|  |  |

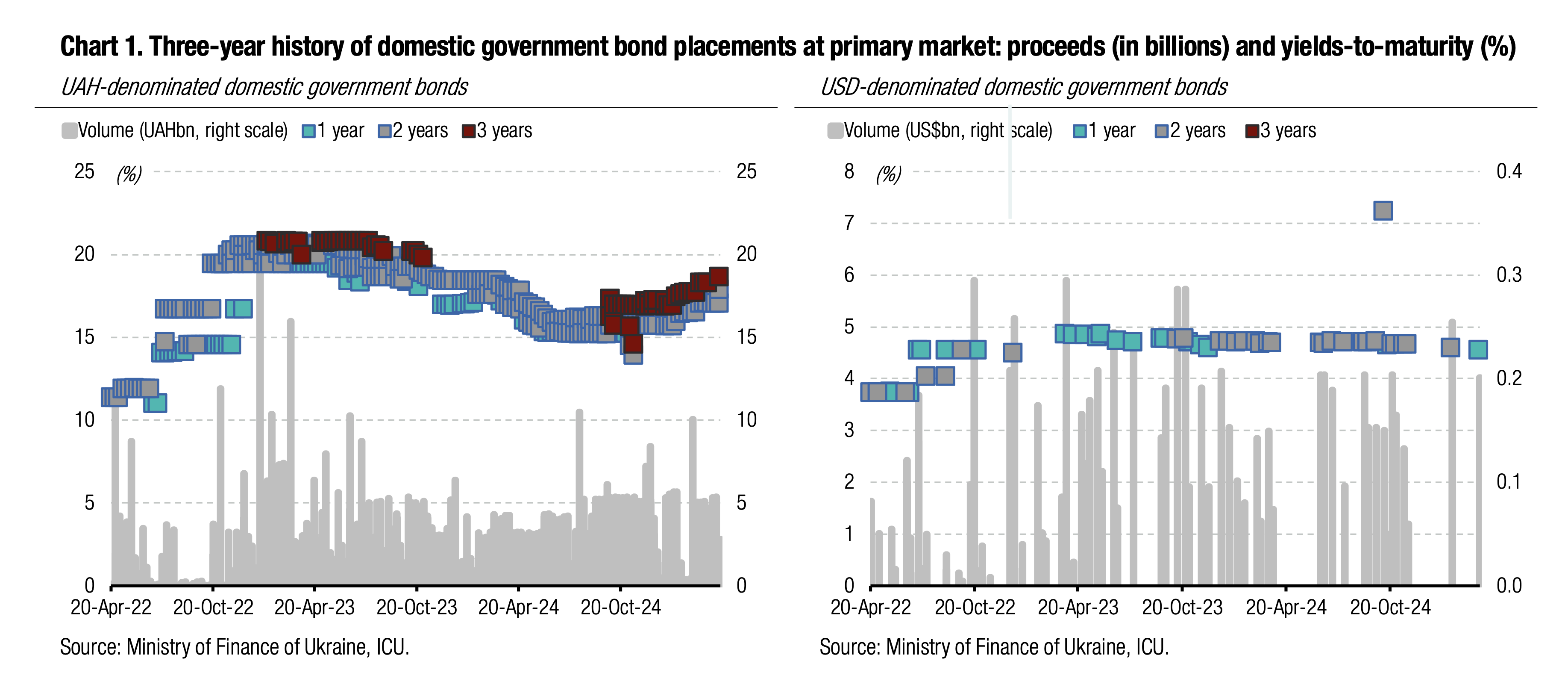

After a three-month break, the MoF offered an ordinary three-year note yesterday. The new bond was oversubscribed, and the MoF did not accept all bids.

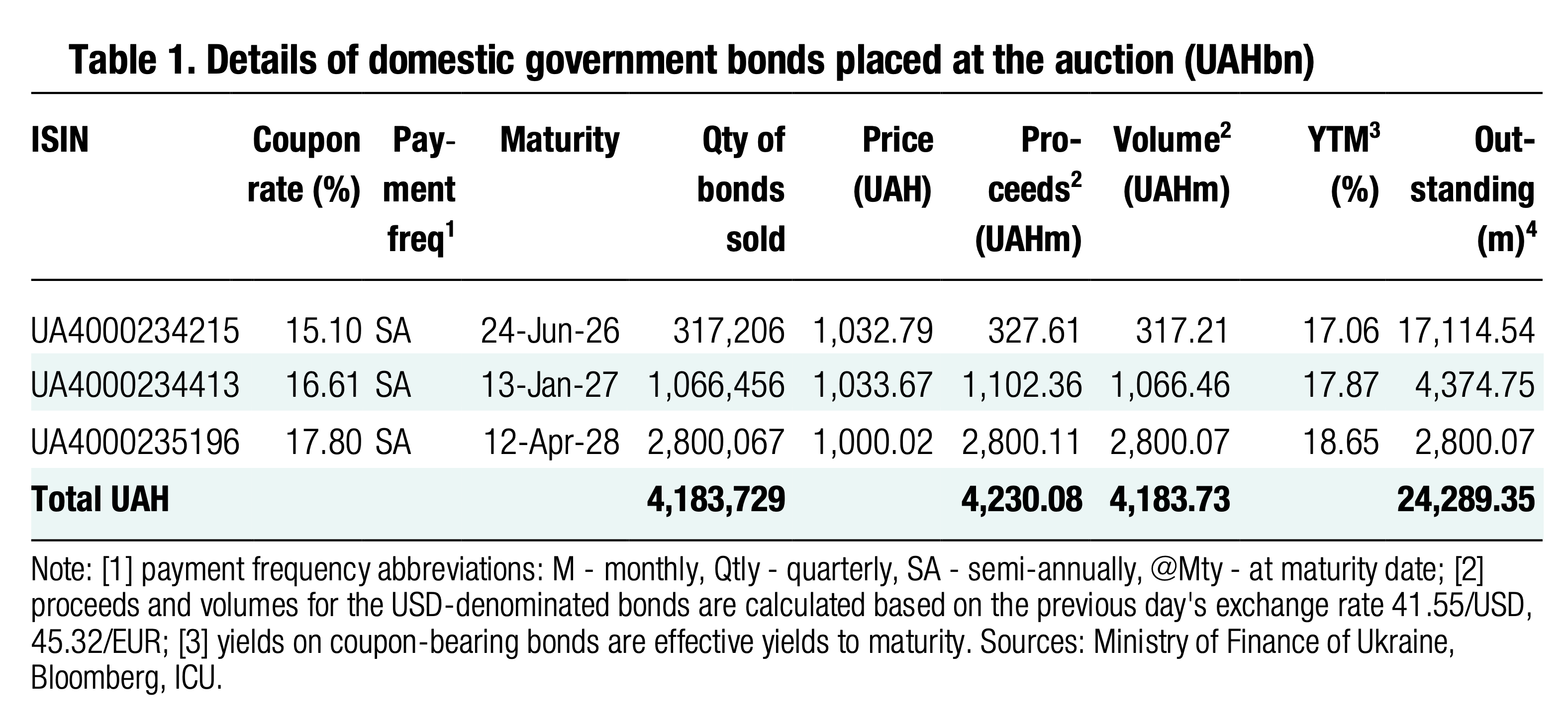

The 14-month military bill received 17 bids, amounting to just UAH317m, one of the smallest amount of demand for this paper. Interest rates in bids were as expected. Therefore, the MoF accepted all of them, receiving UAH328m of proceeds.

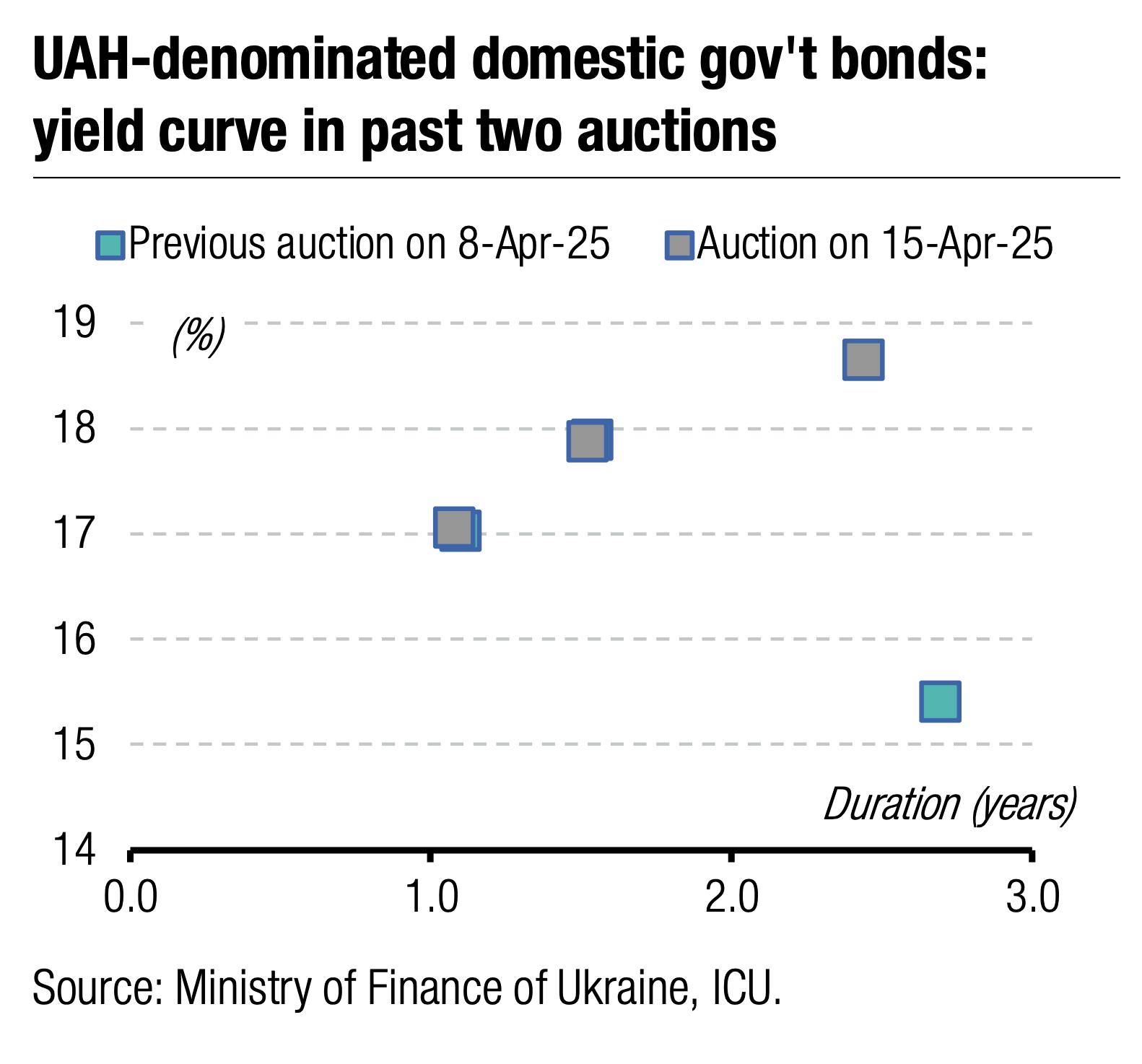

Demand for the 1.8-year ordinary paper was more significant. Despite the small number of bids, the MoF accepted them and borrowed UAH1.1bn. In contrast to the previous two primary auctions, no bid required an increase in yields.

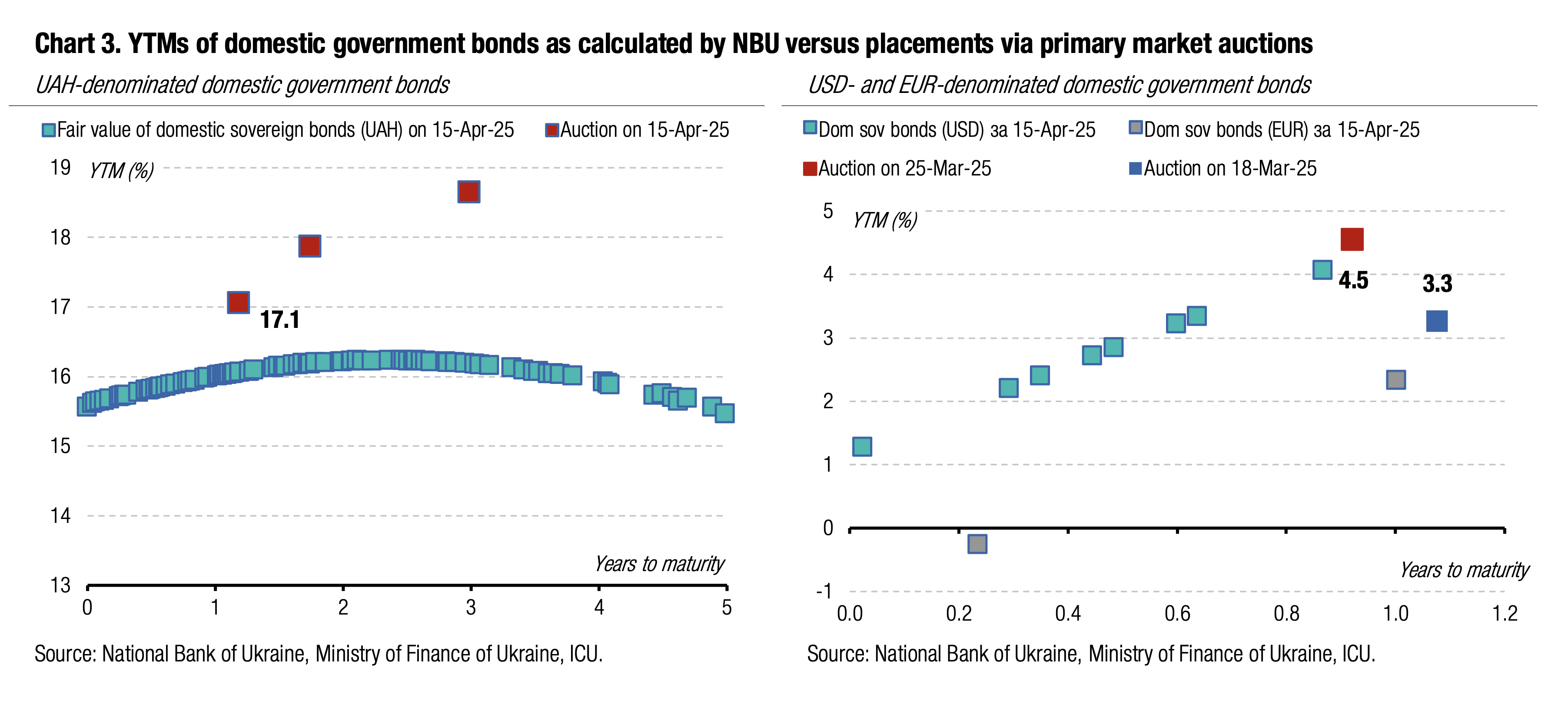

The new three-year ordinary note received 18 bids for bonds worth UAH6.3 bn. Most of the bids, (for UAH2.8bn), were with interest rates in the 17.7-17.8% range or were non-competitive. The MoF accepted such bonds, rejecting just three for UAH3.5bn, which required an increase in the cut-off rate up to 18.5%.

The MoF agreed to the maturity premium for the three-year note at 70bp to 1.8-year paper or with 15 months or longer tenor, or 5bp less than between 14-month and 1.8-year bills. However, the new cut-off rate is 131bp above the rate for the same maturity sold at the beginning of January. The MoF increased yields this year by 125bp for the one- and two-year securities.

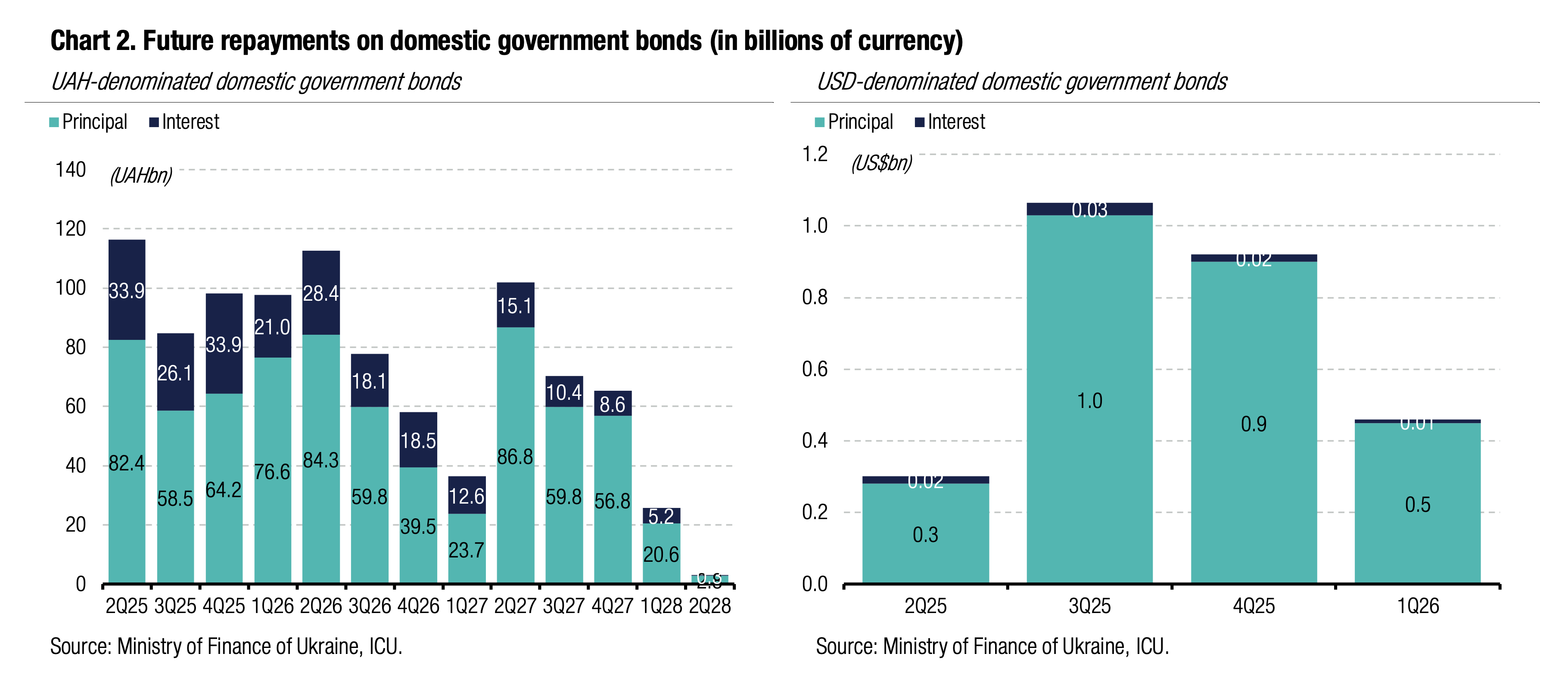

Finally, the MoF received UAH4.2bn of budget proceeds, a good amount without reserve bonds. The MoF will offer a special reserve bond today in exchange for reserve paper due in a month. This week's offering demonstrated the MoF's unwillingness to hurry up in preparation for the 100% rollover.

Appendix