|  |

|  |

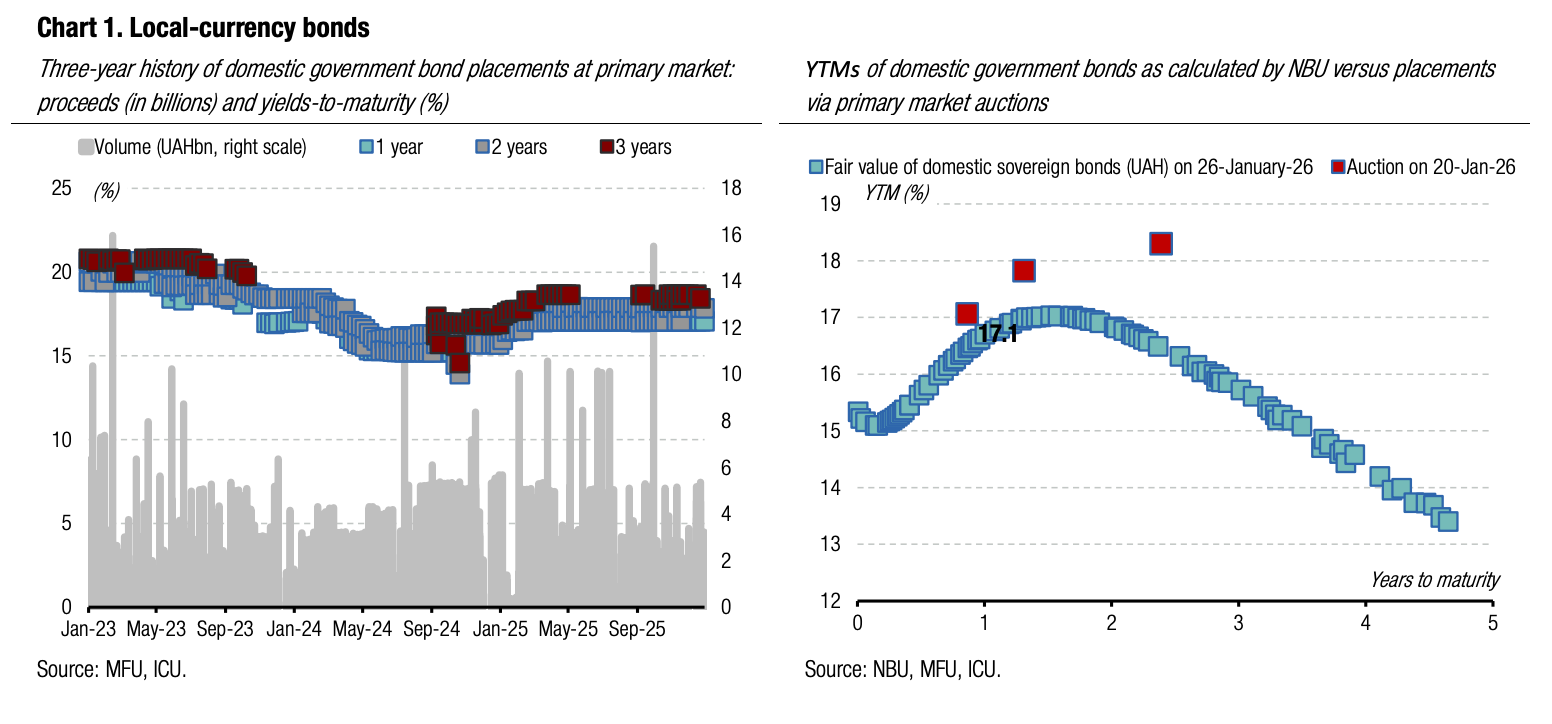

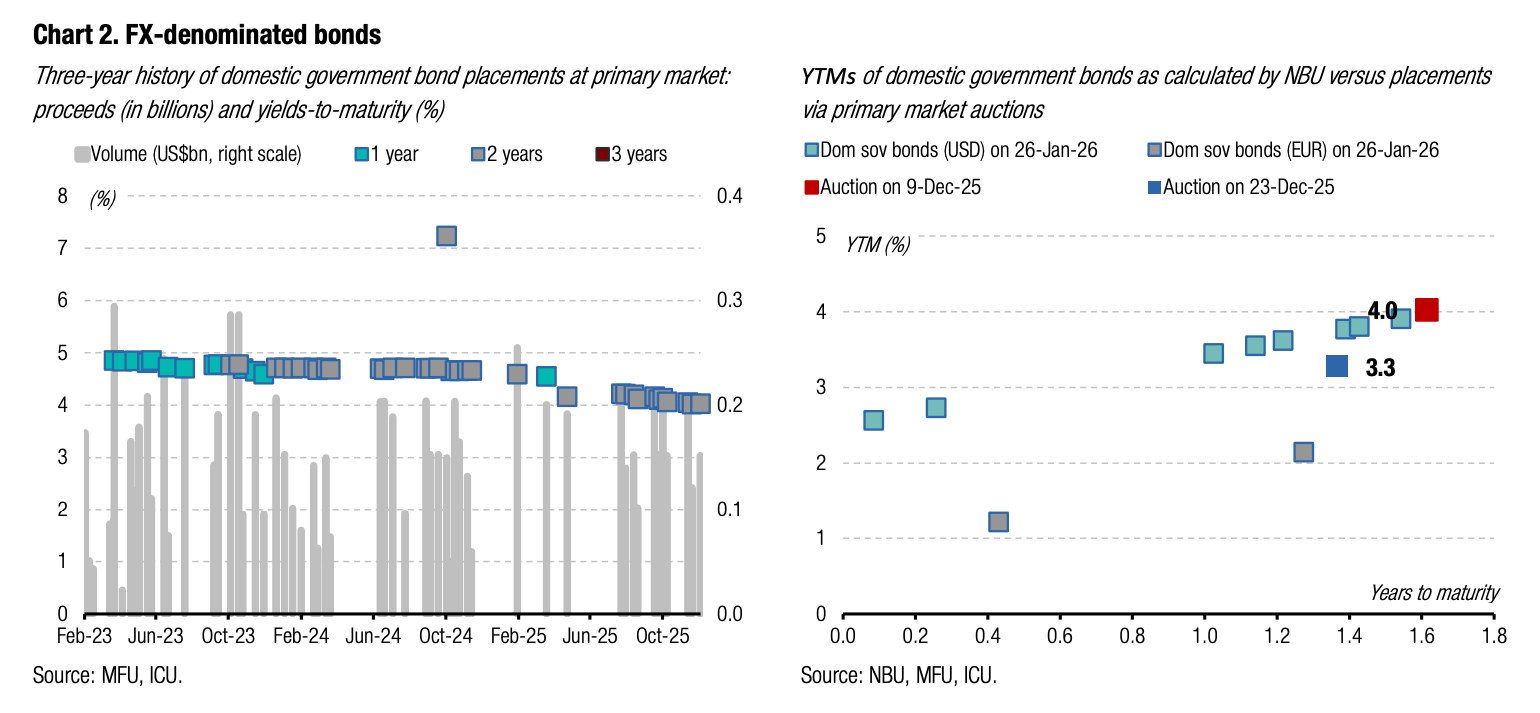

Bonds: MoF pushes yields down

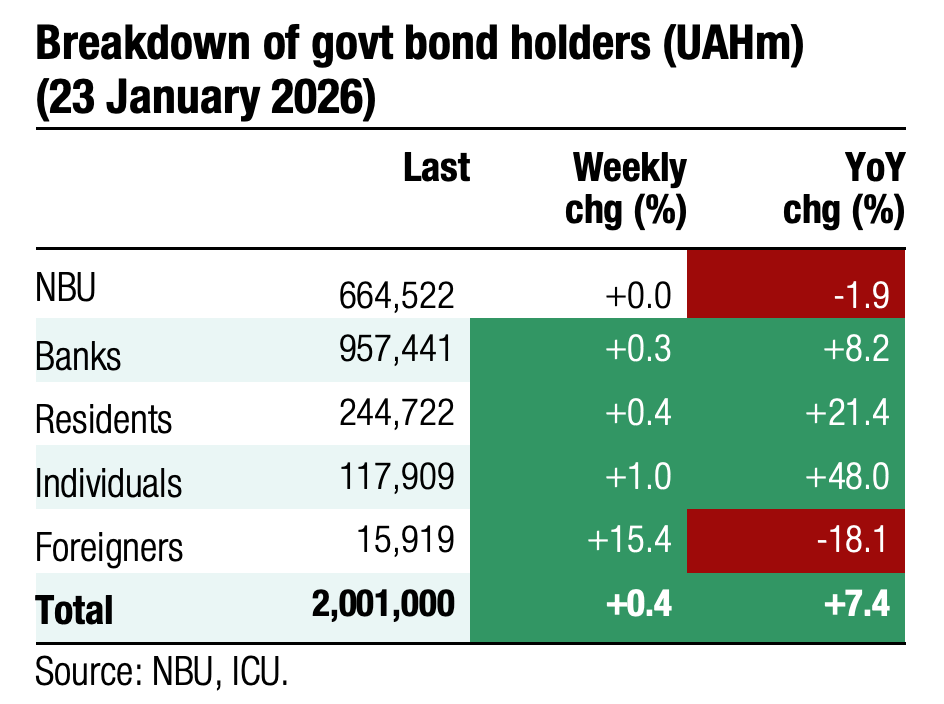

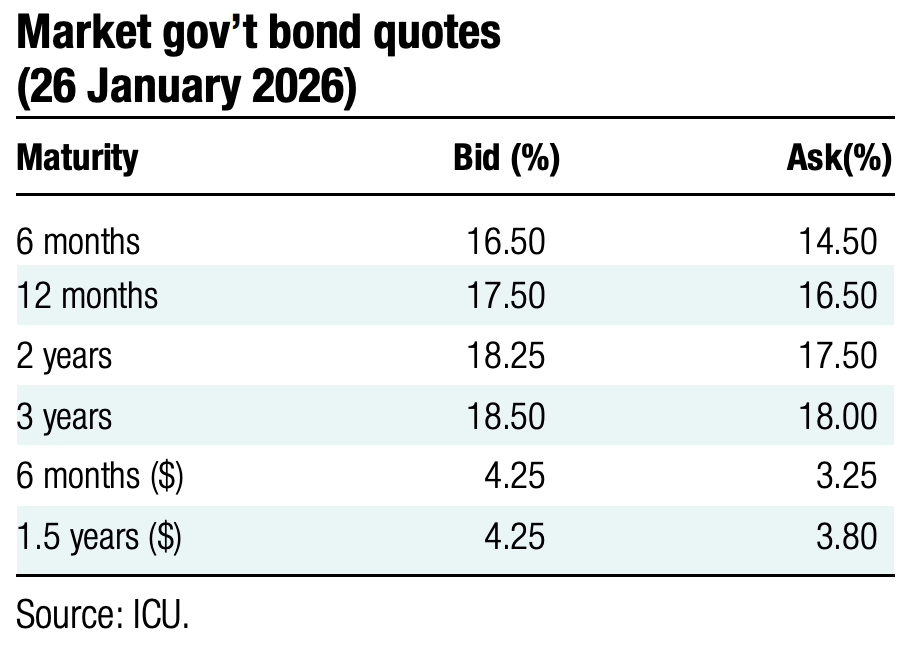

For the first time in almost 10 months, the Ministry of Finance made a move towards lower bond yields in anticipation of the NBU's cut in the key policy rate.

Last Tuesday, the MoF reduced the size of the UAH bond offering from the usual UAH5bn to UAH2-3bn, depending on the instrument. Lower caps resulted in higher oversubscription and encouraged bidders to compete through yields to have at least a part of their bid satisfied.

A new three-year instrument received strong interest and was oversubscribed by more than six times. The MoF managed to reduce the cut-off rate by 31bp and the coupon rate by 32bp compared with a similar instrument placed until mid-January. See details in the auction review.

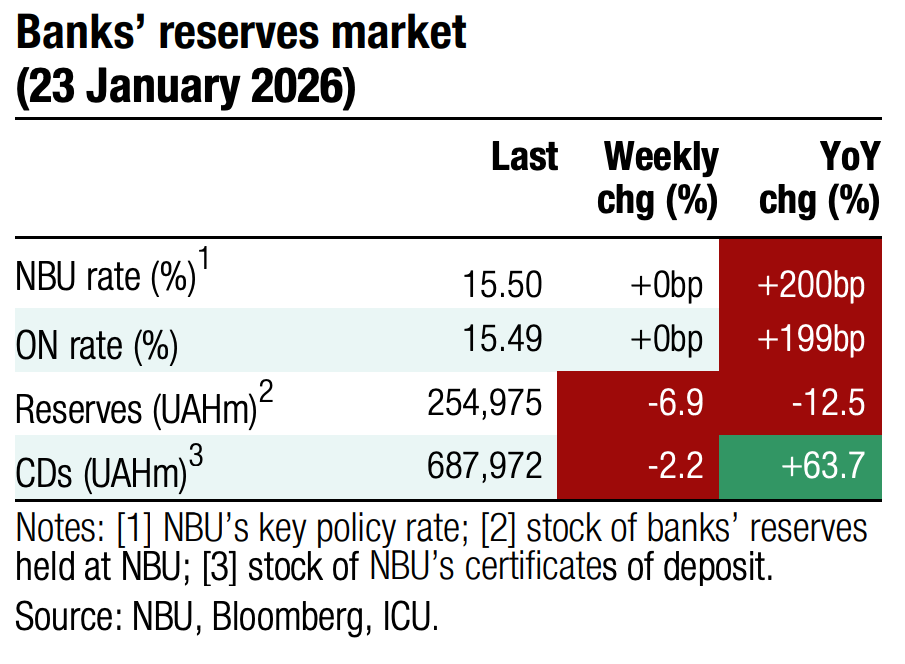

ICU view: In anticipation of a key policy rate cut at the end of January, the Ministry of Finance encouraged bidders to step up competition by submitting more bids with varying yields. Yet, auction participants were in no rush to adjust yields aggressively and allowed the MoF to reduce the coupon rate by only 32bp. We expect the NBU to switch to a monetary policy easing cycle and reduce its key rate by 50bp to 15% this week. Such a decision may also affect yields of UAH bonds in the primary market. However, given the frontloaded reaction last week, the additional decline in rates on medium-term paper is unlikely to be significant. Yet, the rates on short-term bonds may see larger declines as they remained unchanged last week.

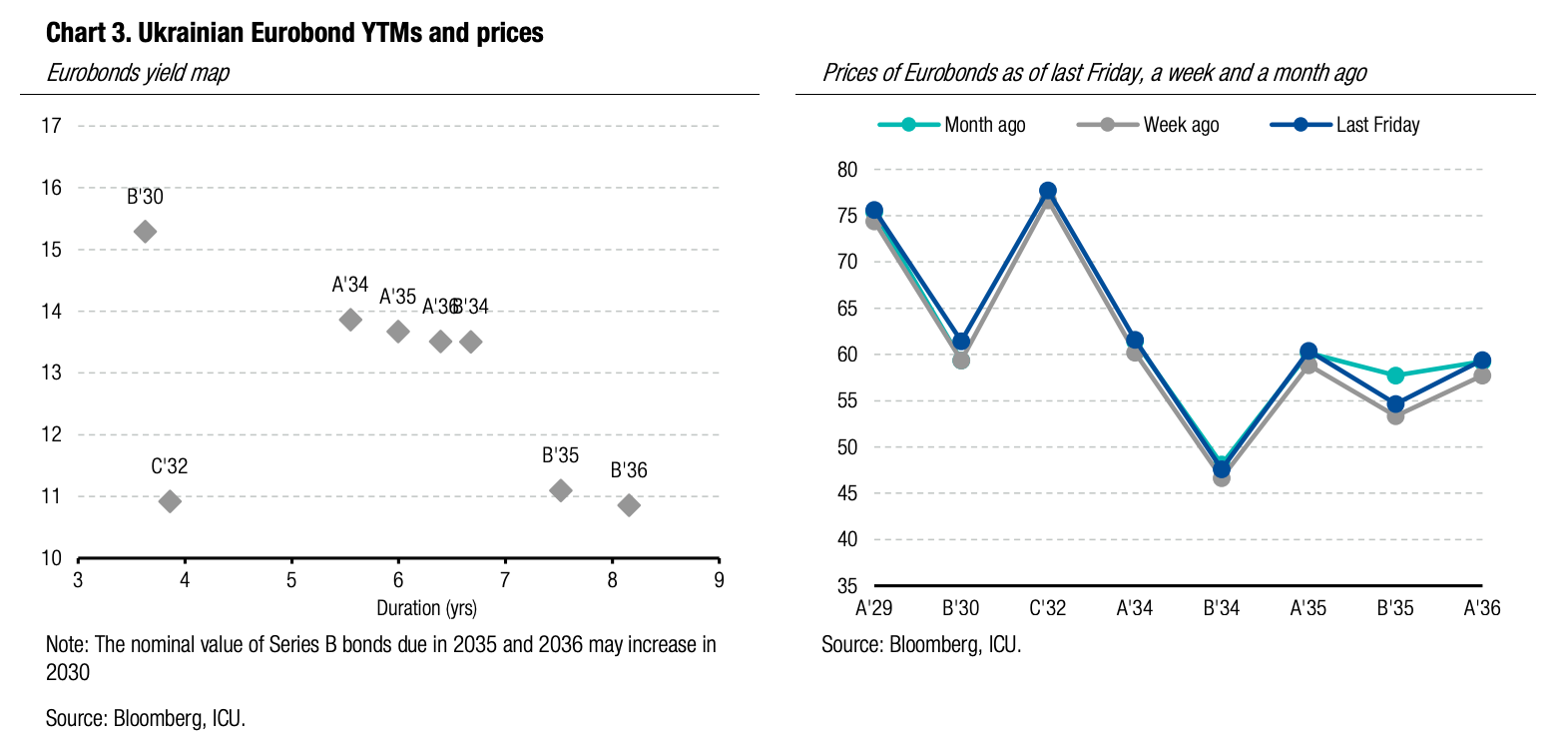

Bonds: Negotiations momentum adds some optimism

Peace negotiations to stop russia’s war in Ukraine intensified last week with high-level meetings held during the World Economic Forum in Davos. Yet, the net effect of the emotionally volatile talks was only marginally positive.

Ukrainian Eurobond prices rose sharply last Thursday, by an average of almost 4%, when the meeting of Ukraine and US presidents at the Davos forum was confirmed. During the meeting, the presidents agreed to start trilateral US-Ukraine-russia talks, the first since the war. The first round of these talks took place on Saturday. Although information on specific points of discussion is very fragmented and incomplete, the feedback from all three parties indicates some progress.

ICU view: In the coming weeks, the progress of the peace talks or lack of it will be the only significant factor influencing investor sentiment. At this stage, we do not see sufficient signals that russia is close to a crucial decision to reduce hostilities along the front line and the shelling of the civilian infrastructure.

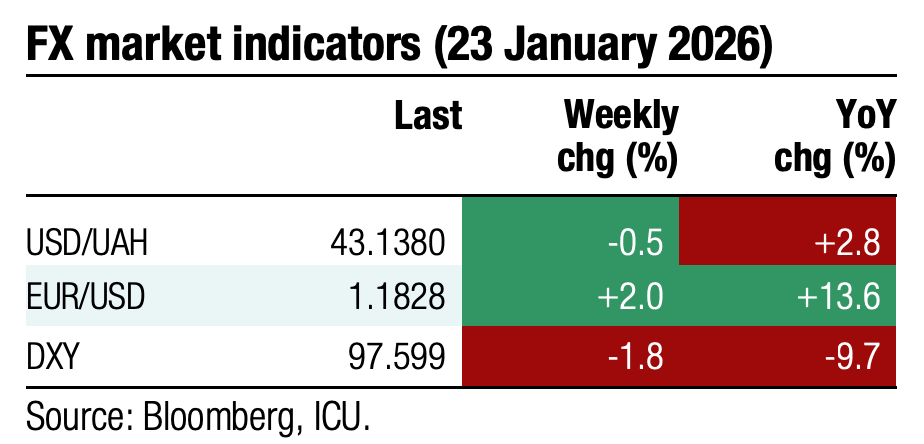

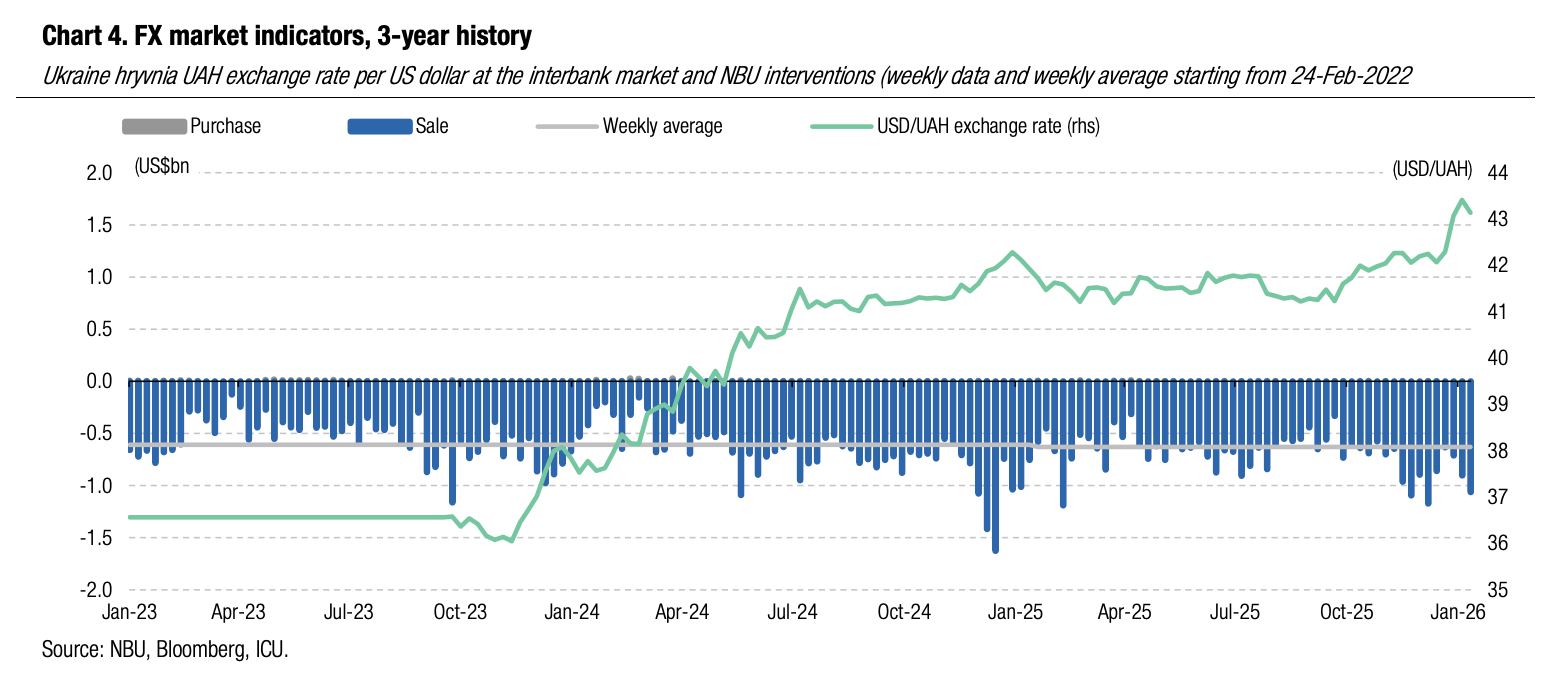

FX: NBU takes efforts to strengthen hryvnia

Last week, the NBU increased interventions aiming to push the hryvnia exchange rate back closer to UAH43/US$.

The foreign currency shortage in the market continued to grow last week and reached US$696m in four business days, +26% WoW.

To meet higher net demand, the NBU sold almost US$1.1bn of foreign currency last week, the highest level in five weeks. Thanks to these NBU efforts, the official hryvnia exchange rate remained below UAH 43.2/$ for most of the week.

ICU view: Heightened demand for foreign currency has been present for the third week in a row, which does not allow the NBU to strengthen hryvnia exchange rate below UAH43/US$ and forced the NBU to increase interventions. We expect the NBU to maintain its efforts to strengthen the hryvnia exchange rate after the rapid devaluation YTD.