|  |

|  |

Bonds: Refinancing of domestic debt below 100% in 1Q25

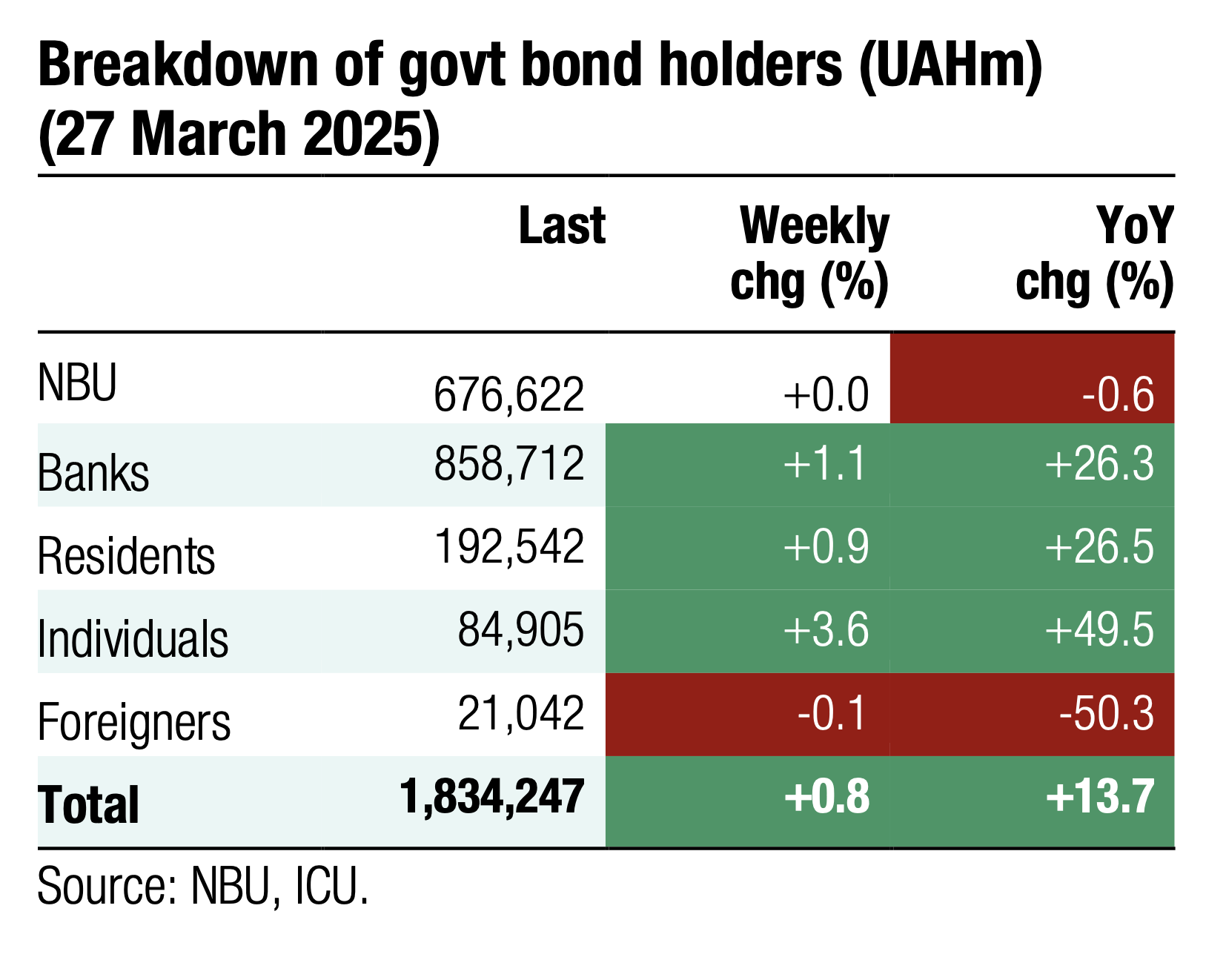

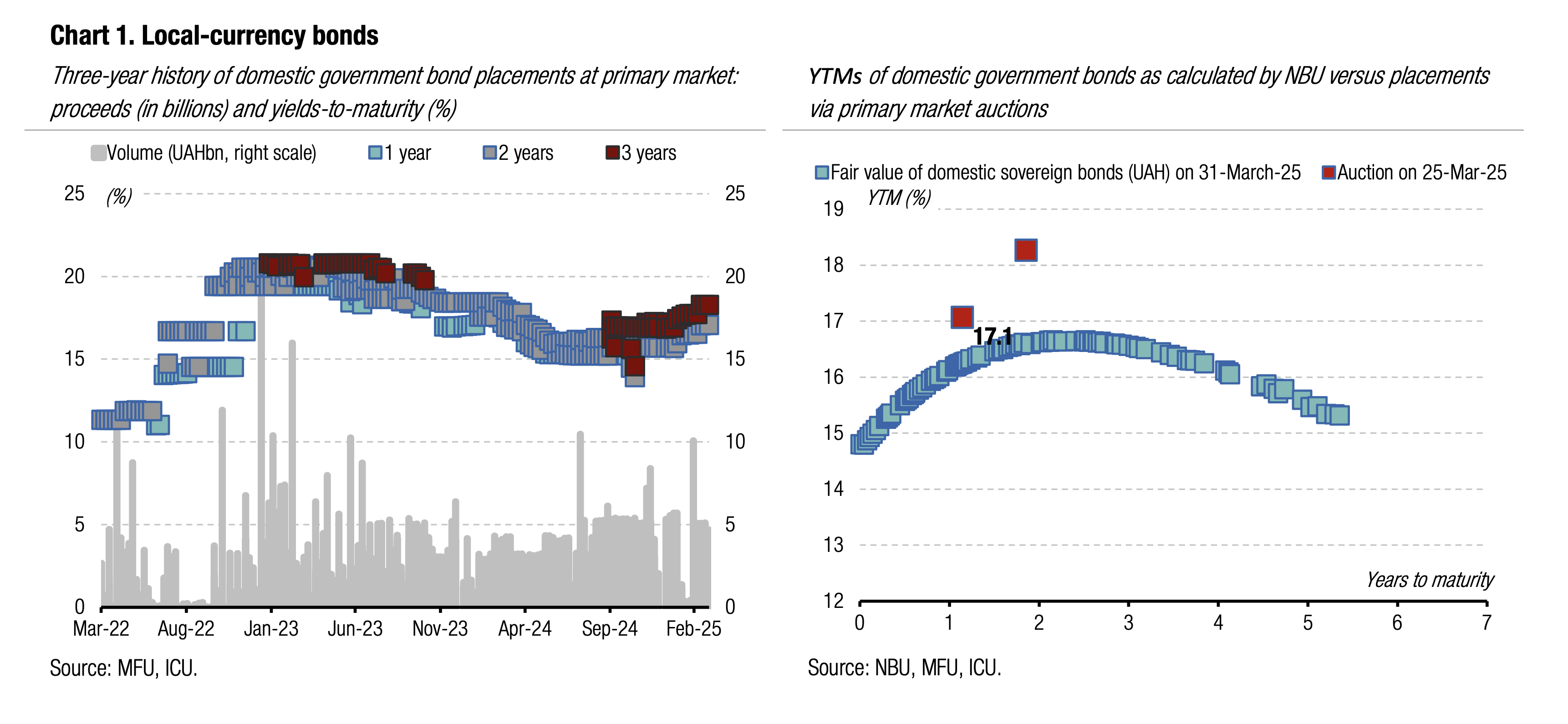

Last week, the Ministry of Finance raised UAH15bn, but total domestic debt rollover was below 100% in 1Q25.

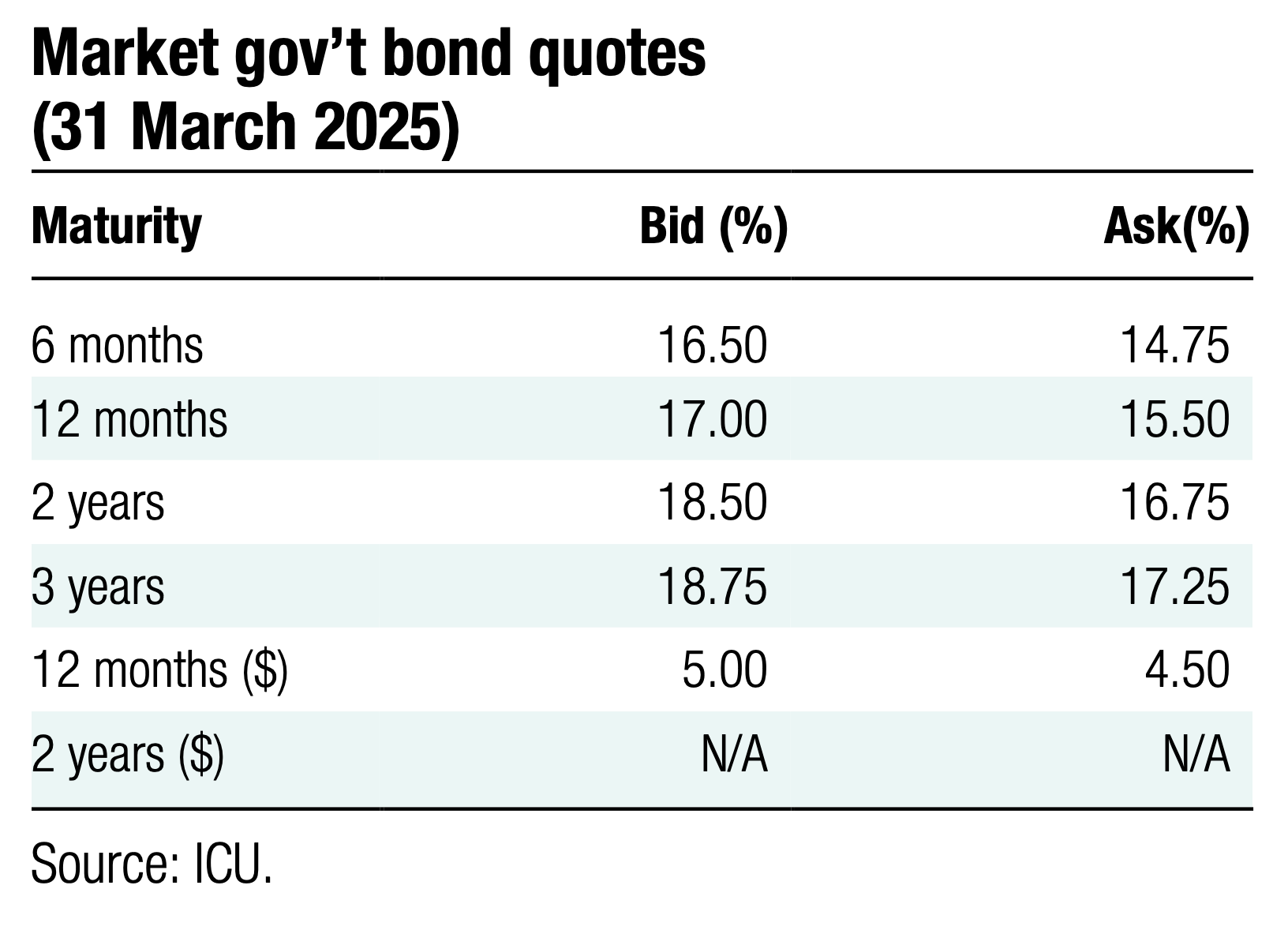

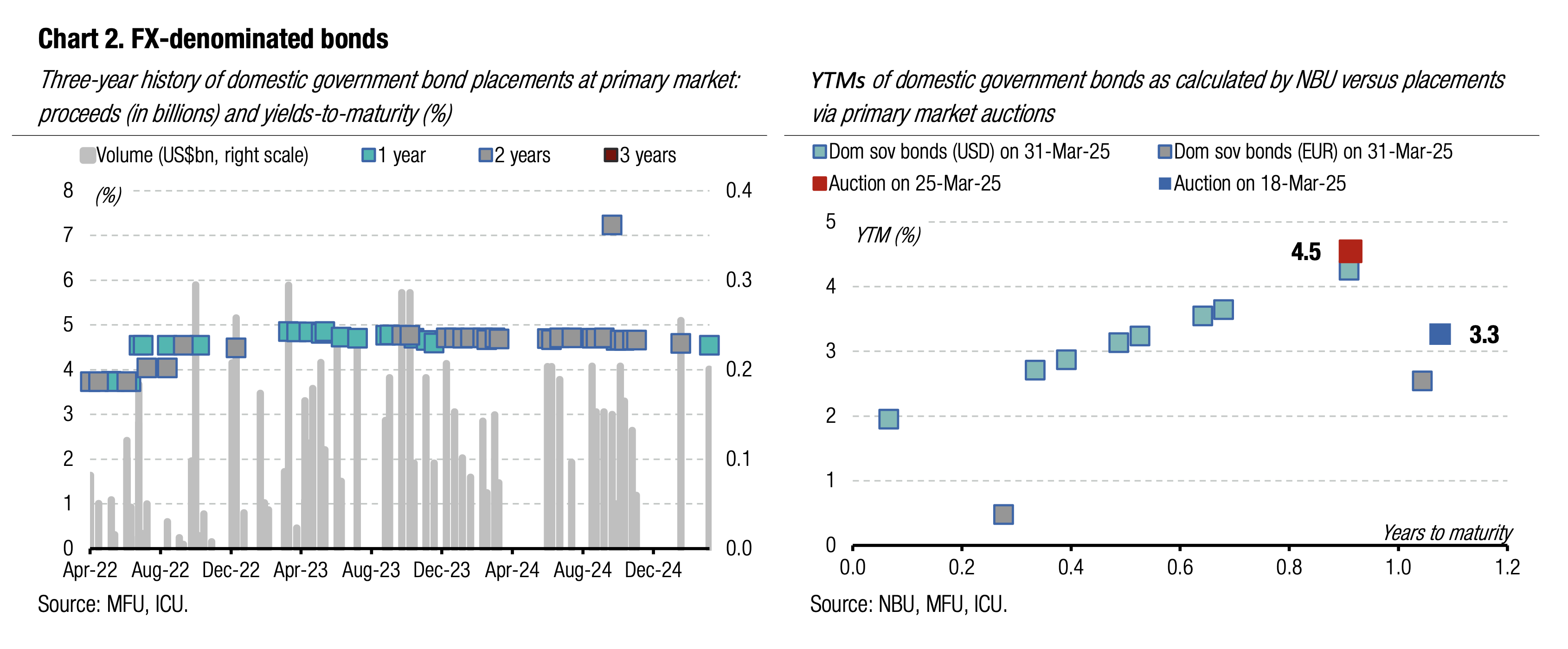

At last week's primary auction, the MoF offered two UAH military bills and one USD-denominated paper. Interest rates in bids for UAH bonds were not higher than the cut-off level of the previous auction, so the MoF accepted them without changes in yields, while rejecting only one bid. At the same time, most funds were raised via a USD-denominated paper, which was more than 2x oversubscribed. The MoF rejected some bids and decreased rates by 10bp to 4.5%. Overall, the MoF's proceeds amounted to the equivalent of UAH15bn last week, including over US$200mn (UAH8.4bn). See details in the auction review.

Higher borrowings over the last weeks of March still did not help the Ministry end 1Q25 with full rollover of domestic debt. For UAH debt, the 1Q rollover rate was 86%, while it stood at 67% and 59% for USD and EUR, respectively. The overall rollover for all currencies is 79%.

ICU view: Despite higher interest in UAH bonds following an increase in yields, the Ministry of Finance did not manage to get closer to 100% for overall debt refinancing. Yet, it’s unlikely the Ministry wanted to achieve this target at all cost, as it offered a minimal set of securities and capped the volume of the offer at a relatively low level. The IMF memorandum published over the weekend confirms that the inflows of external financial assistance should be fully sufficient to cover the state budget deficit this year. Therefore, the Ministry of Finance is not under pressure to increase its borrowings. The MoF remains quite flexible in terms of new borrowings and can adapt the debt placement schedule and conditions depending on its liquidity position and expectations of the cost of debt by the end of the year. Given that the NBU is expected to switch to a monetary policy loosening cycle in 2H25, the Ministry of Finance may postpone part of the borrowings until then to benefit from lower cost of new debt.

Bonds: Sluggish negotiation progress weighs on mood of Eurobond holders

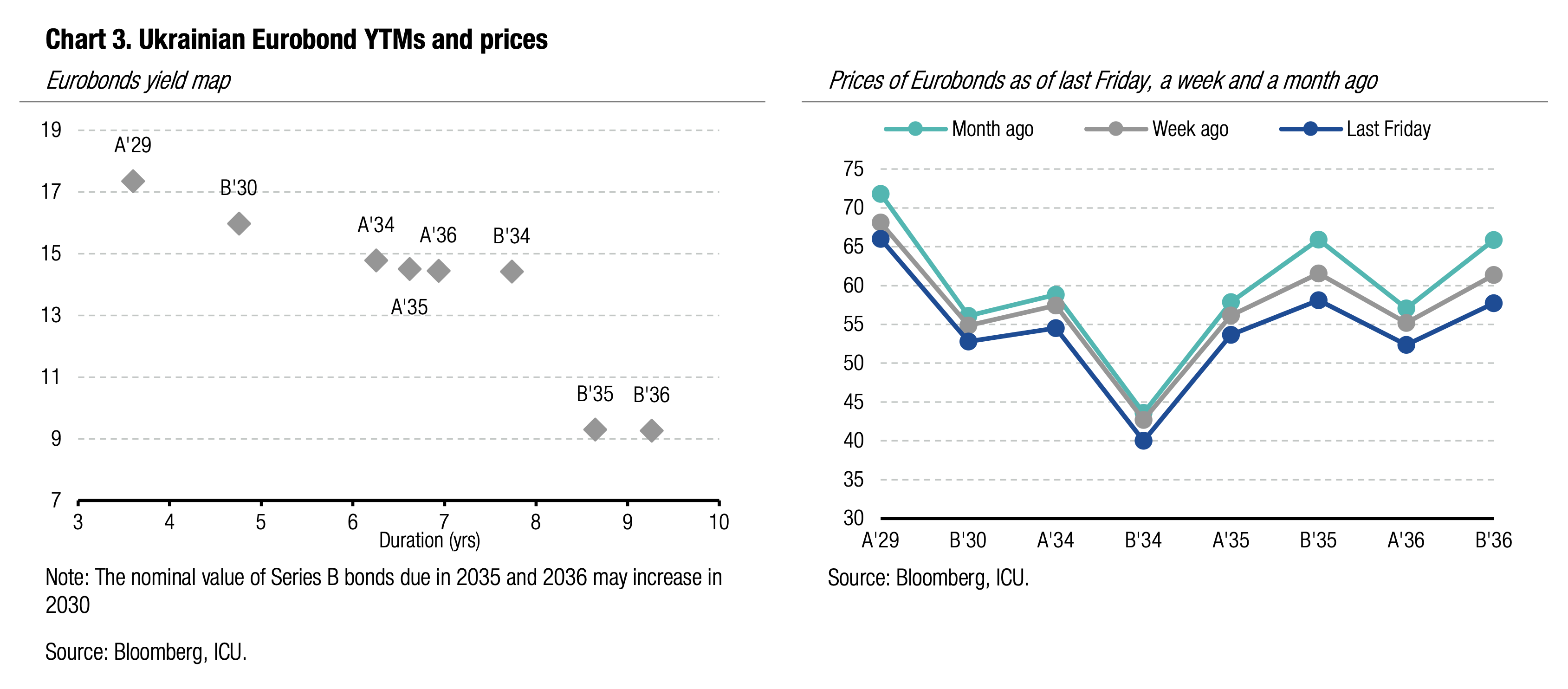

Ukrainian Eurobond prices continued to fall last week as the parties did not make any visible progress in the negotiations.

Last week's main news was the negotiations in Saudi Arabia in the Ukraine-US and US-russia formats without direct communication between Ukraine and russia. Although the parties allegedly reached an understanding on a number of issues, this was not followed by any practical steps. In addition, at the end of the week, the media published a new version of a minerals deal drafted by the US administration, which turned out to be generally unacceptable for Ukraine, increasing the risk of renewed tensions between Ukraine and the United States.

Against this background, the value of Ukrainian securities decreased by 5% WoW. The VRI's price decreased by 7% WoW, below 75 cents per dollar of notional value. The EMBI index slid by 0.6% over the past week.

ICU view: Pessimism is the dominating sentiment of Eurobond holders at this point. The prices of Ukrainian sovereign Eurobonds are still above the levels seen before the US presidential elections, but have already lost most of their gains due to increasing skepticism about the timeline for the end of the war. We expect that better assumptions about foreign aid to Ukraine laid out in a new IMF MEFP may provide some limited room for optimism this week.

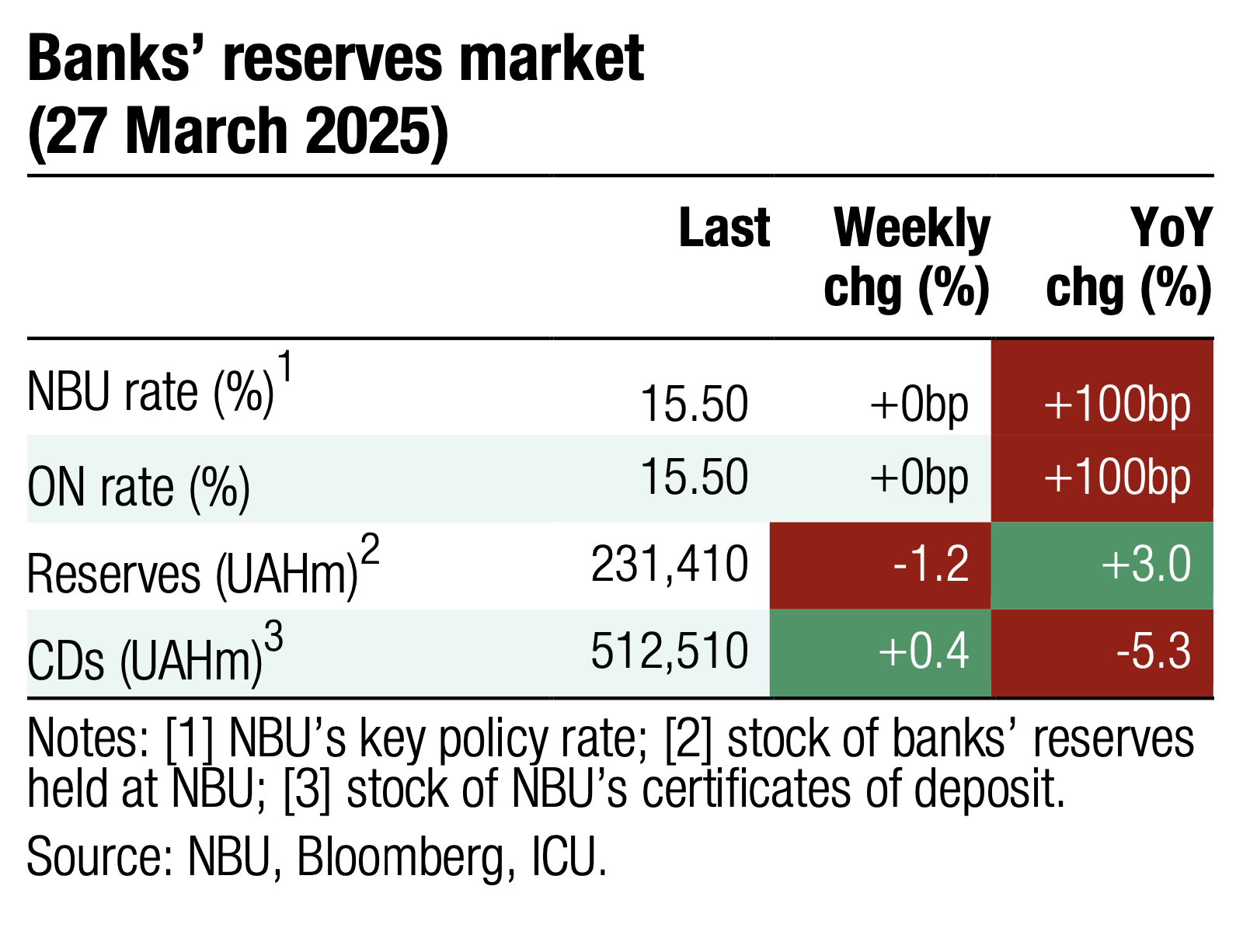

FX: NBU increases interventions; hryvnia marginally appreciates

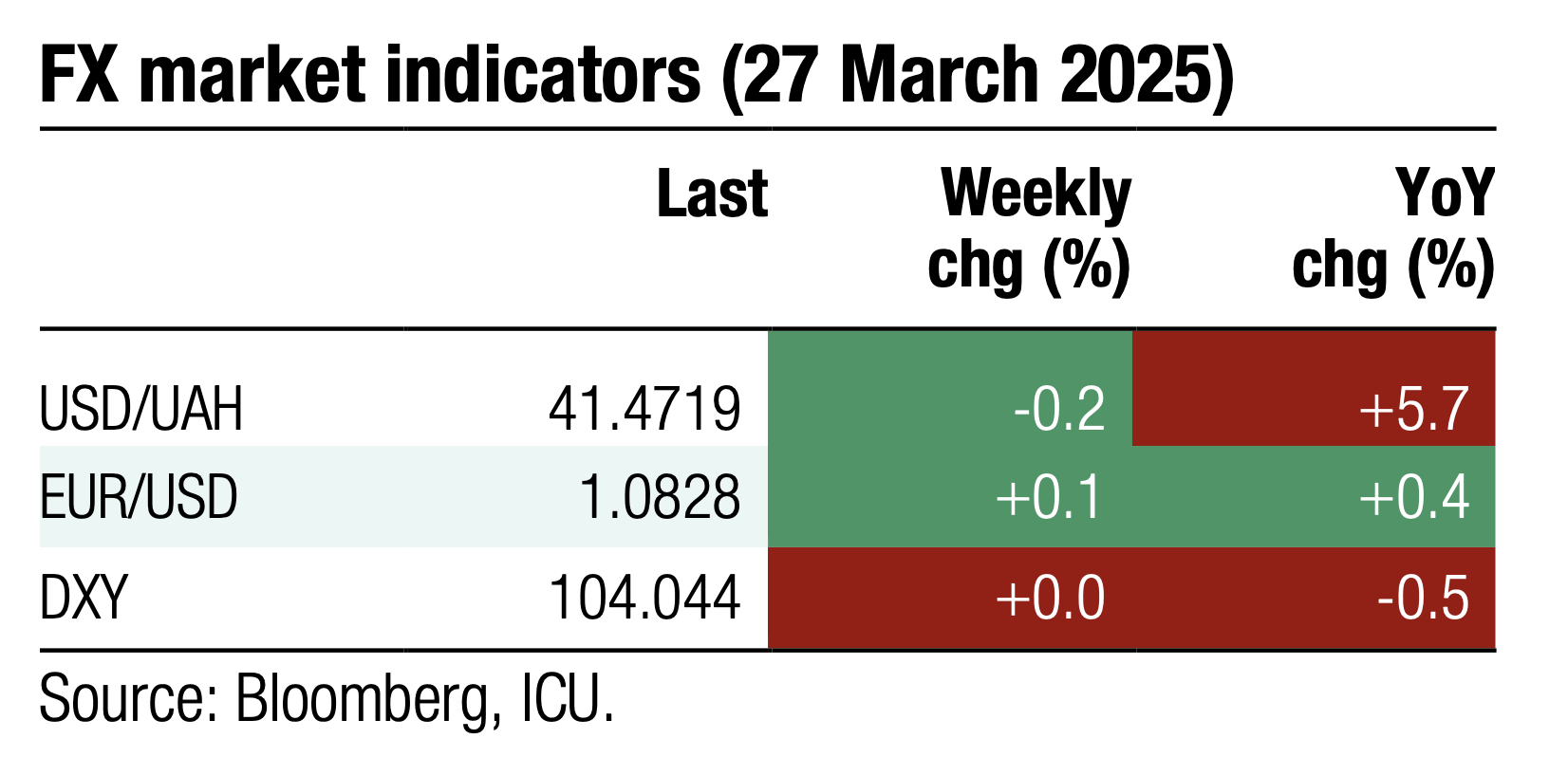

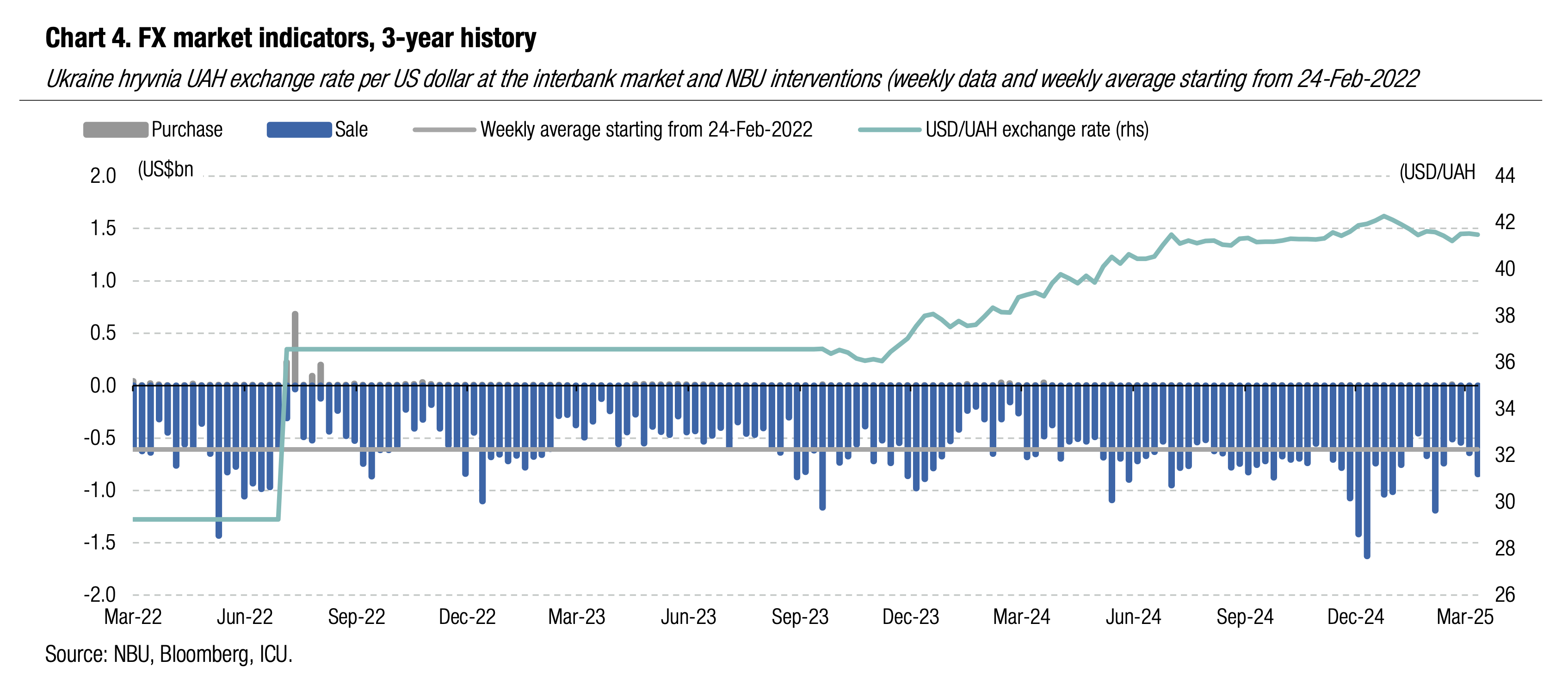

The National Bank of Ukraine significantly increased interventions, strengthening the official hryvnia exchange rate over the week.

The hard-currency deficit in the market continued to grow. Net purchases of foreign currency in the interbank market increased by 53% WoW to US$488m, which forced the NBU to increase its interventions by a third to US$846m. In the retail segment, net FX purchases decreased by 7.5% WoW to US$80m—the lowest since August last year.

The increase in interventions allowed the NBU to strengthen the official hryvnia exchange rate by 0.1% WoW to UAH41.49/US$.

ICU view: The NBU seeks to maintain the official exchange rate near UAH41.5/US$ despite a sharp and significant increase in foreign currency purchases on the interbank market last week. Therefore, there are no signals the NBU may make small steps towards hryvnia weakening in the coming weeks. In addition, a planned increase in international financial assistance in 2025, as revealed in the fresh IMF memorandum, may give the NBU additional comfort and strengthen its determination to keep hryvnia relatively stable in the near future.

Economics: IMF increases foreign aid assumptions

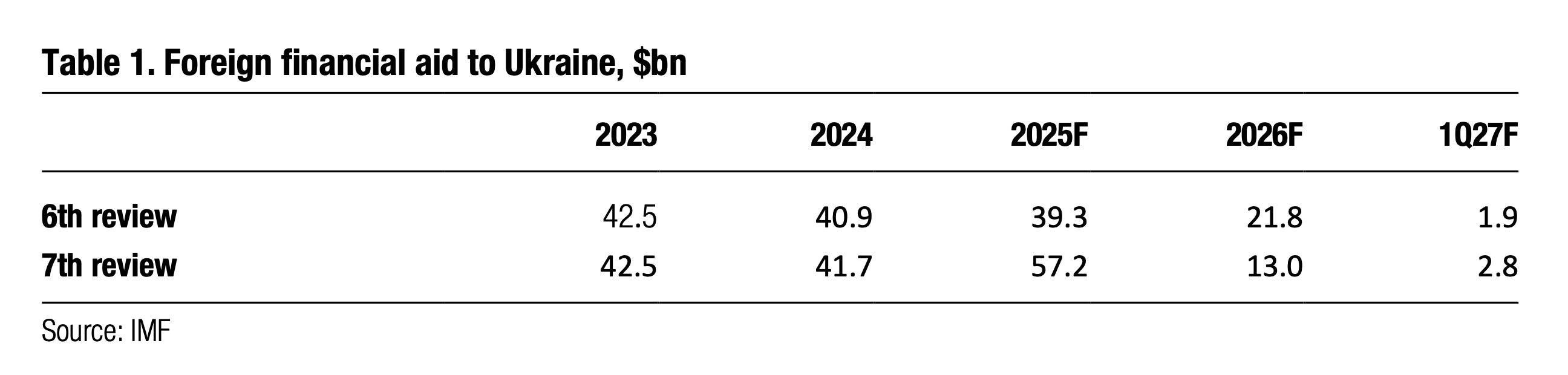

On Friday, the IMF board approved the 7th review of the EFF program for Ukraine, which opens the way for a $0.4bn loan tranche. The IMF memorandum revealed that Ukraine expects more financial aid than previously planned.

The IMF revised some of the key macroeconomic indicators and, most important, assumptions about the size of foreign financial aid that Ukraine is going to receive over the period of the EFF program. As per the document, in 2025, Ukraine is going to receive $57.2bn of foreign financial aid (vs $39.3bn planned previously) of which $39.4bn will be channeled via ERA facility from the G7 countries and $12.9bn via the Ukraine Facility from the EU. The increase is partly due to a portion of funds being moved forward from 2026 to 2025 and also due to an increase of total ERA funds earmarked for direct budget support to $44.1bn, up from $33.1bn previously. The IMF also sees a significant reduction in the state budget deficit (excl. grants) to 9.9% of GDP in 2026 from 19.6% in 2025 and also a reduction in the BoP gap to $22.1bn in 2026 from $47.3bn in 2025. In view of this, the IMF now believes that the NBU gross international reserves will remain above $50bn at the end of both 2025 and 2026.

Some other important revisions of macroeconomic indicators include a downgrade in 2025 real GDP forecast to 2-3% from 2.5-3.5% previously and an increase in end-2025 CPI forecast to 9.0% from 7.5% previously.

ICU view: A sharp increase in the size of foreign financial aid destined to Ukraine in 2025 (and an overall increase in aid package) is a big positive surprise. We share the view that the NBU reserves may end up well above $50bn at the end of 2025. This implies the NBU may remain reluctant to weaken hryvnia longer than we previously expected. This means our end-2025 exchange rate forecast of UAH45.7 may be somewhat pessimistic. Yet, we are highly confident that the IMF assumptions for BoP gap and NBU reserves for 2026 are fully unrealistic, and Ukraine will face a much higher BoP gap while the NBU reserves may decline to $30-35bn (rather than $51bn assumed by the IMF) if a proper adjustment of the exchange rate is not done over the next 18 months. Overall, we think an increase in foreign aid provides more breathing space for the NBU in terms of FX policies, but this doesn’t diminish the need for the NBU to address the fundamental problem of huge external imbalances.