|  |  |

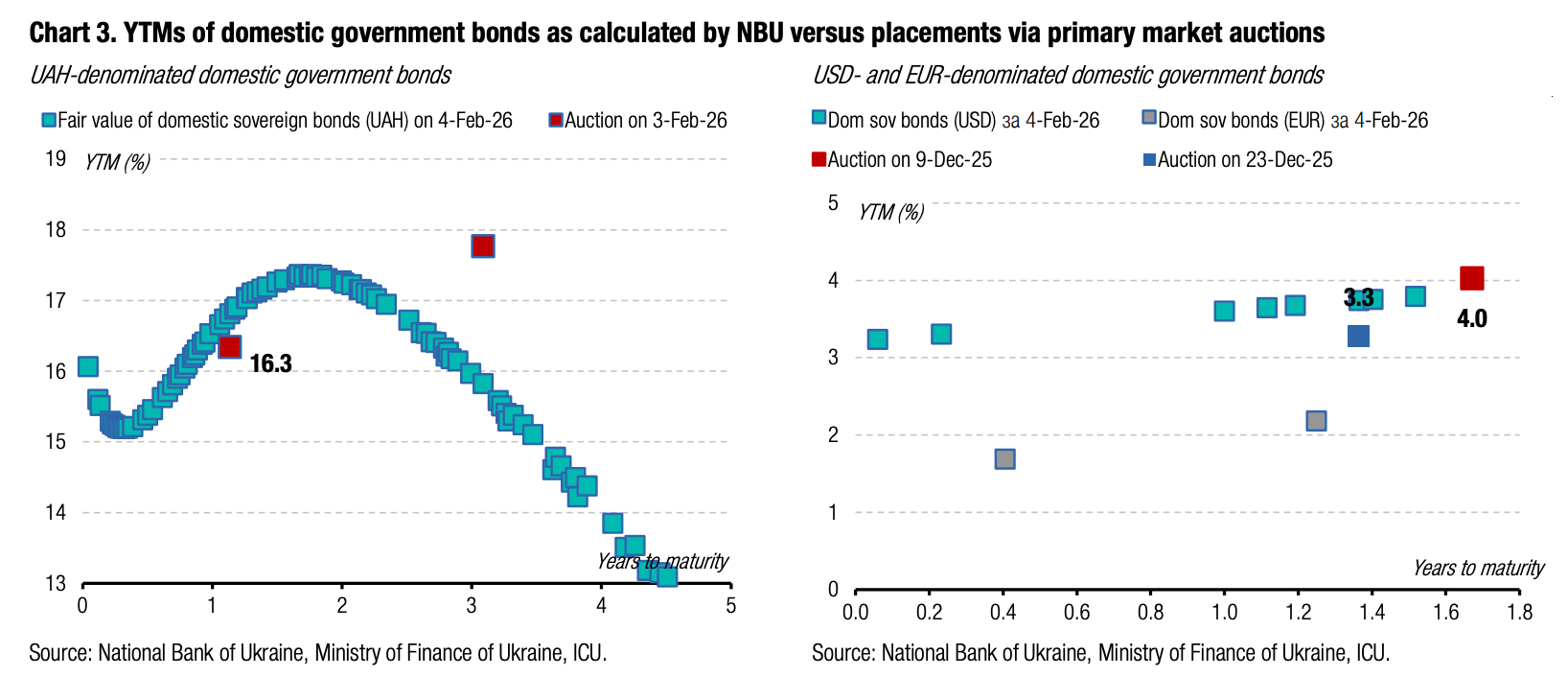

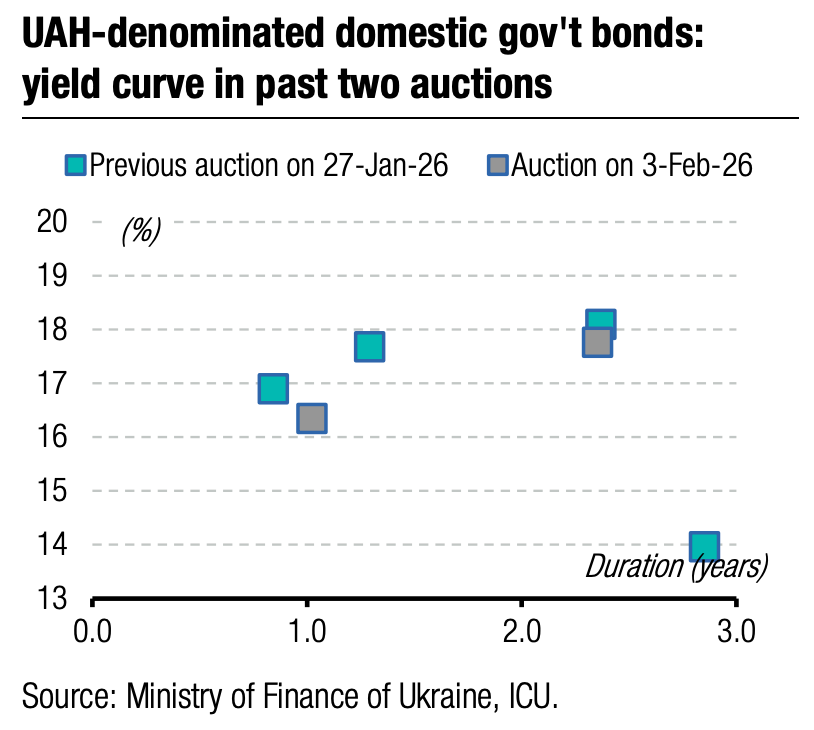

Yesterday, the Ministry of Finance continued to reduce yields on UAH bonds, offering small volumes and encouraging competition among bidders.

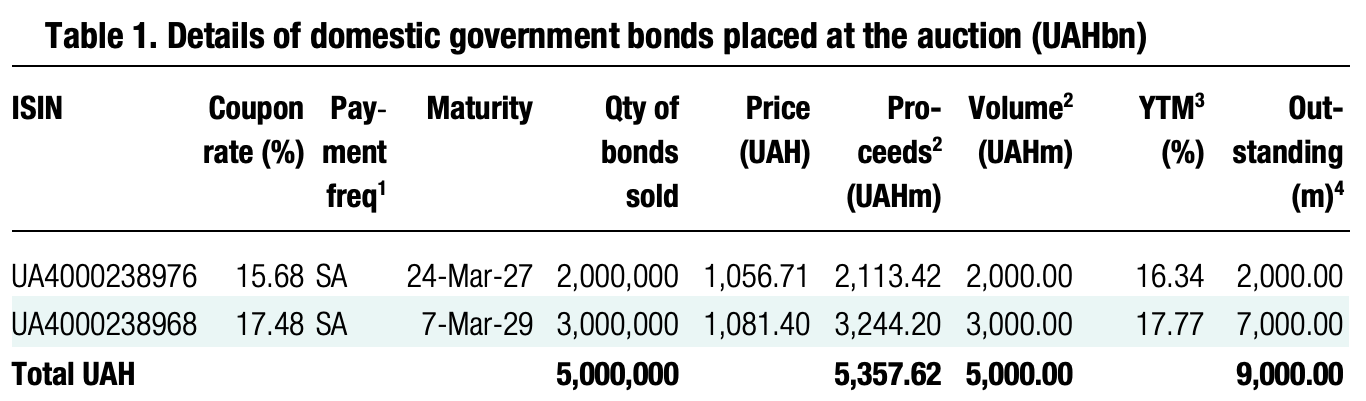

The new "one-year" government bond maturing in March 2027 was almost tenfold oversubscribed: demand amounted to UAH19.4bn vs a cap of UAH2bn, with yields in bids ranging from 15.68% to 16.35%. According to auction rules, the MoF began accepting bids at the lowest rate and did not deviate from it. So, both the cut-off rate and the weighted average (as well as the coupon rate) were set by the MoF at 15.68%. In total, 23 out of 69 bids were satisfied, and most likely all only partially.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.39/USD, 49.53/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

The rate cut for the three-year bond also continued. The MoF received almost UAH20.3bn in demand, against an offer of UAH3bn, resulting in nearly 7x oversubscription. The yields in bids ranged from 16.85% to 17.5%. However, here the appetite to compete has already decreased somewhat. In satisfying bids, the MoF reached the 17% cut-off and satisfied 29 bids, setting the weighted average rate at 16.99%, only 1bp lower. So, the MoF could see bids at lower rates in small numbers or small volumes, with minimal impact on the weighted average rate.

It is quite clear that the small offer and the prospect of an NBU key rate reduction in March or April increased investors' desire to purchase bonds as early as possible and lock in a higher rate. But increased competition continues to push yields down, and ultimately, the decline in rates may exceed the NBU's rate cut.

Appendix: Yields-to-maturity, repayments