|  |

|  |

Bonds: MoF updates auction schedule

The Ministry of Finance updated its bond auction schedule last week, but the revision of the offer structure was postponed to June.

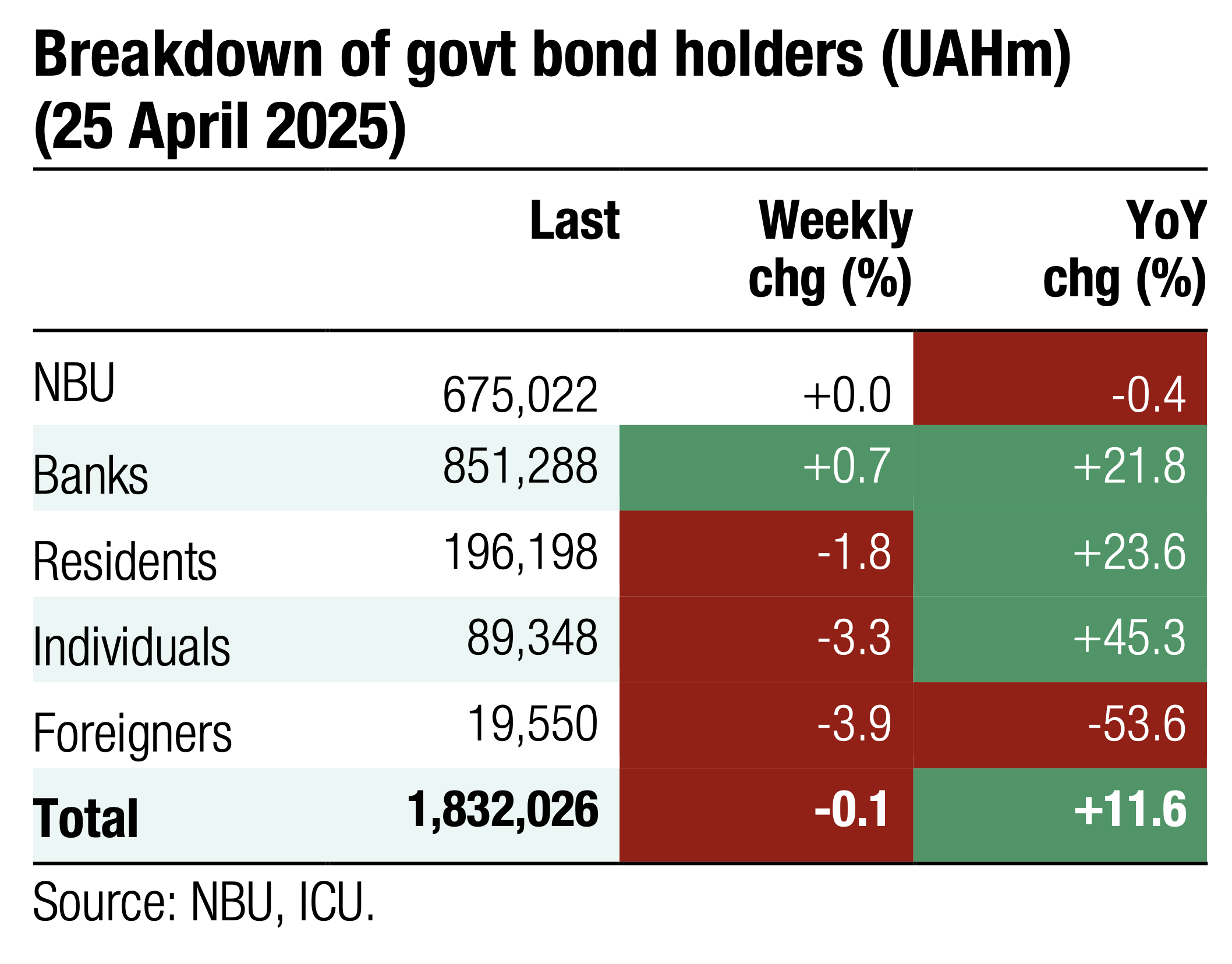

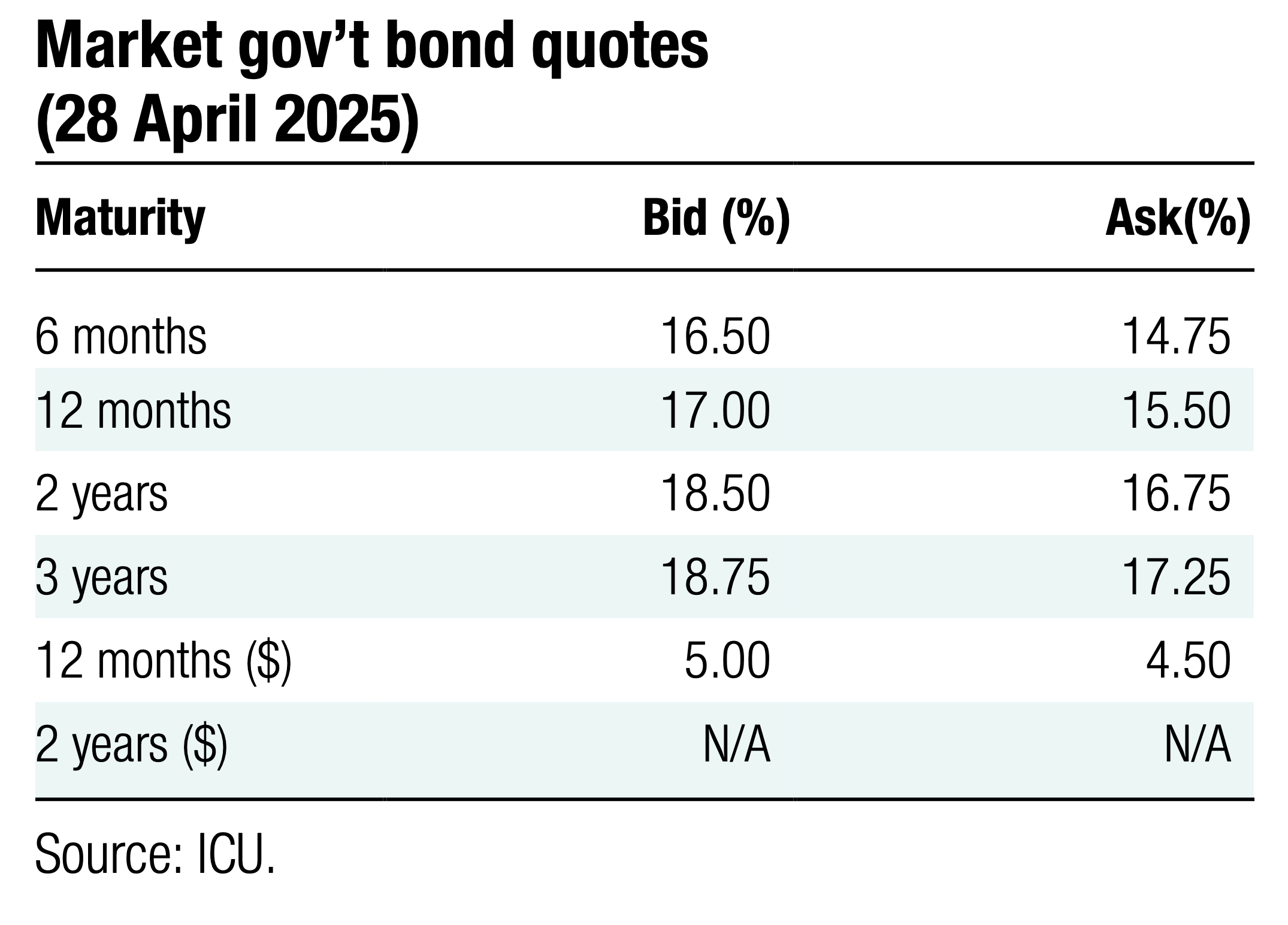

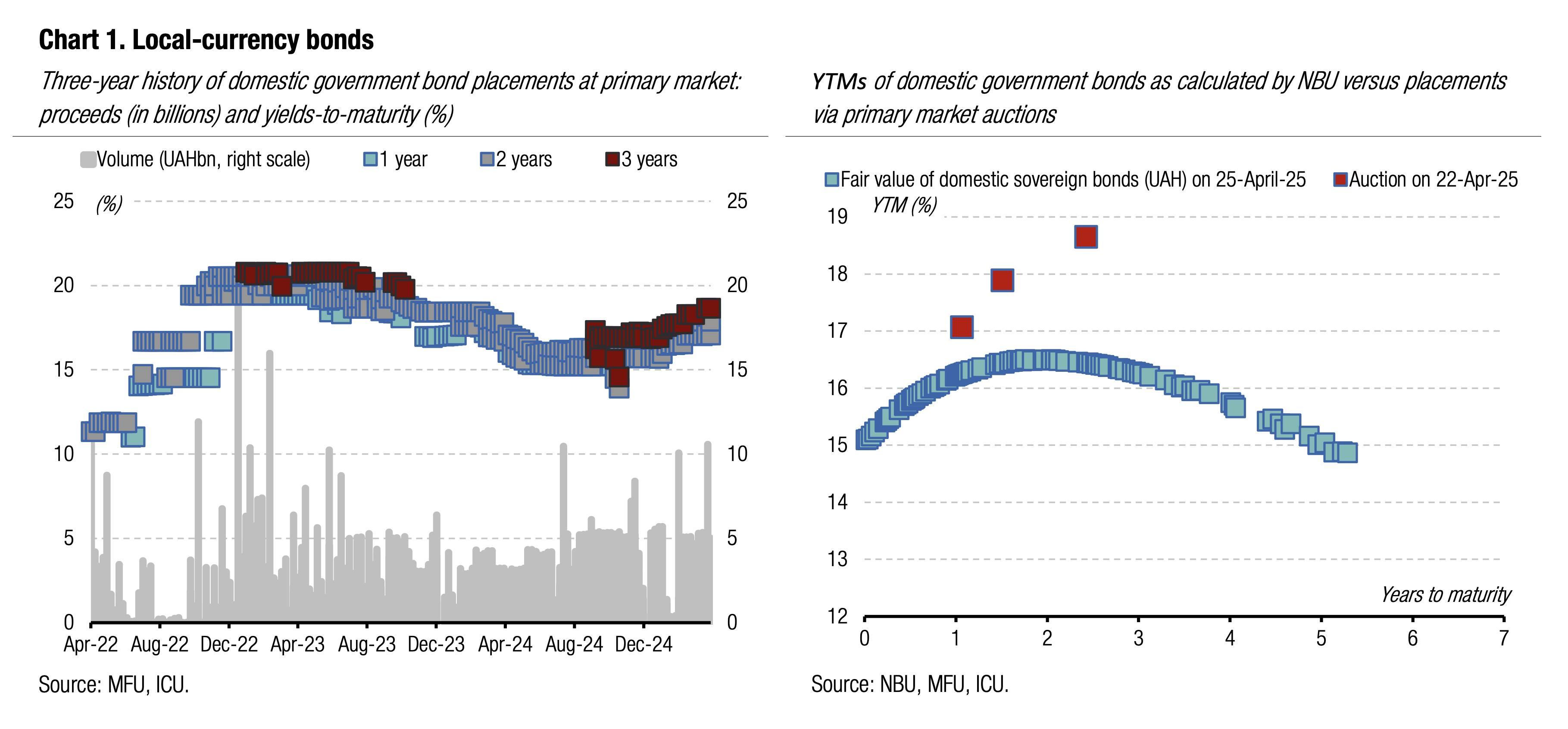

At last week's primary auction, the MoF's proceeds from the placement of three UAH bonds exceeded UAH9bn. The demand was the highest for a 14-month military bill and a regular three-year note. Despite the significant demand, interest rates remained unchanged. See details in the auction review.

Several successful primary auctions led the MoF to update its auction schedule. In May, the MoF will continue to offer the same three UAH bonds that are scheduled for tomorrow's auction. The offer structure will remain unchanged until June, even though the MoF previously indicated its revision could happen in May.

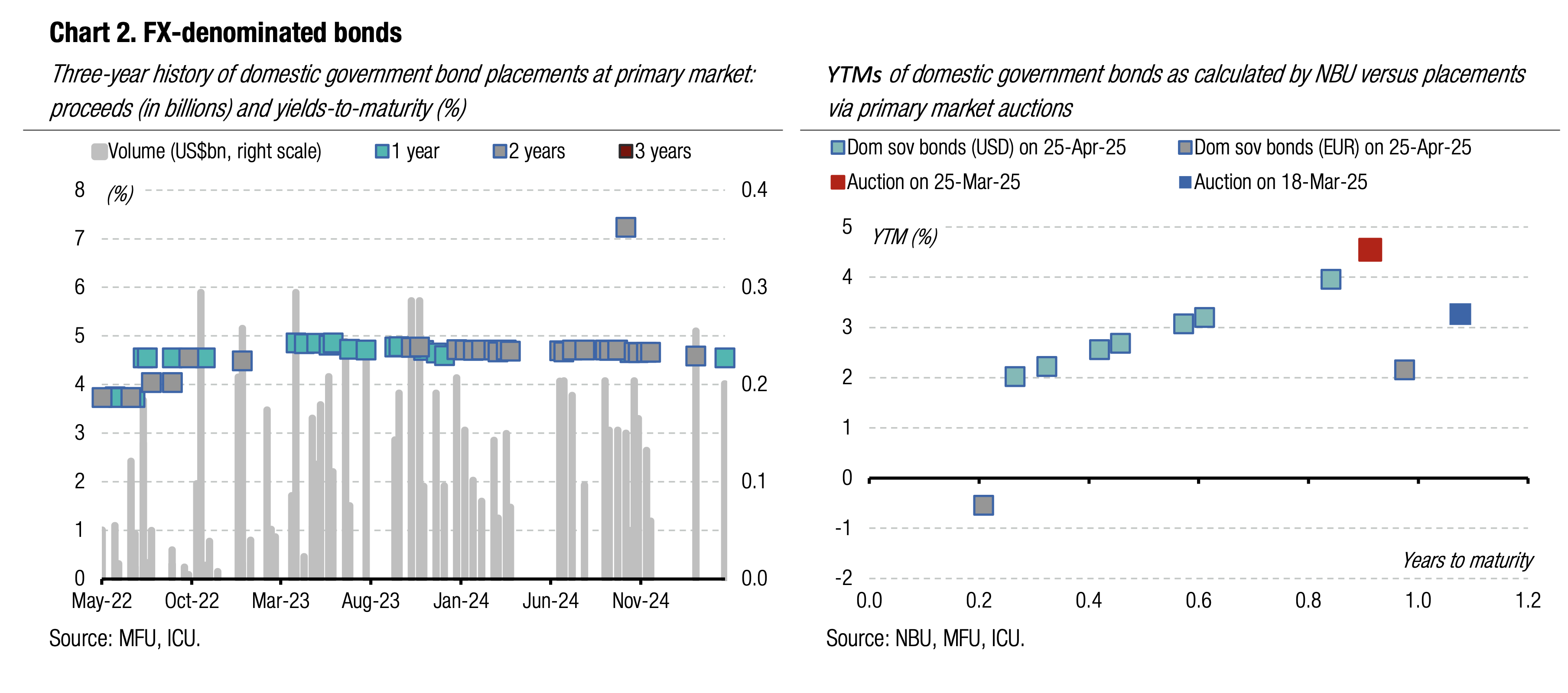

Tomorrow, the MoF will offer a new 15-month paper in place of a 14-month bill while two—and three-year bonds that were sold at recent auctions will remain on the offer. Also tomorrow, the MoF will sell a 12-month USD-denominated bill following last week's redemptions of US$281m worth of bonds.

The next scheduled redemptions include a) UAH20bn military bond this week, b) EUR156m bond in mid-May; c) UAH10.5bn of reserve bond on May 21 (the part that was not swapped in a recent exchange auction).

ICU view: Last week's budget proceeds were the largest YTD (excluding reserve bonds). The NBU's recent decision to keep the key policy rate unchanged may lead to higher demand for UAH bonds as some investors show interest in locking in the current attractive YTMs for longer in anticipation that the monetary policy stance will be reversed later this year. Therefore, three-year note was oversubscribed last week, and the MoF may sell a sizeable amount of this paper in the following weeks. The MoF may offer a new reserve note in June or at the end of May after one of the outstanding reserve bonds matures in May.

Bonds: Eurobond holders stay cautiously optimistic

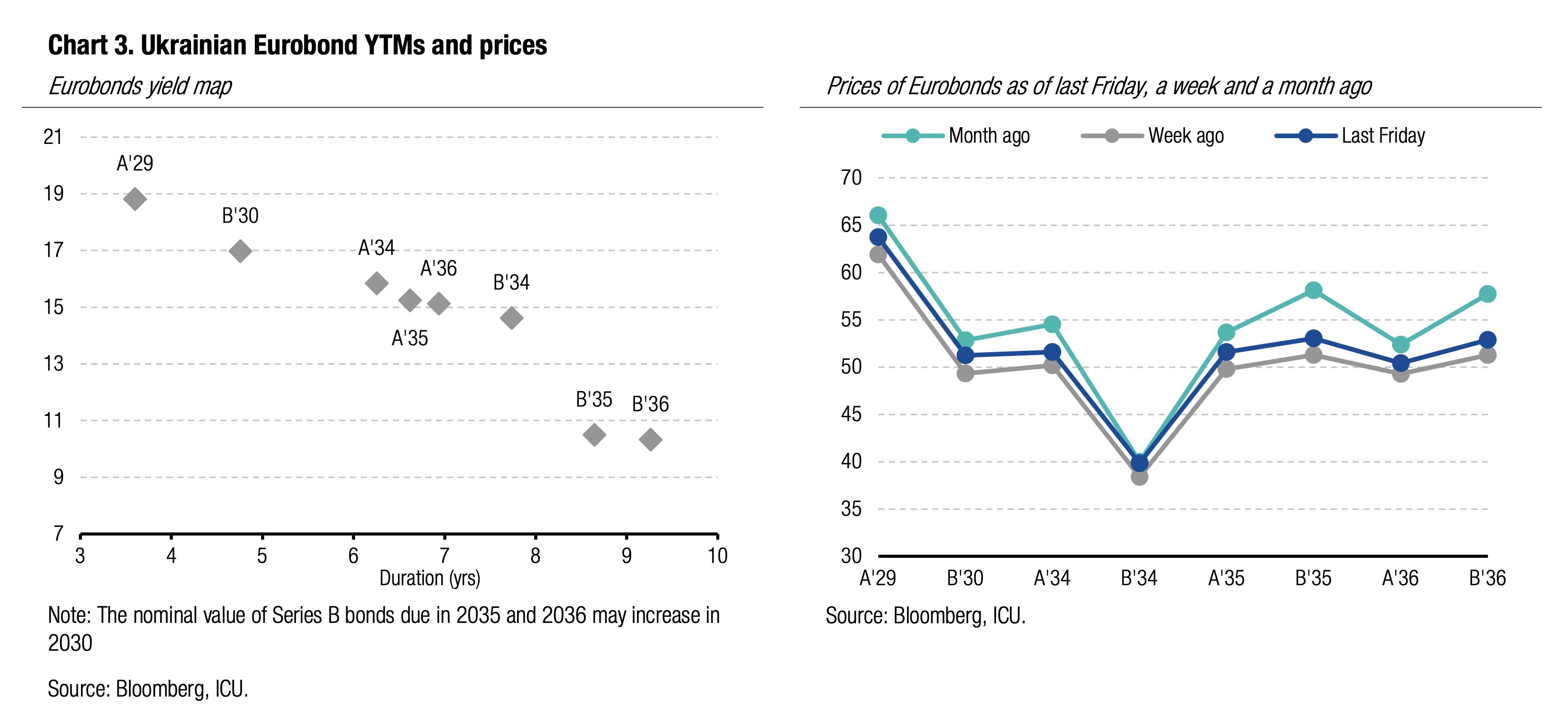

Ukrainian Eurobond prices rose slightly last week, on the back of small steps in negotiations toward a ceasefire in Ukraine.

Last Wednesday, representatives of Ukraine, several European countries, and the US met to discuss steps toward a just and lasting peace in Ukraine. The President of Ukraine and the President of the US exchanged public statements that, unlike in many previous instances, did not lead to an escalation. Last Saturday, they also briefly met during the funeral of the Pope and thereafter provided broadly positive comments and signals about the prospects of a deal.

Ukrainian Eurobond prices rose by an average of 3% last week, partially due to the impact of warming global sentiment toward emerging markets, as the EMBI index rose by 1.4% last week. However, prices are still lower than a month ago.

ICU view: Discussions about the key conditions of the peace plan for Ukraine are ongoing. Public statements by politicians indicate the next couple of weeks may be critical and decisive for Ukraine. This fuelled some optimism among bondholders, even though the market is still far from convinced that a quick settlement is possible.

Bonds: VRI restructuring offer unimpressive for investors

Last week, the MoF announced the results of its debut attempt to agree the terms of VRI restructuring. The initial offer was rejected by investors.

The MoF proposed two options for holders. The first option is to exchange VRIs into StepUp bonds A and B, pro rata to their current outstanding volume with the exchange ratio of 1.35x, i.e. US$135 for each US$100 of the notional amount of VRIs. The second option envisages a cancellation of all payments due in 2025-28, extension of the call option to May 31, 2029, and modification of the redemption price that is to be set at 85c of the notional amount if securities called until May 31, 2027, at 90c if called until May 31, 2028, and at 100c if called until May 31, 2029. The MoF offered VRI holders a compensation through the reopening of existing Eurobonds: US$36.6 of series A and B bonds for each US$100 notional amount of VRIs.

At the same time, VRI holders proposed to restructure only the payment due this year with regard to GDP growth in 2023. They proposed the MoF to pay 75% of the amount scheduled for the May 31, exchanging 25% of the payment for new C Eurobonds due in 2029 and a 7.75% coupon.

During the restricted period, VRI's price rose to almost 74 cents. After the MoF issued the press release detailing the offers, the price slid to 72 cents last Friday, still 3% above the previous Friday.

ICU view: The MoF and holders will converge their proposals and organize the next meeting soon, as the payment date is May 31. During last year's restructuring, the MoF made significant concessions to bondholders after its initial proposal was rejected. This gives investors hope that a new offer may offer much bigger upside.

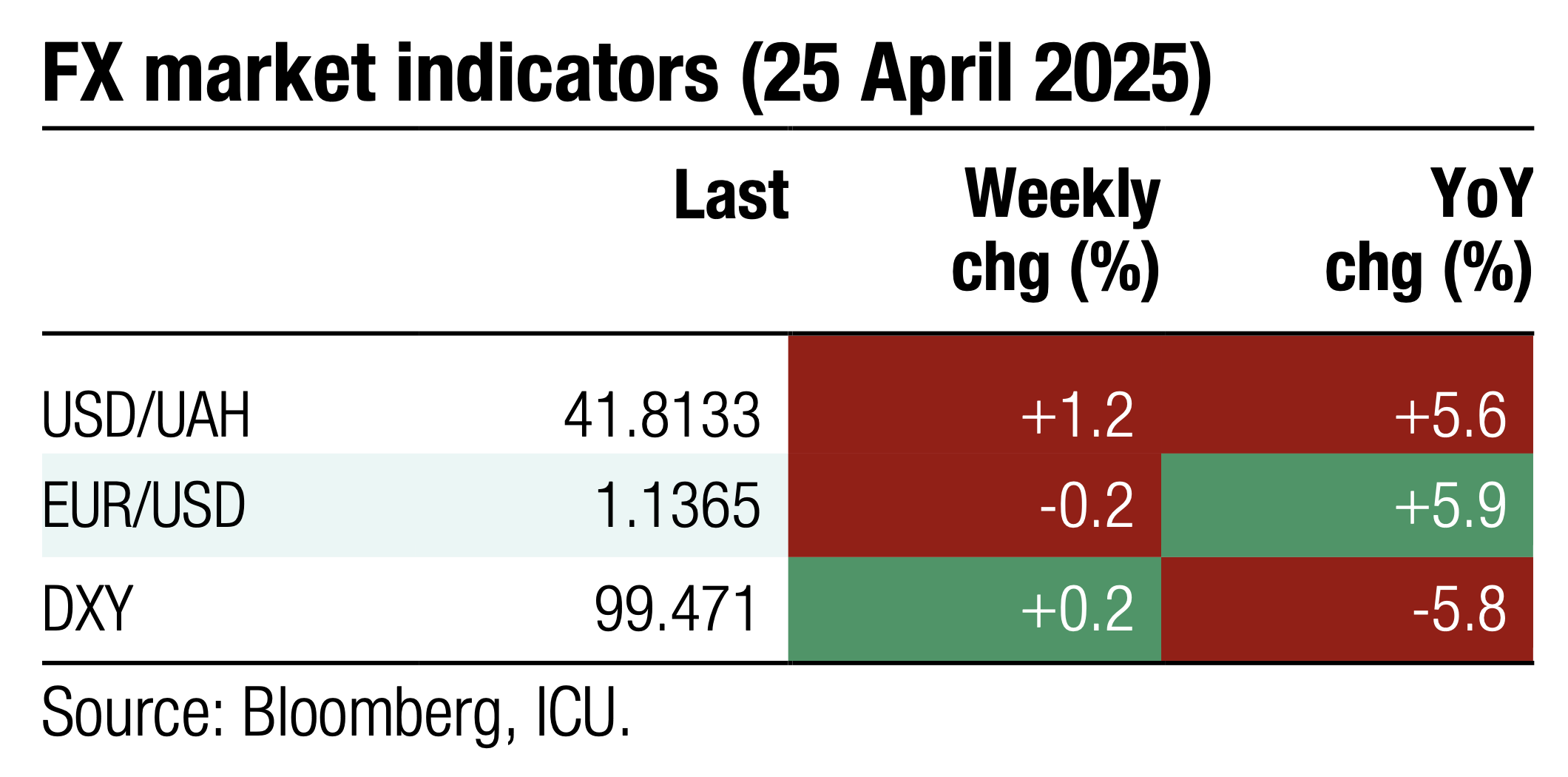

FX: NBU weakens hryvnia on higher deficit

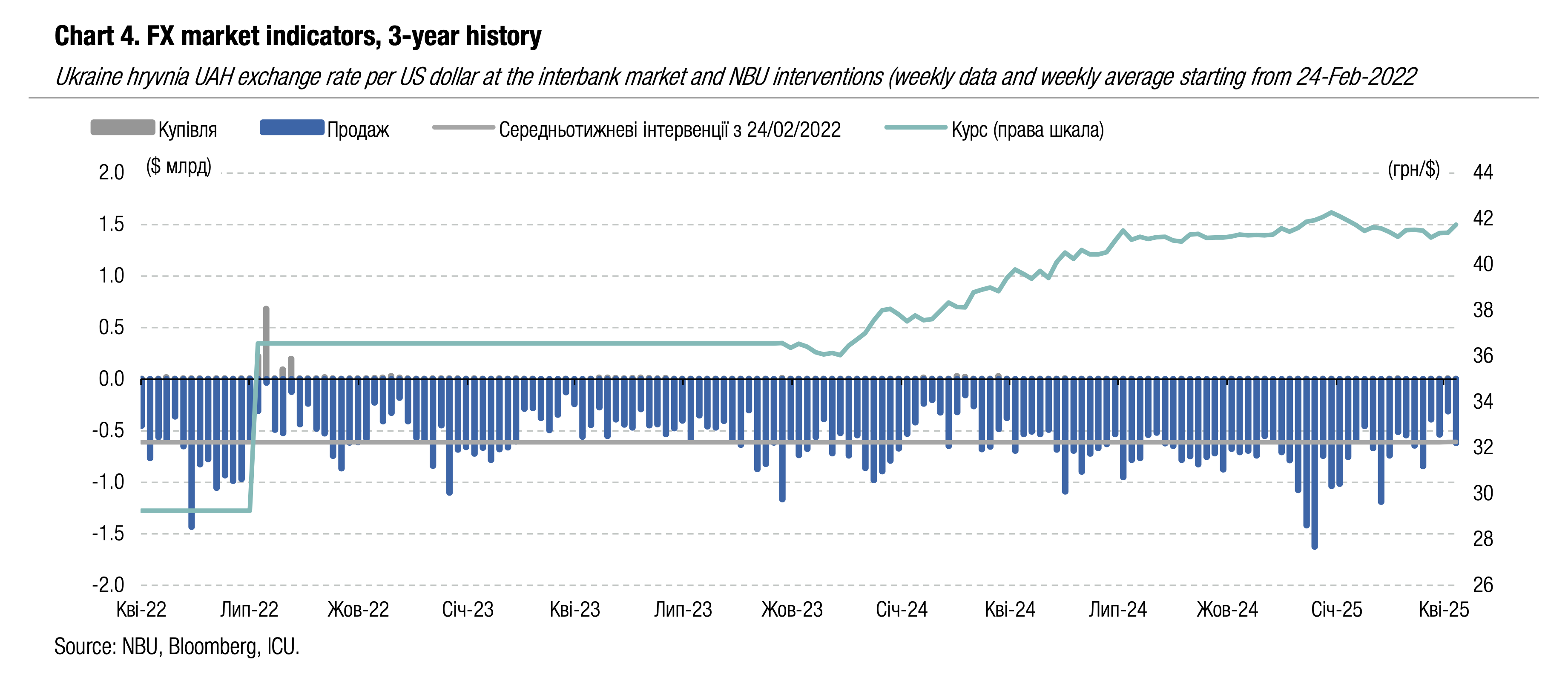

The hard currency shortage rose last week, forcing the NBU to increase interventions and weaken the hryvnia slightly.

Net foreign currency purchases last week (in four business days) almost doubled WoW to US$300m. In the FX interbank market net purchases were up by 70% WoW to US$315m. At the same time, in the retail segment, net sales slid WoW to US$19m.

Lower hard currency supply forced the NBU to nearly double its interventions WoW to US$619m, slightly above the weekly average during the full-scale war. The NBU also weakened the hryvnia by 0.9% to UAH41.75/US$.

ICU view: Lower foreign currency sales could be situational. The NBU has not moved toward gradual hryvnia weakening, and we can see hryvnia appreciation soon when the shortage narrows. This week, exporters have to pay some taxes and can increase hard currency sales.