|  |

|  |

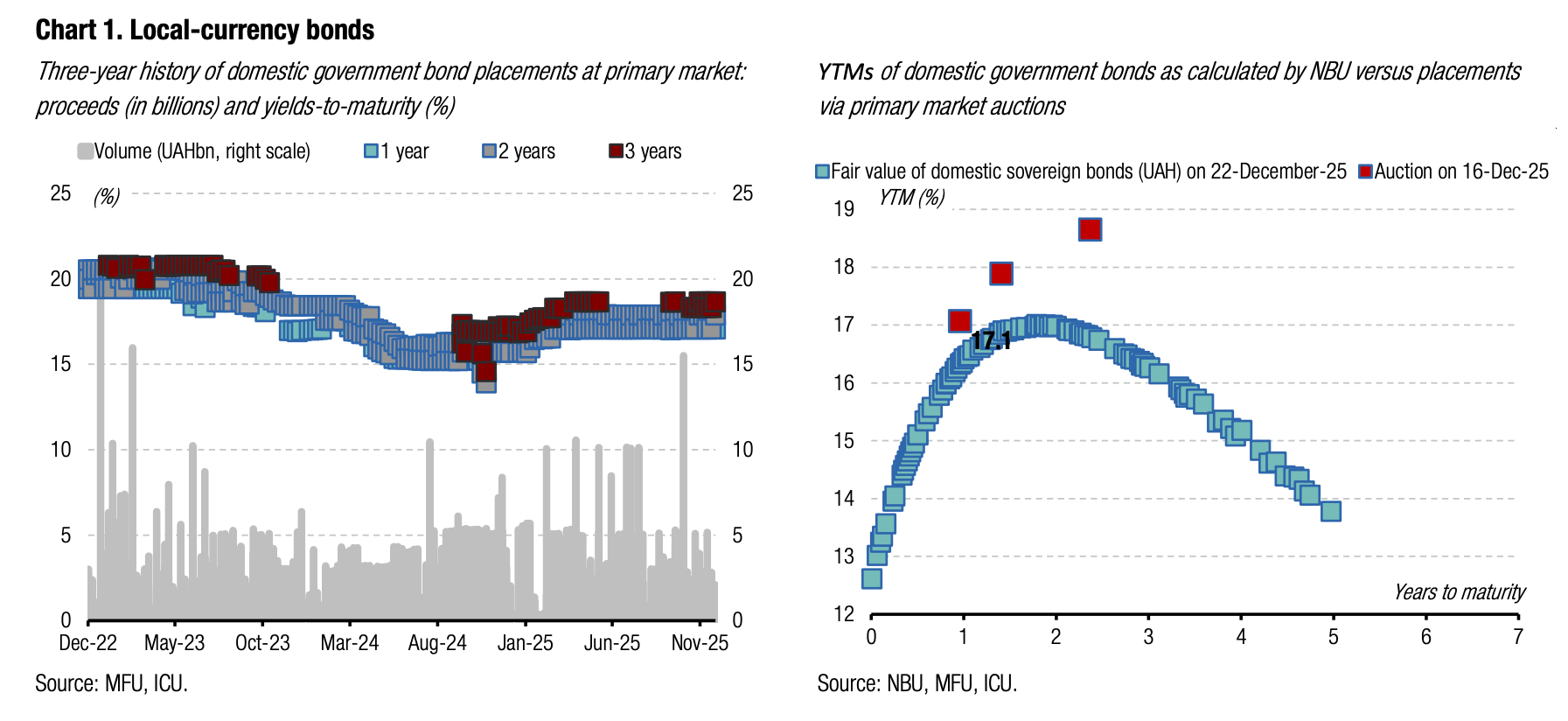

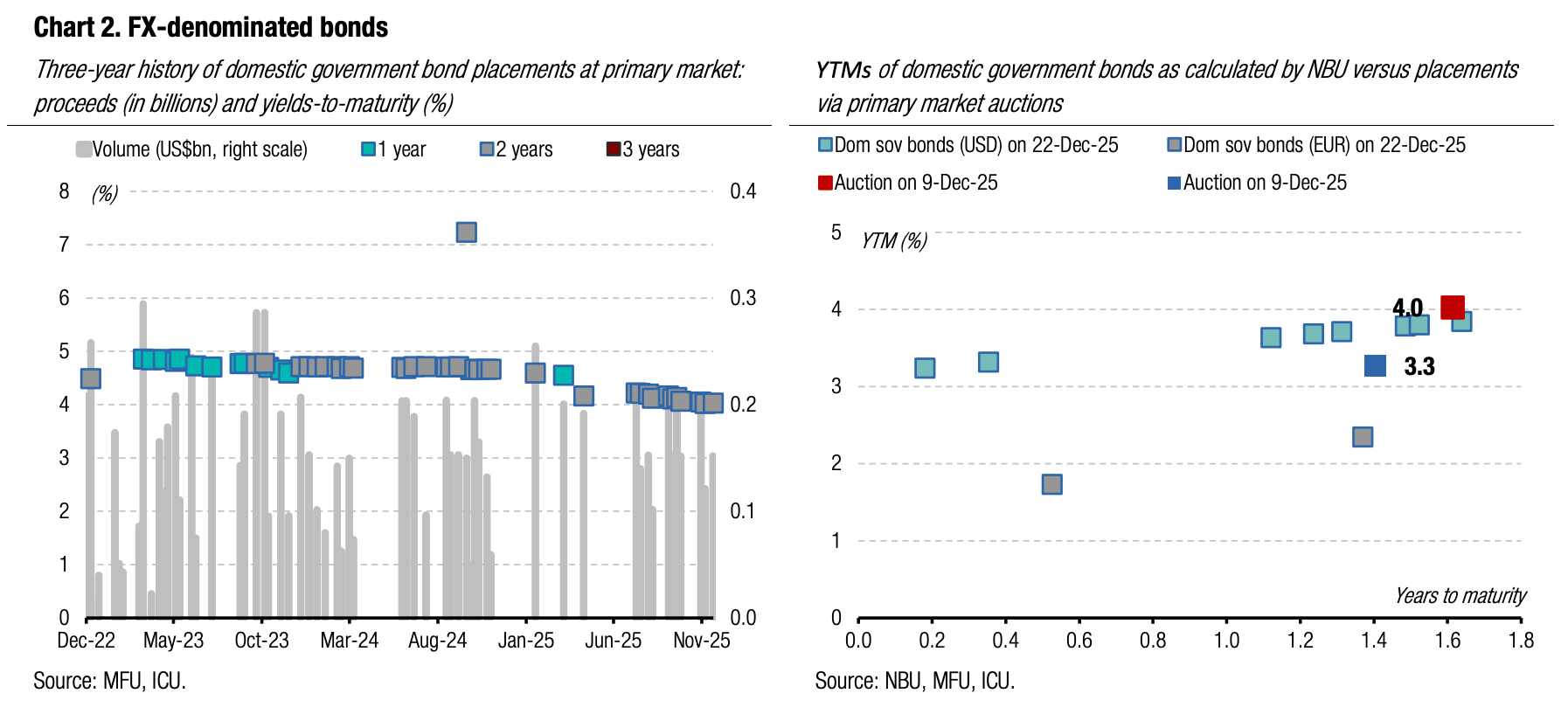

Bonds: Demand shifting to longer-term securities

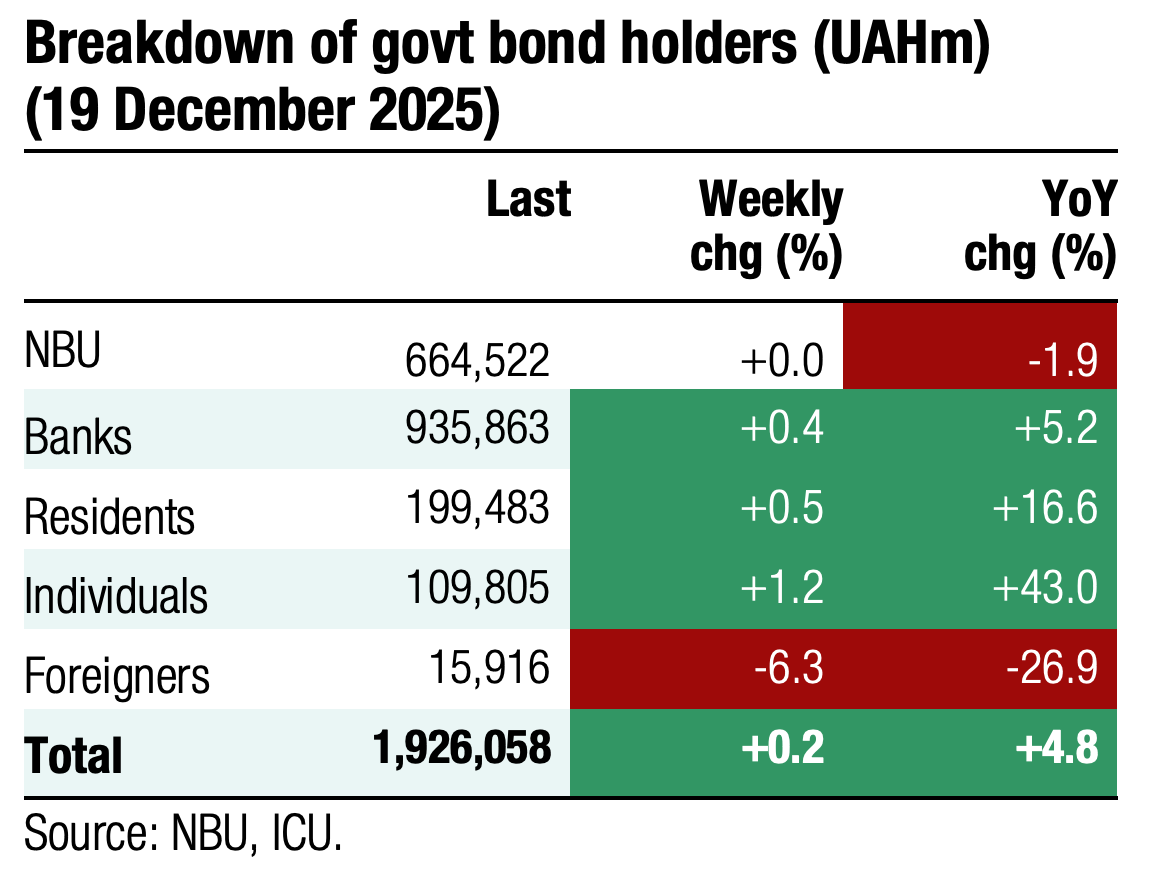

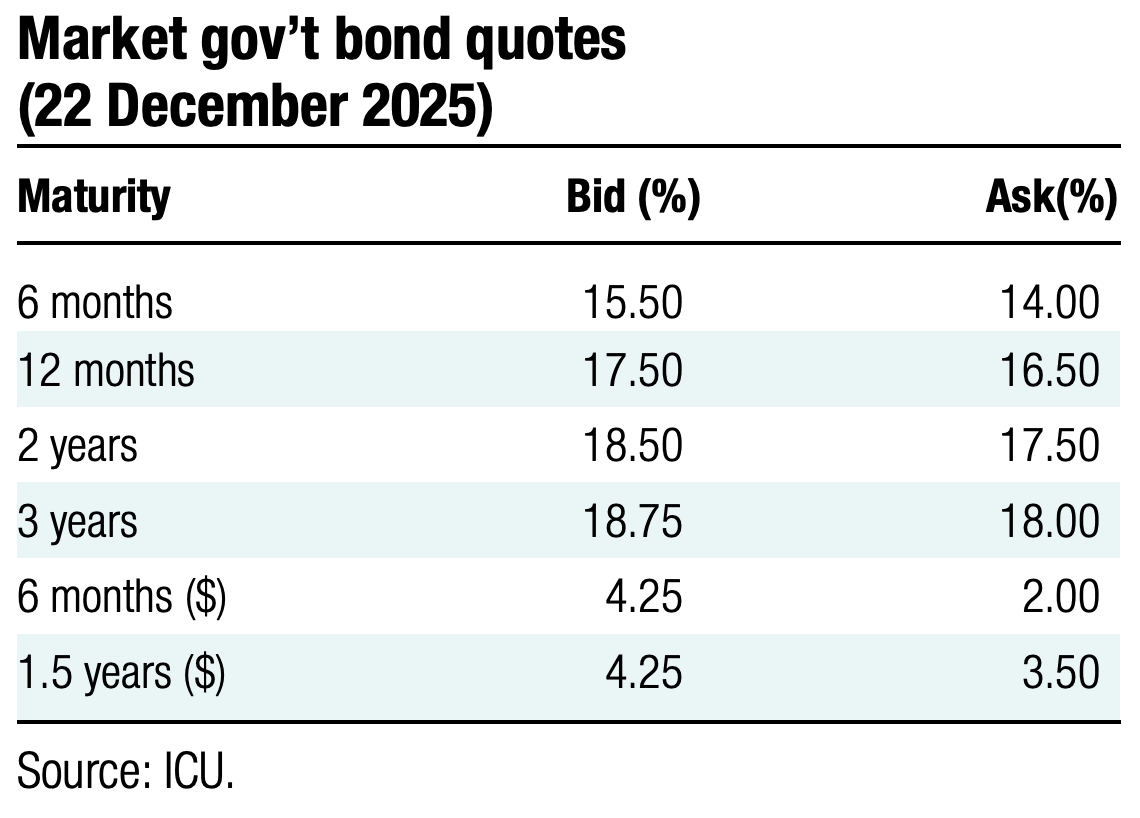

Over the past couple of weeks, investors' focus has gradually shifted to bonds with longer maturities. That may indicate that banks are beginning to factor in the possibility of a near-term key policy rate cut in their investment plans.

Last week, one-year UAH paper brought only 12% of the funds at the auction, while a three-year paper accounted for over UAH2bn, or 45% of funds raised. See details in the auction review.

In the secondary bond market, the trading structure is similar. For six consecutive weeks, investors' focus has been shifting to securities with a maturity of more than one year. The weekly trading in UAH bonds ranged from UAH6bn to UAH18bn, of which those with tenor of two years and above accounted from 54% to 84%. A similar pattern was last seen in summer, when expectations of a NBU key rate cut were high. Yet, for most of the year, more than 50% of trades were in bonds with a maturity of less than one year, and their share in trades exceeded 60% on numerous weeks.

ICU view: Expectations of the NBU switching to monetary policy easing cycle in January are now growing stronger. The key risk that held the NBU back from transitioning to looser monetary policy has now been nearly eliminated. Last week, the EU decided to provide Ukraine with a EUR90bn loan, which will be funded through joint EU borrowings. Therefore, by the time of the next monetary policy committee meeting at the end of January 2026, the NBU will already have a comprehensive view of international assistance for 2026-2027.

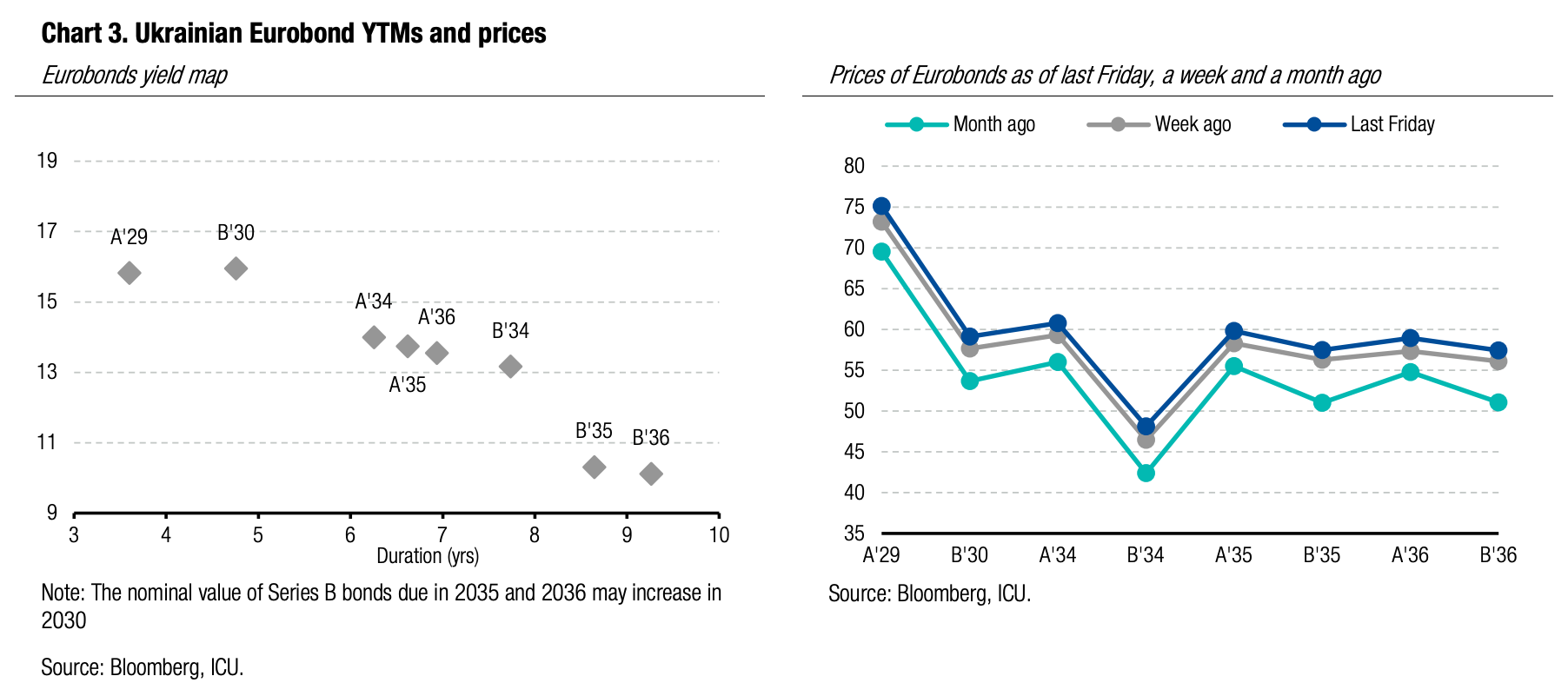

Bonds: Investors' optimism fueled by decision on loan from EU

Last week, the intensity of peace negotiations lowered, but the restructuring of VRIs and the EU's decision on a loan to Ukraine provided a positive impetus.

Ukrainian Eurobond prices reached a local maximum last Tuesday, but due to unimpressive progress in peace talks, they reversed slightly on Wednesday and Thursday. On Friday, the EU reached an agreement to offer a EUR90bn zero-interest loan to Ukraine. Eurobond prices rose to new highs of 48-75 cents. Over the week, prices increased by 2.5%.

Last Wednesday, the vote on the exchange of GDP warrants for new Series C bonds was completed. On Thursday, the Ministry of Finance reported that more than 99% of warrant holders supported the transaction so that they will receive new bonds worth almost US$3.5bn in place of the US$2.6bn notional value of the VRIs. A small number of investors who did not submit participation instructions will receive Series B securities maturing in 2030 and 2034. On the settlement day, the MoF will pay fees to warrant holders who agreed to the deal including a US$497,197,35 cash consideration to those who voted in the early period. The Ministry of Finance will cancel warrants owned by the government and the NBU.

ICU view: The importance of the EU's decision to cover Ukraine's needs for the next two years can hardly be overstated. This loan effectively alleviates the liquidity pressures for the Ukrainian budget and bolsters investor confidence that the country will be able to pay coupons on all Eurobonds. It is also crucial that this loan will be excluded from the IMF debt sustainability analysis.

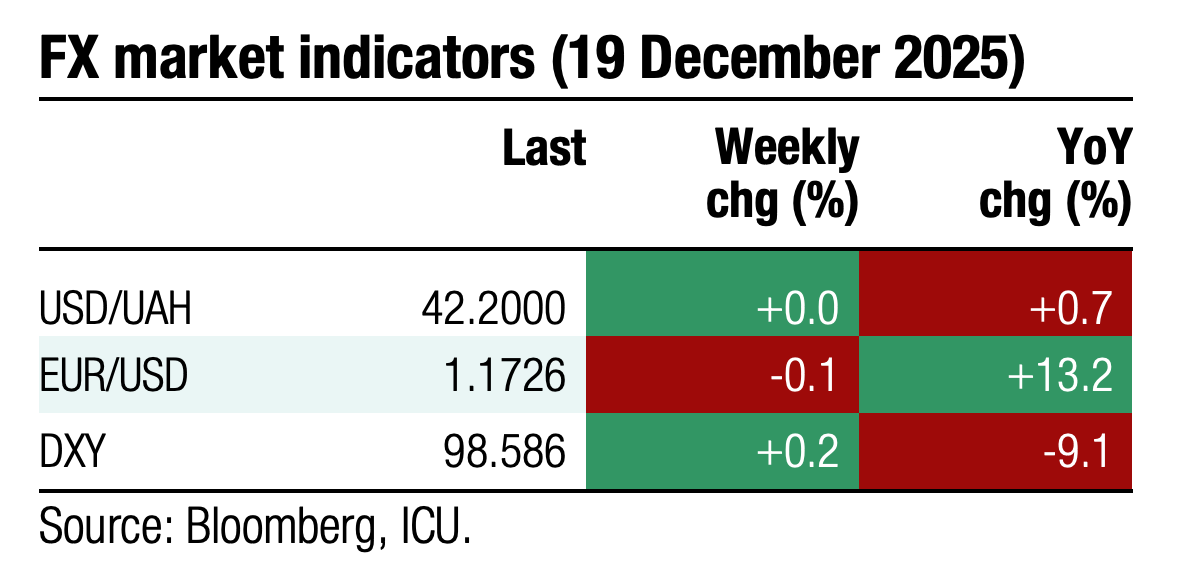

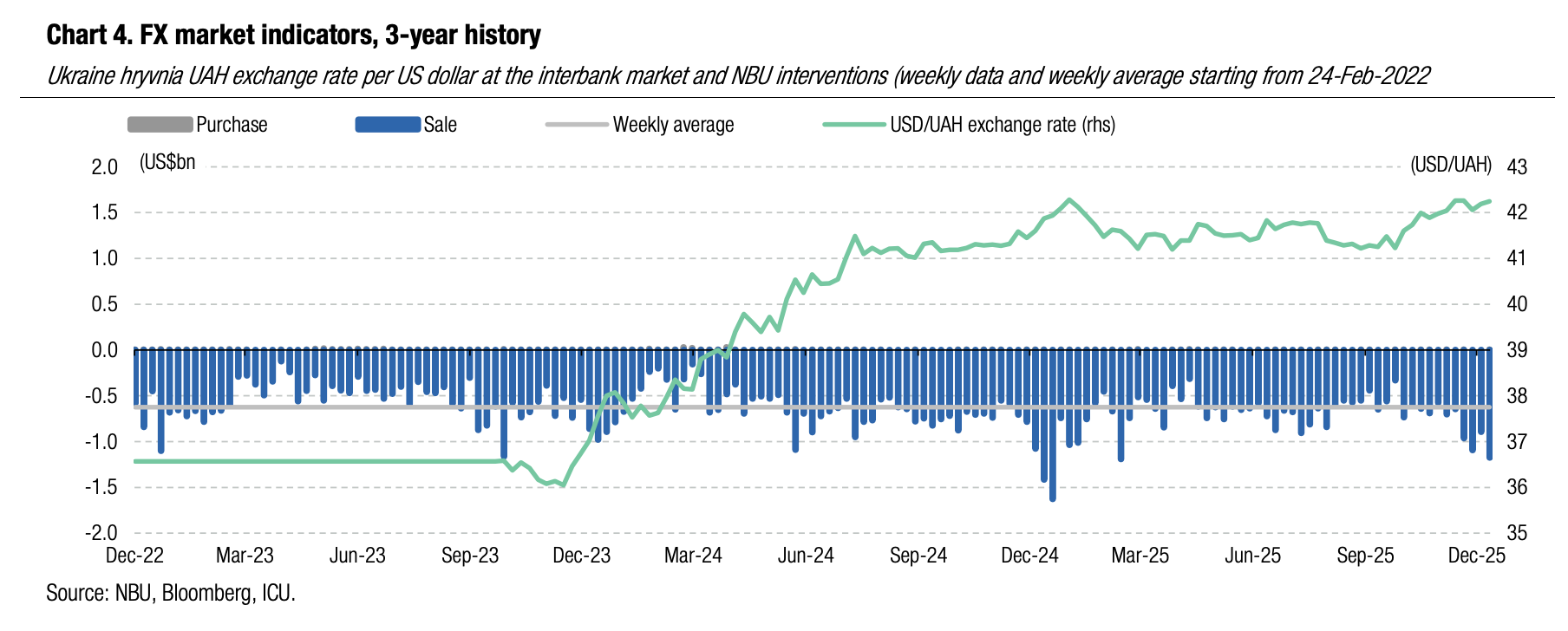

FX: NBU hikes interventions

The National Bank of Ukraine hiked its FX interventions to nearly the maximum level this year and kept the hryvnia exchange rate broadly unchanged by the end of the week.

The NBU sold almost US$1.2bn last week, which is only US$20 million less than this year's maximum. At the same time, this is US$244m less than interventions in the penultimate week of December 2024. The exchange rate weakened by only 0.1% to UAH42.25/US$ over the week.

Such NBU steps occurred against the background of a significant increase in the hard currency deficit on the FX market to US$708m in Monday-Thursday, up 27% WoW. The FX demand in the interbank surged to US$1.7bn for the four days of the week.

ICU view: The hard currency shortage typically increases at the end of each December. This year, the NBU kept the hryvnia relatively stable as it awaited the EU's decision on the reparation loan. We expect the FX market deficit to increase this week. Still, the NBU is unlikely to allow the hryvnia to weaken significantly, and the volume of interventions may rise to a new high this year.