|  |  |

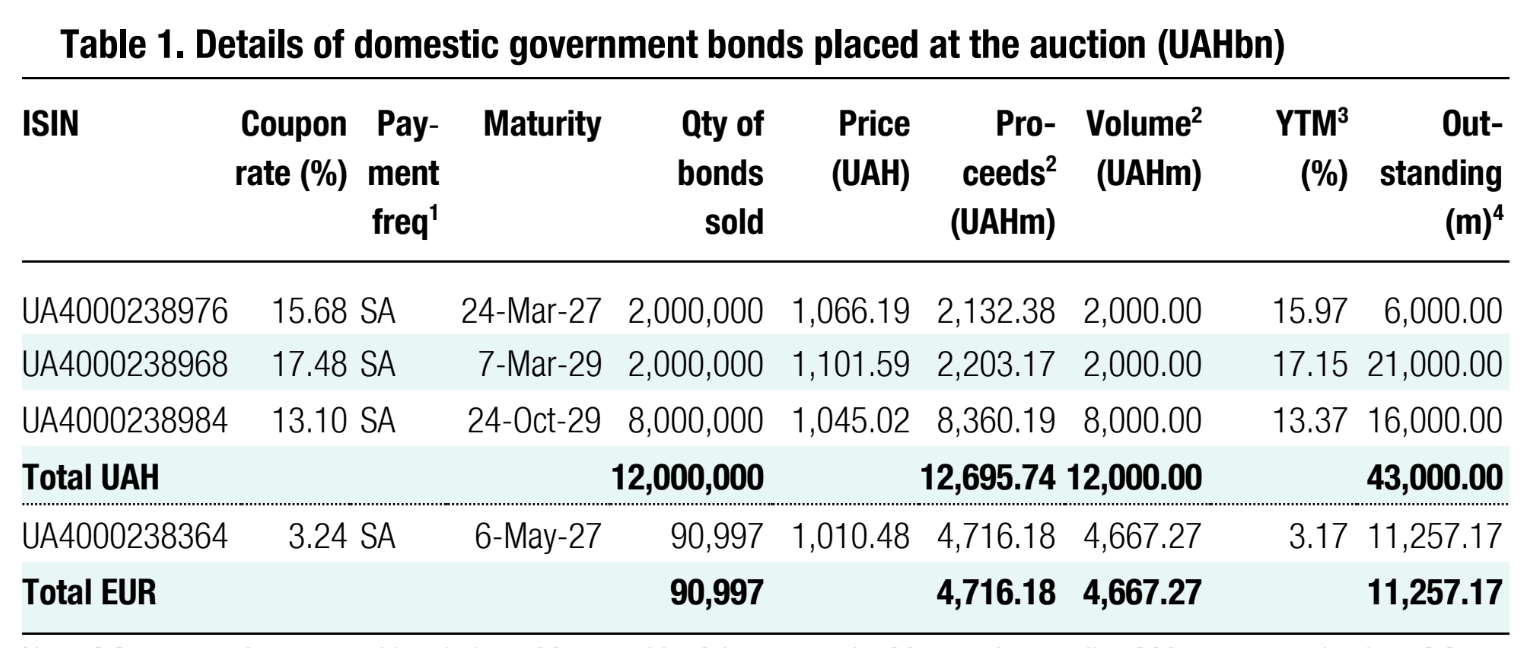

All UAH instruments attracted considerable oversubscription again yesterday, and yields fell further, reflecting a decrease in the maturity premium.

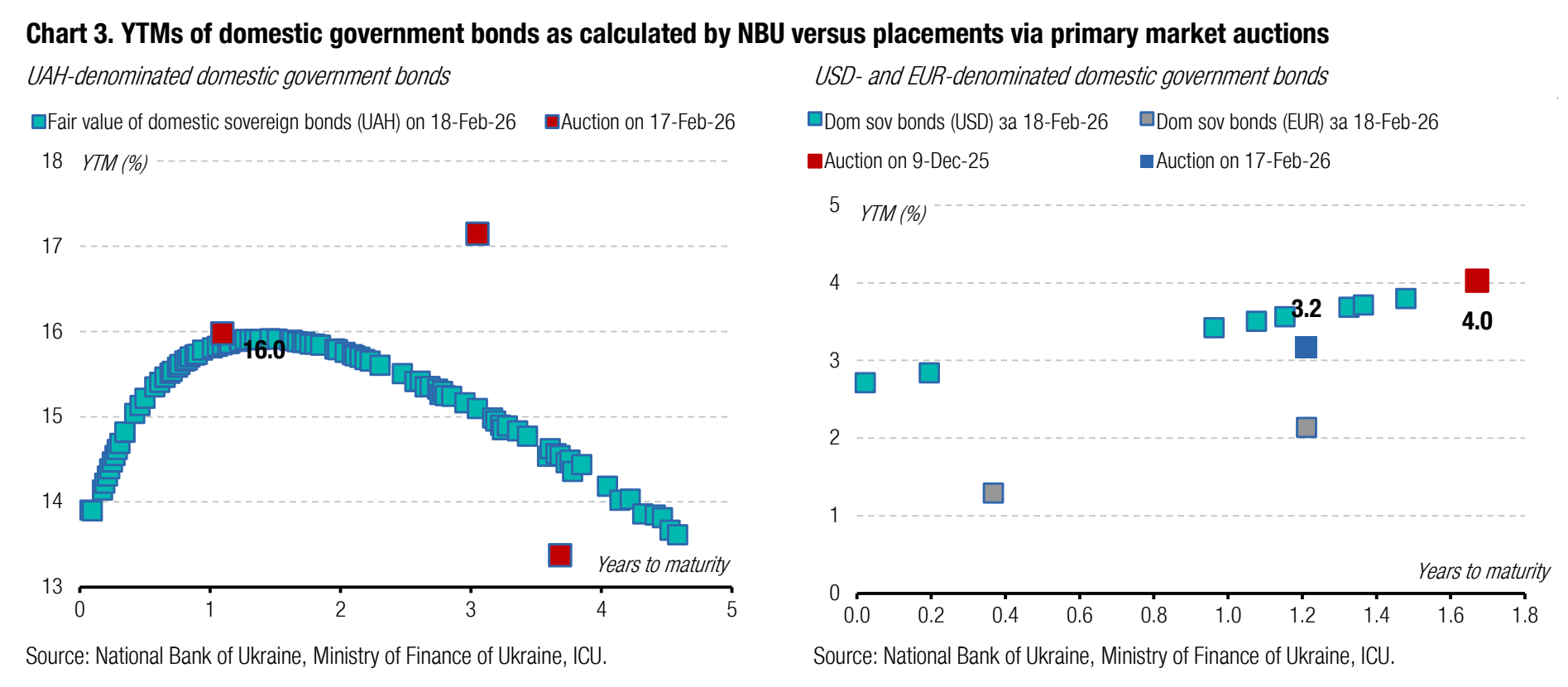

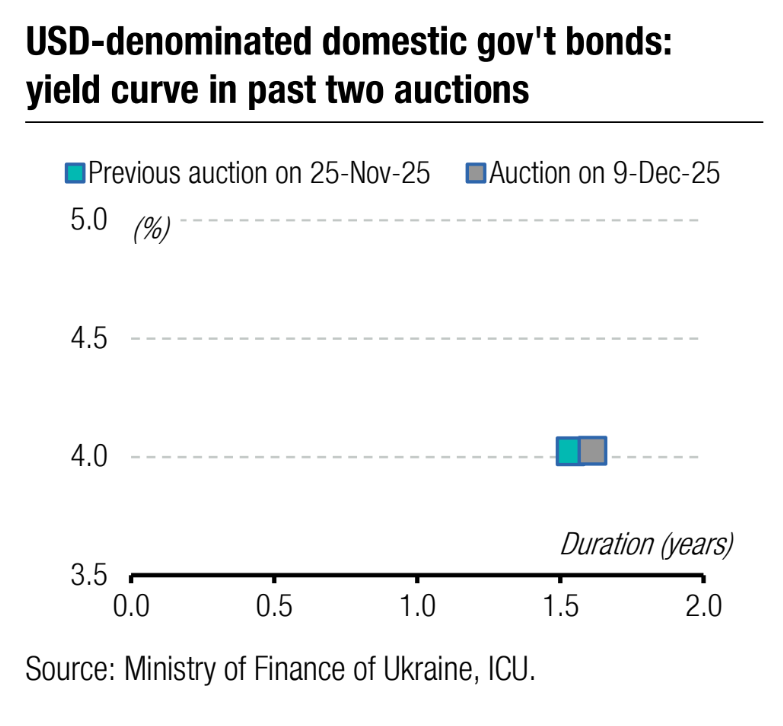

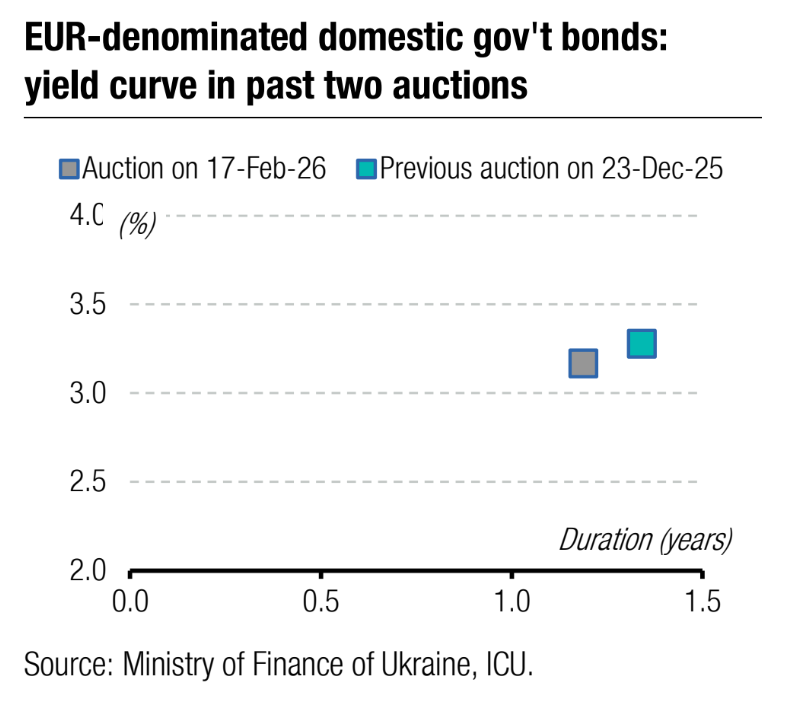

Yesterday, the Ministry of Finance sold FX-denominated bonds for the first time this year. The MoF offered EUR200m of bills with a May 2027 redemption. The last time the MoF sold these bonds was at the end of December 2025. This instrument received 39 bids totalling almost EUR91m with rates no higher than the cut-off level from last year's auction. So, the ministry satisfied all bids and reduced the weighted-average rate by 11bp to 3.14%, while the cut-off rate remained at 3.25%.

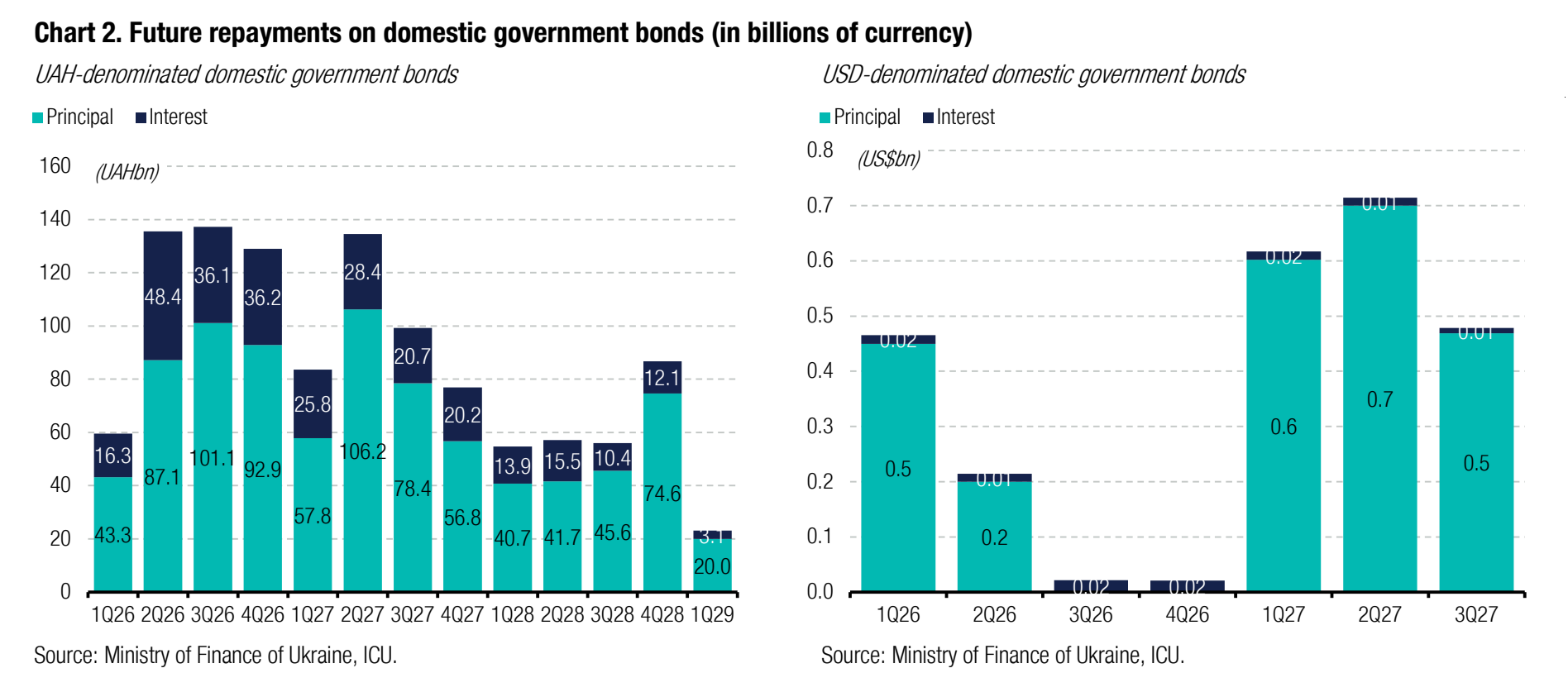

Having received a fourfold oversubscription for the "reserve" note, the MoF sold the planned UAH8bn of bonds and reduced their rates even further to a 13.1% cut-off rate and a 12.92% weighted-average. New yields are already 150bp lower than those on the first reserve bond placement this year.

Note: 11 payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; (2) proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.39/USD, 51.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

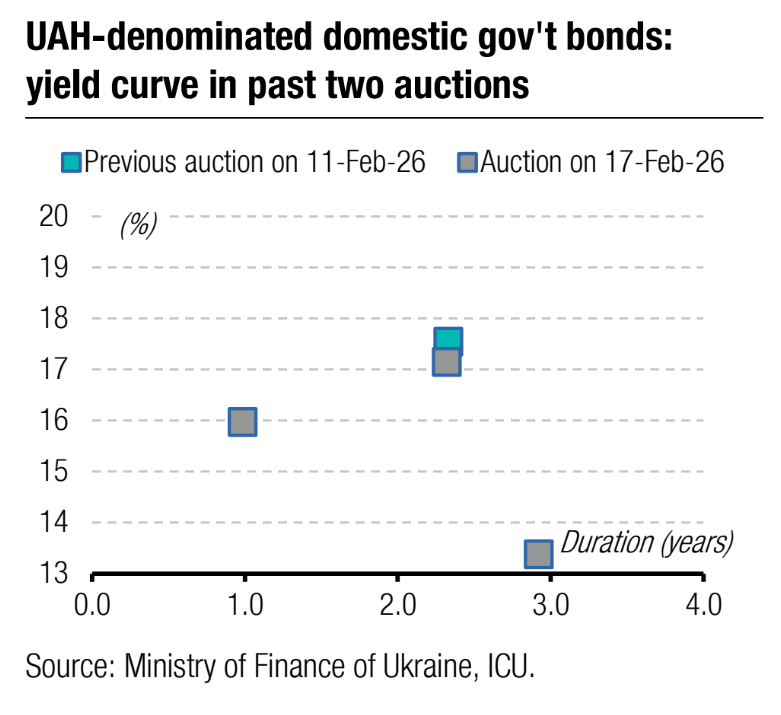

One-year military paper received 5x oversubscription yesterday. However, the yields in the bids were in a very narrow range - 15.2%—15.54%, and mostly up to 15.4%. This is the level that the Ministry of Finance set as the cut-off yesterday, satisfying 40 out of 49 bids, although, of course, most of them partially. Yields on one-year securities have decreased by 101bp YTD, or twice as much as the NBU key rate cut, and the current yield is only 40bp higher than the key policy rate.

The decline in yields on the three-year note continued. Yesterday, bid volume exceeded the offer by 9x, and the MoF rejected almost half of the bids. However, it is unlikely that all the rest purchased the desired volume of securities. Rates decreased by another 37bp, the maximum satisfied rate to 16.43%, and the weighted average rate to 16.42%. Finally, the decline in yields has already amounted to 138bp YTD.

Thus, the maturity premium on hryvnia-denominated government bonds gradually decreases. While at the beginning of the year the difference in rates between the one-year and three-year instruments was 145bp, today it has reduced to 103bp. We do not rule out that yields will continue to decline faster at longer maturities. Therefore, the term premium may decrease further.

Appendix: Yields-to-maturity, repayments