|  |

|  |

Bonds: MoF to scale up placement of reserve bonds

This week, the Ministry of Finance will hold a swap auction to exchange reserve bonds, the third one since the beginning of the year.

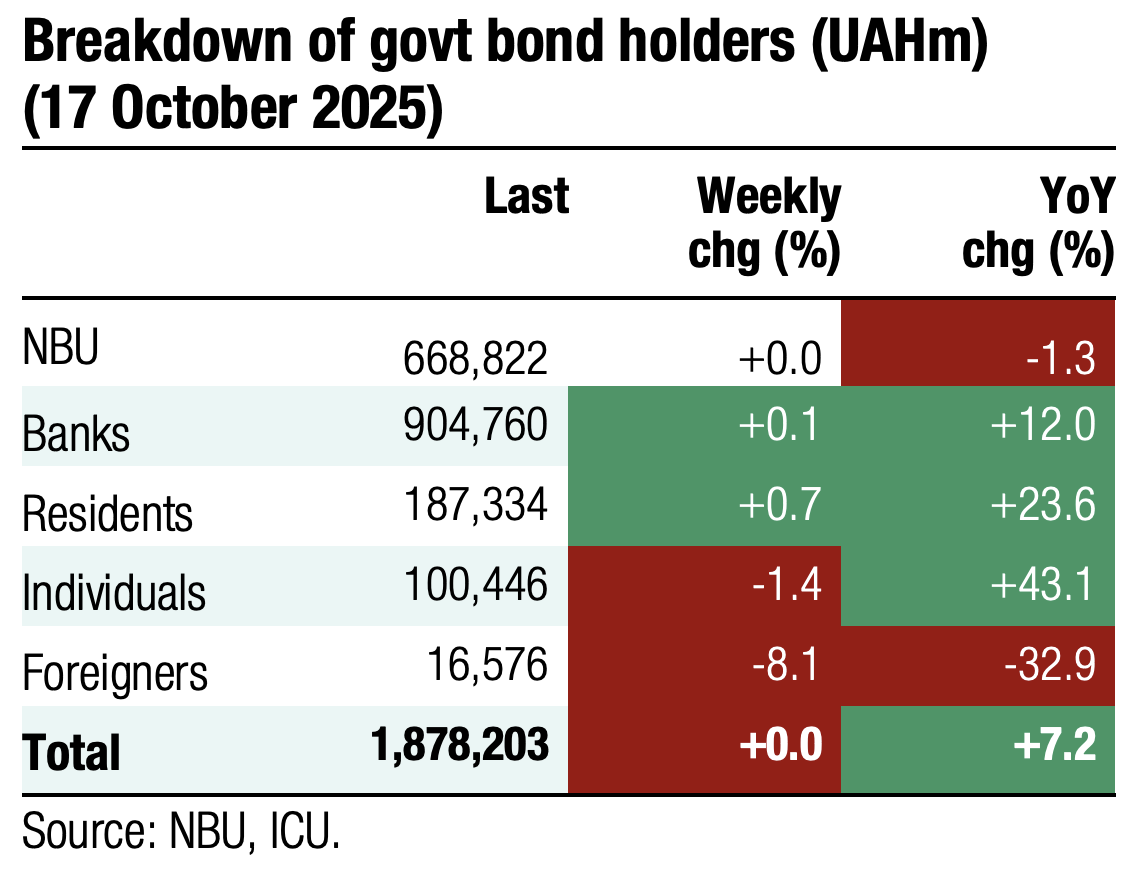

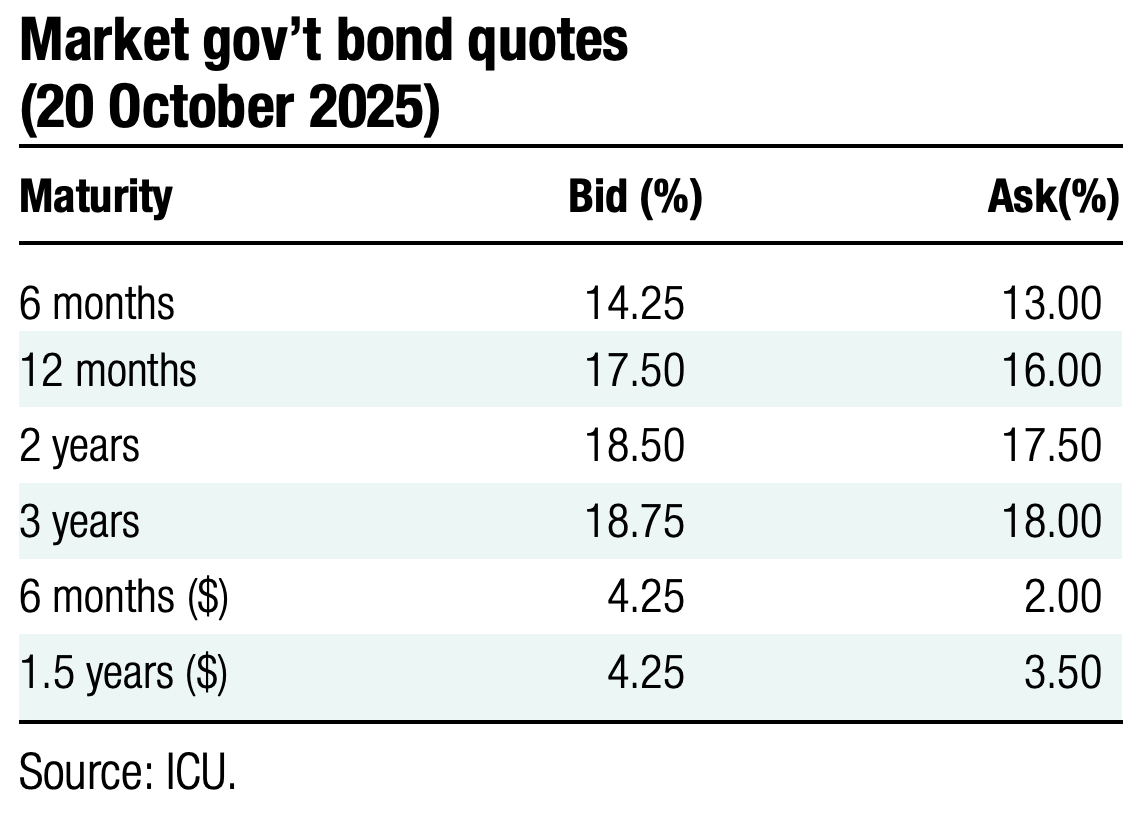

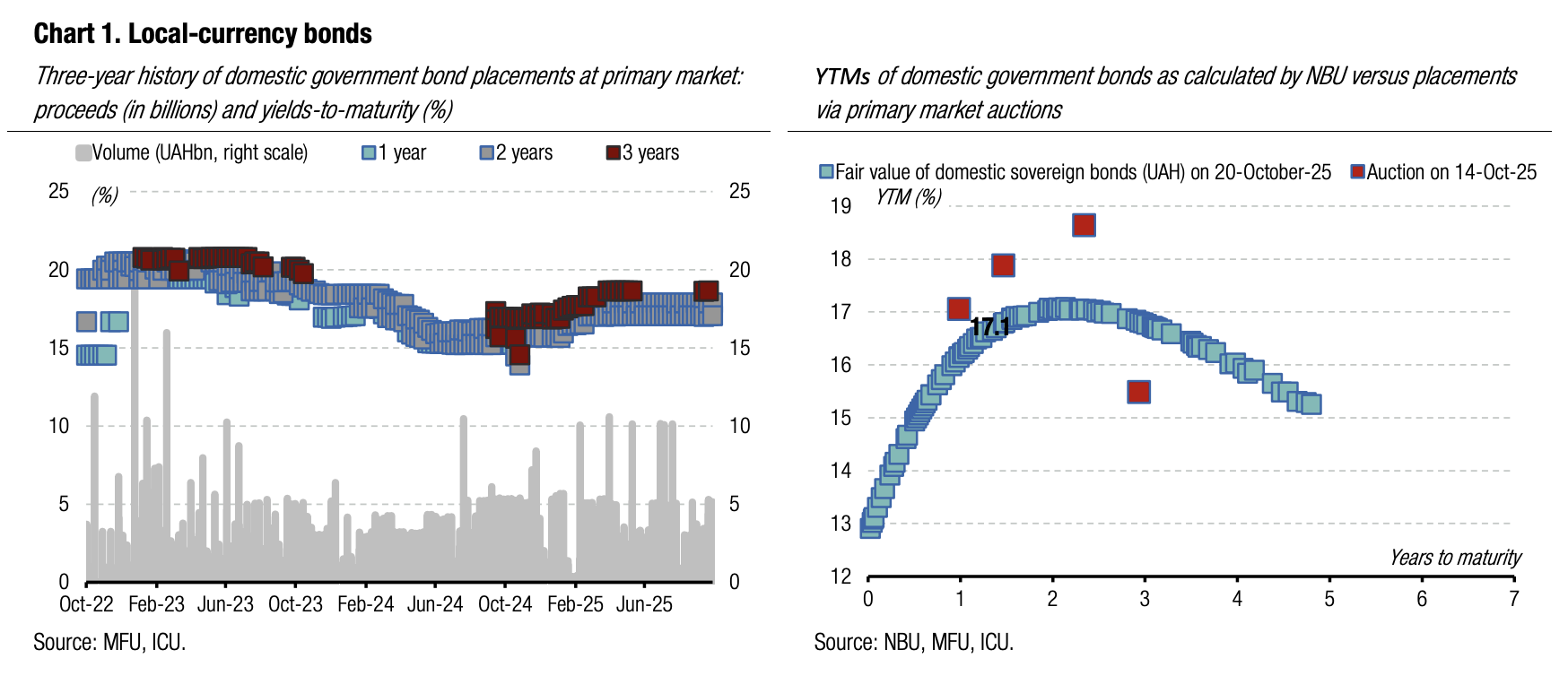

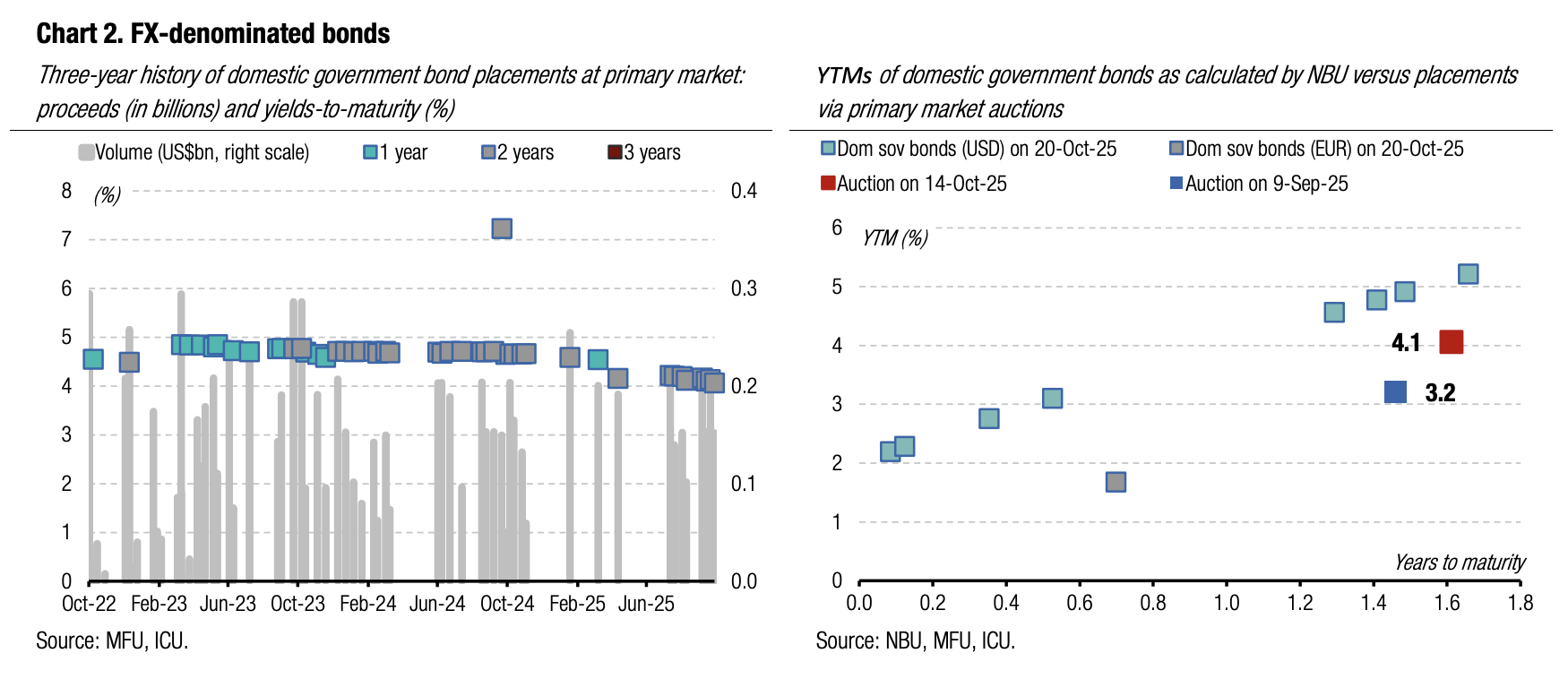

Last week, the MoF borrowed UAH19.6bn via sale of military, regular, reserve, and USD-denominated bonds. Reserve securities accounted for more than a quarter of total funds raised. See details in the auction review.

The MoF started offering a new reserve bond last week and announced it will offer the paper this Wednesday through a swap auction for UAH15bn. Banks can purchase the new reserve bond in exchange for the reserve bond due on November 5. Settlements will take place on Friday.

ICU view: Last week, the demand for the new reserve security (apparently, the NBU will add this paper to the list of securities that are allowed to be included into mandatory reserves) exceeded UAH22bn, meaning it was 4.5x oversubscribed. The swap auction may see an even higher demand on Wednesday, enabling the ministry to sell the planned volume and reduce November debt amortization burden.

Bonds: New diplomatic efforts improve sentiment

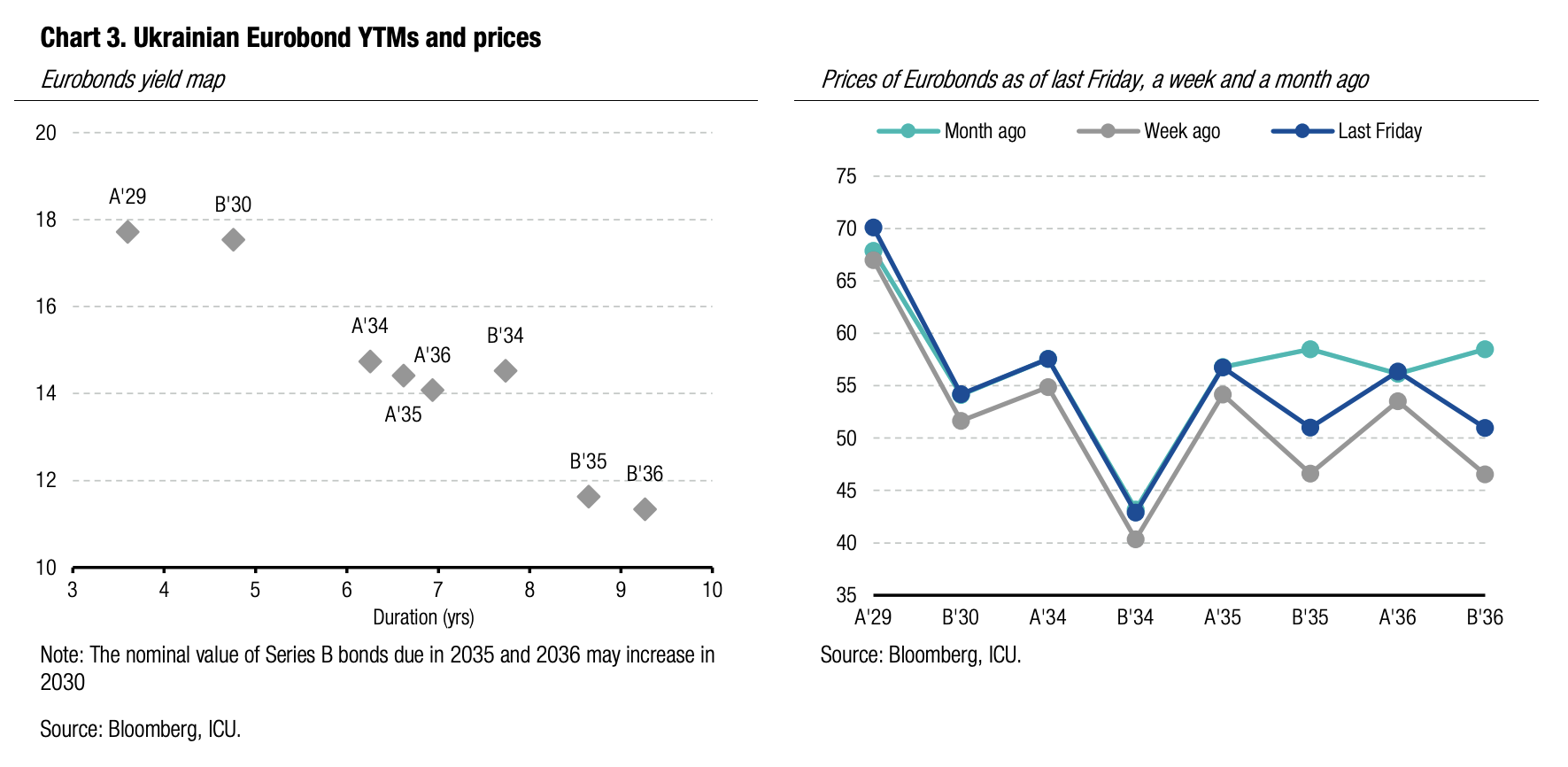

Bondholders had a positive reaction to recent diplomatic efforts to end the war in Ukraine, which resumed last week, but the meeting of the US and Ukrainian presidents on Friday was inconclusive.

Last week, the discussions about likely supply of long-range missiles to Ukraine by the US were on the front pages. The mood became much less optimistic on Thursday after the presidents of the US and russia concluded a phone conversation and agreed to hold another meeting in Budapest within the following two weeks. The meeting of the presidents of the US and Ukraine in Washington on Friday did not yield any visible positive result in terms of weapons supply arrangements, which will likely keep investor sentiment on a less optimistic note this week.

At the same time, the IMF held its annual meetings in Washington, where the Ukrainian delegation discussed the macro framework for an upcoming IMF program. According to Bloomberg, the total loan package of the IMF could be about US$8bn while the vast majority of the funding is expected to come in the form of the EU reparation loan. IMF chief Kristalina Georgieva may visit Ukraine in the coming weeks/months to send a clear message of the IMF commitment to supporting Ukraine as long as needed.

Against this background, Eurobond prices rose gradually throughout the week and exceeded the levels seen before Alaska meeting. The reaction of Series B bonds was much more muted as Ukraine economic growth prospects for 2026-28 remain relatively weak.

ICU view: The prices of Ukrainian Eurobonds remain driven by headlines related to the US president’s efforts to end the war in Ukraine and discussions of a new financial aid package from the IMF/EU. While there is clear progress on the financial aid side, the volatile path to a de-escalation of the war will remain the key drag on the prices in the coming weeks/months.

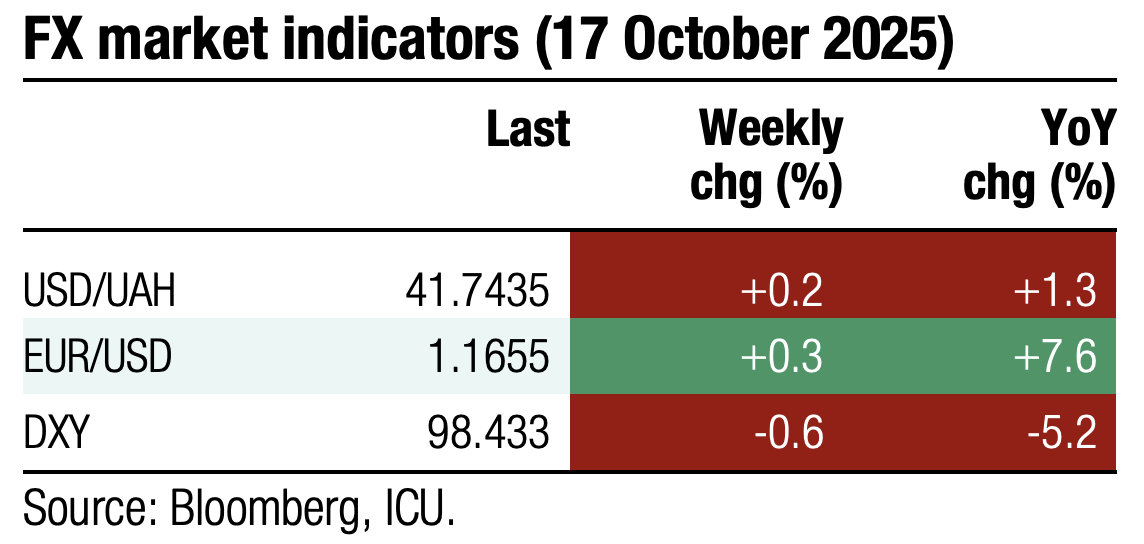

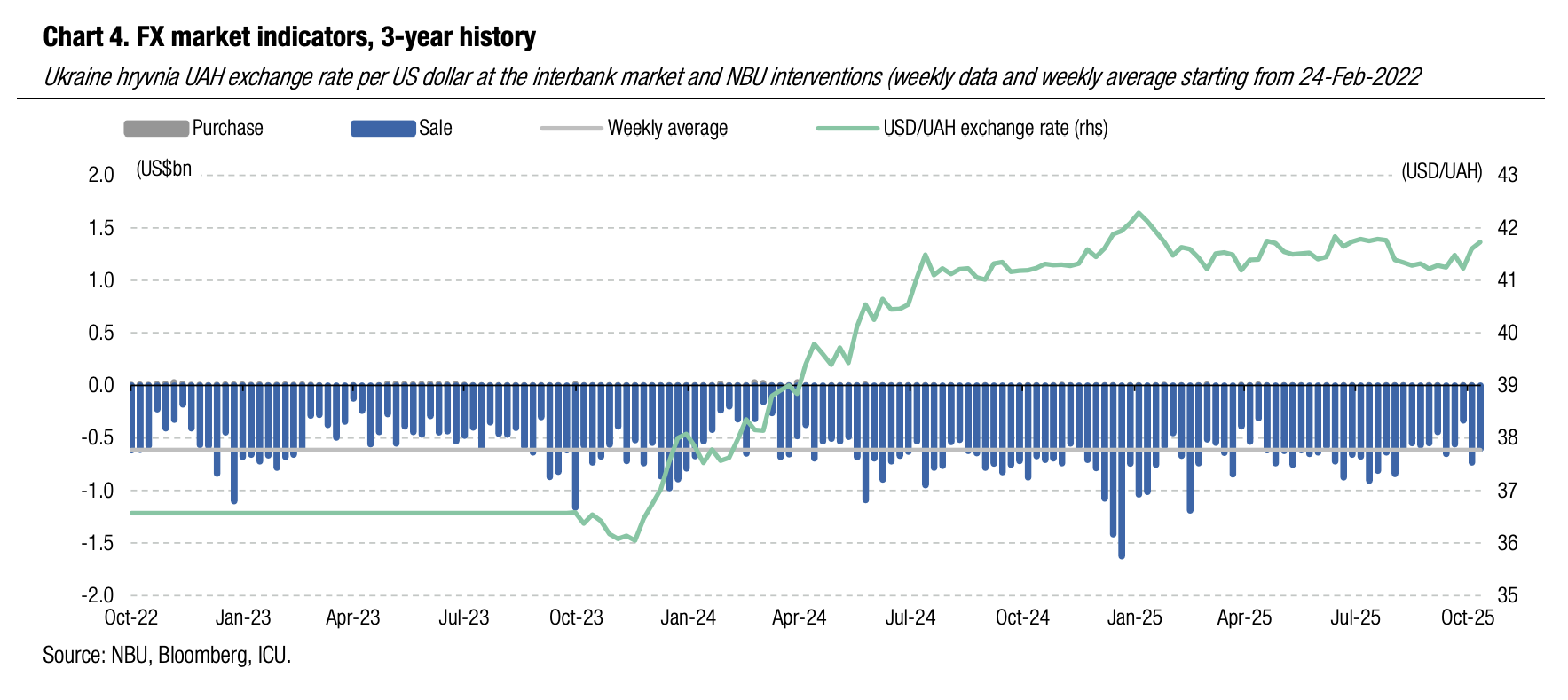

FX: NBU weakens hryvnia further

A significant foreign currency deficit prompted a new wave of hryvnia weakening last week.

The FX shortage remained significant last week at US$361m in four business days, and likely exceeded US$500m for the full week. The NBU sold US$603m from international reserves, 18% less than a week ago. At the same time, the NBU continued to weaken the hryvnia exchange rate. Over the week, the dollar was up by 0.3% to UAH41.73/US$ and the Euro rate increased by 1.4% to UAH48.76/EUR.

ICU view: Demand for foreign currency from bank clients (legal entities) grew last week, but the NBU was in no hurry to sell enough foreign currency to restrain the weakening of the hryvnia. The NBU managed to reduce the size of interventions since there were no significant FX purchases by the public sector. According to Bloomberg, the NBU continues to resist the IMF's pressure to weaken the hryvnia more significantly.

Economics: Reparation loan is a likely game changer for economy

The lingering war and heightened safety risks imply Ukraine will remain critically dependent on foreign financial aid for its defense efforts and macroeconomic stability.

Key points of our new macro review, published last Wednesday, are given below.

A new IMF program would be of little help if not funded properly. Fortunately, the EU started serious discussions about an EUR140bn reparation loan for Ukraine linked to russian frozen assets. The Ukrainian authorities believe the loan approval is highly likely and only the timeline is uncertain. Should the loan be stamped, Ukraine will receive much-needed reassurance that its fiscal needs are fully covered even in a pessimistic scenario of a prolonged war. Also, the NBU would be fully equipped to keep the FX market and hryvnia exchange rate under its full control for many years.

The flipside is that russian frozen assets were supposed to cover Ukraine reconstruction needs after the war, but the lack of alternative funding leaves no other choice for Ukraine and the EU but to start tapping them now.

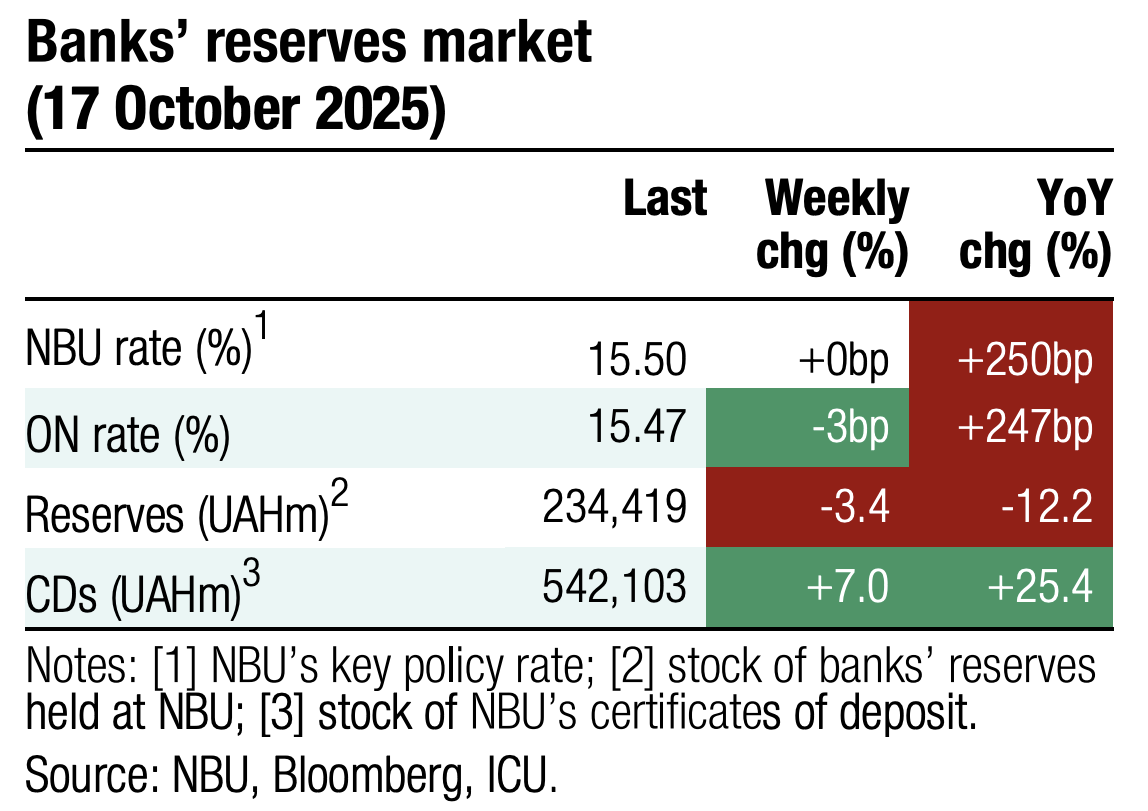

Economic growth is set to remain sluggish in the near future unless safety risks subside considerably. Inflation is decelerating at a good pace, exceeding NBU expectations. Price growth for nearly all consumer-basket components is slowing, indicating the disinflationary process is robust. However, we think that the NBU’s inflation target of 5% will remain out of reach in the coming years. All in, we believe preconditions are now in place for the central bank to switch to a gradual monetary-policy loosening cycle next week. We see the end-2025 key policy rate at 14.5%. In 2026, rate cutting will gain pace if a reparation loan is eventually approved.

The ample current-account deficit will remain a major long-term challenge, but it should be safely covered with foreign aid in the mid-term. Given this, we take a more constructive view on the exchange rate and see the end-2025 level at UAH42.4/US$ and end-2026 level at UAH44.5/US$. Our conviction is that growing external imbalances (net of foreign financial aid) will force the NBU to change its de-facto fixed exchange-rate policy and start a managed gradual hryvnia depreciation policy.

On the fiscal side, we see few risks as long as reparation loan approval is a realistic scenario. Importantly, this loan will not affect Ukraine’s debt sustainability metrics.