|  |

|  |

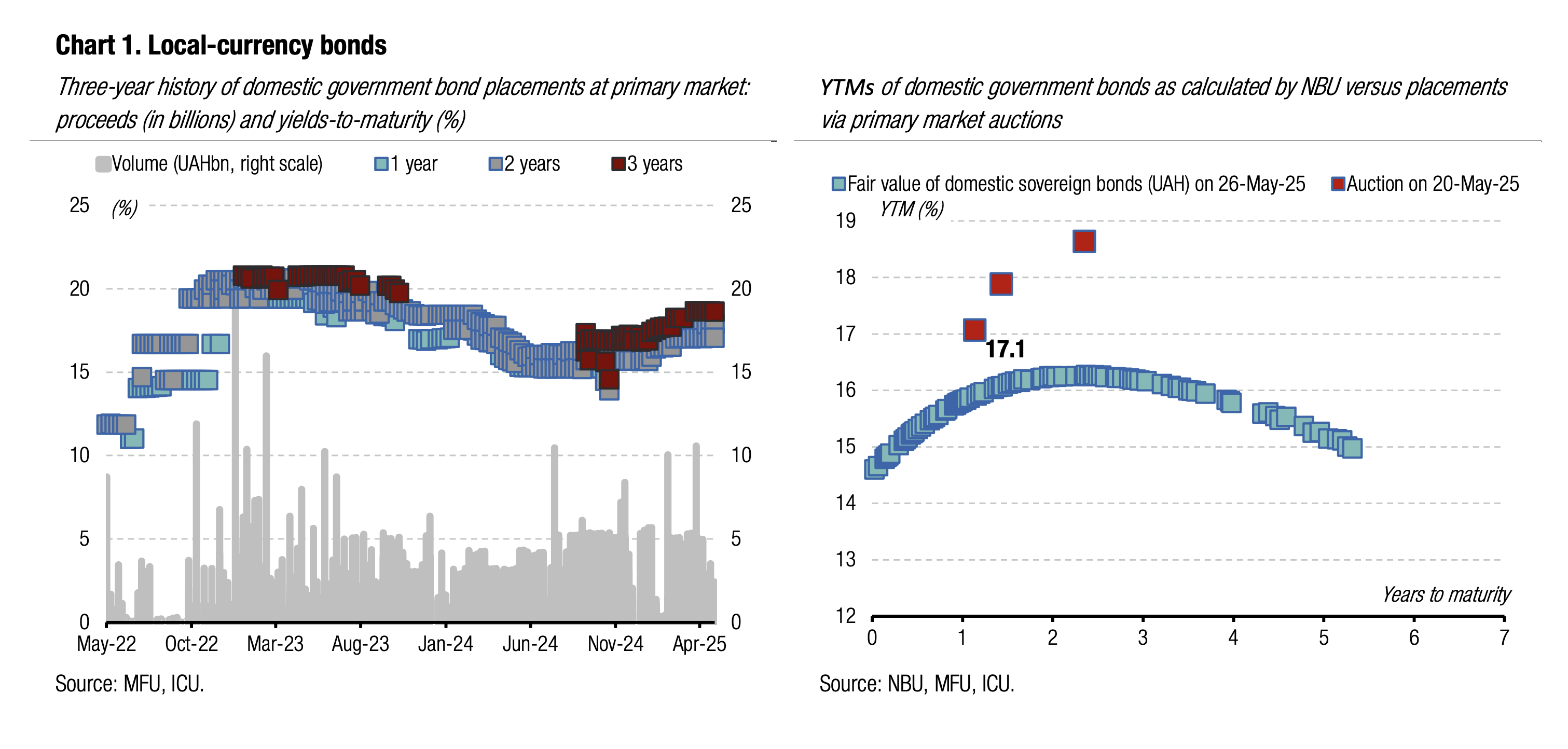

Bonds: MoF extends offering of UAH bonds

The Ministry of Finance updated the schedule of its bond auctions last Friday and added a four-year bond to the list. This may deepen the fragmentation of the bond trading further.

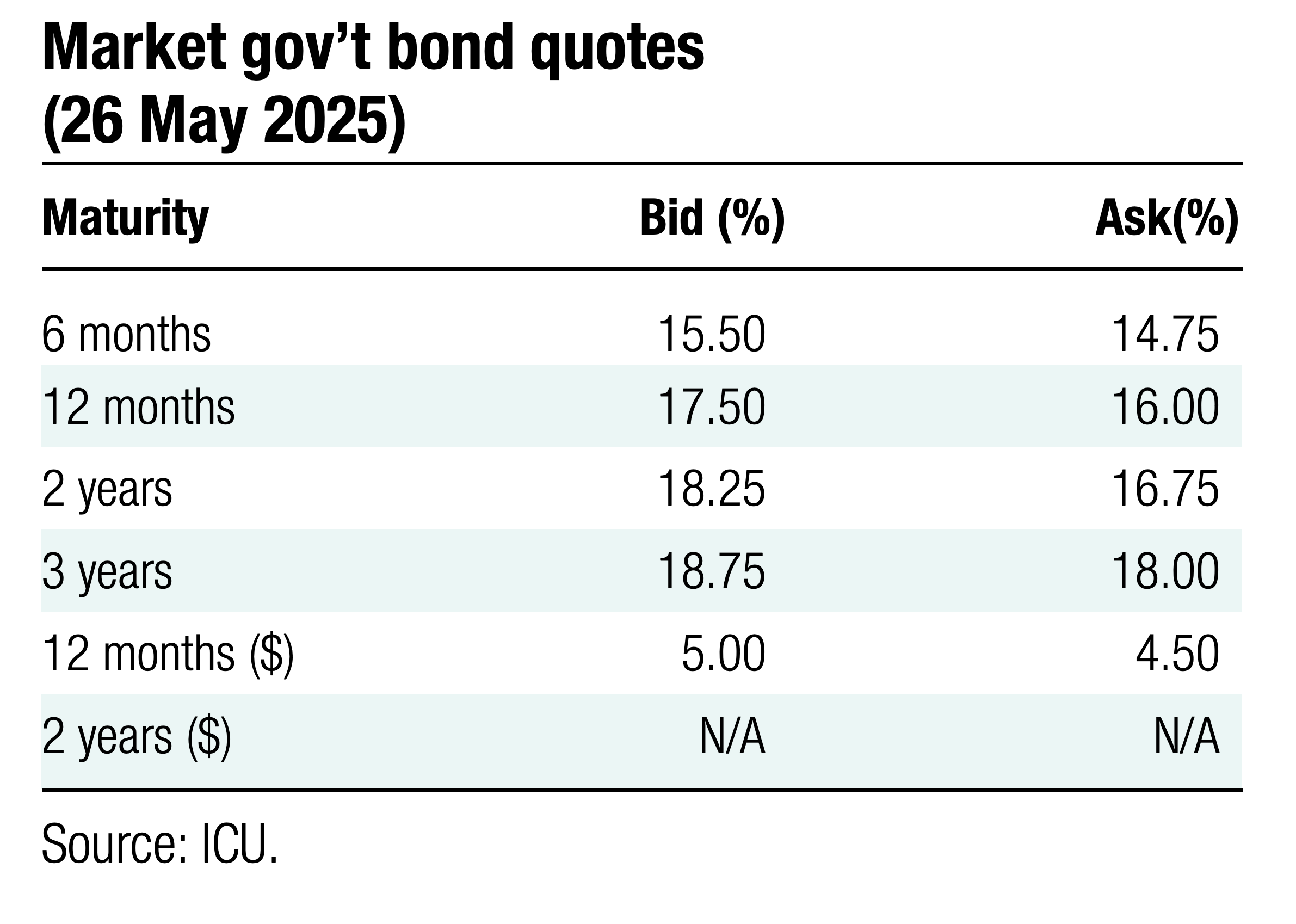

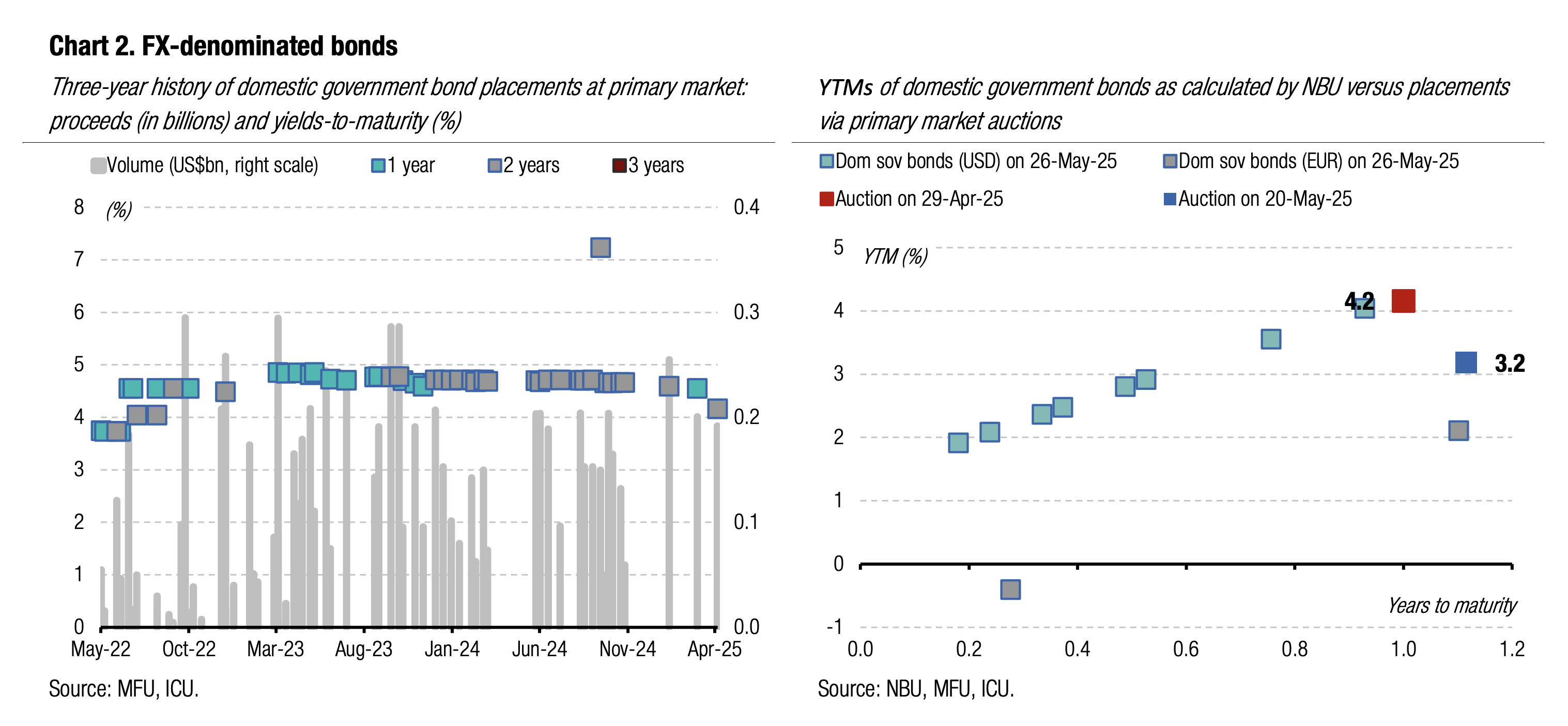

Last Tuesday, the MoF issued a EUR-denominated paper, which was oversubscribed and accounted for two-thirds of last week's total proceeds for the state budget. Demand for UAH bonds remains fragmented, with most interest focused on the 15-month and three-year securities. Yields for UAH bonds stayed unchanged. For more details, please see the auction review.

In the secondary bond market, FX-denominated bills accounted for a significant share of last week's trading, rising to 28%, compared with 10-18% over the previous five weeks. Trading in UAH bonds continues to be fragmented, with the most actively traded instruments being bills maturing in June (26% of UAH bonds traded), and three-year notes (19%).

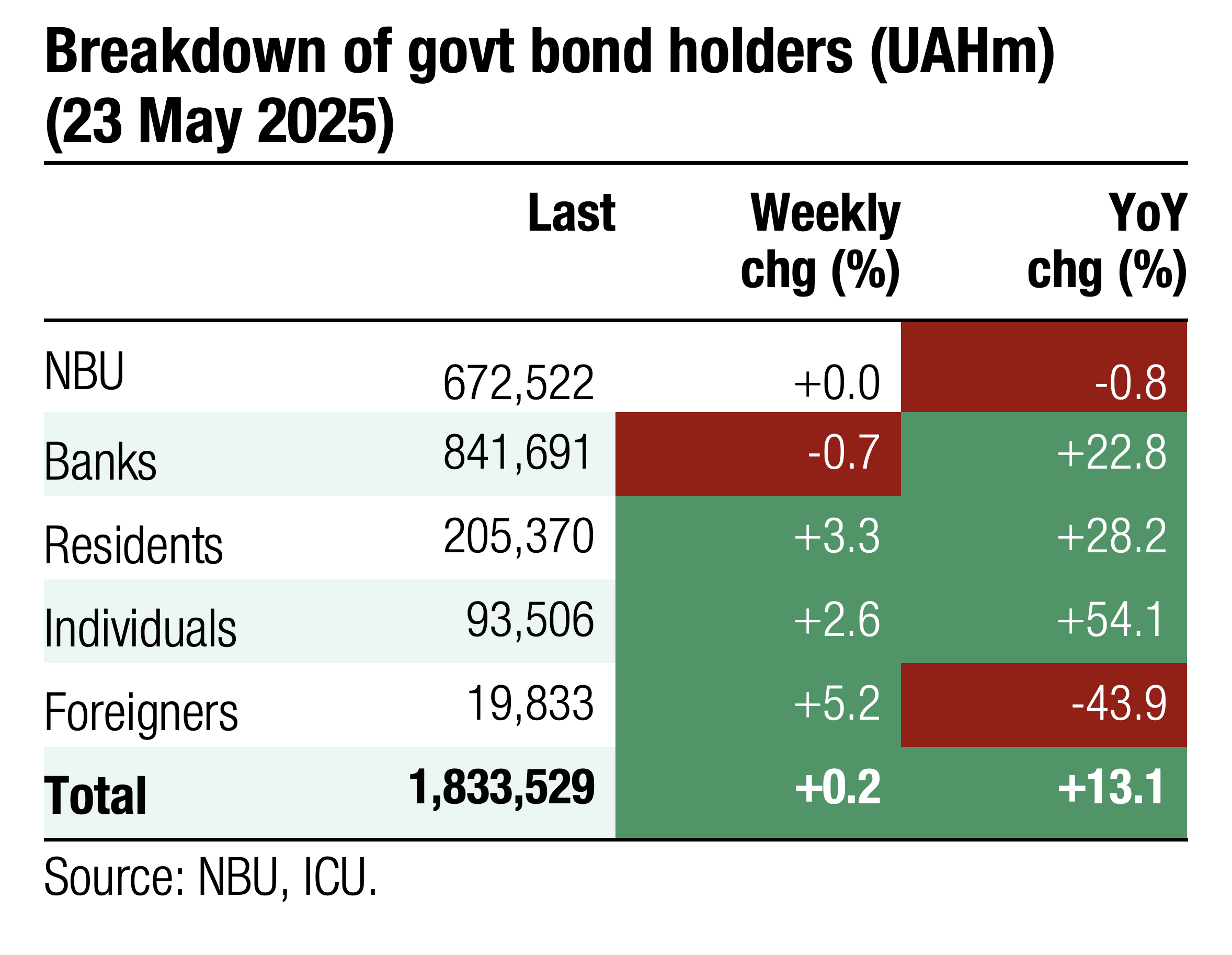

Foreign investors increased their portfolios by 6%, reaching approximately UAH20bn. However, this is still six times below the peak seen in February 2020. Meanwhile, individual investors raised their portfolios by 2.6% last week, setting a new record of UAH93.9bn. UAH bonds now stand at 53% of the retail investor portfolios.

Last Friday, the Ministry of Finance updated its bond auction schedule by adding a new four-year bond to its usual offerings of 15-month, 20-month, and three-year instruments.

ICU view: The demand for UAH bonds remains fragmented. Some investors focus on very short maturities, while others prefer the longest. An introduction of a new four-year note may deepen this fragmentation even further as it is likely to steal much of the investor attention. However, if this new bond is designated as a reserve paper, it may attract excessive demand from banks resulting in a low yield and discouraging demand of other investors.

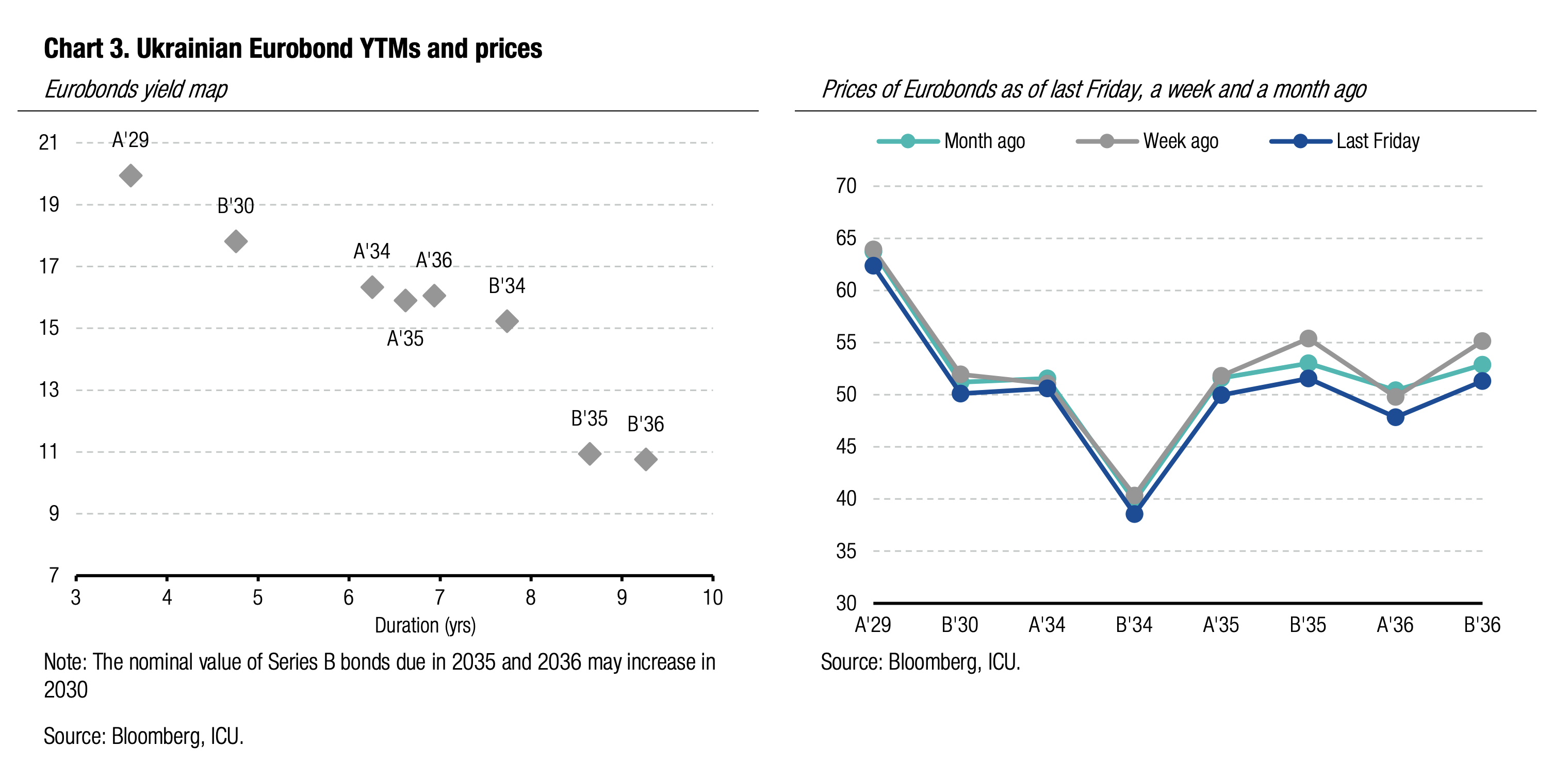

Bonds: Bondholders remain cautious

Holders of Ukrainian Eurobonds remain cautiously optimistic in anticipation of progress in the negotiation process.

Last week, investors were cautious due to the lack of significant updates on the progress of negotiations. The only tangible outcome of the Istanbul meeting was a one-thousand-prisoner exchange that happened last week. However, the timeline and location for the continuation of the ceasefire talks remain uncertain. Thus, Eurobond prices decreased by an average of 4% over the last week. In contrast, the price of VRIs increased by 0.9%, reaching 75.4 cents per dollar of notional value. The EMBI index slid by 0.5%.

ICU view: russia's refusal to accept the Vatican's offer to facilitate the next round of negotiations has lowered Eurobond holders' expectations of the negotiation progress. Currently, Eurobond prices show little volatility against the backdrop of noteworthy developments.

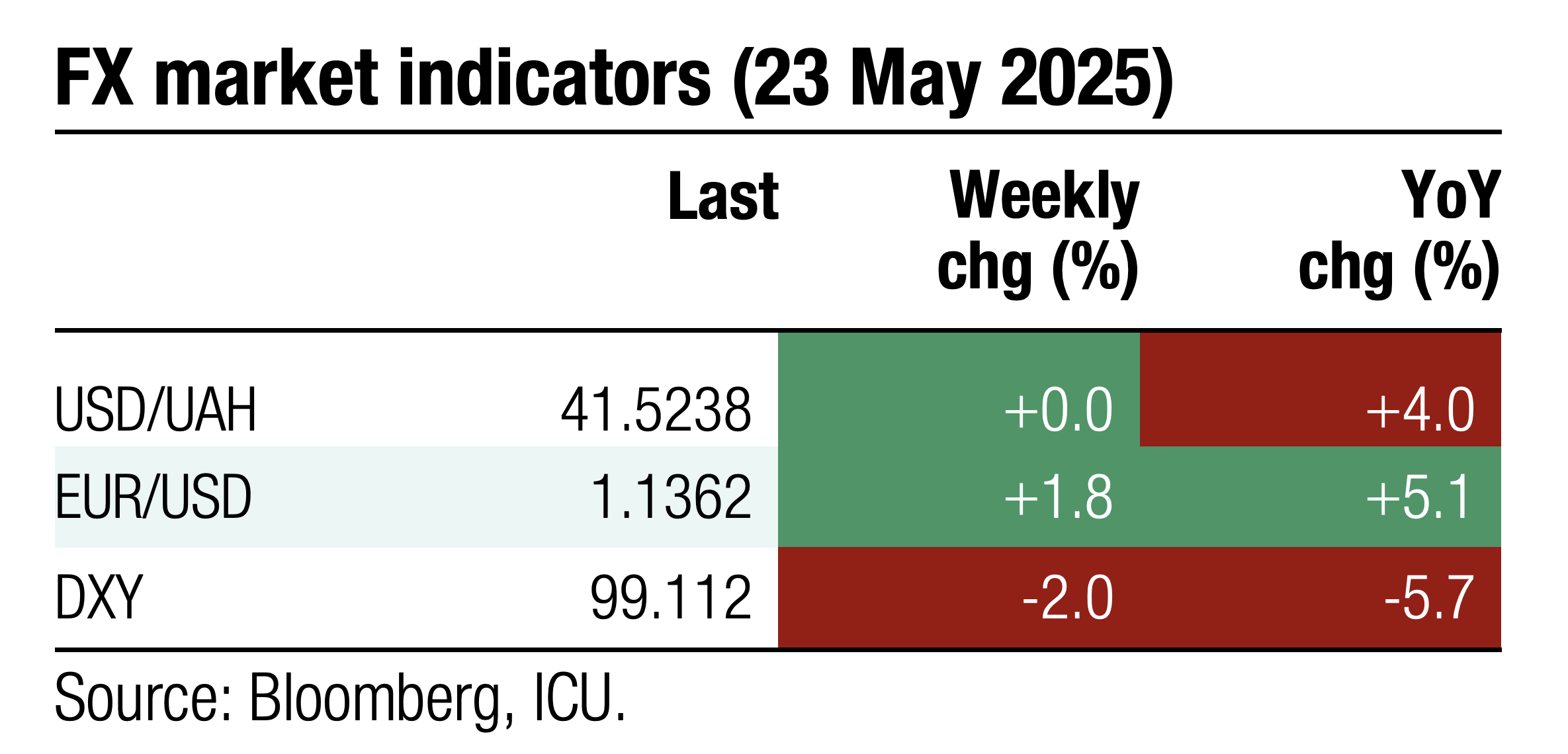

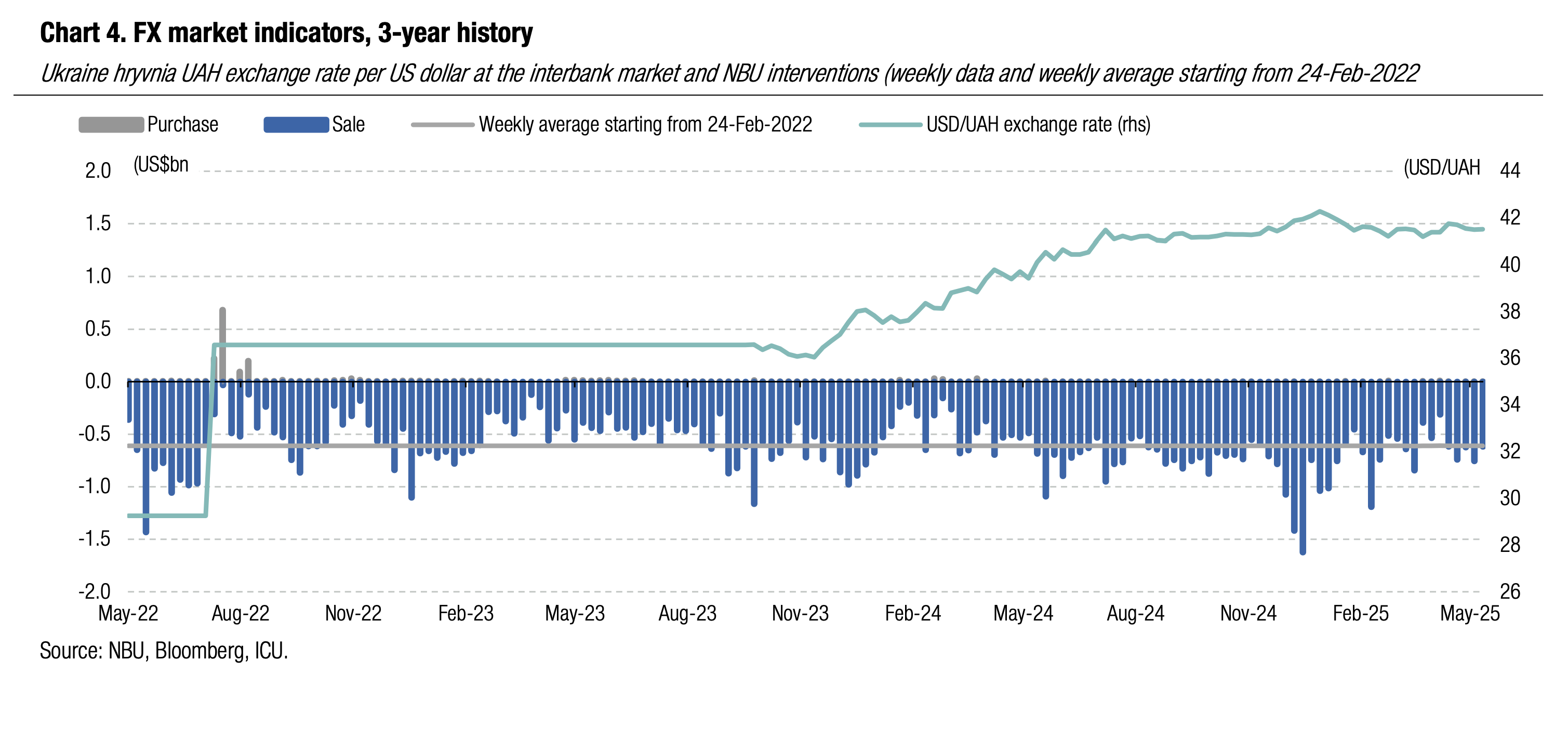

FX: NBU interventions down

The hryvnia official exchange rate remains steady despite a slight increase in FX market deficit.

Last week, the NBU reduces its interventions by 18% to US$618m, while the shortage of hard currency increased by 11% WoW to US$362m (for four business days). By our estimates, about US$300m in last week’s interventions was related to an FX shortfall a week before. The NBU kept the official exchange rate of the hryvnia relatively stable at UAH41.51/US$.

ICU view: The NBU effective smoothened its interventions over time since a part of FX deficit from a week before was covered last Monday. By doing this, the NBU maintains weekly interventions close to the average weekly level during the full-scale war. The NBU also prevents sharp fluctuations in the hryvnia exchange rate, keeping it relatively stable at UAH41.5/US$. We anticipate that this policy will continue in the coming months.