|  |  |

Yesterday, demand for military and regular bonds was more than threefold higher WoW, as investors reinvested funds from UAH paper redeemed last week.

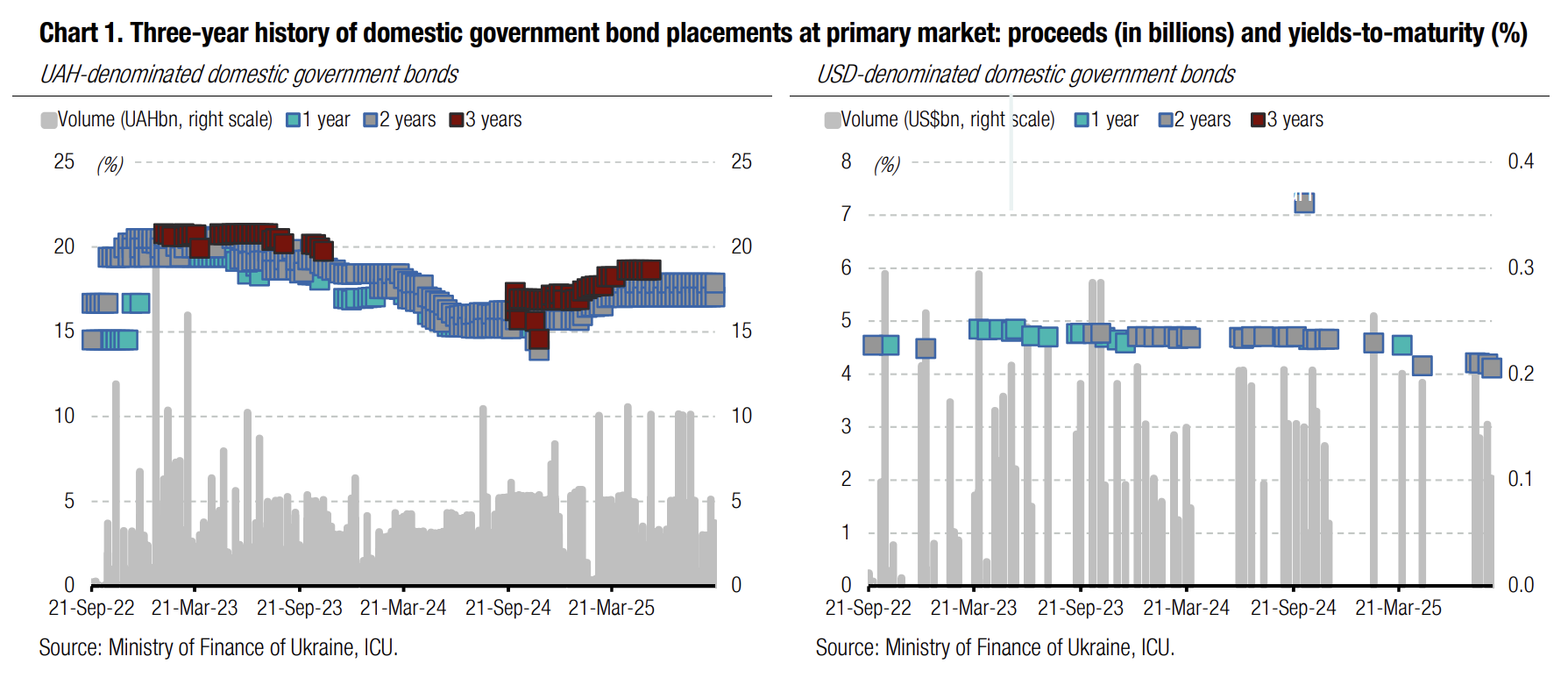

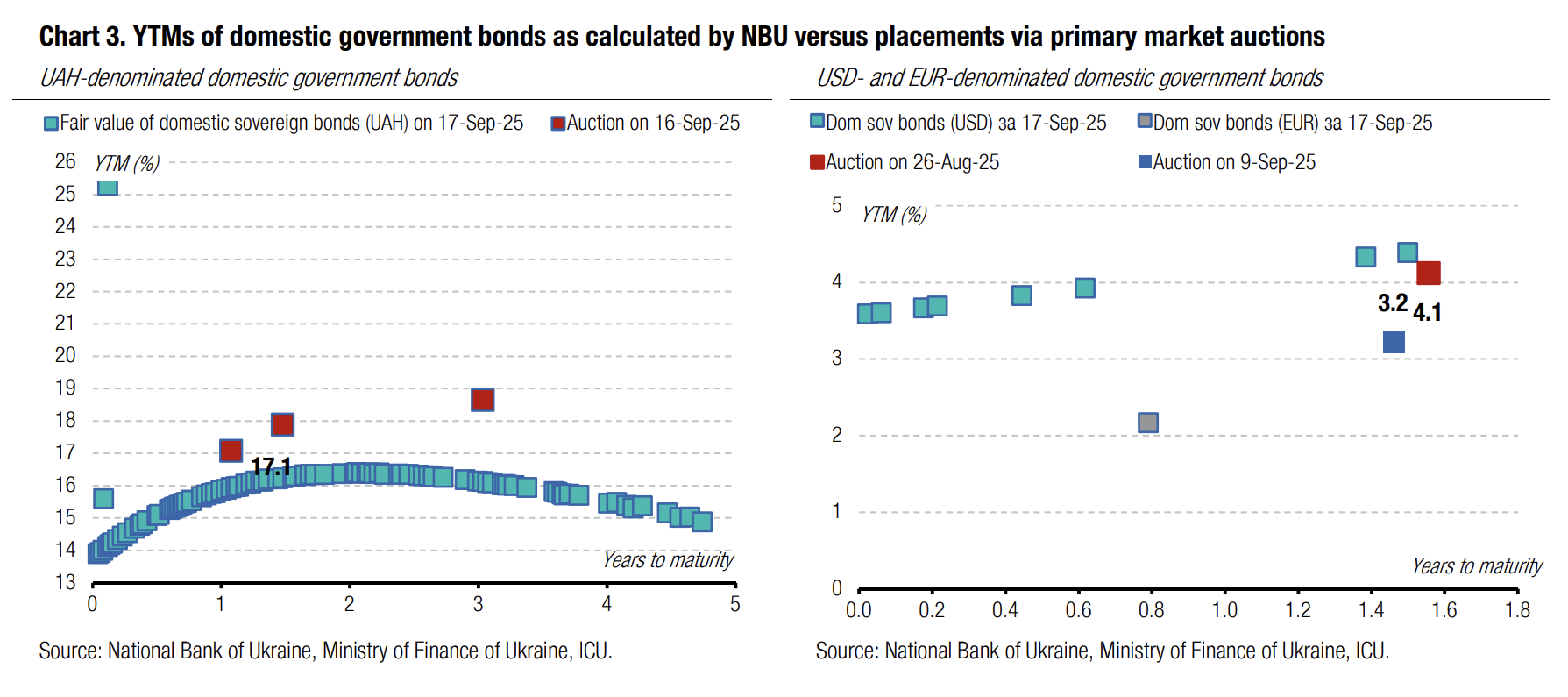

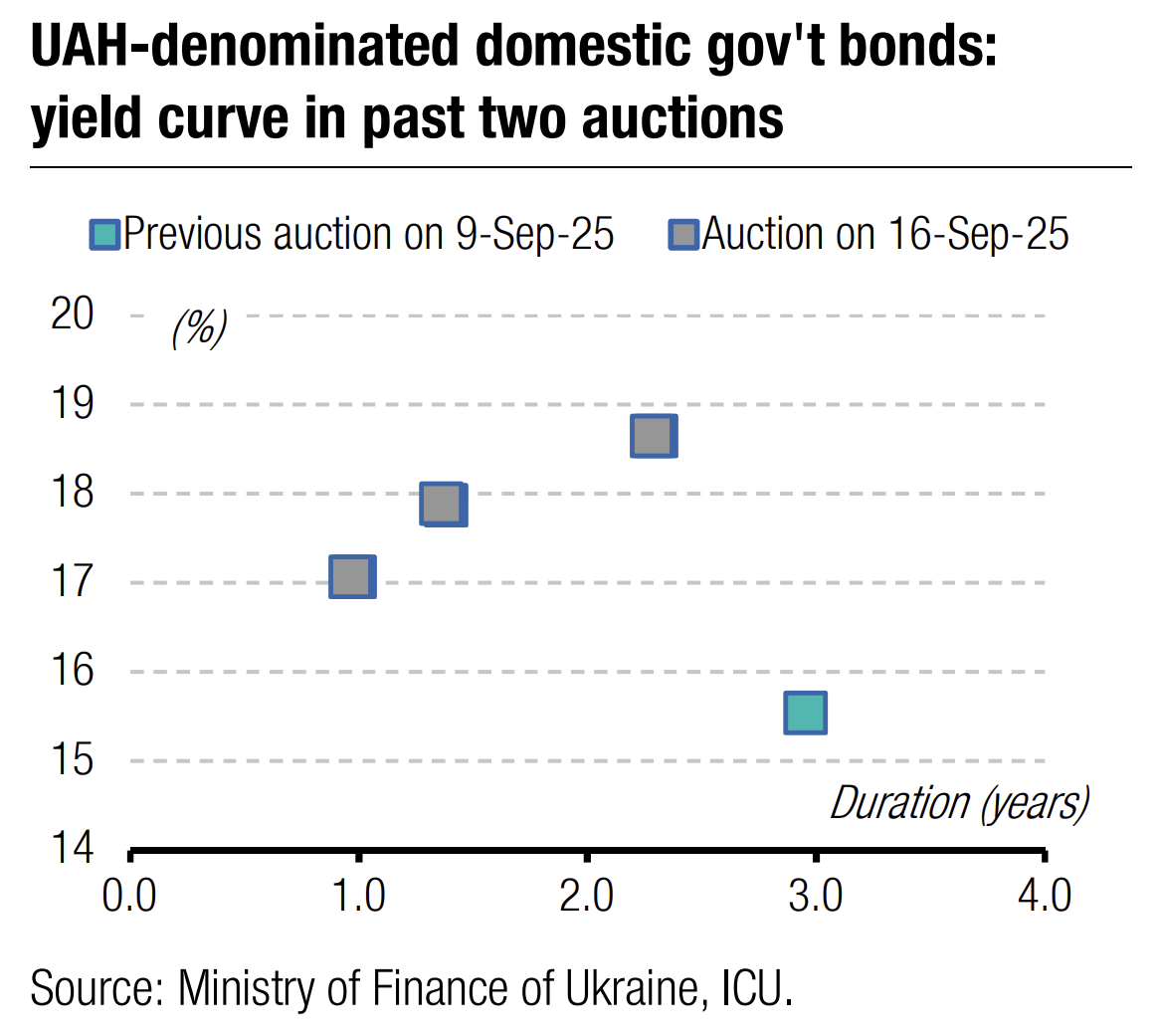

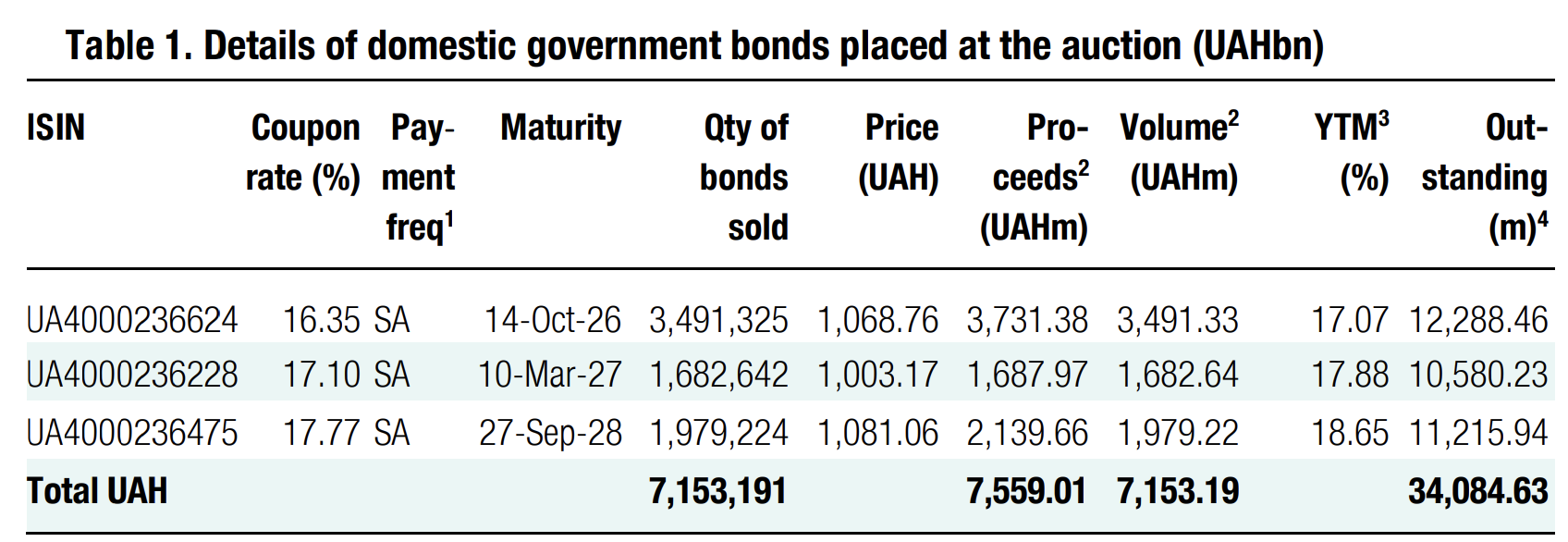

The demand for a one-year military bill doubled WoW to UAH3.5bn, record-high demand for this paper since its primary placement in early August. The placement conditions have not changed: the cut-off and the weighted average rates remained at the usual level of 16.35%, unchanged since March.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.36/USD, 48.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

Demand for 1.5-year paper increased tenfold WoW, although not to a historical maximum. In total, the MoF satisfied all 18 bids for UAH1.7bn, setting the cut-off and weighted average rates at 17.1%, the usual level since April.

Yields on three-year securities did not change either. Rates on these instruments have also not changed since April when they were 17.8%. The volume of bids amounted to almost UAH2bn, almost a four times increase WoW.

Budget proceeds amounted to UAH7.5bn without offering reserve or foreign currency bonds. The increased demand may be caused by the recent redemption of UAH bonds and the desire or need to reinvest funds in new instruments. Therefore, the volume of trading in the secondary market also increased last week.

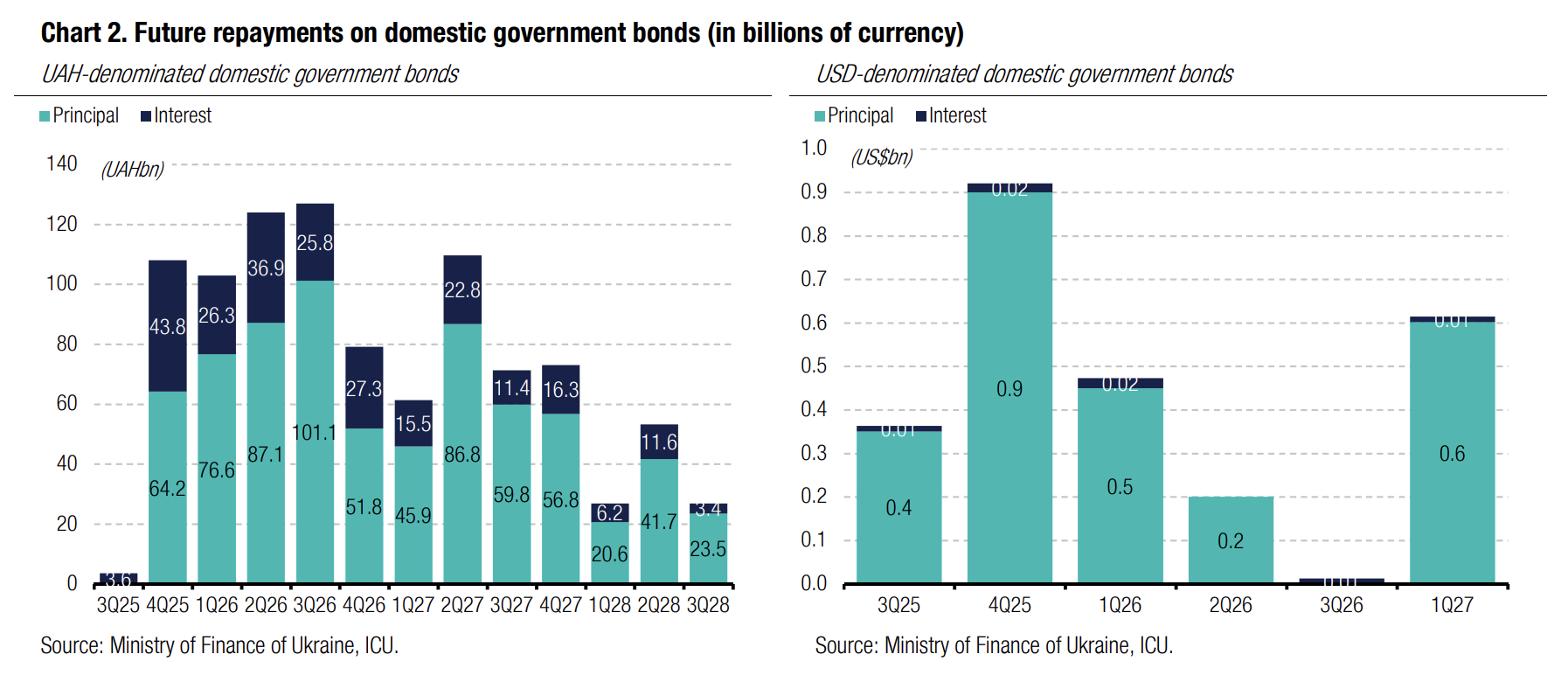

Appendix: Yields-to-maturity, repayments