|  |

|  |

Bonds: Local debt rollover marginally up in September

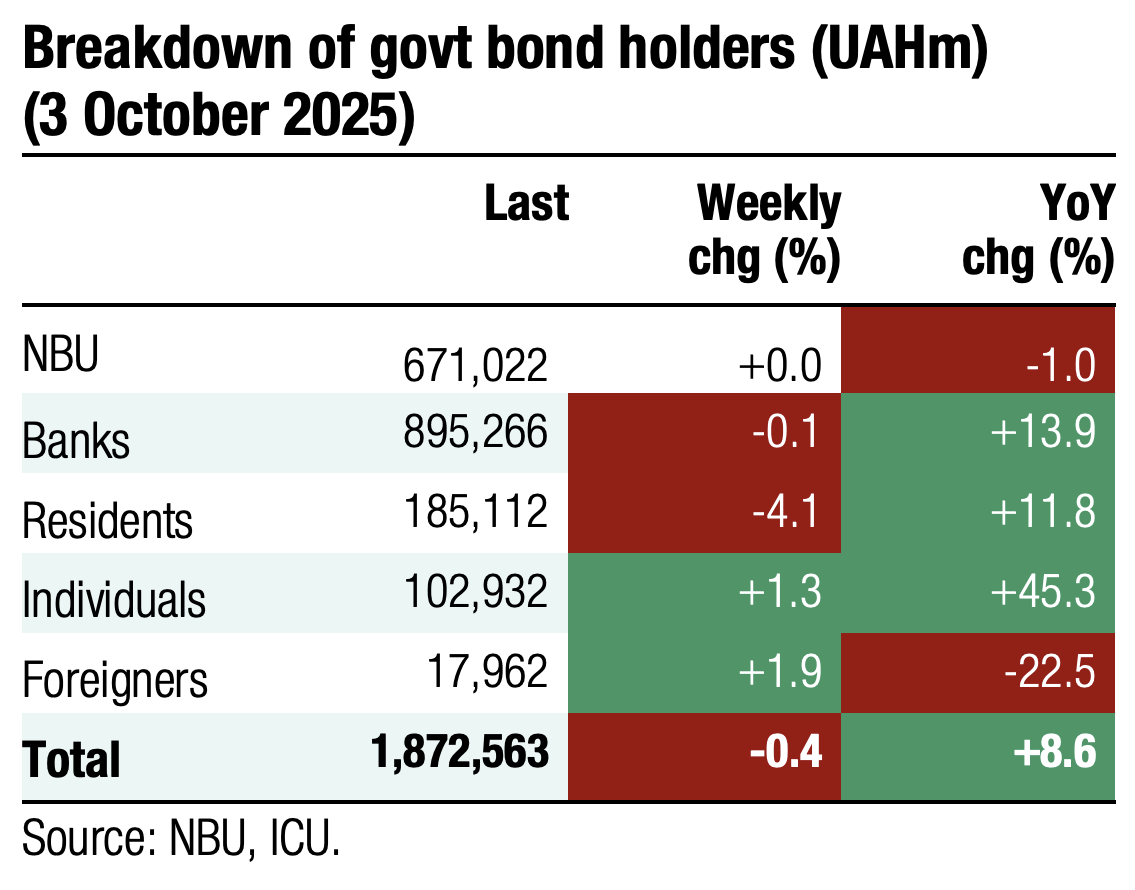

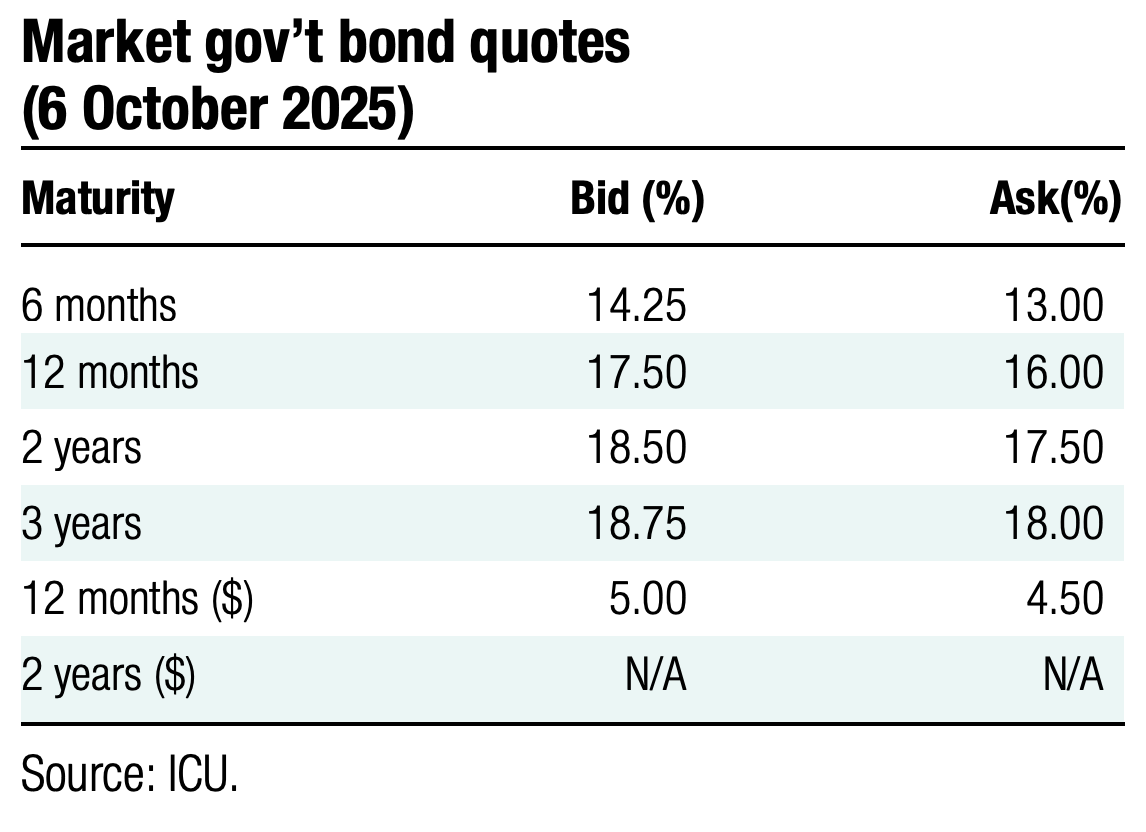

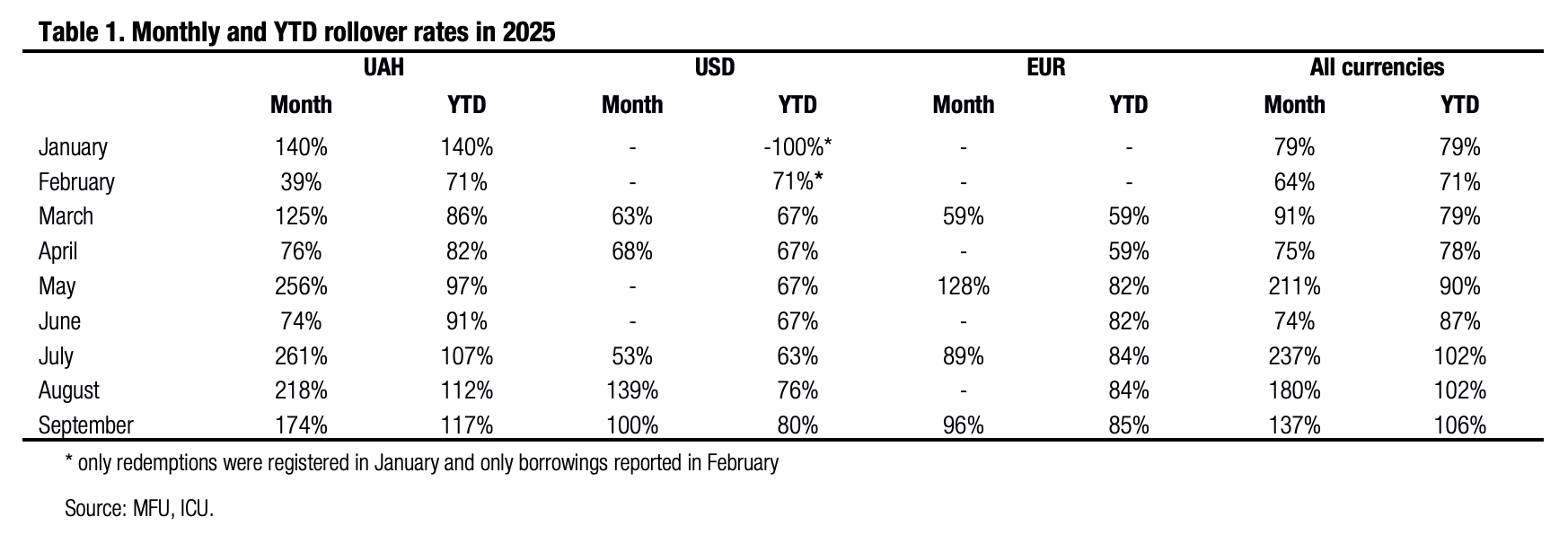

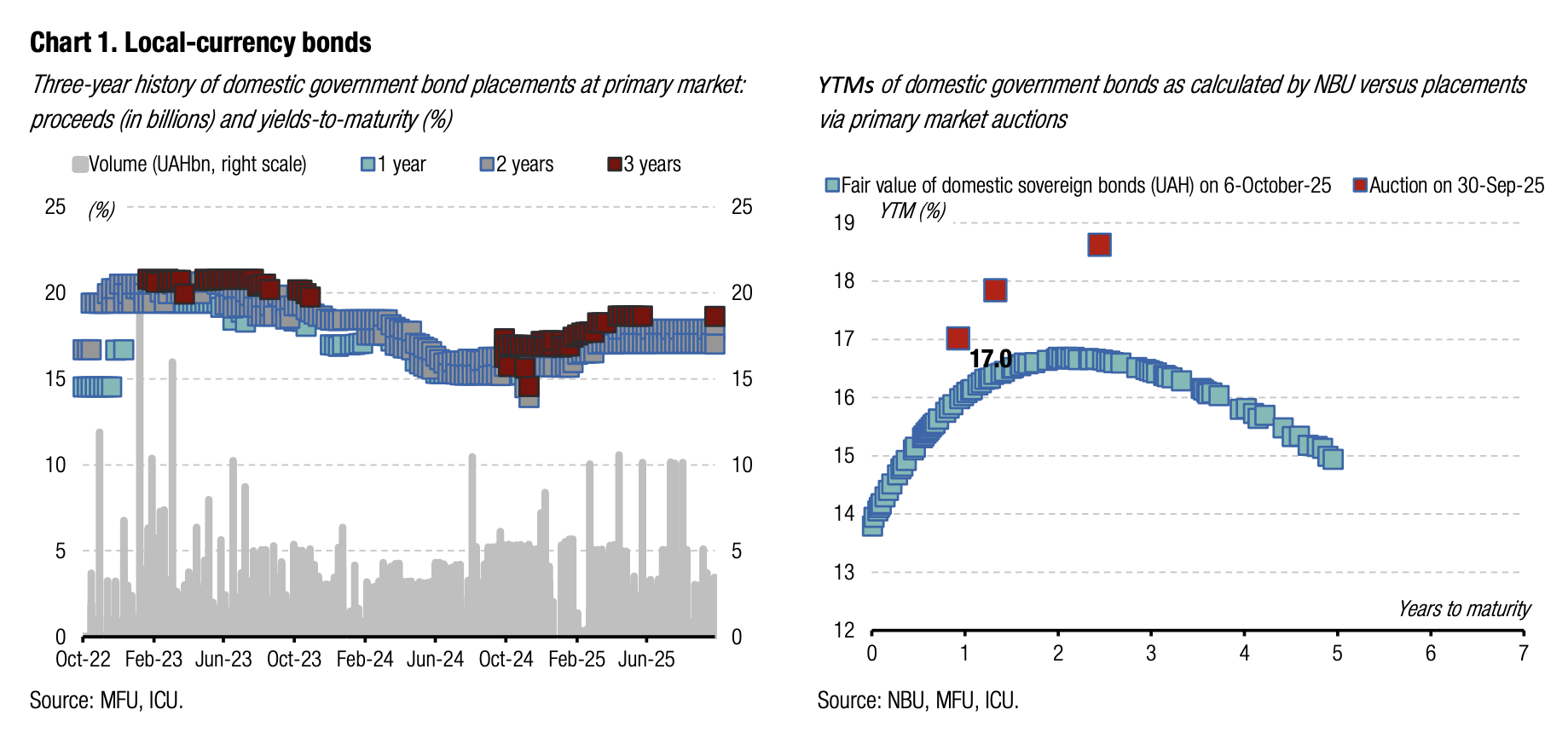

The Ministry of Finance marginally increased domestic debt rollover in September.

During September, the MoF sold UAH51bn worth of bonds in all currencies, which improved the rollover rate by several percentage points compared with 8M25. During 9M25, the rollover of UAH debt rose by 4pp to 117%, for USD debt it was up by the same 4pp to 80%, while for debt in euros, it inched up by only 1pp to 85%. Domestic debt refinancing in all currencies improved by 4pp to 106%. In September, the MoF refinanced 100% of redeemed USD-denominated paper for the first time this year.

In October, the Ministry of Finance already repaid UAH20bn and another UAH25bn is due by the end of the month. Also, this week, the MoF will repay another US$350m.

ICU view: In October, the Ministry of Finance will likely target to increase net borrowing to push the rollover ratio up further. According to the published schedule, the MoF will offer a new benchmark bond next week, which the NBU will be allowed to use to include in bank mandatory reserves. The MoF may again aim at 100% rollover of USD-denominated debt with a new bond offering scheduled for tomorrow and the next week.

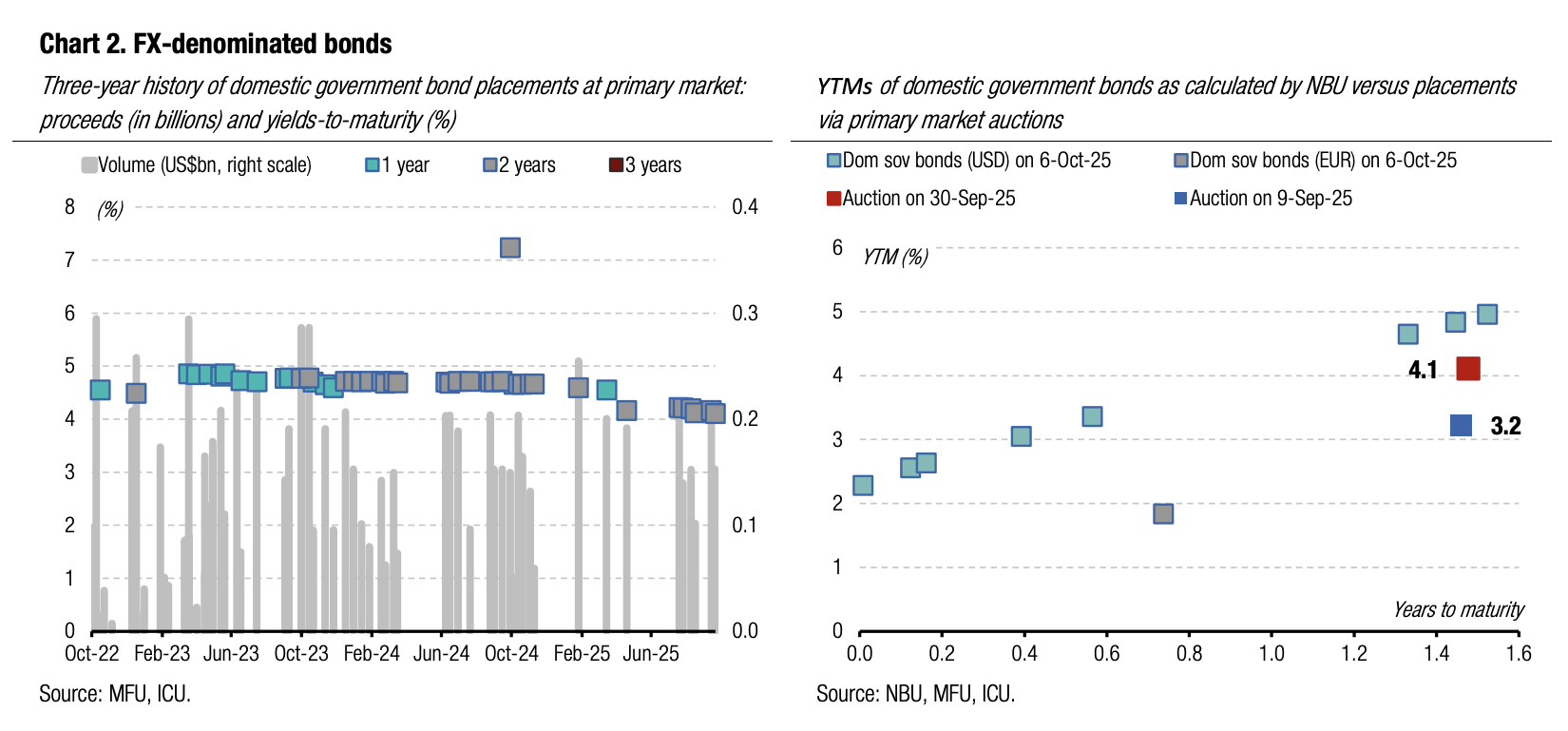

FX: NBU interventions at multi-month lows

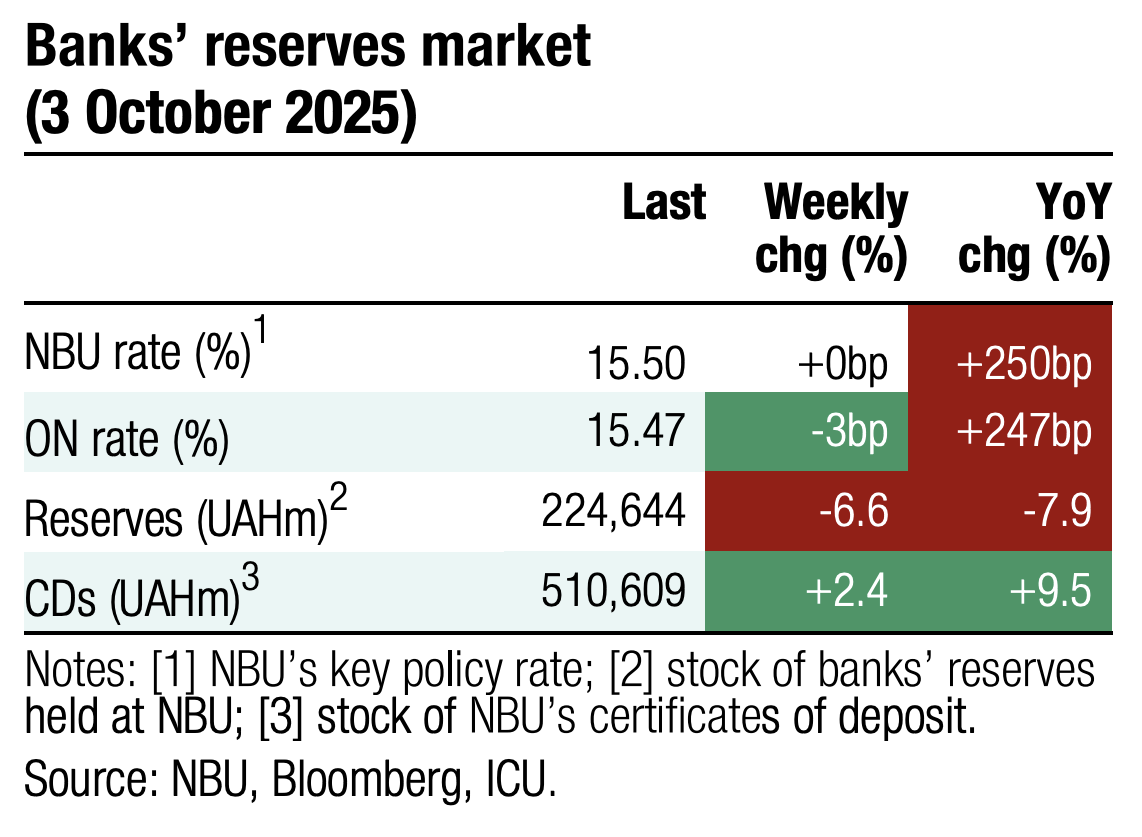

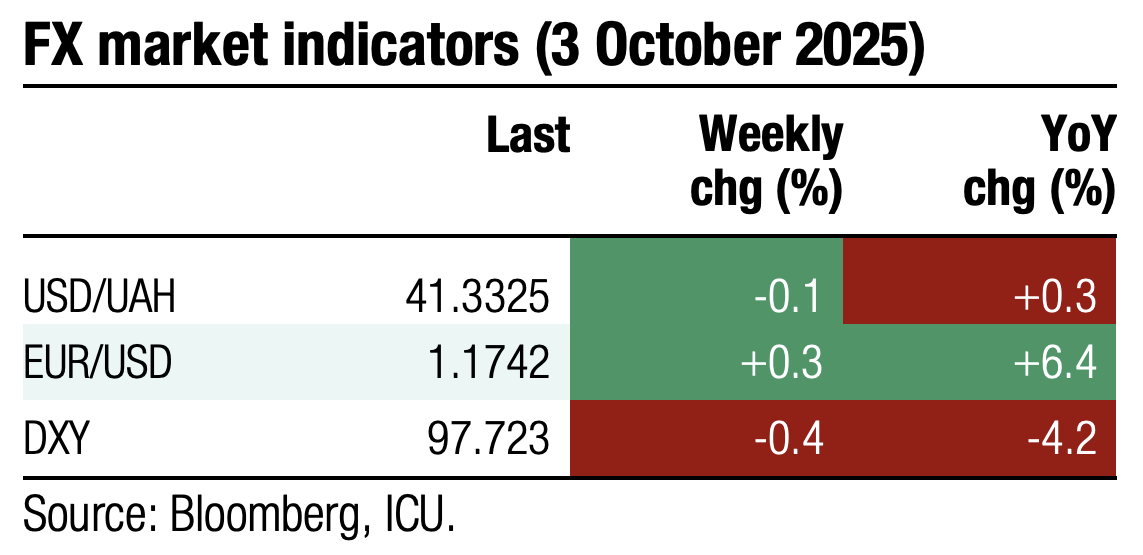

Tax payments in the last days of September helped the NBU significantly reduce interventions and strengthen the hryvnia last week.

At the beginning of last week, bank clients (legal entities) significantly stepped up their sales of foreign currency, which helped narrow the FX shortage in the market to US$47m for four days of the week. Given such a favourable backdrop, the NBU allowed the dollar to weaken to below UAH41.3/US$. Central bank interventions were down to US$333m last week, the smallest weekly amount since April.

ICU view: At the end of September, exporters had to sell more foreign currency to pay VAT and excise taxes in UAH. This was likely the main reason for a decline in FX market imbalances last week. Yet, we believe this is a temporary improvement, and we expect interventions will soon return to a US$500-600m range per week, i.e. close to the average during a full-scale war.

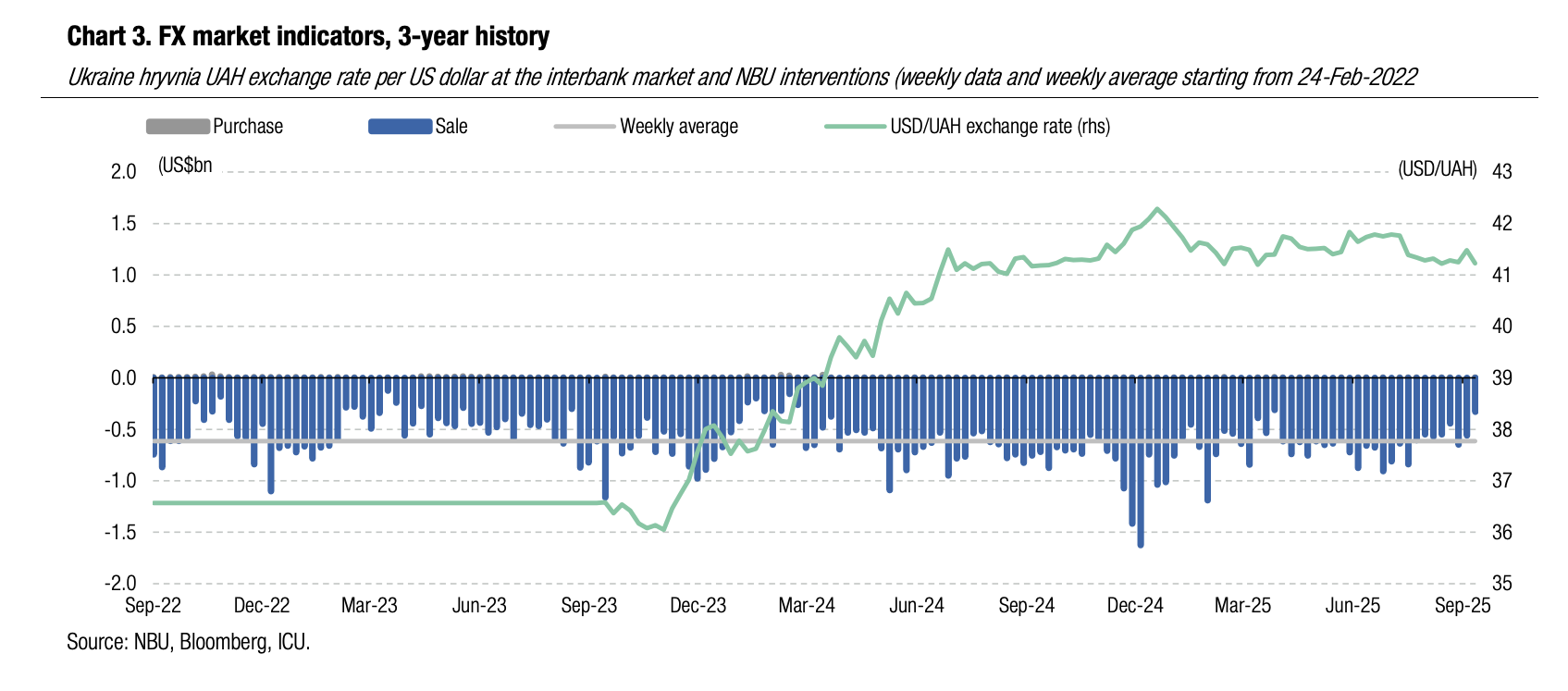

Economics: Monthly C/A gap narrows in August

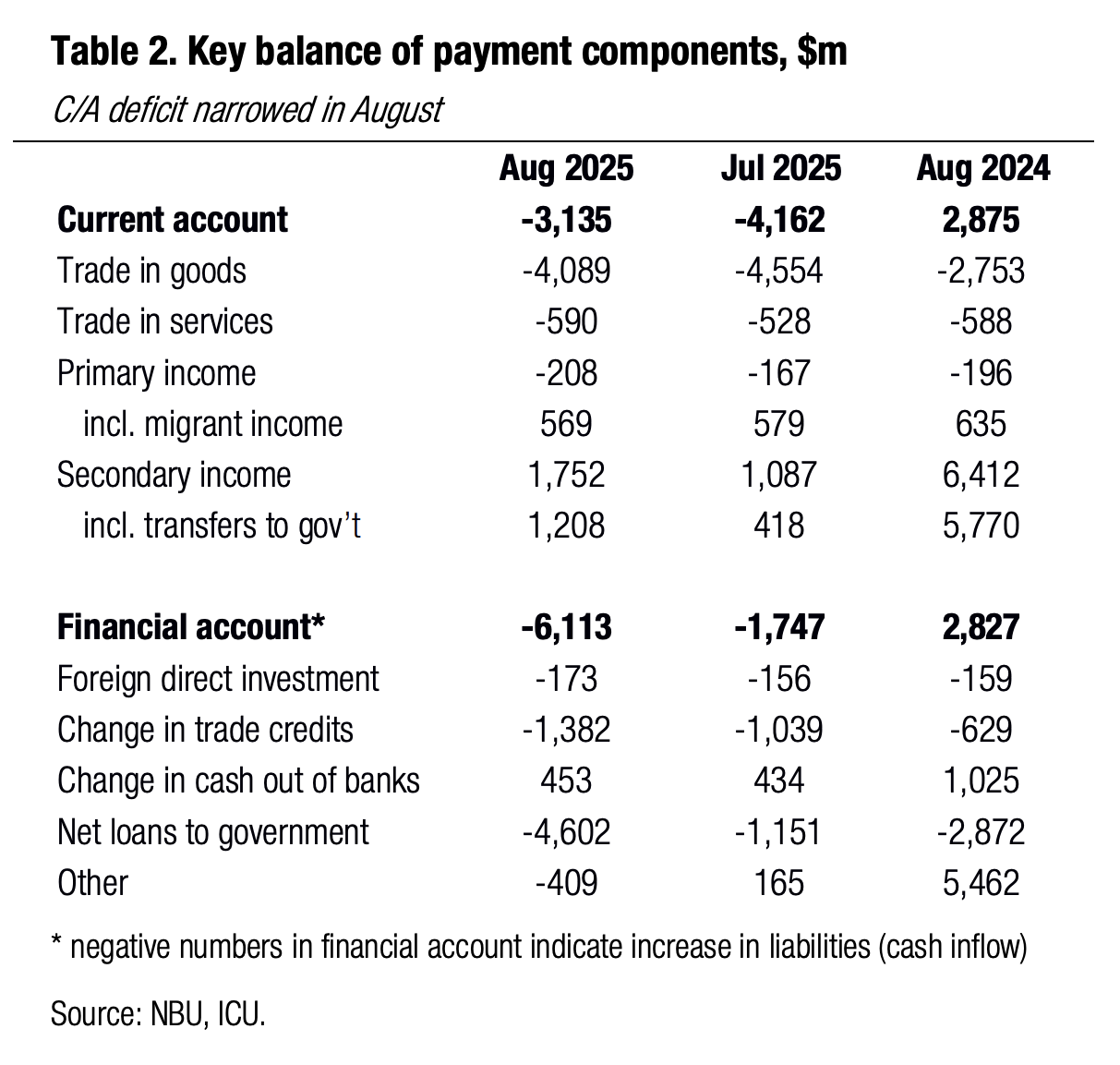

The monthly current account (C/A) deficit narrowed to US$3.1bn from a record high of US$4.2bn in July.

The trade-of-goods deficit saw an improvement on a decline in imports vs July, but still remained large at US$4.1bn taking the 8M25 result to US$30.4bn from US$20.2bn in 8M24. August export of goods was lackluster as it declined 9% YoY (-4% in 8M25) on sluggish sales of agricultural products. Imports continued to grow at a double-digit pace (+17.5% YoY in August and +19.8% in 8M25). The deficit of trade in services and the deficit of primary income remained little changed vs. both July and August 2024. Secondary income surplus was the key factor that drove the improvement in C/A balance in August vs. July on larger foreign budgetary transfers to the Ukrainian government.

Financial account trends remained positive with a significant net inflow of funds of US$1.4bn due to a reduction of the stock of trade credits (likely a transfer of earlier sales proceeds of exporters to Ukraine). The outflows of FX cash from the banking sector (the key drag on financial account in 2024) remained reasonably small. The inflows of concessional loans from Ukraine’s allies stood at US$4.6bn. The combined balance of the current and financial accounts was significantly positive driving the NBU reserves 7% MoM to US$46bn.

|  |

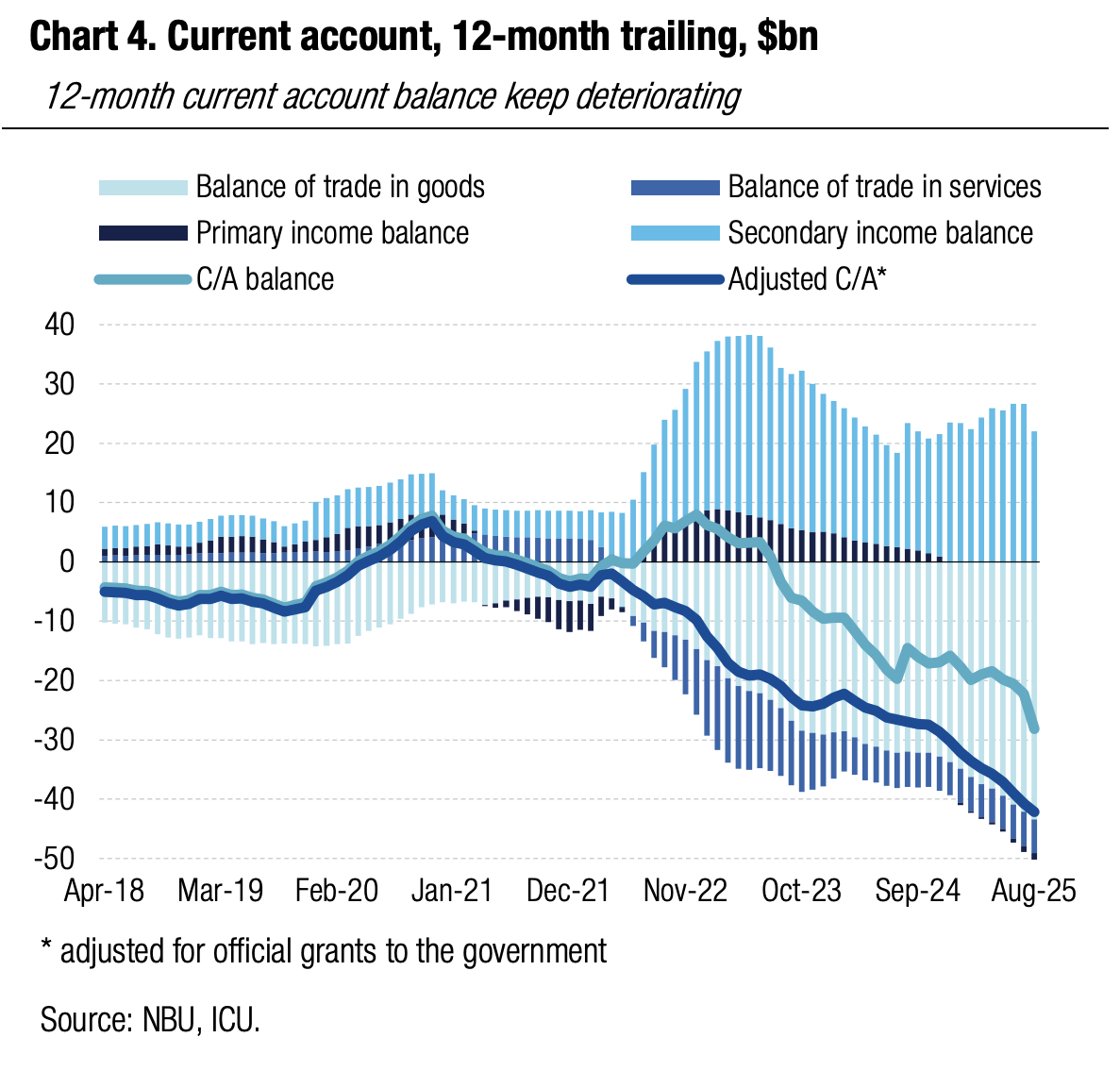

ICU view: The size of the C/A deficit remains the key long-term concern but since the start of the full-fledged war, it has been safely covered by foreign financial aid. Given commitments by Ukraine’s foreign partners, we expect this pattern to remain intact at least over the next 12 months. Should the EU approve a reparation loan for Ukraine, Ukraine’s external accounts will remain in safe territory for another couple of years. We expect the NBU will have more than enough firepower to keep the FX market and hryvnia exchange rate under its full control at least in the next 12 months.