|  |  |

The MoF offered both military and regular bonds, seemingly not in a hurry to borrow more funds. Therefore, the MoF did not offer reserve bonds.

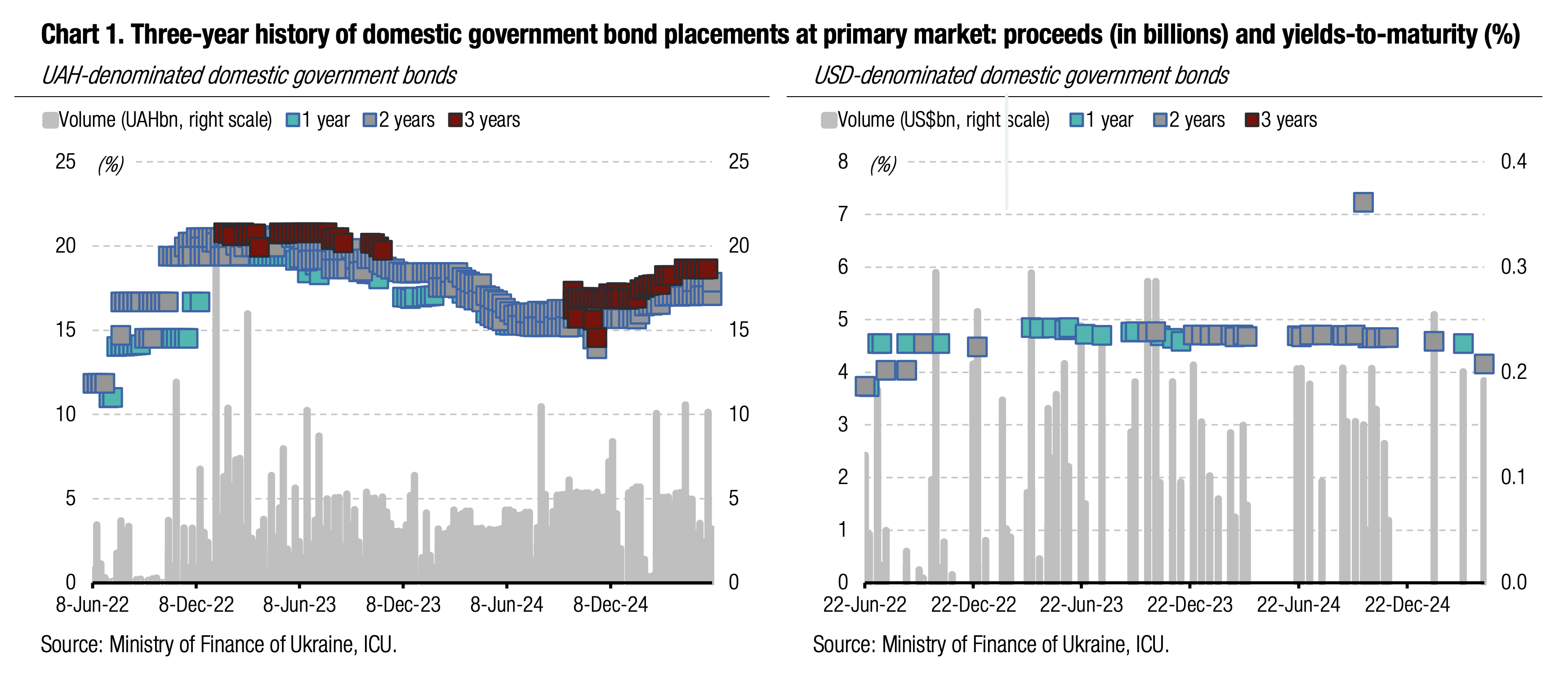

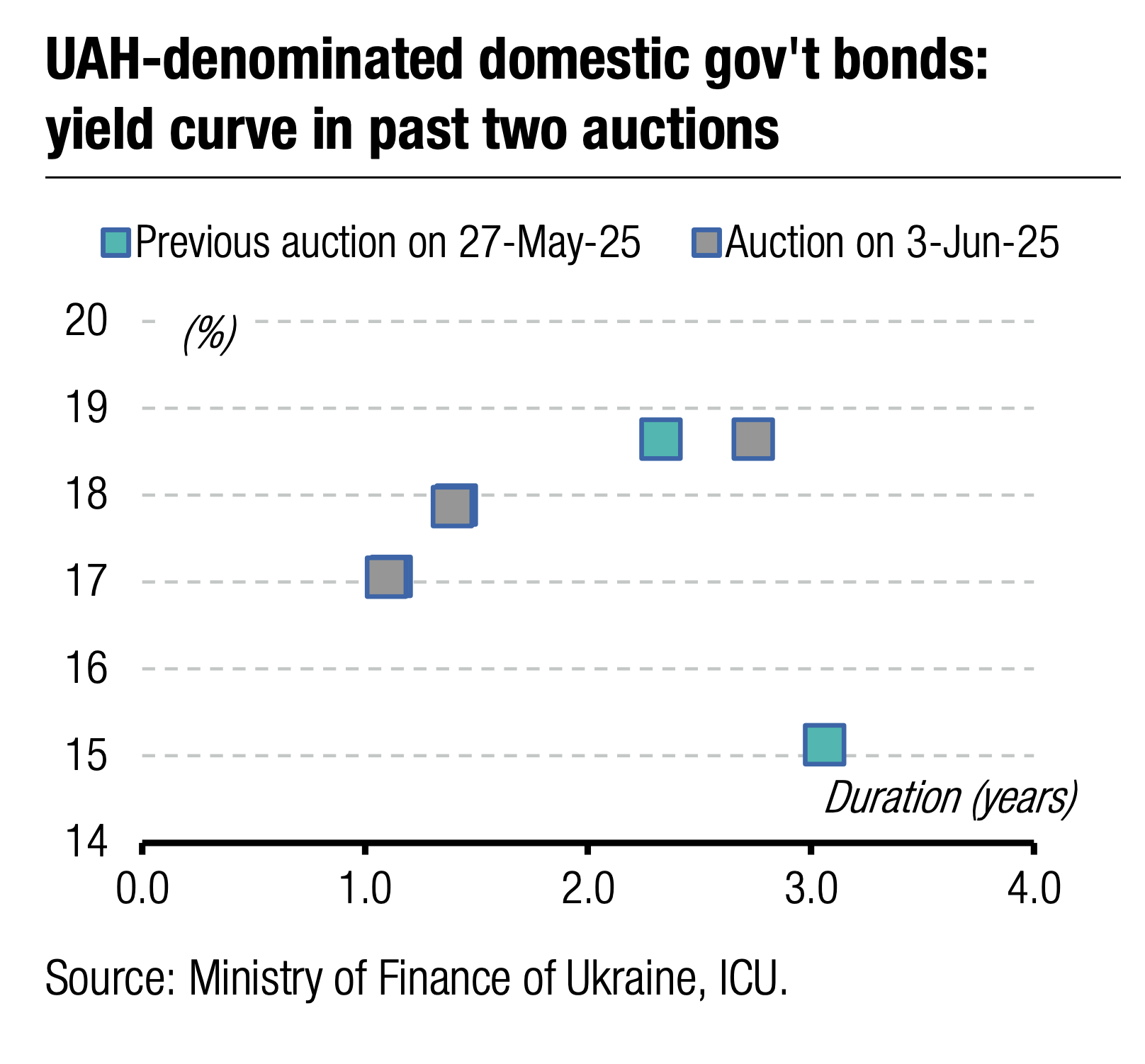

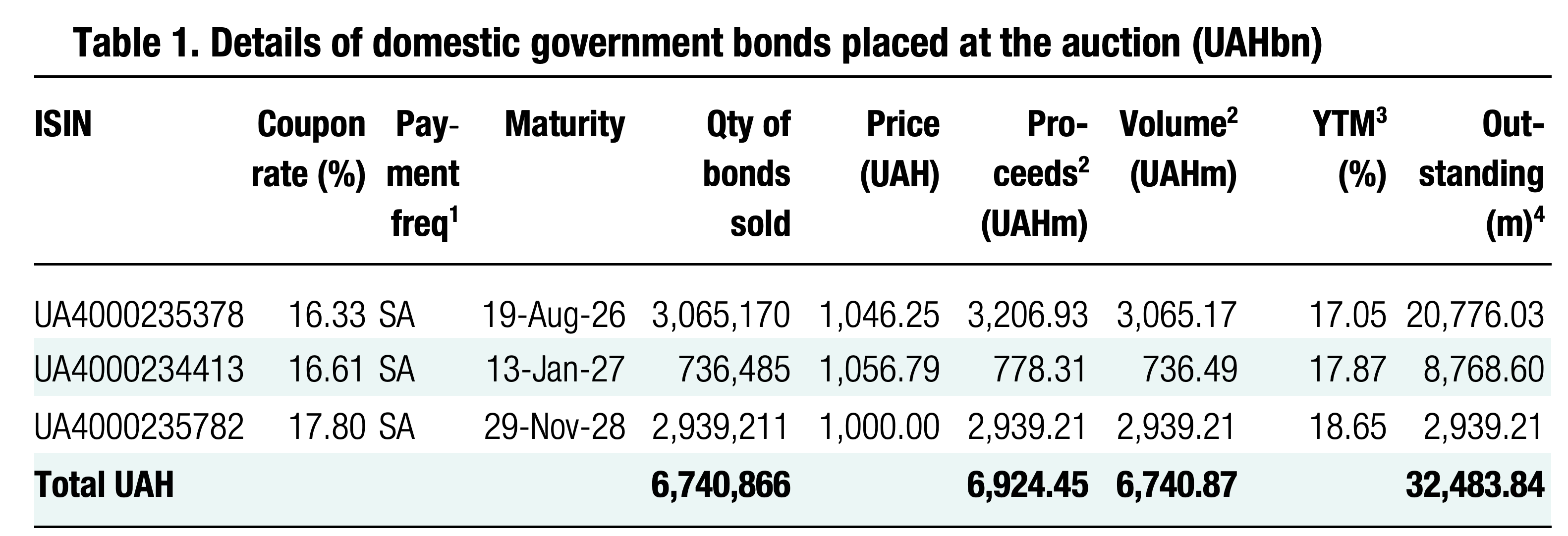

The MoF offered the usual 15 and 20-month bills yesterday, replacing a three-year note with a new issue due at the end of November 2028.

Demand expectedly focuses on 15-month and three-year bonds, while 20-month paper received just 0.7bn of bids.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 46.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

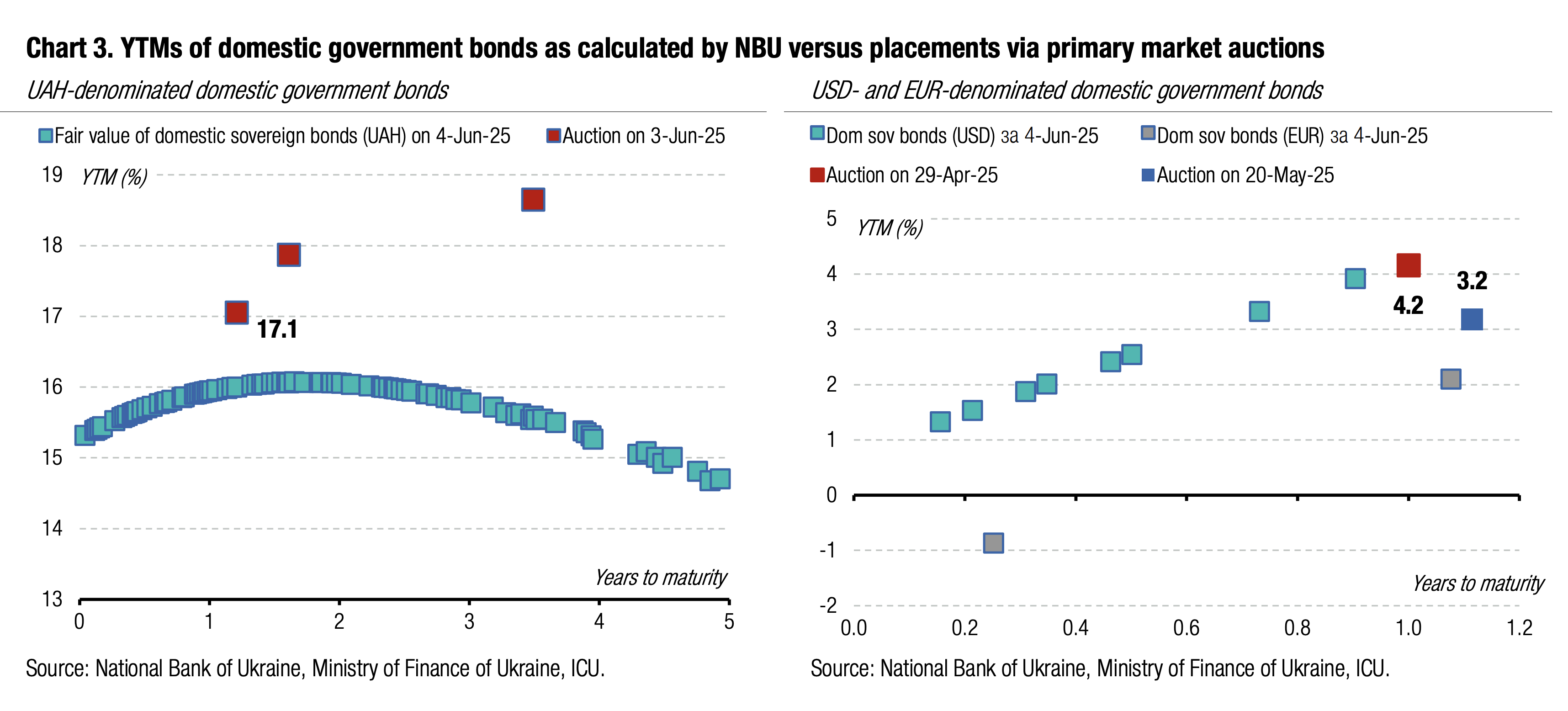

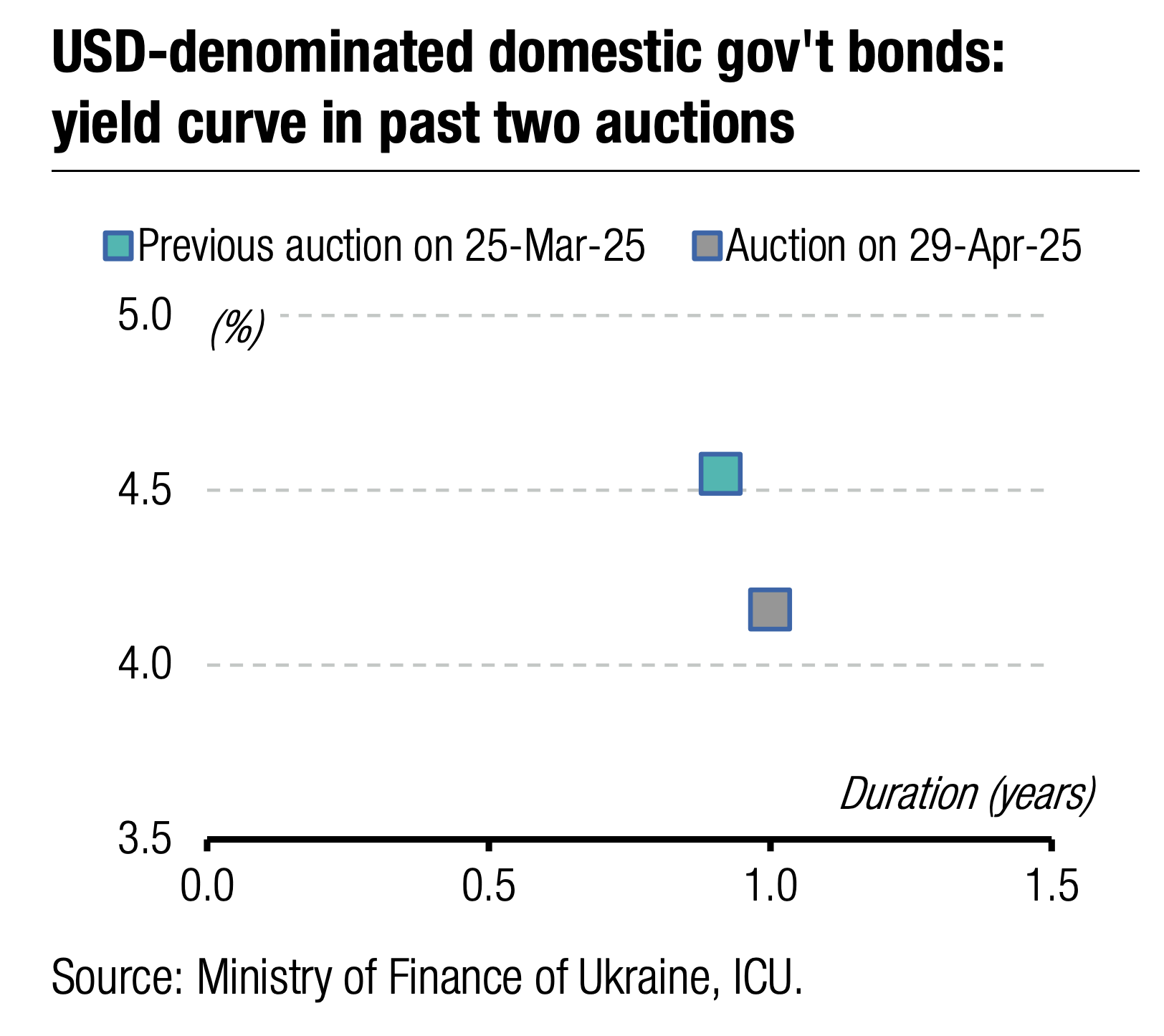

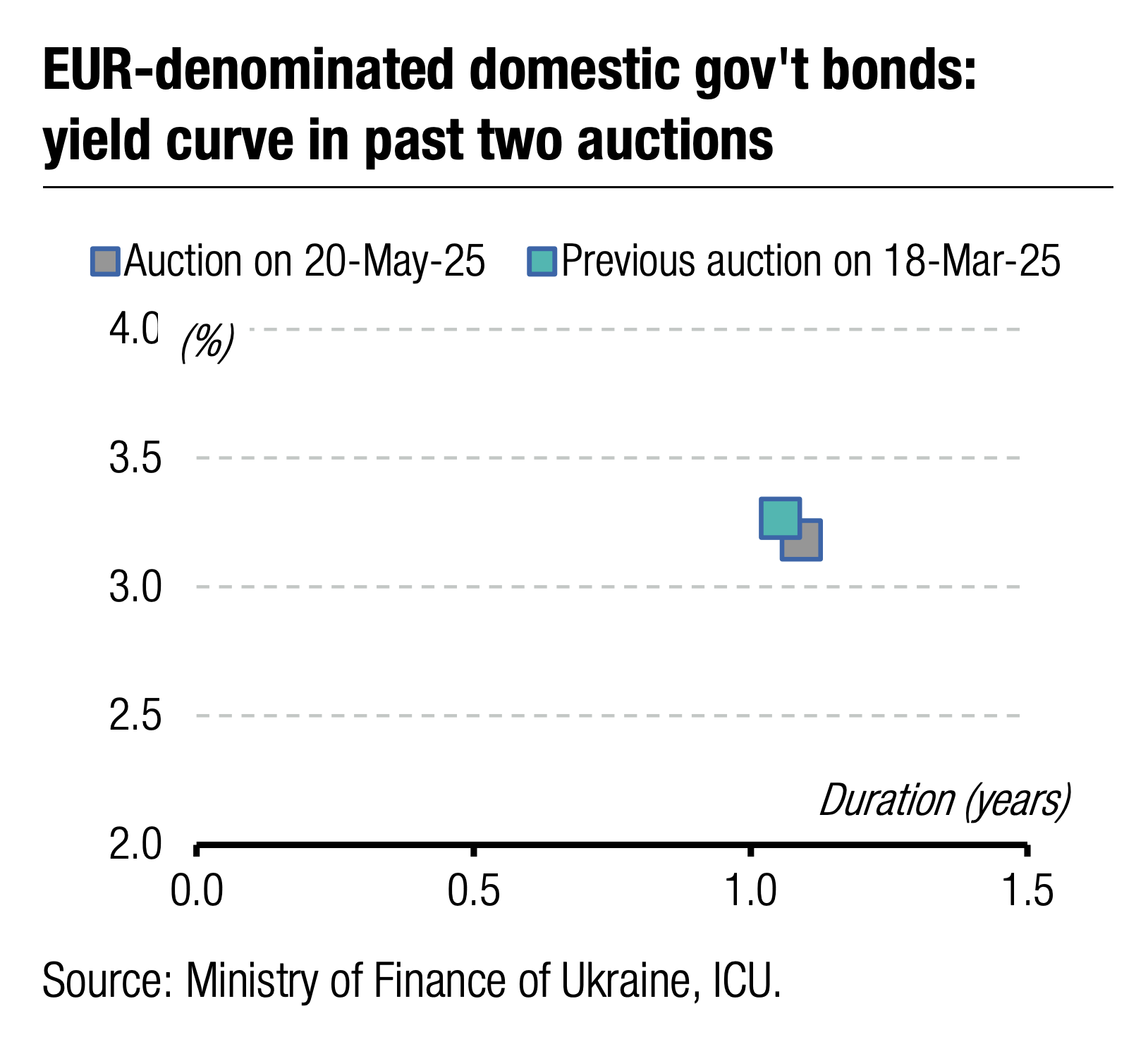

Interest rates for 15 and 20-month bills remain almost unchanged. At the same time, the MoF set cut-off and weighted average rates for the new three-year note at 17.8%, rejecting three bids with higher yields.

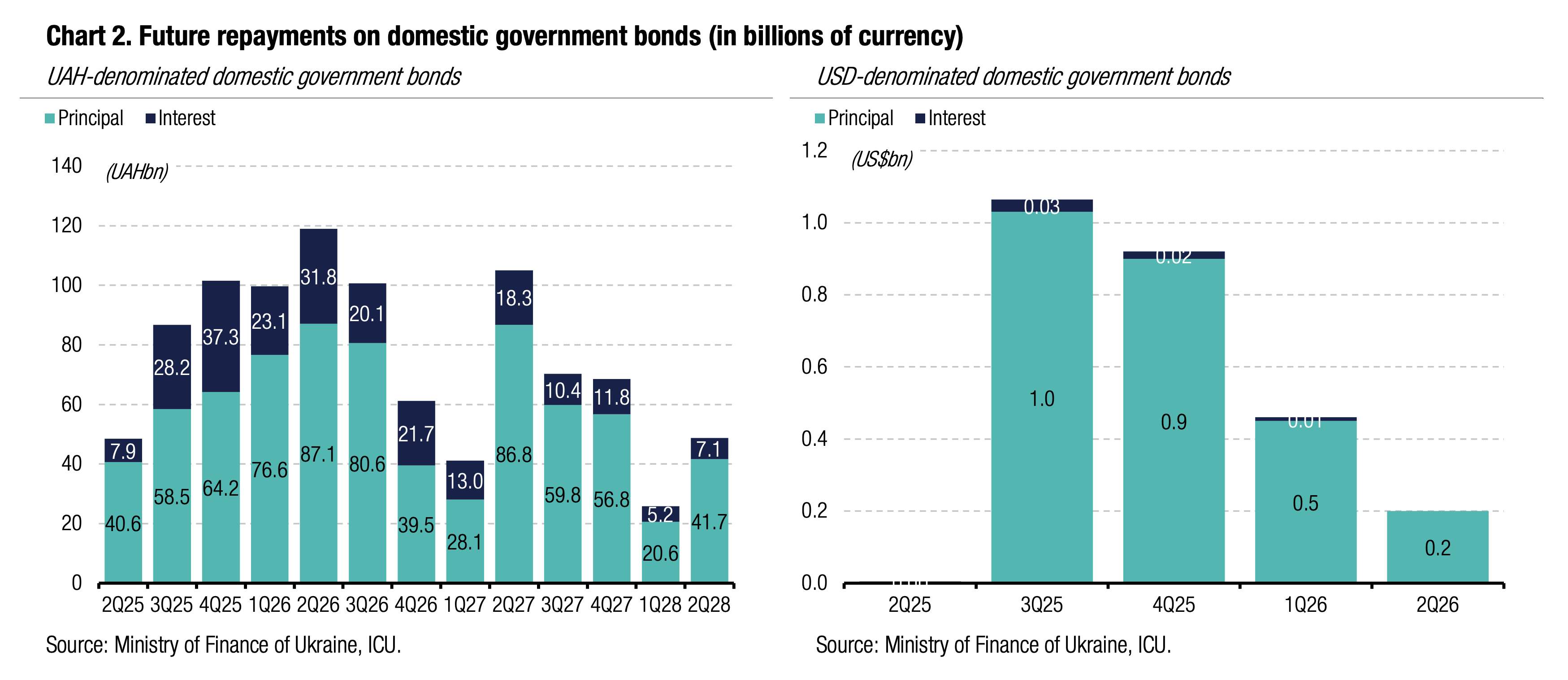

The state budget received UAH6.9bn of proceeds yesterday, which will not cover weekly needs to maintain the rollover of the UAH debt above 100%.

Appendix