|  |

|  |

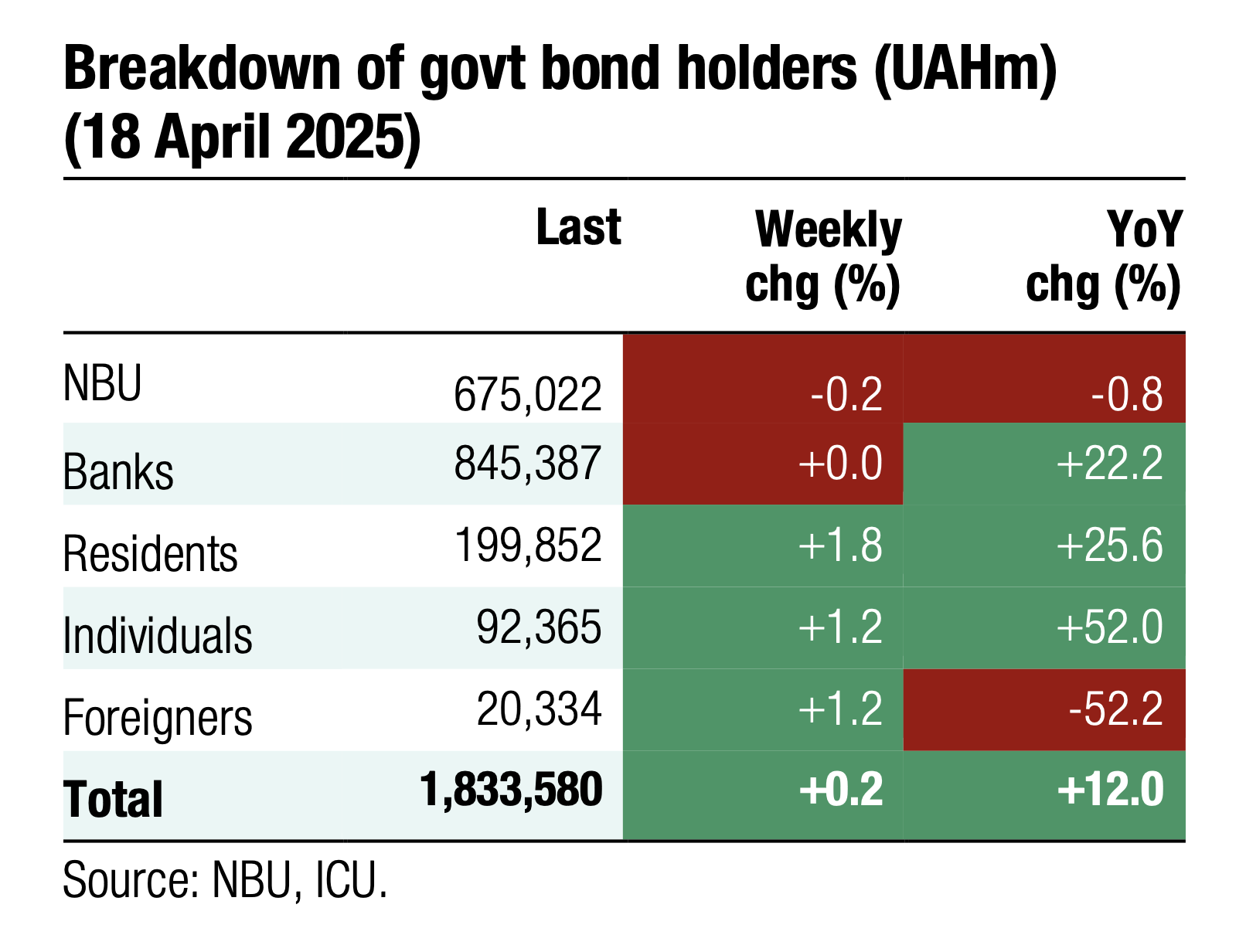

Bonds: Bond auctions successful

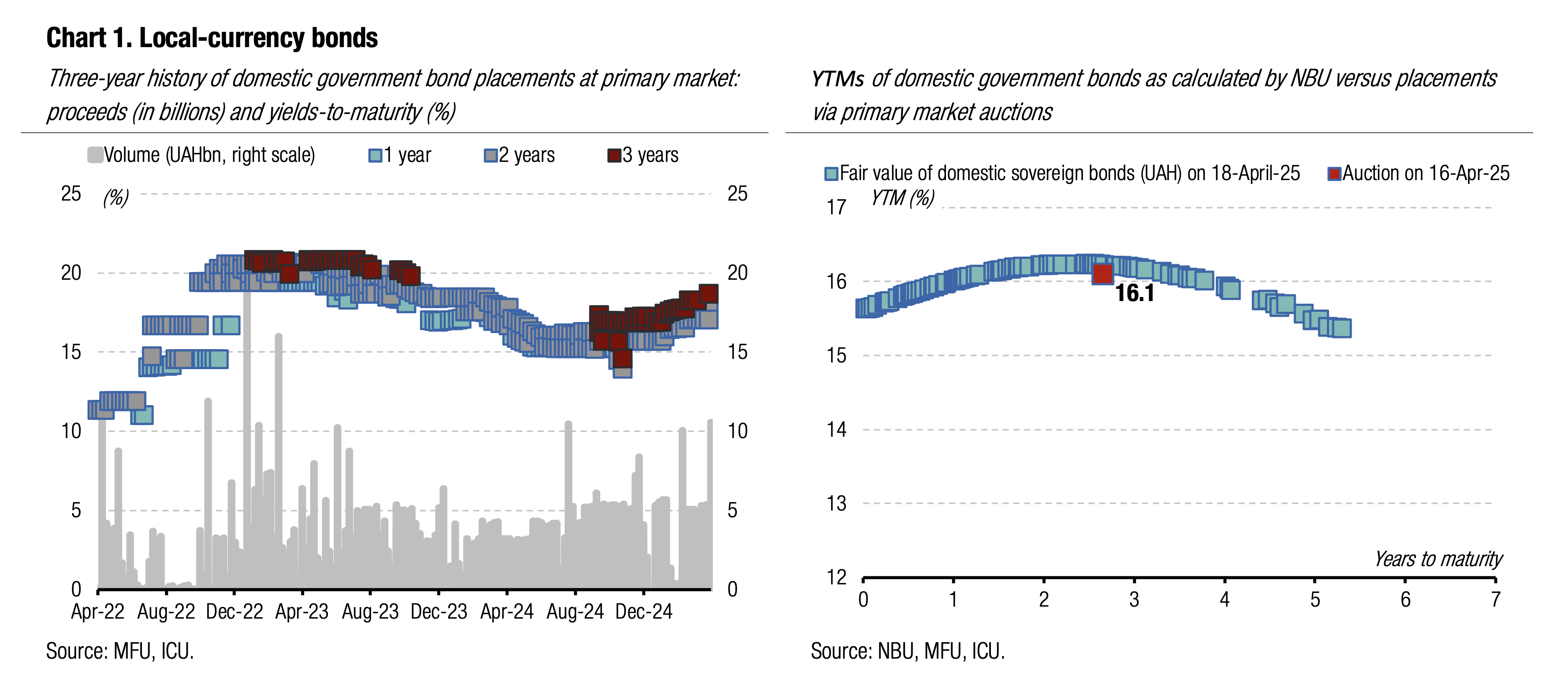

The MoF held two auctions last week, one regular and the other one was a bond exchange auction. Both were successful.

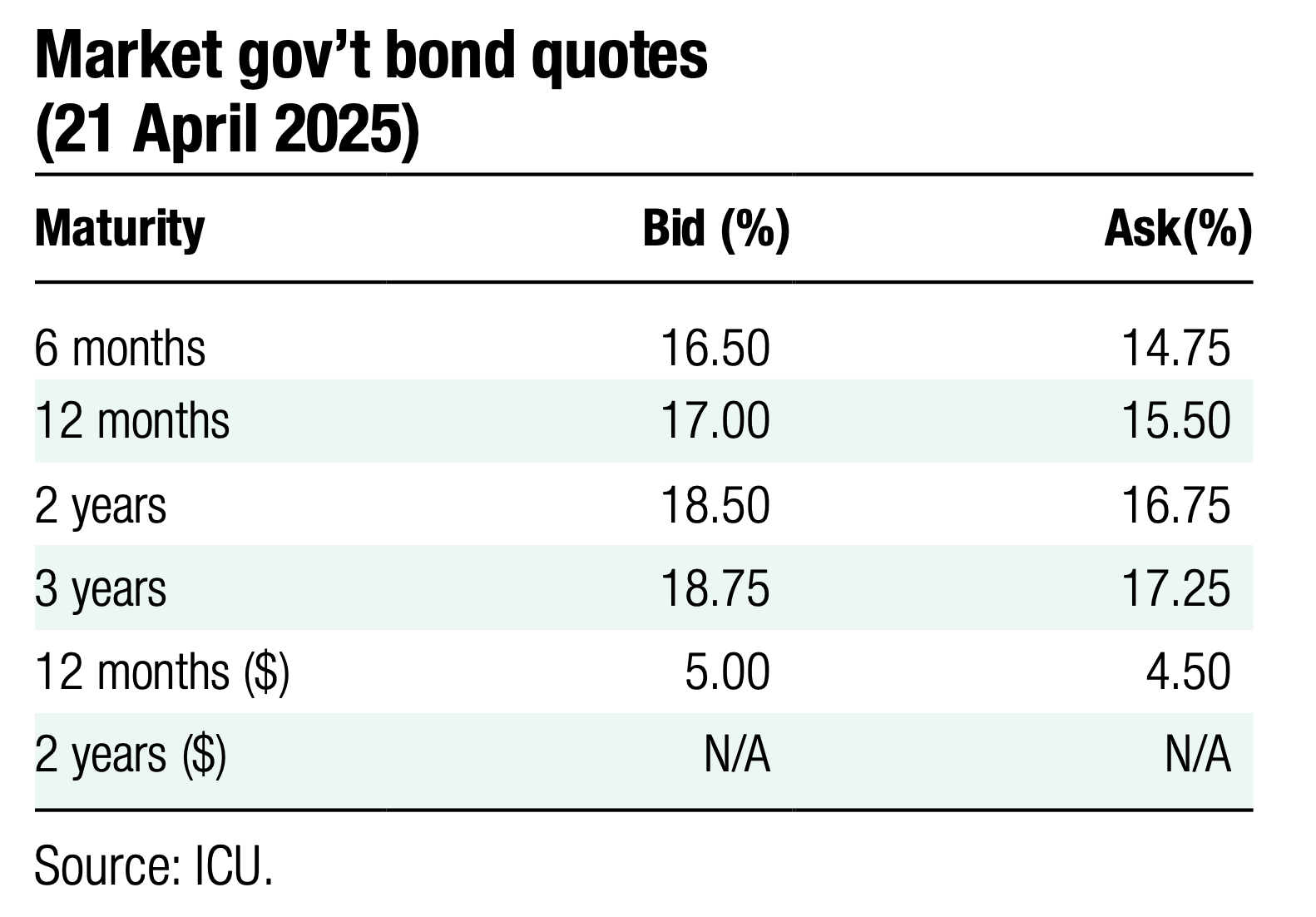

At the regular primary auction, the MoF offered three UAH bonds. The proceeds from a 14-month military bill stood at UAH328m with no changes in interest rates. The placement of a 1.8-year paper reached UAH1.1bn also without a change in yields. The MoF also sold a new, regular three-year UAH note. It was oversubscribed, but the MoF rejected bids with high interest rates, yet still increased the cut-off rate by 131bp to 17.8% compared to the auction in January of a similar paper. The yield implies a maturity premium of 70bp to 1.8-year paper. See details in the auction review.

At the second auction, the MoF offered banks the chance to exchange an outstanding reserve bond due in May for a new three-year reserve note. The MoF received UAH 13.4bn worth of demand, above the cap of UAH10bn, but the MoF had to increase yields by about 65bp to 15.6% to match the demand. See details in our review.

The exchange auction had a technical impact on the secondary bond market. Total turnover rose by 57% to UAH14.9bn, with a half of that being trading with reserve bonds.

ICU view: In contrast to a debut exchange auction held this February, the MoF managed to sell the planned volumes in full. Banks took advantage of the special terms of the offering and submitted bids with interest rates that were higher than a week before at a usual auction of the same paper.

Bonds: Minerals deal adds subtle optimism

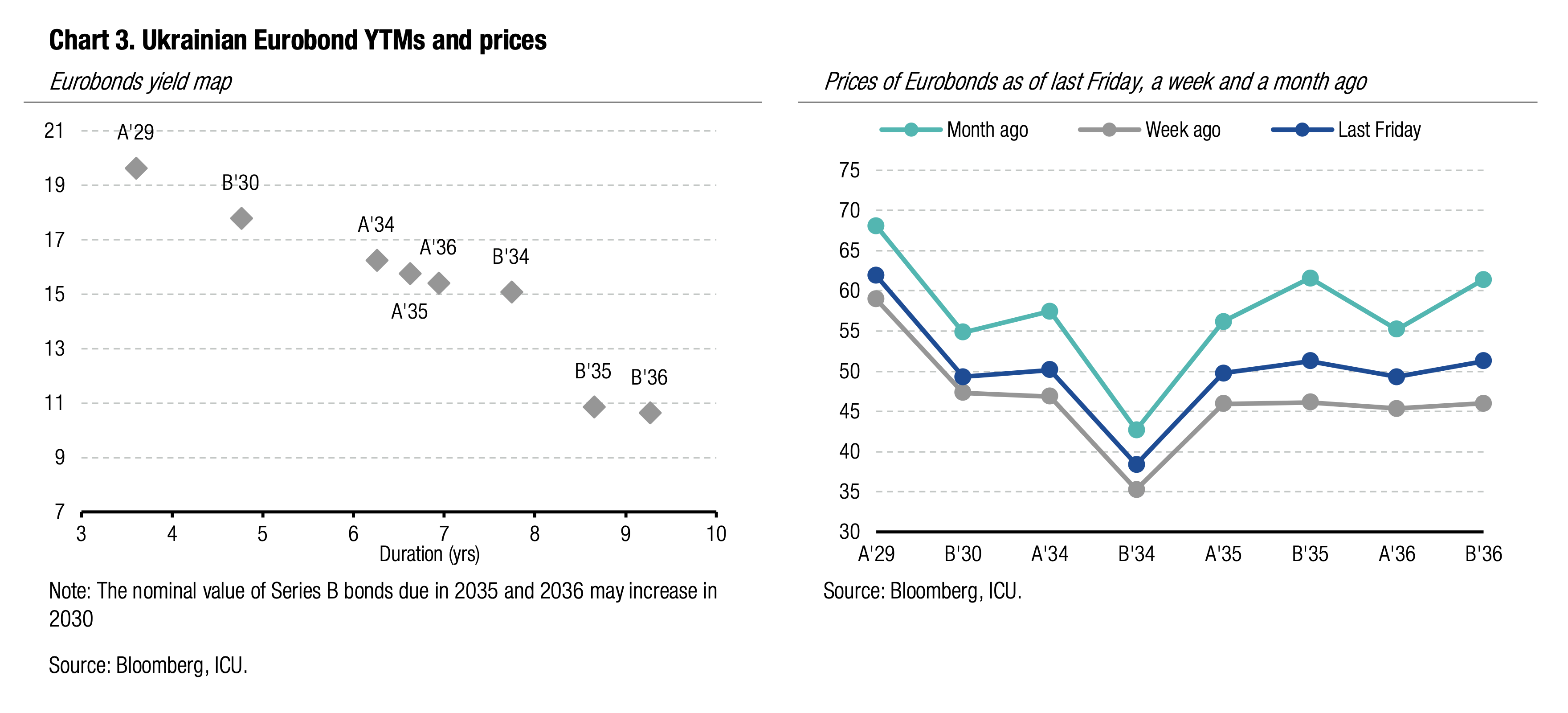

Prices of Eurobonds rose last week after the news emerged that Ukraine and the US will sign a memorandum about a minerals deal.

Prices of Ukrainian Eurobonds rose by an average of 8% last week to the level last seen at the beginning of the month. Prices of Series B StepUp bonds due in 2035-2036 rose the most, over 11%. VRIs' price rose by 12% to 70 cents per dollar of notional value. The EMBI index rose by 2.1% last week.

ICU view: Last Wednesday, it was announced that Ukraine and the US will sign a memorandum about the minerals deal, which the two countries may sign this week. This news had a positive impact on the bondholders’ sentiment. A Memorandum was signed online last Thursday. The final deal may be signed this week and require ratification by the Ukrainian Parliament and the US Congress. Fortunately, the new version of the documents addresses some of the critical concerns of Ukraine. Overall, the usual harsh tone of the US statements regarding the deal was softened significantly in the memorandum, giving Eurobond holders hope that a final deal may be much more constructive and mutually beneficial than previously thought. Eurobond prices may continue to rise, particularly reflecting improved sentiment towards emerging markets.

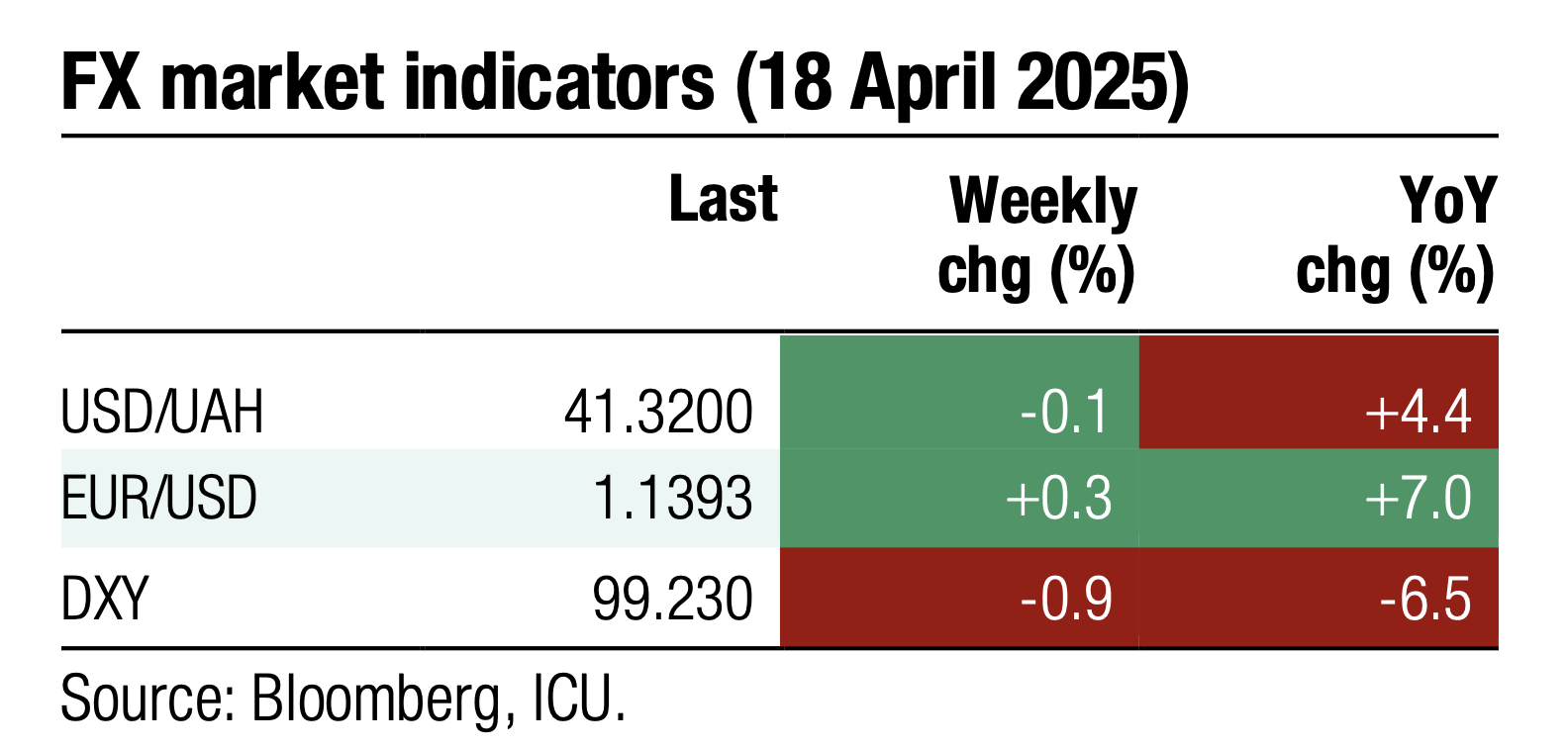

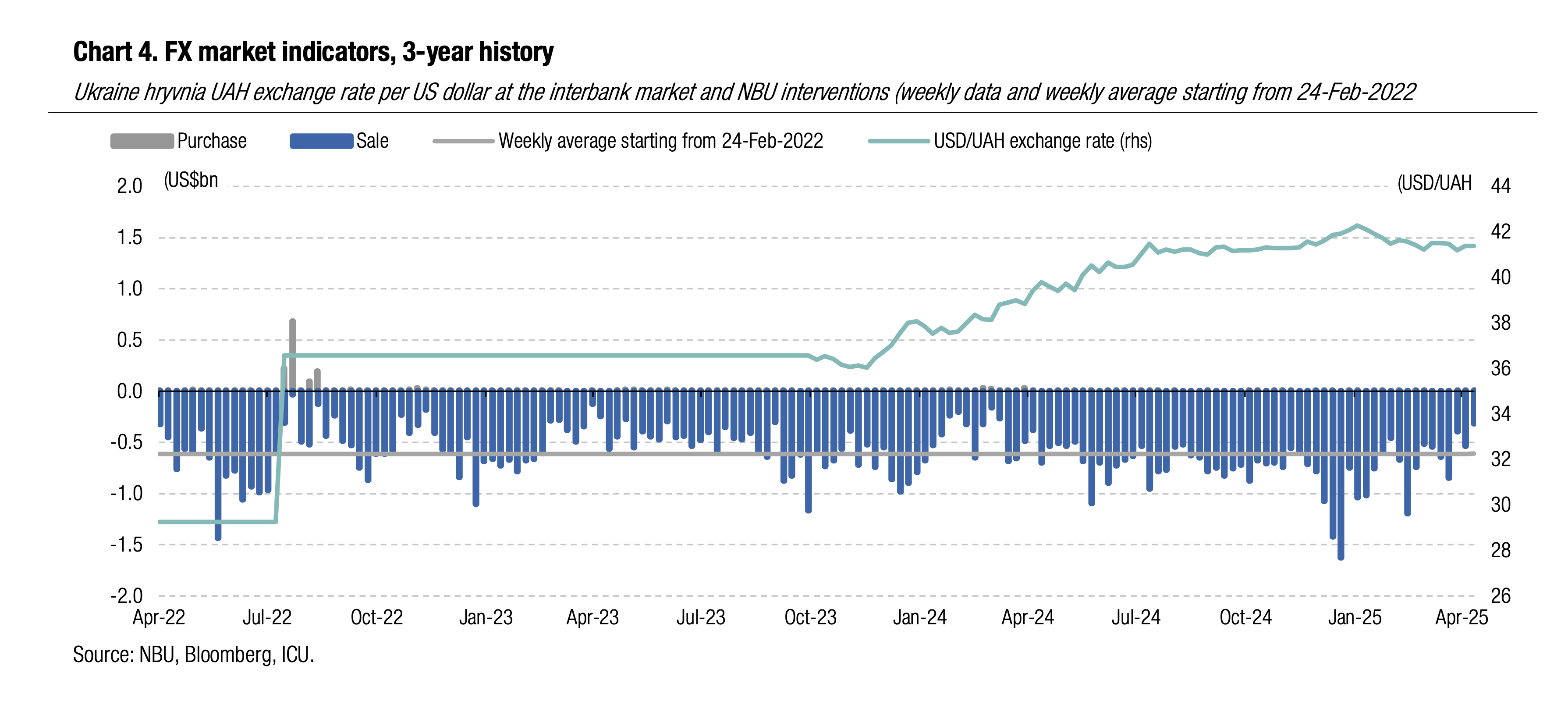

FX: NBU lowers interventions without weakening hryvnia

The National Bank almost halved interventions WoW, while keeping the hryvnia / US$ rate steady while marginally weakening the hryvnia vs the euro.

Shortage in the FX market decreased sharply last week due to lower demand. Net hard currency purchases in the interbank FX market fell by almost a third to US$185m. In the retail segment, foreign currency sales prevailed over purchases for the first time since August 2023. Households sold US$32m more than they purchased. The total hard currency shortage fell by 57% to US$153m.

Given the low foreign currency deficit, the NBU decreased interventions by 41% to US$314m, keeping the hryvnia steady vs the US dollar at UAH41.39/US$.

ICU view: The week before Easter, there was lower demand for hard currency from businesses and increased sales by households in preparation for the holidays. Therefore, we saw narrower hard currency shortages and lower NBU interventions. Against this backdrop, the NBU has fewer reasons to weaken the hryvnia.

Economics: Larger international aid adds time for economy to adjust

A larger financial aid package implies the economy now has more time to tackle its surging imbalances in external accounts.

Key points of our new macro review, published last Thursday, are given below.

Ukraine’s economy has been in a sluggish recovery mode since 3Q24, and chances for a significant near-term acceleration are slim. The need to cut the fiscal deficit and budget expenditures will significantly restrain GDP growth going forward. We see economic growth close to 3% this year and next, supported by recovery in household consumption and higher agricultural output.

Inflation is set to start decelerating rapidly from June on last year’s high base and larger supply of agricultural harvest. We see good chances of consumer prices slowing to 7-8% at the end of 2025, supported by weaker growth in domestic demand, a relatively stable exchange rate, and cheaper food products. The NBU will keep its tight monetary policy stance unchanged until September and will likely deliver three 50bp cuts thereafter to end the year reaching 14%.

The revised schedule of foreign aid commitments revealed by the IMF is a huge positive surprise for Ukraine. The aid package has been increased by US$15bn vs. the December plan, and the supply of loans/grants became much more frontloaded. Ukraine should receive over US$50bn in 2025, implying a spike in NBU reserves and strengthened central bank firepower to keep the hryvnia strong. We upgrade our end-2025 exchange rate projection to UAH43.5/US$. A larger financial aid package implies the economy now has more time to tackle its surging imbalances of external accounts. Should inflows of financial aid subside substantially beyond 2025, the pressures in the FX market will rise and the NBU will likely need to resort to relatively significant hryvnia devaluation.

The state budget financing looks to be fully secured for 2025, even though some increase in expenditure targets is likely in 3Q. Yet, the visibility for 2026 in terms of deficit financing is very low at this point.

Our projections assume no significant changes in the balance of safety risks over the 12-month horizon. We believe that even if a ceasefire agreement is reached soon, the hostilities on the frontline and russian attacks on civil infrastructure all over Ukraine will not subside completely. Ukrainian businesses and households will continue to operate under great uncertainty that will weigh on their sentiment and activities.

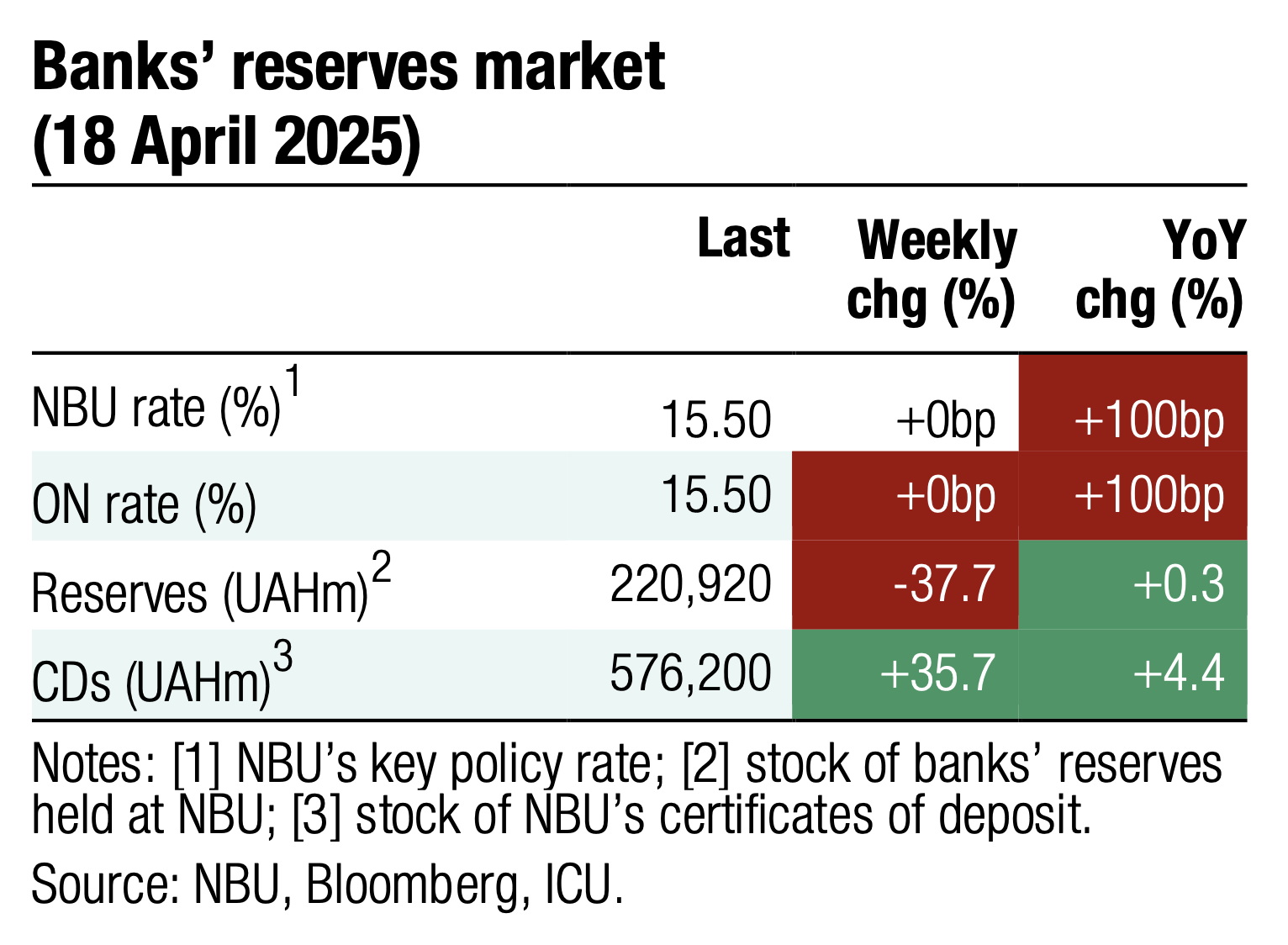

Economics: NBU holds key rate unchanged at 15.5%

The regulator has paused its tightening cycle and now forecasts a rate cut in September.

Despite accelerating inflation, which reached 14.6% YoY in March and some expectations of another hike, the NBU stuck to its earlier plan and refrained from further increases. This marks the end of three consecutive hikes totaling 250bp. The new macro forecast now implies a slower pace of easing, with the updated rate path showing a 50–100bp higher trajectory than projected in January.

ICU view: Even the revised, more cautious forecast implies an aggressive pace of easing—250bp in total by year-end. In our view, the NBU will need to proceed more gradually, as concerns about potential hryvnia depreciation grow and the regulator remains focused on preserving the attractiveness of hryvnia-denominated assets. We, therefore, expect a total of 150bp in cuts, to 14% at the end of 2025.