Bonds: MoF announce reserve bonds exchange

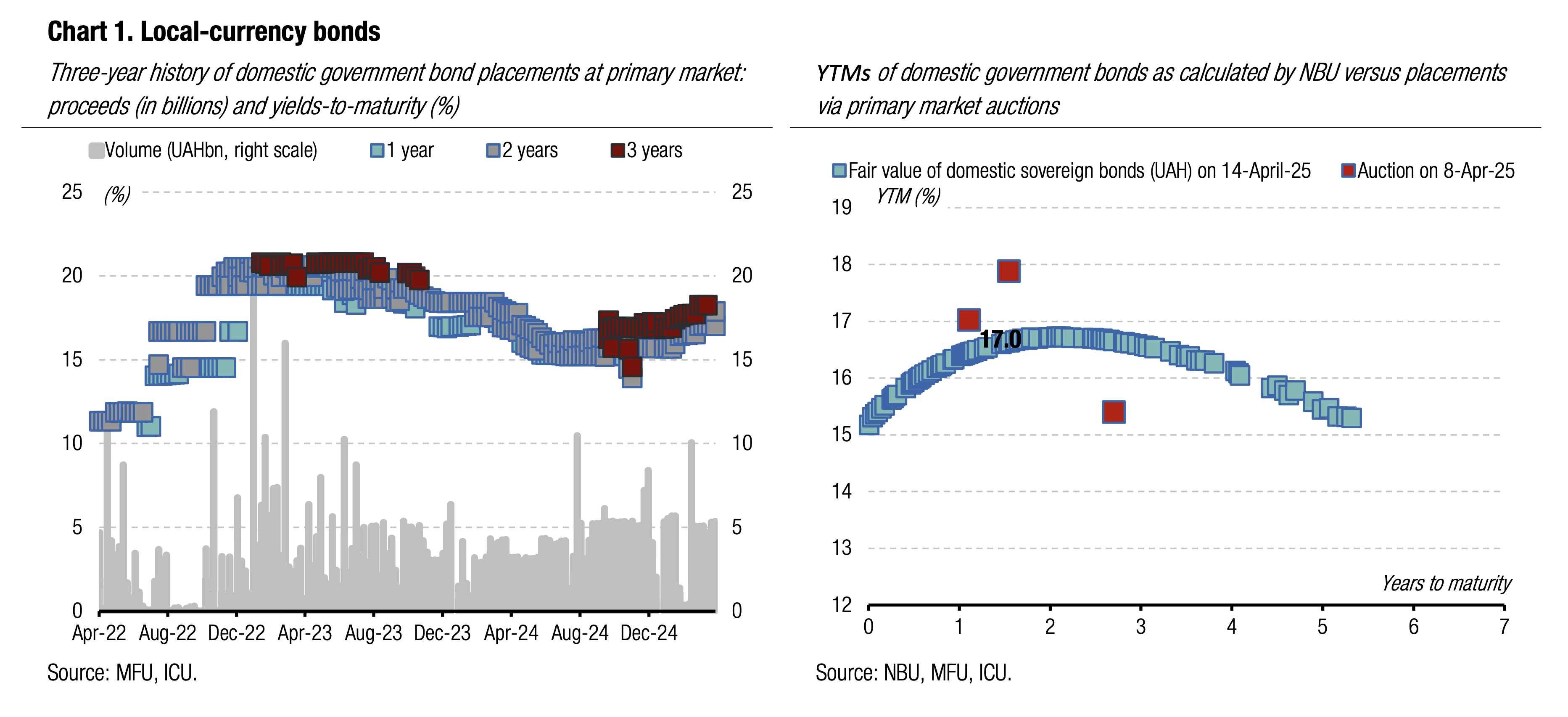

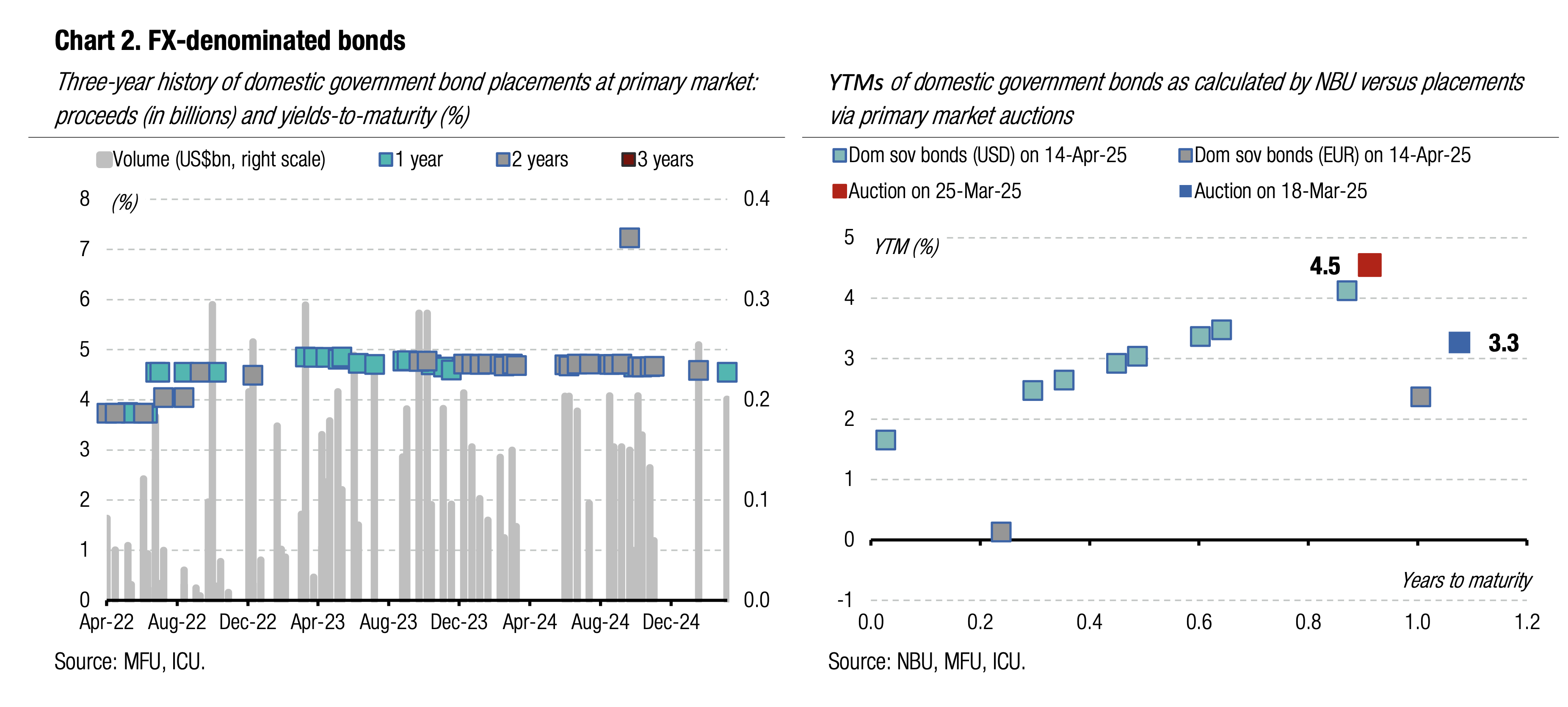

Demand for new reserve bonds remains enormous. This has prompted the MoF to announce an exchange auction for reserve bonds maturing next month, and they will offer a new three-year bond at a regular auction.

Last week, the MoF borrowed just UAH2.5bn via 15-month military and two-year regular UAH bills without changes in interest rates. At the same time, yields for the reserve bond continued to decline, as it was 5x oversubscribed. The weighted-average rate declined to 14.81% last week, which is just 22bp above the rate for a similar note last December, before the NBU switched to the rate-hiking cycle. See details in the auction review.

This week, the MoF removed a reserve bond from the primary auction list and will offer a new three-year regular note along with the usual 15-month and two-year bills. At the same time, the MoF proposed that banks acquire new reserve bonds maturing in 2028 in exchange for reserve paper due on May 21.

Individuals continued to increase portfolios to new records. Last week, their portfolios rose by 4% to UAH91.6bn. The share of UAH bonds in total portfolios of individuals rose by almost 1pp YTD to 51.3%.

ICU view: The MoF decided to continue with its practice of bond exchange auctions and now aims to exchange paper a month before their redemption. This proposal is interesting for banks, as it allows them to replace short-term paper with significantly longer maturities and decrease the competition for such securities in May. However, the exchange deal will not allow banks to replace reserve bonds redeemed two weeks ago. Most investors continue to increase portfolios, except foreigners. Individuals remain leaders in portfolio growth having the highest growth rate.

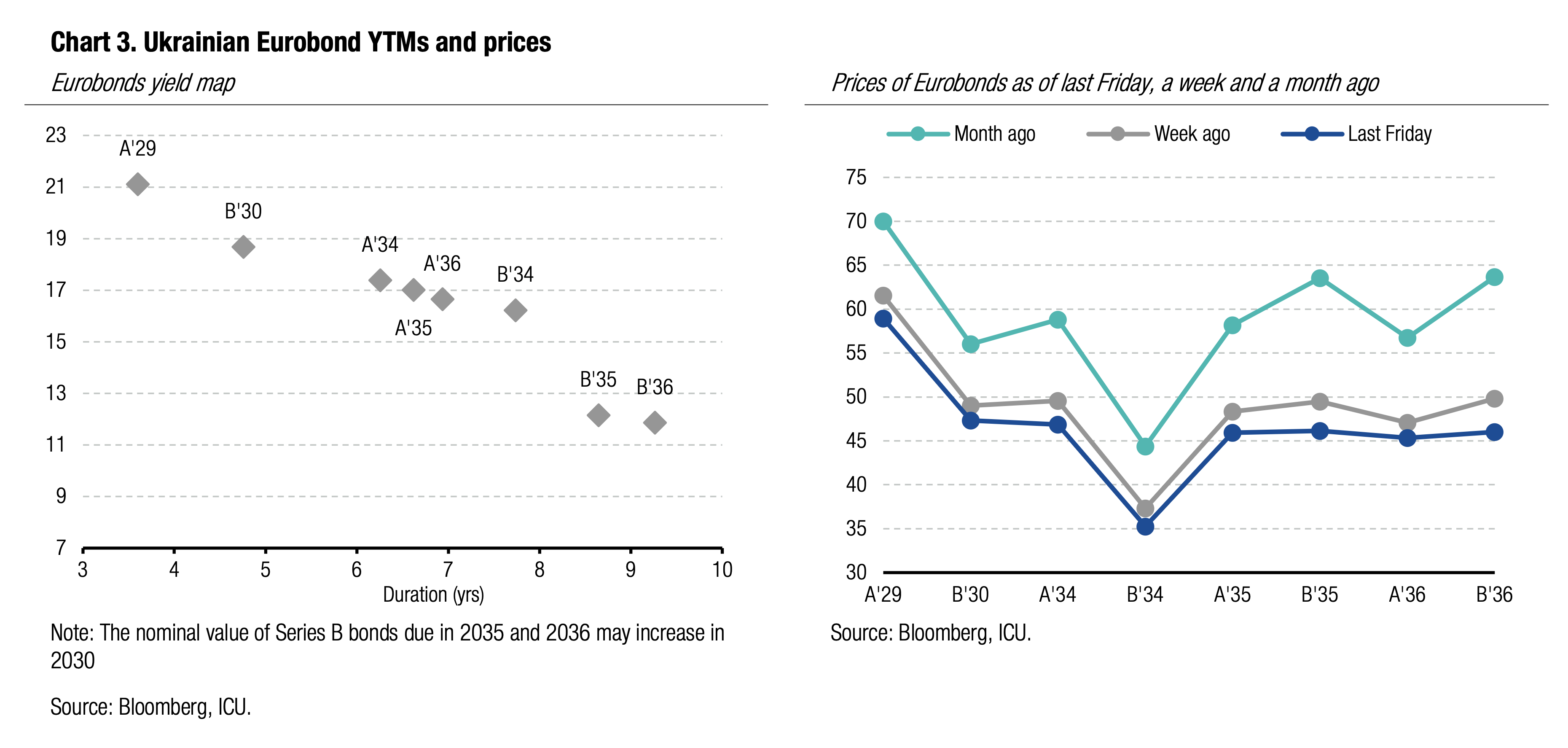

Bonds: Hopes for quick end of war melt away

Prices of Ukrainian Eurobonds have fallen below the level seen before last year's US elections, losing all the gains generated by hopes for a quick end to the war in Ukraine.

The prices of Ukrainian securities fell by an average of 5% over the past week. Eurobonds of series B with maturity in 2035-36 dropped the most by about 7%. Last Friday, all Eurobonds were already 3% below the level seen on the eve of the US presidential election. The VRI's price fell by 7% to 62 cents per dollar of notional value. The emerging market bond index fell by 2.9% last week.

ICU view: There was no progress in the ceasefire talks last week, so Ukrainian Eurobonds aligned with the general market sentiment towards emerging markets. The US-China trade war affected investors’ sentiment and they continued to seek safe havens and sold bonds of less creditworthy countries. VRI holders remain concerned about the lack of a finalized restructuring proposal despite close deadlines. russia is dragging out negotiations, and clearly without any realistic intention to reduce the intensity of hostilities. Only the threat of additional sanctions against russia by the US can change the situation.

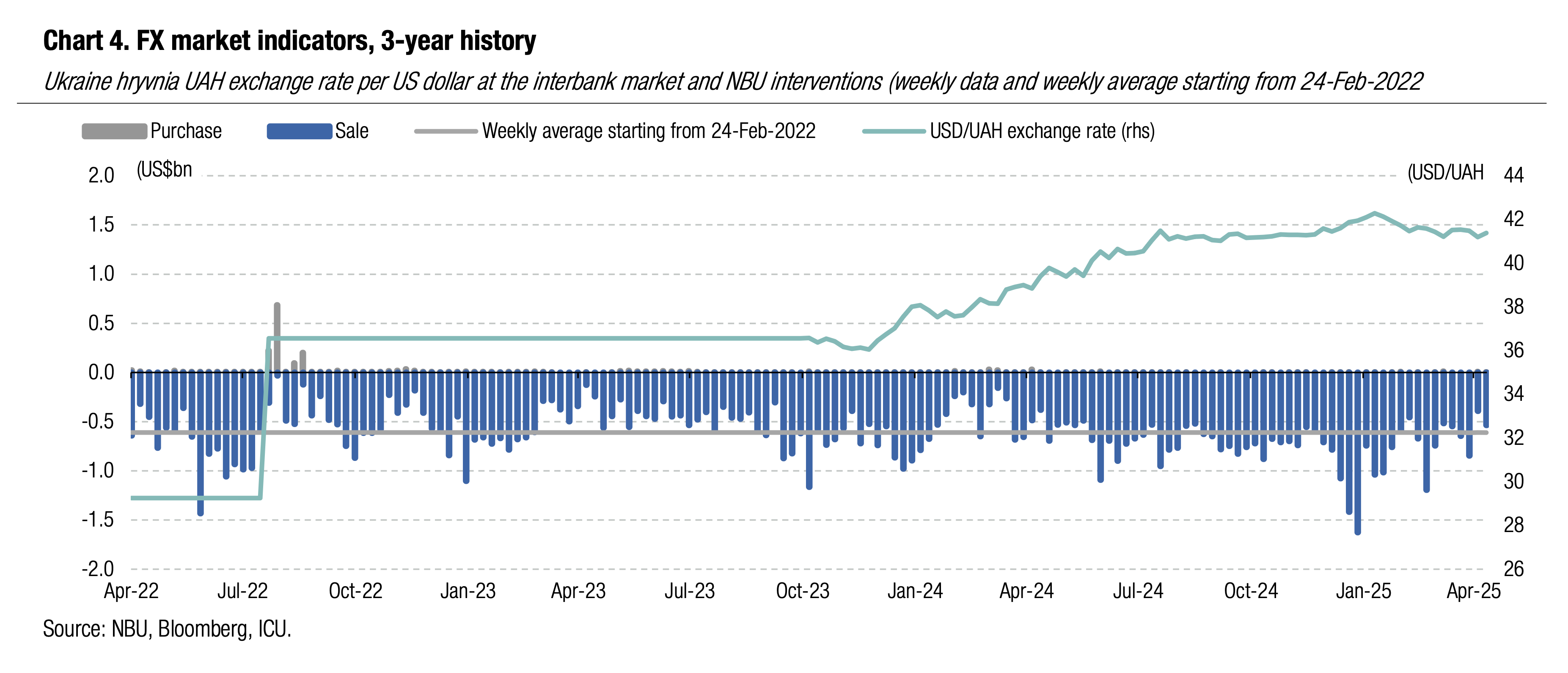

FX: EUR/USD exchange rate impacts Ukrainian FX market

Last week, the EUR/USD exchange rate jumped to 1.14, spilling into the Ukrainian FX market. The NBU weakened the hryvnia against the US dollar and euro, increasing the spread between the two.

Hard currency sales in the interbank FX market declined by 12% WoW while purchases slid by 1% WoW, pushing the net purchase of foreign currency up by 63% WoW to US$275m (in four business days). Net purchases in the retail segment dropped by 36% WoW to US$80m. The total shortage in the FX market rose by 25% WoW to US$356m.

The NBU had to cover such shortage and increased its interventions by 37% WoW to US$536m.

Finally, the NBU weakened the hryvnia last week by 0.5% WoW to UAH41.39/USD and by 3% WoW to UAH46.92/EUR.

ICU view: Lower foreign currency sales may reflect the exporters' unwillingness to sell hard currency proceeds due to increased turbulence in global financial markets. Last week's weakening of the hryvnia was insignificant, as the NBU still kept hryvnia 1.5% stronger YTD. Despite small exchange rate movements the NBU is not showing signs it is prepared for a more significant, though gradual, weakening of hryvnia.

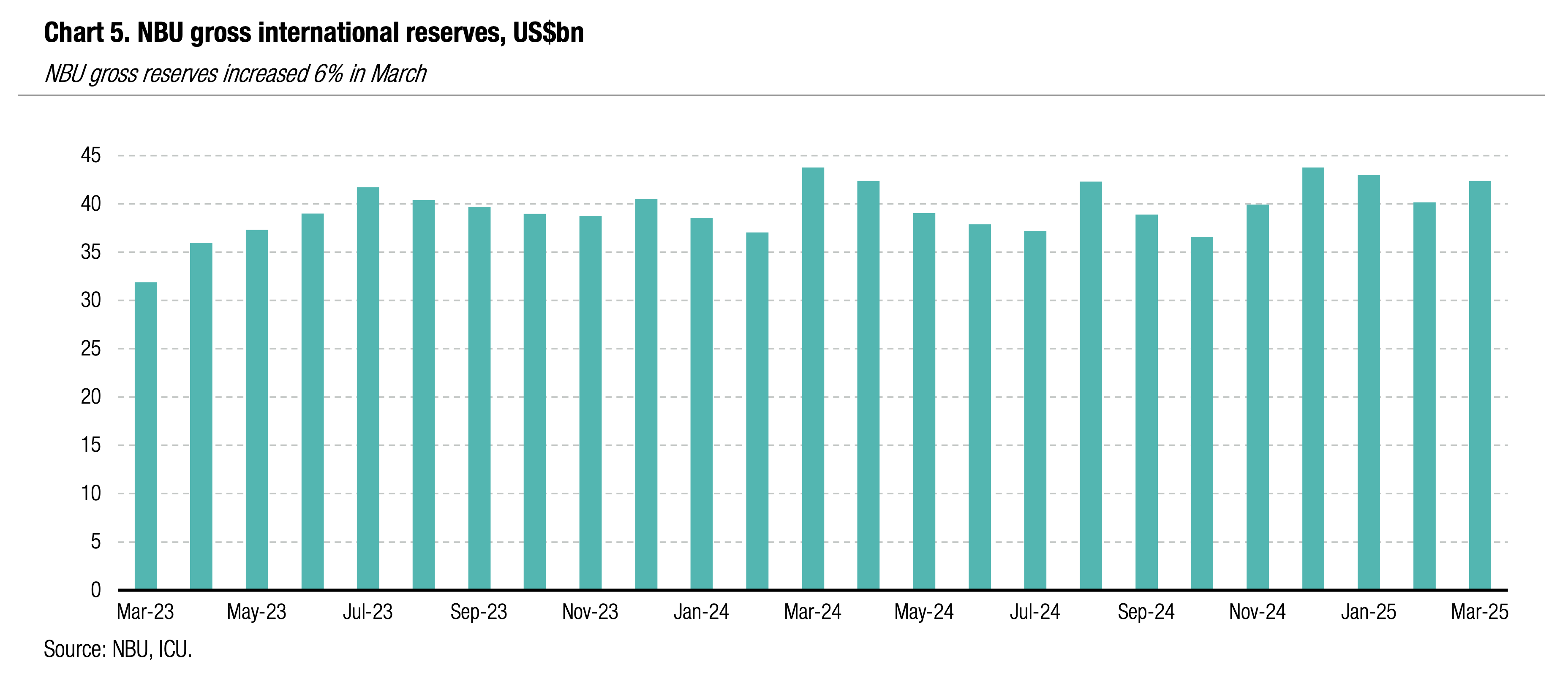

Economics: NBU reserves up 6% in March on inflows of foreign aid

The gross international reserves of the NBU were up 5.6% in March (down 3.2% in 1Q25) to US$42.4bn.

Inflows of foreign financial aid restarted in March after a short pause in February and included a US$5.2bn loan via ERA facilities and a US$0.4bn tranche from the IMF. The NBU reported that a US$1.0bn loan from the UK within the ERA facility was not included in gross international reserves as this money can only be used for specific purposes (likely purchase of weapons). Yet, the NBU has to spend about US$2.6bn in March to maintain stability of the FX market. Additionally, a part of reserves was spent on debt service by Ukraine, including US$0.7bn to the IMF.

ICU view: The NBU reserves remain at a healthy level and provide the NBU with sufficient firepower to guard the stability of the FX market. An increase in the foreign aid package to Ukraine by US$15bn and a more frontloaded disbursement of the money, as revealed in the latest MEFP, implies NBU gross international reserves may exceed US$55bn at the end of the year. This means the NBU may be fully reluctant to weaken hryvnia significantly through end-2025.

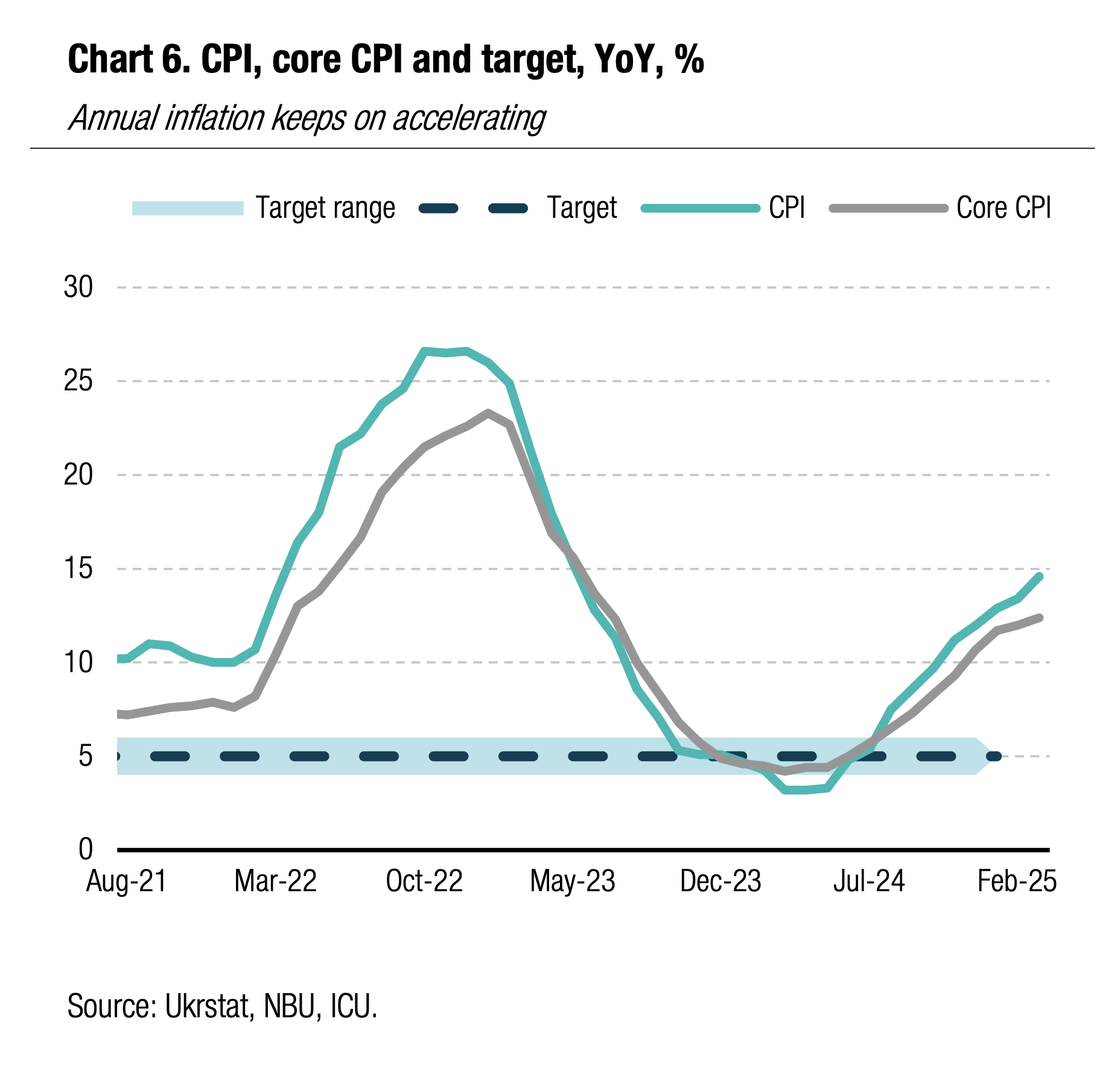

Economics: Monthly inflation surges in March

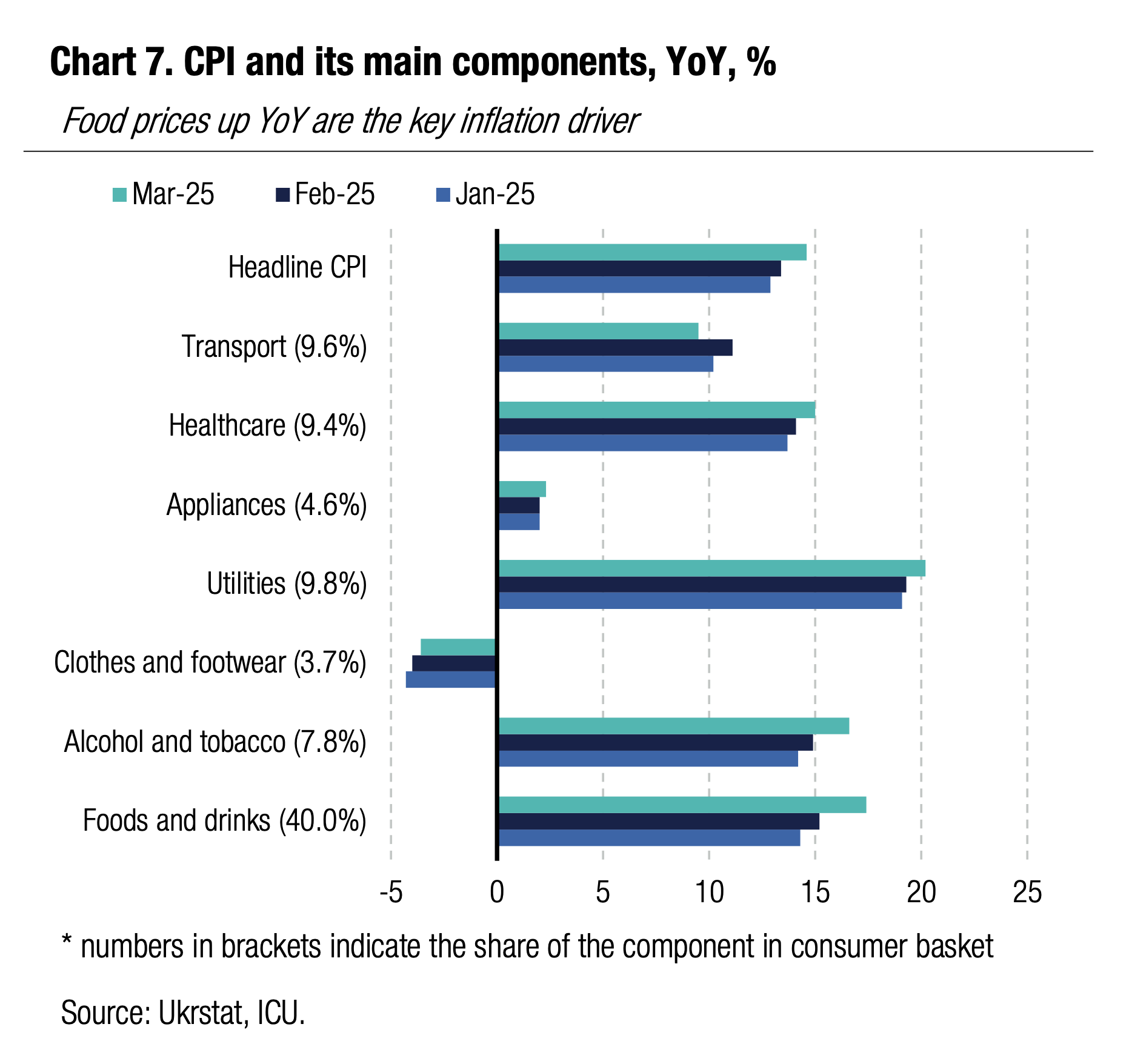

Monthly inflation surged 1.5% in March, taking the annual tally to 14.6%. Monthly inflation will decelerate markedly from April while annual inflation will start decelerating from June.

Unexpectedly, prices of food and non-alcoholic drinks spiked 1.7% in March with annual growth accelerating to 17.4% from 15.2% in February. They contributed about 0.68pp to monthly inflation. A seasonal increase in the price of cloths and footwear (+13.3% MoM) contributed another 0.5pp to monthly CPI, with the remaining components making much less significant contributions. In YoY terms, prices for the vast majority of consumer basket components accelerated, while transportation was a notable exception thanks to a decline in motor fuel prices.

|  |

ICU view: The CPI in March came in higher than we expected, but that does not change our view of trend through end-2025. We expect monthly inflation to start decelerating from April while annual inflation will start to trend down from June. The key supporting factors will be a larger supply of agricultural harvest after a significant decline last year and slower growth in household incomes as salaries in the public sector were increased only marginally in 2025. Other supporting factors include a relatively stable exchange rate and a decline in global oil prices. We see consumer prices decelerating to 7-8% by the end of 2025. Our forecast also assumes no hikes in electricity or gas tariffs for households in 2025. In view of this, we expect the NBU will keep the key policy rate at the current level of 15.5% until September before making three 50bp cuts by the end of the year.