|  |

|  |

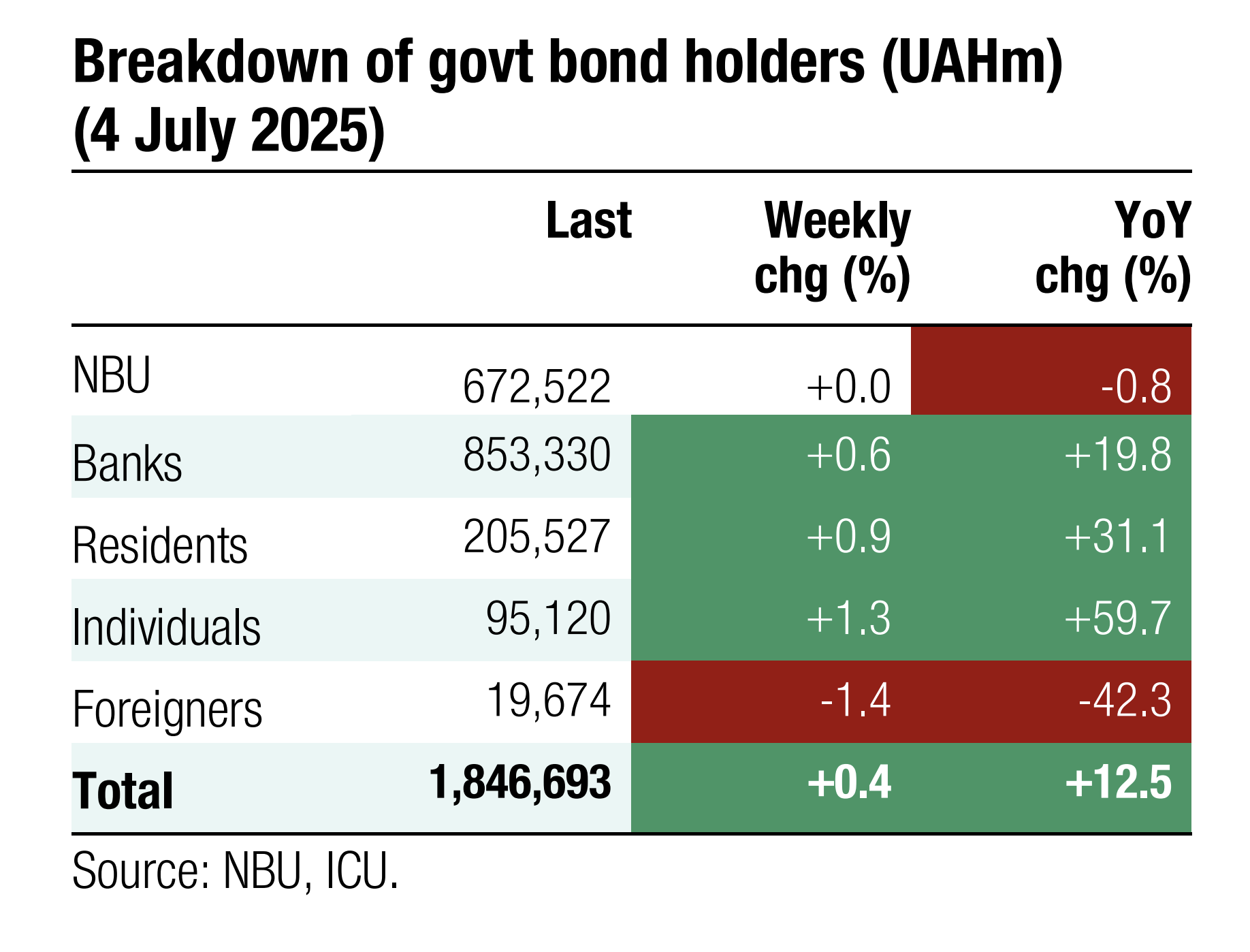

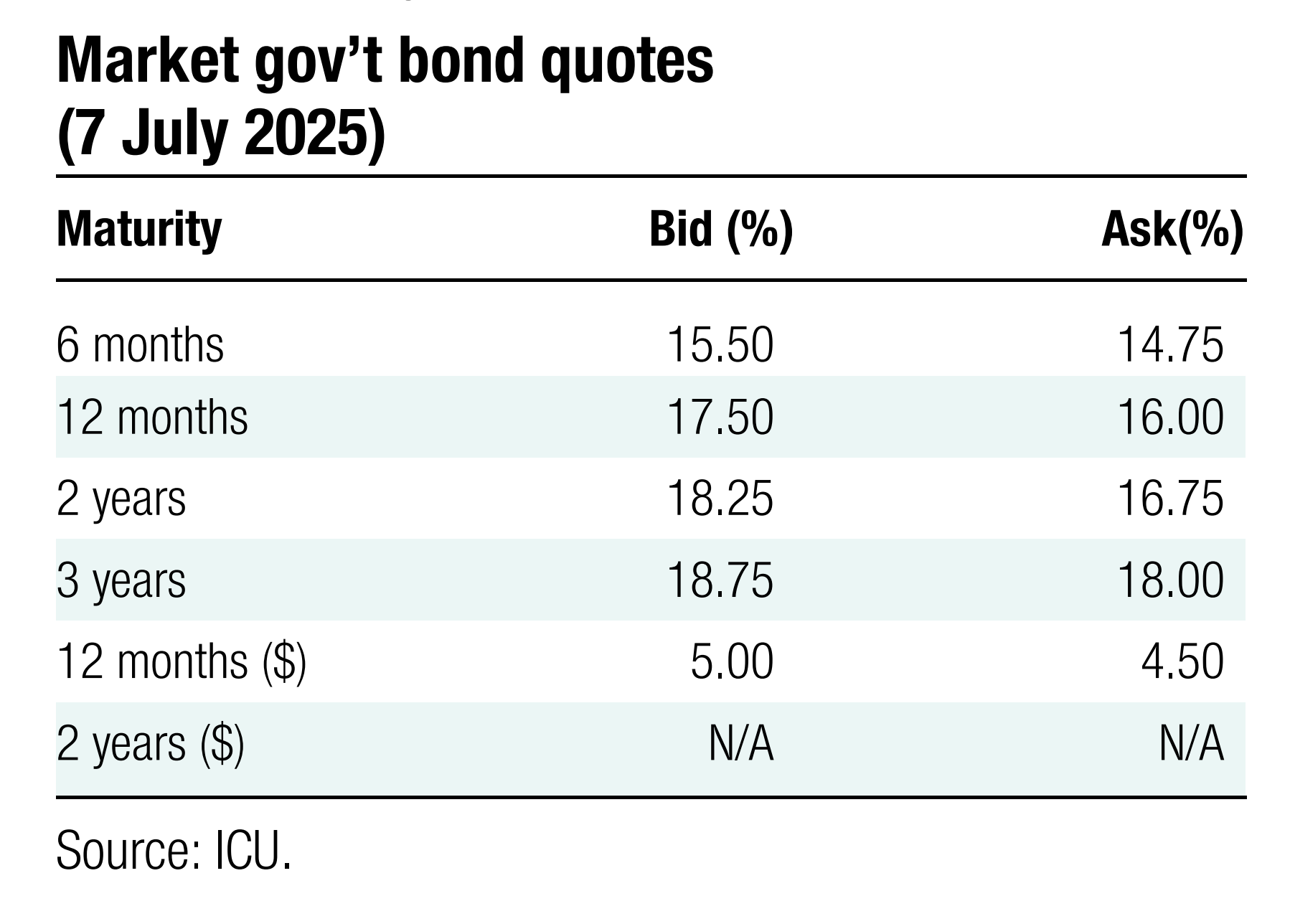

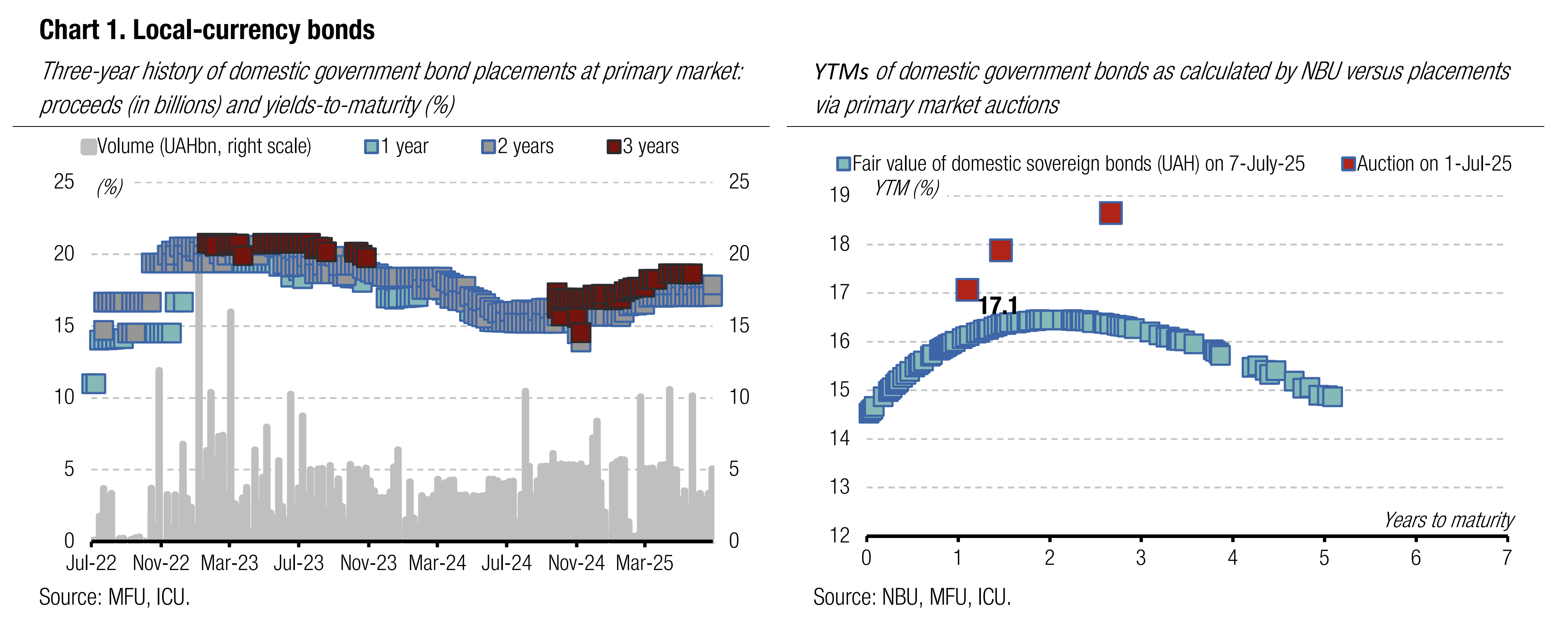

Bonds: Investor interest shifting to longer maturities

Investors switched demand from short maturities to 3.5-year notes in the primary bond market and 1.8-year bills in the secondary bond market.

Last week, the MoF sold UAH0.9bn of 15-month bills, UAH1.1bn of 20-month securities, and UAH5bn of 3.5-year notes. See details in the auction review.

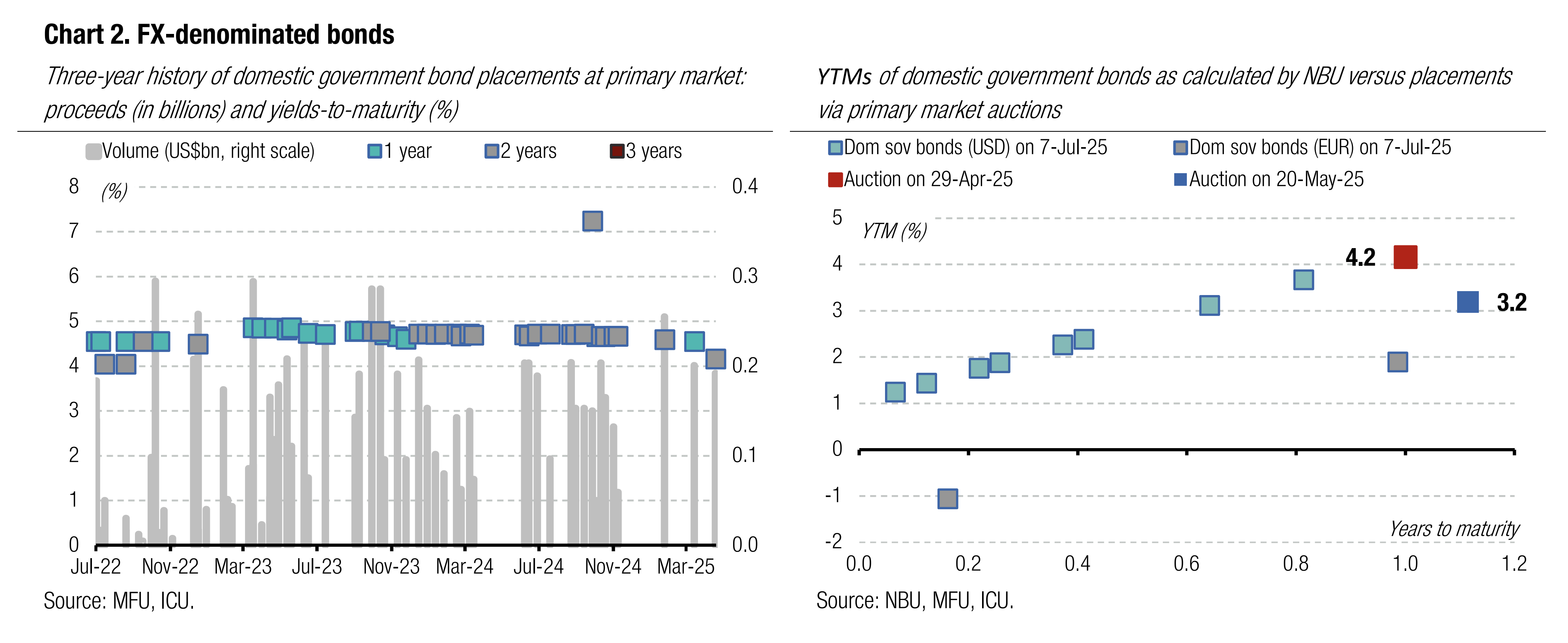

For tomorrow's auction, the MoF announced an offering of the same UAH bonds and also added a one-year EUR-denominated paper to partially refinance this week's redemption of EUR 190m.

The secondary bond market focused on bonds maturing later than in one year. Their share in deals was almost 75% last week. The most traded papers were military bills with maturity in April 2027 (28% in total trading volume). Reserve bonds had a 24% share, and regular securities had 19%.

ICU view: The current yield on UAH bonds seems to offer investors an acceptable premium for the risk of a possible moderate hryvnia devaluation. We expect demand for bonds from banks will remain muted until clear prospects for key policy rate reduction crystalize.

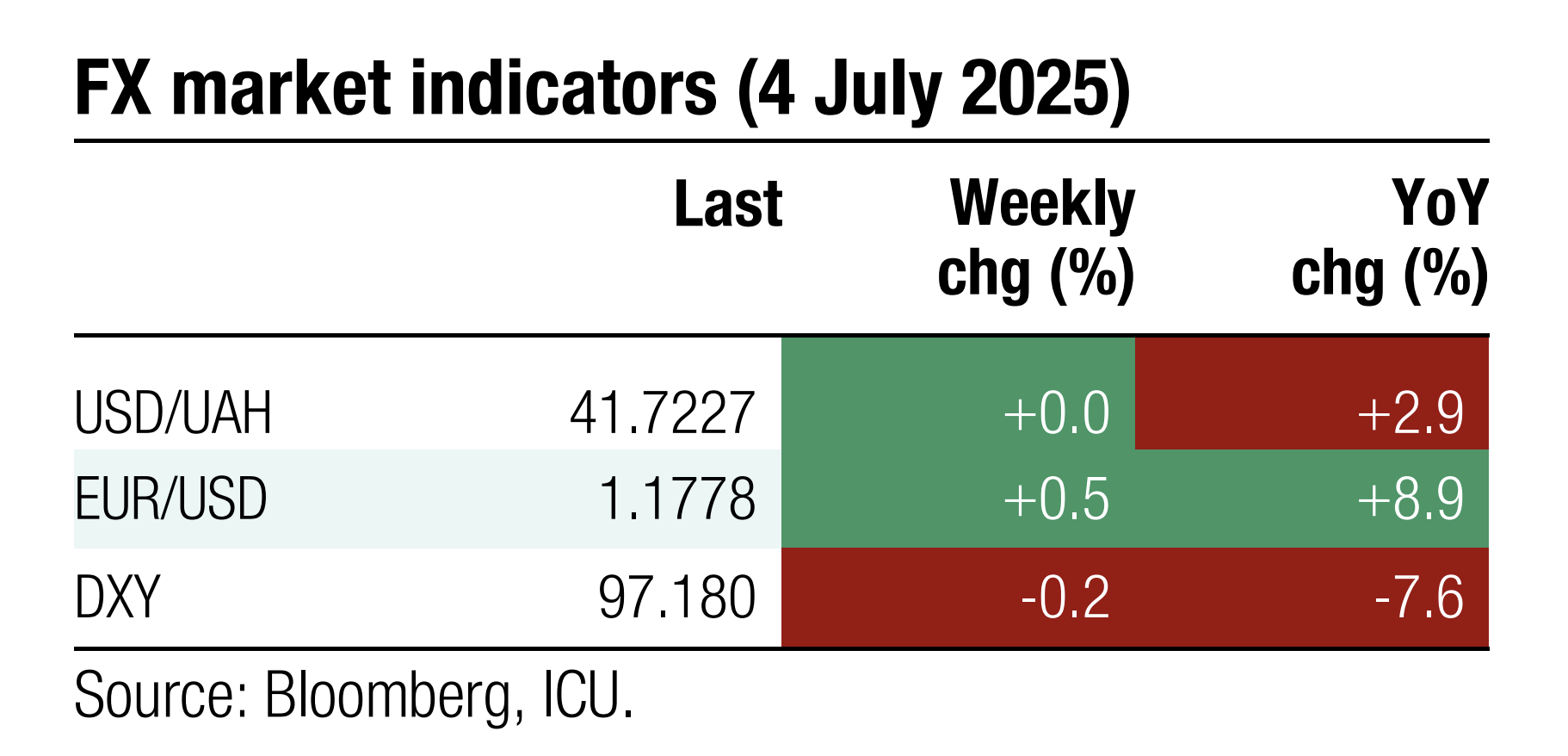

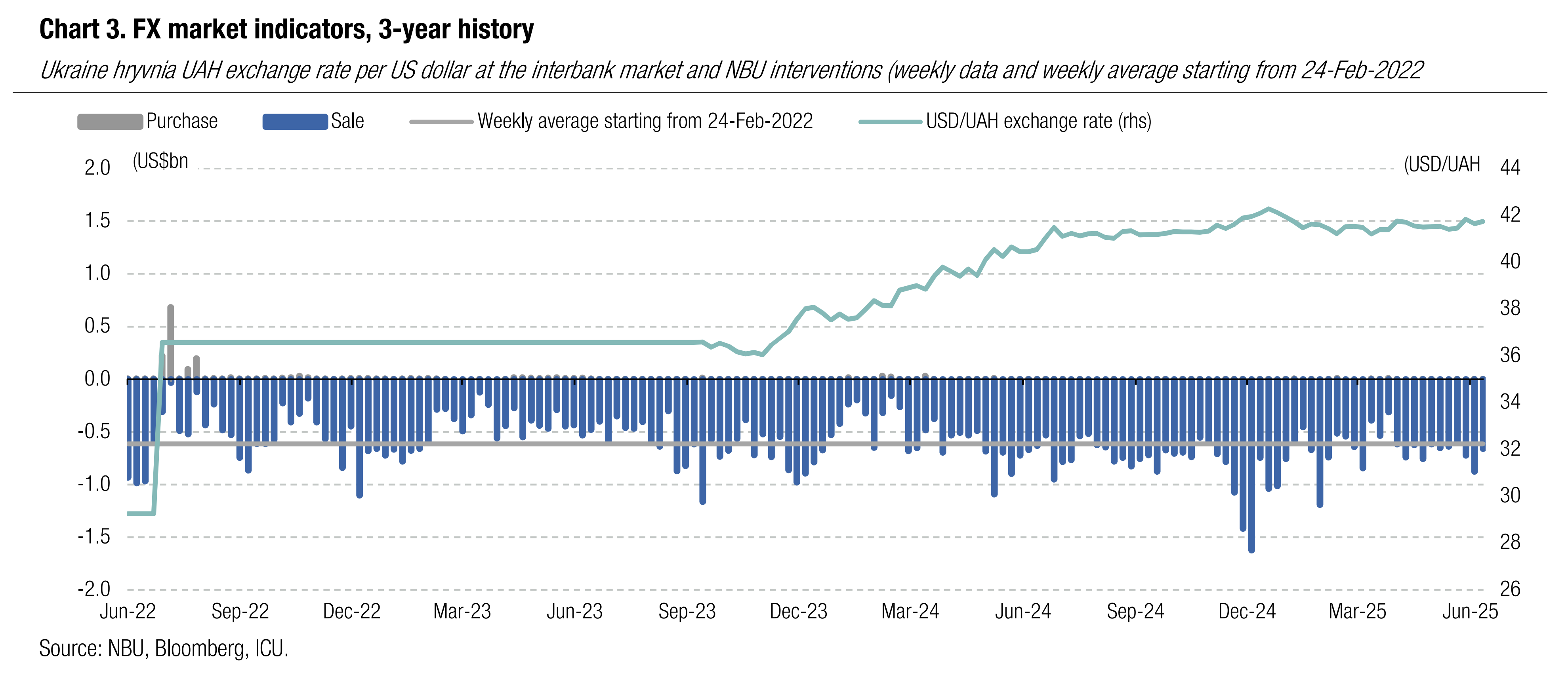

FX: FX shortage slightly down

Last week, net hard currency purchases decreased somewhat, and the NBU was able to maintain the hryvnia relatively stable with lower interventions.

In the interbank FX market, average daily net foreign currency purchases declined from US$125m to US$86m last week for a total shortage of US$343bn in four business days, a fifth lower than a week before. Net purchases in the retail segment rose by a third to US$75m, as households doubled online operations. To cover this shortage, the NBU sold US$661m from international reserves.

The NBU weakened the hryvnia by UAH0.14 last Monday and then kept fluctuations within the range of UAH41.72-41.82. The hryvnia weakened by 0.2% WoW vs. the US dollar and 0.7% against euro.

ICU view: Since the spring, the US dollar has significantly weakened vs. the euro, making the hryvnia also much weaker vs euro. The effective hryvnia depreciation against the basket of currencies of its key trading partners over recent months implies the NBU may have even fewer reasons to abandon its policy of keeping the UAH/US$ rate in a narrow range. We expect the central bank to keep defending the hryvnia vs the US$ close to the current level in the coming months before allowing moderate weakening by the end of the year.

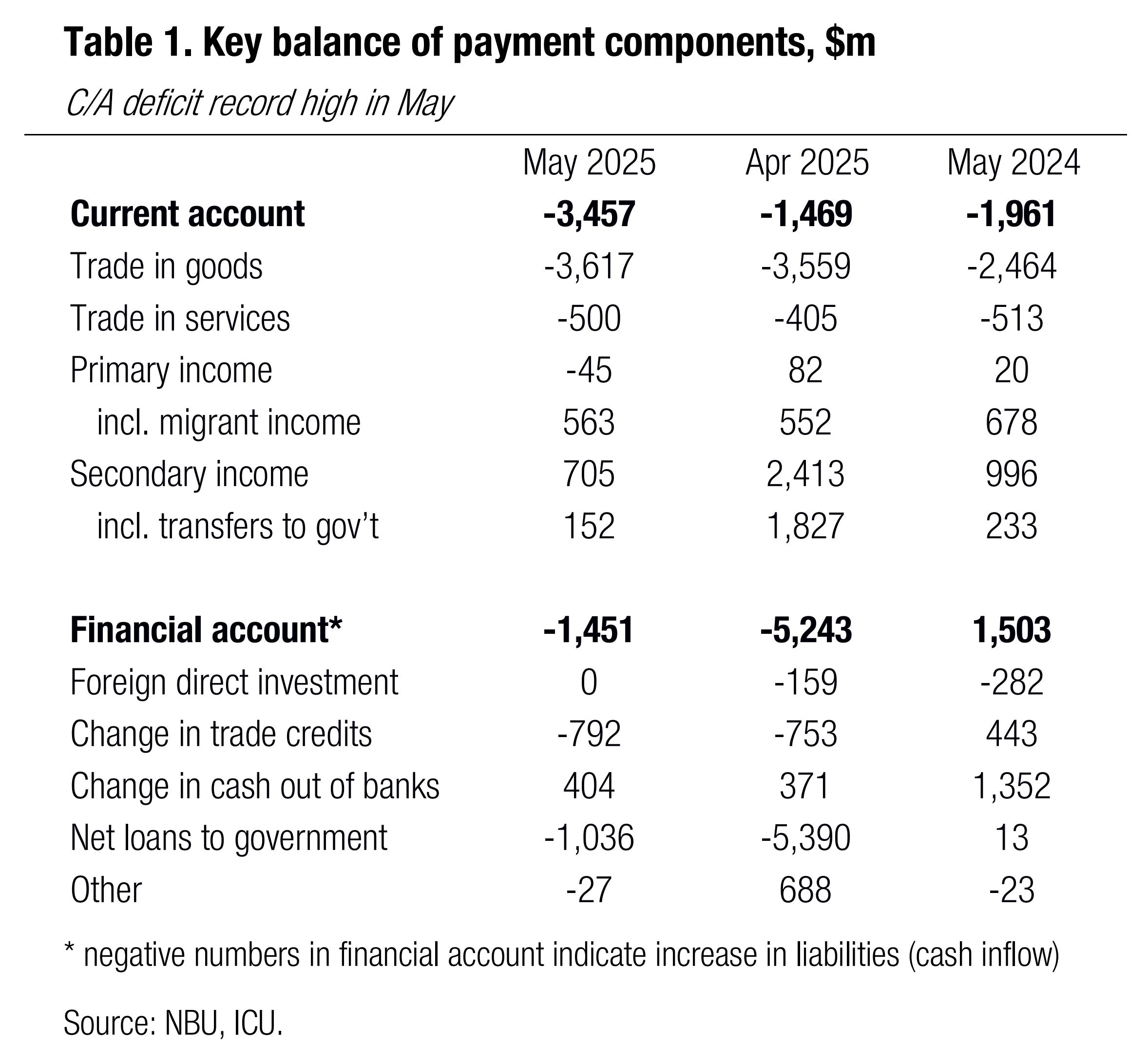

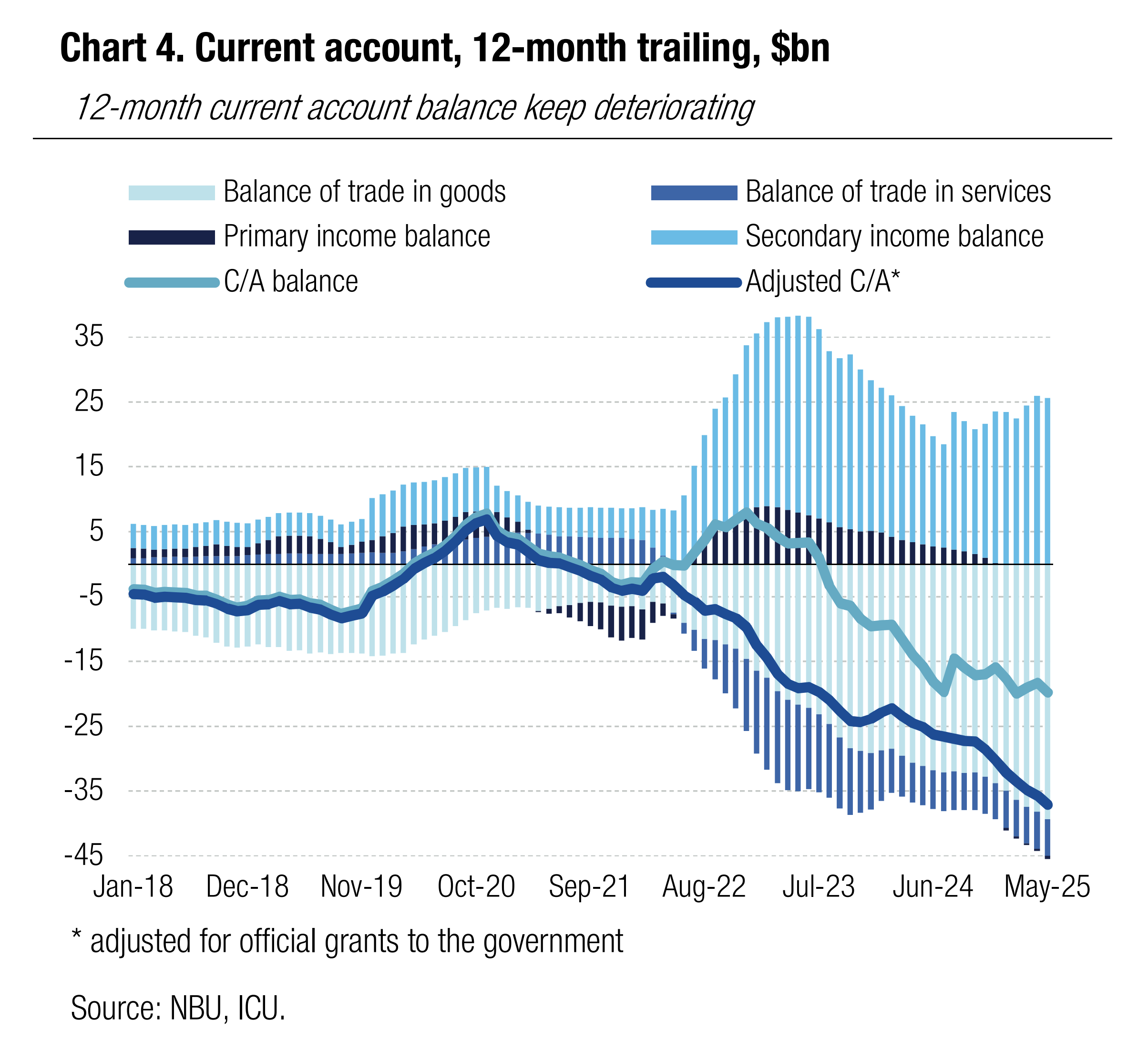

Economics: May C/A deficit record high

In May, Ukraine’s current account deficit surged to US$3.5bn, the largest amount ever, on a massive gap in foreign trade.

Deficit of external trade in goods widened to above US$3.6bn in May taking the 5m25 number to US$17.2bn vs. US$11.7bn in 5m24. The upsurge was primarily driven by larger purchases of energy-saving equipment and imports of natural gas. In 5m25, import of goods was up 17% YoY while exports decreased 4%. The deficit of trade in services was little changed YoY and the primary income balance has stayed close to zero over the past three months as incomes of Ukrainian migrants abroad remain broadly offset with interest income and earnings on FDI of non-residents. As Ukraine did not receive any sizeable budgetary grants in May, the secondary income balance was below the monthly average YTD.

On the financial account side, net inflow stood at close to US$1.5bn on an EUR1.0bn ERA loan to the government from the EU and a reduction in trade credits. External accounts, thus, remained in deficit in May at US$2.0bn and were marginally positive at US$0.5bn in 5m25. This led to a 5% MoM reduction in NBU reserves in May, but they were still up 2% in 5m25 to US$44.5bn.

|  |

ICU view: We expect much of the same pattern over the next 9-12 months: the current account will remain deep in the red while the capital inflows via the financial account (mainly in the form of concessional loans) will cover the C/A gap. Given this, the NBU reserves are on track to exceed US$50bn at the end of 2025, enabling the NBU to maintain the hryvnia relatively stable vs the US dollar. In 2026, concession loans to Ukraine are likely to decline substantially and pressure on NBU reserves and the hryvnia may re-emerge.

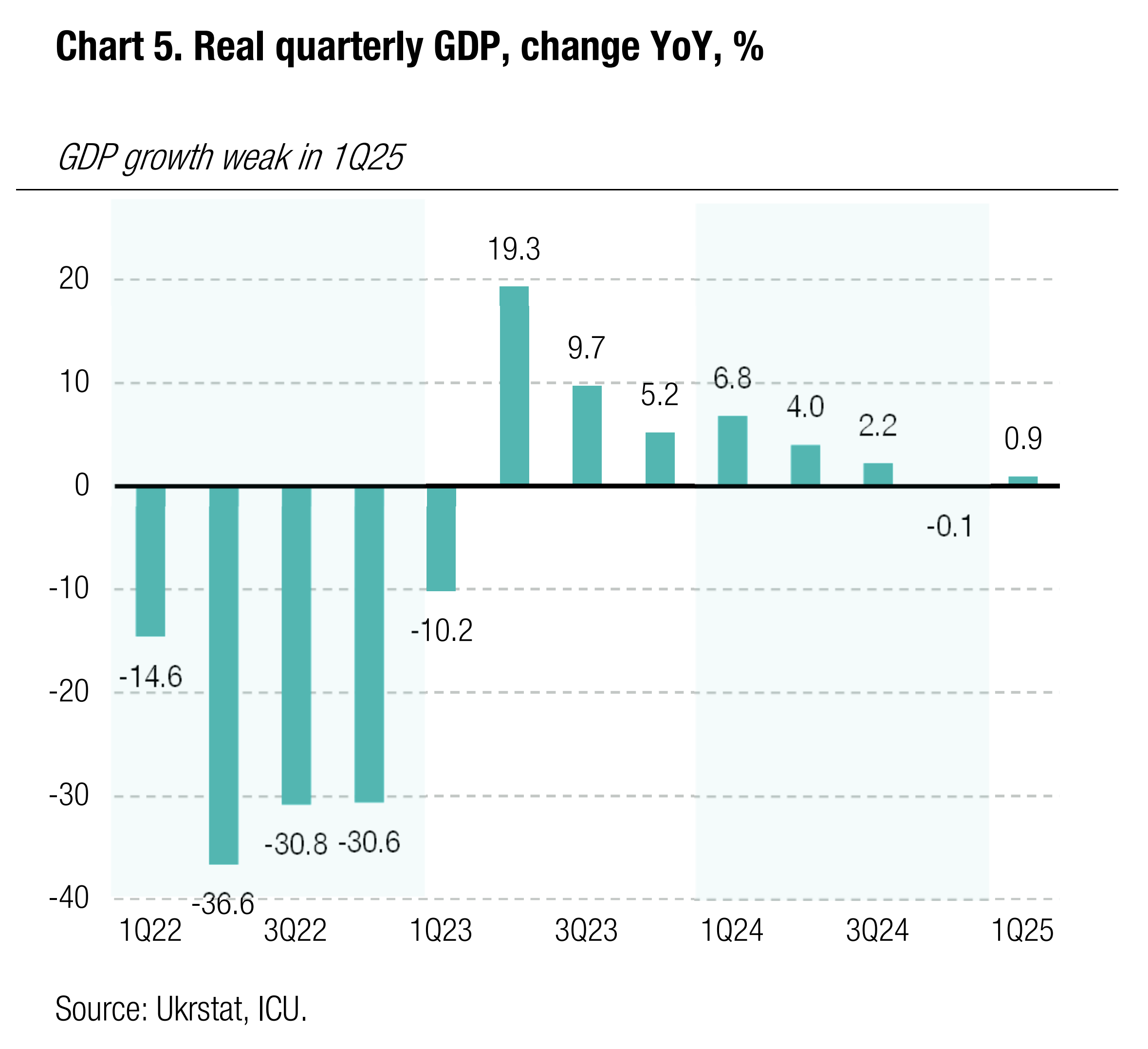

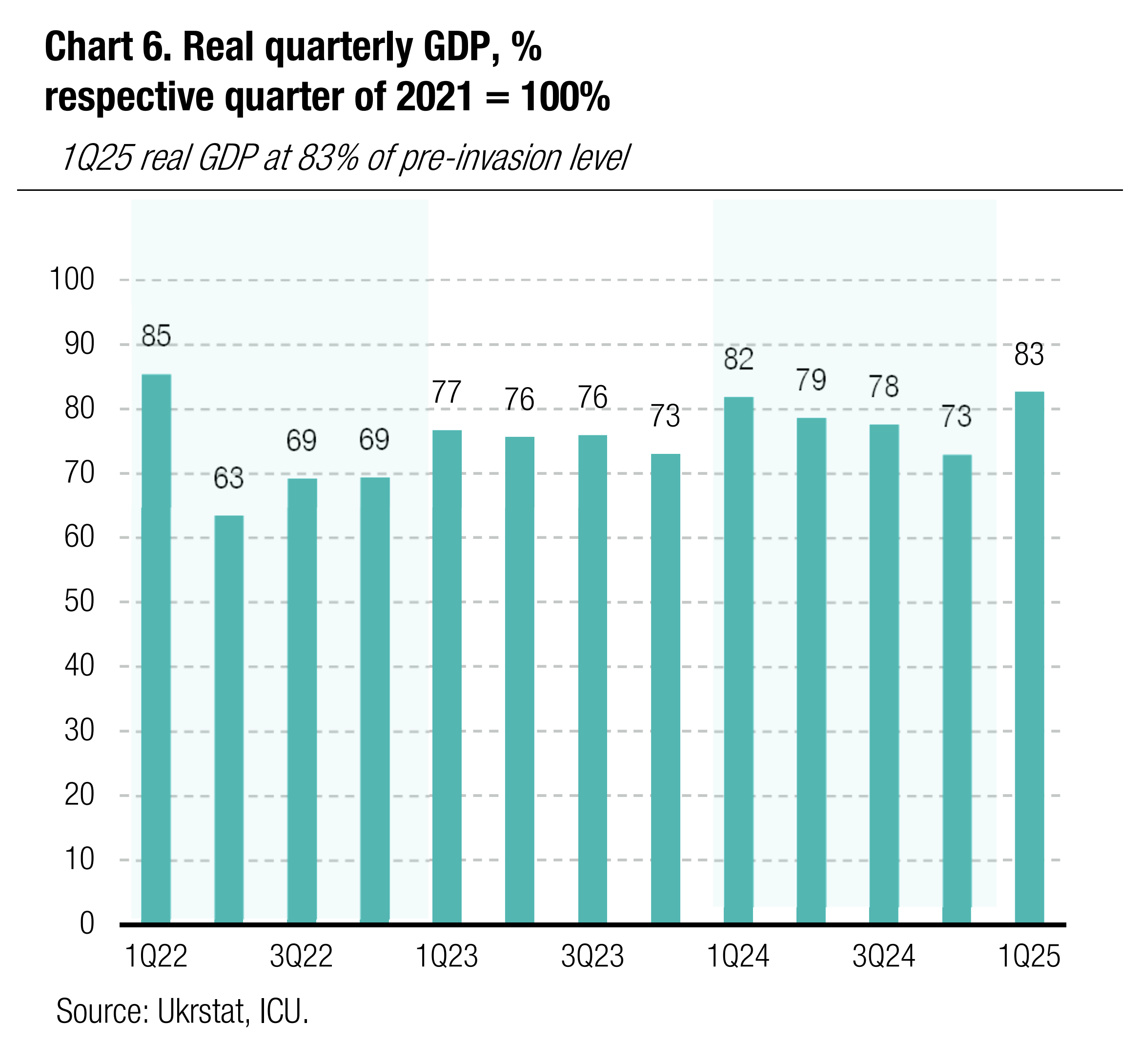

Economics: Economy grew marginally in 1Q25

Ukraine’s GDP edged up 0.9% YoY in 1Q25, reaching about 83% of the pre-invasion (2021) level.

|  |

ICU view: The 1Q25 data were expectedly weak due to last year’s high base effect as GDP surged 6.8% YoY in 1Q24. The 1Q growth data alone doesn’t change our view of full 2025 growth prospects. However, the latter may be impacted by declining prospects for a rebound in harvest as this year’s weather also presents a risk to the yields of grains and oilseeds. We see downside risks to our 2025 GDP forecast that now stands at 3.0%.

Economics: IMF approves 8th Ukraine EFF review

Last week, the IMF Board approved the 8th review of the EFF program for Ukraine, unlocking a new US$0.5bn loan tranche.

The key takeaways from the revised memorandum include:

- Ukraine met all quantitative performance criteria as well as most structural benchmarks.

- GDP and inflation forecast remained unchanged vs. the 7th review: expected economic growth is 2-3% this year, while the CPI will decelerate to 9.0%. The current account forecast deficit is up marginally to 16.5% of GDP for 2025.

- fiscal deficit projection for 2025 is increased by 2.5pp to 21.3% of GDP. The incremental gap will be primarily funded via local debt.

- the IMF baseline scenario still assumes a significant reduction of economic imbalances in 2026 – the fiscal balance is expected to narrow to 10.1% of GDP while the current account balance will shrink to 12.6% of GDP.

- the total package of financial aid to Ukraine is increased by US$4.1bn over the remaining lifetime of the EFF program. This implies total gross external financing from the IMF and other donors of US$54.3bn in 2025 (including pre-financing of US$12.2bn for 2026), US$22.2bn for 2026 (including US$11.1bn buffer for downside scenario), and US$3.0bn for 1Q27 (US$1.3bn for downside scenario).

- the schedule of further reviews changed: only one review is scheduled for 2H25 as opposed to two reviews in a previous schedule.

ICU view: Sentiment clearly indicates that for 2026 the IMF will likely need to design a fiscal scenario that is close to the current downside scenario, not the baseline one. This is due to the fact that the war assumptions that were used for the baseline scenario proved unrealistic. This implies that the current size of the financial aid package is not enough to cover the expected 2026 fiscal gap (even if the downside buffer is utilized) and the government will need to secure additional funding.