|  |

|  |

Bonds: MoF improves rollover further

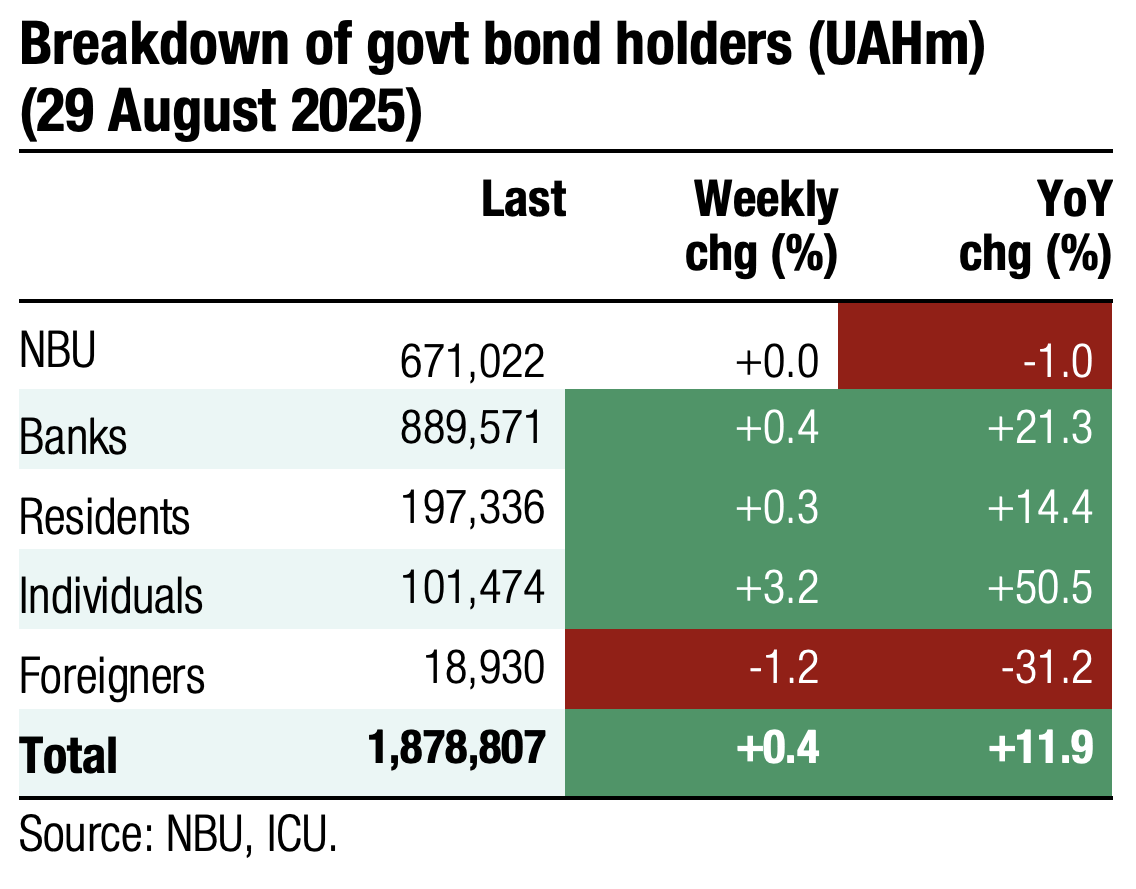

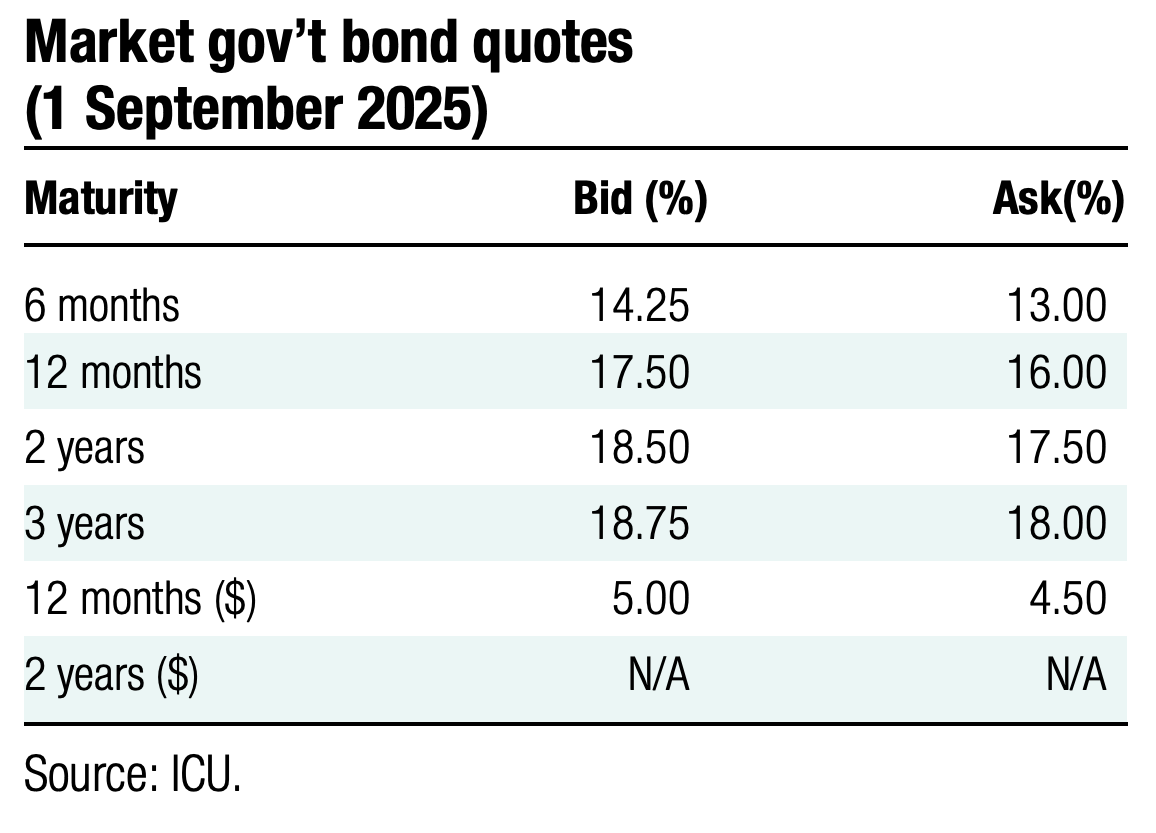

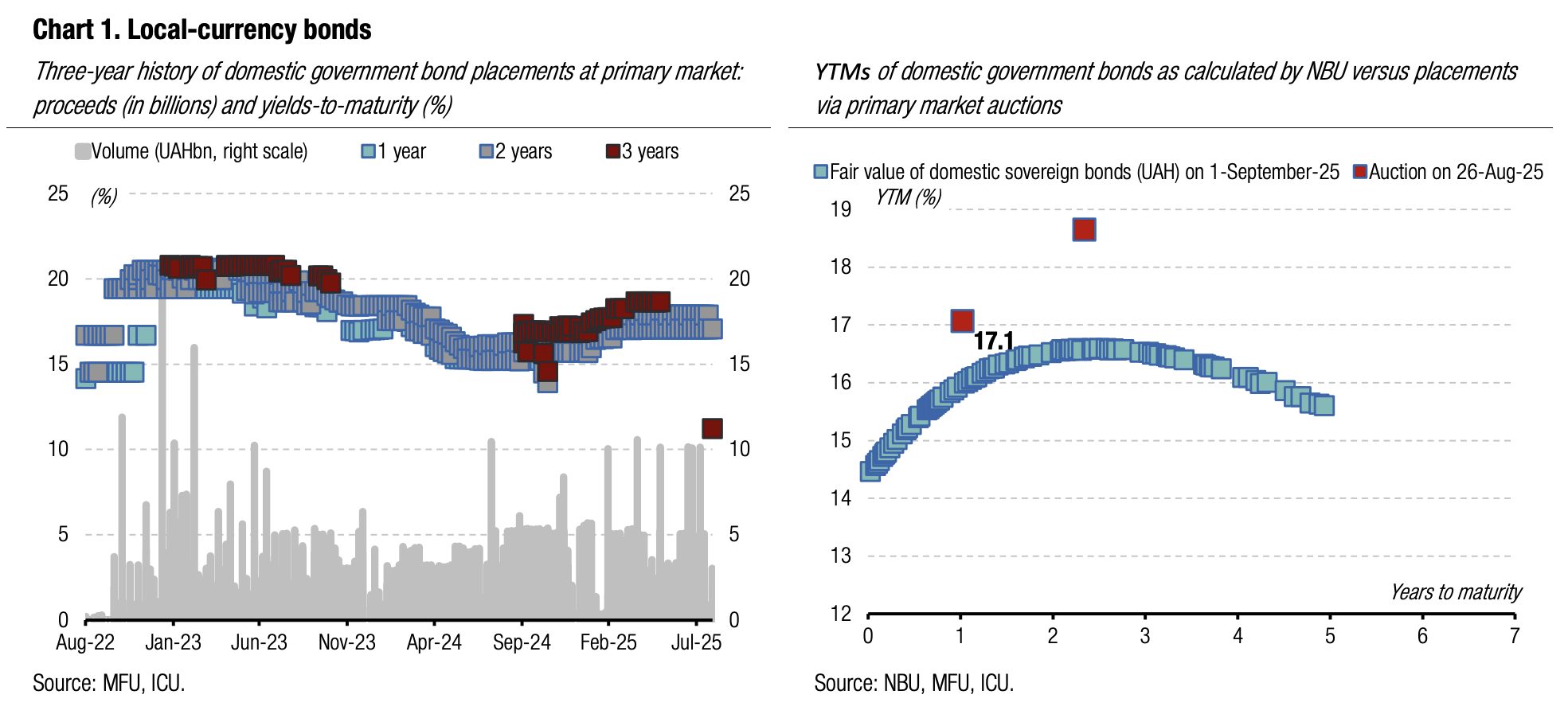

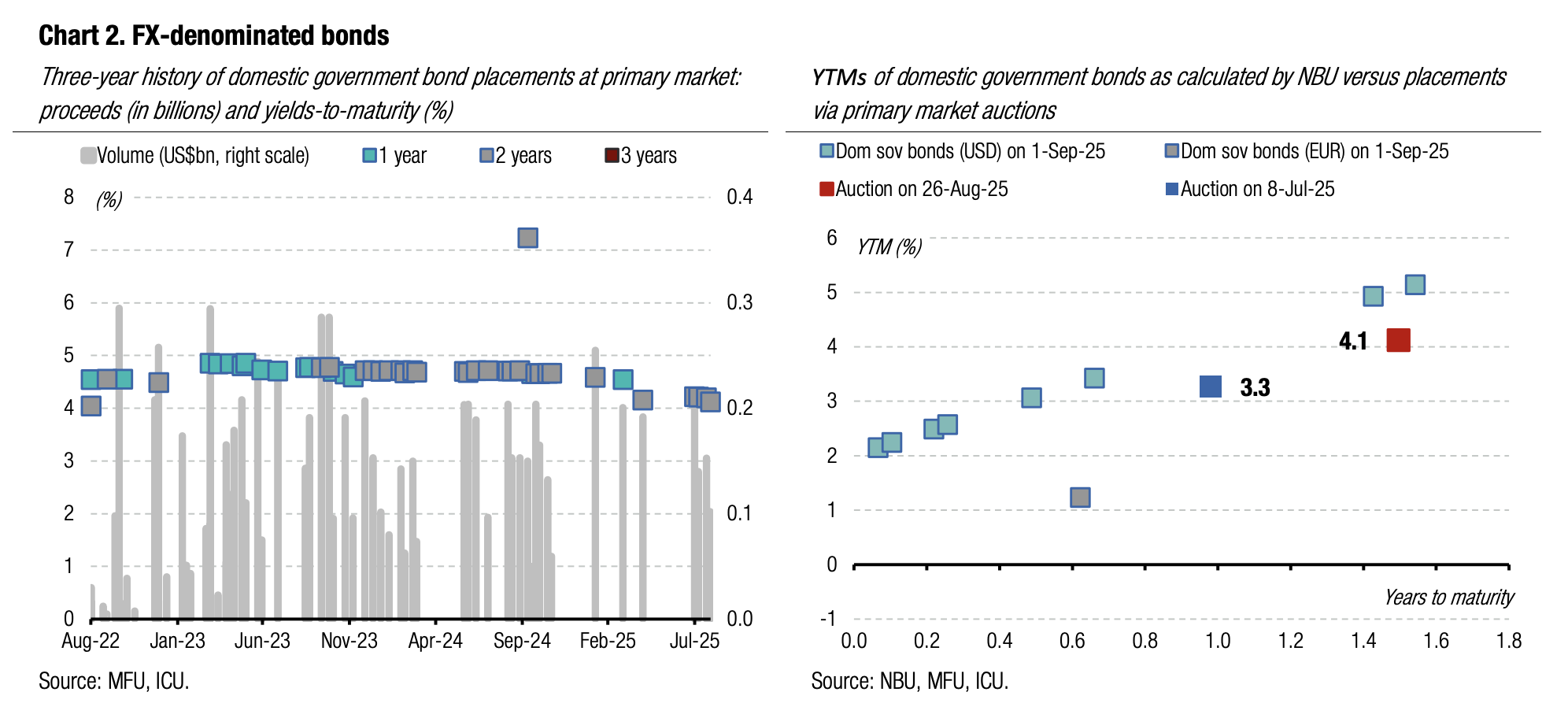

In August, the Ministry of Finance increased borrowings in foreign currency while maintaining a high level of UAH debt refinancing.

Last month, the MoF borrowed UAH26.4bn and redeemed UAH12.1bn worth of bonds. Also, the MoF borrowed US$390m, significantly above repayments in USD for the month. There were no repayments or borrowings in euros last month.

The rollover ratio of UAH debt in August was 218%, pushing the 8M25 number to 112%. For US dollars, the ratio was 139% in August and 76% for 8M25. In euros, rollover remained unchanged from the previous month at 84%.

The MoF raised net UAH8bn (US$200m) in all currencies YTD. To follow the budget plan, in September-December, the Ministry will need to borrow almost a net UAH259bn (US$6.2bn), implying gross borrowings of UAH409bn (almost US$10bn). Therefore, the MoF average gross borrowings need to top UAH100bn per month, which is a challenging target.

In September, the MoF will redeem UAH18.8bn scheduled for the next week and US$350m at the end of the month. The Ministry plans to offer UAH bonds every week, a bond in euros next week, and will add USD-denominated paper to the list in the last two weeks of September.

ICU view: The MoF stepped up the placement of FX bonds and UAH reserve paper in August, but the total volume of borrowings still fell below July’s volume. With the current pace of borrowings, the ministry is unlikely to meet the annual debt raising target. MoF is likely waiting for signals from the NBU about the path of the key policy rate in 4Q25, perhaps hoping that a strong indication of possible rate cuts in 4Q will encourage banks to step up investments in anticipation of lower yields. However, that may not be enough to increase borrowings significantly. Therefore, the NBU may need to step in again with administrative measures like increasing mandatory reserve requirements for banks and/or the limits to which bonds can be used to meet the reserve requirements.

Bonds: No light in the tunnel of peace negotiations

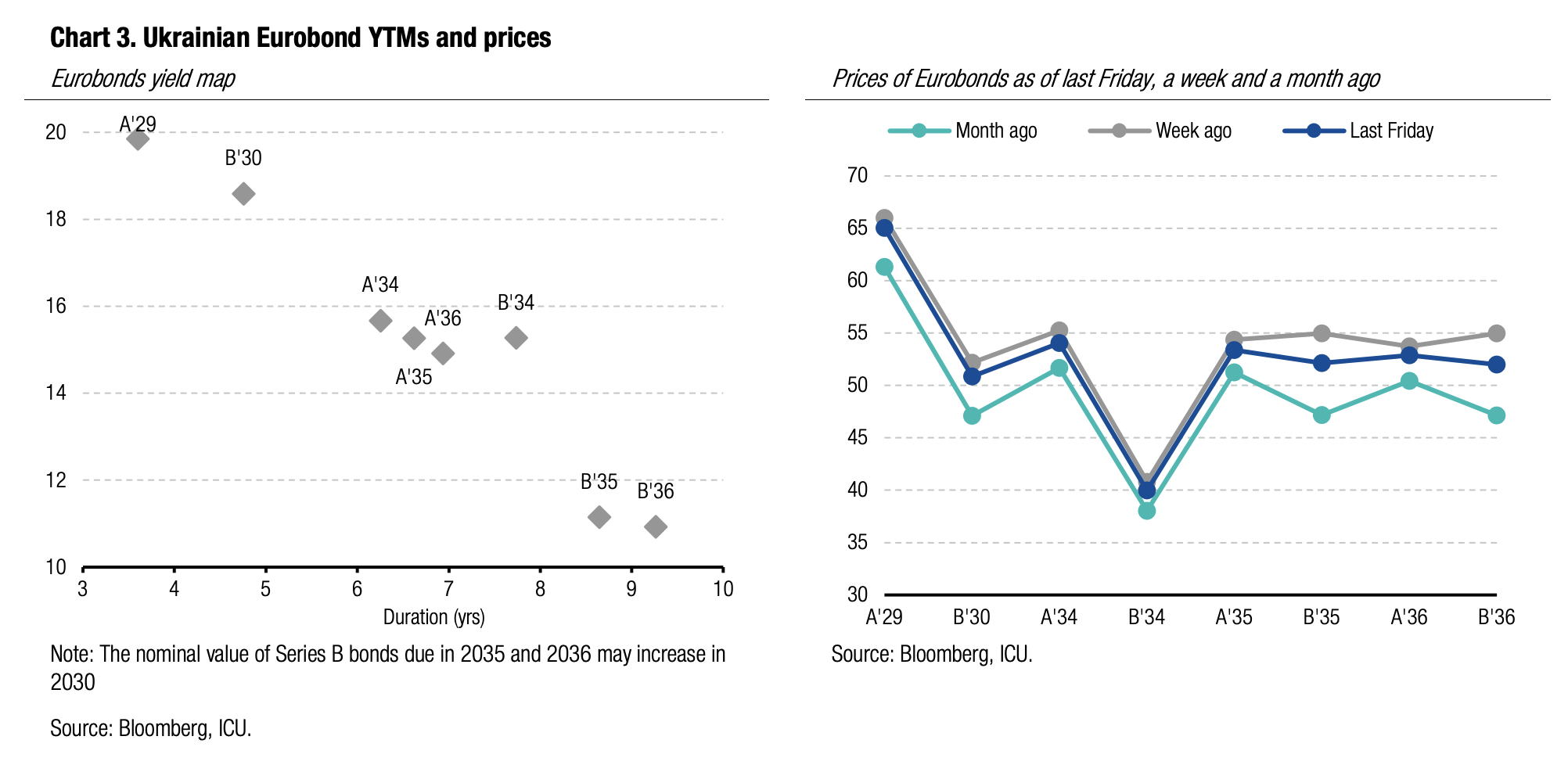

Holders of Ukrainian Eurobonds still hope that diplomatic efforts will end the war in Ukraine, but such hopes are clearly fading.

The Ukrainian Eurobond rally in early August followed the announcement of a meeting of the US president with putin. The optimism was premature. A subsequent meeting of the presidents of Ukraine and the United States also yielded no material results and later it became clear that Russia was in no hurry to move on to peace talks. The massive shelling of Ukrainian civilian infrastructure continues, a clear signal a peace deal is not a near-term prospect.

Against this background, Ukrainian Eurobond prices continued to decline, although they remain slightly above the pre-Alaska-meeting level. Over the past week, Eurobond prices slid by almost 3% and more than 5% post-Alaska with step-up bonds B maturing 2035-36 losing almost 9%.

ICU view: We do not expect a significant breakthrough in peace negotiations any time soon, although diplomatic steps to end the war will continue.

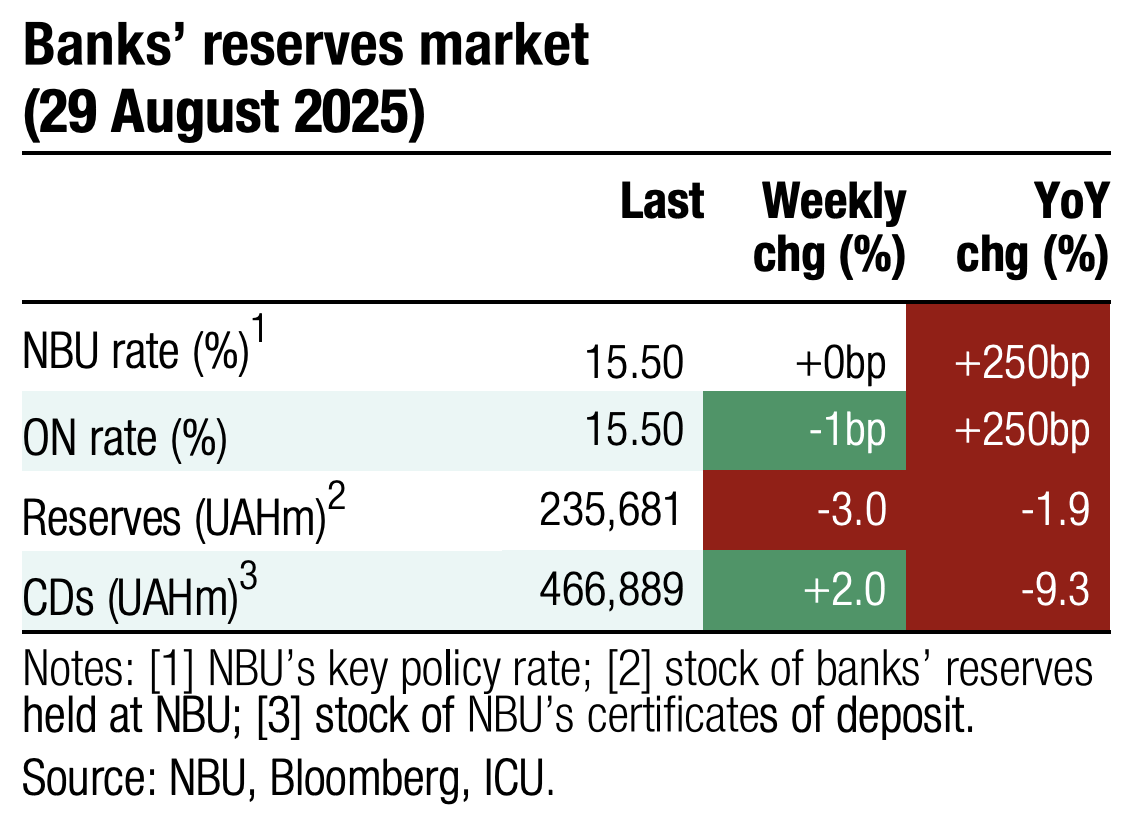

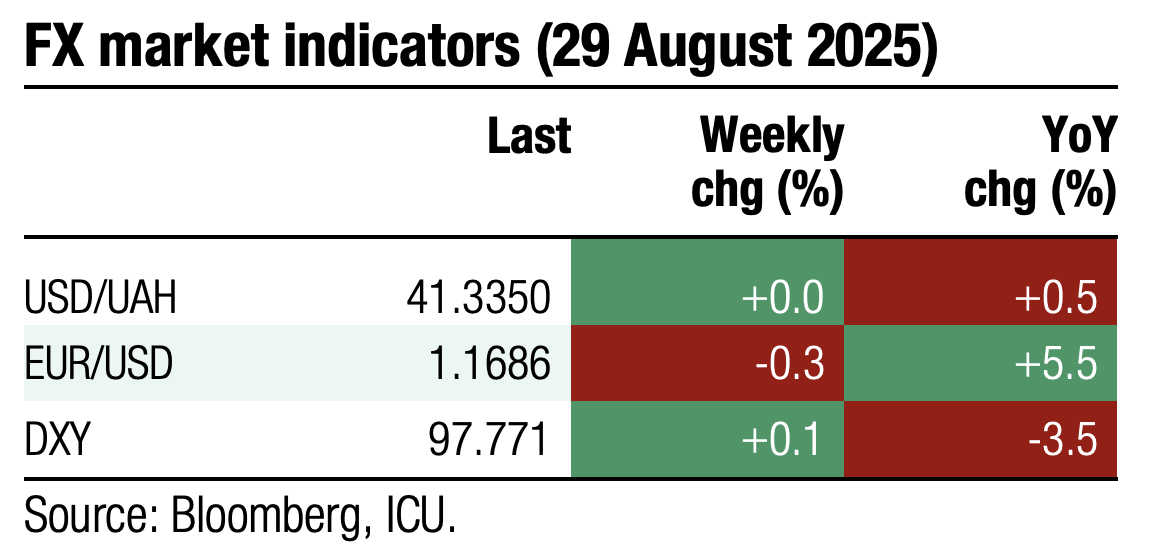

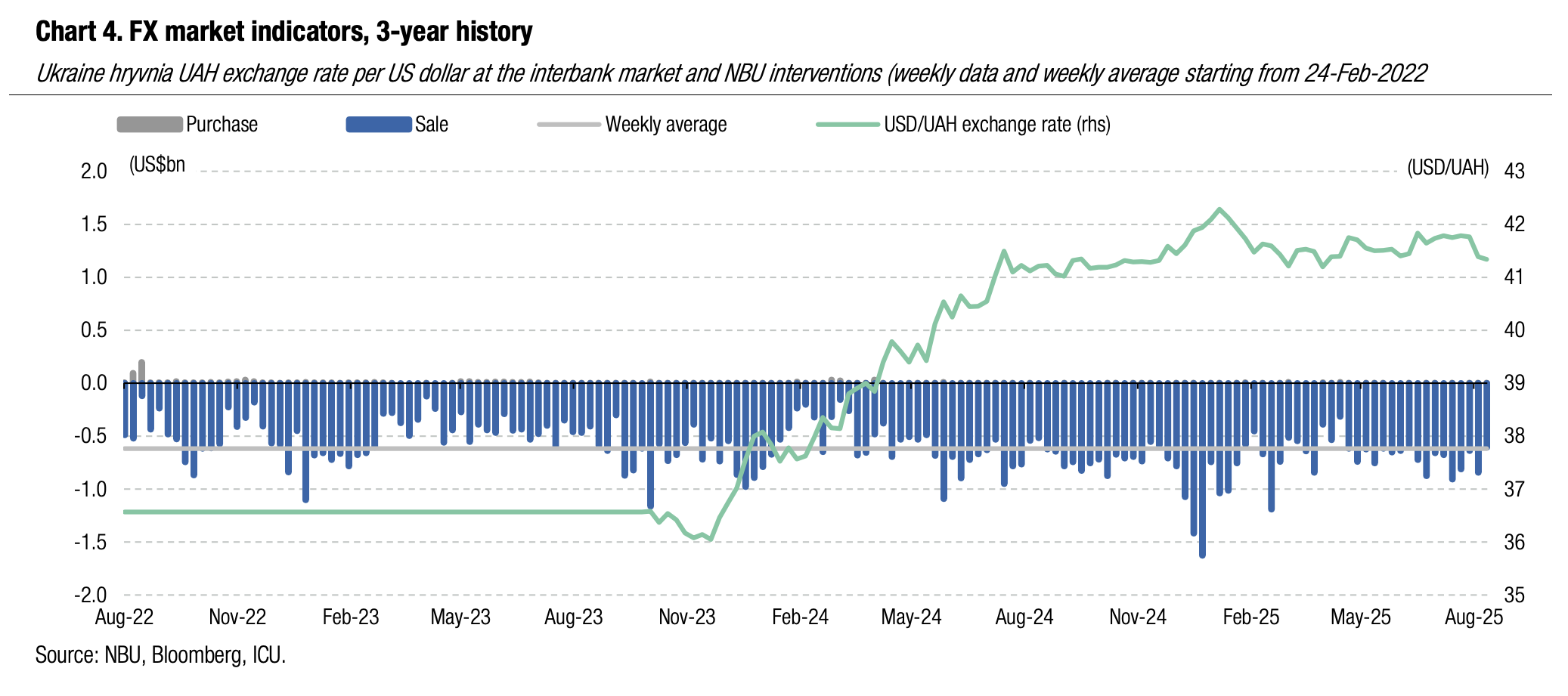

FX: NBU keeps hryvnia strong

The National Bank has maintained the hryvnia exchange rate close to UAH41.3/US$ for the second week in a row as its interventions remained below the weekly average of the full-scale war period.

The FX deficit narrowed slightly last week to the lowest amount since the end of April. The NBU sold US$573m from reserves during the week, only 4% more WoW.

ICU view: The situation on the FX market remains broadly favourable as the NBU remains quite comfortable with the current size of interventions. The NBU may keep the hryvnia exchange rate below UAH41.5/US$ for some time, while gradually broadening the hryvnia fluctuation range.

Economics: C/A deficit record high in July

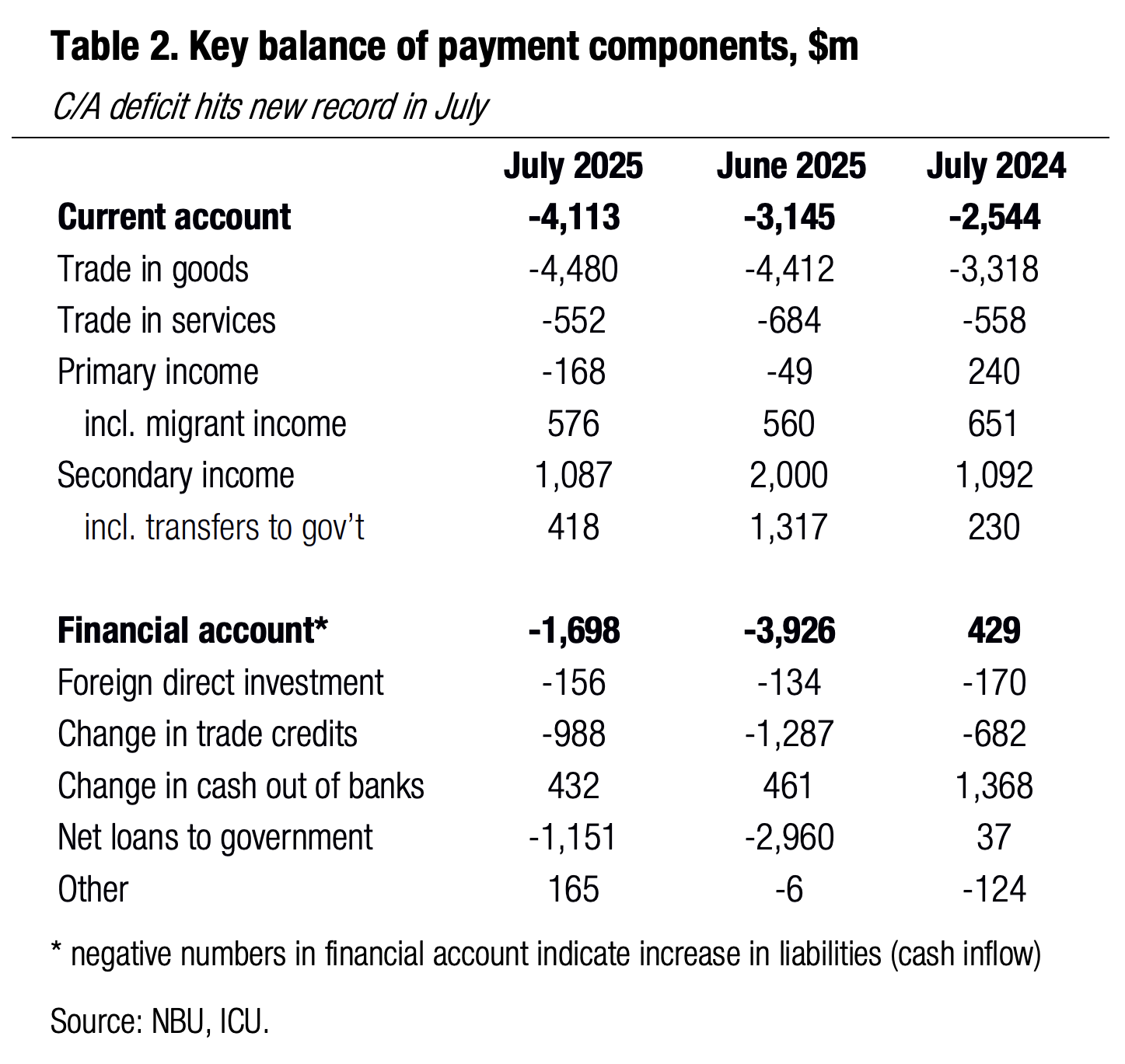

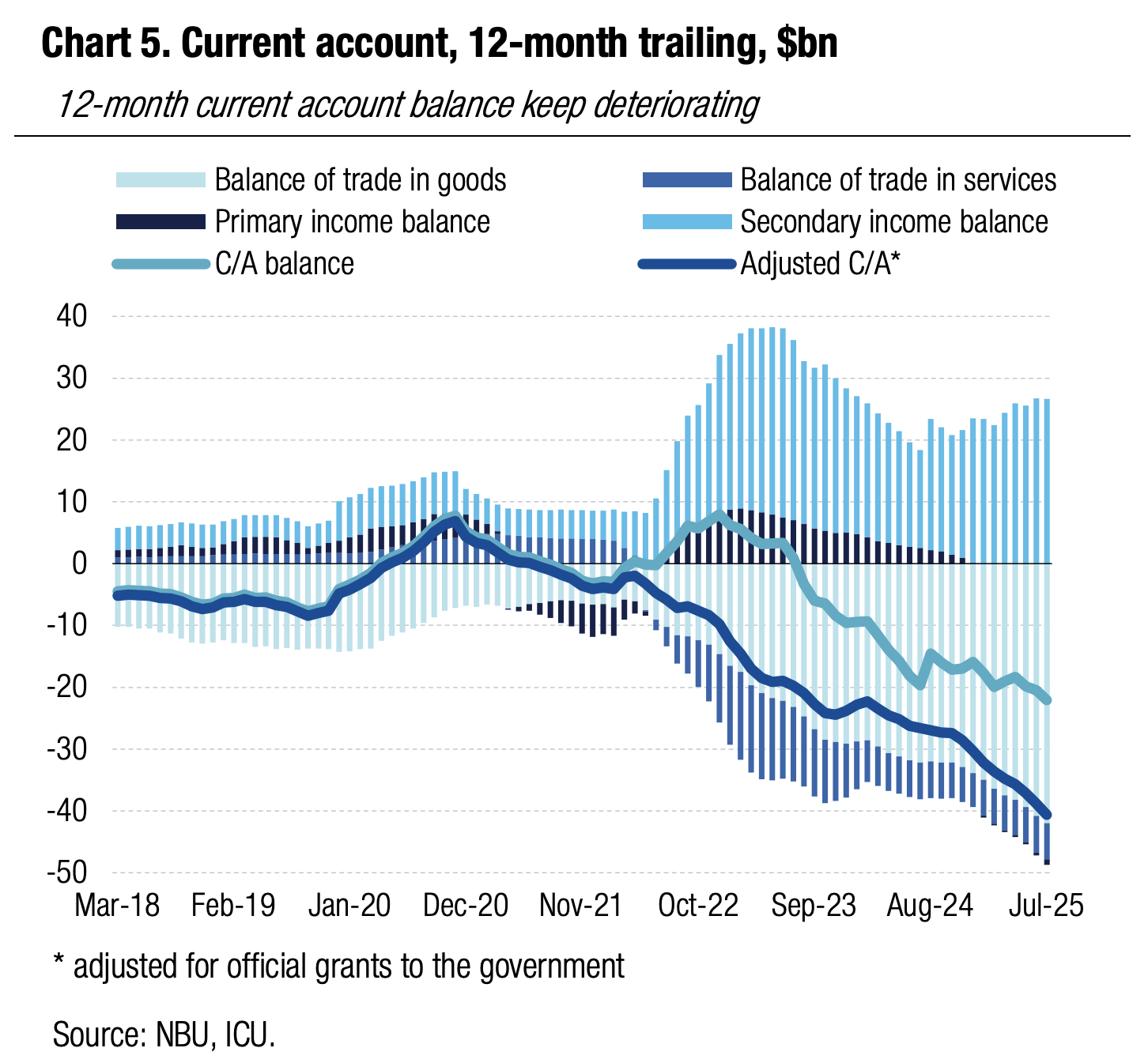

Monthly current account (C/A) deficit exceeded US$4.1bn in July, the level seen first time ever.

The surging trade-in-goods deficit (US$4.4bn in July and US$42bn over 12-month period) was the key culprit behind the record high C/A gap. Export of goods remain suppressed with only marginal 3% growth YoY in July while imports surged 20% with significant growth seen across the board. The deficit of trade in services brought no surprises while primary income ended negative at US$0.2bn on an uptick in interest payments to non-residents. With no significant transfers to the government sector, the secondary income account surplus was below monthly average of the past year.

The financial account was in a surplus of US$1.7bn in July primarily supported by concessional loans to the government of US$1.2bn. As the financial account surplus significantly fell short of the C/A gap, the NBU reserves were down 4.5% in July to US$43.0bn.

|  |

ICU view: Even though the C/A deficit continues to hover around all-time highs and somewhat above our projections, we think it poses very limited risks over the horizon of 12-18 months. The scheduled inflows of foreign financial aid from Ukraine’s allies are sufficient to offset the C/A gap in both 2025 and 2026 without letting NBU reserves to slip below US$40bn. This implies the NBU will have the resources to keep the hryvnia relatively stable through end-2026. Yet, the prospects beyond 2026 clearly depend on whether the financial aid package for Ukraine will be enhanced following the launch of a new IMF program.