|  |  |

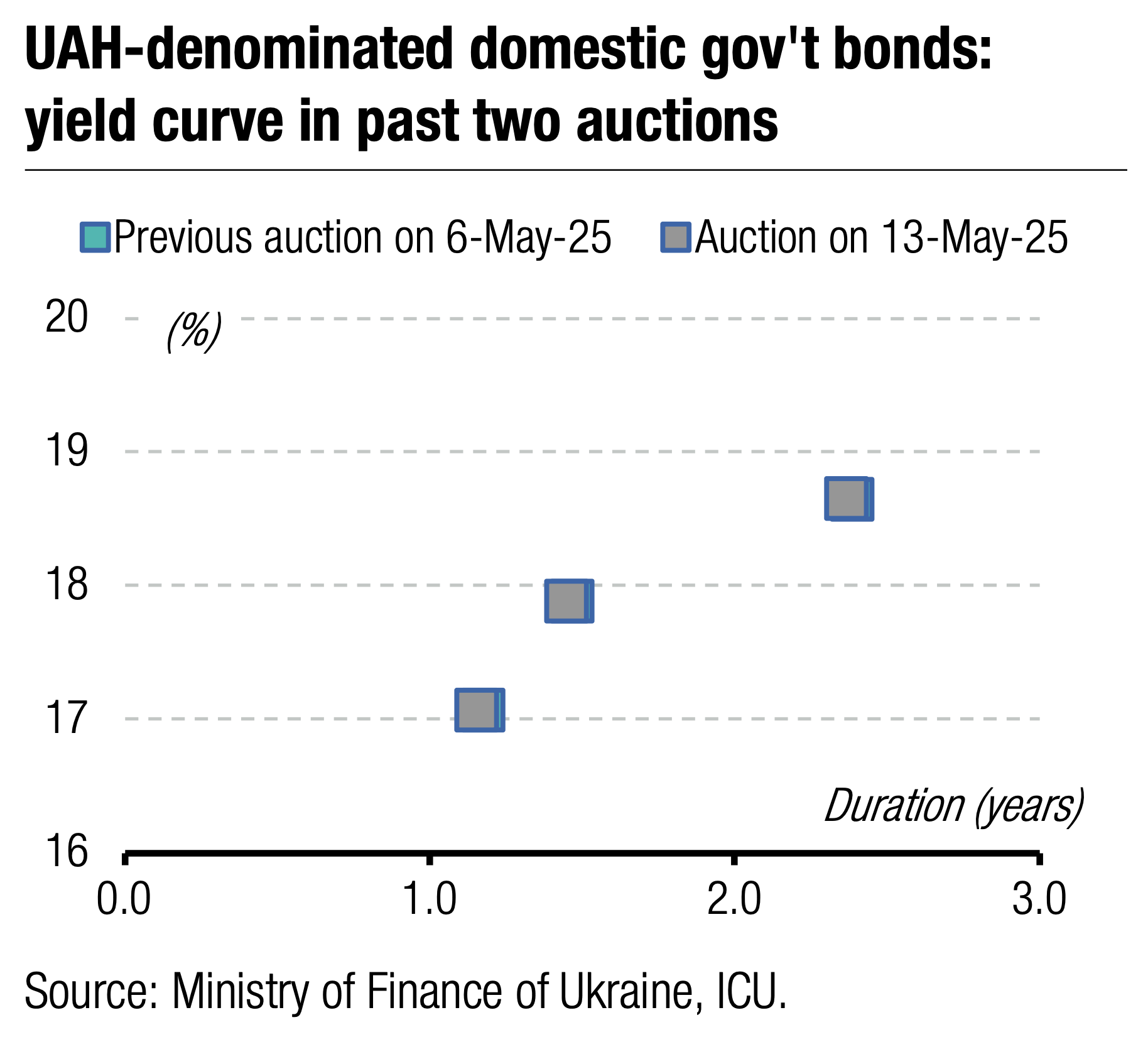

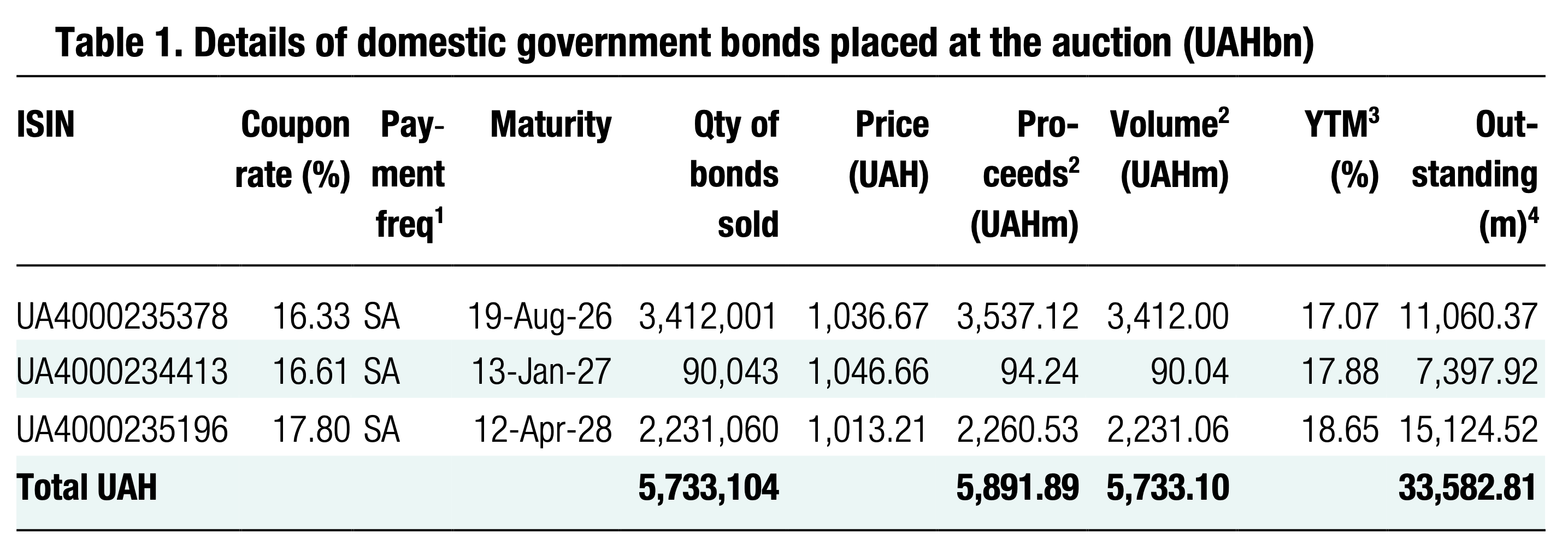

The MoF borrowed UAH5.9bn yesterday, mostly from 15-month and three-year UAH bonds.

The most significant demand was for 15-month military bills, which received UAH3.4bn in 31 bids. As interest rates were at the usual level, the MoF accepted all bids.

The MoF received another UAH2.4bn from the three-year note, which received 25 bids with the usual yields.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 45.32/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

The smallest demand was for 20-month bills, just UAH90m in six bids, which the MoF accepted, too.

Segmentation of demand in the primary bond market deepened. Bids concentrated in 15-month and three-year bonds. The shortest bill is the one military paper in the MoF's offer for the second month, while a three-year paper is the longest maturity available in the market. While 15-month military paper is attractive to investors because the proceeds are used for defence, the three-year note allows investors to lock in current yields for the longest available period. Therefore, the two-year bill is not of interest to domestic investors.

Appendix