|  |  |

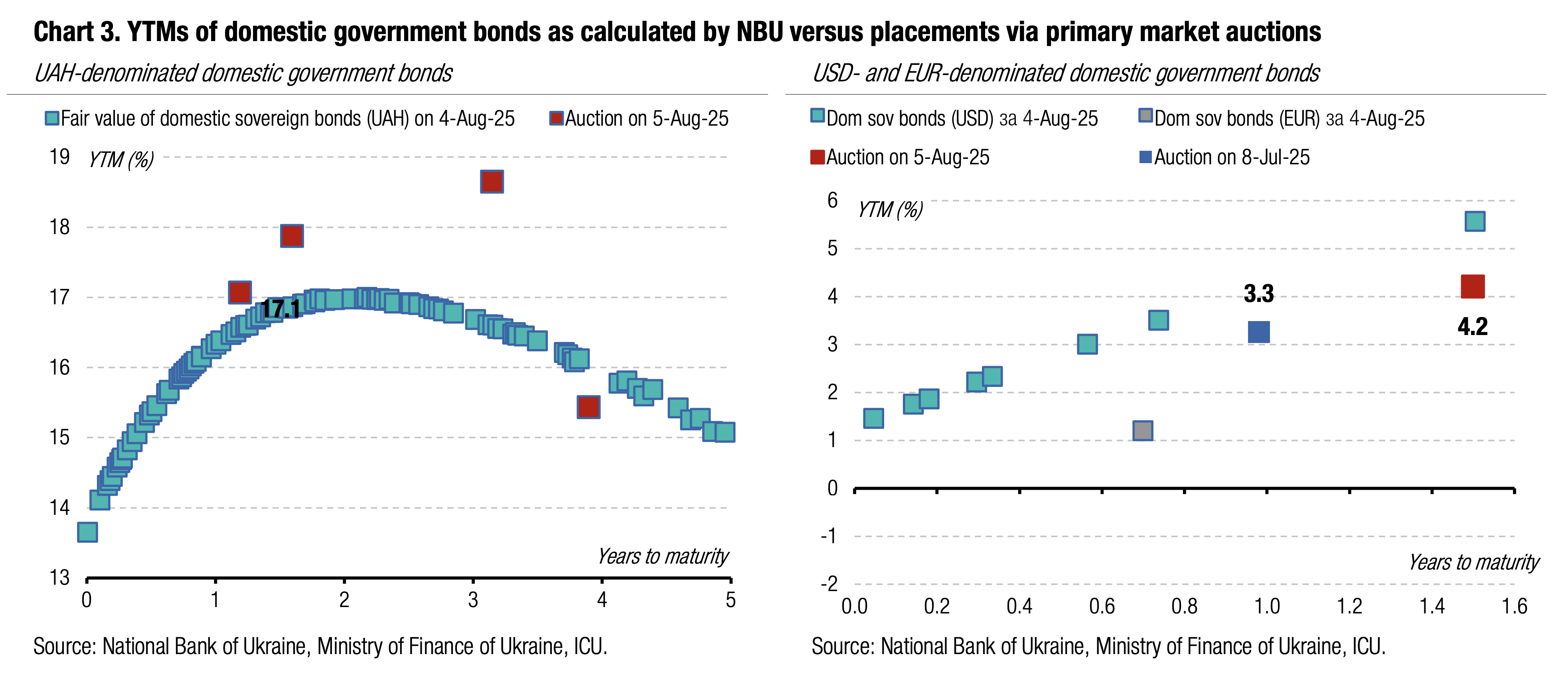

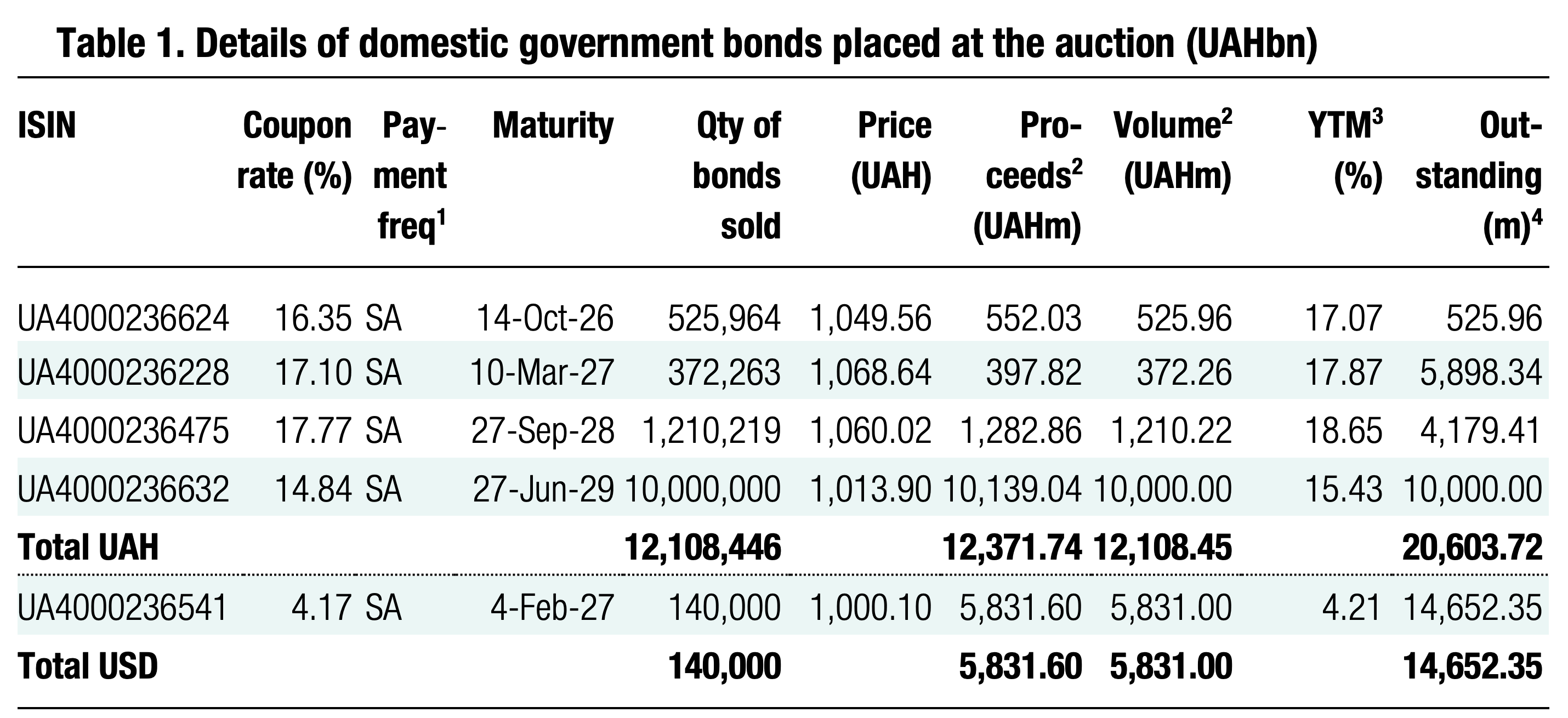

Yesterday, the MoF borrowed over UAH18bn, mostly from USD-denominated paper and a four-year note.

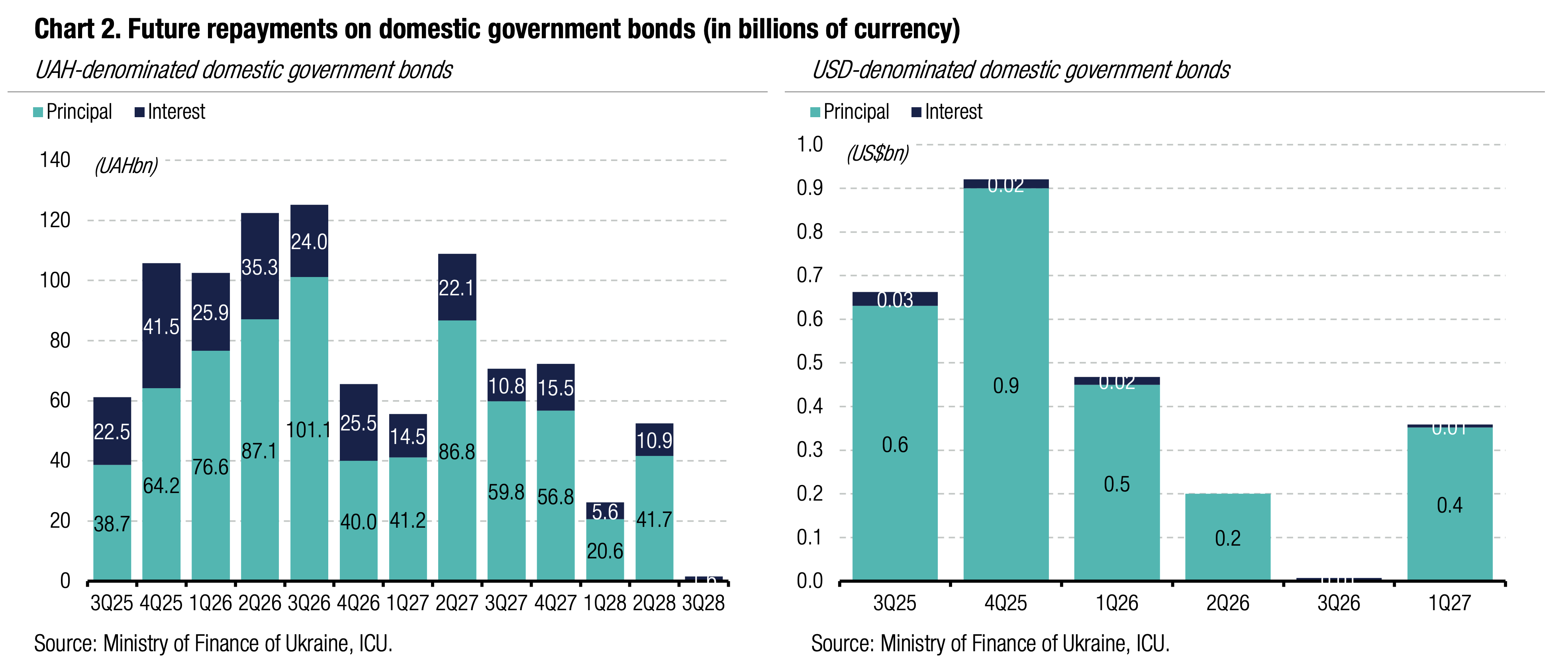

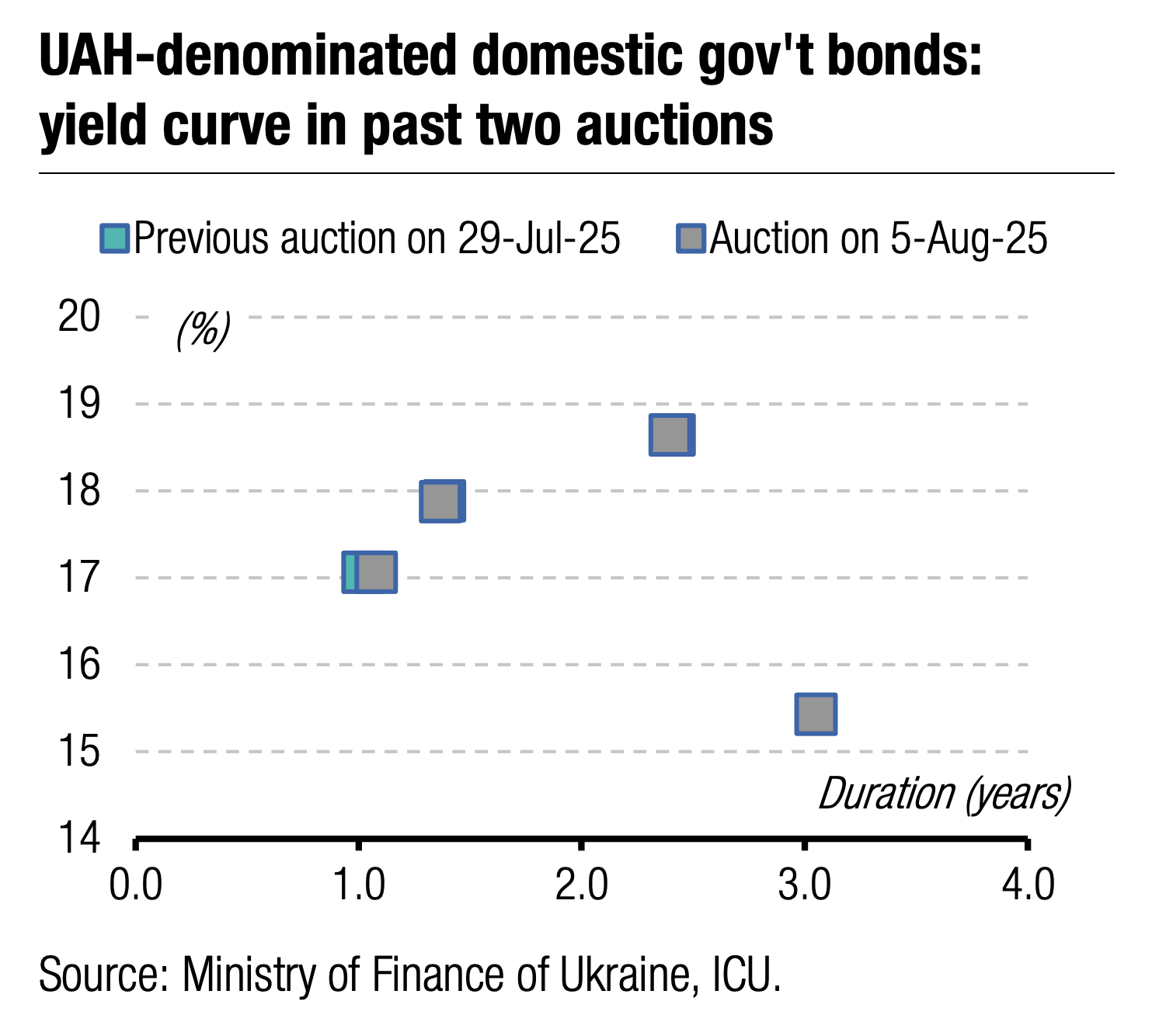

The least amount of budget proceeds was from bills with a maturity of less than two years. Fourteen-month bills provided the budget with UAH552bn, and 19-month paper raised UAH398m of funds. A three-year note provided UAH1.3bn.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.65/USD, 48.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

At the same time, a new four-year note saw oversubscription, doubling from the UAH10bn cap. Such demand, with interest rates around 15%, below the interest rates for a three-year bond, suggests that this paper will become a reserve paper. However, the cut-off rate rose 16bp to 15%, and the weighted-average rate rose 21bp to 14.84%.

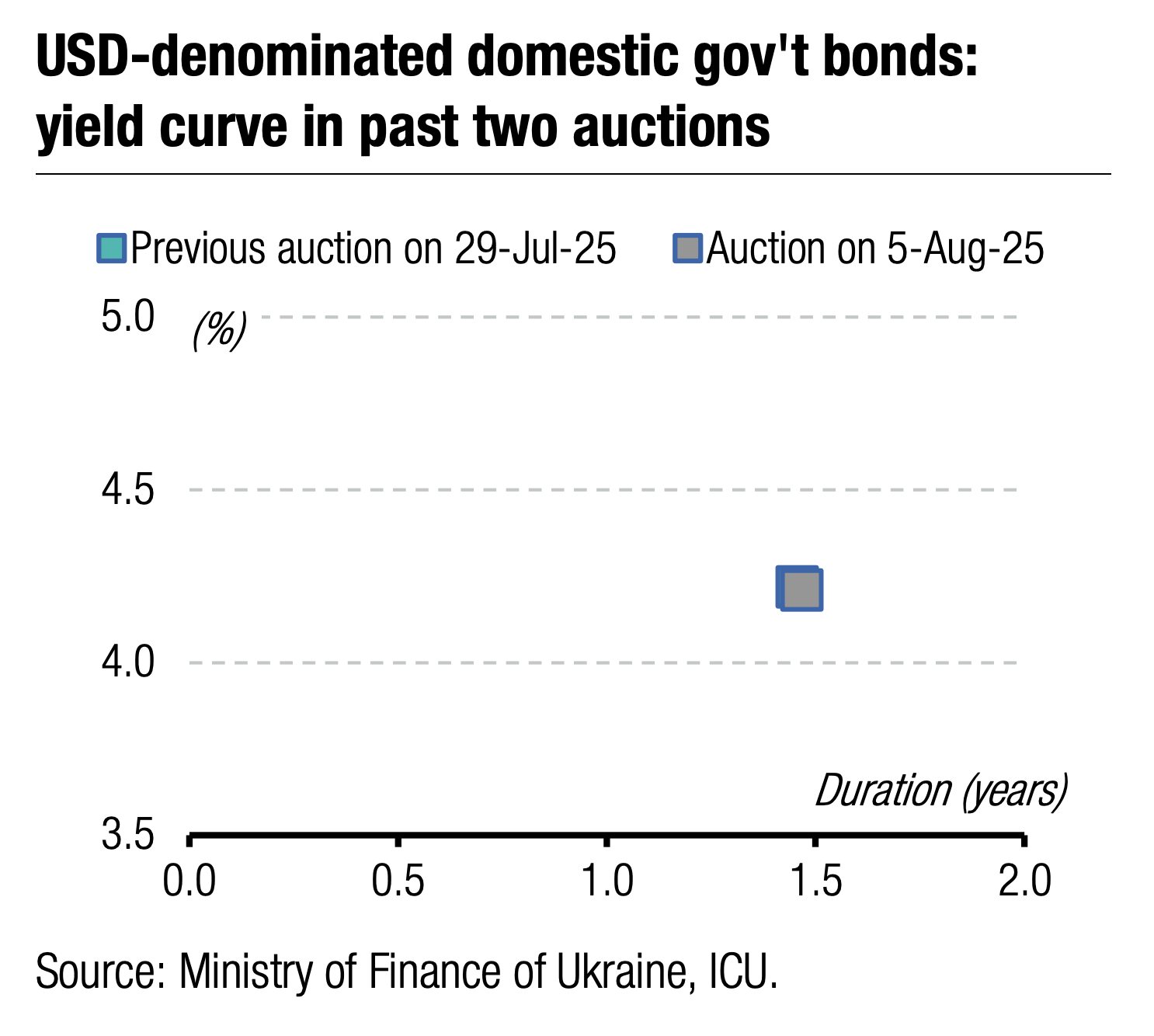

Finally, the FX-denominated bill saw almost 3x oversubscription. The MoF offered UA$140m of bills, which saw almost US$412m of demand. Interest rates were hardly changed, as the MoF rejected just two bids, and some were partially satisfied.

Appendix: Yields-to-maturity, repayments