|  |  |

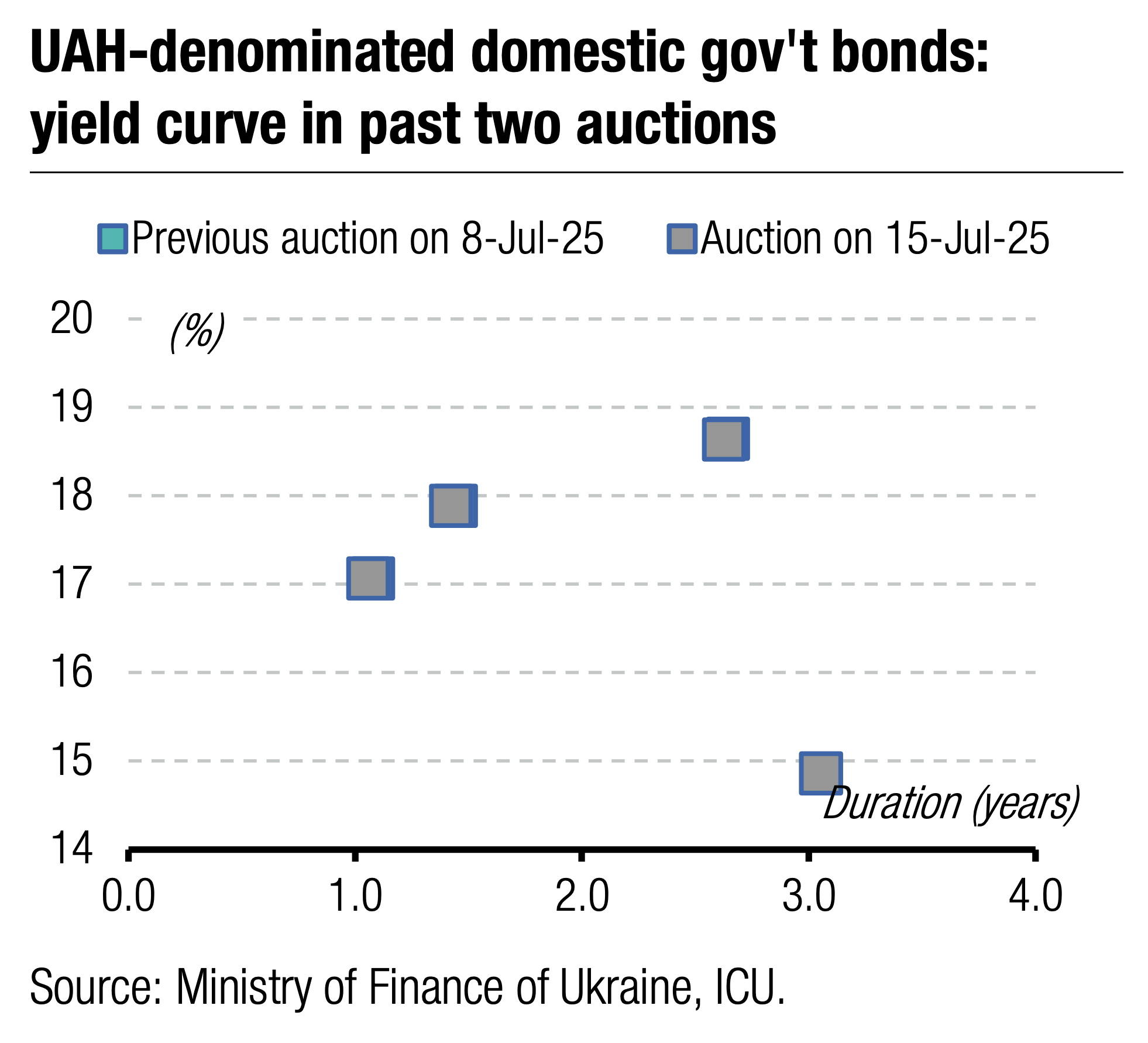

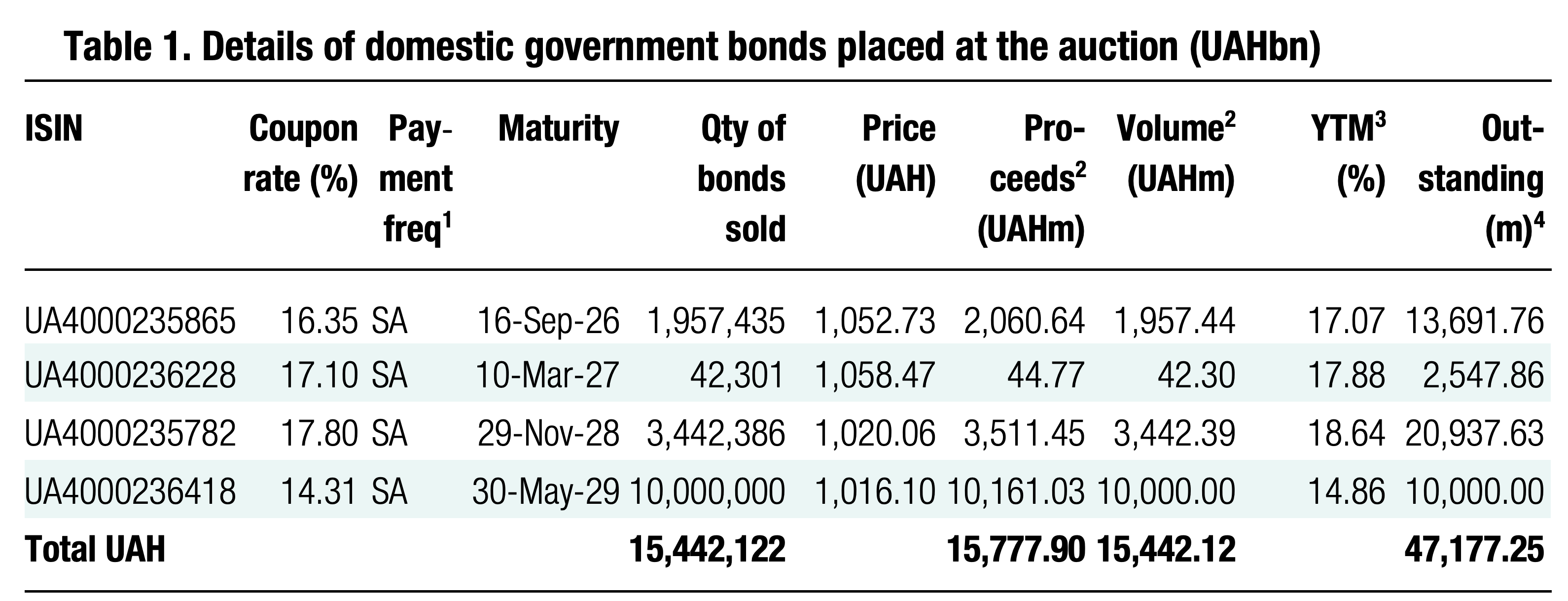

The Ministry of Finance raised almost UAH16bn for the state budget yesterday by issuing a new reserve note and three standard bonds maturing in 2026-28.

New reserve paper maturing in late May 2029 received fivefold oversubscription – UAH52.2bn vs. the UAH10bn cap. However, there was no extraordinary competition. The maximum and minimum bid rates increased by 25bp and 45bp to 15.25% and 13.95%, respectively, compared with the swap auction in June. At the same time, the cut-off and weighted average rates decreased, but only by 21bp and 9bp, respectively, to 14.79% and 14.31%. Of course, the MoF satisfied only 33 out of 69 bids, some of them partially.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 48.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

At the same time, the demand for military and ordinary bonds was less than the cap. Military bonds brought the budget UAH2bn, and 3.4-year ordinary bonds added another UAH3.5bn. A 20-month paper received only six bids for UAH42m.

Yesterday, banks focused on reserve securities, while the rest of the participants again preferred the longest instruments from ordinary bonds. However, the desire to fix current yields for the longest possible term is not yet a mass phenomenon, as it is still unknown when and how the NBU will lower the key police rate and whether the Ministry of Finance will follow this move.

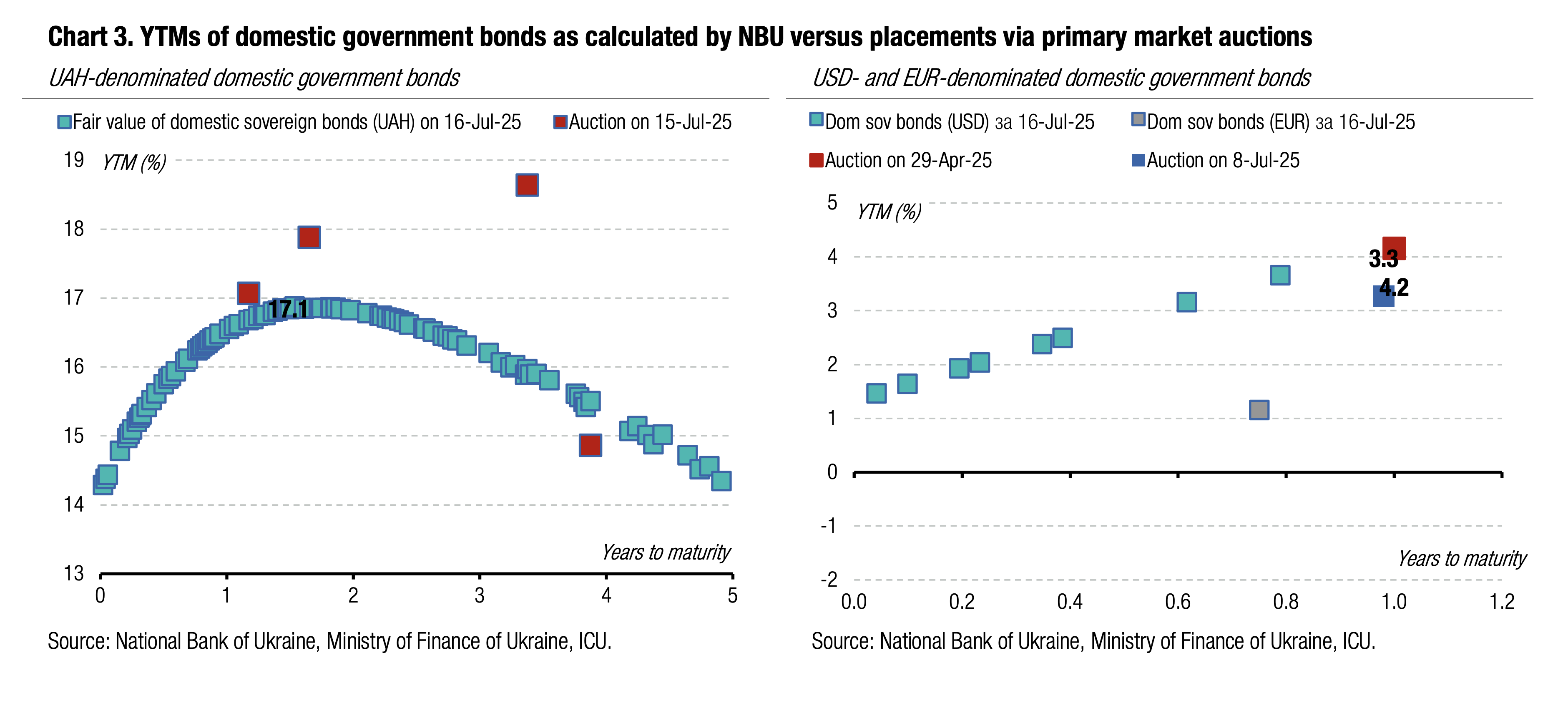

Appendix: Yields-to-maturity, repayments