|  |  |

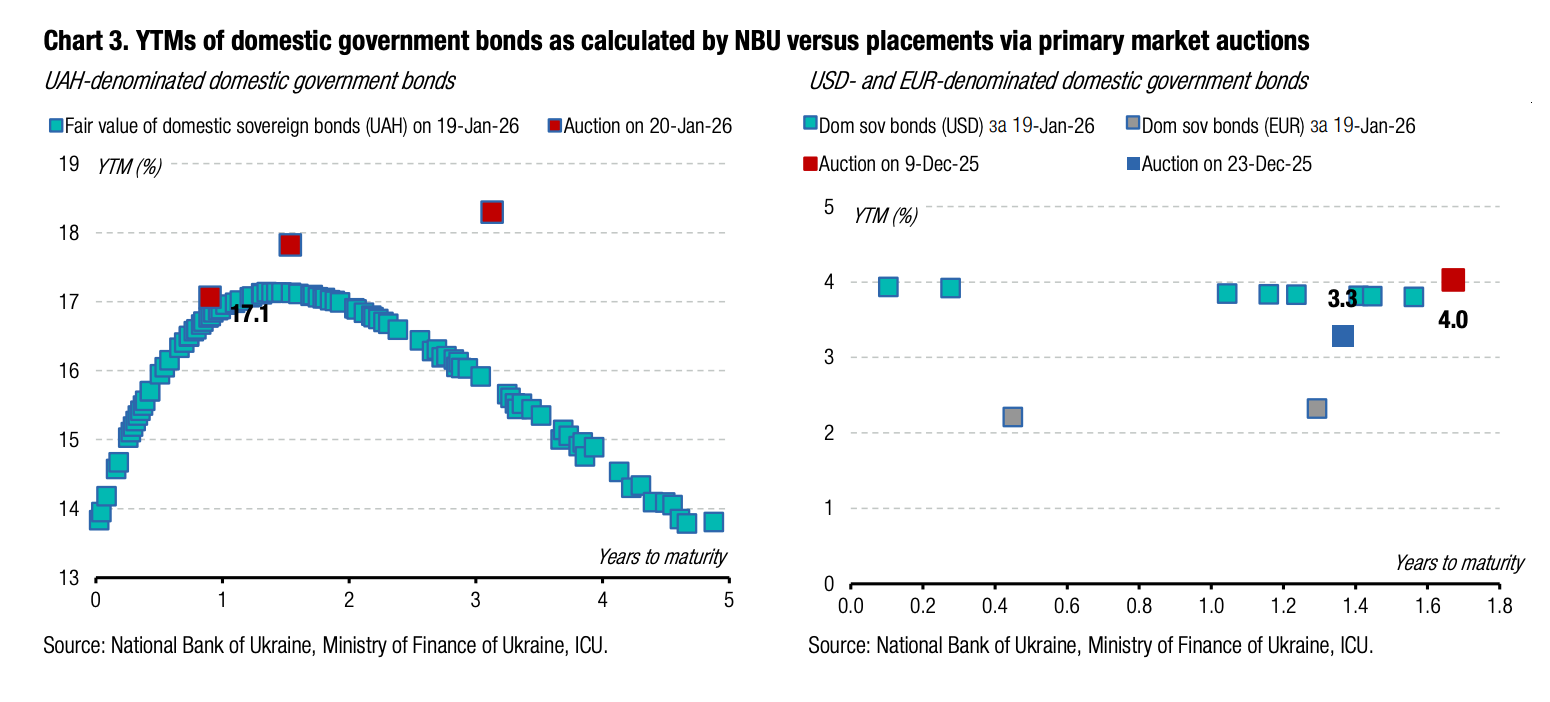

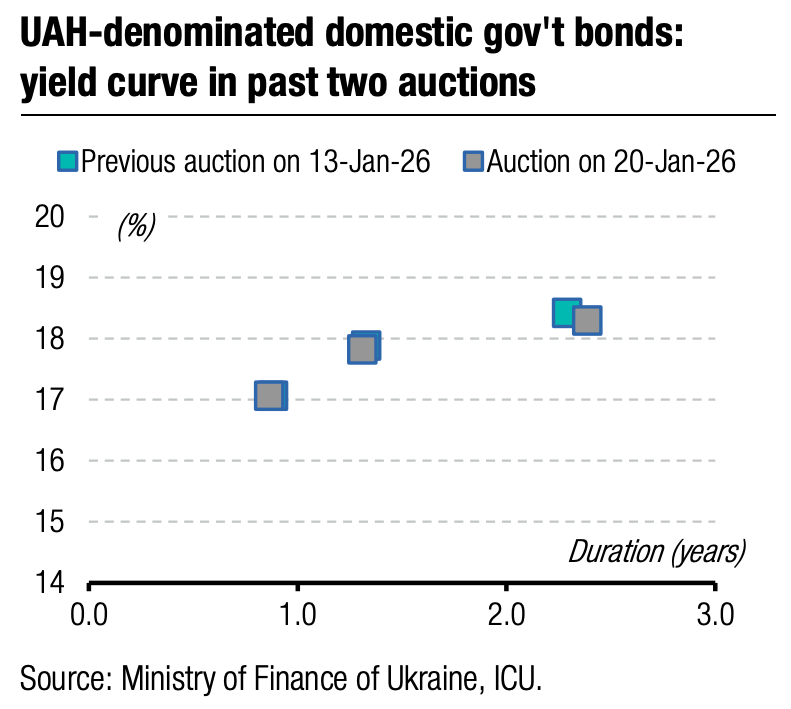

Yesterday's auction demonstrated the MoF's desire to reduce the cost of servicing new debt and move towards lower interest rates ahead of the National Bank, which, in a week, will announce the key rate for the next month.

For the first time in a very long time, the MoF reduced the cap for all offered UAH bonds from the usual UAH5bn to UAH2-3bn, and also offered a new instrument with a maturity in March 2029.

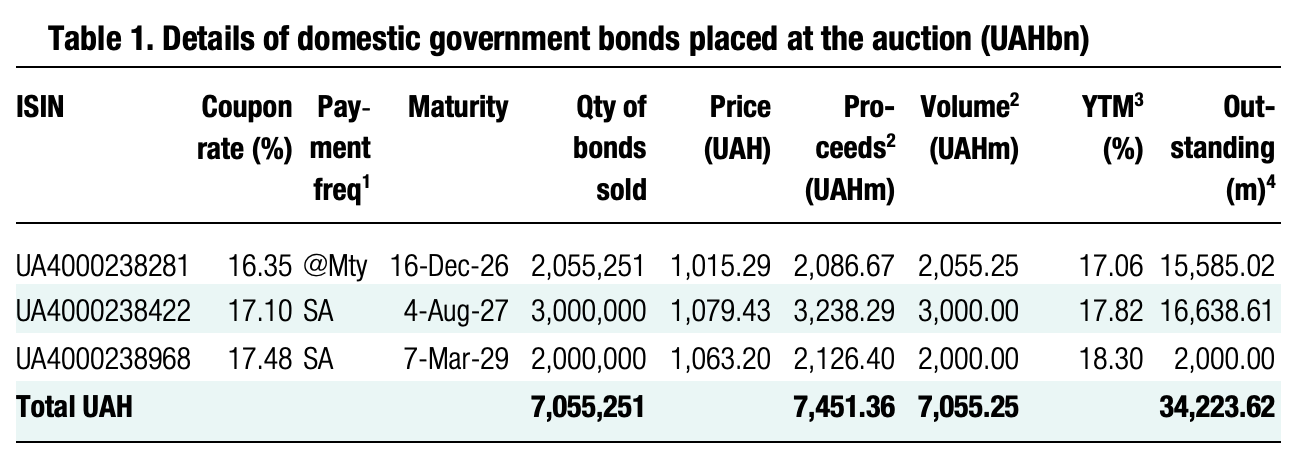

The shortest military bills received very restrained demand, at UAH2bn in 27 bids. The bid rates were typical, 16.3-16.35%, so the final yields were unchanged: a 16.35% cut-off rate and a 16.34% weighted-average yield.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.39/USD, 49.53/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

At the same time, longer bonds received considerable oversubscription and saw yields decrease. The 1.5-year paper received almost UAH11bn in demand, i.e., 3.6x oversubscription, and the new three-year note – 6.5x.

Yields on bids for the purchase of 18-month bills ranged from 16.94% to 17.1%, and the offered volume was exhausted at 17.05%. The MoF set the cut-off rate at this level and the weighted average rate was 17.04%.

Bids for the new three-year note were all at rates lower than for bonds maturing in November 2028, which were sold until last week. The maximum bid rate was 17.7% (10bp lower), and the minimum was 17.44%, which was 16bp lower than it has been for such securities for almost a year.

Since the offer volume was only UAH2bn, the Ministry rejected most of demand. The cut-off rate was set at 17.49%, or 21bp lower than last week, and the MoF set the weighted average rate at 17.48%, which was 32bp lower than the coupon rate for government bonds maturing in November 2028.

The MoF encouraged bidders to increase competition, especially for new securities, as expectations that the NBU will indeed lower the discount rate at the end of January are growing. At the same time, auction participants were very restrained in their attitude towards competition and allowed the Ministry of Finance to reduce the coupon rate by only 32bp.

Appendix: Yields-to-maturity, repayments