|  |

|  |

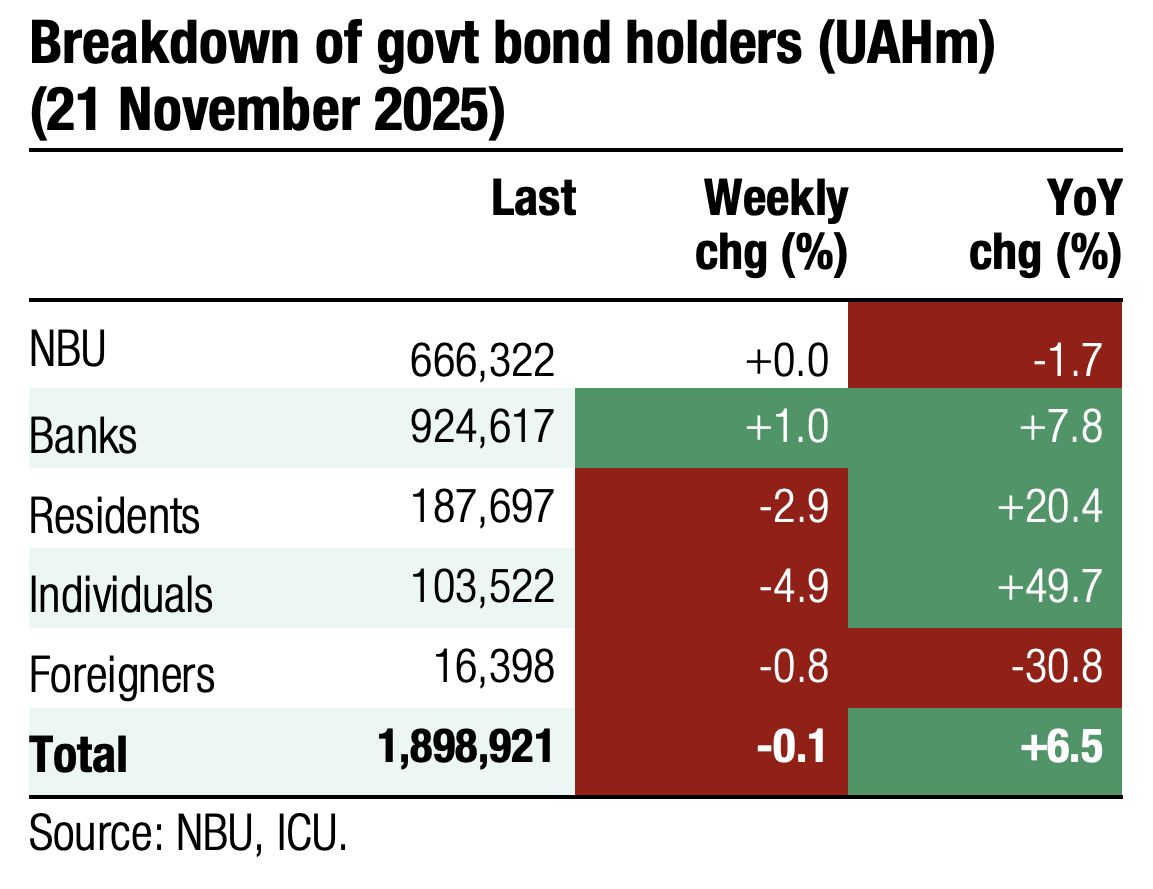

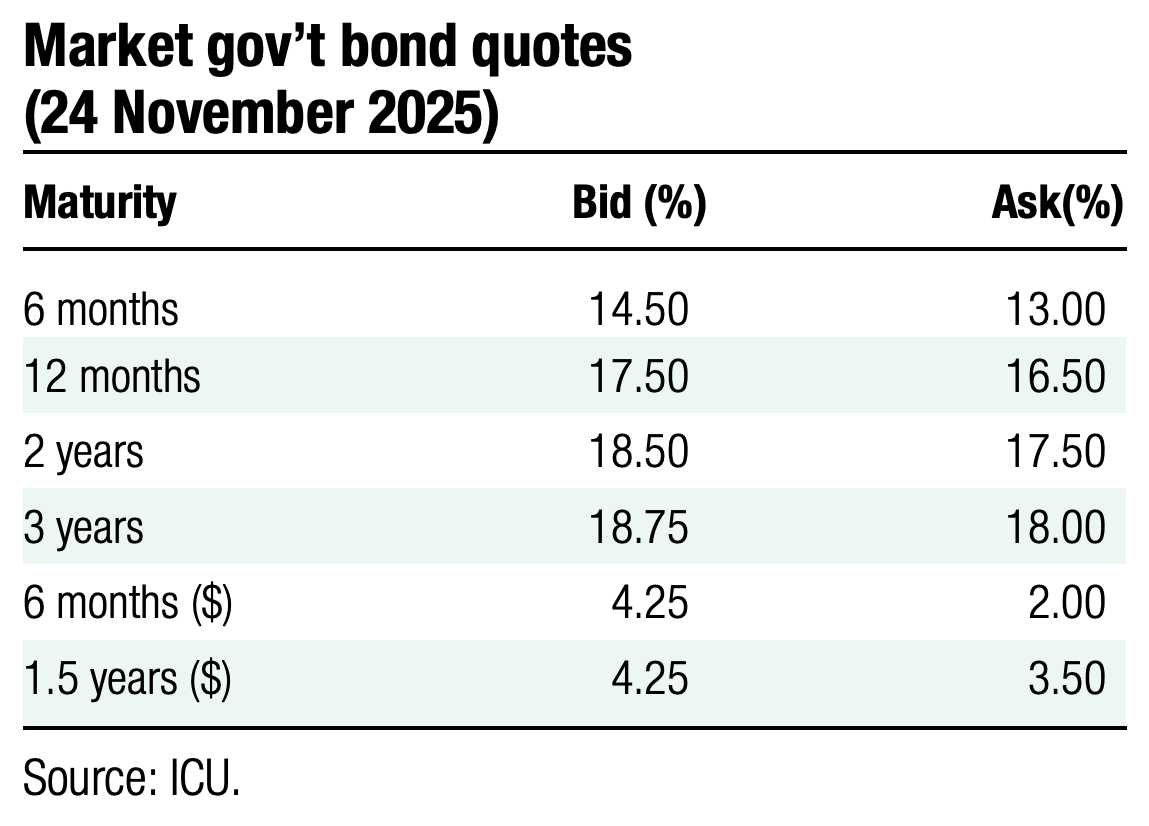

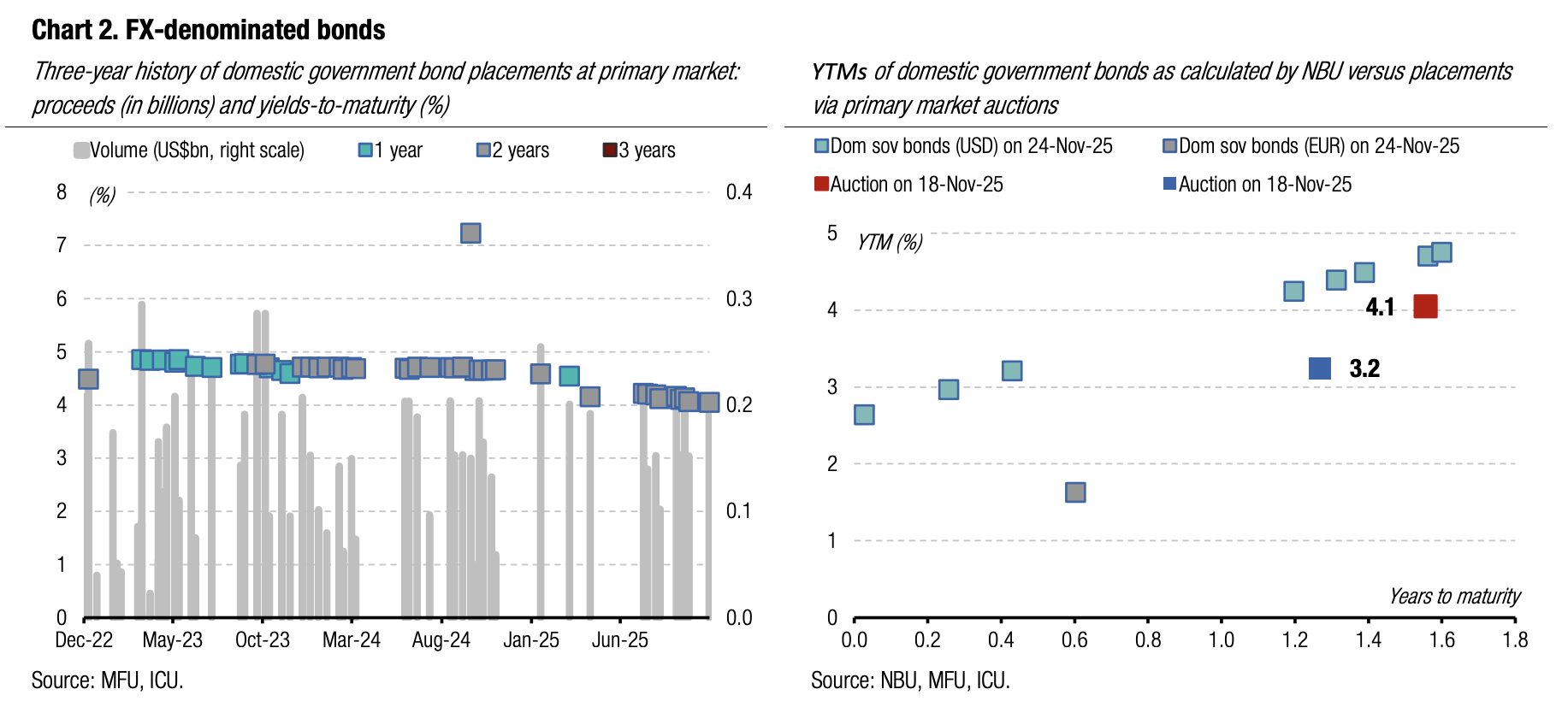

Bonds: MoF maintains full rollover of FX debt

The Ministry of Finance will maintain 100%+ rollover for USD-denominated local debt in November, for the third consecutive month.

Last week, the MoF redeemed US$362m and issued new bonds for US$200m (see auction review). Tomorrow, the MoF plans to sell another US$200m of the same paper that matures in July 2027. The next (and the last) redemption of FX debt in 2025 is scheduled for early December, totalling US$188m.

ICU view: This autumn, the Ministry of Finance increased borrowings in US dollars taking the rollover in this currency up to 100%, whereas earlier this year, the MoF had kept the monthly rollover at 63-88%. The MoF plans to reduce the volume of FX-denominated local bonds in the market gradually, which implies the current 100% refinancing rate is likely an exception rather than an established trend.

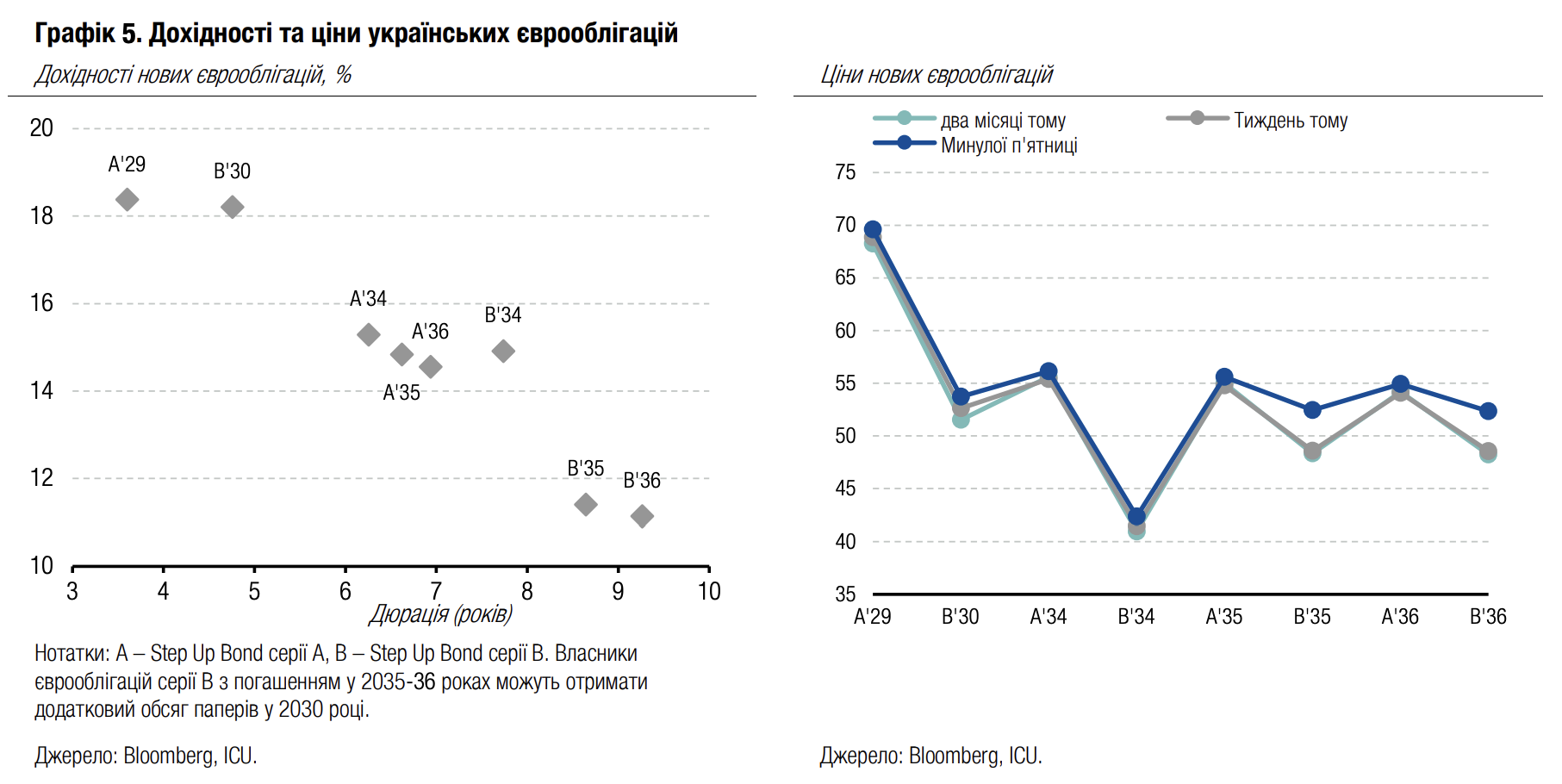

Bonds: Eurobonds up on new peace initiative

Investors welcomed the news of a new peace plan to end the war in Ukraine presented by the US, but the revealed details later contained their optimism.

Last Wednesday, the news of the US unveiling a new version of the peace plan for ending the war in Ukraine reignited optimism among investors. While the initial reaction was broadly positive, the subsequent disclosure of details (a lot of them are unacceptable for Ukraine and the EU) dampened the optimism. Overall, the price increase over the week was relatively insignificant, with an average 1.4% increase for series A bonds and 2% for series B bonds due in 2030 and 2034. Series B bonds maturing in 2035-36 grew by 8% as investors reassessed the chances for a principal increase event happening in the future.

ICU view: While the announcement of a new peace plan catalysed the price, the reaction was much more muted compared with previous episodes of “peace deal making” in 2025. This week, market sentiment will be dominated by facts and (to a larger extent) rumours about progress with peace negotiations. The negotiations held among Ukraine, the EU, and the US in Switzerland yesterday brought some relief for Ukraine as some of the unacceptable plan elements seem to the off the table. The IMF mission, which may reach a staff-level agreement on a new program with Ukraine, was a much less important event of the last week. The prospects for launching a new program now largely depend on the EU's ability to agree on a reparations loan for Ukraine in the coming months.

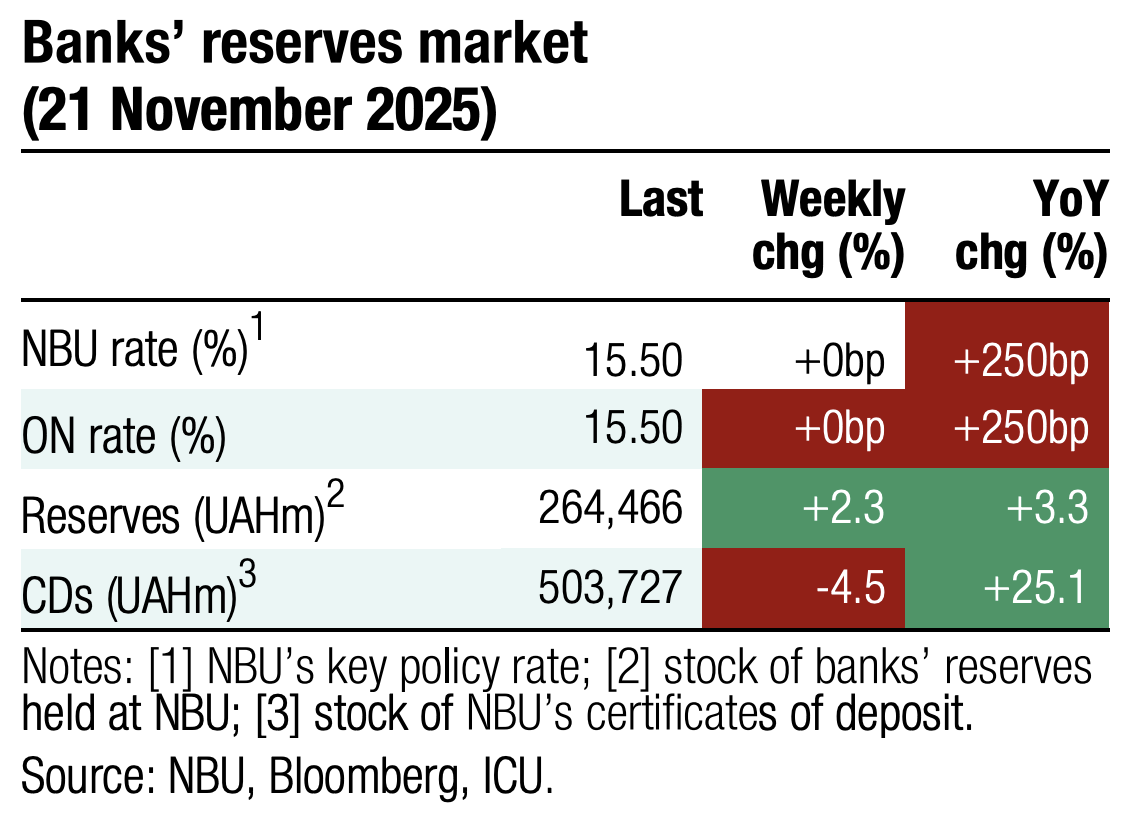

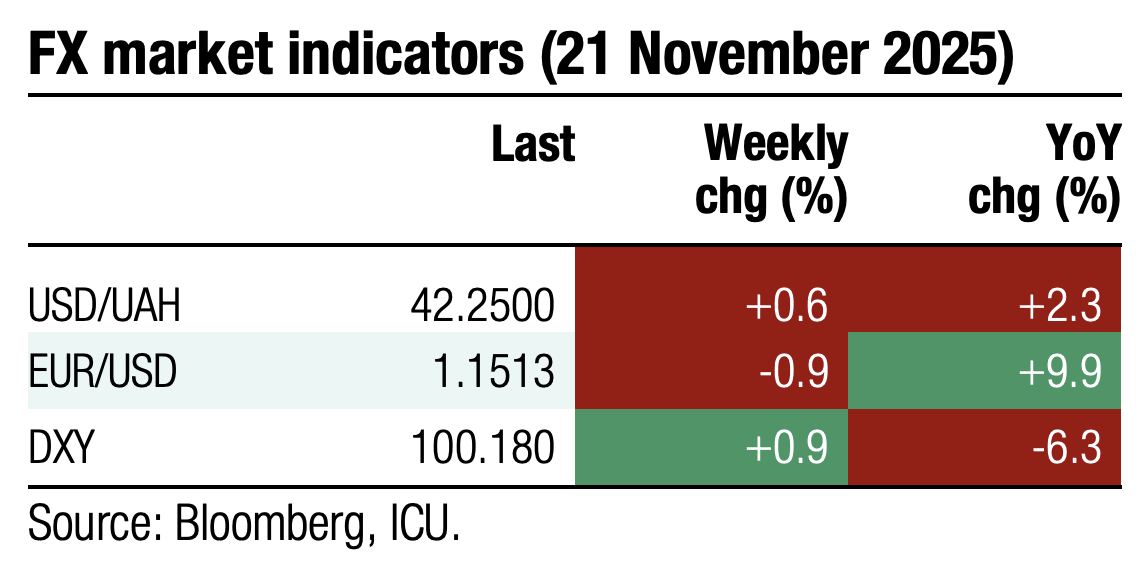

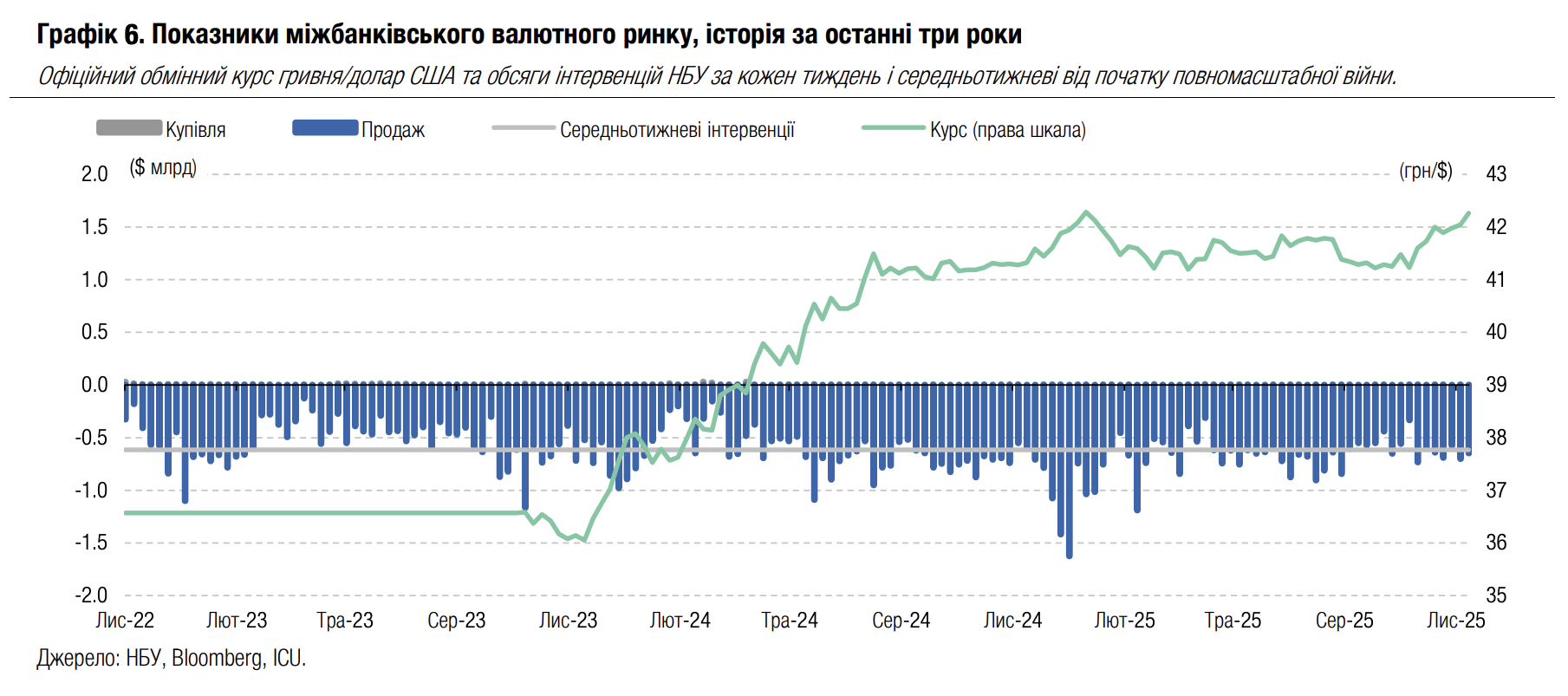

FX: NBU takes another step toward larger volatility band

The National Bank continued to weaken the hryvnia exchange rate, which approached this year's highs seen in January.

Last week, the shortage in the FX market fell by a quarter WoW to US$304m and the NBU cut interventions to US$648m. Despite that, at the end of the week, the NBU decided to let the dollar price move up to UAH42.27/US$. After fluctuations had stayed close to UAH 42/US$ for four weeks, the NBU made a move to let hryvnia test new levels that are close to this year’s lows.

ICU view: The NBU keeps widening the hryvnia fluctuation band. It may extend the range of exchange rate fluctuations further and then slightly strengthen the hryvnia towards the end of the month, as exporters require extra UAH liquidity to pay taxes. Therefore, we do not expect a significant weakening of the hryvnia soon.