|  |

|  |

Bonds: Debt refinancing below 100% YTD

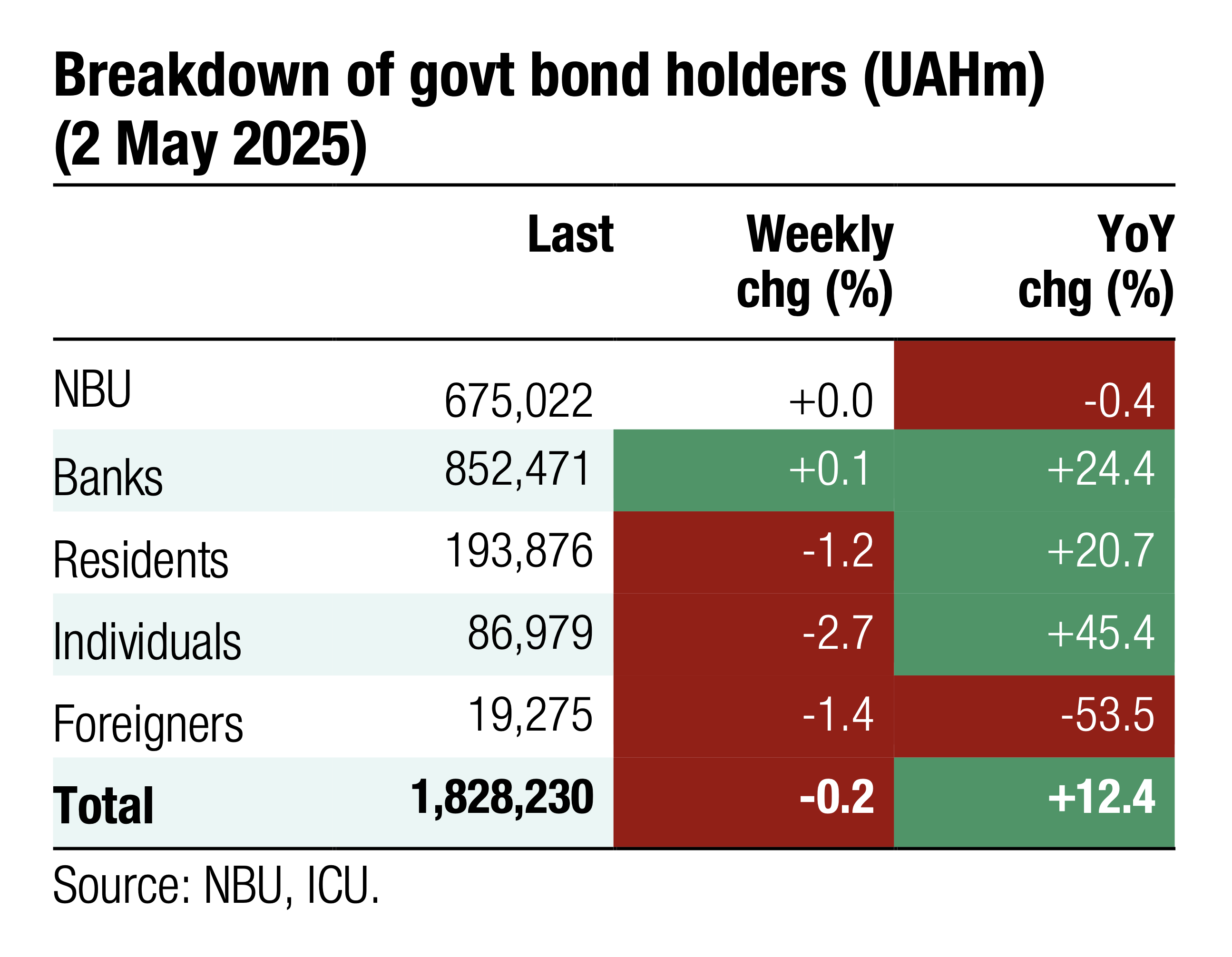

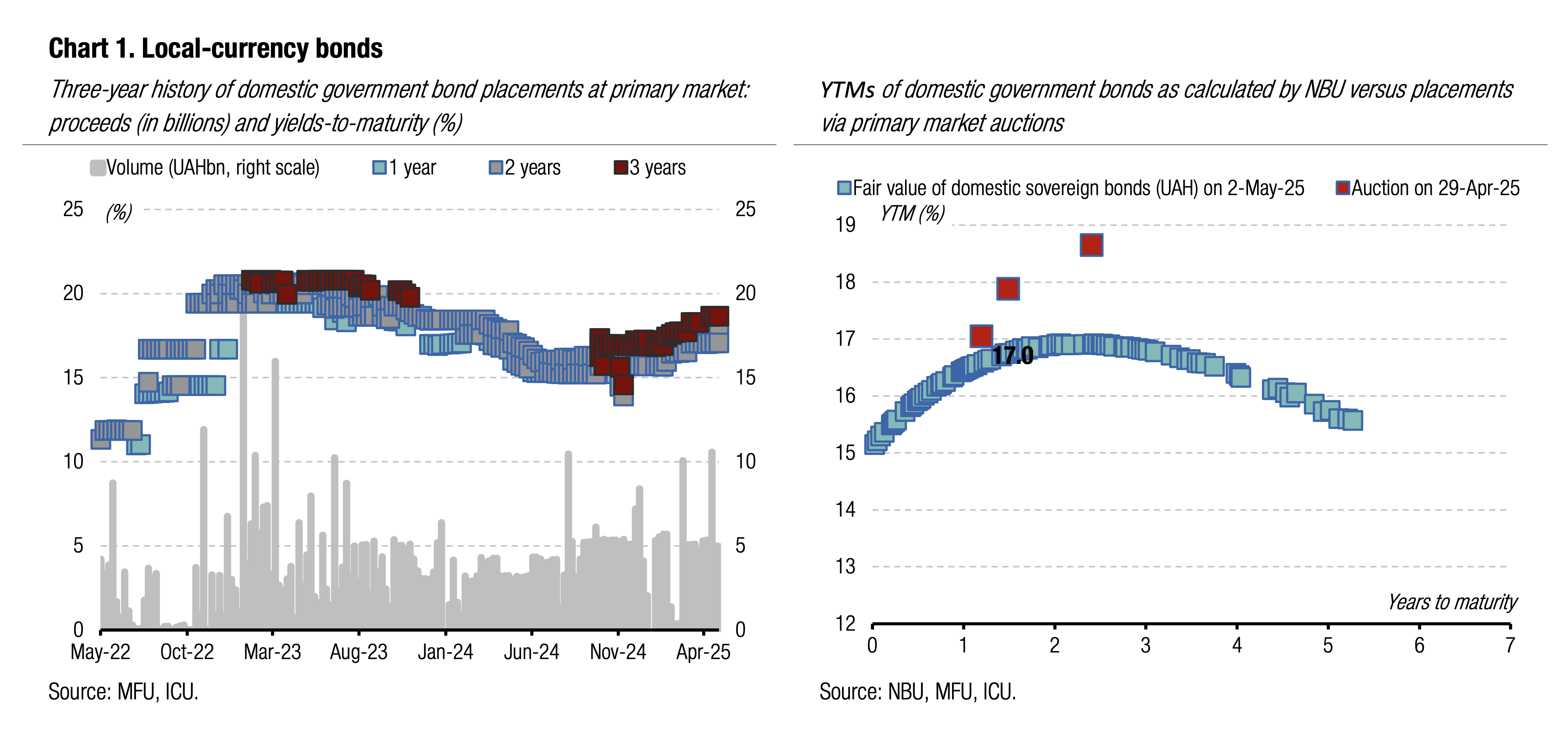

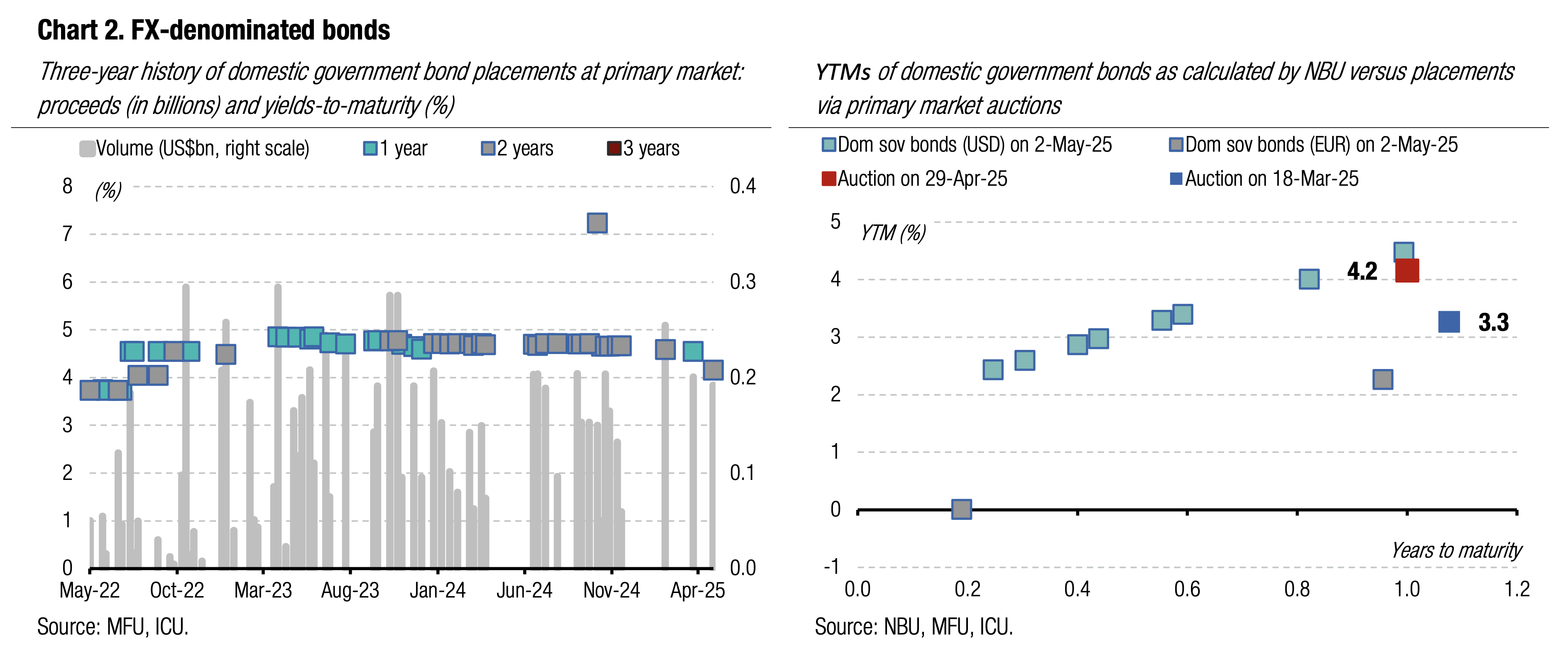

Despite an increase in UAH borrowing in recent weeks, the total debt rollover remains relatively low YTD.

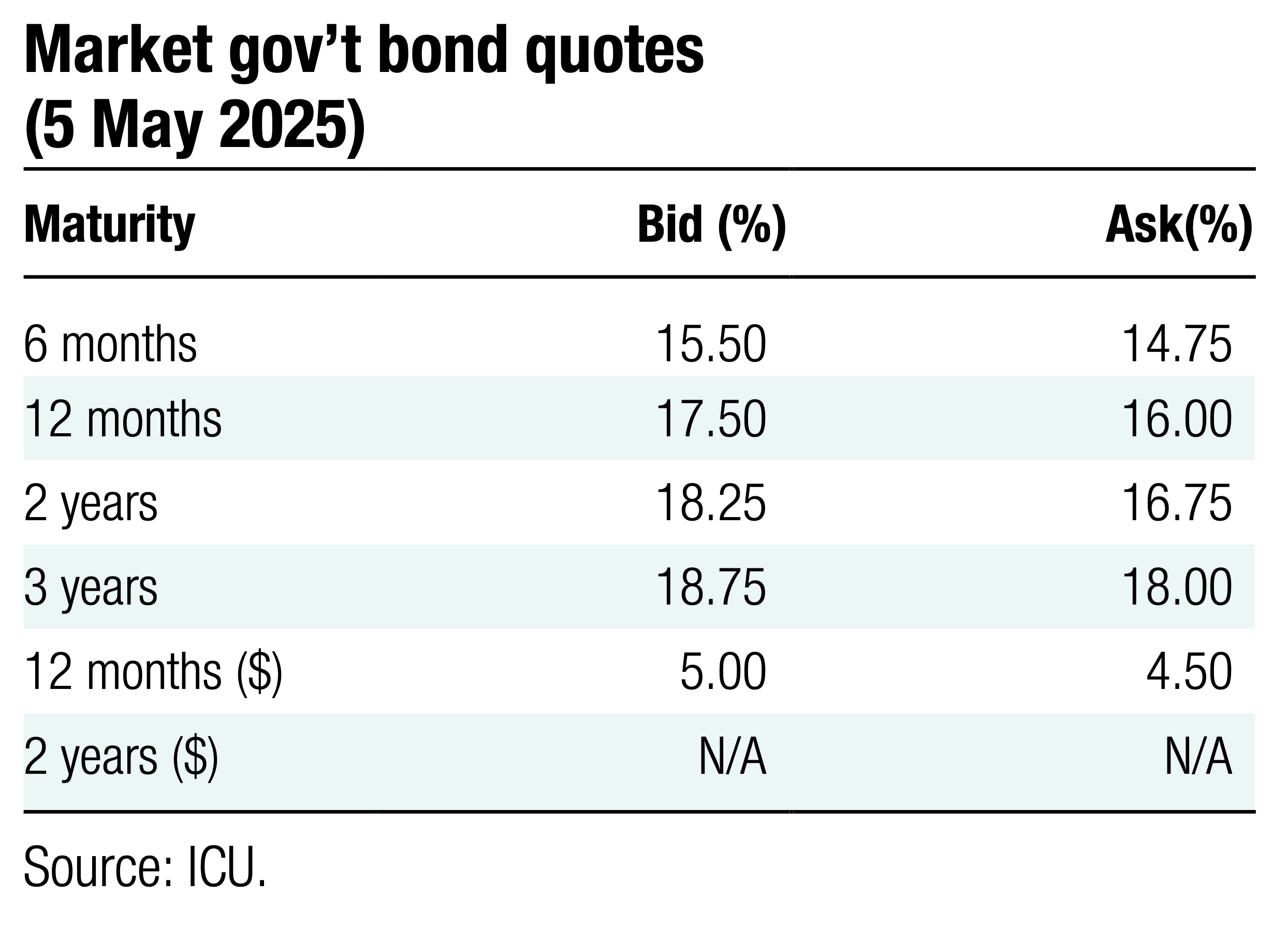

Last week, the MoF borrowed UAH16.5bn via a placement of UAH and USD-denominated bonds, one of the largest volumes YTD. Demand for UAH securities decreased slightly and shifted from a three-year note to a 15-month military bill, with no changes in interest rates. In total, UAH8.5bn of funds were raised via UAH bonds while the placement of the USD bill stood at US$192mn (UAH8bn) with a slight correction in yields. See details in the auction review.

The recent increase in borrowings was not enough for the MoF to improve the rollover rate significantly. Total rollover rose by just 3pp to 82% in 4M25 vs. 1Q25. Refinancing of UAH debt rose from 86% in 1Q25 to 88% in 4M25, while rollover in USD and Euros remained little changed at 67% and 59%, respectively.

Debt redemptions will be low in May, at just UAH13bn and EUR156m.

ICU view: Debt repayments in May are relatively small, and if demand for UAH bonds remains steady, the MoF may improve rollover this month. In an unlikely scenario when urgent liquidity needs emerge, the MoF may offer new reserve bonds for banks and, thus, boost borrowings. However, the new reserve paper is unlikely to be added to the offer before June, when bond redemptions increase sharply to UAH41bn. The MoF is scheduled to offer an EUR-denominated paper this week, with an offer cap likely set to be equal to the size of the scheduled upcoming redemption.

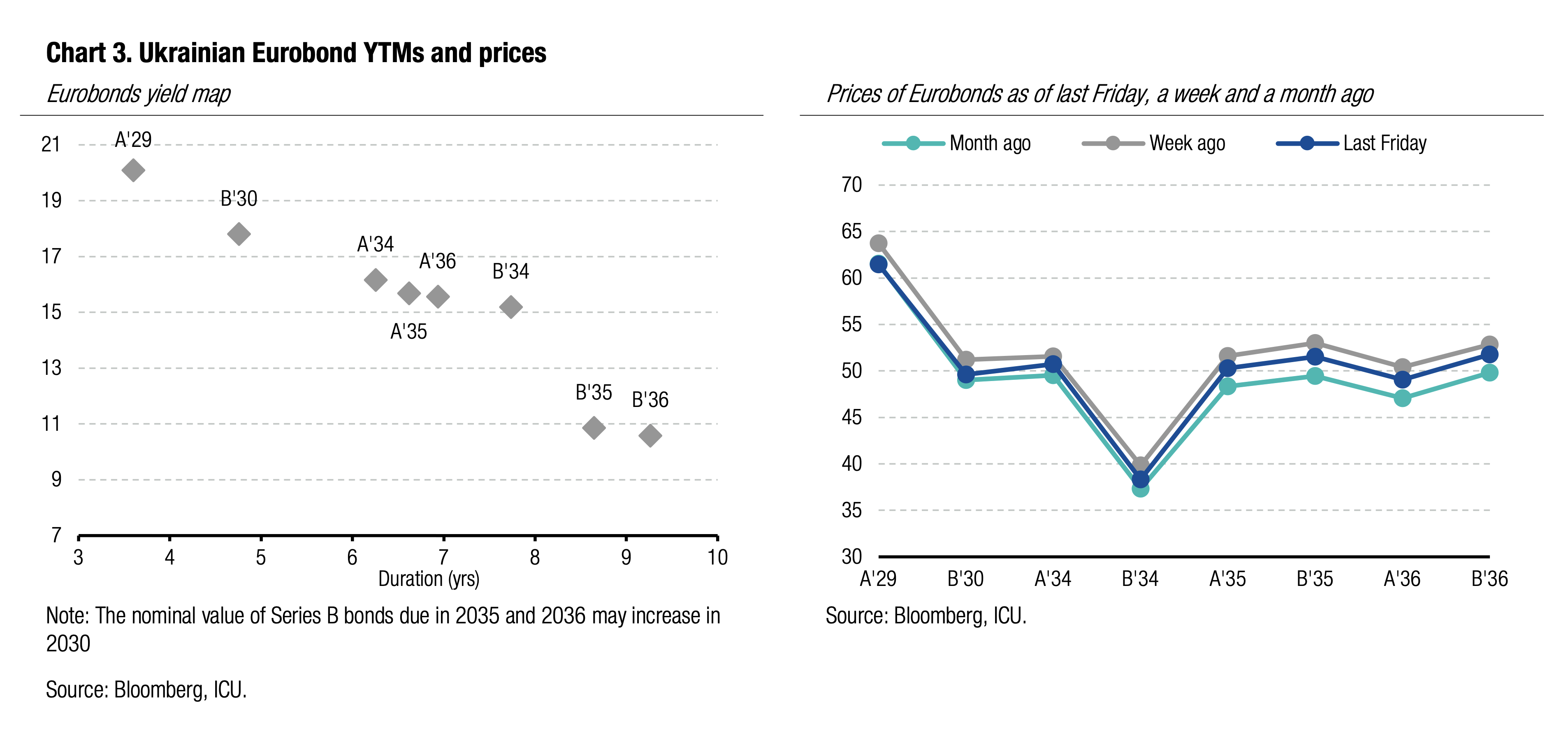

Bonds: Minerals deal does little to improve market sentiment

The positive effects of the minerals deal that was signed last week were very short-lived, and bondholders' sentiment remained fully cautious last week.

Last week's key news was the signing of the first part of the minerals deal between Ukraine and the US. The Ukrainian Parliament must ratify it, and then a second technical part of the agreement will follow.

Against the backdrop of overall negative global sentiment toward emerging markets, Ukrainian Eurobonds slid by 3% on average last week, with a small bounce seen last Thursday after the minerals deal was signed. The EMBI index slid last week by 0.7%.

VRIs' price remains steady at about 72 cents per dollar of notional value, in anticipation of a new MoF restructuring offer.

ICU view: Global sentiment towards bond markets and emerging markets was negative last week, affecting Ukrainian Eurobonds and pushing prices down. Investors remain concerned about the pace of VRI's restructuring that seems to be too slow to complete the process on time. The MoF is set to improve its offer, but it is unlikely that it will make at least a partial cash payment related to real GDP growth in 2023.

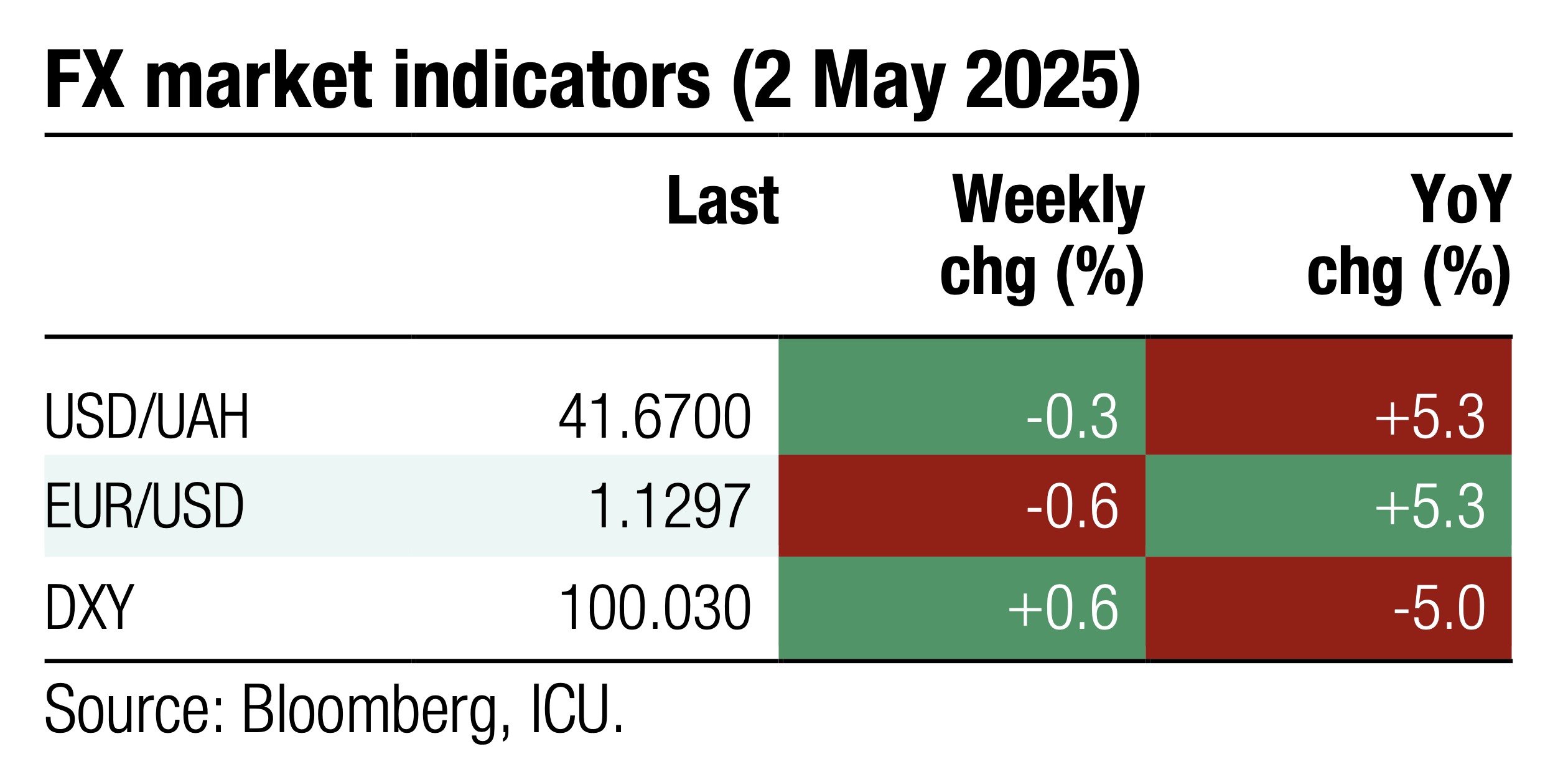

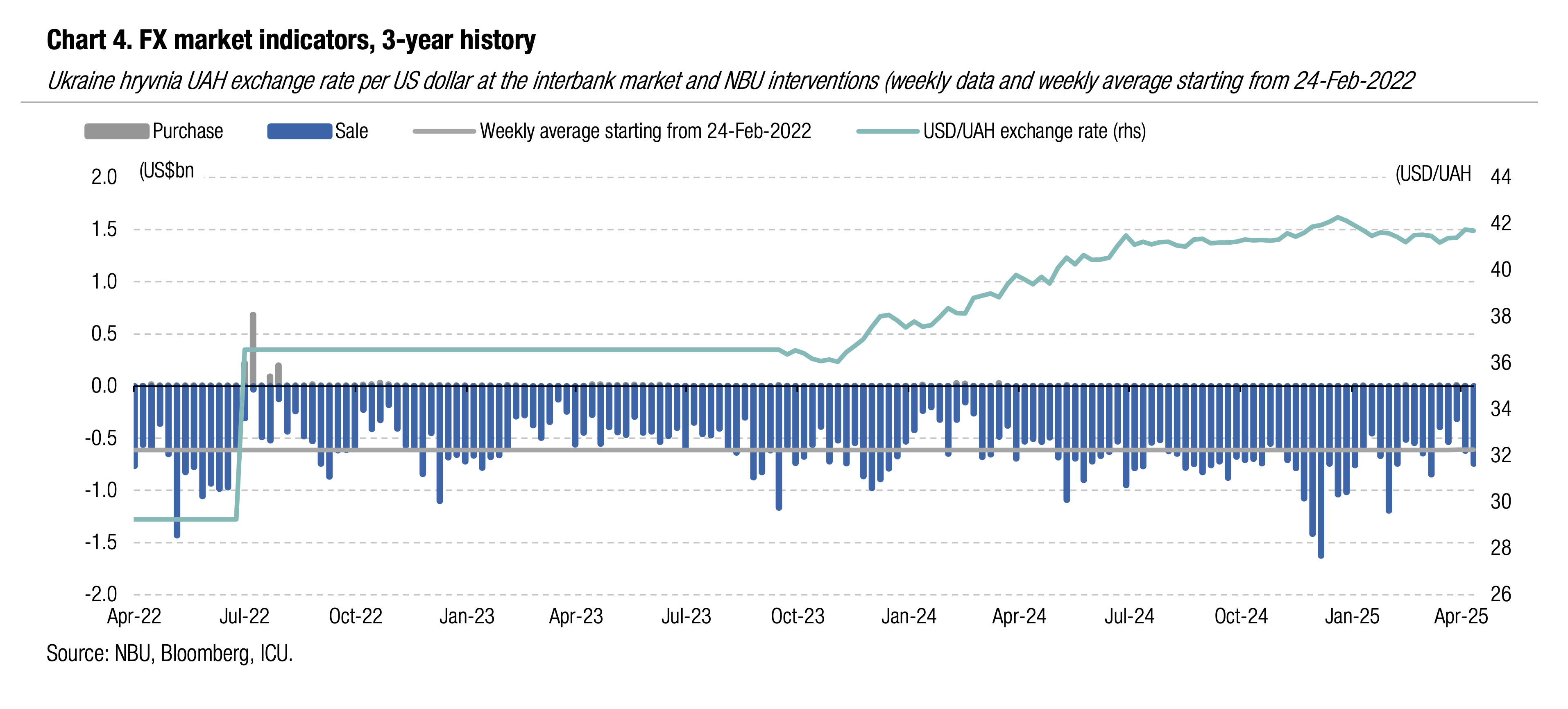

FX: NBU prevents weakening of hryvnia again

NBU increased its FX interventions last week, while keeping the hryvnia exchange rate steady.

Weekly hard currency interventions rose by 20% WoW to almost US$743m. The NBU strengthened the hryvnia to UAH41.47/USD last Wednesday and allowed it to weaken back to UAH41.7/USD by last Friday, the same level as a week before.

These exchange rate fluctuations were due to an increased hard currency shortage in the FX market. In four business days, net foreign currency purchases rose by 40% WoW to US$487m.

ICU view: The daily FX deficit was above April's and YTD average. End-month tax payments by exporters led to only a short-lived increase in the hard currency supply in the interbank FX market.

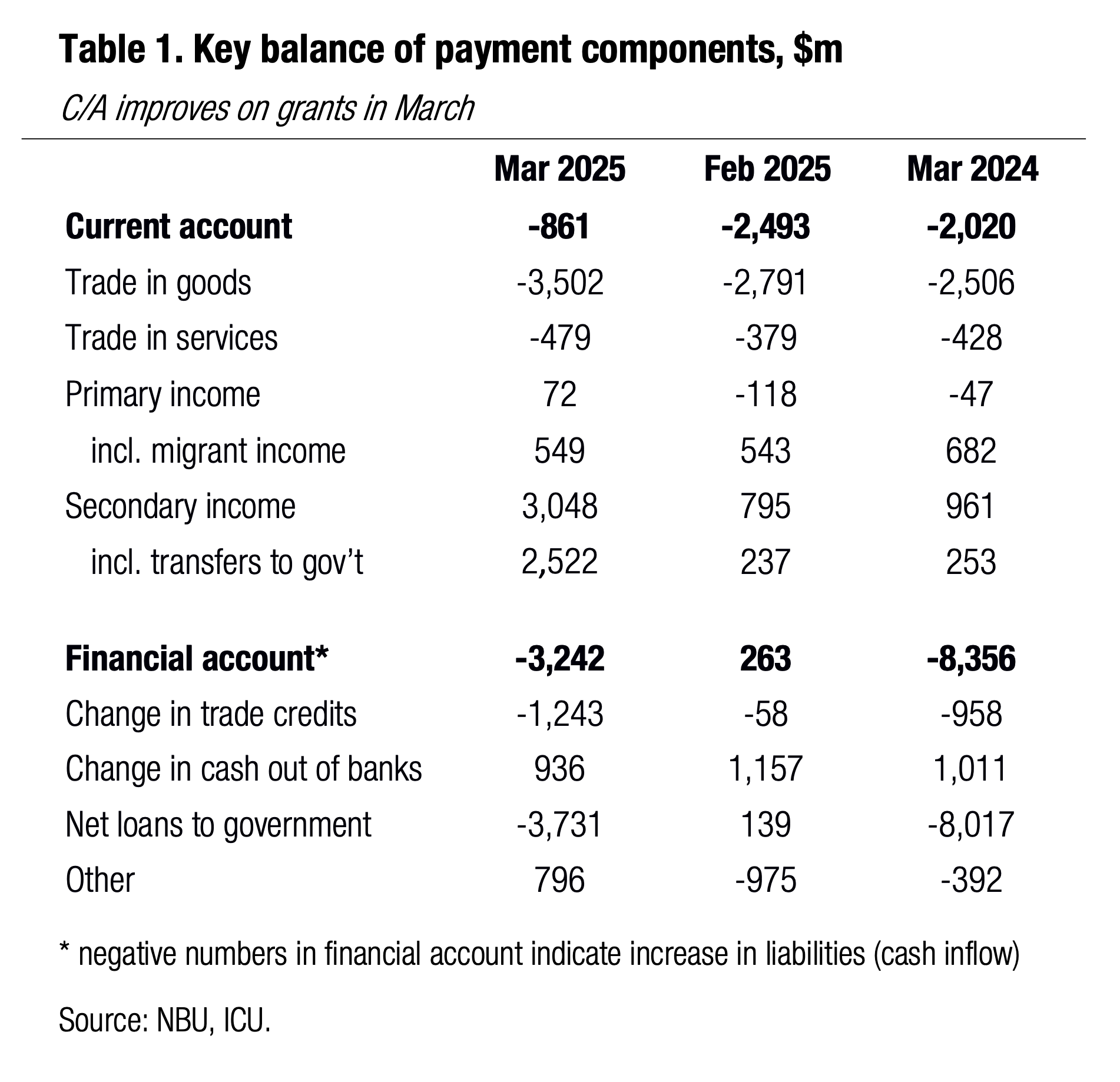

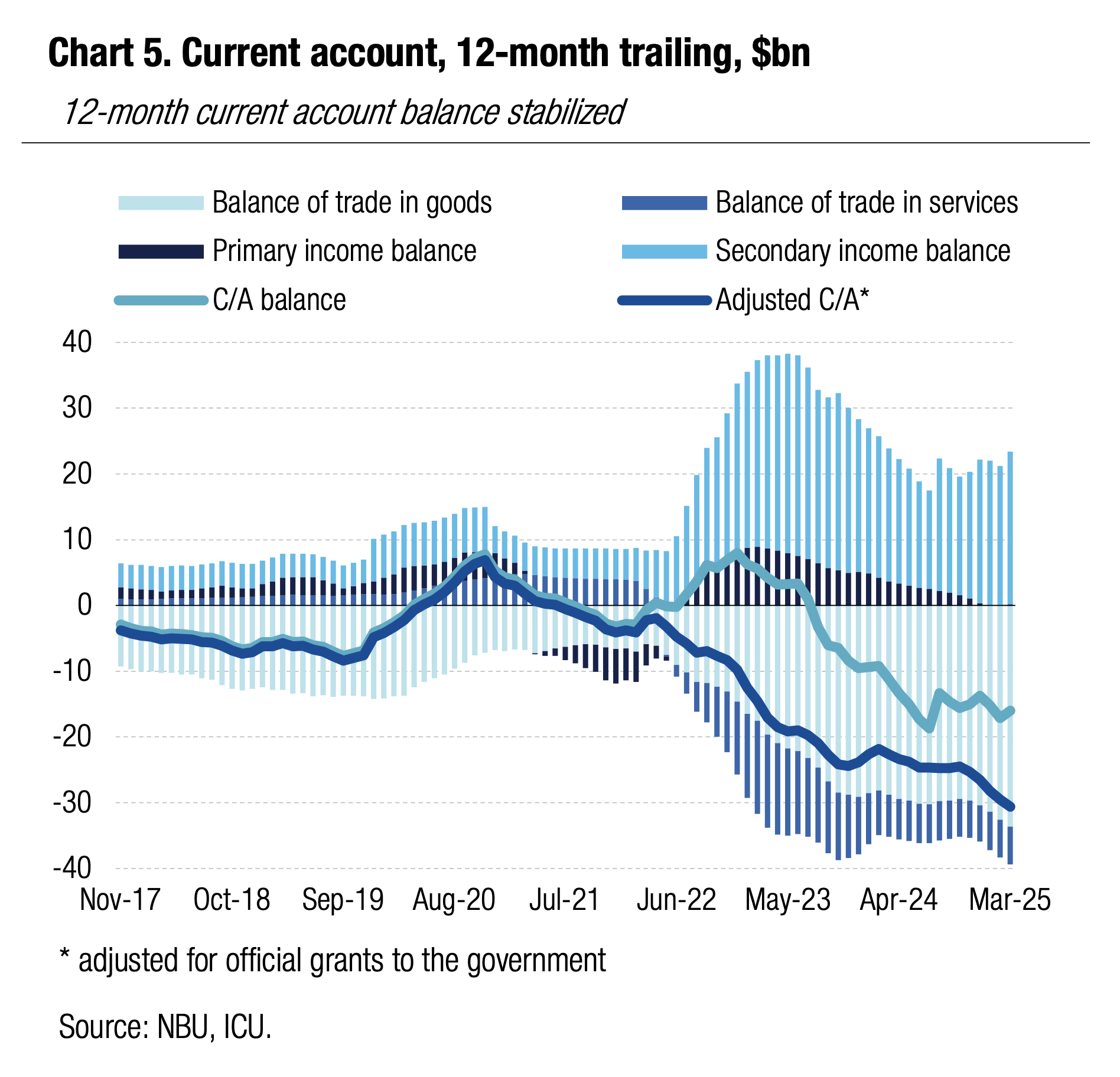

Economics: C/A improves on budgetary grants in March

In March, Ukraine’s current deficit narrowed to US$0.9bn as the inflow of foreign budgetary grants resumed.

The balance of trade in goods worsened substantially in March as imports surged 20% YoY on larger purchases of natural gas abroad while exports were up only 5% YoY. The deficit of foreign trade in services was close to last year’s March value. The improved C/A balance in March vs February is solely the result of inflows of budgetary grants to the Ukrainian government. Apparently, a $2.4bn part of ERA facility that was provided to Ukraine in March was classified as grants by the NBU with the remainder treated as loans and accounted for in the financial account.

The net inflows via the financial account also improved substantially on foreign concessional loans. Also, partial relief to the financial account came from lower outflows of FX cash from the banking system that likely reflects lower household demand for hard currency against the backdrop of a stable exchange rate. With net inflow via the financial account considerably exceeding the C/A deficit, the NBU managed to increase its reserves by 5.6% to $42.4bn in March.

|  |

ICU view: The developments of the balance of payments remain in line with our projections detailed in Macro Insight dated April 17, 2025. We expect the current account deficit to be in the range of 12-13% of GDP in 2025 (if budgetary grants via ERA facilities are excluded). Yet, huge inflows of concessional loans scheduled for 2025 (primarily via the Ukraine Facility and ERA) will boost the financial account surplus and lead to a substantial increase in reserves to above $55bn by the end of 2025. This implies the NBU may remain reluctant to weaken the hryvnia noticeably through end-2025.