|  |

|  |

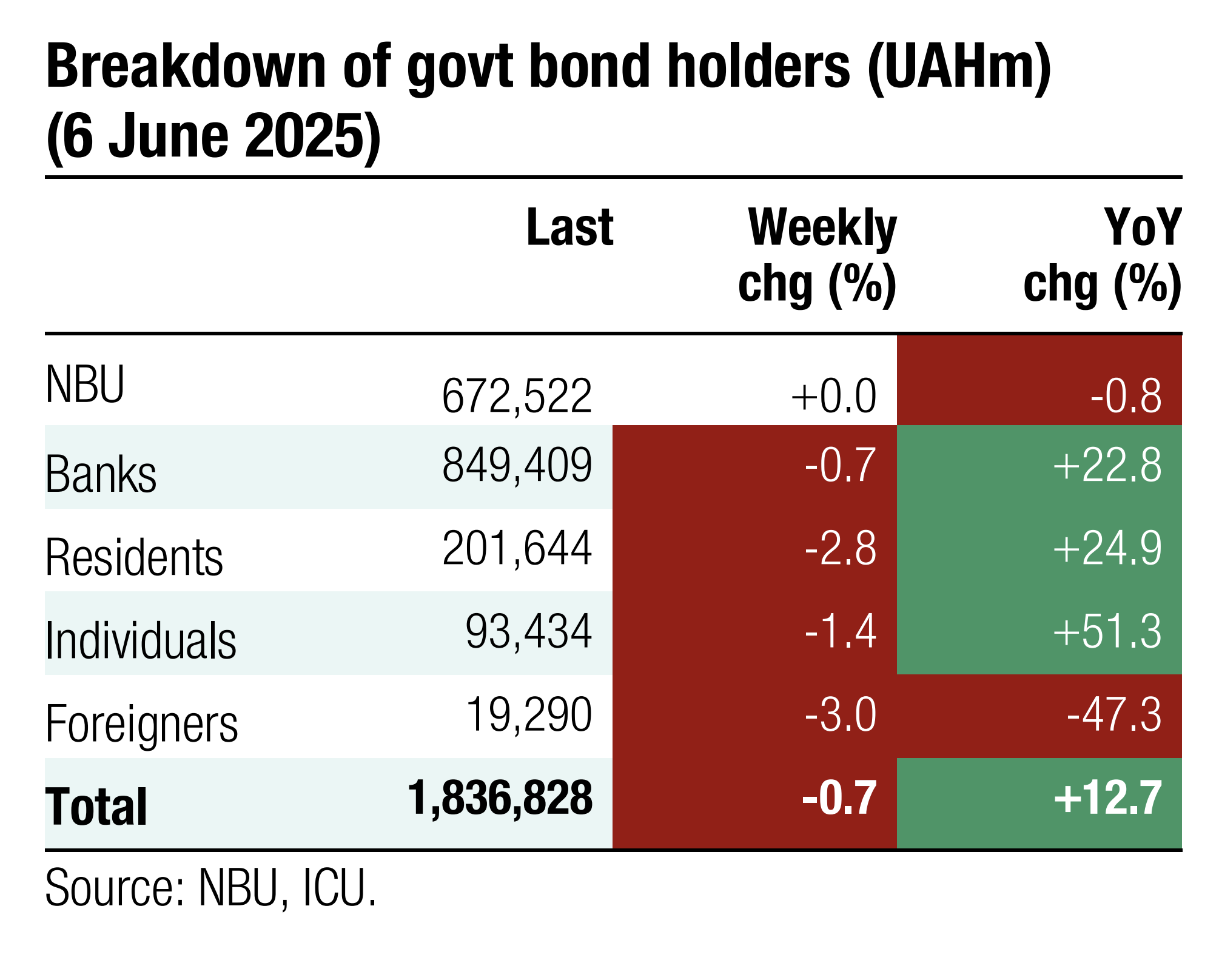

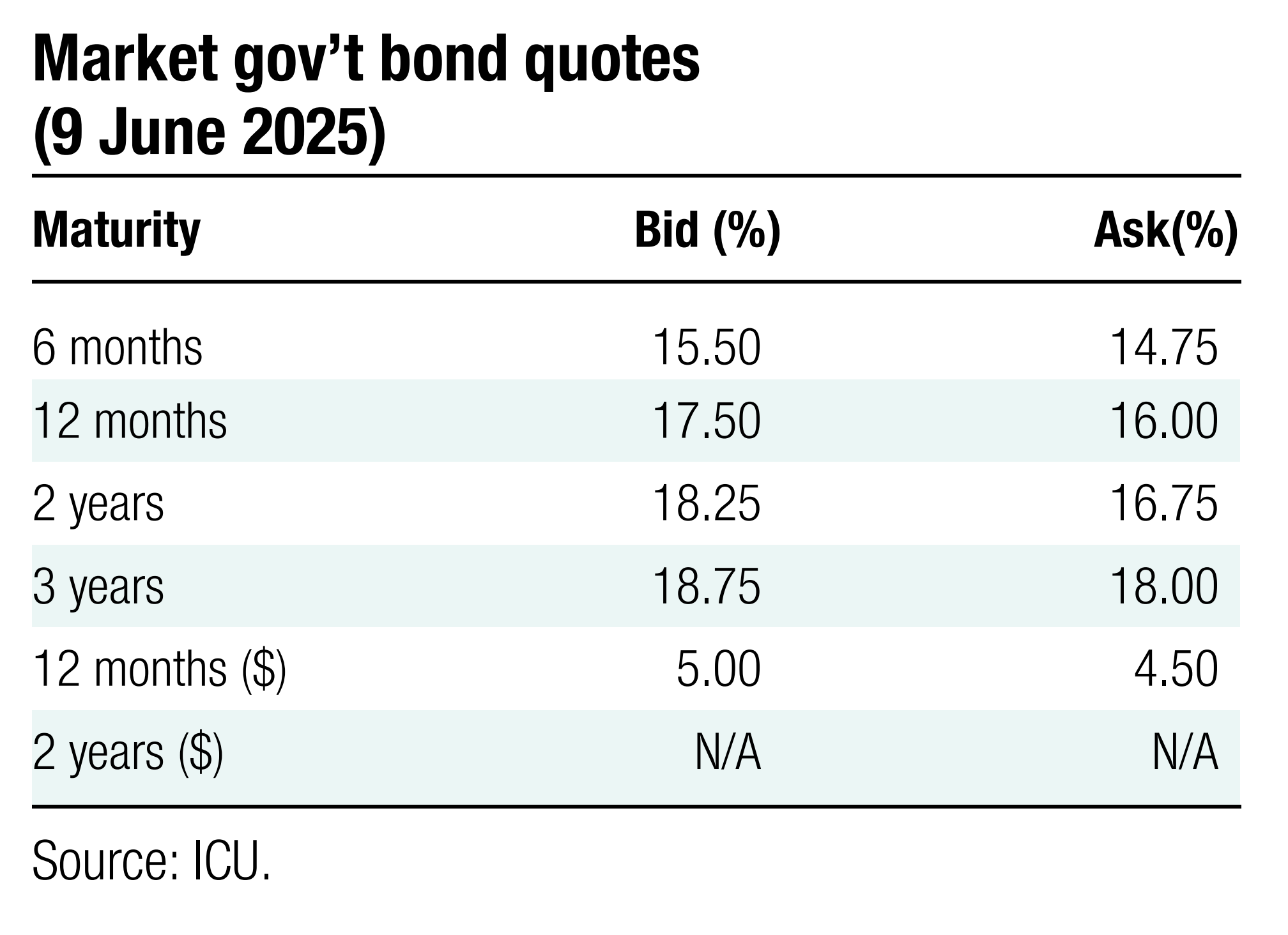

Bonds: MoF pauses offering of reserve bonds

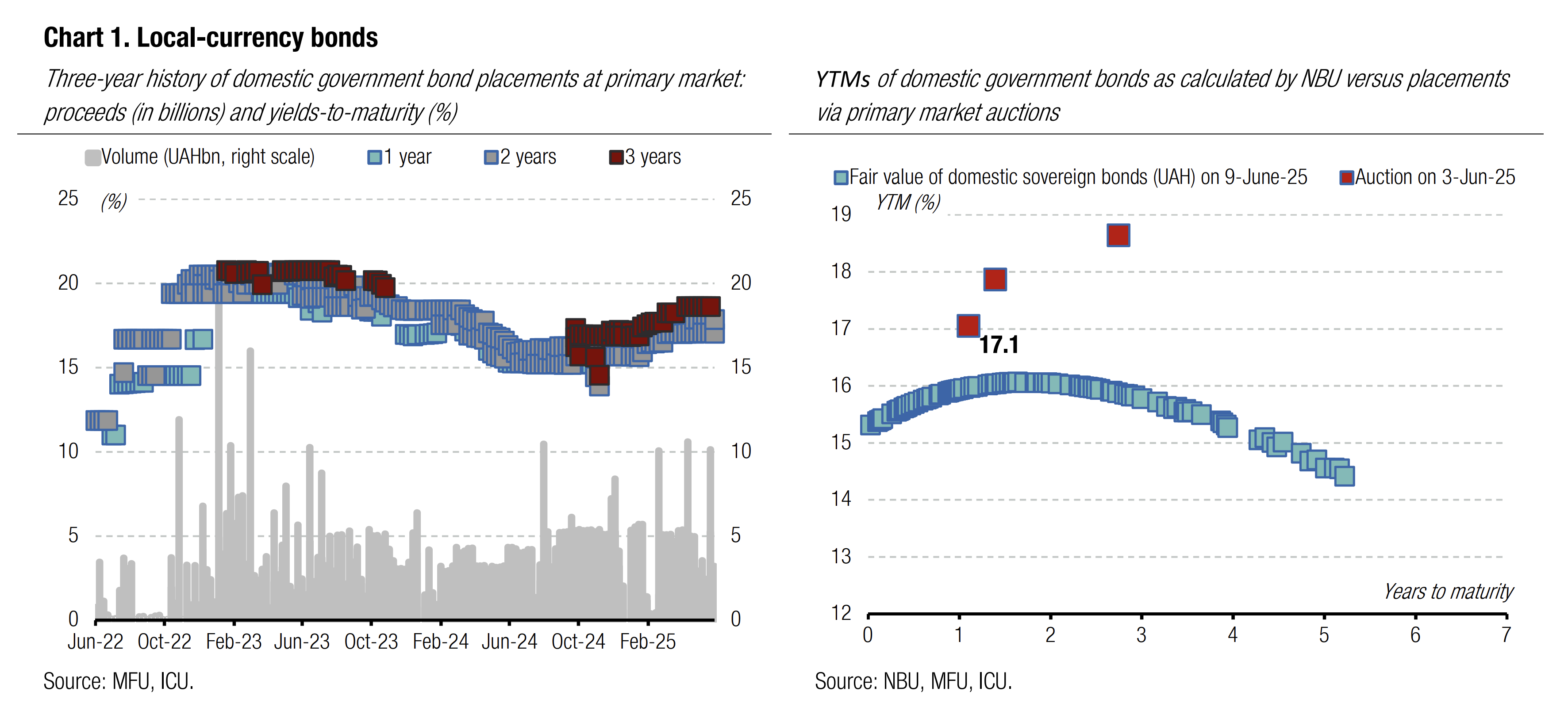

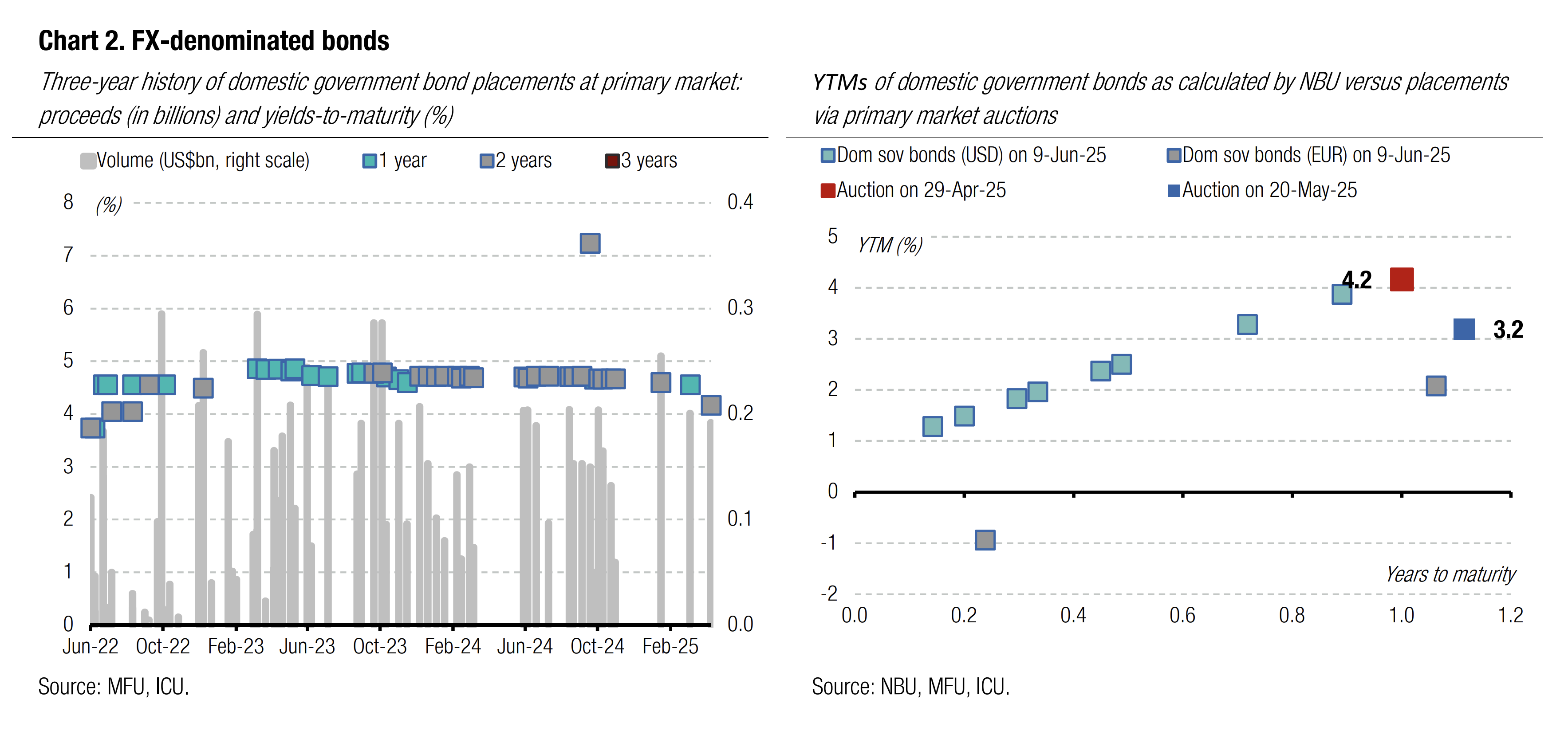

The Ministry of Finance updated its offer of military and regular bonds while pausing the offering of reserve bonds.

Last week, the MoF sold the usual 15-month and 20-month bills and replaced the three-year note with a new 3.5-year paper. Meanwhile, the MoF withheld the offer of the four-year security, which may soon be designated by the NBU as a reserve bond.

The size of bids for the new 3.5-year bond maturing in November 2028 was below the cap. Even so, the demand was concentrated in the shortest and the longest paper, as they accounted for nearly 89% of all proceeds. See details in the auction review.

The MoF redeemed UAH20bn of bonds last week, about half of all redemptions scheduled for June. The remaining half is coming next week.

Tomorrow, the Ministry of Finance will issue a new 15-month security due in September 2026 that will replace a similar issue, whose total cumulative issuance exceeded UAH20bn last week.

ICU view:If the average weekly borrowings remain at the same level as last Tuesday, the Ministry of Finance won’t be able to refinance all of the redemptions due in June. The UAH debt rollover may thus decline in June. Additional issuance of reserve bonds may be a game changer, but they are currently not in the offering pipeline for June. We expect the Ministry will increase domestic borrowings in the autumn after the NBU switches to a monetary policy easing cycle (see comment below).

Bonds: Bondholders' expectations deteriorate

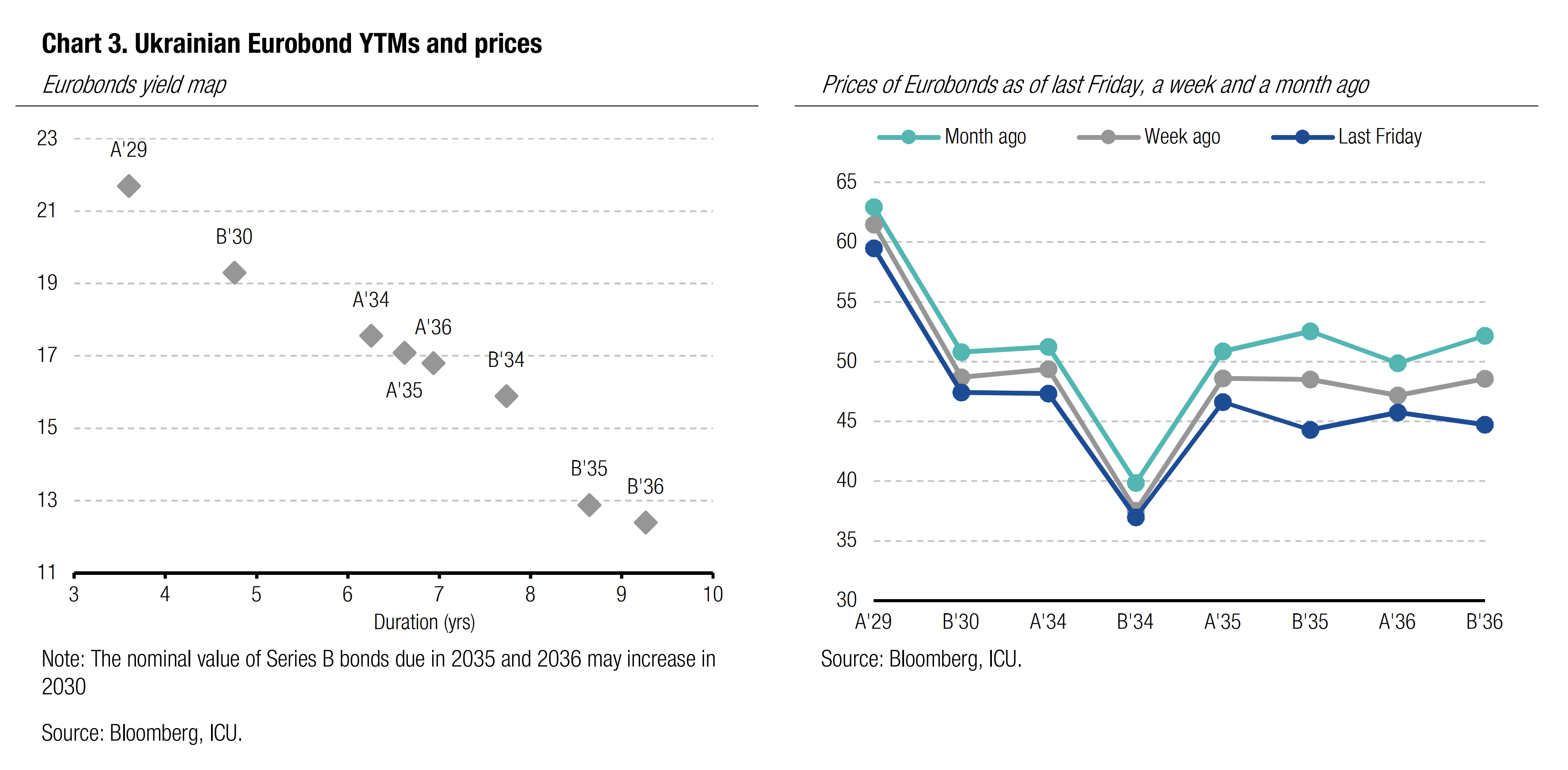

Ukrainian Eurobond prices dropped last week as investors became less optimistic about the prospects of peace talks.

The US and russian presidents had a phone conversation last Wednesday. President Trump described their call as "good," but "not a conversation that will lead to immediate peace." On the same day, Bloomberg reported that European allies concluded that the US would not provide air defence to support the "reassurance force" that the UK and France may deploy in postwar Ukraine.

Therefore, Eurobond prices dropped by 5% last Thursday, with only a slight recovery last Friday, resulting in a weekly decline of 4.4%. The EMBI index added 0.1% last week.

Last week, the ad hoc group of warrant holders expressed disappointment over Ukraine's decision to default on its payment due in June. The group noted it remains ready and willing to engage with Ukraine to find a mutually acceptable solution. They emphasize that Ukraine must consider that the restructuring of warrants in 2022 provided significant concessions to the country. This contrasts with the actions of Ukraine’s Eurobond holders at that time, who only agreed to a standstill. Last week, the price of VRIs fell by 3%, reaching 71%.

ICU view:Bondholder sentiment continued to deteriorate as President Trump showed no willingness to increase pressure on russia to agree to a ceasefire. russia continues to make inflated and unrealistic demands for a ceasefire and has only agreed to exchanges of prisoners and bodies of fallen soldiers, which does not bring peace negotiations any closer.

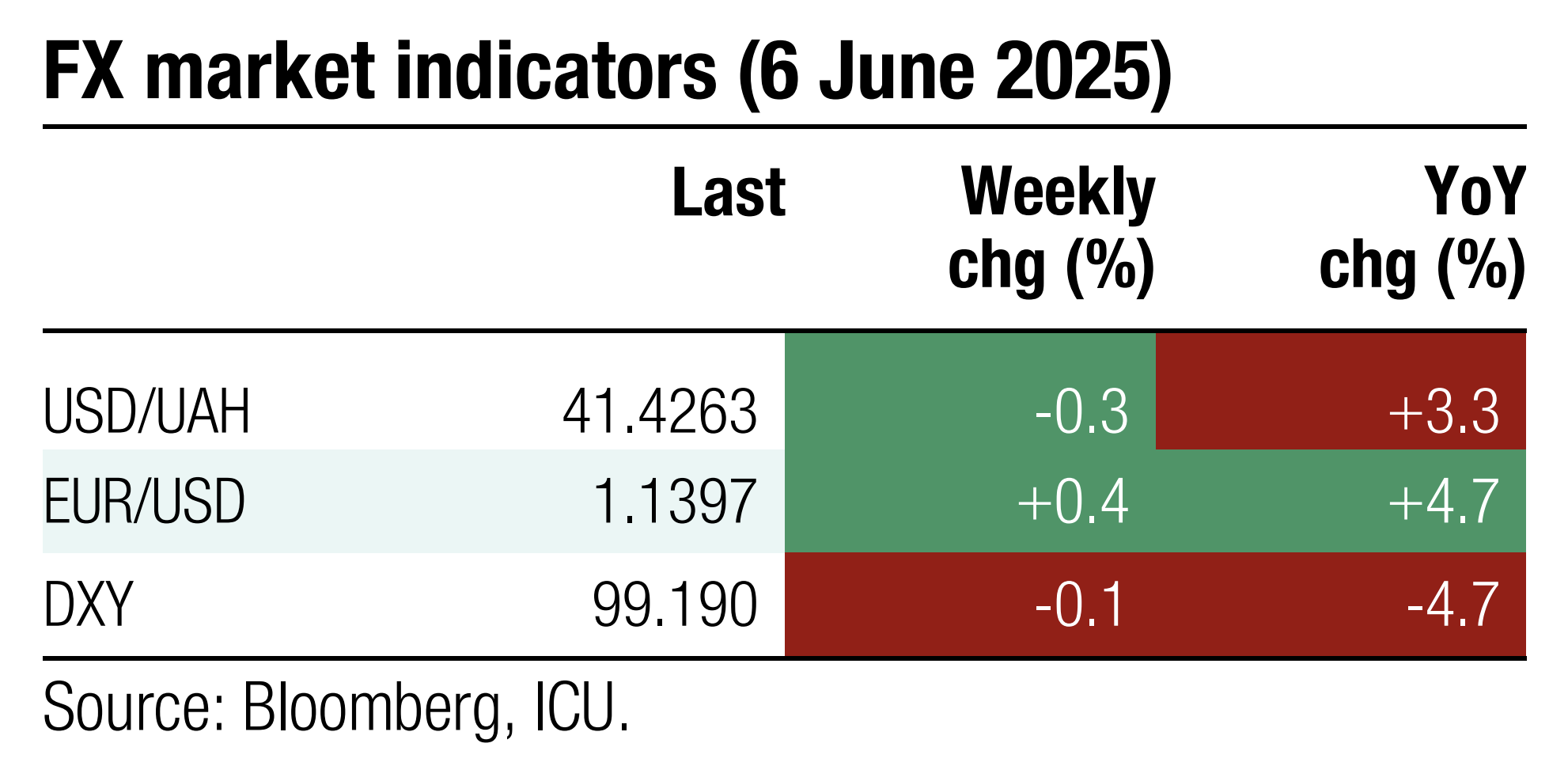

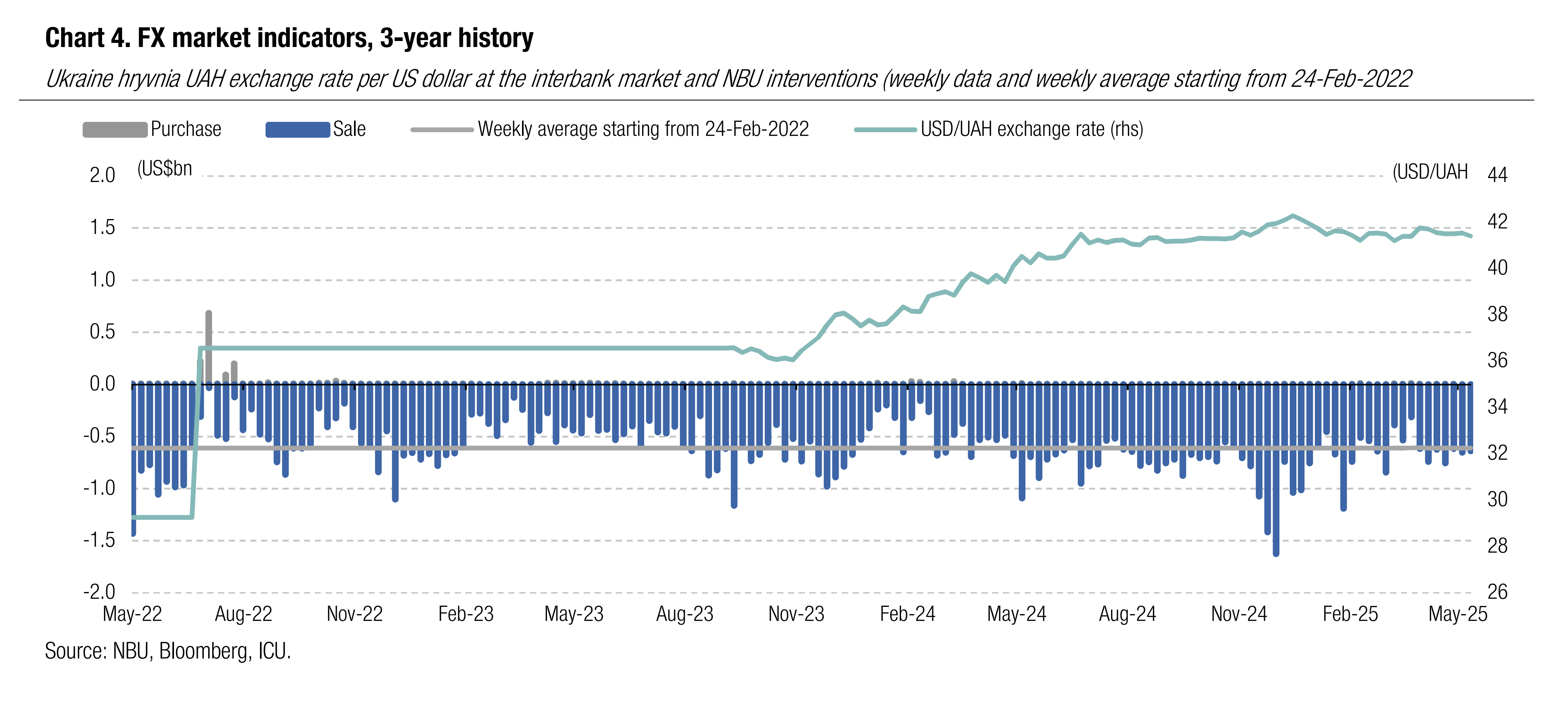

FX: NBU maintains a stable hryvnia rate

The NBU strengthened the hryvnia last week despite a significant shortage of hard currency and despite interventions remaining large.

The total foreign currency deficit rose by almost 11% WoW last week to US$430m (in four business days), primarily after net hard currency purchases in the retail segment doubled to US$46m. At the same time, in the interbank FX market, net purchases remained little changed at US$384m.

Therefore, the NBU had to sell US$639m via interventions last week, which is above the weekly average during the full-scale war.

At the same time, the NBU strengthened the hryvnia official exchange rate last week by 0.3%, WoW, to UAH41.4/US$.

ICU view: The NBU continues to be the main seller of hard currency in the market, which is instrumental in preventing hryvnia depreciation. The NBU seems to be fully comfortable with its current level of weekly interventions, which are slightly above the weekly average since the start of the full-scale war. We expect the NBU to maintain its strong hryvnia policy in the coming months.

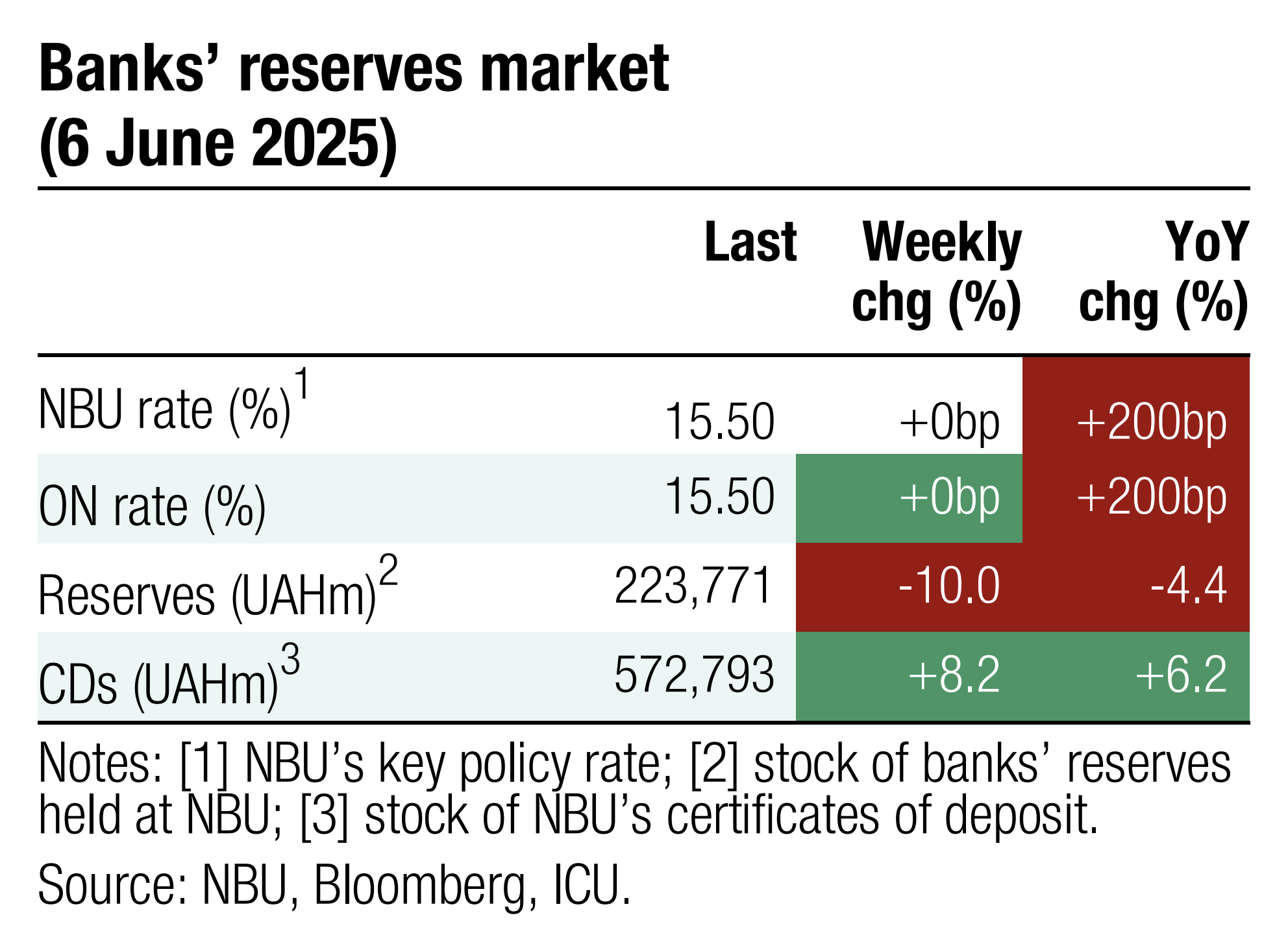

Economics: Key rate kept unchanged

The NBU has left its key policy rate unchanged at 15.5%, while highlighting upside risks to inflation.

Markets had largely expected the rate to remain steady, as inflation reached 15.1% YoY in April and is likely to exceed the NBU’s forecast for May. The central bank noted that adverse weather conditions could slow the disinflation process in the coming months, with agricultural prices expected to decline more slowly than previously anticipated.

ICU view:As noted in our previous macro report, we believe the NBU is likely to opt for a smaller rate cut this year. We expect a total reduction of 150 bps between September and December. The NBU’s current forecast implies a more aggressive 250 bps cut, which we think will be revised downward in July.

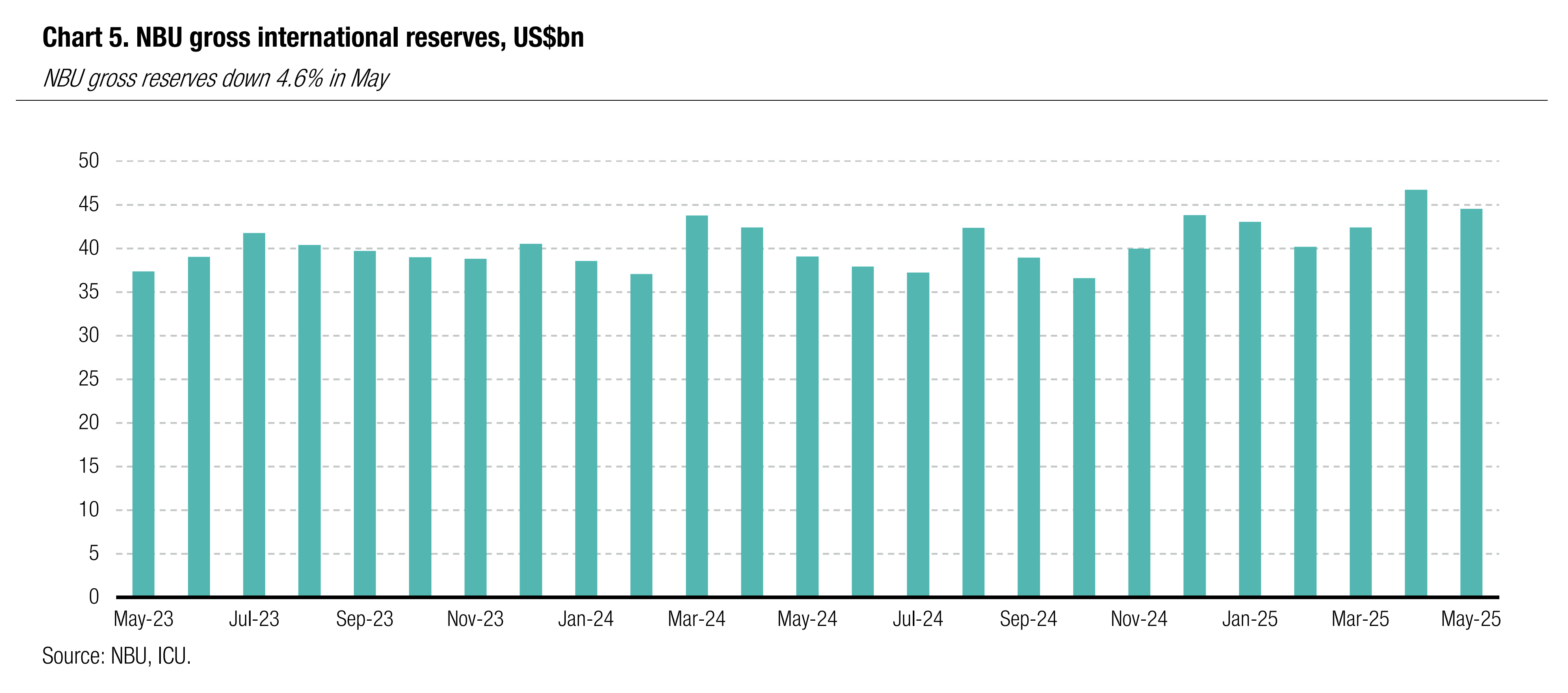

Economics: NBU reserves down 4.6% in May

The gross international reserves of the NBU declined 4.6% in May (+1.7% YTD) to US$44.5bn on large FX interventions and lower foreign financial aid.

The NBU had to spend a net US$3.0bn in interventions last month to maintain the stability of the FX market. External debt servicing amounted to US$0.4bn. Meanwhile, Ukraine received US$1.1bn of foreign financial aid via ERA facility from the EU. The reserves are equal to 5.4 months of future imports, according to NBU estimates.

ICU view: The current short-term ups and downs of NBU reserves should be ignored as the reserves will remain on an upward underlying trend through end-2025. We expect NBU reserves to exceed US$55bn at the end of the year if the scheduled financial aid from Ukraine’s partners is provided on time. High reserves will enable the NBU to maintain full control of the FX market, and we think only moderate hryvnia depreciation is possible in 2025. That said, we expect a notable reduction in NBU reserves and heightened hryvnia depreciation pressure next year if the foreign aid package for 2026 is not upscaled substantially.