|  |  |

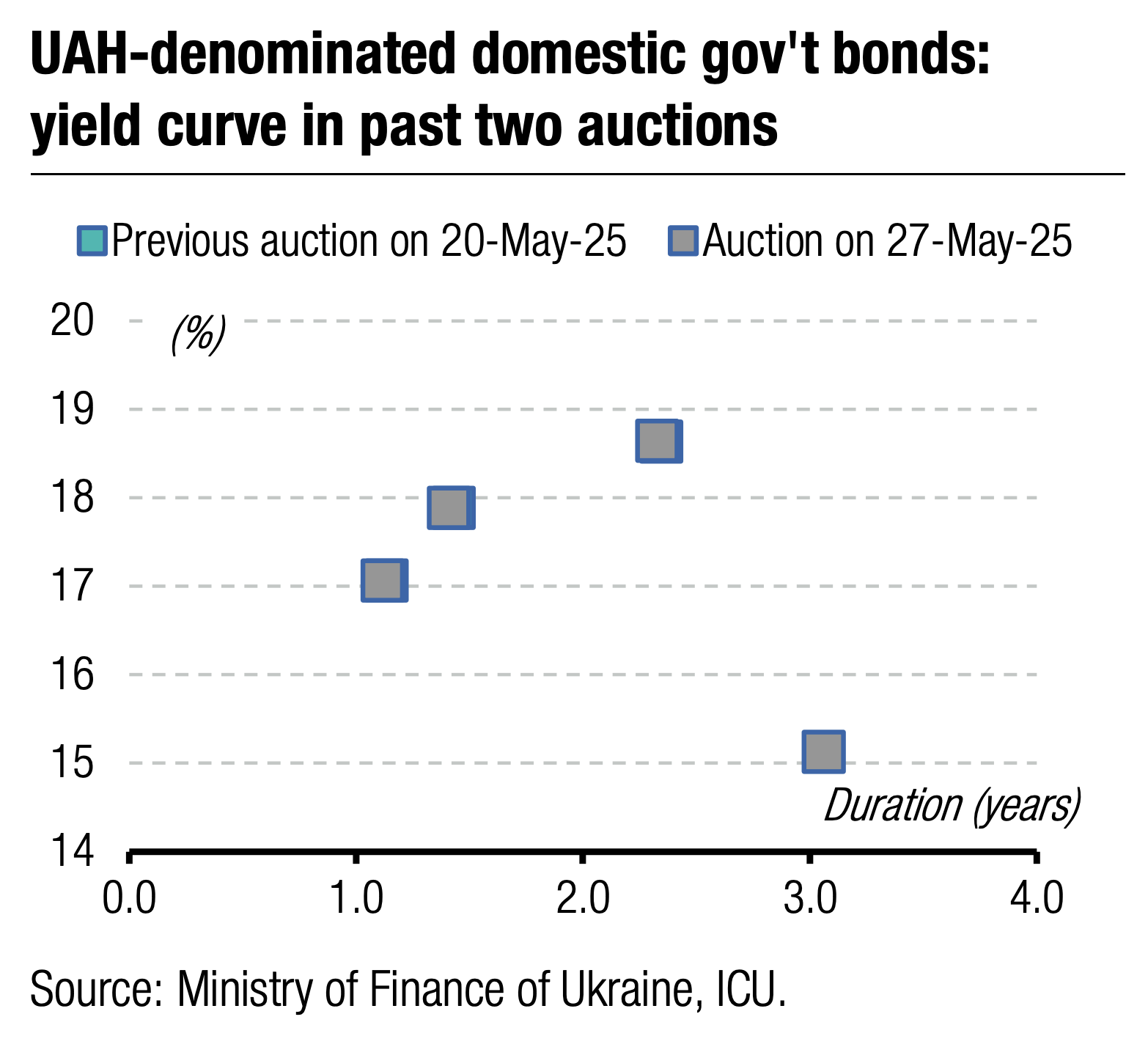

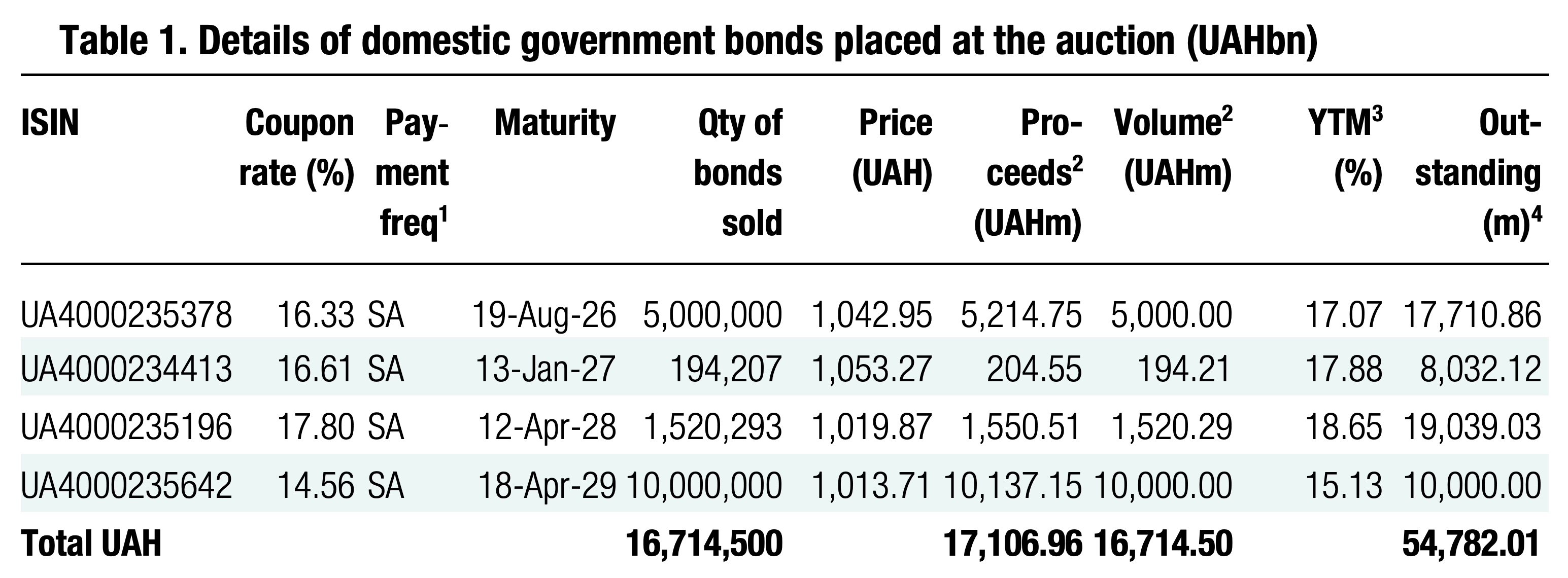

The Ministry of Finance has reintroduced reserve bonds in the primary bond auctions, resulting in a significant increase in proceeds in local currency.

The 15-month military bills were oversubscribed almost 2x in 25 bids at interest rates ranging from 16.3% to 16.35%. However, due to a UAH5bn cap, the MoF had to partially satisfy these bids.

In contrast, demand for the 20-month bonds halved yesterday. The MoF chose to satisfy all bids without changing the cut-off and weighted average rates.

Interest rates for the three-year notes remained unchanged as well. The MoF sold these notes to all 13 bidders for UAH1.5bn.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 46.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

The most notable demand was seen for the new four-year note. It is expected that banks will be allowed to use these notes to cover their mandatory reserves. The MoF received UAH41.2bn of bids, exceeding the UAH10bn cap. The highest bid rate was 15.8%, which is 170bp lower than the rates for similar reserve bonds at the end of January. The lowest bid rate was 13.9%, which is 62bp higher than in January. Ultimately, the MoF set the cut-off rate at 14.85% and the weighted average rate at 14.56%, reflecting increases of 86bp and 64bp compared with January. It is important to note that these interest rate increases are smaller than the 125bp rise that has been observed for regular bonds since January.

After a month-long break, the MoF has resumed offering reserve bonds, and the NBU is expected to soon allow banks to use these bonds to cover part of their mandatory reserves.

Appendix