|  |  |

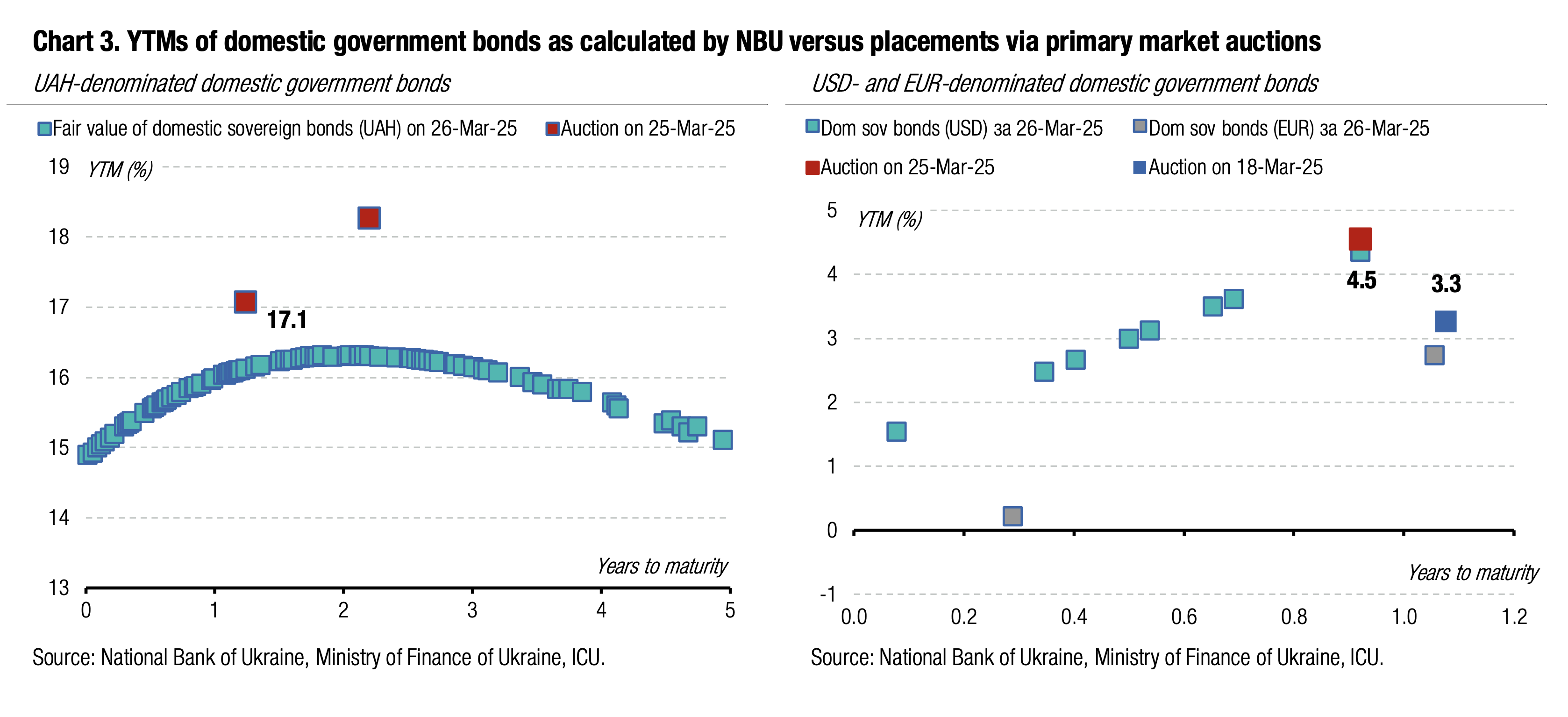

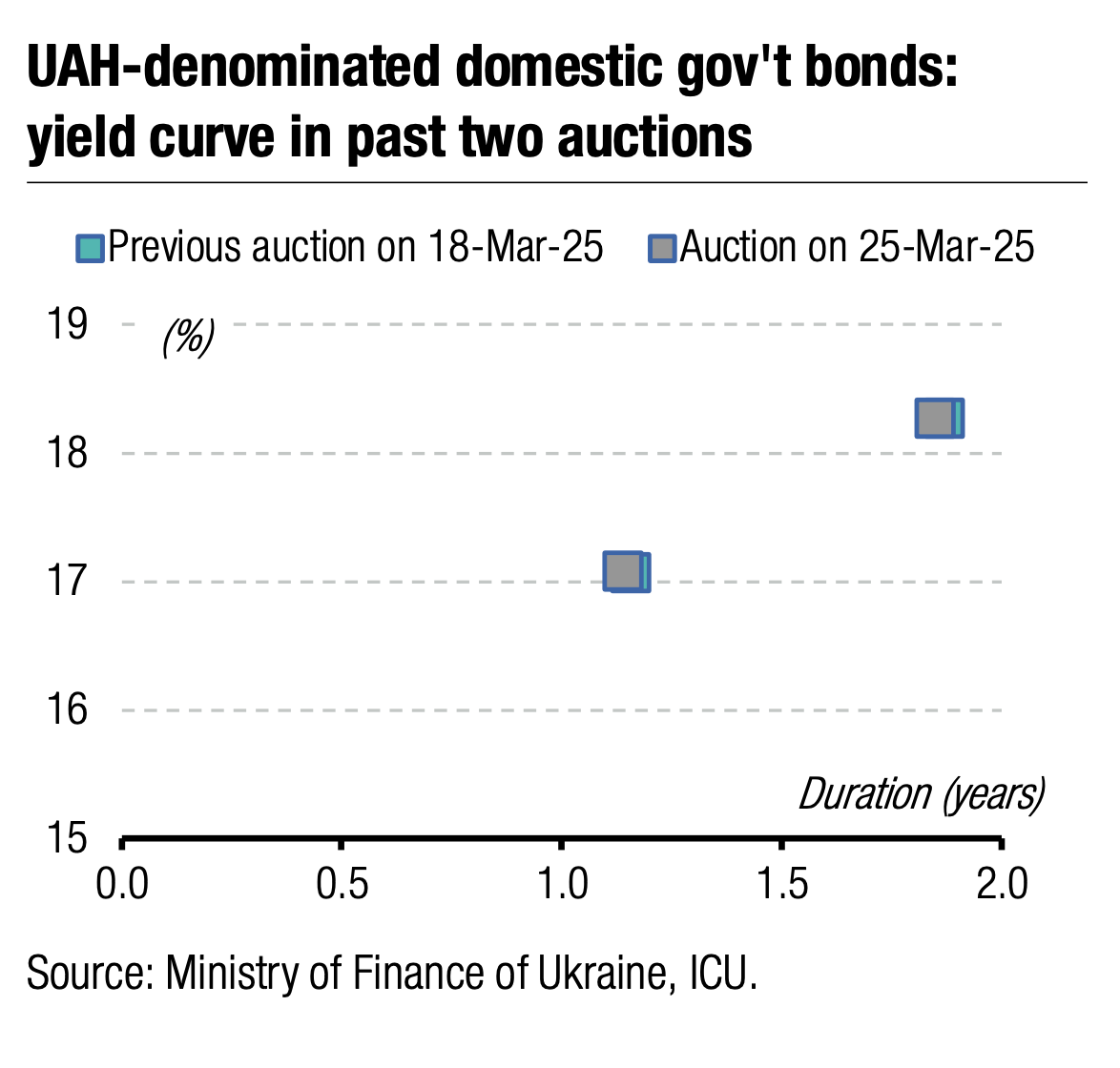

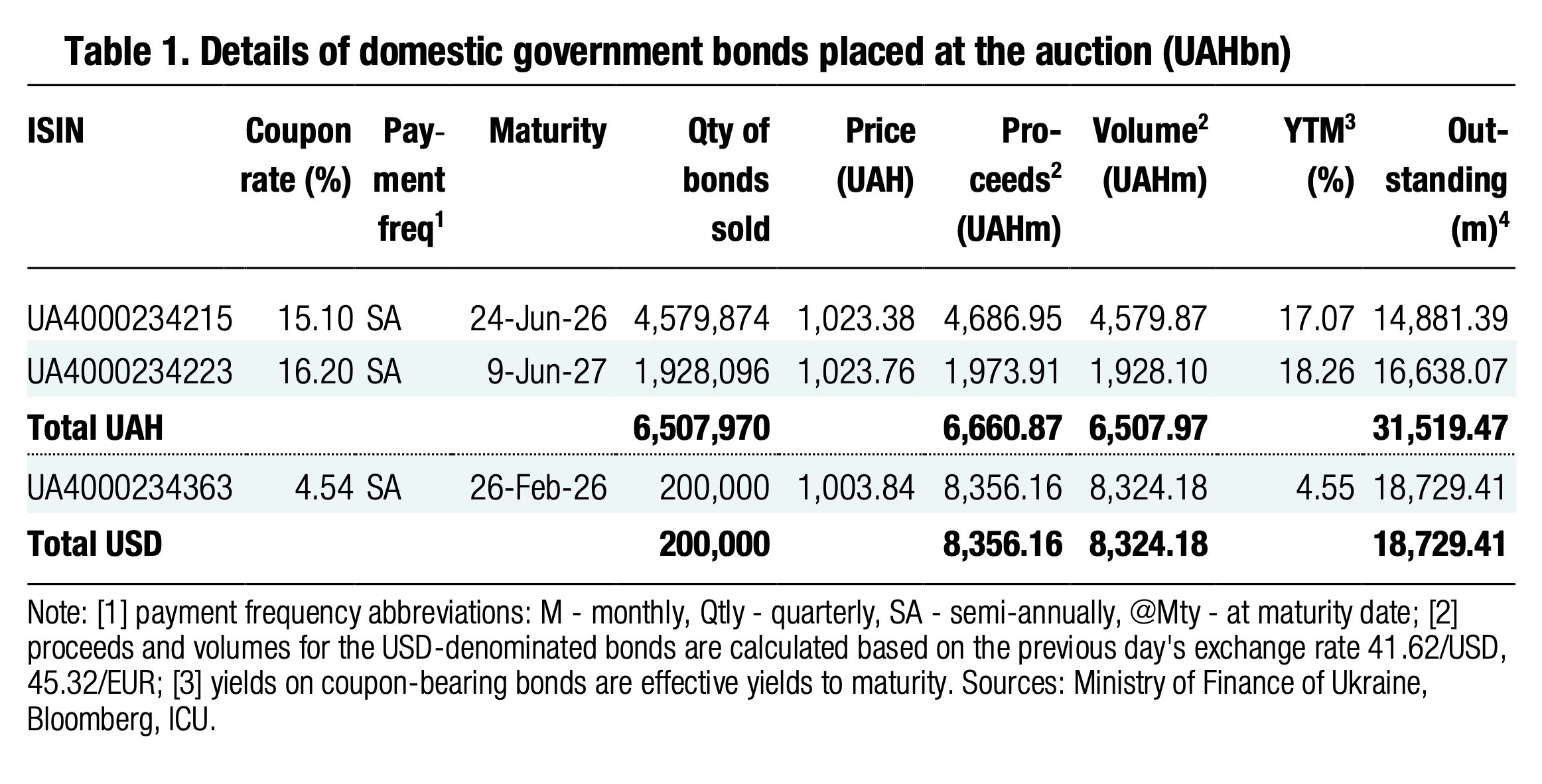

Yesterday, the MoF received uniform demand for UAH bonds and rejected just one small bid. At the same time, USD-denominated bills received over 2x oversubscription. Therefore, many investors did not purchase the amount of bonds they needed.

Fifteen-month bills saw demand for UAH4.7bn. Just one bid required increased rates, but only for 10bp to 16.45%. The MoF rejected this expensive bid, keeping the cut-off and the weighted average rates unchanged at 16.35%.

The two-year paper received just UAH2bn of bids with rates up to the cut-off rate. The MoF accepted all bids for these securities.

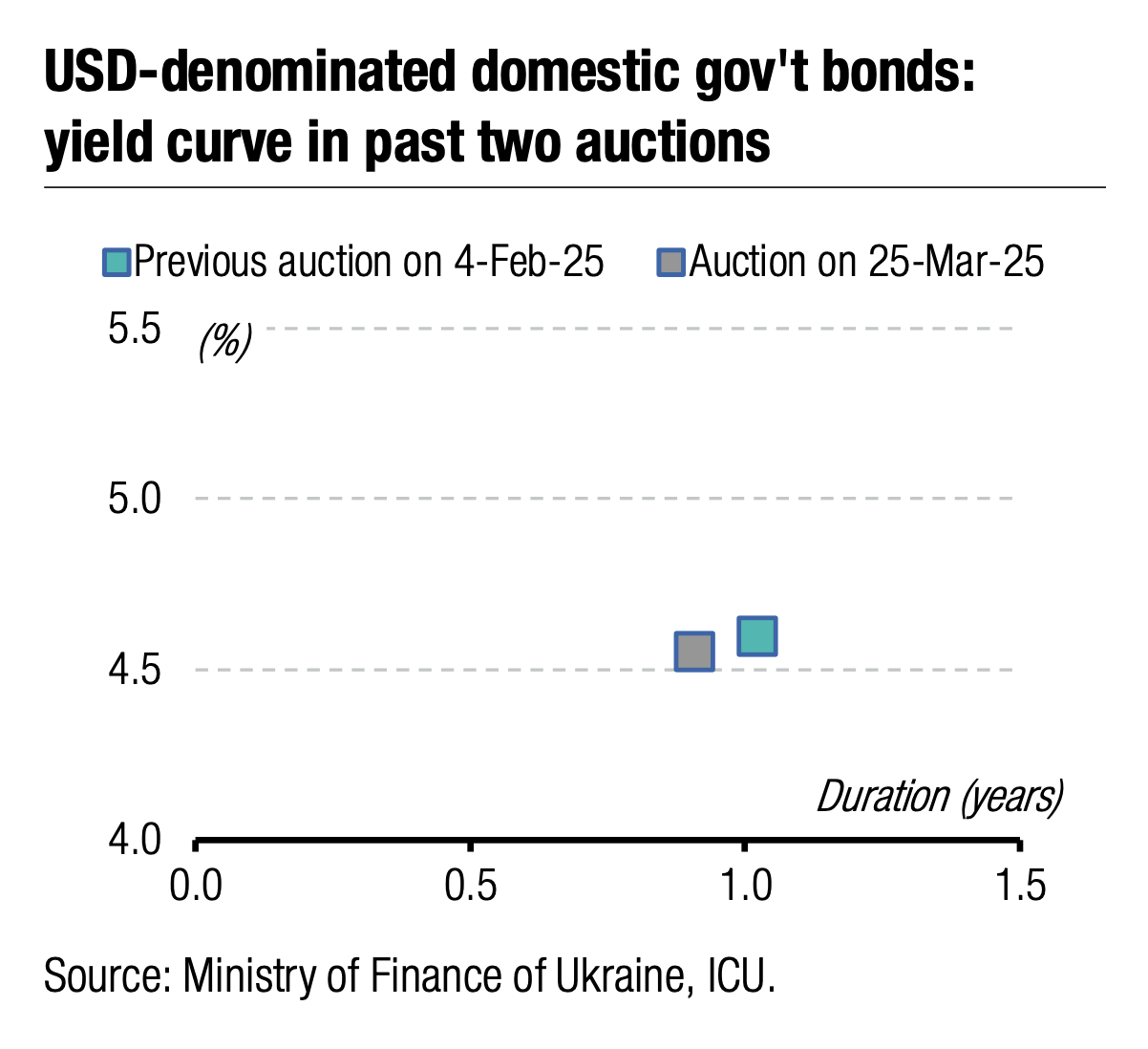

The greatest demand was for the USD-denominated paper, exceeding 2x oversubscription. The MoF sold only US$200m of bonds vs US$450m of demand.

Finally, the MoF borrowed UAH15bn (including USD-denominated funds in UAH equivalent). UAH proceeds declined slightly, but there were almost no attempts to increase the rate. The recent auction shows that the MoF and the market found balance, and we likely will not see any further increase in bond rates.

Appendix