|  |  |

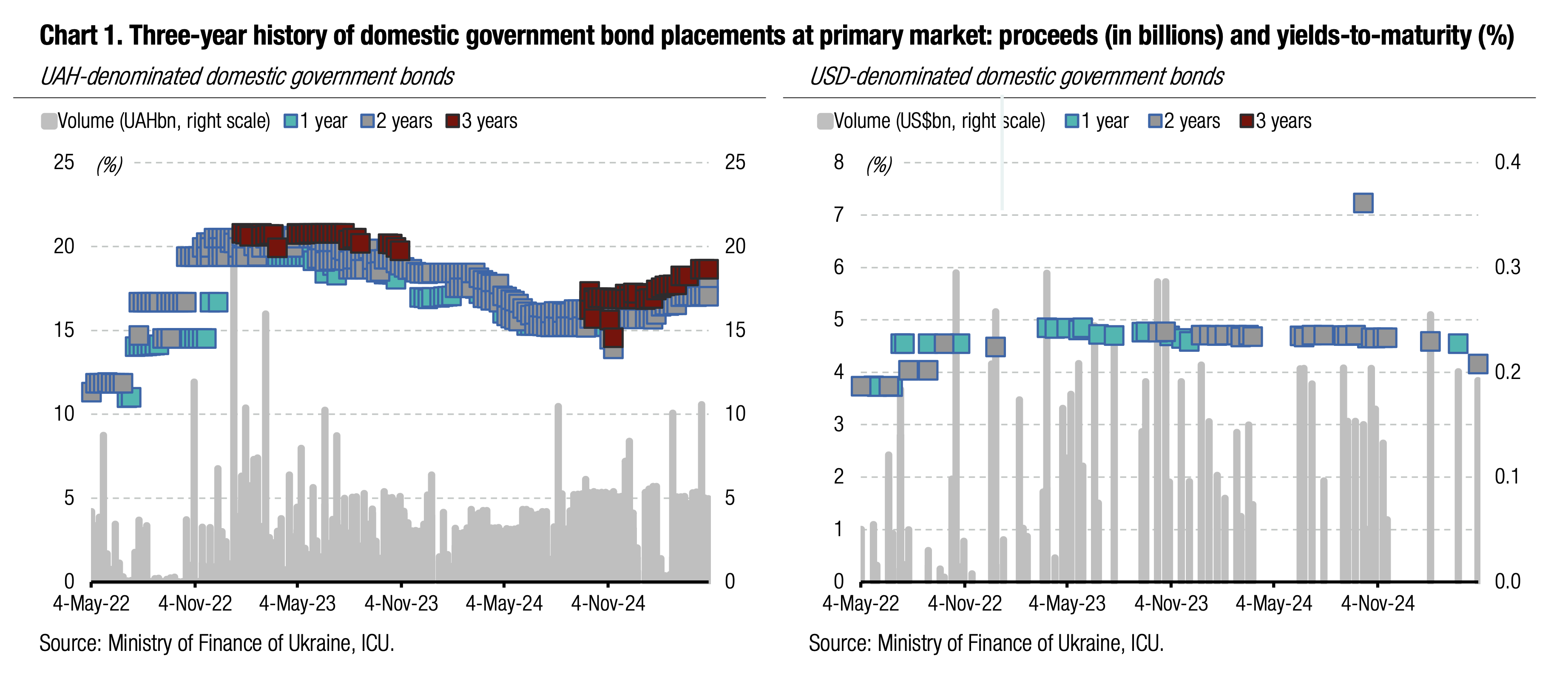

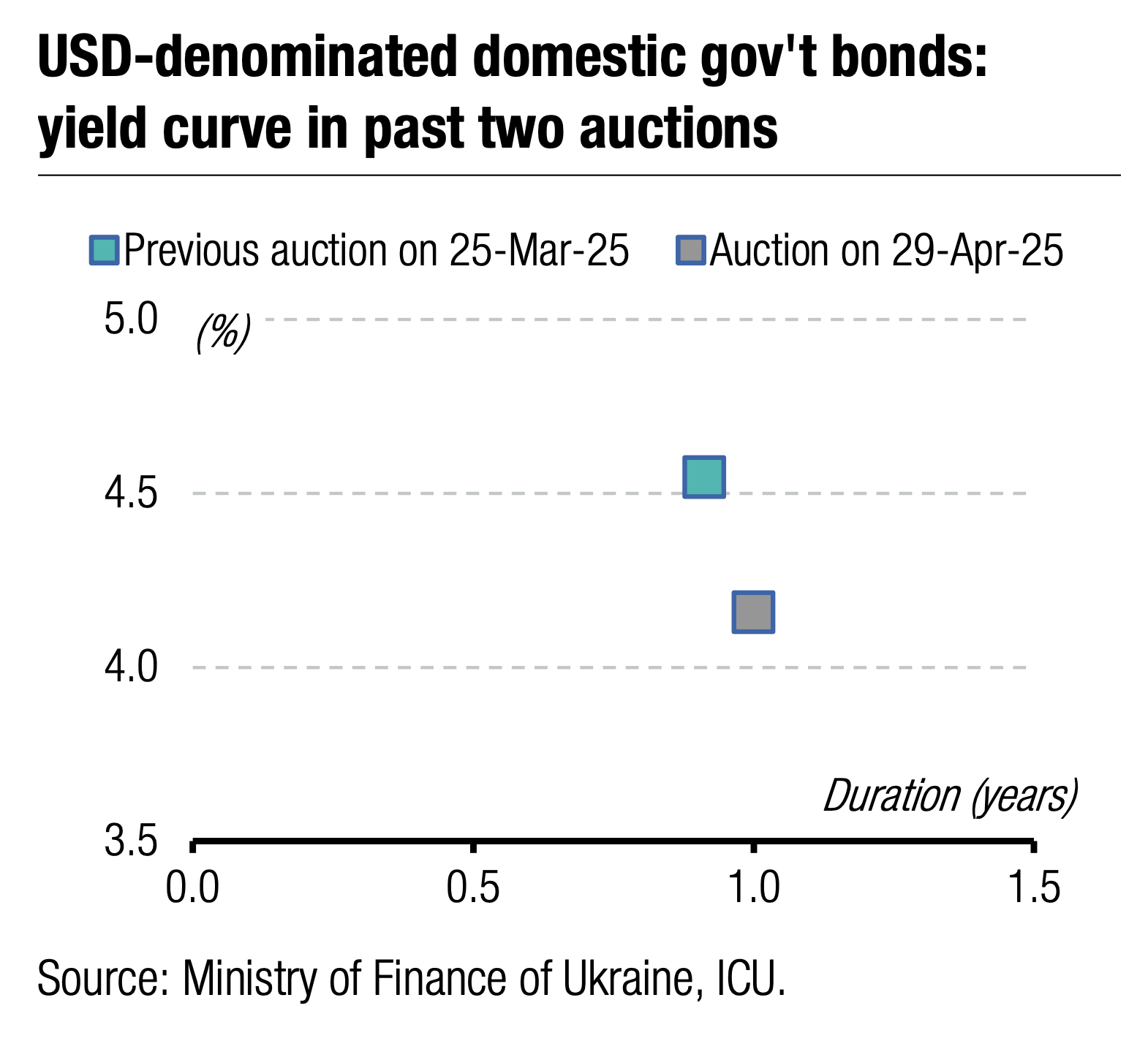

Yesterday's UAH bonds offer was without surprises. Demand was low, but no bids required a change in interest rates. At the same time, USD-denominated paper saw 5x oversubscription with decline in interest rates.

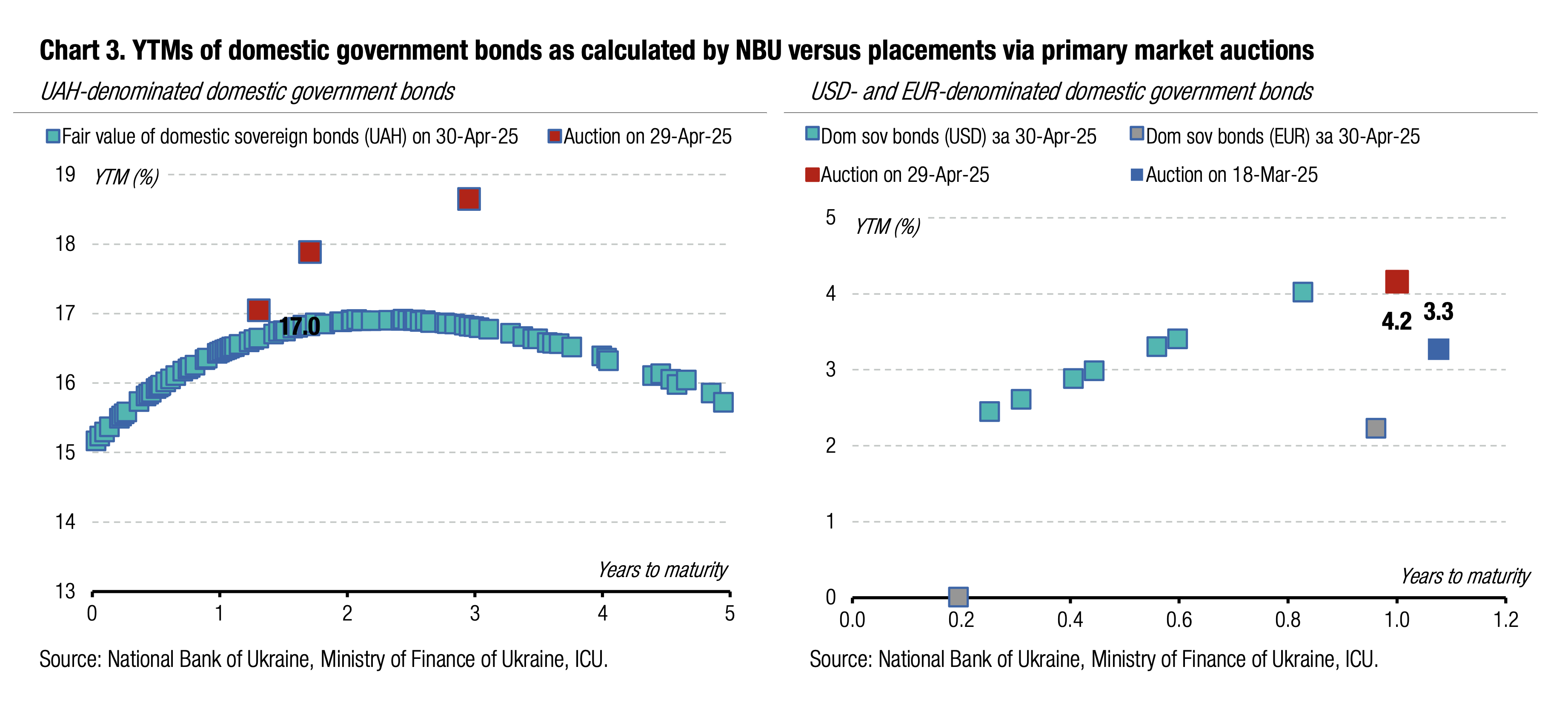

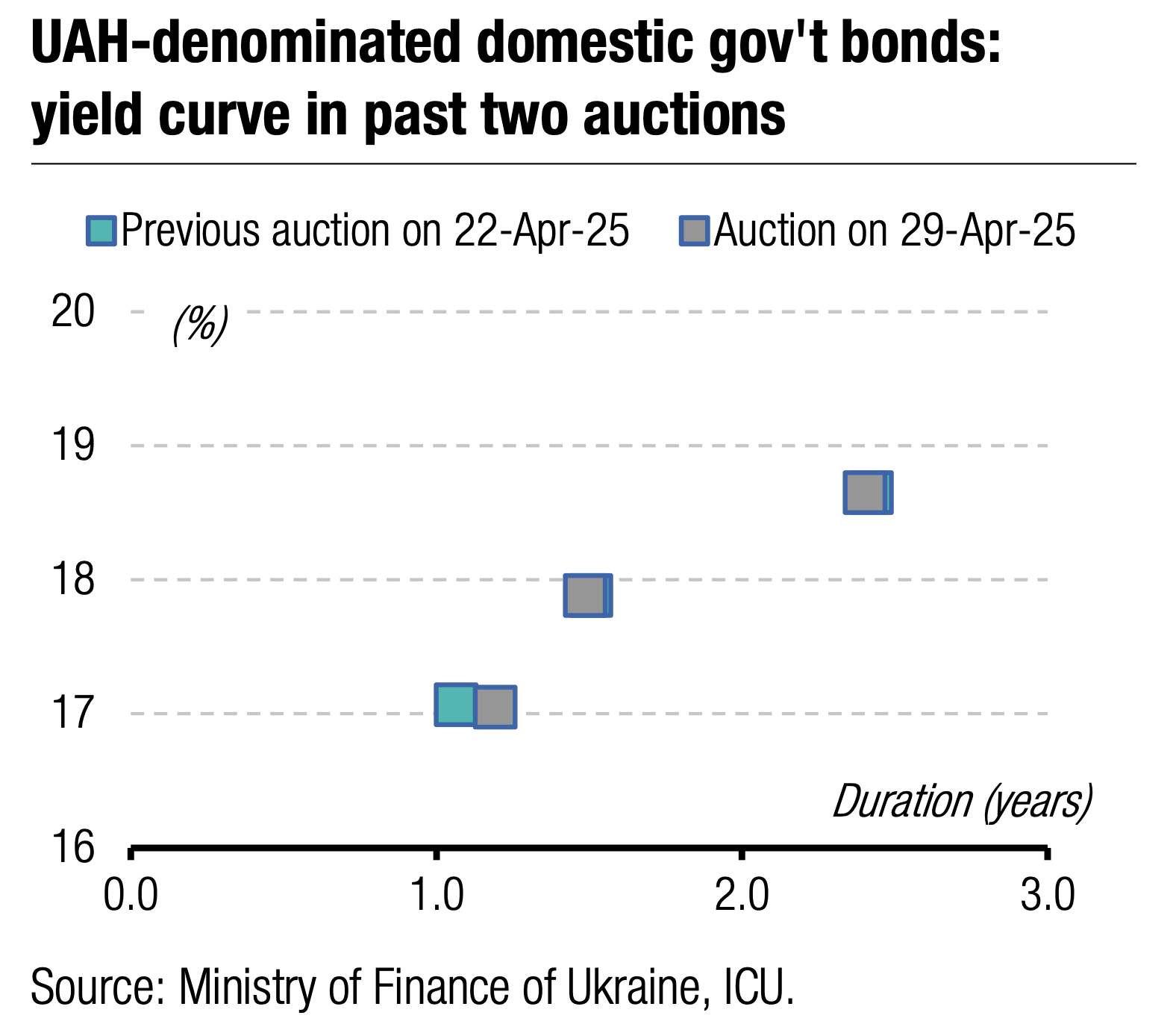

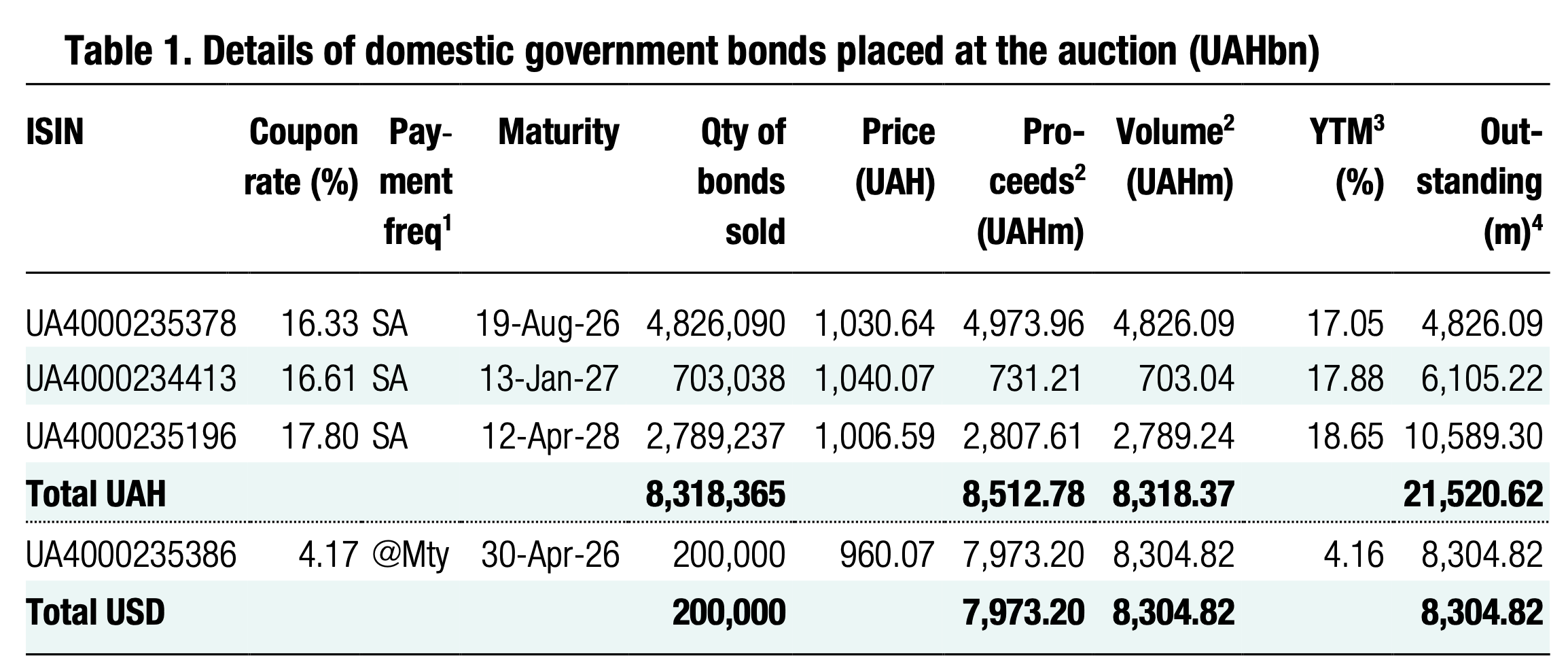

Twenty-six bids amounting to UAH4.8bn were received for a 15-month military bill. However, despite a slightly longer maturity, all bids had the same range of interest rates as for 14-month papers sold almost four months ago: 16.3-16.35%. The MoF accepted all these bids fully.

Longer maturities had lower demand than in recent weeks.

Usually, the 1.7-year paper saw low demand, slightly above UAH1bn, but yesterday, it slid to UAH0.7bn. The MoF accepted all bids, as all bids were with rates in the usual range of 17.0-17.1%.

Demand fell for the three-year note, too. After two weeks of oversubscription, yesterday's demand amounted to just UAH2.8bn. However, all bids were in the 17.7-17.8% range and were accepted by the MoF.

The excitement was for USD-denominated paper.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.52/USD, 45.32/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

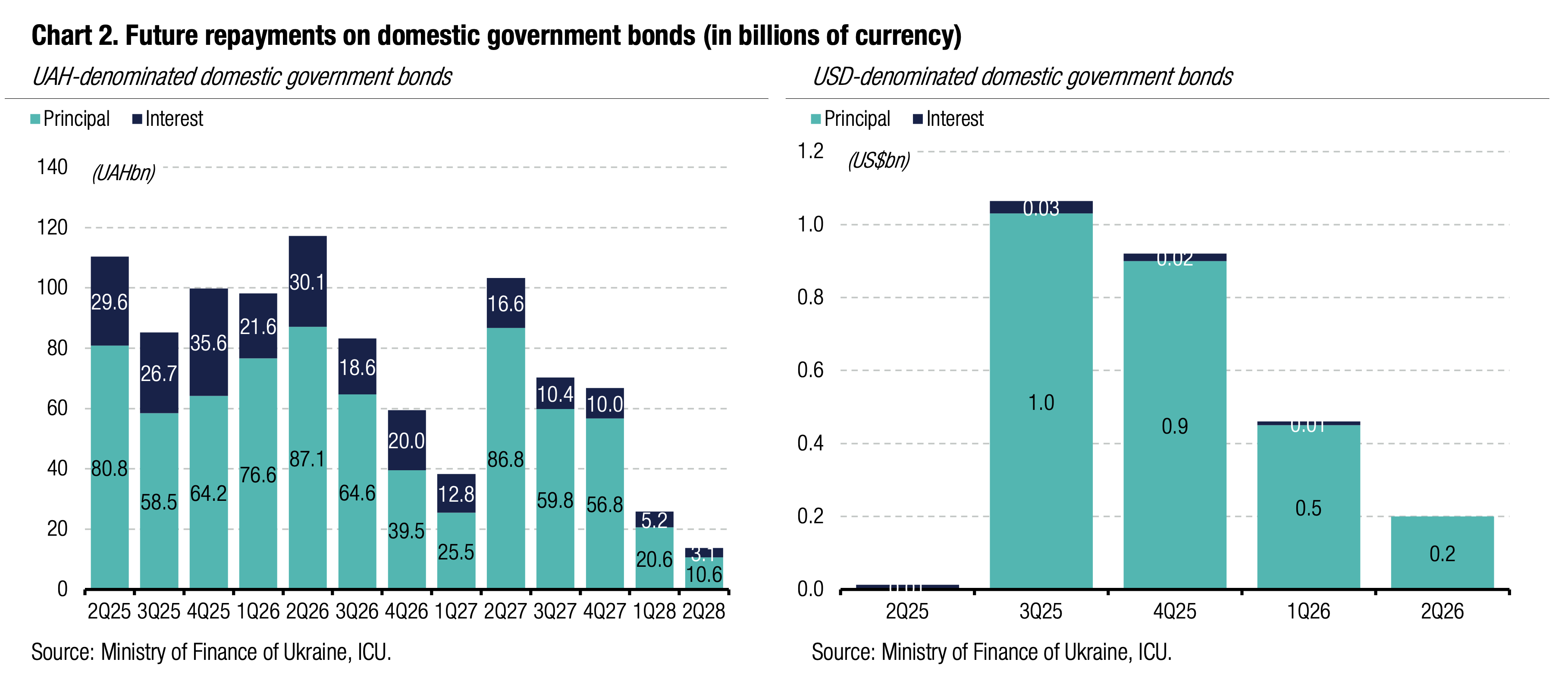

Last week, the MoF redeemed US$281m of bills, bringing total redemptions to almost US$1bn YTD. At the same time, the MoF sold only US$450 of bills YTD before yesterday's auction, which offered just US$200 of securities.

Therefore, there was huge investor demand for the new USD-denominated paper to reinvest money from this and last year's redemptions, as the MoF rolled only 78% of redemptions in USD last year.

However, the MoF is not in a hurry to borrow more foreign currency, as it has enough hard currency for budget needs and a positive outlook on international aid.

Finally, USD-denominated paper was 5x oversubscribed as some bidders submit bids with different interest rates to increase the chances of purchasing a new bond. The MoF accepted 2/3 of the bids and satisfied 1/5 of the demand. Most likely, many bids were satisfied partially due to auction conditions. The MoF sold US$60m to non-competitive bidders (all purchased less than requested) at a weighted average rate—the rest of the cap the MoF used to satisfy competitive bids at their rates. Bidders with rates from 4% and below 4.25% received the requested amount of bonds, while bids with a cut-off rate 4.25% were satisfied partially within the rest of the cap after accepting bids with lower rates.

Appendix