dynamics. November inflation declined to 9.3% YoY for both headline and core measures, considerably below the NBU October forecast trajectory. The slowdown in inflation was driven primarily by seasonal food supply increases from new harvests. However, inflation expectations remain elevated, with web-search data indicating continued household attention to price pressures.

ICU view: Should the EU loan decision remain unresolved by January 29, the NBU will likely keep the rate unchanged again. In the case of a positive outcome for Ukraine, the regulator will probably proceed with a 50bp cut, though the overall easing cycle may be more gradual than the October forecast envisioned.

Economics: New positive inflation surprise

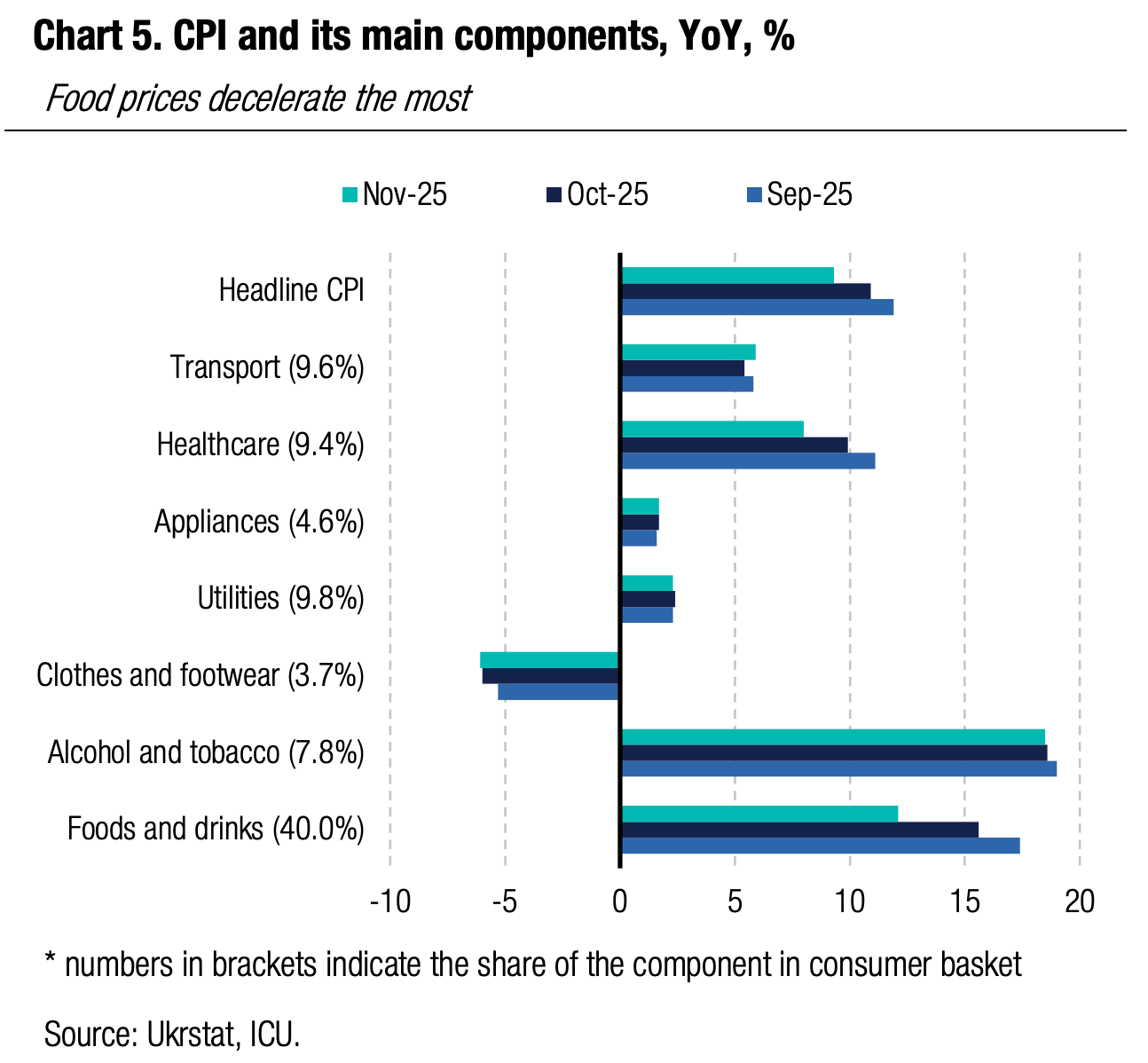

Annual CPI fell to 9.3% in November from 10.9% in October and a peak of 15.9% in May. Core CPI was also down to 9.3% from 10.2% in October.

The deceleration in food prices was especially pronounced as end-November growth rate stood at 11.8% vs 15.4% in October. The annual price rates fell or stayed unchanged for all consumer basket components, except for transportation where a slight increase in gas prices spoiled the picture.

|  |

ICU view: The disinflation trend is broadly in line with our below-consensus end-2025 projection of 8.5% and well below the NBU forecast that stands at 9.2% for end-2025. All preconditions are in place for annual inflation to decelerate further in each month at least through end-1H26. The NBU still appeared reluctant to cut the key policy rate last week due to heightened risks related to external funding in 2026.

Economics: Economy accelerates in 3Q25

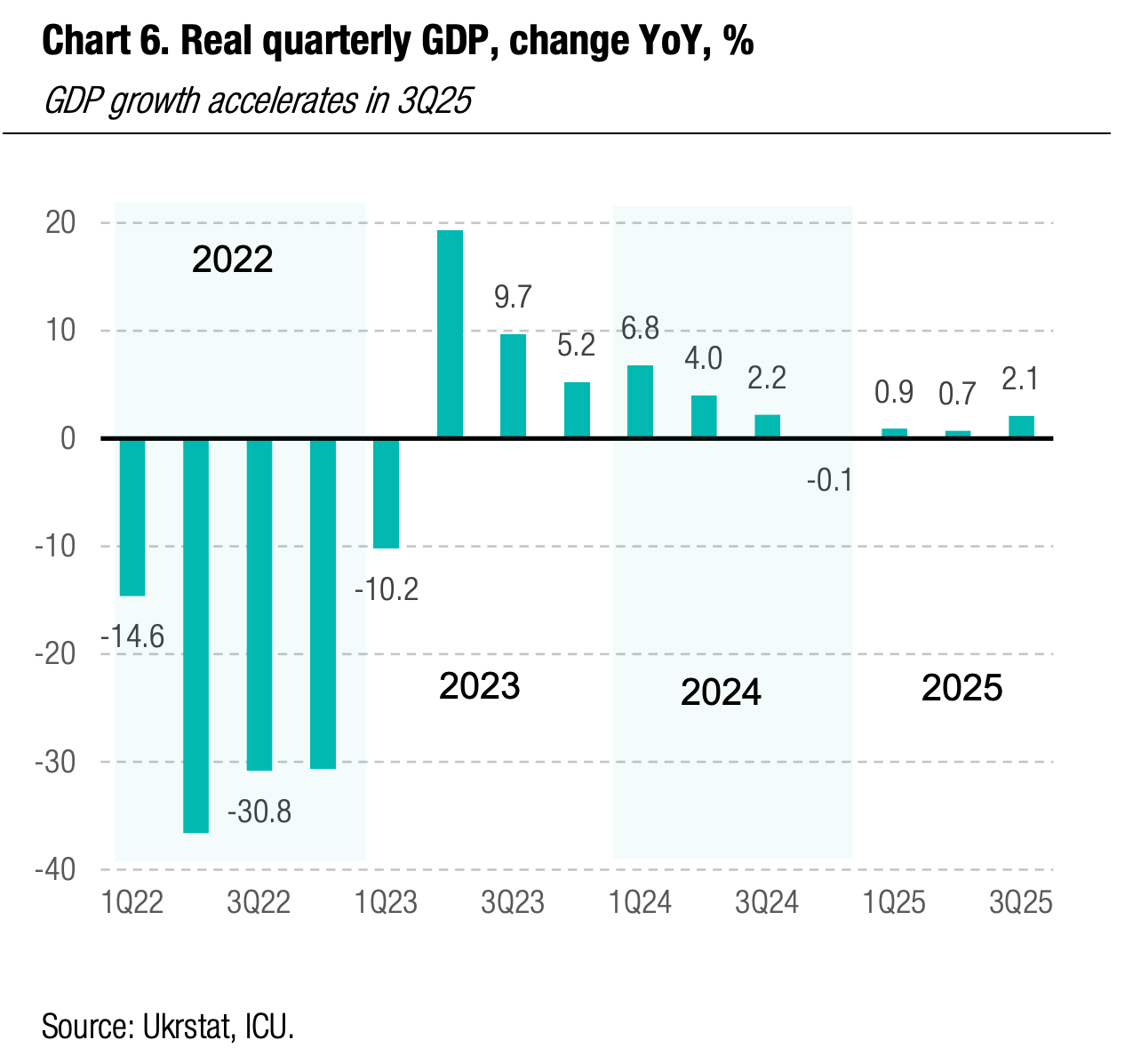

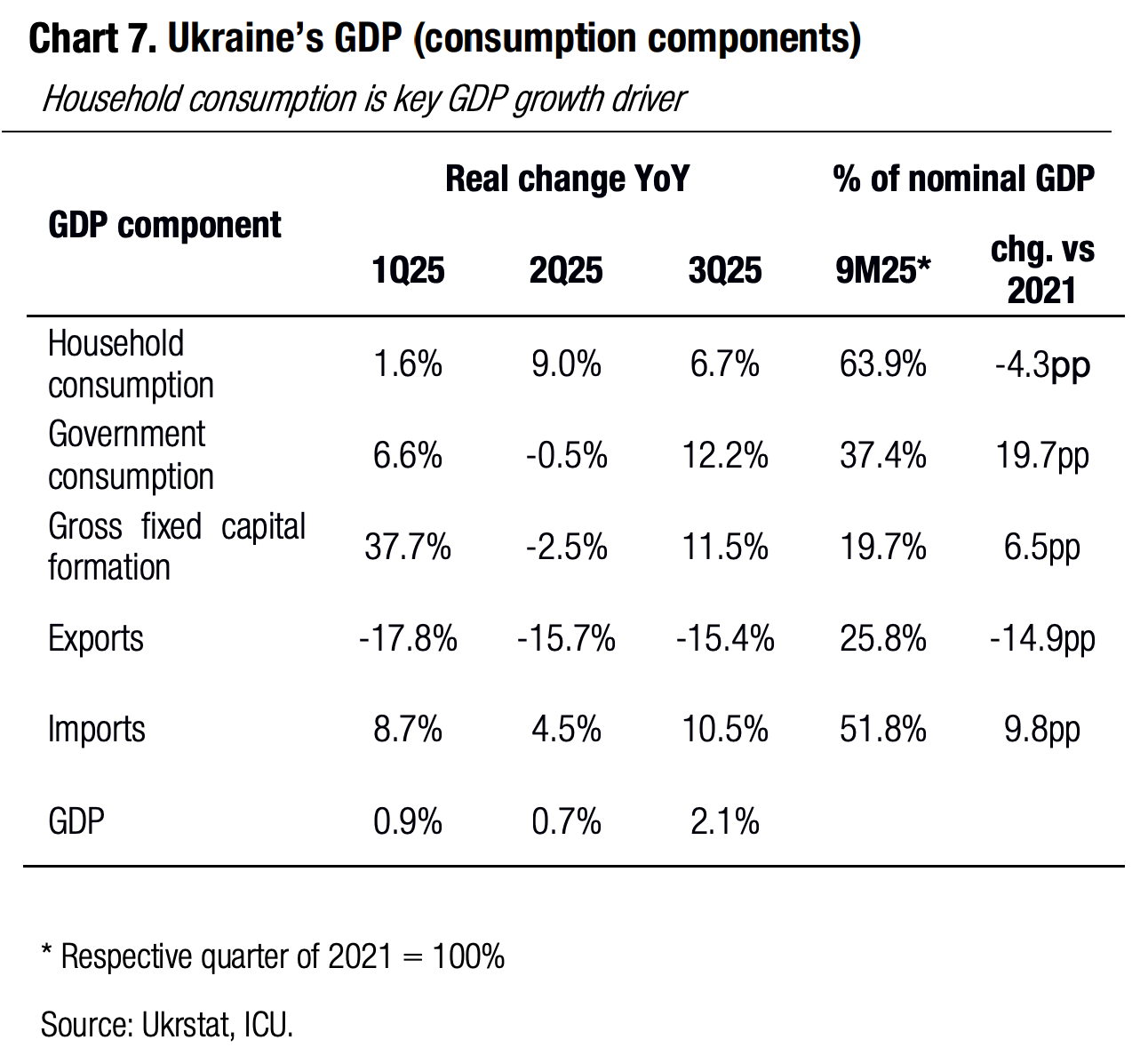

Ukraine’s GDP accelerated to 2.1% YoY in 3Q25, implying it was at 79% of the pre-invasion (2021) level.

On the demand side, the economy remained predominantly driven by household consumption supported by strong growth of salaries in the private sector. Government consumption also increased substantially, likely on the back of an upsurge in defence-related expenditures. The contribution of foreign trade was whoppingly negative as exports slumped 15% YoY and imports jumped 11%. The fastest growing sectors were construction (+32% YoY in 3Q) and public administration, including defence (+15%).

|  |

ICU view: GDP data for 3Q25 clearly show the economy is struggling to grow in the current safety environment. The fastest growing GDP components on both the production and consumption side are mainly related to defence activities. The brightest spot in the 3Q set of data is private consumption of households that is holding up surprisingly well. We expect GDP to accelerate even further in 4Q driven by crop harvesting, but the full-year GDP growth is still set to be close to 2%.